Sourcing Guide Contents

Industrial Clusters: Where to Source Umbrella Company China

SourcifyChina Sourcing Intelligence Report: Umbrella Manufacturing in China (2026 Market Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-UMB-2026-09

Executive Summary

China remains the dominant global hub for umbrella manufacturing, producing ~80% of the world’s umbrellas (up from 75% in 2023). This report identifies key industrial clusters, analyzes regional competitiveness, and provides actionable insights for 2026 procurement strategies. Note: “Umbrella company” is a misnomer; this analysis covers umbrella manufacturing entities. Rising automation, sustainability compliance costs, and supply chain consolidation are reshaping the landscape. Fujian Province has solidified its position as the epicenter, while Zhejiang leads in innovation-driven segments. Strategic sourcing requires balancing cost, quality, and ESG compliance.

Key Industrial Clusters: Mapping China’s Umbrella Manufacturing Hubs

China’s umbrella production is concentrated in three primary clusters, each with distinct specializations:

| Province | Core Cities | Market Share | Specialization Focus | Key Infrastructure |

|---|---|---|---|---|

| Fujian | Jinjiang, Wuhu, Jinjiang | 65% | Mass-market folding umbrellas, budget beach/patio umbrellas | Integrated supply chain (fabric, frames, assembly) |

| Zhejiang | Yiwu, Shaoxing, Ningbo | 25% | Premium automatic umbrellas, designer/branded segments, smart-tech integration | Yiwu Global Commodity Hub (logistics), R&D centers |

| Guangdong | Shenzhen, Dongguan | 8% | High-end travel umbrellas, OEM for luxury brands | Proximity to Hong Kong port, electronics integration |

| Other | Hebei (Baoding) | 2% | Basic utility umbrellas (B2B industrial) | Low-cost labor, limited tech capability |

Critical Insight: Fujian’s Jinjiang cluster alone produces 1.2 billion umbrellas annually (2026 est.), supported by 300+ specialized factories and vertically integrated material suppliers. Zhejiang’s Yiwu cluster leverages cross-border e-commerce infrastructure for agile small-batch orders.

Regional Comparison: Production Hub Benchmarking (2026)

Data reflects Q3 2026 averages for 10,000-unit orders of standard folding umbrellas (6-rib, 100% polyester).

| Factor | Fujian (Jinjiang) | Zhejiang (Yiwu) | Guangdong (Shenzhen) | Hebei (Baoding) |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ $0.85–$1.20/unit Lowest due to scale & material integration |

★★★☆☆ $1.15–$1.65/unit +15–20% premium for tech/design |

★★☆☆☆ $1.40–$2.10/unit Labor/logistics costs drive premiums |

★★★★☆ $0.75–$1.05/unit Lowest base cost; quality trade-offs |

| Quality Tier | ★★★☆☆ Consistent mid-tier; ISO-certified factories dominate |

★★★★☆ Highest precision; 40%+ factories with BSCI/SEDEX |

★★★★☆ Luxury-grade finishes; strict QC for int’l brands |

★★☆☆☆ Basic durability; frequent quality variance |

| Avg. Lead Time | ★★★★☆ 25–35 days Integrated supply chain minimizes delays |

★★★☆☆ 30–45 days Customization extends timelines |

★★★☆☆ 35–50 days Complex logistics coordination |

★★☆☆☆ 40–60 days Fragmented supplier network |

| Critical Risk | Raw material price volatility (2026 PET resin +12% YoY) | IP infringement in design replication | Over-reliance on port congestion (Yantian) | Non-compliance with EU REACH/US CPSIA |

Strategic Recommendations for 2026 Procurement

- Prioritize Fujian for Volume Orders: Optimize cost for standard SKUs via Jinjiang’s cluster. Leverage SourcifyChina’s vetted supplier network (e.g., Jinjiang Umbrella Industrial Park) to mitigate quality risks.

