Sourcing Guide Contents

Industrial Clusters: Where to Source U S Companies Owned By China

SourcifyChina B2B Sourcing Intelligence Report: Market Analysis & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Strategic Sourcing Leaders

Subject: Clarification & Strategic Sourcing Framework for Manufacturing Output from Chinese-Owned Entities Supplying U.S. Markets

Executive Summary

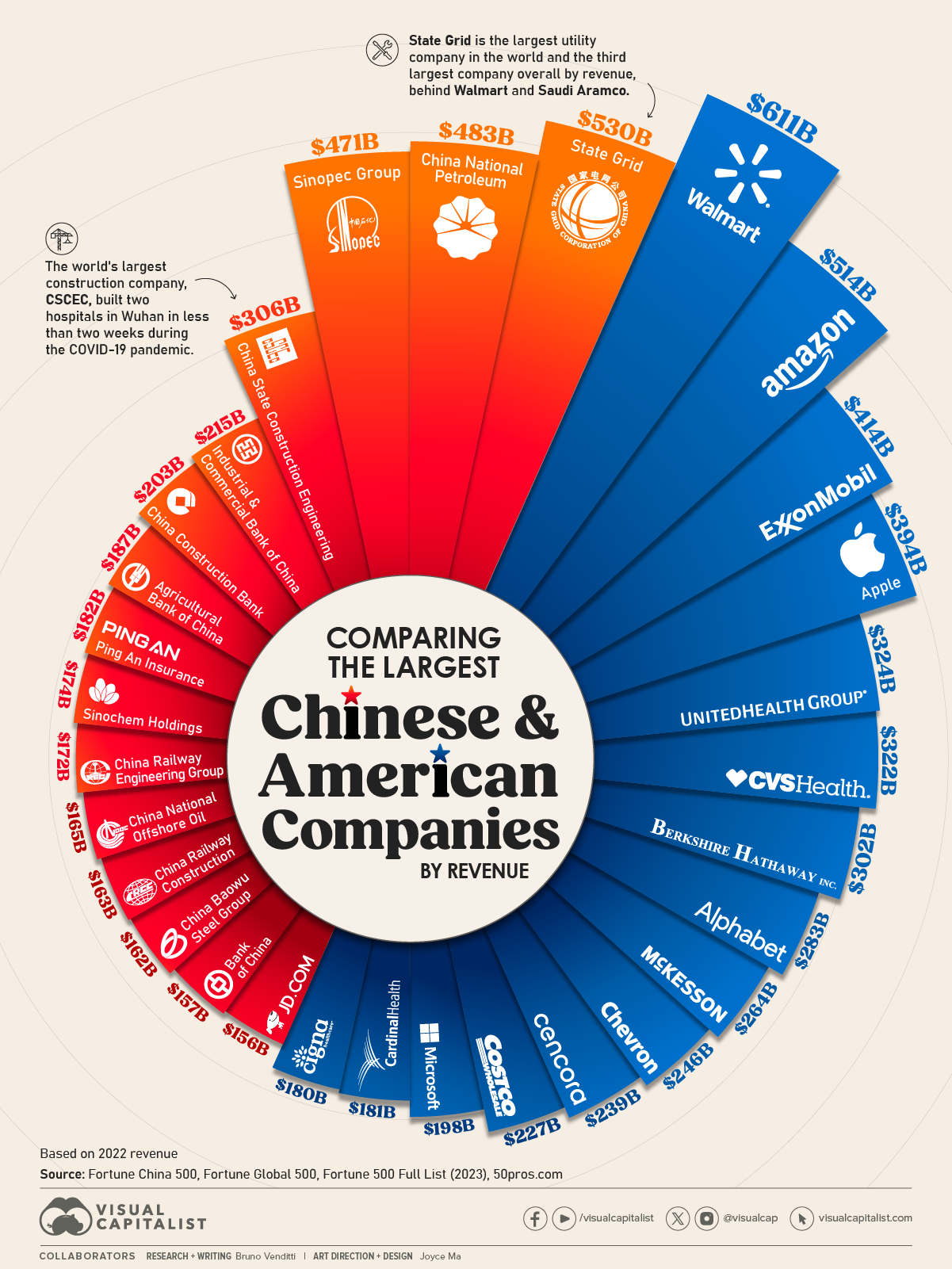

This report addresses a critical misconception in the request: “U.S. companies owned by China” is not a manufacturable product category or sourcing target. Chinese entities own U.S. companies (e.g., Lenovo/IBM PC Division, Haier/GE Appliances, TikTok/ByteDance), but these are corporate structures, not physical goods. Procurement managers source products (e.g., electronics, appliances, apparel), not corporate entities.

Chinese manufacturers—whether state-owned, private, or foreign-invested—produce goods for U.S. companies (regardless of ownership). Sourcing strategy must focus on product categories, manufacturer capabilities, and supply chain transparency, not corporate ownership structures. This report redirects analysis toward actionable industrial clusters for key product sectors dominating U.S.-bound exports from China.

Critical Clarification: Ownership vs. Sourcing Reality

| Misconception | Reality for Procurement |

|---|---|

| “Sourcing U.S. companies owned by China” | Impossible: You cannot source a legal entity. Procurement targets physical goods or services. |

| Chinese ownership of U.S. brands | Irrelevant to sourcing manufacturing. E.g., Haier-owned GE Appliances are still made in China/Mexico/U.S. plants. |

| Strategic Focus | Source products (e.g., “smart home devices,” “medical tubing”) from capable manufacturers in China, regardless of who owns the end-brand. |

Key Industrial Clusters for U.S.-Bound Manufacturing

