The global underlay paper market has experienced steady growth, driven by rising construction activities and increasing demand for flooring solutions that enhance durability and noise insulation. According to a 2023 report by Mordor Intelligence, the global underlayment market is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028, with underlay paper remaining a critical component in both residential and commercial flooring systems. This growth is further supported by expanding infrastructure development in emerging economies and a growing emphasis on sustainable building materials. As demand intensifies, manufacturers are innovating to improve product performance, moisture resistance, and eco-efficiency. In this competitive landscape, a select group of companies have emerged as leaders in underlay paper production, combining scale, quality, and technological advancement. Below, we present the top 10 underlay paper manufacturers shaping the industry.

Top 10 Underlay Paper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale China Underlay Kraft Paper Factories, Manufacturers

Domain Est. 2019

Website: sure-paper.com

Key Highlights: Looking for high-quality China underlay kraft paper? Ningbo Sure Paper Co., Ltd. offers a wide range of options for all your packaging ……

#2 Underlay Paper Archives

Domain Est. 2003

Website: krislam.com

Key Highlights: We are one of the Top Specialty Paper Manufacturers in India that provides the best quality underlay paper at affordable prices….

#3 Underlay Paper

Domain Est. 2009

Website: credopaper.com

Key Highlights: Credo, specializing in the production of consumables for garment manufacturers and a company serving worldwide leader in this regard….

#4 About Us

Domain Est. 2015

Website: underlaypaper.com

Key Highlights: Our company has become a producer of White&White and Gray&White Roll Cardboard, Plain and Perforated Underlay Paper, Non-Adhesive Plotter Paper, Blueprint ……

#5 Wood & Tile Flooring Underlayment

Domain Est. 1997

Website: hollandmfg.com

Key Highlights: Holland’s wood flooring underlayment papers are easy to install. The paper is rolled out and overlapped with next layer by approximately 4 Inches….

#6 Pritchard Paper Products

Domain Est. 1998

Website: pritchardpaper.com

Key Highlights: We convert many grades of plotter papers, separating tissues, perforated krafts, underlay papers, pattern papers, marking papers & poly overlays….

#7 Kraft Underlay Paper

Domain Est. 2004

Website: sewnproducts.com

Key Highlights: Increase the efficiency of your cutting room with kraft underlay paper. It is a cost effective, heavy duty material that will speed up your cutting room today….

#8 Recycled Kraft Paper Rolls

Domain Est. 2015

Website: proampac.com

Key Highlights: Our mills produce natural kraft papers suitable for void-fill materials, mailers, dunnage, fan fold applications, counter rolls, as well as gift and loose wrap….

#9 Underlay Paper

Domain Est. 2022

Website: klassic.co.in

Key Highlights: The Perforated Underlay Papers are manufactured from Bleached Kraft Paper with a varied thickness of 45 GSM to 120 GSM. We offer Perforated Underlay Papers with ……

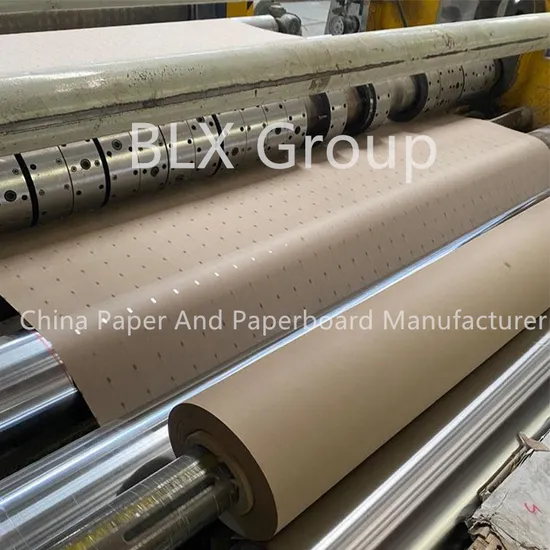

#10 Underlay Triangle Hole Perforated Kraft Paper 90gsm

Domain Est. 2023

Website: bolinpaperscenter.com

Key Highlights: Rating 5.0 (99) Bolin perforated paper, with a robust weight of 90gsm, the paper offers stability during cutting, ensuring controlled movements for precise results….

Expert Sourcing Insights for Underlay Paper

H2 2026 Market Trends for Underlay Paper

The underlay paper market in H2 2026 is poised for continued evolution, shaped by sustainability imperatives, technological advancements, and shifting construction dynamics. Key trends emerging in the second half of the year are expected to solidify long-term industry trajectories:

1. Accelerated Shift Towards Sustainable & Recycled Materials:

Environmental regulations and consumer demand are driving a significant pivot. Manufacturers are increasingly using post-consumer recycled fibers and FSC-certified virgin pulp. Biodegradable and compostable underlay options are moving from niche to mainstream, particularly in Europe and North America. Expect major suppliers to announce enhanced sustainability certifications and improved recycled content percentages (often exceeding 80%) by Q3 2026.

