The global PVC materials market has experienced steady expansion, driven by rising demand across construction, healthcare, automotive, and packaging industries. According to Mordor Intelligence, the global polyvinyl chloride (PVC) market was valued at approximately USD 55.6 billion in 2023 and is projected to reach USD 70.3 billion by 2029, growing at a CAGR of around 4.0% during the forecast period. This growth is fueled by increasing infrastructure development, especially in emerging economies, and the material’s advantageous properties such as durability, chemical resistance, and low production cost. As demand climbs, a diverse array of PVC material manufacturers has emerged, specializing in different formulations—including rigid PVC, flexible PVC, and specialty compounds—tailored to specific industrial applications. Below are the top 10 types of PVC material manufacturers shaping the industry landscape based on innovation, production scale, and market reach.

Top 10 Types Of Pvc Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

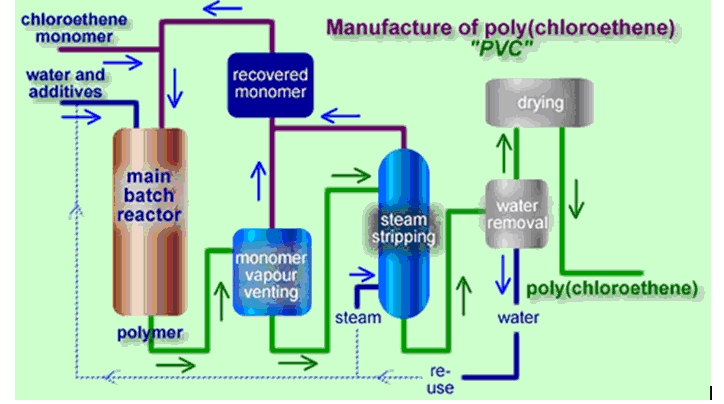

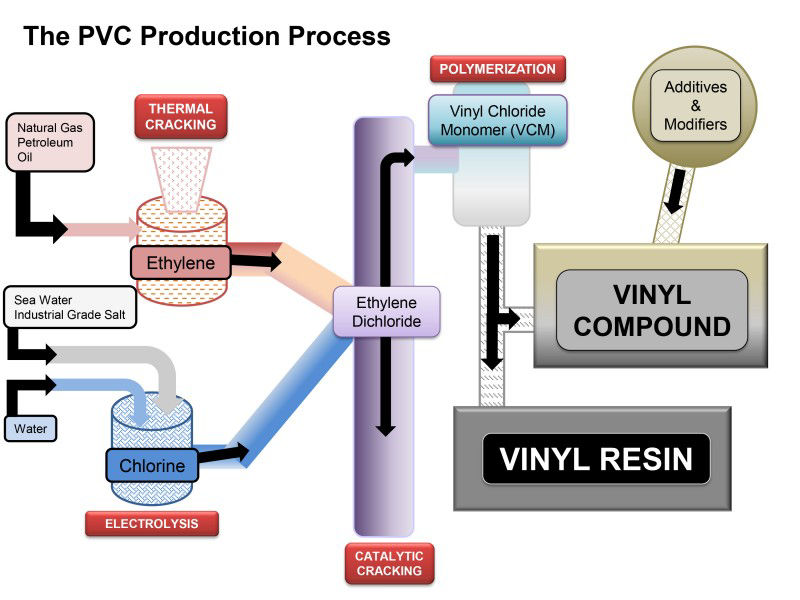

#1 About PVC

Domain Est. 1996

Website: pvc.org

Key Highlights: Learn what PVC or vinyl is, how it’s made, and why it matters. A versatile plastic used in healthcare, construction, and more….

#2 Leading PVC Extrusion Manufacturers

Domain Est. 2000

Website: extrudedplastics.com

Key Highlights: Types of PVC Extrusions: Rigid vs. Flexible and More · Flexible PVC Extrusions · Rigid PVC Extrusions · PVC Tubing and Custom Plastic Tubing….

#3 JM Eagle™

Domain Est. 2007

Website: jmeagle.com

Key Highlights: JM Eagle · Delivering life’s essentials through the most eco-friendly plastic pipe products on the market. · Express Service Trucks (ESTs) Deliver within 24 hours ……

#4 IPEX Inc.

