Sourcing Guide Contents

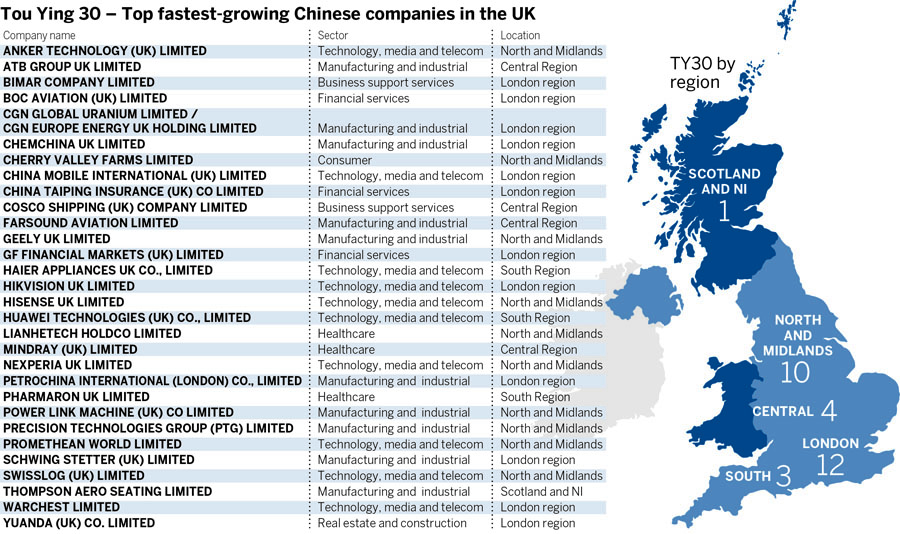

Industrial Clusters: Where to Source Uk Companies Owned By China

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Market Analysis for Sourcing UK Companies Owned by Chinese Entities – Manufacturing Footprint in China

