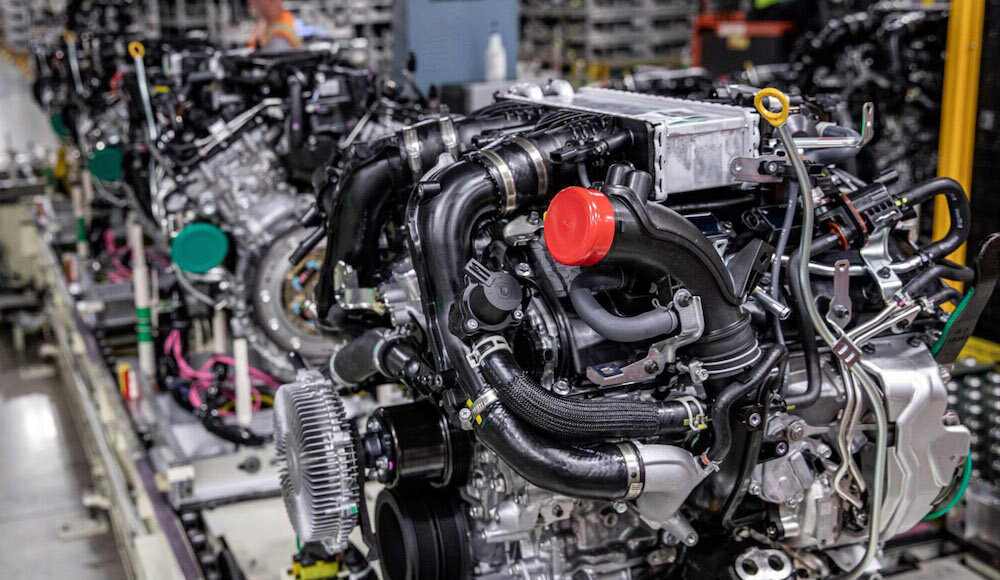

The global turbocharger market is experiencing robust growth, driven by increasing demand for fuel-efficient engines and stringent emission regulations. According to a report by Mordor Intelligence, the turbocharger market was valued at USD 25.3 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. This expansion is further fueled by widespread adoption in light-duty vehicles, particularly in emerging economies where automakers like Toyota are ramping up production of downsized, turbocharged engines to meet environmental standards and consumer demand for performance. As Toyota continues to invest in turbocharged powertrains across models like the RAV4, Camry, and Crown, the need for reliable, high-performance turbocharger solutions has never been greater. This analysis identifies the top 9 turbocharger manufacturers serving Toyota, selected based on technical innovation, OEM partnerships, market share, and compatibility with Toyota’s current engine platforms.

Top 9 Turbocharger For Toyota Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Turbochargers

Domain Est. 2000

Website: toyota-industries.com

Key Highlights: Toyota Industries develops and manufactures turbochargers for internal-combustion engines (ICEs) for both automobile and industrial applications….

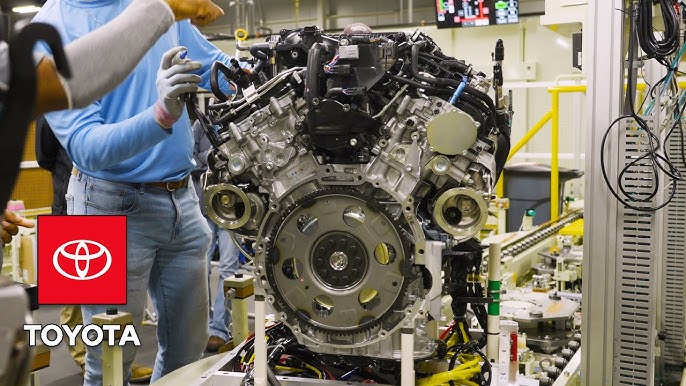

#2 New Cars, Trucks, SUVs & Hybrids

Domain Est. 1994

Website: toyota.com

Key Highlights: Explore the newest Toyota trucks, cars, SUVs, hybrids and minivans. See photos, compare models, get tips, calculate payments, and more….

#3 Toyota Unleashes the Turbo Trail Cruiser at 2025 SEMA Show

Domain Est. 1994

Website: pressroom.toyota.com

Key Highlights: The Toyota Motorsports Garage team engineered new motor mounts and machined an adapter plate to mate the i-FORCE V6 engine to the bell housing ……

#4 Turbo Kits, Turbocharger Upgrades, and Performance Auto Parts

Domain Est. 2000

Website: turbokits.com

Key Highlights: 7-day delivery 15-day returnsGlobal supplier of quality Turbo Kits, Turbochargers, Turbo Upgrades. Garrett Precision BorgWarner HPT Turbo Xona Rotor Turbosmart…

#5 Performance Turbochargers

Domain Est. 2002

Website: borgwarner.com

Key Highlights: AirWerks turbochargers cover a wide range of power ratings ranging from 220 HP all the way up to 1,875 HP per turbo. AirWerks is an excellent choice when it ……

#6 Pureturbos

Domain Est. 2010

Website: pureturbos.com

Key Highlights: We are a company offering high quality new and remanufactured turbochargers. We pride ourselves in providing the best in turbocharger services and products….