Domain Est. 2009

Website: ipexna.com

Key Highlights: IPEX Inc. manufactures advanced PVC & CPVC piping systems for several applications for the Canadian market. Learn more….

#5 About PVC (Polyvinyl Chloride)

Domain Est. 1995

Website: ppfahome.org

Key Highlights: Polyvinyl Chloride (PVC) piping is the most widely used plastic piping material. Learn more about PVC benefits, uses, installation and more….

#6 Polyvinyl Chloride PVC

Domain Est. 1996

Website: bpf.co.uk

Key Highlights: PVC is a very durable and long lasting material which can be used in a variety of applications, either rigid or flexible, white or black and a wide range of ……

#7 Spears Manufacturing, PVC & CPVC Plastic Pipe Fittings & Valves

Domain Est. 1996

Website: spearsmfg.com

Key Highlights: ISO9001 Certified – PVC & CPVC Sch 40 and 80 fittings molded from 1/8 – 14 inch….

#8 Polyvinyl Chloride (PVC)

Domain Est. 1998

Website: sabic.com

Key Highlights: Polyvinyl Chloride, or PVC for short, is a synthetic plastic polymer made from vinyl chloride monomer. It is one of the most widely used thermoplastics in ……

#9 PVC

Domain Est. 1998

Website: ineos.com

Key Highlights: PVC is produced according to two types of polymerisation techniques: suspension PVC and emulsion PVC….

#10 PVC

Domain Est. 2007

Website: seaperch.org

Key Highlights: PVC, Polyvinyl Chloride, is a thermoplastic polymer, a material that can be heated to its melting point, then formed into a shape and allowed to cool to a ……

Expert Sourcing Insights for Types Of Pvc Material

2026 Market Trends for Types of PVC Material

The global polyvinyl chloride (PVC) market is poised for significant transformation by 2026, driven by evolving regulatory landscapes, technological innovations, and shifting consumer preferences across key industries. As one of the most widely used synthetic plastic polymers, PVC exists in several forms—primarily rigid (uPVC or RPVC) and flexible (plasticized PVC)—each serving distinct applications. This analysis explores the anticipated market trends for different types of PVC material in 2026, highlighting growth drivers, regional dynamics, sustainability challenges, and emerging applications.

Rigid PVC (uPVC/RPVC)

Rigid PVC, known for its durability, chemical resistance, and low maintenance, continues to dominate in construction and infrastructure applications. By 2026, the demand for uPVC is expected to grow steadily, particularly in:

- Building and Construction: uPVC remains a preferred material for window frames, door profiles, and piping systems due to its energy efficiency and longevity. Urbanization in Asia-Pacific and infrastructure development in emerging economies will fuel demand.

- Water and Wastewater Management: Governments investing in modernized water infrastructure are increasingly adopting uPVC pipes for their corrosion resistance and long service life, especially in regions like India, Southeast Asia, and Africa.

- Technological Advancements: Innovations such as foam-uPVC and co-extruded profiles are improving insulation properties and aesthetics, broadening appeal in residential and commercial construction.

Environmental regulations may tighten, pushing manufacturers to adopt lead-free stabilizers and increase recycling rates—key trends shaping the uPVC segment.

Flexible PVC (Plasticized PVC)

Flexible PVC, modified with plasticizers to enhance elasticity, is widely used in healthcare, automotive, and consumer goods. However, the 2026 outlook for this segment shows both opportunities and challenges:

- Healthcare Sector Demand: Flexible PVC remains essential for medical devices such as blood bags, IV tubing, and gloves, especially post-pandemic. However, concerns over phthalate-based plasticizers are driving a shift toward non-phthalate alternatives like DINCH and DOTP.

- Automotive Applications: Lightweight materials are critical for fuel efficiency, and flexible PVC is used in wire insulation, interior trims, and under-the-hood components. Growth in electric vehicle (EV) production will sustain demand, though competition from thermoplastic elastomers (TPEs) is increasing.

- Regulatory Pressure: The European Union’s REACH regulations and similar policies globally are restricting hazardous plasticizers. This is accelerating R&D into bio-based and non-toxic plasticizers, expected to gain market share by 2026.