Executive Summary

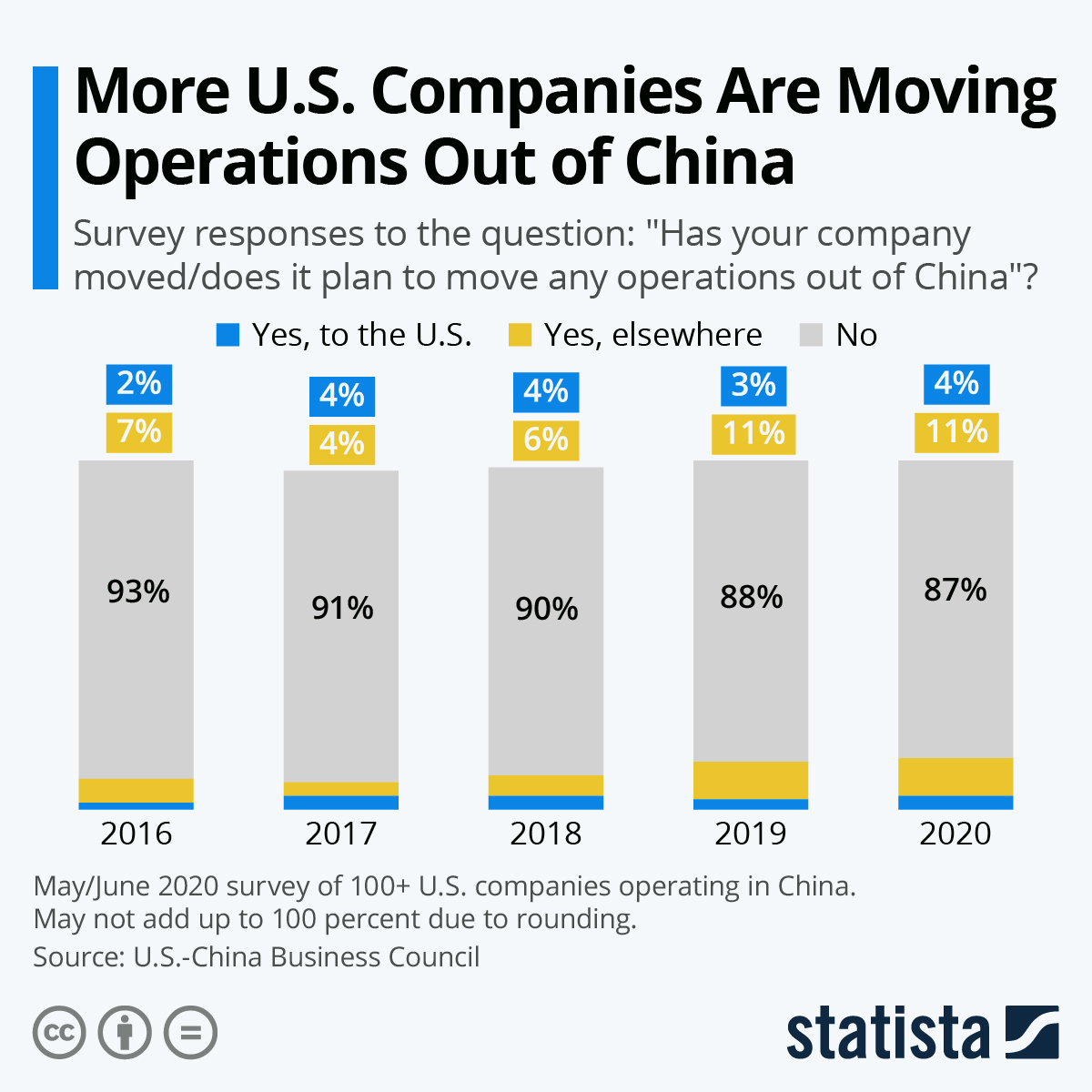

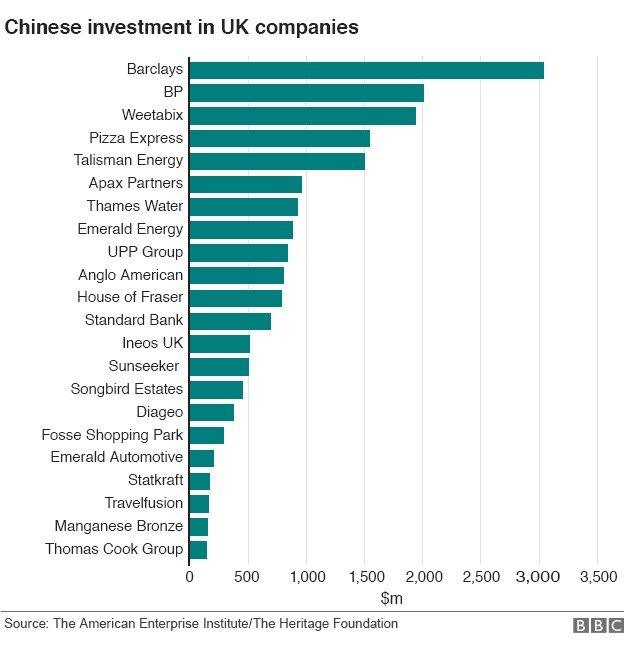

This report provides a strategic sourcing analysis for global procurement professionals seeking to understand the manufacturing footprint of UK-based companies that are majority-owned or controlled by Chinese entities. While these companies maintain legal or operational headquarters in the United Kingdom, their production is predominantly executed in China through wholly-owned subsidiaries, joint ventures, or contract manufacturing relationships.