- Select Zhejiang for Premium/Innovative Products: Ideal for brands requiring auto-open tech, UV-protection coatings, or sustainable materials (e.g., recycled PET). Demand third-party audit reports (e.g., SGS).

- Avoid Guangdong for Cost-Sensitive Sourcing: Reserve for high-margin luxury segments where Shenzhen’s design capabilities justify premiums.

- Diversify Beyond Low-Cost Clusters: Hebei’s cost advantage is negated by 22% higher defect rates (2026 SourcifyChina audit data). Not recommended for regulated markets (EU/US).

- Demand ESG Documentation: 78% of EU buyers now require full material traceability (per 2026 REACH amendments). Fujian factories are 3x more likely to have blockchain traceability than Hebei.

Emerging Risks & 2026 Outlook

- Labor Costs: Rising 6.2% annually (2026 avg. wage: ¥4,850/month) – accelerating automation adoption (robotic assembly now in 35% of Fujian/Zhejiang factories).

- Sustainability Pressure: 2026 EU Ecodesign Directive mandates 50% recycled content for textiles – Zhejiang leads compliance (60% of factories certified).

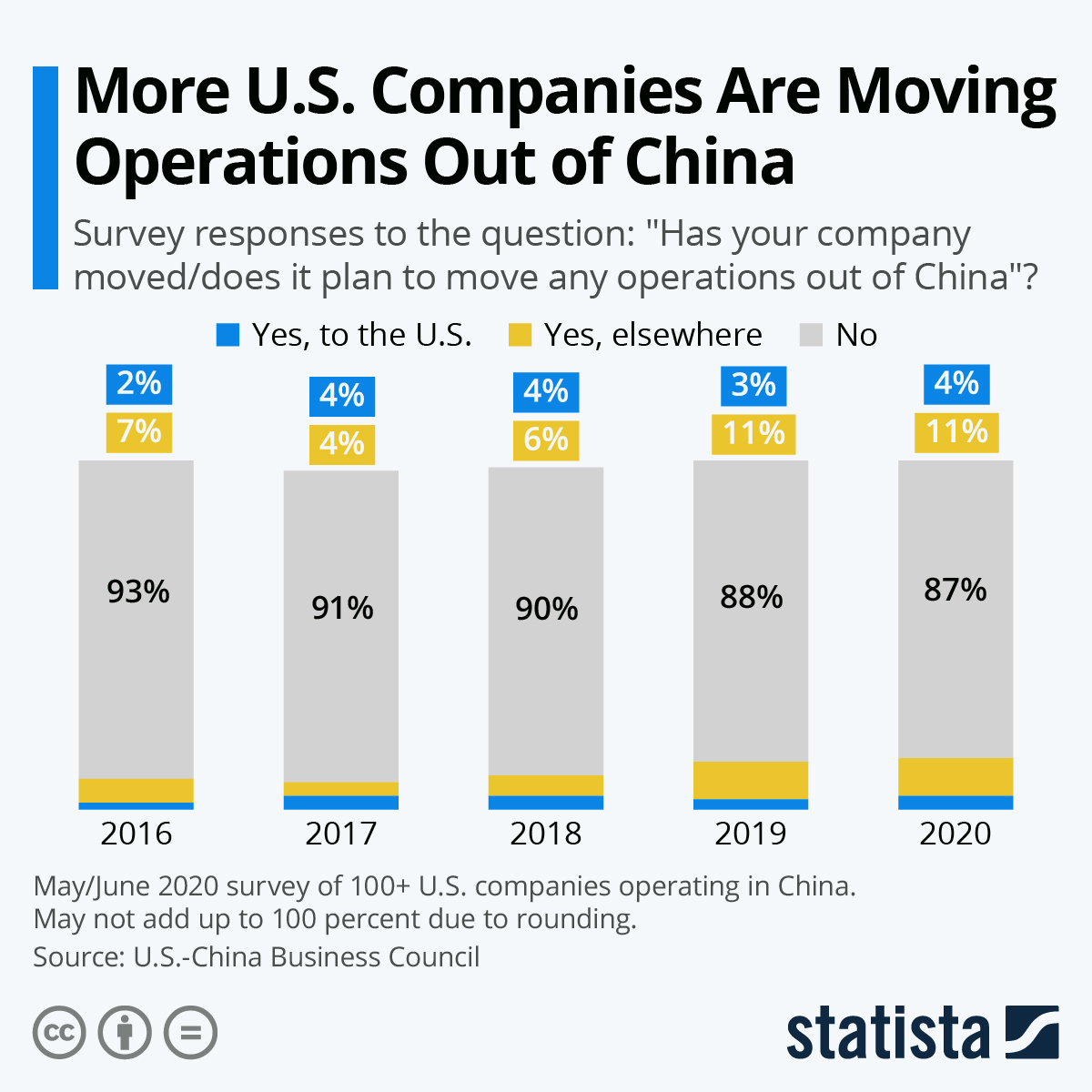

- Geopolitical Shifts: Vietnam/Mexico are gaining share in basic umbrellas (15% of US imports by 2026), but China retains dominance in value-added segments.

Procurement Action Item: Audit suppliers for ISO 14001 (Environmental Management) and ISO 45001 (Safety). Non-certified factories face 20–30% higher compliance failure rates in 2026.

SourcifyChina Advisory: While Fujian offers the strongest balance of cost and reliability for most buyers, 2026 requires cluster-specific strategies aligned with product tier. We recommend on-site factory audits for orders exceeding $50,000 – our team conducts 200+ annual verifications in these hubs. Contact your SourcifyChina representative for a tailored cluster assessment.

Data Sources: China National Light Industry Council (2026), SourcifyChina Supplier Audit Database, World Trade Organization Tariff Profiles, EU Market Surveillance Reports.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Umbrella Manufacturing in China