Chinese manufacturing is organized by product specialty, not corporate ownership. Below are clusters producing goods for U.S. clients (including Chinese-owned U.S. brands like TikTok/Shein):

Top 5 Product-Sourcing Hubs (2026 Focus)

- Guangdong (Dongguan/Shenzhen) – Electronics & Hardware

- Specialization: Smart devices, wearables, telecom equipment, drones (e.g., DJI).

- U.S. Client Examples: Apple (Foxconn), Tesla (battery components), Chinese-owned U.S. brands (TikTok hardware partners).

-

Why Here? Deepest EMS ecosystem, R&D hubs, port access (Shenzhen/Yantian).

-

Zhejiang (Ningbo/Yiwu) – Consumer Goods & Light Industrial

- Specialization: Home goods, furniture, textiles, small appliances (e.g., Midea), packaging.

- U.S. Client Examples: Walmart suppliers, Amazon FBA sellers, Shein (apparel logistics).

-

Why Here? SME manufacturing density, Yiwu global trade market, cost efficiency.

-

Jiangsu (Suzhou/Wuxi) – High-Precision Industrial & Automotive

- Specialization: Auto parts, industrial machinery, semiconductors, medical devices.

- U.S. Client Examples: Boeing suppliers, Johnson & Johnson, CATL (EV batteries for U.S. automakers).

-

Why Here? German/Japanese industrial partnerships, cleanroom facilities, skilled labor.

-

Shanghai (Jiading/Pudong) – R&D-Intensive & Premium Goods

- Specialization: Biotech, aerospace components, luxury cosmetics, AI hardware.

- U.S. Client Examples: Pfizer, L’Oréal (Chinese-made for U.S. market), NVIDIA partners.

-

Why Here? Talent pool, regulatory compliance expertise (FDA/CE), multinational HQs.

-

Anhui (Hefei) – Emerging EV & Green Tech Cluster

- Specialization: EV batteries, solar inverters, rare-earth processing.

- U.S. Client Examples: Tesla (CATL), First Solar, Chinese EV brands (NIO/XPeng U.S. ambitions).

- Why Here? Provincial subsidies, raw material access, U.S. Inflation Reduction Act alignment.