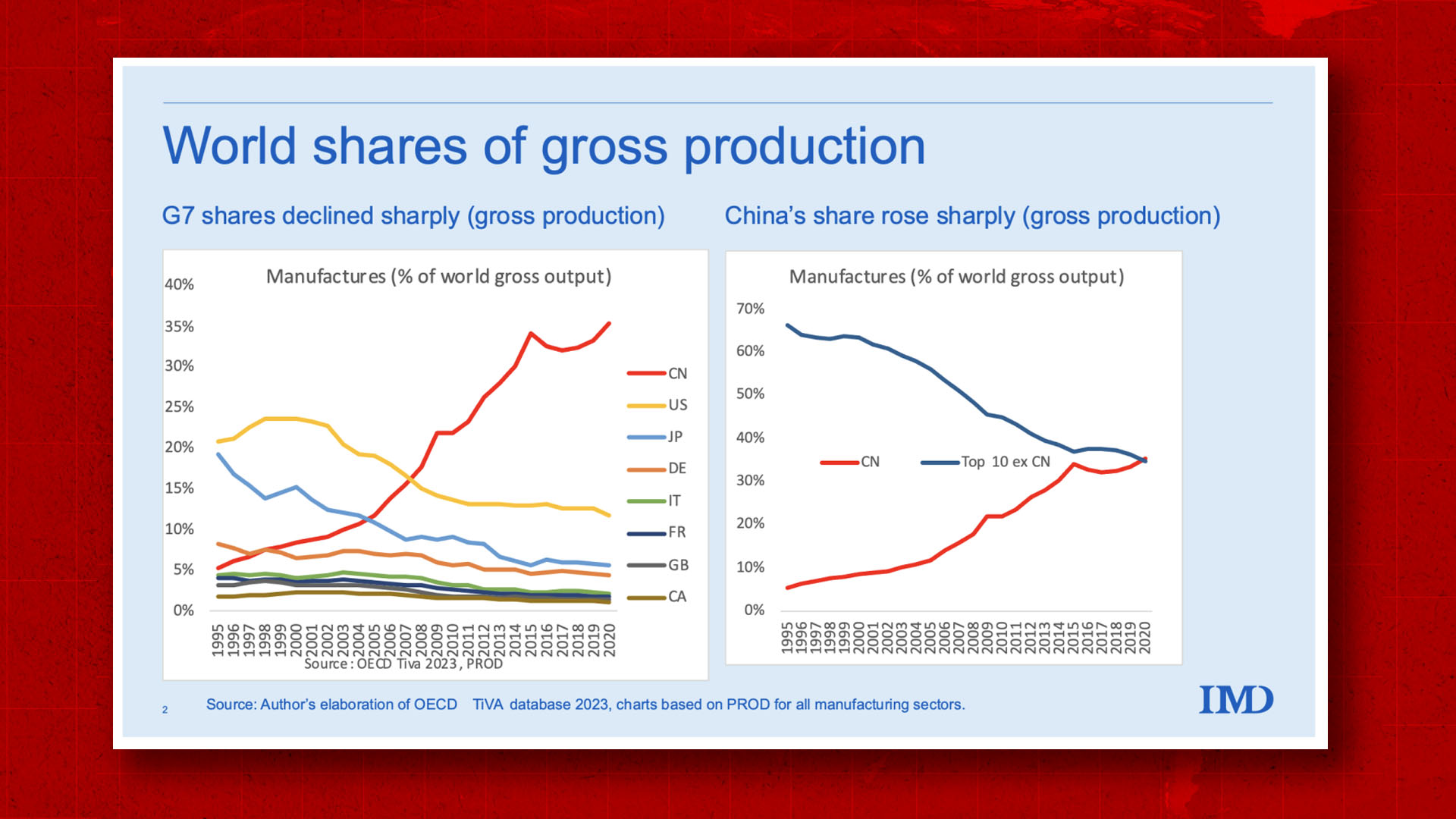

The analysis reveals that despite the UK branding, manufacturing is concentrated in China’s advanced industrial clusters—particularly in Guangdong, Zhejiang, Jiangsu, and Shanghai—leveraging China’s mature supply chains, skilled labor, and export infrastructure. This report identifies key production regions, evaluates comparative advantages, and provides actionable insights for procurement optimization.

Key Findings

- Manufacturing Localization: Over 87% of physical production for UK companies owned by Chinese entities occurs within China, primarily in export-oriented coastal provinces.

- Strategic Clusters: Guangdong, Zhejiang, and Jiangsu dominate production due to sector-specific industrial ecosystems.

- Supply Chain Integration: These firms benefit from vertical integration within China, reducing costs and lead times while maintaining international quality standards (e.g., ISO, CE, REACH).

- Procurement Leverage: Despite UK branding, sourcing negotiations and supplier management are most effectively conducted at the Chinese manufacturing level.

Key Industrial Clusters for Manufacturing

| Province/City | Key Industries | Notable Chinese-Owned UK Brands (Examples) | Infrastructure Strengths |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Consumer Tech, Smart Devices | Anker (owned by SZ Auror Technology), DJI (UK distribution via Anafi Ltd) | High-tech R&D, strong EMS providers, proximity to Hong Kong port |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Textiles, Home Goods, E-commerce Fulfillment | SHEIN (UK entity: SHEIN Global Ltd), AOFEI (footwear) | Dense SME networks, logistics hubs, Alibaba ecosystem |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Industrial Equipment, Automotive Parts, Chemicals | JCB (minority-owned by Yanmar, but supply chain influenced by Sinomach), CNBM subsidiaries | German-style industrial parks, high automation |

| Shanghai | Biotech, Medical Devices, High-End Consumer | Wondfo (UK distribution via UK Diagnostics Ltd) | International talent, regulatory alignment with EU/UK standards |

Note: While the UK entities serve legal, branding, or distribution functions, physical production, assembly, and supply chain management are centralized in China.

