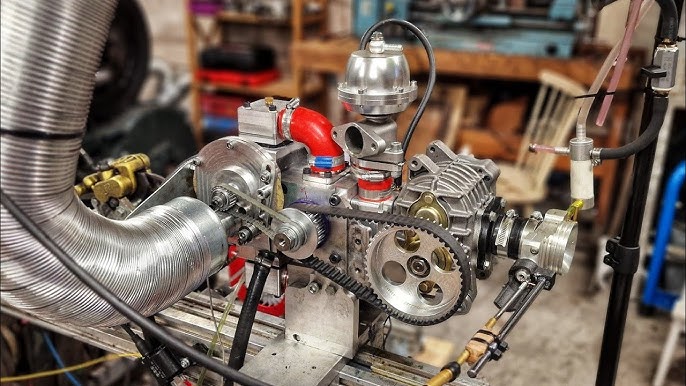

The global two-stroke 50cc engine and vehicle market has experienced steady demand, driven by low-cost urban mobility solutions, lightweight performance applications, and robust adoption in emerging economies. According to Mordor Intelligence, the small engine market, including two-stroke variants under 100cc, is projected to grow at a CAGR of approximately 5.2% from 2023 to 2028, with 50cc platforms maintaining a significant share due to their prevalence in scooters, mopeds, and recreational equipment. This growth is further supported by increasing demand for affordable personal transportation in Asia-Pacific and Latin America, where regulatory environments remain favorable for smaller-displacement engines. As urban congestion rises and fuel efficiency becomes paramount, manufacturers specializing in two-stroke 50cc technology continue to innovate, balancing performance, emissions compliance, and cost-effectiveness. In this competitive landscape, nine manufacturers have emerged as leaders, combining production scale, technological refinement, and global distribution to dominate the segment.

Top 9 Two Stroke 50Cc Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SYM

Domain Est. 2007

Website: sym-global.com

Key Highlights: Top two-wheeler brand – Sanyang Motor, known as brand-name SYM, is a world leading manufacturer in the design and production two-wheeled products for over ……

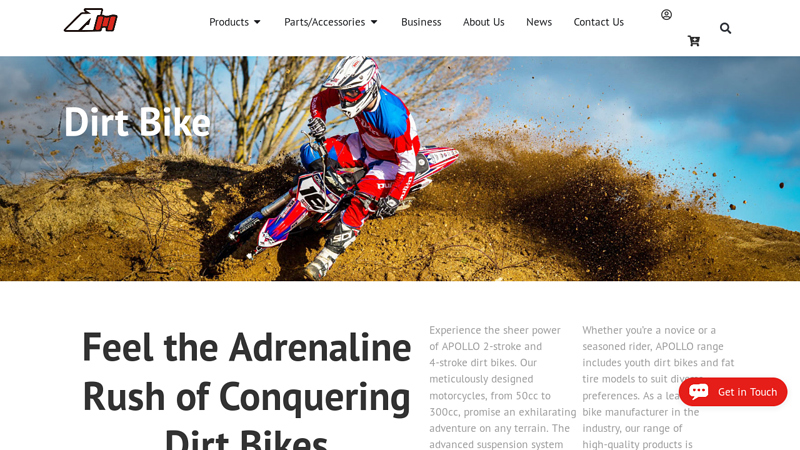

#2 APOLLO

Domain Est. 2023

Website: apollino.com

Key Highlights: Experience the sheer power of APOLLO 2-stroke and 4-stroke dirt bikes. Our meticulously designed motorcycles, from 50cc to 300cc, promise an exhilarating ……

#3 GASGAS Motorcycles

Domain Est. 1996

Website: gasgas.com

Key Highlights: Discover GASGAS Off-Road Motorcycles – crafted for performance, fun, and fearless riding. Experience the thrill and join the community today!…

#4 RR 2T 50

Domain Est. 1997

Website: betamotor.com

Key Highlights: Single-cylinder, 2-stroke, liquid cooled. Bore. 40,3 mm. Stroke. 39 mm. Displacement. 49,7 cc. Compression ratio. 12:1. LOAD MORE. Starter. Kick. Generator….