Specialty and High-Performance PVC Variants

Emerging niche segments are gaining traction due to performance enhancements and sustainability goals:

- Chlorinated PVC (CPVC): Widely used in hot and cold water distribution and industrial piping, CPVC offers higher thermal resistance than standard PVC. Growth is anticipated in industrial and commercial building sectors, especially in North America and China.

- PVC-O (Oriented PVC): Known for superior strength and impact resistance, PVC-O is increasingly used in pressure piping for water distribution. Its adoption is rising in municipal projects due to lifecycle cost savings and reduced environmental impact.

- Bio-based and Recycled PVC: Though still a small fraction of the market, eco-friendly PVC variants are expected to grow by 2026. Companies are investing in PVC recycling technologies and exploring bio-attributed feedstocks to meet circular economy targets.

Regional Market Dynamics

- Asia-Pacific: The largest consumer of PVC, driven by China and India’s construction booms. Sustainability initiatives may slow growth slightly, but demand remains robust.

- North America: Steady growth in uPVC for housing and infrastructure, supported by government spending. Regulatory focus on recyclability will influence material choices.

- Europe: The most regulated market, with strong emphasis on PVC recycling (via VinylPlus program) and phase-out of hazardous additives. Growth will be moderate but focused on sustainable innovations.

- Latin America and Middle East: Infrastructure development and urban expansion will drive demand, though economic volatility may affect long-term projections.

Sustainability and Circular Economy

By 2026, environmental considerations will be central to PVC market dynamics:

- Recycling Rates: Mechanical and feedstock recycling technologies are improving. The industry aims to recycle over 1 million tons of PVC annually in Europe by 2026.

- Green Building Standards: LEED and BREEAM certifications are encouraging the use of recyclable and low-emission PVC products, particularly in construction.

- Extended Producer Responsibility (EPR): More countries are implementing EPR schemes, requiring manufacturers to manage end-of-life PVC products.

Conclusion

By 2026, the PVC market will be characterized by a dual trajectory: continued growth in traditional applications, particularly rigid PVC in construction, and a strategic pivot toward safer, sustainable, and high-performance variants. Regulatory pressures, environmental awareness, and technological innovation will shape the evolution of PVC types, ensuring the material remains relevant in a rapidly changing industrial landscape. Companies that invest in green chemistry, recycling infrastructure, and product transparency are likely to lead the market in the coming years.

Common Pitfalls When Sourcing Types of PVC Material (Quality, IP)

Sourcing PVC (Polyvinyl Chloride) materials requires careful evaluation to ensure quality, compliance, and suitability for the intended application. Below are common pitfalls related to quality and intellectual property (IP) that buyers and manufacturers should be aware of:

1. Inconsistent Material Quality

One of the most frequent issues is receiving PVC materials with inconsistent physical or chemical properties. Variations in resin grade, plasticizer content, stabilizers, or additives can affect performance, durability, and safety. Sourcing from unverified suppliers may result in off-spec materials that fail to meet industry standards (e.g., ASTM, ISO).

2. Misrepresentation of PVC Type

PVC comes in various forms—rigid (uPVC), flexible (plasticized PVC), and specialty variants (e.g., chlorinated PVC or CPVC). Suppliers may mislabel or misrepresent the type, leading to incorrect material selection. For example, substituting flexible PVC for rigid applications compromises structural integrity.

3. Lack of Certifications and Compliance

Reputable PVC materials should come with documentation proving compliance with health, safety, and environmental standards (e.g., RoHS, REACH, FDA for food-grade applications). Sourcing without proper certification risks legal liabilities and end-product failures, especially in regulated industries like medical devices or potable water systems.

4. Use of Recycled or Contaminated Materials

Some suppliers blend recycled PVC with virgin resin to reduce costs. While recyclable PVC has its place, uncontrolled recycling can introduce contaminants, inconsistent melt flow, or degraded mechanical properties. Without clear disclosure, this undermines product reliability and longevity.

5. Intellectual Property Infringement

Branded or patented PVC formulations (e.g., specialty flame-retardant or UV-stabilized compounds) may be protected under IP law. Sourcing knockoffs or unauthorized equivalents can expose companies to litigation, especially in high-tech or industrial applications where material performance is protected.