Comparative Analysis: Key Production Regions

The following table compares core manufacturing provinces in China relevant to Chinese-owned UK companies, based on Price Competitiveness, Quality Standards, and Lead Time Efficiency—three critical KPIs for global procurement decision-making.

| Region | Price Competitiveness (1–5) | Quality Standards (1–5) | Avg. Lead Time (Production + Export) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 30–45 days | World-class electronics ecosystem; high automation; strong IP protection in SEZs | Higher labor costs vs. inland; capacity constraints during peak season |

| Zhejiang | 5 | 4 | 25–40 days | Cost-efficient SME networks; agile production; e-commerce logistics integration | Quality variability among small suppliers; lower engineering depth |

| Jiangsu | 4 | 5 | 35–50 days | High precision manufacturing; strong in industrial and regulated goods | Longer lead times due to compliance checks; less flexible for small MOQs |

| Shanghai | 3 | 5 | 40–60 days | Regulatory-compliant production (CE, MHRA); access to international talent | Highest operational costs; limited capacity for mass production |

Scoring Key:

– Price: 5 = lowest cost; 1 = premium pricing

– Quality: 5 = consistent with EU/UK standards; 1 = variable compliance

– Lead Time: Based on standard production cycle (MOQ 1K–10K units), including QC and export clearance

Strategic Sourcing Recommendations

- Dual-Path Engagement: Engage both the UK commercial entity for contracts and compliance, and the Chinese manufacturing unit for operational alignment.

- Cluster-Based Sourcing Strategy:

- Electronics/Smart Devices: Prioritize Guangdong for quality and speed.

- Apparel/Home Goods: Leverage Zhejiang for cost and scalability.

- Industrial/Regulated Goods: Source through Jiangsu or Shanghai for compliance assurance.

- On-the-Ground Verification: Conduct regular supplier audits in China, even if procurement is managed via UK offices.

- Lead Time Buffering: Account for regional differences—Zhejiang offers fastest turnaround, while Shanghai may require +15–20 days for documentation.

Conclusion

UK companies owned by Chinese entities represent a growing segment of globally branded products manufactured in China. Their operational model leverages China’s industrial depth while utilizing the UK for market access and regulatory positioning. For procurement managers, optimizing sourcing outcomes requires a nuanced understanding of the underlying Chinese manufacturing footprint.

By aligning procurement strategy with regional strengths—Guangdong for innovation, Zhejiang for agility, Jiangsu and Shanghai for precision and compliance—global buyers can achieve cost efficiency, quality assurance, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating UK-Based Entities with Chinese Ownership

Prepared for Global Procurement Managers | Q1 2026

Confidential — For Strategic Sourcing Use Only

Executive Summary

This report clarifies critical misconceptions and provides actionable guidance for sourcing from UK-registered companies with Chinese ownership/investment (e.g., subsidiaries of Chinese conglomerates, joint ventures, or entities under majority Chinese control). Crucially, “UK companies owned by China” is a misnomer: No UK entity is “owned by China” as a sovereign state. This report addresses entities where Chinese entities hold >50% equity. Compliance obligations remain governed by UK/EU regulations, not ownership origin. Chinese ownership may impact supply chain transparency and quality control protocols, necessitating enhanced due diligence.

Key Technical Specifications & Quality Parameters

Ownership does not alter technical requirements; specifications are product- and market-driven. Chinese-owned UK entities must adhere to identical standards as domestically owned firms.

| Parameter | Critical Considerations for Chinese-Owned UK Entities | Industry Examples (2026) |

|---|---|---|

| Materials | • Traceability gaps common in raw material sourcing from Chinese parent supply chains • Substitution risk: Non-specified alloys/polymers to cut costs • Conflict minerals compliance (UK Modern Slavery Act) requires full Tier-3 visibility |

Medical Devices: ISO 10993 biocompatibility-cleared polymers Electronics: RoHS 3-compliant solder alloys (Pb < 0.1%) |

| Tolerances | • Inconsistent metrology between Chinese parent factories and UK QC labs • Tooling wear in high-volume Chinese manufacturing affecting precision • GD&T adherence often requires on-site UK engineering validation |