#7 Kinugawa Turbo Systems Bolt

Domain Est. 2016

Website: store.kinugawaturbosystems.com

Key Highlights: Free delivery 30-day returnsKinugawa Turbo Systems supplies world class performance turbocharger upgrade kits as well as turbocharger repair kits with highest quality standard and …

#8 TOYOTA MARKETS NEW CROWN TURBO

Domain Est. 2018

Website: global.toyota

Key Highlights: The M-TEU gasoline engine mounted on the Crown Turbo is a turbocharger-mounted version of the highly evaluated Toyota M-TEU engine (maximum horsepower 125, ……

#9 Turbochargers for sale

Domain Est. 2021

Website: br-turbo.com

Key Highlights: New and remanufactured turbochargers for sale. Thousands of turbos in stock at all times. ➤ Worldwide delivery! 100% Quality Guarantee!…

Expert Sourcing Insights for Turbocharger For Toyota

H2: 2026 Market Trends for Turbochargers for Toyota

The market for turbochargers specifically designed for Toyota vehicles in 2026 is poised for significant transformation, driven by evolving regulatory standards, technological advancements, and shifting consumer preferences. As automakers, including Toyota, accelerate their transition toward more efficient and lower-emission powertrains, turbocharger demand remains resilient, especially in hybrid, performance, and emerging markets. Below are the key market trends shaping the turbocharger sector for Toyota by 2026:

-

Increased Demand for Downsized, Turbocharged Engines

Toyota continues to adopt smaller-displacement turbocharged engines (e.g., the 1.5L and 2.4L Dynamic Force turbo engines) across its lineup, from the RAV4 to the new Lexus models. These engines offer improved fuel efficiency and reduced emissions without sacrificing performance. By 2026, this trend will drive aftermarket and OEM turbocharger demand, particularly as these models age and require maintenance or upgrades. -

Growth in Hybrid and Plug-in Hybrid Applications

Toyota’s commitment to hybrid technology means turbocharged hybrid systems (e.g., the 2.4L turbo in the 2023+ Grand Highlander and Crown hybrids) will become more common. These systems use turbocharging to boost performance while maintaining electrified efficiency. As hybrid adoption increases globally, replacement and performance turbocharger markets will expand to support maintenance and tuning needs. -

Expansion of the Aftermarket and Performance Sector

Enthusiast communities and tuning markets for Toyota platforms like the GR Corolla, GR Supra, and turbocharged trucks are growing. By 2026, the aftermarket for performance turbochargers—such as ball-bearing turbos from brands like Garrett, BorgWarner, and Turbonetics—will see robust growth. Demand will be fueled by owners seeking enhanced horsepower, improved throttle response, and reliability under high-stress conditions. -

Advancements in Turbocharger Technology

Variable geometry turbochargers (VGT) and electric turbochargers (e.g., e-boost systems) are increasingly being explored by OEMs and suppliers. While Toyota has been cautious in adopting VGT for gasoline engines, supplier partnerships may bring advanced turbo systems to future models by 2026. These technologies reduce lag, improve low-end torque, and enhance overall efficiency—key selling points for next-gen Toyota applications. -

Regional Market Dynamics

In emerging markets such as Southeast Asia, Latin America, and the Middle East, demand for durable, cost-effective turbochargers for Toyota pickups (e.g., Hilux, Fortuner) and SUVs remains strong. These markets prioritize reliability and power in harsh operating conditions, supporting a steady replacement market. Meanwhile, in North America and Europe, emissions regulations and consumer demand for eco-performance hybrids will shape turbocharger development. -

Sustainability and Remanufactured Components

Environmental regulations and cost-conscious consumers are boosting the remanufactured turbocharger market. By 2026, companies specializing in rebuilding OEM-equivalent turbo units for Toyota models will gain market share. These remanufactured turbos offer a sustainable, lower-cost alternative to new units, aligning with circular economy goals. -

Supply Chain and Material Innovation

The integration of lightweight materials (e.g., titanium aluminide in turbine wheels) and improved thermal coatings will enhance turbocharger durability and efficiency. Additionally, supply chain resilience—especially in semiconductor and rare earth material sourcing—will influence production timelines and costs for turbo OEMs supplying to Toyota.