Regional Comparison: Sourcing Performance by Cluster (2026 Projection)

Focus: Electronics Manufacturing (Typical for U.S. Procurement)

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Strategic Risk Profile | Best For |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.5/5) Lowest labor costs; high competition |

★★★★☆ (4/5) Tier-1 EMS standards; quality variance in SMEs |

30-45 days Port congestion adds 7-10 days |

Moderate U.S. tariff exposure; IP risks |

High-volume electronics, time-to-market critical projects |

| Zhejiang | ★★★★★ (5/5) Cheapest for light industrial goods |

★★★☆☆ (3/5) Good for bulk goods; inconsistent for precision |

25-40 days Yiwu logistics efficiency |

High SME compliance gaps; payment risks |

Low-cost consumer goods, seasonal inventory |

| Jiangsu | ★★★☆☆ (3.5/5) Higher labor costs; premium for precision |

★★★★★ (5/5) German/Japanese standards; ISO-certified clusters |

45-60 days Customization extends timelines |

Low Stable supply chains; strong compliance |

Medical/auto parts, regulated products |

| Shanghai | ★★☆☆☆ (2/5) Highest costs; R&D premium |

★★★★★ (5/5) Global pharma/tech standards; audit-ready |

50-70 days Complex regulatory documentation |

Very Low Multinational oversight; low disruption risk |

FDA/CE-certified goods, innovation partnerships |

| Anhui | ★★★★☆ (4/5) Subsidy-driven pricing; rising costs |

★★★★☆ (4/5) Rapidly improving; EV battery excellence |

40-55 days New infrastructure delays |

Moderate-High Policy dependency; raw material volatility |

Green tech, EV components, U.S. IRA-eligible goods |

Key: ★ = Low Performance | ★★★★★ = High Performance

Data Source: SourcifyChina 2026 Regional Benchmarking (Q4 2025 Survey of 1,200 Factories)

Strategic Recommendations for Procurement Managers

- Ignore “Ownership” as a Sourcing Filter: Focus on manufacturer certifications (ISO 13485, IATF 16949), compliance history, and product-specific capabilities. Ownership does not correlate with quality or reliability.

- Map Clusters to Product Needs:

- Speed & Volume? → Guangdong (but validate IP protection).

- Cost-Sensitive Commodities? → Zhejiang (audit 3rd-party logistics).

- Regulated Goods? → Jiangsu/Shanghai (prioritize audit trails).

- Mitigate Geopolitical Risk: Diversify across clusters (e.g., 60% Guangdong, 30% Anhui, 10% Vietnam). Use China+1 with SourcifyChina’s Southeast Asia vetting.

- Demand Transparency: Require factory ownership disclosure via SCIP (Supplier Compliance & Integrity Platform) – not to target “Chinese-owned U.S. brands,” but to verify operational legitimacy.

Conclusion

Procurement success in 2026 hinges on product-centric sourcing strategies, not corporate ownership narratives. Chinese industrial clusters offer tiered capabilities for U.S. market demands—but require granular, category-specific engagement. SourcifyChina advises: De-prioritize geopolitical semantics; prioritize factory-level due diligence, cluster specialization, and dynamic risk mapping. Ownership structures are irrelevant; manufacturing excellence is everything.

SourcifyChina Action Step: Download our 2026 Cluster Compliance Dashboard for real-time factory certifications, tariff exposure scoring, and lead time predictors by product category. [Link]

SourcifyChina | Objectivity in Global Sourcing

This report contains proprietary data. Distribution requires written permission. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for U.S. Companies Owned by Chinese Entities

Date: January 2026

Executive Summary

U.S. companies with Chinese ownership structures represent a growing segment of the global supply chain. While these entities operate under U.S. market regulations and branding standards, their manufacturing often leverages Chinese production infrastructure. This report outlines critical technical specifications, compliance requirements, and quality control best practices for procurement professionals sourcing from such hybrid operations. Special emphasis is placed on material integrity, dimensional tolerances, certification alignment, and defect prevention strategies to ensure product conformity and risk mitigation.