6. Inadequate Traceability and Documentation

Lacking batch traceability, material data sheets (MDS), or certificates of conformance (CoC) makes it difficult to verify quality or respond to failures. This is particularly problematic during audits, recalls, or when proving compliance in export markets.

7. Supplier Reliability and Transparency

Small or offshore suppliers may offer competitive pricing but lack the infrastructure for consistent quality control. Hidden subcontracting, lack of direct manufacturing oversight, and poor communication increase the risk of receiving substandard or counterfeit materials.

8. Overlooking Regional Regulatory Differences

PVC regulations vary by region—phthalate restrictions in Europe (REACH), lead stabilizer bans in North America, or specific food-contact requirements in Asia. Sourcing without understanding these differences can lead to non-compliant materials and market access issues.

Conclusion

To avoid these pitfalls, conduct thorough due diligence: audit suppliers, demand full documentation, request samples for testing, and verify IP rights when using proprietary formulations. Establishing long-term relationships with certified, transparent suppliers is key to ensuring consistent quality and legal compliance in PVC sourcing.

Types of PVC Material: Logistics & Compliance Guide

Understanding the different types of Polyvinyl Chloride (PVC) is essential for ensuring safe, efficient logistics and regulatory compliance across supply chains. This guide outlines the primary PVC types and their associated handling, transportation, and compliance considerations.

Rigid PVC (RPVC or uPVC)

Rigid PVC, also known as unplasticized PVC (uPVC), is a stiff and durable form of PVC commonly used in construction (e.g., pipes, window frames, siding) and industrial applications.

Logistics Considerations:

– Packaging: Typically supplied in solid profiles, sheets, or pipes. Must be bundled securely with protective end caps and wrapped in moisture-resistant materials to prevent surface damage.

– Handling: Susceptible to cracking under impact, especially in cold environments. Requires careful loading/unloading using appropriate lifting equipment (e.g., cradles for pipes).

– Storage: Store indoors or under cover, away from direct sunlight and extreme temperatures to prevent warping or embrittlement. Stack flat and avoid excessive pressure.

Compliance Requirements:

– REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern) regulations; some stabilizers (e.g., lead-based) are restricted.

– RoHS (EU/UK/China): Must not contain restricted hazardous substances like lead, cadmium, or certain phthalates above allowable thresholds.

– LEED & Building Codes: Often required to meet specific fire, smoke, and toxicity standards (e.g., ASTM E84 for flame spread).

– Transportation (IMDG/ADR/IATA): Generally non-hazardous for transport; classified as UN 3082, Environmentally Hazardous Substance, solid, n.o.s., only if containing regulated additives.

Flexible PVC (Plasticized PVC)

Flexible PVC contains plasticizers (e.g., phthalates) to increase softness and elasticity. Used in cables, flooring, medical tubing, inflatables, and consumer goods.

Logistics Considerations:

– Packaging: Supplied as rolls, sheets, or molded parts. Rolls should be stored vertically to avoid deformation; sheets must be interleaved to prevent sticking.

– Temperature Sensitivity: High temperatures can cause plasticizer migration, leading to product hardening or surface tackiness. Avoid prolonged exposure above 50°C (122°F).

– Light Exposure: UV radiation degrades plasticizers. Use opaque or UV-protected packaging and avoid sunlight during transit and storage.

Compliance Requirements:

– REACH & SVHC: Phthalate plasticizers (e.g., DEHP, DBP, BBP) are restricted or banned in toys, childcare articles, and medical devices under REACH Annex XIV/XVII.

– RoHS & Prop 65 (California): Must meet limits for hazardous plasticizers and heavy metals. Proposition 65 requires warnings if containing listed chemicals.

– Medical Devices (FDA/ISO 10993): For medical-grade PVC, strict biocompatibility and leaching standards apply. Requires full traceability and documentation.

– REACH SCIP Database: If containing SVHCs above 0.1%, notification in the SCIP database is mandatory for articles placed on the EU market.

Chlorinated PVC (CPVC)

CPVC is a modified form of PVC with enhanced thermal and chemical resistance, used in hot water piping, industrial fluid handling, and fire sprinkler systems.