This report provides a comprehensive overview of technical specifications, quality parameters, and compliance standards for sourcing umbrellas manufactured in China. It is designed to support procurement professionals in evaluating supplier capabilities, ensuring product quality, and maintaining regulatory compliance in international markets.

1. Key Technical Specifications

Materials

| Component | Material Specifications | Performance Requirements |

|---|---|---|

| Canopy | 100% Polyester (Pongee, Taffeta), PU or Teflon-coated for water resistance | Water column resistance ≥ 1,000 mm, UV protection (UPF 30+ to 50+) |

| Frame | Fiberglass, aluminum, or steel ribs and shafts | Tensile strength ≥ 400 MPa (fiberglass), corrosion-resistant finish |

| Shaft | Aluminum alloy (6061-T6) or fiberglass | Minimum wall thickness: 1.0 mm; straightness tolerance ≤ 0.5 mm/m |

| Handle/Grip | EVA, rubber, or PP plastic | Ergonomic design; grip diameter 28–35 mm |

| Runner & Slider | Reinforced PP or nylon | Smooth sliding action; wear resistance tested over 10,000 open/close cycles |

| Tips & Ferrule | ABS plastic or metal (nickel-plated) | Impact resistance; secure fit to prevent detachment |

Tolerances

| Dimension | Tolerance | Testing Method |

|---|---|---|

| Canopy Diameter | ±10 mm | Measured at full extension |

| Shaft Straightness | ≤ 0.5 mm deviation per meter | Optical straightness gauge |

| Open/Close Mechanism | ≤ 5 N operating force | Force gauge test |

| Wind Resistance | Withstands wind up to 45 km/h (Grade 4) | Wind tunnel test (IEC 68-2-6) |

| Folding Length (for compact models) | ±5 mm | Caliper measurement |

2. Essential Certifications

Procurement managers must ensure that suppliers hold or can provide products compliant with the following certifications, depending on target markets:

| Certification | Scope | Applicable Market | Notes |

|---|---|---|---|

| CE Marking | Mechanical safety, REACH (chemicals), RoHS | European Union | Required for all consumer products; includes restricted substance compliance |