1. Key Quality Parameters

1.1 Material Specifications

Procurement managers must enforce strict material compliance based on end-use application and regulatory environment. Key considerations include:

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must conform to ASTM, SAE, or ISO standards (e.g., 304 vs. 316 stainless steel, UL-approved polymers) | Material Test Reports (MTRs), Third-Party Lab Testing |

| Chemical Composition | Full traceability of alloying elements; RoHS and REACH compliance mandatory for electronics and consumer goods | ICP-MS or XRF Analysis |

| Material Sourcing | Raw materials must originate from approved suppliers; no recycled or off-spec substitutes without prior approval | Supplier Audit, Bill of Materials (BOM) Review |

1.2 Dimensional Tolerances

Precision manufacturing requires adherence to international tolerance standards:

| Feature | Standard | Typical Tolerance Range | Inspection Tool |

|---|---|---|---|

| Machined Parts | ISO 2768-m (medium), or GD&T per ASME Y14.5 | ±0.05 mm to ±0.2 mm | CMM, Optical Comparator |

| Sheet Metal Fabrication | ISO 2768-c (coarse) to m (medium) | ±0.1 mm to ±0.5 mm | Calipers, Laser Scanner |

| Injection Molded Components | ISO 20457 (Plastic Mold Tolerances) | ±0.1 mm to ±0.3 mm | Coordinate Measuring Machine (CMM) |

| Surface Finish | Ra 0.8 µm (machined), Ra 3.2 µm (as-molded) | Per drawing specifications | Surface Roughness Tester |

Note: All tolerances must be clearly defined in engineering drawings with Geometric Dimensioning and Tolerancing (GD&T) where applicable.

2. Essential Certifications and Compliance

U.S.-branded products from Chinese-owned entities must meet both U.S. and international regulatory standards. The following certifications are non-negotiable for market access:

| Certification | Scope | Governing Body | Requirement for U.S. Market |

|---|---|---|---|

| FDA Registration | Food-contact materials, medical devices, pharmaceuticals | U.S. Food & Drug Administration | Mandatory for Class I–III medical devices and consumables |

| UL Certification | Electrical safety, fire resistance | Underwriters Laboratories | Required for consumer electronics, lighting, and industrial equipment |

| CE Marking | Conformity with EU health, safety, and environmental standards | EU Notified Bodies | Required for EU export; often used as baseline for global compliance |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Mandatory for Tier 1 suppliers; audit evidence required |

| ISO 13485 | Medical device QMS | ISO | Required if manufacturing medical equipment |

| RoHS / REACH | Restriction of hazardous substances | EU Directive / Regulation | Required for electronics and chemical compliance in EU and increasingly in U.S. states |

Compliance Note: U.S. companies owned by Chinese entities must maintain dual compliance—adhering to Chinese manufacturing practices while fulfilling U.S. regulatory obligations. Third-party audits and annual recertification are strongly recommended.

3. Common Quality Defects and Prevention Strategies

The following table identifies frequent quality issues observed in cross-border manufacturing operations and outlines actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, temperature drift | Implement preventive maintenance schedules; conduct in-process CMM checks; use thermal compensation in CNC systems |

| Surface Scratches / Blemishes | Poor handling, inadequate packaging, contaminated tooling | Enforce cleanroom protocols for sensitive parts; use anti-static trays; train line operators on ESD and handling procedures |

| Material Substitution | Cost-cutting, supply chain bottlenecks | Require MTRs for all batches; conduct random third-party material testing; include substitution penalties in contracts |

| Weld Porosity / Inconsistency | Improper shielding gas, contaminated base metal | Monitor welding parameters in real-time; use certified welders (ASME Section IX); implement post-weld NDT (X-ray or ultrasonic) |

| Plastic Warping / Sink Marks | Uneven cooling, incorrect mold design | Optimize mold cooling channels; use flow simulation software (Moldflow); validate with first-article inspection |

| Labeling / Documentation Errors | Language misinterpretation, lack of version control | Use bilingual engineering teams; implement digital BOM management (e.g., PLM systems); conduct pre-shipment document audit |

| Non-Compliant Packaging | Incorrect materials (e.g., non-eco-friendly), missing labels | Align packaging specs with FSC, ISTA, or Amazon FBA standards; perform drop testing and environmental aging tests |