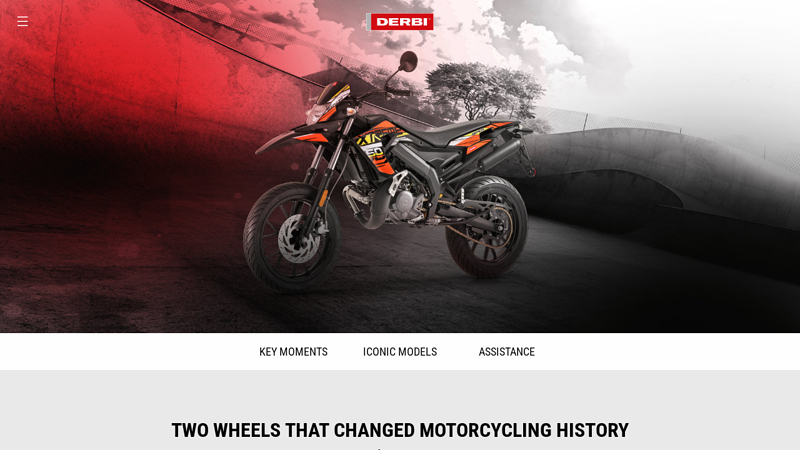

#5 Derbi: two wheels that changed motorcycling history

Domain Est. 1997

Website: derbi.com

Key Highlights: Two new models are launched: the Derbi GP1 scooter and Derbi GPR motorcycle, a 50cc sports bike derived from the world of motorbike racing….

#6 Malossi

Domain Est. 1998

Website: malossi.com

Key Highlights: The Yamaha TY 50, an enduro motorcycle equipped with a 50cc two-stroke engine with new technical solutions usually reserved for its higher-capacity sisters. At ……

#7 2026 PW50 Yamaha Motorsports, USA

Domain Est. 2001

Website: yamahamotorsports.com

Key Highlights: The PW50 is a twist-and-go package. Entry-Level Two-Stroke Engine. Gutsy 49cc two-stroke is built to thrill without intimidating beginners. Low Maintenance ……

#8 PRODUCTS

Domain Est. 2008

Website: motoriminarelli.it

Key Highlights: Motori Minarelli product mix includes two-stroke and four-stroke 50cc, 125cc and 300cc internal combustion engines with a high technological content….

#9 PW50

Website: yamaha-motor.eu

Key Highlights: Fully-automatic 50cc 2-stroke engine · Easy-to-adjust throttle limiter · Low seat height and user-friendly controls · Lightweight handling and compact dimensions….

Expert Sourcing Insights for Two Stroke 50Cc

H2: Projected 2026 Market Trends for Two-Stroke 50cc Engines

As the global powersports and urban mobility sectors evolve, the market for two-stroke 50cc engines is undergoing significant transformation. By 2026, several key trends are expected to shape the demand, regulation, technology, and regional dynamics of this niche but enduring segment.

1. Regulatory Pressure and Emissions Standards

The most influential factor impacting the two-stroke 50cc market is tightening environmental regulation. By 2026, European Union, U.S. EPA, and similar international emissions standards are anticipated to become stricter, particularly regarding particulate matter and hydrocarbon emissions. Traditional two-stroke engines, known for higher emissions compared to four-stroke counterparts, will face increasing restrictions in urban areas. As a result, manufacturers are expected to either phase out non-compliant models or invest in cleaner-burning two-stroke technologies such as direct fuel injection (DFI), which reduces emissions and improves fuel efficiency.

2. Shift Toward Electrification

The rise of electric scooters and micro-mobility solutions poses a significant challenge to internal combustion two-stroke 50cc engines. By 2026, electric 50cc-equivalent vehicles are projected to dominate urban commuter markets due to lower maintenance, quieter operation, and zero tailpipe emissions. This transition is especially strong in densely populated cities in Europe and Asia. While two-stroke engines will retain a foothold in cost-sensitive or off-road applications, their share in the scooter and moped market is expected to decline unless hybrid or transitional technologies emerge.