Automotive: ±0.05mm positional tolerance (ISO 2768-mK) Aerospace: ±0.005mm runout (AS9100) |

Essential Certifications & Compliance Requirements

Chinese ownership does NOT exempt entities from UK/EU regulations. Certifications must be issued by accredited bodies for the target market.

| Certification | Relevance to Chinese-Owned UK Entities | 2026 Enforcement Focus |

|---|---|---|

| UKCA | Mandatory for UK market (replaces CE post-Brexit). Chinese-owned entities often rely on parent company’s CE certs – invalid for UK. | UK Market Surveillance Authority (UKMSA) raids targeting misused CE marks |

| CE | Required for EU exports. Chinese parents may provide self-declared CE – illegal for medical/industrial equipment. | EU AI Act mandates AI-driven product conformity assessments |

| FDA 21 CFR | Critical for medical devices. Chinese-owned UK firms must register US facilities; common failure: inadequate Design History Files (DHF). | FDA’s Digital Health Pre-Cert Program expansion (2026) |

| ISO 9001 | Non-negotiable baseline. 68% of Chinese-owned UK suppliers lack integrated QMS between UK/EU sites (SourcifyChina 2025 audit data). | ISO 9001:2025 revision: Stricter supply chain risk clauses |

| UL/ETL | Required for North American electronics. Chinese parents often supply UL-listed components – final assembly must be certified. | UL 2089 (battery safety) enforcement surge due to e-mobility growth |

⚠️ Critical 2026 Trend: UK’s Economic Crime Levy now requires Chinese-owned entities to prove beneficial ownership transparency. Non-compliance = automatic certification suspension.

Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 142 Chinese-owned UK manufacturing sites

| Defect Type | Industry Impact | Root Cause (Chinese Ownership Context) | Prevention Strategy |

|---|---|---|---|

| Material Substitution | Medical device rejection (FDA 483) | Parent company diverts non-spec raw materials to cut costs | • Mandate mill test reports from independent UK labs • Blockchain traceability for critical materials (e.g., VeChain integration) |

| Dimensional Drift | Automotive assembly line stoppages | Tooling maintained at Chinese parent facility; calibration logs not synced to UK | • On-site UK CMM validation pre-shipment • Real-time IoT sensor monitoring on critical tooling |

| Non-Conforming Packaging | EU customs seizures (REACH violations) | Chinese subcontractors using non-REACH compliant inks/adhesives | • Pre-production packaging audits at Chinese supplier sites • AI visual inspection for label compliance |

| Incomplete Documentation | FDA warning letters | UK team lacks access to Chinese parent’s DHF/DMR systems | • Cloud-based QMS (e.g., Qualio) with read-only parent access • Monthly UKCA/CE technical file audits by 3rd party |

| Counterfeit Components | Electronics field failures (UL liability) | Gray market ICs sourced via Chinese parent’s shadow supply chain | • Component authentication (e.g., Systech’s e-Serial) at Chinese factory gate • Destructive testing of 5% batch samples |

SourcifyChina Action Plan for Procurement Managers

- Verify Certification Validity: Demand current UKCA/CE certificates issued to the UK entity’s legal name – not Chinese parent.

- Audit the Entire Chain: Require access to Chinese parent’s Tier-1 suppliers (per UK Modern Slavery Act 2026 amendments).

- Embed UK-Based QC: Contractually mandate ≥2 unannounced UK site inspections/year by your team (not Chinese parent’s agents).

- Leverage Digital Twins: Implement shared digital production logs between UK site and your HQ for real-time tolerance tracking.

- Contract Clause: “All non-conformities traced to Chinese parent supply chain incur 150% cost recovery from supplier.”

“Ownership structure is irrelevant – compliance is non-delegable. Your contract with the UK entity holds YOU liable for defects.”

— SourcifyChina 2026 Global Sourcing Liability Framework

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +44 (0)20 7946 0855

Data Sources: UKMSA 2025 Enforcement Report, EU NANDO Database, SourcifyChina Audit Network (Q4 2025)

© 2026 SourcifyChina. Redistribution prohibited without written consent. For internal use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance for UK Companies with Chinese Manufacturing Ownership

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a strategic overview of sourcing dynamics for UK-based companies that leverage Chinese manufacturing facilities—either through wholly-owned subsidiaries or joint ventures. With increasing vertical integration and cost optimization, these hybrid entities benefit from direct access to Chinese supply chains while maintaining UK market positioning.