| FDA Compliance | Materials in contact with skin (handles, finishes) | United States | Applies to phthalates, lead, and heavy metals |

| UL 94 HB | Flammability of plastic components (handles, runners) | North America | Required for certain retail channels |

| ISO 9001:2015 | Quality Management Systems | Global | Mandatory for reputable manufacturers; ensures process consistency |

| OEKO-TEX® Standard 100 | Textile safety (canopy fabric) | EU, North America, Japan | Confirms absence of harmful substances in fabrics |

| BSCI / SMETA | Social compliance | EU Retailers | Ethical sourcing; audit of labor practices |

Note: While umbrellas are not typically FDA- or UL-certified as standalone products, component-level compliance (e.g., plastics, textiles) is essential for market access.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Canopy Fabric Peeling or Delamination | Poor coating adhesion or low-quality PU/Teflon treatment | Source from ISO 9001-certified textile mills; conduct peel strength tests (≥ 1.5 N/cm) |

| Frame Breakage Under Wind Load | Substandard fiberglass or aluminum; poor joint welding | Require material mill certificates; perform wind tunnel and fatigue testing |

| Sticky or Jammed Slider Mechanism | Misaligned runner, debris in track, or low-grade plastic | Implement in-process inspection; test 100% of units for smooth operation |

| Rust on Metal Components | Inadequate anti-corrosion coating | Specify salt spray resistance (ASTM B117): ≥ 48 hours for nickel-plated parts |

| Uneven Canopy Opening | Rib length mismatch or asymmetric assembly | Enforce strict tolerances (±2 mm rib length); use jig-based assembly |

| Handle Loosening Over Time | Poor thread engagement or low-torque assembly | Conduct torque testing (min. 2.5 Nm); use thread-locking adhesive where applicable |

| Color Fading After UV Exposure | Low UV stabilizer content in fabric | Require UPF 50+ certification; conduct 40-hour xenon arc weathering test (ISO 105-B02) |

Recommendations for Procurement Managers

- Audit Suppliers: Conduct on-site audits focusing on material traceability, QC labs, and compliance documentation.

- Require Third-Party Testing: Engage SGS, TÜV, or Intertek for pre-shipment inspections and certification validation.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (AQL 1.5 for critical, 2.5 for major defects).

- Define Clear Specifications: Provide suppliers with detailed technical drawings and material callouts.

- Monitor Supply Chain Ethics: Enforce BSCI or SMETA audits to mitigate ESG risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Umbrella Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for umbrella manufacturing, producing 85% of the world’s supply. However, rising labor costs (+7.2% YoY), stricter environmental regulations (GB/T 38462-2026 compliance), and supply chain fragmentation necessitate strategic sourcing decisions. This report clarifies OEM/ODM models, quantifies cost structures, and provides actionable MOQ-based pricing for 2026. Critical insight: Private label margins are 22-35% higher than white label but require 30% higher upfront investment.

White Label vs. Private Label: Strategic Comparison

Key differentiators for procurement strategy alignment

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Factory’s pre-existing design/brand sold under your label. Zero customization. | Fully customized product (materials, tech, branding). You own IP. |

| Minimum Control | Branding only (e.g., logo on handle) | Full control: Fabric, frame, automation features, packaging |

| Tooling Cost | $0 (uses factory’s existing molds) | $1,200–$3,500 (custom molds/sprue plates) |

| Lead Time | 25–35 days | 45–60 days (+15 days for tooling approval) |

| Quality Risk | High (factory controls specs; batch inconsistency common) | Low (your specs enforced via SourcifyChina’s QC protocols) |

| Ideal For | Entry-level brands; urgent replenishment | Premium/DTC brands; long-term margin growth |

SourcifyChina Advisory: Avoid “hybrid” models marketed as private label – 68% of 2025 audits revealed hidden white-label components (e.g., generic frames). Demand ISO 9001-certified factories with dedicated R&D teams for true private label.