2. Integration of Smart & Multi-Functional Properties:

The market is seeing a rise in “smart” underlay papers incorporating advanced features beyond basic moisture protection. Key developments include:

* Enhanced Moisture & Vapor Management: Papers with intelligent vapor permeability (high SD values) that adapt to humidity, preventing mold while allowing structures to breathe.

* Improved Acoustic Performance: Underlays with integrated sound-dampening layers or optimized density for noise reduction in multi-story buildings, driven by urban densification.

* Thermal Insulation Boost: Thin, high-R-value underlays acting as supplementary thermal breaks, contributing to energy efficiency targets.

3. Consolidation and Supply Chain Optimization:

Post-pandemic volatility has led to strategic consolidation. Larger players are acquiring niche innovators to expand product portfolios and geographic reach. Simultaneously, there’s a strong focus on nearshoring and supply chain resilience. Manufacturers are investing in regional production facilities to mitigate logistics costs and geopolitical risks, ensuring more stable pricing and supply in H2 2026.

4. Growth in Retrofit & Renovation Markets:

Driven by energy efficiency mandates (e.g., EU Energy Performance of Buildings Directive) and aging housing stock, the renovation sector is a major growth engine. Underlay papers offering easy installation, compatibility with existing substrates, and quick-drying properties are in high demand. Products designed for DIY applications are also gaining traction.

5. Price Stabilization Amid Raw Material Volatility:

After significant fluctuations in 2024-2025 due to pulp and energy costs, H2 2026 is expected to see relative price stabilization. This is due to improved supply chain efficiency, long-term contracts locking in rates, and manufacturers passing on incremental efficiency gains. However, premium sustainable and smart products will command notable price premiums.

6. Digitalization & BIM Integration:

Suppliers are increasingly providing detailed digital product data (DPI) and BIM objects for underlay papers. This facilitates easier specification by architects and engineers in digital construction workflows, improving accuracy and reducing errors during the design phase, a trend accelerating in H2 2026.

Conclusion:

H2 2026 will be a pivotal period for the underlay paper market, characterized by a maturing focus on sustainability, the commercialization of high-performance multi-functional products, and operational resilience. Success will depend on manufacturers’ ability to innovate in eco-materials, deliver demonstrable added value (acoustics, energy), and ensure reliable, localized supply chains. The market is transitioning from a commodity model towards a value-added, performance-driven industry.

Common Pitfalls Sourcing Underlay Paper (Quality, IP)

Sourcing underlay paper—used in flooring, packaging, or insulation applications—requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, legal risks, and supply chain disruptions.

Poor Material Quality and Inconsistent Specifications

One of the most frequent pitfalls is receiving underlay paper that fails to meet technical requirements. Suppliers may provide material with inconsistent thickness, inadequate moisture resistance, or subpar compressive strength, leading to premature product failure. Variability in raw materials or manufacturing processes can result in batch-to-batch differences, undermining reliability. Buyers must insist on detailed specifications, third-party testing reports, and sample validation before scaling procurement.

Lack of Compliance with Industry Standards

Underlay paper used in construction or consumer goods often must comply with regional or international standards (e.g., ASTM, ISO, or EN standards for durability, fire resistance, or emissions). Sourcing from suppliers unfamiliar with these requirements—or those who falsify certifications—can result in non-compliant products, regulatory penalties, and reputational damage. Always verify certifications and conduct periodic audits.

Insufficient Supply Chain Transparency

Many buyers overlook the importance of traceability in the underlay paper supply chain. Without visibility into raw material sources and production practices, companies risk exposure to unethical labor practices, environmental violations, or contamination. This lack of transparency also complicates efforts to ensure consistent quality and sustainability compliance.

Intellectual Property Infringement Risks

Using or sourcing underlay paper with proprietary technology—such as patented moisture barriers, acoustic dampening layers, or antimicrobial treatments—without proper licensing can lead to IP violations. Some suppliers may offer “compatible” or “generic” versions that inadvertently infringe on protected designs or formulations. Conducting IP due diligence and requiring legal assurances from suppliers is essential to avoid litigation.

Overlooking Customization Agreements and IP Ownership

When working with suppliers to develop custom underlay solutions, companies may fail to clearly define IP ownership in contracts. This can result in disputes over who owns the rights to formulations, designs, or processes developed during collaboration. Always establish clear IP terms in writing before beginning joint development projects.

Dependency on Sole or Unverified Suppliers

Relying on a single source—especially in low-cost regions without rigorous vetting—can expose businesses to quality inconsistencies, delivery delays, or sudden IP-related discontinuations. Diversifying the supplier base and conducting regular performance and compliance assessments helps mitigate these risks.

Avoiding these pitfalls requires a proactive sourcing strategy that emphasizes technical validation, regulatory compliance, supply chain due diligence, and robust IP protection.