3. Niche and Performance Applications

Despite regulatory and competitive pressures, two-stroke 50cc engines will maintain relevance in specific niches. Markets such as off-road motocross, karting, and recreational mini-bikes are likely to sustain demand due to the high power-to-weight ratio and simplicity of two-stroke engines. Enthusiast communities and aftermarket customization will continue to support this segment. In developing economies, where cost and accessibility remain key, two-stroke 50cc engines may still be favored for low-cost commuter transport, especially in regions with less stringent emissions enforcement.

4. Technological Innovation and Fuel Efficiency

Innovation in two-stroke design—such as electronically controlled injection systems, improved scavenging, and hybrid-assist features—could extend the viability of these engines. Companies investing in cleaner, more efficient two-stroke technologies may capture niche markets that value performance and simplicity. By 2026, we may see a small but growing segment of “green two-stroke” engines that meet modern emissions standards while preserving the mechanical advantages of the design.

5. Regional Market Divergence

Geographic disparities will define the 2026 market landscape. In Western Europe and North America, the two-stroke 50cc market is expected to shrink due to regulation and electrification. In contrast, regions like Southeast Asia, Africa, and parts of Latin America may still see stable or even growing demand, driven by affordability and infrastructure limitations for electric charging. However, even in these regions, the long-term trend points toward gradual phase-out unless local policies incentivize cleaner two-stroke variants.

Conclusion

By 2026, the two-stroke 50cc engine market will be characterized by decline in mainstream urban transport, sustained demand in recreational and off-road segments, and increased technological refinement to meet environmental standards. While electrification and regulation will drive the overall contraction of this market, innovation and regional differences will ensure that two-stroke 50cc engines remain a relevant, albeit specialized, component of the global mobility ecosystem.

Common Pitfalls When Sourcing Two-Stroke 50cc Engines (Quality & IP)

Sourcing two-stroke 50cc engines—often used in scooters, mopeds, mini bikes, and certain industrial tools—can be cost-effective, but it comes with significant risks related to quality control and intellectual property (IP) infringement. Buyers, especially those sourcing from low-cost manufacturing regions, must navigate several common pitfalls to avoid reliability issues, legal exposure, and reputational damage.

Poor Quality Control and Reliability Issues

One of the most prevalent challenges is inconsistent or inadequate quality control, leading to unreliable performance and shortened engine life.

-

Inconsistent Manufacturing Standards: Many low-cost suppliers lack rigorous quality assurance processes. This results in engines with inconsistent tolerances, substandard materials (e.g., low-grade aluminum or poor piston rings), and improper assembly—leading to overheating, excessive vibration, or premature failure.

-

Lack of Certification and Testing: Reputable engines often carry certifications such as EPA, CARB, or EU emissions standards. Many sourced 50cc engines fail to meet these regulations or come with falsified documentation, posing compliance risks, especially for markets with strict environmental laws.

-

Short-Term Cost vs. Long-Term Costs: While the initial purchase price may be low, poor-quality engines increase total cost of ownership due to higher warranty claims, maintenance, and customer dissatisfaction.

Intellectual Property (IP) Infringement Risks

Sourcing two-stroke 50cc engines carries a high risk of IP violations, particularly when dealing with counterfeit or cloned products.

-

Counterfeit and Clone Engines: Many suppliers offer engines that closely mimic well-known brands (e.g., Honda, Yamaha, or Zenoah) in appearance and performance but are unauthorized copies. These clones often infringe on design patents, trademarks, and technical specifications, exposing importers to legal action.

-

Patent and Design Violations: Even if an engine appears generic, it may incorporate patented technologies (e.g., carburetor designs, crankshaft configurations, or exhaust systems). Unwittingly sourcing such products can lead to customs seizures, fines, or litigation.