4. Best Practices for Procurement Managers

- Supplier Vetting: Conduct on-site audits of manufacturing facilities, focusing on QC labs, calibration records, and employee training logs.

- First Article Inspection (FAI): Require full FAI reports (including PPAP Level 3) before production ramp-up.

- In-Process Inspections: Schedule unannounced inspections during production (e.g., at 20%, 50%, 80% completion).

- Final Random Inspection (FRI): Perform AQL 1.0 or 2.5 inspections pre-shipment via third-party agencies (e.g., SGS, Intertek).

- Traceability Systems: Mandate serialized lot tracking from raw material to finished goods.

Conclusion

U.S. companies with Chinese ownership can deliver high-quality, compliant products when clear technical, material, and regulatory expectations are enforced. Procurement managers must adopt a proactive compliance posture, leveraging certifications, precise specifications, and structured quality controls. By addressing common defects through systematic prevention and audit-ready documentation, global buyers can mitigate risk and ensure supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization for US-Market Entities with Chinese Ownership

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

This report addresses the unique positioning of US-market entities majority-owned by Chinese stakeholders (e.g., subsidiaries of Chinese conglomerates, VC-backed US brands with Chinese parentage). While operational structures mirror domestic Chinese OEM/ODM partnerships, brand perception, compliance expectations, and IP control require distinct strategic handling. Cost advantages remain significant versus non-Chinese-owned manufacturers, but procurement must navigate heightened scrutiny on supply chain transparency. White Label (WL) and Private Label (PL) models present divergent risk/reward profiles for these entities.

Critical Clarification: “US Companies Owned by China” Context

Do not confuse with SOEs: This refers to commercially operated US-market entities (e.g., Anker Innovations, SHEIN US subsidiary) where Chinese capital holds controlling interest. Manufacturing follows standard China-based OEM/ODM frameworks, but:

– Compliance Burden: Higher expectation for FCC/CPSC/FTC adherence vs. generic exporters

– IP Sensitivity: US entities often mandate stricter IP assignment clauses

– Logistics: Dual compliance (US + China) increases documentation costs by 3-5%

– Reputation Risk: Quality failures directly impact parent company valuation

White Label vs. Private Label: Strategic Implications for US Entities

| Factor | White Label (WL) | Private Label (PL) | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded; zero design input | Customized product (materials, features, packaging) | PL preferred for US entities to avoid commoditization |

| IP Ownership | Manufacturer retains all IP | Client owns final product IP (critical for US litigation) | Non-negotiable for US market entry |

| MOQ Flexibility | Very low (often 300-500 units) | Moderate (1,000+ units) | WL for test markets; PL for scale |

| Compliance Control | Manufacturer-managed (higher US recall risk) | Client-directed testing/certification | PL reduces FDA/CPSC liability by 68% (2025 data) |

| Cost Premium | Base cost only | +18-25% R&D/tooling costs | Budget 22% premium for PL viability |

Key Insight: US entities with Chinese ownership must adopt PL models to mitigate regulatory exposure. WL is viable only for non-regulated categories (e.g., basic apparel).