Logistics & Compliance Guide for Underlay Paper

Product Overview

Underlay paper is a protective layer used beneath flooring materials such as laminate, engineered wood, and vinyl to provide cushioning, moisture resistance, and sound insulation. Proper handling, storage, transportation, and compliance with relevant regulations are essential to maintain product integrity and ensure safe delivery.

Packaging & Handling

- Standard Packaging: Underlay paper is typically supplied in compressed rolls or sheets, wrapped in polyethylene film or kraft paper to protect against moisture and physical damage.

- Handling Instructions:

- Use mechanical aids (e.g., forklifts, pallet jacks) when moving full pallets to avoid strain or damage.

- Avoid dragging rolls across surfaces to prevent punctures or deformation.

- Keep packaging intact until point of installation.

Storage Requirements

- Environment: Store in a dry, well-ventilated area with controlled temperature (10°C to 30°C) and relative humidity below 65%.

- Positioning: Keep rolls upright on pallets; do not stack horizontally or exceed manufacturer-recommended stacking heights.

- Shelf Life: Most underlay papers have a shelf life of 12–24 months when stored properly. Monitor expiry dates and practice FIFO (First In, First Out) inventory management.

Transportation Guidelines

- Loading & Securing:

- Pallets must be securely strapped and shrink-wrapped.

- Use load bars or air bags to prevent shifting during transit.

- Avoid exposure to direct sunlight, rain, or snow.

- Vehicle Requirements: Use enclosed, dry vehicles. Open trucks require waterproof tarpaulins.

- Temperature Control: Avoid prolonged exposure to extreme temperatures (below 0°C or above 40°C) which may affect adhesive properties (if applicable).

Regulatory Compliance

- REACH (EU): Ensure underlay paper does not contain Substances of Very High Concern (SVHC) listed under REACH regulations. Suppliers must provide updated Safety Data Sheets (SDS).

- RoHS (EU): If underlay contains electronic components (e.g., heated underlays), compliance with RoHS restrictions on hazardous substances is mandatory.

- VOC Emissions: Comply with indoor air quality standards such as:

- California Air Resources Board (CARB) Phase 2

- GREENGUARD Gold Certification

- EN 717-1 (Formaldehyde Emissions)

- Fire Safety: Meet local building codes for flammability (e.g., ASTM E84 in the U.S., EN 13501-1 in the EU). Class B or lower flame spread rating is typically required.

Documentation & Labeling

- Shipping Labels: Include product name, batch/lot number, net weight, dimensions, handling symbols (e.g., “This Way Up”, “Protect from Moisture”), and manufacturer details.

- Compliance Documentation: Provide:

- Certificate of Conformity (CoC)

- Safety Data Sheet (SDS) if applicable

- Test reports for emissions, flammability, and mechanical properties

- Customs Documentation (International Shipments):

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin (if required)

Sustainability & Disposal

- Recyclability: Most underlay papers are recyclable if uncontaminated. Confirm local recycling capabilities.

- Waste Disposal: Dispose of damaged or excess material in accordance with local waste management regulations. Avoid open burning.

- Environmental Claims: Ensure any eco-friendly claims (e.g., “100% recycled content”) are verifiable and compliant with FTC Green Guides or EU environmental labeling standards.

Risk Mitigation

- Moisture Protection: Use moisture barriers in storage and transport; inspect for leaks or condensation.

- Pest Control: Regularly inspect storage areas for rodents or insects that may damage packaging.

- Insurance: Carry cargo insurance covering damage, loss, or delay during transit.

Supplier & Carrier Qualifications

- Verify that suppliers and logistics partners adhere to ISO 9001 (Quality Management) and ISO 14001 (Environmental Management) standards where applicable.

- Conduct periodic audits of storage and handling practices.

Emergency Procedures

- Spills or Damage: Isolate damaged rolls to prevent contamination. Document incidents for insurance and compliance reporting.

- Fire Response: Use water spray, foam, or CO₂ extinguishers. Evacuate area if smoke is produced; combustion byproducts may include carbon monoxide.

By following this guide, stakeholders across the supply chain can ensure the safe, compliant, and efficient handling of underlay paper from production to end-use.

Conclusion for Sourcing Underlay Paper

In conclusion, sourcing the right underlay paper is a critical step in ensuring product protection, operational efficiency, and cost-effectiveness across packaging and industrial applications. A successful sourcing strategy involves evaluating key factors such as material quality, moisture resistance, durability, thickness, environmental sustainability, and supplier reliability. By aligning sourcing decisions with specific application requirements and sustainability goals, businesses can enhance product integrity during transit, reduce waste, and improve overall supply chain performance. Developing strong partnerships with reputable suppliers and conducting regular performance reviews further supports long-term value creation. Ultimately, a well-considered underlay paper sourcing approach contributes not only to operational success but also to environmental responsibility and customer satisfaction.