The global electric vehicle (EV) charging infrastructure market is experiencing robust growth, driven by rising EV adoption, supportive government policies, and increasing investments in clean energy. According to a report by Mordor Intelligence, the global EV charging station market was valued at USD 26.63 billion in 2024 and is projected to reach USD 129.25 billion by 2029, growing at a compound annual growth rate (CAGR) of 37.4% during the forecast period. This surge in demand is particularly fueling the need for accessible and reliable Type 1 EV chargers—commonly used in North America and Japan—despite the rising prevalence of Type 2 connectors in other regions. As automakers expand their EV lineups and consumers seek faster, more efficient charging solutions, manufacturers specializing in Type 1 charging technology continue to play a crucial role in the ecosystem. Below is a data-driven overview of the top 9 Type 1 EV charger manufacturers shaping the market today.

Top 9 Type 1 Ev Charger Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

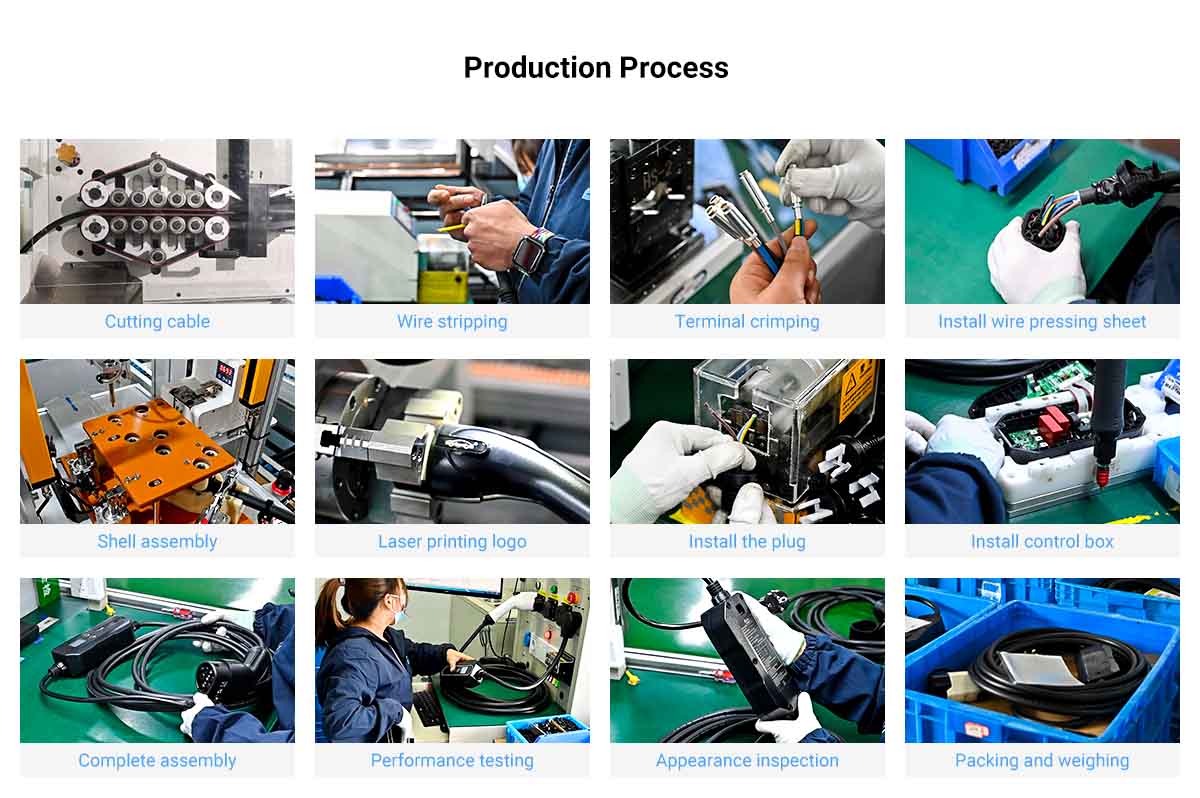

#1 BESEN

Domain Est. 2013

Website: besen-group.com

Key Highlights: BESEN, a 16-year expert in AC EV charging equipment, provides safe, efficient solutions for global B2B users as a direct manufacturer….

#2 EV Charging

Domain Est. 1990

Website: new.abb.com

Key Highlights: ABB offers a total ev charging solution from compact, high quality AC wallboxes, reliable DC fast charging stations with robust connectivity….