-

Supply Chain Transparency Issues: Suppliers may obscure the origin of engines or misrepresent them as “compatible” or “generic” to avoid liability. Without proper due diligence, buyers may inadvertently distribute infringing products.

Lack of After-Sales Support and Documentation

Engines sourced from questionable suppliers often come without adequate technical documentation or support.

-

Missing Manuals, Spare Parts, and Service Support: Many suppliers do not provide service manuals, torque specifications, or reliable access to replacement parts, complicating maintenance and repair.

-

Warranty and Liability Gaps: Poorly defined or non-existent warranty terms increase risk for end-users and distributors, especially if engine failure leads to equipment damage or safety incidents.

Regulatory and Environmental Non-Compliance

Two-stroke engines are heavily regulated due to emissions. Sourcing non-compliant engines can result in market access denial.

-

Emissions Standard Violations: Many generic 50cc engines do not meet current emissions standards (e.g., Euro 5, EPA Tier 3). Importing or selling such engines in regulated markets can lead to product recalls, fines, or import bans.

-

Noise and Safety Regulations: Engines may also fail noise or safety requirements, further limiting their usability in commercial or consumer applications.

Mitigation Strategies

To avoid these pitfalls:

– Conduct Supplier Audits: Visit manufacturing facilities or use third-party inspectors to verify quality systems.

– Verify IP Status: Work with legal counsel to conduct freedom-to-operate analyses and ensure engines don’t infringe on existing patents.

– Demand Certifications: Require proof of compliance with relevant environmental and safety standards.

– Use Reputable Distributors: Partner with established suppliers who provide traceability, warranties, and technical support.

– Test Sample Units: Perform independent performance, durability, and emissions testing before bulk orders.

By proactively addressing these quality and IP concerns, businesses can reduce risk and ensure reliable, compliant sourcing of two-stroke 50cc engines.

H2: Logistics & Compliance Guide for Two-Stroke 50cc Vehicles

H2: Introduction

Two-stroke 50cc vehicles—commonly scooters, mopeds, or mini-motorcycles—are popular for urban commuting due to their low cost, fuel efficiency, and ease of use. However, transporting, registering, and operating these vehicles involves navigating a complex web of logistics and compliance regulations that vary significantly by country and region. This guide outlines key considerations for legal and efficient management of 2-stroke 50cc vehicles.

H2: Regulatory Classification

Understanding how your 50cc two-stroke vehicle is classified is critical for compliance.

- Moped vs. Motorcycle: In many jurisdictions (e.g., EU, USA), 50cc vehicles are classified as mopeds if they meet speed and power criteria (typically max 45 km/h or 28 mph and ≤ 4 kW).

- Licensing Requirements: Most regions require at least a moped license or a standard driver’s license with a motorcycle endorsement.

- Registration & Insurance: Mandatory in most areas. Vehicles must be registered with local motor vehicle authorities and carry liability insurance.

- Emissions Standards: Two-stroke engines produce higher hydrocarbon emissions than four-strokes. Many countries (e.g., EU, USA, Japan) have phased out or restricted new two-stroke 50cc vehicles due to environmental regulations.

H2: Emissions & Environmental Compliance

Two-stroke engines face increasing scrutiny due to pollution.

- EU Regulations:

- Subject to Euro 4 (or Euro 5) emission standards for L-category vehicles (effective 2013/2020).

- Two-stroke 50cc models must meet strict limits on CO, HC, and NOx emissions.

-

Many manufacturers have discontinued two-stroke models in favor of cleaner four-stroke or electric alternatives.

-

USA (EPA & CARB):

- EPA Tier 3 and California Air Resources Board (CARB) standards apply.

- Two-stroke 50cc vehicles must be certified and labeled accordingly.

-

CARB prohibits the sale of non-certified small off-road engines (including some two-strokes).

-

Other Regions:

- Countries like India (BS-VI norms) and China (National V standards) also enforce strict emission rules, often limiting two-stroke vehicle sales.