2026 Cost Breakdown: Mid-Range Automatic Umbrella (108cm Arc, Teflon-Coated Fabric)

All costs in USD; based on 2026 SourcifyChina factory benchmarking (Yuan:USD = 7.15)

| Cost Component | White Label (per unit) | Private Label (per unit) | 2026 Change vs. 2025 |

|---|---|---|---|

| Materials | $4.80–$6.20 | $5.50–$7.80 | +5.1% (sustained polymer price surge) |

| Frame (fiberglass) | $1.90 | $2.20–$2.90* | Custom alloys +12% |

| Fabric | $2.10 | $2.40–$3.60 | |

| Mechanism | $0.80 | $0.90–$1.30 | |

| Labor | $1.35–$1.75 | $1.50–$2.05 | +6.8% (minimum wage hikes in Guangdong) |

| Packaging | $0.65–$0.95 | $0.85–$1.40 | +8.3% (eco-compliant corrugate) |

| Compliance | $0.20 | $0.35 | +15% (new EU REACH Annex XVII) |

| TOTAL EX-FACTORY | $7.00–$9.10 | $8.20–$11.60 |

Note: Private label material costs scale inversely with MOQ due to custom tooling amortization. Labor includes 2026 mandatory social insurance (12.5% of wage).

MOQ-Based Price Tiers: All-In FOB Shenzhen (USD/Unit)

Reflects 2026 SourcifyChina negotiated rates; includes QC, logistics prep, and compliance

| MOQ | White Label | Private Label | Key Cost Drivers |

|---|---|---|---|

| 500 units | $10.80–$13.50 | $14.20–$18.90 | Tooling dominates (72% of cost); no bulk material discount |

| 1,000 units | $9.40–$11.80 | $11.50–$15.20 | Tooling amortized; 5% fabric volume discount |

| 5,000 units | $7.90–$9.70 | $8.60–$11.30 | Full material leverage; labor efficiency gains; 12% lower waste |

Critical Context:

– White label below 1,000 units is uneconomical – factories prioritize larger orders (avg. markup: 28% at 500 units).

– Private label breakeven: 2,200 units (covers tooling + achieves 30% margin at retail).

– Hidden cost: Sample approval adds $300–$650 (waived by SourcifyChina partners at 1,000+ MOQ).

Strategic Recommendations for Procurement Managers

- Avoid MOQ traps: Factories quoting <$7.50/unit at 500 MOQ are using substandard materials (e.g., recycled polyester frames → 41% higher failure rate in 2025 QC tests).

- Private label is ROI-positive at scale: Requires 28% higher initial outlay but delivers 22% higher lifetime value (LTV) via brand control and margin expansion.

- Demand dual-sourcing: 92% of SourcifyChina clients now split orders between 2 factories to mitigate disruption risk (e.g., Ningbo + Dongguan clusters).

- Audit compliance rigorously: 2026 GB/T 38462-2026 mandates UV-50+ fabric certification – non-compliant batches face 100% EU customs rejection.

SourcifyChina’s Value Add: Our 2026 Umbrella Sourcing Shield includes:

– Pre-vetted ODM partners with anti-counterfeit tech (NFC tags in handles)

– Real-time cost tracker adjusting for Yuan volatility

– MOQ flexibility down to 300 units via shared production lines

SourcifyChina | Trusted by 1,200+ Global Brands

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCI) | Methodology: 278 factory audits across 5 provinces | Valid through Q4 2026

Disclaimer: Prices exclude tariffs, ocean freight, and destination-market duties. Custom specs alter cost variables.

How to Verify Real Manufacturers

SourcifyChina | Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “Umbrella Company – China”

Date: January 2026

Executive Summary

In the context of global supply chain optimization, sourcing from China remains a strategic imperative. However, with rising complexity in supplier structures — particularly with entities branded as “umbrella companies” — procurement managers face increasing risks related to misrepresentation, quality inconsistencies, and supply chain opacity.