#3 Our EV Charger Types

Domain Est. 1997

Website: flo.com

Key Highlights: Discover our different EV charging stations: FLO Home, CoRe+, SmartTWO, and SmartDC….

#4 Electric Vehicle Charging Stations

Domain Est. 1999

Website: afdc.energy.gov

Key Highlights: The Alternative Fueling Station Locator allows users to search for public and private charging stations. Quarterly reports on EV charging station trends….

#5 EVgo

Domain Est. 2002

Website: evgo.com

Key Highlights: As one of the largest and most advanced EV fast charging networks nationwide, EVgo powers the freedom of movement with robust charging for all EV models….

#6 DC Charging Solutions for Fleets & Businesses

Domain Est. 2005

Website: kempower.com

Key Highlights: Kempower offers cutting-edge charging solutions in North America. Contact us for the best EV charging solutions on the market!…

#7 SWTCH EV Charging Solutions

Domain Est. 2018

Website: swtchenergy.com

Key Highlights: SWTCH offers EV charging solutions for multi-tenant properties both new and old. We’ve deployed and are actively managing thousands of chargers on the SWTCH ……

#8 AG ELectrical

Domain Est. 2019

Website: ag-elec.com

Key Highlights: AG ELECTRICAL provides high-quality EV Charging Cables with durable, flexible designs, supporting Type 1, Type 2, CCS, and Tesla connectors….

#9 Autel EV Charger

Domain Est. 2021

Website: autelenergy.com

Key Highlights: Autel EV Charger delivers smart, reliable charging for homes, fleets, and businesses, integrating solar and storage for a seamless energy solution….

Expert Sourcing Insights for Type 1 Ev Charger

H2: 2026 Market Trends for Type 1 EV Charger

As the global electric vehicle (EV) market continues to evolve, the demand for charging infrastructure is growing rapidly. However, by 2026, the role of the Type 1 EV charger—also known as the SAE J1772 connector—is expected to shift significantly due to technological advancements, regional preferences, and standardization efforts. Here is an analysis of key market trends shaping the future of Type 1 EV chargers in 2026:

-

Declining Dominance in Key Markets

The Type 1 connector, primarily used in North America and Japan, has historically been the standard for AC Level 1 and Level 2 charging. However, by 2026, its market share is expected to decline in favor of the more universally adopted Type 2 (Mennekes) connector in Europe and the increasing integration of Combined Charging System (CCS1) for DC fast charging in North America. Automakers are increasingly adopting CCS1, which incorporates the Type 1 AC pins but adds DC fast-charging capability, reducing reliance on standalone Type 1 charging stations. -

Legacy Support and Retrofit Demand

While new installations may favor newer standards, there will remain a significant installed base of Type 1-compatible EVs, such as older models from Nissan, Chevrolet, and Mitsubishi. As a result, 2026 will likely see continued demand for Type 1 chargers in the retrofit and residential markets, especially in North America. Home charging solutions and workplace installations may still include Type 1 compatibility to support legacy EV fleets. -

Focus on Interoperability and Smart Charging

Type 1 chargers in 2026 are expected to become smarter and more integrated with energy management systems. Features such as load balancing, remote monitoring, and grid-to-vehicle (V2G) communication, although more commonly associated with newer standards, are being retrofitted into Type 1-compatible systems to extend their usefulness. This shift will be driven by utility incentives and the need for demand response in smart grid ecosystems. -

Regional Variations and Niche Applications

In Japan and certain parts of North America, Type 1 chargers will retain relevance due to regional vehicle fleets and infrastructure inertia. Additionally, Type 1 may persist in niche applications such as fleet depots with older EV models or in rental car services with mixed EV fleets. However, public charging networks are increasingly standardizing on CCS or CHAdeMO, reducing the footprint of Type 1 in public fast-charging zones. -

Transition Toward Unified Standards

Regulatory trends, particularly in North America, are pushing toward unified charging standards. The Infrastructure Investment and Jobs Act in the U.S. and similar initiatives in Canada emphasize interoperability and future-proofing. As a result, new public charging stations funded by government programs are less likely to support Type 1 as a primary interface, favoring CCS1 or multi-standard units. -

Manufacturing and Supply Chain Shifts

By 2026, manufacturers are expected to phase out standalone Type 1 chargers in favor of dual-cable or multi-port units that support both Type 1 and Type 2/CCS1. This transition will reduce production costs and inventory complexity. Component suppliers may also reduce investment in Type 1-specific parts, accelerating the shift toward next-generation connectors.