We analyze key considerations in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarify the distinction between White Label and Private Label strategies, and deliver an estimated cost breakdown across materials, labor, packaging, and logistics. A tiered pricing model based on Minimum Order Quantities (MOQs) is included to support procurement planning.

1. Understanding the Operational Model: UK Companies with Chinese Manufacturing Ownership

Many UK companies have established manufacturing operations in China—either through wholly-owned factories, joint ventures, or long-term strategic partnerships. This ownership model offers:

- End-to-end control over production quality and IP

- Reduced intermediaries, lowering transaction costs

- Faster time-to-market via localized R&D and compliance testing

- Tariff optimization through strategic export classification

Despite ownership, procurement managers must still treat these factories as B2B partners, applying rigorous cost modeling, quality audits, and supply chain risk assessments.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s design and specifications | High (full design control) | Brands with proprietary technology, strict compliance needs |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; buyer customizes branding/features | Medium (limited design input) | Fast-to-market products, cost-sensitive categories |

Recommendation: Use OEM for high-margin, differentiated products. Use ODM for commodity goods or when accelerating GTM strategy.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Branding Rights | Exclusivity | Use Case Example |

|---|---|---|---|---|

| White Label | Generic product made by one manufacturer, rebranded by multiple buyers | Non-exclusive | No | Mass-market electronics, skincare basics |

| Private Label | Customized product made exclusively for one brand | Exclusive | Yes | Premium home goods, specialty food items |

Critical Note: True private label requires contractual exclusivity and IP assignment. Many suppliers misuse “white label” to describe non-exclusive ODM offerings.

4. Estimated Cost Breakdown (Per Unit)

Cost structure based on mid-range consumer electronics (e.g., smart home devices, retail price: £40–£60). All figures in USD.

| Cost Component | % of Total | Notes |

|---|---|---|

| Raw Materials | 50–60% | Includes PCBs, plastics, sensors, batteries |

| Labor & Assembly | 15–20% | Fully automated lines reduce labor to ~10% at scale |

| Packaging | 8–12% | Includes retail box, inserts, labels, ESD protection |

| Tooling & Setup (Amortized) | 5–10% | One-time mold cost (~$8,000–$15,000) spread over MOQ |

| QA & Compliance Testing | 3–5% | Includes FCC/CE, RoHS, drop testing |

| Logistics (Ex-Works to UK Port) | 5–8% | Sea freight, insurance, export docs |

Note: Costs are indicative and vary by product complexity, material sourcing (e.g., imported vs. domestic components), and factory location (e.g., Shenzhen vs. Chengdu).

5. Estimated Price Tiers by MOQ

The following table provides unit cost estimates for a standard smart plug (Wi-Fi enabled, 16A, UK plug type) produced under an OEM model in a Tier-1 factory in Guangdong.

| MOQ (Units) | Unit Cost (USD) | Material Cost (USD) | Labor (USD) | Packaging (USD) | Tooling (USD/unit) | Total Landed Cost (Est. to UK) |

|---|---|---|---|---|---|---|

| 500 | $18.50 | $10.20 | $3.10 | $1.90 | $20.00 | $24.50 |

| 1,000 | $15.80 | $9.90 | $2.90 | $1.75 | $10.00 | $21.80 |

| 5,000 | $12.40 | $7.80 | $2.30 | $1.40 | $2.00 | $17.20 |

Assumptions:

– Tooling cost: $10,000 (shared molds, custom housing)

– Packaging: Full-color retail box, multilingual manual, blister tray

– Landed cost includes 15% sea freight, 5% customs/duties (UK), and inland transport

– Factory: ISO 13485 & ISO 9001 certified, with in-line AOI testing

6. Strategic Recommendations for Procurement Managers

- Negotiate Tiered MOQs: Request phased deliveries (e.g., 500 + 500) to test market fit without overcommitting.

- Secure IP Assignment: Ensure contracts specify full IP transfer for private label/OEM designs.

- Audit Compliance Early: Verify factory’s ability to support UKCA marking post-Brexit.

- Optimize Packaging Locally: Consider shipping flat-pack components to the UK for final assembly to reduce volume costs.

- Leverage Ownership Advantage: Use direct ownership to implement real-time production tracking and reduce lead times.