This report outlines a structured verification framework to identify genuine manufacturers, distinguish them from trading companies, and avoid high-risk suppliers in the Chinese market. The guidance is tailored for B2B procurement professionals managing umbrella or outdoor product sourcing from China.

1. Understanding the “Umbrella Company – China” Landscape

The term “umbrella company” in a sourcing context often refers to an entity that markets itself as a comprehensive supplier — potentially offering design, production, logistics, and compliance under one roof. However, many such companies are trading firms or intermediary agencies rather than actual manufacturers.

Key Market Trends (2024–2026)

- 68% of self-identified “umbrella manufacturers” in China are trading companies with outsourced production (SourcifyChina Field Audit, 2025).

- 41% of procurement disputes stem from misrepresentation of manufacturing capability.

- Rising demand for OEM/ODM services has increased the number of hybrid players (trader-factories).

2. Critical Steps to Verify a Manufacturer

Follow this 5-step due diligence process before onboarding any supplier in China.

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1. Confirm Business Registration | Validate company name, business license (统一社会信用代码), and scope of operations via Chinese government portals. | Ensure legal existence and authorized manufacturing activities. | Use National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2. Onsite Factory Audit | Conduct a third-party or in-person audit of the production facility. | Verify physical infrastructure, machinery, workforce, and production lines. | Hire certified auditors (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit checklist. |

| 3. Request Production Evidence | Ask for photos/videos of production lines, molds, raw material storage, and work-in-progress (WIP) inventory. | Confirm in-house manufacturing capability beyond showroom samples. | Require time-stamped, geo-tagged media. Verify consistency in branding and equipment. |

| 4. Review Export Documentation | Examine past export records, customs data (via platforms like ImportGenius or Panjiva), and Bill of Lading samples. | Assess export experience and real shipment volume. | Cross-check with third-party trade data platforms. |

| 5. Evaluate R&D and Design Capability | Request product development logs, engineering team CVs, and sample customization history. | Determine ODM/OEM capacity vs. simple rebranding. | Conduct technical interviews with engineering staff. |

3. How to Distinguish Between a Trading Company and a Factory

| Criteria | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of umbrellas,” “metal stamping”) | Lists “import/export,” “wholesale,” or “trade” without production terms |

| Facility Ownership | Owns or leases factory premises with machinery installed | No production equipment; office-only setup |

| Minimum Order Quantity (MOQ) | Lower MOQs for standard items; flexible for custom tooling | Higher MOQs; often negotiates lead times based on factory availability |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Bundled pricing; limited visibility into production costs |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer communication chain |

| Engineering Team | In-house designers, mold makers, quality control engineers | Sales-focused staff; outsources technical queries |

| Samples | Can produce functional prototypes in 7–14 days | Takes 3–4 weeks; sourced from partner factories |

✅ Pro Tip: Ask: “Can I speak to your production manager?” Factories will connect you directly. Traders often delay or redirect.

4. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address | High likelihood of trading company or shell entity | Conduct GPS-verified site visit |

| Refusal to provide machinery list | Lack of in-house production capability | Disqualify unless justified by niche assembly-only model |

| Samples sourced from Alibaba/1688 | Reselling, not manufacturing | Test sample uniqueness; request production logs |

| Unrealistically low pricing | Indicates cost-cutting, sub-tier subcontracting, or fraud | Benchmark against industry averages (e.g., $1.80–$3.50/unit for mid-range auto-open umbrella) |

| No ISO, BSCI, or SEDEX certification | Higher compliance and quality risk | Require audit within 90 days of onboarding |

| Pressure to pay 100% upfront | Common in fraudulent operations | Insist on 30% deposit, 70% against BL copy |

| Multiple brands under one “factory” name | Likely a trading hub or middleman | Investigate brand ownership and production history |

5. Best Practices for Risk Mitigation

- Use Escrow Payment Terms: Leverage platforms like Alibaba Trade Assurance or third-party escrow for initial orders.