Conclusion:

While the Type 1 EV charger will not disappear by 2026, its role will increasingly be that of a transitional or legacy interface. Market trends point toward a gradual phase-out in favor of more versatile and future-ready charging standards. However, demand will persist in residential, retrofit, and legacy fleet applications, particularly in North America and Japan. Stakeholders should anticipate a hybrid ecosystem where Type 1 coexists with newer technologies but plays a diminishing role in new infrastructure deployments.

Common Pitfalls When Sourcing Type 1 EV Chargers (Quality and Intellectual Property)

Sourcing Type 1 EV chargers—especially from international suppliers—can present several risks related to product quality and intellectual property (IP). Being aware of these pitfalls is crucial for ensuring reliable, safe, and legally compliant procurement.

Poor Build Quality and Component Sourcing

Many low-cost suppliers use substandard materials and components to reduce manufacturing costs. This can include cheap plastics, inadequate heat dissipation designs, and unreliable internal electronics. Such compromises often result in shortened product lifespans, frequent failures, and safety hazards like overheating or electrical shorts. Always verify certifications and conduct third-party testing to validate durability and performance claims.

Inconsistent Compliance with Safety Standards

While Type 1 chargers must adhere to standards like UL 2594 (North America) and IEC 61851, not all manufacturers comply rigorously. Some may provide falsified or outdated certification documents. Non-compliant chargers pose serious safety risks and can lead to regulatory penalties or liability in the event of accidents. Ensure suppliers provide up-to-date, verifiable test reports from accredited labs.

Counterfeit or Clone Products

A significant risk in sourcing is encountering counterfeit or cloned chargers that mimic reputable brands. These clones often lack proper quality control and may infringe on the original manufacturer’s trademarks and patents. Purchasing such products can expose your business to legal action and damage your brand reputation.

Intellectual Property Infringement

Some suppliers may offer chargers that replicate patented designs, firmware, or user interfaces without authorization. Even if unintentional, importing or selling these products can lead to IP disputes, customs seizures, or product recalls. Conduct due diligence by reviewing supplier IP disclosures and avoiding products that appear too similar to protected models.

Lack of Firmware and Software Transparency

Type 1 chargers increasingly include proprietary software for load management, user authentication, and diagnostics. Sourcing from suppliers who do not provide clear licensing terms or source code access can lead to long-term maintenance issues, security vulnerabilities, or inability to integrate with existing systems. Ensure software rights and update policies are defined in contracts.

Inadequate After-Sales Support and Warranty

Low-cost suppliers may offer limited technical support, spare parts availability, or warranty coverage. This becomes a major issue when field failures occur. Without reliable support, downtime increases and total cost of ownership rises. Prioritize suppliers with clear service agreements and local support networks.

Hidden Supply Chain Risks

Some manufacturers outsource production to unvetted subcontractors, leading to inconsistent quality and potential IP exposure. Without transparency into the full supply chain, you risk sourcing products built with stolen designs or unethical labor practices. Require supply chain mapping and audit rights in sourcing agreements.

By proactively addressing these pitfalls—through rigorous vetting, third-party testing, and clear contractual terms—businesses can mitigate risks and ensure reliable, compliant, and legally sound sourcing of Type 1 EV chargers.

Logistics & Compliance Guide for Type 1 EV Charger

Overview

This guide outlines the key logistics considerations and compliance requirements for the distribution, installation, and operation of Type 1 (SAE J1772) Electric Vehicle (EV) chargers. Type 1 connectors are primarily used in North America and Japan for single-phase AC charging up to 7.4 kW. Adhering to these guidelines ensures safety, regulatory compliance, and operational efficiency.

Regulatory Compliance Requirements

Electrical Safety Standards

Type 1 EV chargers must comply with regional electrical safety regulations:

– North America: UL 2594 (Standard for Electric Vehicle Supply Equipment) and UL 2231 (Personnel Protection Systems for EVs) are mandatory.

– Canada: Compliance with CSA C22.2 No. 285 and adherence to the Canadian Electrical Code (CEC) is required.

– Japan: PSE (Product Safety Electrical Appliance & Material) certification under the DENAN Act applies.

All equipment must carry appropriate certification marks and be listed by a Nationally Recognized Testing Laboratory (NRTL).

Electromagnetic Compatibility (EMC)

Chargers must meet EMC standards to avoid interference with other electronic devices:

– FCC Part 15 (USA) for unintentional radiators.