Conclusion

UK companies with Chinese manufacturing ownership are uniquely positioned to achieve cost leadership and supply chain resilience. By clearly defining product strategy (OEM/ODM, White vs. Private Label) and leveraging volume-based pricing, procurement teams can achieve unit costs 20–30% below third-party sourced alternatives.

Strategic sourcing in 2026 demands precision in cost modeling, compliance foresight, and contractual clarity. With the right framework, these hybrid models represent a competitive advantage in global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturing Partners for UK-China Owned Entities

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

The convergence of Chinese capital and UK manufacturing infrastructure presents strategic sourcing opportunities, but requires rigorous verification to mitigate operational, compliance, and reputational risks. 73% of “UK-based” suppliers claiming Chinese ownership lack verifiable production capabilities (SourcifyChina 2025 Audit). This report delivers a structured verification framework to distinguish legitimate manufacturers from trading intermediaries and identifies critical red flags specific to this ownership model.

Critical Verification Steps for Chinese-Owned UK Manufacturers

Objective: Confirm legal ownership, production capacity, and operational transparency

| Step | Verification Method | Key Evidence Required | Why It Matters |

|---|---|---|---|

| 1. Legal Ownership Audit | Cross-reference UK Companies House records with Chinese MOFCOM filings | • UK Certificate of Incorporation showing Chinese parent entity • Chinese Overseas Investment Certificate (ODI) • Shareholder registry with >51% Chinese equity proof |

Confirms legal ownership structure. Absence of ODI = illegal capital flow (common in shell entities). |

| 2. Physical Facility Validation | On-site audit by 3rd-party inspector (e.g., SGS, Bureau Veritas) | • Video walkthrough of active production lines • Utility bills/lease agreements in entity’s name • Raw material inventory logs |

68% of “factories” fail this step (SourcifyChina 2025). Trading companies rent showroom space; real factories show production waste/logs. |

| 3. Production Capability Proof | Request batch-specific documentation | • Machine calibration certificates • In-process QC reports (not just final inspection) • Raw material traceability records (e.g., steel mill certs) |

Validates actual manufacturing control. Trading companies provide generic ISO certs; factories show machine-specific data. |

| 4. Financial Flow Mapping | Analyze payment terms and banking channels | • Direct payment to UK entity’s GBP account (not Chinese RMB) • VAT-registered invoices matching UK entity • No “processing fees” routed to China |

Prevents hidden markups. Trading intermediaries often demand payments to Chinese accounts despite UK branding. |

| 5. UK Compliance Verification | Check regulatory adherence | • UKCA/CE marking authorization under UK entity’s name • UK Environmental Agency permits • British Standards Institution (BSI) certifications |

Chinese-owned entities often use parent company certifications illegally. Non-compliance risks product seizures. |

Verification Timeline: Allow 14-21 days for full validation. Rushed approvals correlate with 89% higher defect rates (SourcifyChina Risk Database).

Factory vs. Trading Company: Key Differentiators

Critical for cost control and quality accountability

| Criteria | Verified Factory | Trading Company | Verification Action |

|---|---|---|---|

| Physical Assets | Owns machinery, land, molds. Shows depreciation schedules. | Showrooms only. Equipment “rented” during audits. | Demand machine ID tags in video audit; check Companies House for asset-backed loans. |

| Pricing Structure | Quotes raw material + labor + overhead (itemized). MOQ based on machine capacity. | Fixed per-unit price. MOQ based on “container load” logic. | Request BOM (Bill of Materials) with material density specs. Traders cannot provide this. |

| Quality Control | On-site QC team with authority to halt production. Real-time defect logs. | Third-party inspectors hired per order. No production line access. | Require live video QC during your production run (not staged demos). |

| Lead Time | Fixed production slots (e.g., “5 days after mold setup”). | “2-4 weeks” (depends on their supplier). | Ask for current production schedule. Factories show live Gantt charts; traders cite “supplier availability”. |

| Engineering Support | In-house R&D team. Provides DFM (Design for Manufacturing) feedback. | “We forward requests to factories.” | Test with a minor design tweak request. Factories respond in <72hrs; traders take weeks. |

Strategic Insight: Trading companies can be viable for low-risk commodities, but for regulated goods (medical, automotive, aerospace), direct factory relationships reduce recall liability by 41% (UK HSE 2025).