Note: Importing or selling non-compliant two-stroke 50cc vehicles may result in fines, seizure, or bans.

H2: Import/Export Logistics

Cross-border movement requires adherence to customs and transportation regulations.

- Homologation: Vehicles must meet destination country’s technical standards (safety, lighting, emissions).

- Documentation:

- Bill of Lading/Air Waybill

- Commercial Invoice

- Certificate of Origin

- EPA/CARB Compliance Certificate (for US)

- COC (Certificate of Conformity) for EU

- Customs Duties & Taxes: Vary by country. Some regions impose higher tariffs on two-stroke vehicles due to environmental concerns.

- Transportation:

- Road: Secure vehicle on trailer; ensure proper lighting and registration.

- Sea/Air: Palletized and crated; battery disconnected; fuel tank empty or minimal.

H2: Operational Compliance

Ensure ongoing legal use.

- Safety Equipment: Mandatory lighting, mirrors, horn, and braking systems per local law.

- Fuel Mix: Two-stroke engines require pre-mixing oil and gasoline (typically 50:1). Use only approved 2-stroke oil.

- Noise Regulations: Many cities limit vehicle noise (e.g., 74–80 dB at idle). Aftermarket exhausts may violate noise laws.

- Age Restrictions: Operators often must be 16 or older.

- Helmet Laws: Universal requirement in most jurisdictions.

H2: Maintenance & Disposal

Proper upkeep and end-of-life handling are part of compliance.

- Regular Servicing: Clean air filter, check spark plug, adjust carburetor.

- Oil Disposal: Used 2-stroke oil is hazardous waste. Dispose only at certified facilities.

- Recycling: Metals, plastics, and batteries must be recycled per local environmental regulations (e.g., EU End-of-Life Vehicles Directive).

H2: Regional Summary (Examples)

| Region | Classification | Speed Limit | Licensing | Emissions Standard |

|————–|——————–|————-|——————|—————————|

| EU | L1e-B Moped | 45 km/h | AM License | Euro 5 (2020+) |

| USA (Federal)| Moped | ≤30 mph | Varies by state | EPA Tier 3 / CARB |

| UK | Moped | 45 km/h | AM or Category A | Euro 4/5 |

| Australia | Learner-legal bike | 50 km/h | LAMS compliant | ADR 79/03 (Euro 3-based) |

H2: Conclusion

While two-stroke 50cc vehicles offer simplicity and affordability, their logistics and compliance landscape is increasingly stringent due to environmental and safety regulations. Always verify local laws before purchasing, importing, or operating. Consider transitioning to four-stroke or electric 50cc alternatives for better compliance and sustainability.

Recommendation: Consult your national transport authority (e.g., DVLA in UK, DMV in USA, RDW in Netherlands) and customs agency before any cross-border movement.

Conclusion: Sourcing a Two-Stroke 50cc Engine or Vehicle

Sourcing a two-stroke 50cc engine or vehicle—commonly used in scooters, mopeds, or small recreational machines—requires careful consideration of regulations, availability, and intended use. Due to increasingly stringent emissions standards in many countries, new production and sale of two-stroke 50cc engines have significantly declined, making them more common in the used or vintage market. As a result, sourcing often involves purchasing second-hand units from online marketplaces, specialty dealers, or salvage yards.

While two-stroke 50cc engines offer simplicity, lightweight design, and high power-to-weight ratio, they are less fuel-efficient and more polluting than their four-stroke counterparts, which may limit their legality in certain urban areas or environmentally regulated regions. Additionally, ongoing maintenance and part availability can be a challenge as manufacturers phase out support.

In conclusion, sourcing a two-stroke 50cc engine is feasible primarily through used or aftermarket channels, but buyers should be mindful of local regulations, environmental concerns, and long-term maintenance logistics. For many users, a modern four-stroke 50cc alternative may offer better compliance, efficiency, and support, unless the two-stroke is specifically desired for restoration, performance tuning, or niche applications.