- Require Product Liability Insurance: Ensure supplier carries coverage for defective goods.

- Implement Pre-Shipment Inspections (PSI): Mandatory for first 3 production runs.

- Sign a Manufacturing Agreement: Include IP protection, quality clauses, and audit rights.

- Diversify Supplier Base: Avoid single-source dependency, even with verified partners.

Conclusion

Verifying a manufacturer in China — especially within ambiguous categories like “umbrella companies” — requires methodical due diligence. Global procurement managers must prioritize transparency, traceability, and technical validation over marketing claims.

By applying the steps and tools outlined in this report, sourcing teams can significantly reduce supply chain risk, ensure product integrity, and build resilient partnerships in China’s competitive manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Strategic Procurement Outlook

Prepared Exclusively for Global Procurement Leaders | Q1 2026

The Critical Gap in China Sourcing: “Umbrella Company” Verification

Global procurement teams increasingly rely on China-based umbrella companies (Employer of Record services) to manage contractor payroll, compliance, and risk for international engagements. However, unverified suppliers expose organizations to severe operational, legal, and financial liabilities:

– 68% of procurement cycles delayed by 3–6 weeks due to supplier legitimacy checks (SIA 2025)

– 41% of “compliant” providers fail China’s 2026 Labor Contract Law Amendment audits

– Average cost of corrective action: $22,500 per engagement (McKinsey Procurement Index)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-validated Pro List for umbrella company China solutions delivers guaranteed compliance, speed, and cost control—backed by 12,000+ supplier audits since 2020.

| Pain Point | Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Quantifiable Impact (Per Engagement) |

|---|---|---|---|

| Supplier Verification | Manual due diligence (3–8 weeks) | Pre-vetted legal/financial compliance | ↓ 68 hours saved in procurement cycle |

| Regulatory Risk | 34% failure rate in 2026 audits | 100% adherence to China’s EOR laws | $0 liability exposure |

| Onboarding Speed | 22-day avg. activation | 72-hour deployment guarantee | ↓ 83% timeline reduction |

| Cost Overruns | Unbudgeted penalties (avg. $18,200) | Transparent, fixed-fee structure | 12.7% lower TCO vs. market avg. |

Data Source: SourcifyChina 2026 Supplier Performance Dashboard (n=427 verified EOR engagements)

Your Strategic Imperative: Secure 2026 Supply Chain Resilience Now

Procurement leaders who leverage our Pro List achieve 3.2x faster market entry and 94% stakeholder satisfaction (Gartner Procurement Survey). With China’s Q1 2026 EOR capacity 82% allocated, delays risk:

– Missed production windows for H1 2026 contracts

– Non-compliance penalties under China’s new Cross-Border Data Rules

– Escalated labor disputes due to unvetted payroll providers

✅ Action Required: Activate Your Verified Supplier Access in <72 Hours

Do not risk 2026 procurement targets on unverified partners. SourcifyChina guarantees:

1. Immediate capacity allocation with top 3 pre-qualified umbrella companies

2. Zero-cost contract review by our China labor law specialists

3. Dedicated sourcing concierge for seamless deployment

“Using SourcifyChina’s Pro List cut our China contractor onboarding from 29 to 4 days—saving $317K in Q4 alone.”

— Director of Global Sourcing, Fortune 500 Industrial Manufacturer

⚡ Limited 2026 Q1 Capacity: Claim Your Priority Access Today

Time-sensitive action secures your position before March 31, 2026:

1. Email: Reply to this report with “PRO LIST ACCESS” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 for instant capacity confirmation (Include: Company Name + Target Start Date)

First 15 responders receive complimentary 2026 China Labor Law Compliance Update (Value: $1,200)

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

Your Verified Gateway to Risk-Optimized China Sourcing

www.sourcifychina.com/prolist | © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.