Logistics Considerations:

– Fragility: More brittle than standard PVC, especially at low temperatures. Handle with care to prevent cracking.

– UV Sensitivity: Degrades rapidly under UV light. Always transport and store covered or in UV-protected packaging.

– Moisture Protection: Although chemically resistant, prolonged exposure to moisture during storage can affect packaging integrity.

Compliance Requirements:

– NSF/ANSI 61 & NSF-pw: Required for potable water applications to ensure safety from leaching contaminants.

– UL & Fire Codes: Must meet flame spread and smoke development ratings (e.g., UL 723, ASTM E84). Some CPVC formulations are UL 94 V-0 rated.

– REACH & RoHS: Similar to rigid PVC, but verify stabilizer formulations (avoid lead or cadmium compounds).

– Transport: Non-hazardous under most regulations, but check for chlorinated additives that may trigger specific classifications.

PVC Paste & PVC Powder (Suspension & Emulsion)

PVC resin in powder form, used in coatings, inks, plastisols, and synthetic leather. Requires blending with plasticizers and additives.

Logistics Considerations:

– Dust Control: Fine powders pose inhalation risks. Use sealed containers and avoid open handling. Ensure ventilation in warehouses.

– Moisture Sensitivity: Hygroscopic—must be stored in dry, climate-controlled environments to prevent clumping.

– Static Electricity: Can generate static; use grounding during transfer and handling.

Compliance Requirements:

– GHS/CLP Classification: May be classified as harmful if inhaled (H332). Requires proper labeling, Safety Data Sheets (SDS), and workplace controls.

– OSHA PEL (USA): Adhere to permissible exposure limits for vinyl chloride monomer (VCM) residuals (must be <1 ppm in final resin).

– REACH: VCM is a Category 1B carcinogen—ensure residual monomer content is minimized and documented.

– DOT/ADR/IATA: Classified as non-dangerous goods if VCM content is below regulatory thresholds (typically <5 ppm). Otherwise, may require hazardous materials handling.

Recycled PVC

Post-industrial or post-consumer PVC that has been reprocessed. Used in flooring, speed bumps, and non-critical profiles.

Logistics Considerations:

– Contamination Risk: Segregate from other plastics and ensure feedstock is sorted properly to avoid contamination.

– Consistency: Properties may vary; requires quality testing before integration into production.

– Traceability: Maintain records of source and recycling process for compliance audits.

Compliance Requirements:

– REACH & RoHS: Recycled PVC may contain legacy additives (e.g., lead stabilizers, restricted phthalates). Conduct rigorous testing to ensure compliance.

– EU Circular Economy Action Plan: Supports use of recycled content but requires conformity with safety standards.

– Green Claims (FTC/ISO 14021): “Recycled content” claims must be accurate and substantiated. Avoid misleading environmental marketing.

General Compliance & Logistics Best Practices

- Documentation: Maintain up-to-date SDS, certificates of compliance (COC), test reports, and traceability records.

- Labeling: Ensure all shipments are labeled with material type, compliance marks (e.g., CE, UL), and handling instructions.

- Training: Train warehouse and logistics teams on PVC-specific handling, hazard awareness, and emergency procedures.

- Audits: Conduct regular supplier audits to verify compliance with environmental, health, and safety standards.

By aligning logistics operations with the specific characteristics and regulatory demands of each PVC type, businesses can ensure product integrity, legal compliance, and sustainable supply chain performance.

In conclusion, sourcing PVC material involves careful consideration of various types—such as rigid (uPVC), flexible (plasticized PVC), and specialized variants like CPVC or PVC-O—each suited to specific applications in construction, healthcare, automotive, and consumer goods. The choice depends on factors including required durability, flexibility, chemical resistance, environmental conditions, and regulatory standards. Effective sourcing requires evaluating suppliers based on material quality, compliance with industry certifications (e.g., ISO, REACH, RoHS), cost-efficiency, and sustainability practices. As environmental concerns grow, there is an increasing shift toward recycled and eco-friendly PVC options, making sustainable sourcing a strategic priority. Ultimately, understanding the distinct properties and sourcing requirements of each PVC type ensures optimal performance, regulatory compliance, and long-term value in the final application.