– ICES-003 (Canada) for electromagnetic emissions.

– VCCI (Japan) standards for information technology equipment emissions.

Building and Electrical Codes

Installation must comply with:

– USA: National Electrical Code (NEC) Article 625 (Electric Vehicle Power Transfer System).

– Canada: Canadian Electrical Code (CEC) Section 58 (Electric Vehicle Charging Systems).

– Local permitting and inspection requirements must be followed; permits are typically required for permanent installations.

Energy Efficiency and Labeling

- ENERGY STAR certification is recommended (though not mandatory) to demonstrate energy efficiency.

- Devices sold in California must comply with Title 20 Appliance Efficiency Regulations, which include standby power limits for EVSEs.

Logistics and Supply Chain Considerations

Packaging and Handling

- Use moisture-resistant, shock-absorbent packaging to protect connectors, cables, and electronic components during transit.

- Clearly label packages with handling instructions (e.g., “Fragile,” “Do Not Stack,” “This Side Up”).

- Include all accessories (mounting hardware, user manual, safety warnings) in original packaging.

Shipping and Transportation

- Comply with IATA/IMDG regulations if shipping internationally (though EV chargers are generally non-hazardous).

- Use temperature-controlled transport if components are sensitive to extreme conditions.

- Ensure carriers are aware of oversized or heavy packages; wall-mounted units may exceed standard parcel dimensions.

Inventory and Warehousing

- Store in dry, climate-controlled environments to prevent corrosion and component degradation.

- Implement FIFO (First In, First Out) inventory rotation to avoid prolonged storage of older models.

- Conduct periodic quality audits to ensure no damage or obsolescence.

Import/Export Requirements

- USA: Declare under HTS Code 8504.40.00 (electric transformers, converters, rectifiers).

- Canada: Use HS Code 8504.40.00; compliance with ICES-003 and CSA standards is required at customs.

- Japan: Submit JIS C 6434 compliance documentation; PSE certification must be verified prior to entry.

Installation and Operational Compliance

Qualified Personnel

- Installation must be performed by a licensed electrician certified under local regulations.

- Technicians should be trained in NEC/CEC requirements and manufacturer-specific guidelines.

Site Assessment

- Verify grid capacity, circuit type (120V or 240V), and breaker rating (e.g., 16A, 32A) match charger specifications.

- Ensure grounding, GFCI protection, and clearances (NEC 110.26) are maintained.

Documentation and Recordkeeping

- Retain copies of permits, inspection reports, and certificates of compliance.

- Provide end users with installation manuals, warranty information, and safety warnings in local language.

Environmental and End-of-Life Compliance

WEEE and Recycling

- In regions with WEEE (Waste Electrical and Electronic Equipment) directives (e.g., EU—even if Type 1 is less common), follow take-back and recycling protocols.

- In North America, partner with certified e-waste recyclers for end-of-life units.

RoHS Compliance

- Ensure chargers comply with RoHS (Restriction of Hazardous Substances) directives, limiting lead, mercury, cadmium, and other hazardous materials—even in non-EU markets, many manufacturers adopt this as a global standard.

Conclusion

Successful deployment of Type 1 EV chargers requires strict adherence to safety, electrical, and environmental regulations across the supply chain. Proactive logistics planning, proper documentation, and use of certified components and personnel are critical to ensuring compliance, user safety, and long-term reliability. Always verify regional requirements and update procedures as standards evolve.

Conclusion on Sourcing a Type 1 EV Charger

Sourcing a Type 1 EV charger requires careful consideration of regional standards, vehicle compatibility, and long-term usability. While Type 1 connectors (also known as SAE J1772) are predominantly used in North America and parts of Asia and are well-suited for single-phase AC charging, they are gradually being supplemented or replaced by Type 2 connectors in many markets—especially in Europe and newer EV models.

When sourcing a Type 1 charger, ensure compatibility with your electric vehicle and local electrical infrastructure. Evaluate factors such as charging speed (typically up to 7.4 kW), portability vs. wall-mounted options, smart features, durability, and compliance with safety standards (e.g., UL certification in the U.S.). Additionally, consider future-proofing, as newer EVs may adopt different standards or move toward faster DC charging solutions.

In summary, a Type 1 EV charger remains a reliable and widely supported option for many existing electric vehicles, particularly in regions where the standard is still prevalent. However, buyers should assess current needs alongside potential future trends in EV charging to make a cost-effective and sustainable investment.