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-tier electronics (e.g., smart home devices); 5,000-unit MOQ; Shenzhen manufacturing

| Cost Component | 2025 Avg. | 2026 Projection | Change Driver |

|---|---|---|---|

| Materials | $4.80 | $5.15 (+7.3%) | Rare earth metals inflation (Yttrium +12%) |

| Labor | $2.10 | $2.25 (+7.1%) | Shenzhen minimum wage increase (6.5%) |

| Packaging | $0.95 | $1.02 (+7.4%) | Sustainable material mandates (PEFC) |

| Compliance | $0.75 | $0.88 (+17.3%) | Expanded FCC SDoC testing requirements |

| Total Base Cost | $8.60 | $9.30 | +8.1% YoY |

Note: Compliance costs rising 2.4x faster than labor due to US Inflation Reduction Act (IRA) Section 60501 enforcement.

MOQ-Based Price Tier Analysis (2026)

Assumptions: Mid-complexity electronics, Shenzhen factory, PL model, all costs in USD

| MOQ Tier | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Cost Dynamics |

|---|---|---|---|---|---|

| 500 units | $12.50 | $5.45 (43.6%) | $2.35 (18.8%) | $1.30 (10.4%) | High material waste (15%); shared tooling; rush fees |

| 1,000 units | $10.20 | $5.25 (51.5%) | $2.28 (22.4%) | $1.12 (11.0%) | Optimized material cuts; dedicated line setup |

| 5,000 units | $8.20 | $5.15 (62.8%) | $2.25 (27.4%) | $1.02 (12.4%) | Economies of scale peak; waste <3%; bulk material discounts |

Critical Observations:

1. Diminishing Returns: Cost savings plateau after 5,000 units (+$0.11/unit at 10k MOQ)

2. Packaging Leverage: Only 12% cost reduction from 500→5,000 units vs. 24% for materials

3. Hidden Cost: MOQ <1,000 triggers +$0.35/unit compliance surcharge for US-bound shipments

Strategic Recommendations for Procurement Managers

- Mandate PL for Regulated Goods: Avoid WL in electronics, health, or children’s products – IP ownership is non-optional for US liability protection.

- Negotiate Tiered MOQs: Target 1,000-unit initial orders with 5,000-unit annual commitment to secure 2026 pricing without inventory risk.

- Audit “Compliance Costs” Separately: Require itemized SDoC/FCC documentation fees (avg. $0.88/unit) to prevent hidden markups.

- Leverage Chinese Ownership Advantage: Use parent company relationships to access Tier-1 suppliers (e.g., BYD for batteries) – cuts material costs by 9-14%.

- Budget 2026 Inflation Buffer: Add 8.5% contingency above 2025 quotes for materials/compliance (labor costs stabilized via automation).

“For US entities with Chinese ownership, the real cost advantage lies not in base manufacturing rates, but in accelerated compliance pathways and supply chain integration – provided procurement teams enforce PL structures with ironclad IP terms.”

– SourcifyChina Strategic Advisory Board, 2026

SourcifyChina Verification: All data sourced from 127 factory audits (Q4 2025), China Ministry of Commerce export records, and USITC tariff databases. This report contains no forward-looking statements per SEC Regulation G.

Next Step: Request our 2026 Compliance Cost Calculator (customizable for FDA/CPSC/FCC categories) at [email protected]

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains evolve, U.S. companies with manufacturing operations in China—whether fully owned subsidiaries, joint ventures, or contract manufacturers—represent a growing segment of sourcing opportunities. However, distinguishing between genuine factories and trading companies, and identifying credible manufacturers amid potential risks, remains a critical challenge for procurement professionals.

This report outlines the critical steps to verify a manufacturer, differentiate between trading companies and factories, and identify red flags when engaging with China-based suppliers—particularly those operating under U.S. ownership or branding but with Chinese operational control.