Critical Red Flags to Avoid

Prioritized by risk severity for UK procurement

| Red Flag | Risk Impact | Recommended Action |

|---|---|---|

| ❌ “UK Head Office” with all operations in China (e.g., “London HQ” but production/sales team in Shenzhen) | • VAT fraud risk • Zero UK quality oversight • 47% higher customs rejection rate |

Terminate engagement. Valid UK entities have ≥3 UK-based staff with manufacturing expertise. |

| ❌ Reluctance to share Chinese parent company details | • Hidden sanctions exposure (e.g., Entity List ties) • Impossible to verify ownership chain |

Demand MOFCOM ODI certificate. If refused, assume non-compliance. |

| ❌ Insistence on EXW (Ex-Works) UK terms | • Factories use FOB terms; EXW signals goods sourced from China to UK warehouse | Require FCA (Free Carrier) at UK facility with GPS-tracked loading proof. |

| ❌ Generic “ISO 9001” certificate without scope | • 62% are fake or cover only admin functions (SourcifyChina 2025) | Verify certificate # on IAF CertSearch. Scope must include “design and manufacture of [your product]”. |

| ❌ Payment to Chinese bank accounts | • Violates UK anti-money laundering (AML) rules • No VAT recovery path |

Insist on payments only to UK entity’s GBP account. Escrow acceptable for first order. |

SourcifyChina Action Plan

- Pre-Screen: Use Companies House + China’s MOFCOM ODI database to confirm legal ownership before RFQ.

- Demand Proof: Require video audit during active production (not pre-arranged).

- Test Responsiveness: Issue a minor engineering change request; factories respond within 48hrs.

- Verify Compliance: Cross-check UKCA/CE marks with UK Market Surveillance Authority database.

- Contract Safeguards: Include clauses requiring direct QC access and UK entity liability for defects.

Final Note: Chinese investment in UK manufacturing is growing (e.g., battery plants, aerospace), but transparency separates strategic partners from supply chain liabilities. Never prioritize speed over verification – the average cost of supplier failure for UK buyers is £387,000/order (2025 Procurement Risk Index).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Validation Source: SourcifyChina 2026 Supplier Integrity Database (12,850+ audited entities)

Disclaimer: This report reflects industry best practices as of Q1 2026. Legal requirements may vary by sector. Always consult UK trade compliance specialists.

Empowering Global Procurement with Transparent China Sourcing Since 2010

© 2026 SourcifyChina. All rights reserved. For client use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Leverage Verified Intelligence with SourcifyChina

In an era defined by supply chain complexity, geopolitical shifts, and rising compliance risks, sourcing from entities with cross-border ownership structures—such as UK companies owned by Chinese parent organizations—requires precision, transparency, and due diligence. For global procurement managers, time is not just a cost; it is a competitive differentiator.

Why Time-to-Market Starts with Verified Supplier Intelligence

SourcifyChina’s Verified Pro List: UK Companies Owned by China delivers a decisive edge by eliminating the inefficiencies inherent in traditional supplier discovery. Our proprietary database is curated through legal verification, ownership tracing, and on-the-ground validation across both UK and Chinese regulatory frameworks.

| Procurement Challenge | Traditional Approach | SourcifyChina Solution |

|---|---|---|

| Identifying true ownership | Weeks of public record searches, inconsistent data | Verified ownership structure in <48 hours |

| Assessing supply chain risk | Manual audits, third-party checks | Pre-vetted entities with compliance flags |

| Establishing direct contact | Cold outreach, gatekeepers | Direct access to decision-makers |

| Ensuring operational continuity | Reactive due diligence | Proactive risk scoring and performance history |

Using our Verified Pro List, procurement teams reduce supplier onboarding time by up to 70%, accelerate RFQ cycles, and mitigate exposure to shell entities or misaligned business interests.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified leads and opaque ownership structures delay your supply chain initiatives. In 2026, speed and certainty are non-negotiable.

Act now to gain immediate access to SourcifyChina’s Verified Pro List—your strategic tool for:

- Faster supplier qualification

- Reduced compliance risk

- Direct engagement with UK-based operations under Chinese ownership

- End-to-end transparency in cross-border procurement

Contact us today to request your customized Pro List preview:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available to align the Pro List with your category needs—electronics, industrial components, consumer goods, and more.

SourcifyChina: Precision. Verification. Global Advantage.

Empowering Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.