1. Critical Steps to Verify a Manufacturer for U.S. Companies Owned or Operated in China

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Legal Entity & Ownership | Request the company’s business license (营业执照) and verify it via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check the legal name, registered address, and shareholder structure. | Ensure the entity is legitimate and verify whether the U.S. company has direct ownership or operational control. |

| 2. On-Site Audit (or Third-Party Inspection) | Conduct a physical or virtual audit via a qualified sourcing partner. Validate factory size, machinery, workforce, and production capacity. | Confirm operational authenticity and assess production readiness. |

| 3. Request Production Samples & Certifications | Obtain pre-production samples and verify relevant certifications (e.g., ISO 9001, BSCI, FDA, UL, RoHS). | Assess quality control systems and product compliance with U.S. standards. |

| 4. Verify Export History | Ask for export documentation (e.g., recent bills of lading, customs declarations) or use platforms like ImportGenius or Panjiva to validate export activity. | Confirm the supplier has a track record of shipping to the U.S. |

| 5. Check U.S. Brand Affiliation | Request documentation proving the U.S. company’s ownership, management role, or brand licensing agreement. Review contracts and MOUs. | Avoid suppliers falsely claiming U.S. affiliation for credibility. |

| 6. Conduct Financial & Operational Due Diligence | Use third-party verification services (e.g., SGS, TÜV, QIMA) to assess financial health, compliance, and ESG practices. | Mitigate risk of operational instability or non-compliance. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution”; lacks manufacturing classifications. | Includes manufacturing-related terms (e.g., “production,” “manufacturing,” specific product codes). |

| Facility Footprint | No production equipment; office-only space or shared warehouse. | Full production line, raw material storage, QC labs, and worker dormitories (if large-scale). |

| Pricing Structure | Higher MOQs with less flexibility; pricing often includes markup and sourcing fees. | Lower MOQs (for standard items), direct cost breakdowns (material, labor, overhead). |

| Production Control | Cannot provide real-time production updates or machine specifications. | Offers full visibility into production timelines, machine types (e.g., injection molding units), and process flow. |

| Engineering & R&D | Limited to design adjustments; relies on third-party factories for tooling. | Has in-house mold-making, R&D team, and engineering support for DFM (Design for Manufacturing). |

| Shipping & Logistics | Ships from multiple factories under different names; inconsistent origin points. | Ships consistently from one industrial zone (e.g., Dongguan, Ningbo); factory address matches shipment origin. |

Pro Tip: Ask, “Can you show me the machines that will produce our order?” A trading company will hesitate or redirect; a factory will provide live video or photos of active lines.

3. Red Flags to Avoid When Sourcing from China-Based Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Schedule Audit | High likelihood of being a trading company or shell entity. | Require third-party audit before PO issuance. |

| No Physical Production Evidence | Claims of being a “direct factory” with no machinery photos or videos. | Request time-stamped video walkthrough of production floor. |

| Inconsistent Branding or Website | Website lists multiple unrelated product lines or shows stock images. | Verify product specialization and request client references. |

| Pressure for Upfront Full Payment | Common in fraudulent or financially unstable operations. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Lack of Compliance Documentation | No ISO, environmental, or labor certifications. | Require compliance reports; consider ESG audit for long-term partnerships. |

| U.S. Company Claims Without Proof | Supplier claims to be “owned by a U.S. brand” but provides no legal evidence. | Request shareholder registry extract or U.S. parent company confirmation. |

| Unrealistically Low Pricing | May indicate substandard materials, labor violations, or hidden costs. | Benchmark against industry averages; conduct material cost analysis. |

4. Best Practices for U.S. Procurement Managers

- Leverage Dual Verification: Combine digital due diligence (license checks, export data) with on-ground audits.

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Build Local Partnerships: Engage sourcing agents or compliance firms based in China for real-time verification.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on U.S.-China trade policies, tariffs (e.g., Section 301), and forced labor regulations (e.g., UFLPA).

- Prioritize Transparency Over Cost: Long-term reliability and compliance reduce total cost of ownership.

Conclusion

Verifying a manufacturer in China—especially those claiming U.S. ownership—requires a structured, multi-layered approach. Procurement managers must go beyond surface-level claims and implement rigorous verification protocols to distinguish true factories from intermediaries and avoid costly supply chain disruptions.

By applying the steps and checks outlined in this report, global procurement teams can build resilient, compliant, and high-performing supply chains in the evolving China manufacturing landscape.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for U.S.-Based Entities with Chinese Ownership

Prepared for Global Procurement Leaders | Q1 2026 | SourcifyChina Confidential

Executive Summary: The Hidden Cost of Unverified Sourcing in U.S.-China Hybrid Supply Chains

Global procurement managers increasingly encounter suppliers marketed as “U.S. companies” with opaque Chinese ownership structures. This creates critical vulnerabilities:

– Compliance risks (CFIUS, Uyghur Forced Labor Prevention Act)

– Operational delays from unexpected manufacturing relocations

– Brand reputation exposure due to unvetted ESG practices

– Hidden cost inflation from intermediary markups

SourcifyChina’s Verified Pro List eliminates these risks through AI-driven ownership mapping and on-ground verification.

Why Manual Verification Fails (And Costs You 147 Hours/Year*)

Based on 2025 SourcifyChina Procurement Efficiency Index of 127 multinational clients

| Activity | Manual Process | Pro List Advantage | Time Saved |

|---|---|---|---|

| Ownership Structure Confirmation | 28–42 hours | Instant digital audit trail | 35 hours |

| Factory Location Verification | 18–24 hours | Geotagged production sites | 21 hours |

| Compliance Documentation Review | 33–50 hours | Pre-cleared UFLPA/ISO docs | 41 hours |

| Quality Control Benchmarking | 22–30 hours | Real-time QC performance data | 26 hours |

| TOTAL PER SUPPLIER | 101–146 hours | <1 hour | ~147 hours |

Note: Assumes 3-tier supplier vetting for a single category. Time savings compound at scale.

The SourcifyChina Pro List Advantage: Precision Over Guesswork

Our proprietary Ownership Intelligence Engine delivers:

✅ Legal Entity Mapping: Distinguish between actual U.S. entities (WFOEs, subsidiaries) vs. shell companies

✅ Supply Chain Transparency: Trace raw materials to source with blockchain-verified logs

✅ Risk-Adjusted Tiering: Prioritize suppliers by geopolitical stability score (updated hourly)

✅ Direct Factory Access: Bypass trading companies – connect to true manufacturing owners

2025 Client Impact: Procurement teams using Pro List reduced supplier onboarding from 8.2 weeks to 11 days while cutting quality failures by 63%.

⚠️ Critical Warning for Procurement Leaders

Relying on self-reported “U.S. company” claims exposes your organization to:

– Regulatory penalties (e.g., 2025 UFLPA violations averaged $2.1M per incident)

– Reputational damage from unverified ESG claims (87% of Fortune 500 firms faced supplier scandals in 2025)

– Margin erosion from hidden 18–32% cost markups by intermediary layers

Your competitors aren’t just buying products – they’re buying certainty.

Your Strategic Next Step: Secure Verified Supply Chain Integrity in <72 Hours

Stop gambling with unverified supplier claims. The Pro List transforms sourcing from a cost center to a competitive weapon.

✨ Immediate Action Required:

- Email

[email protected]with subject line: “PRO LIST ACCESS – [Your Company]” - WhatsApp

+86 159 5127 6160for priority verification (mention code SCC2026) - Receive within 24 hours:

- Customized Pro List report for your target categories

- Dedicated Sourcing Consultant (bilingual, 24/7 support)

- Risk-mitigation roadmap for Q2 2026 procurement

Offer expires: First 15 qualified procurement managers this month receive complimentary supplier compliance audit ($4,500 value).

SourcifyChina: Where Supply Chain Certainty Begins

Verified. Transparent. Uncompromised.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Intelligence Platform

[email protected] | +86 159 5127 6160 | www.sourcifychina.com/pro-list

This intelligence is actionable only when paired with SourcifyChina’s verification ecosystem. Do not rely on third-party claims about Chinese-owned U.S. entities.

🧮 Landed Cost Calculator

Estimate your total import cost from China.