Conclusion

By 2026, the turbocharger market for Toyota will be characterized by a dual focus: supporting electrified, efficient powertrains and meeting performance demands in both OEM and aftermarket segments. As Toyota balances its hybrid leadership with performance ambitions, turbocharger technology will remain a critical enabler. Stakeholders—including manufacturers, suppliers, and service providers—must adapt to regulatory shifts, technological innovation, and evolving customer expectations to capitalize on this dynamic market.

Common Pitfalls When Sourcing a Turbocharger for Toyota

Sourcing a replacement turbocharger for a Toyota vehicle can be a cost-effective way to restore engine performance, but it comes with several risks—especially concerning quality and intellectual property (IP). Avoiding these common pitfalls is essential to ensure reliability, longevity, and legal compliance.

Poor Quality Components and Counterfeit Products

One of the most significant risks when sourcing a turbocharger—especially from non-OEM or third-party suppliers—is receiving a unit made with substandard materials or imprecise manufacturing. Low-quality turbochargers may use inferior bearings, turbine wheels, or housings that fail prematurely under high heat and rotational speeds. These failures can lead to oil leaks, reduced boost pressure, excessive exhaust smoke, or complete engine damage. Additionally, counterfeit turbochargers often mimic OEM branding but lack proper engineering, resulting in poor fitment, performance issues, and potential safety hazards.

Lack of Genuine OEM or Licensed IP Compliance

Many aftermarket turbochargers infringe on the intellectual property of original equipment manufacturers (OEMs) like Toyota or turbo specialists such as Garrett or BorgWarner. Sourcing a turbocharger that uses patented designs, logos, or technical specifications without proper licensing not only violates IP laws but may also compromise performance and reliability. Genuine OEM or licensed remanufactured units undergo rigorous testing and adhere to strict tolerances. In contrast, unlicensed replicas may cut corners in design and calibration, leading to compatibility issues or long-term engine problems.

Inaccurate Fitment and Application Matching

Toyota offers a wide range of engines and models, each requiring a specific turbocharger variant based on engine displacement, model year, and emissions standards. Sourcing the wrong turbo—due to incomplete part number verification or vague product descriptions—can result in fitment issues, ECU errors, or performance losses. Always verify the turbo model number, engine code (e.g., 1GD-FTV, 2JZ-GTE), and vehicle specifications before purchasing.

Inadequate Warranty and Support

Low-cost turbochargers, particularly from unverified suppliers, often come with limited or no warranty coverage. If the unit fails shortly after installation, replacement or repair costs may fall entirely on the buyer. Reputable suppliers provide clear warranty terms, technical support, and return policies. Always check for documented warranty details and customer service availability before making a purchase.

Insufficient Remanufacturing Standards

Many “remanufactured” or “reconditioned” turbochargers on the market do not meet OEM standards. Poor cleaning processes, improper balancing, or the reuse of worn components can drastically reduce the lifespan of a rebuilt unit. To avoid this, source remanufactured turbos only from certified rebuilders who follow industry-recognized standards and provide performance testing documentation.

By being aware of these common pitfalls—especially around quality control and IP compliance—buyers can make informed decisions and select a reliable, legal, and properly matched turbocharger for their Toyota.

Logistics & Compliance Guide for Turbocharger For Toyota

This guide outlines the essential logistics and compliance considerations for transporting, importing, exporting, and distributing turbochargers designed for Toyota vehicles. Adhering to these guidelines ensures smooth operations, regulatory compliance, and customer satisfaction.

Product Classification and HS Code

Identify the correct Harmonized System (HS) code for the turbocharger to facilitate customs clearance and determine applicable tariffs. Turbochargers typically fall under:

- HS Code: 8414.80 (Parts of air or vacuum pumps, air or other gas compressors, and fans)

- Note: Confirm the exact HS code based on specific product features and country-specific tariff schedules. Misclassification may lead to delays, fines, or incorrect duties.

Packaging and Labeling Requirements

Ensure turbochargers are packaged to prevent damage during transit and labeled in compliance with international standards:

- Packaging: Use sturdy, shock-resistant materials with internal padding. Include moisture barriers if shipping to humid environments.

- Labeling: Include:

- Product name and model number

- OEM part number (e.g., Toyota OEM equivalent)

- Country of origin

- Weight and dimensions

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

- Compliance marks (e.g., CE, if applicable)

Import/Export Documentation

Prepare accurate documentation for customs authorities:

- Commercial invoice (with declared value, product description, and HS code)

- Packing list

- Bill of lading (for sea freight) or air waybill (for air freight)

- Certificate of Origin (may be required for preferential tariff treatment under trade agreements)

- Export license (if required by exporting country for engine components)

Regulatory Compliance

Verify compliance with destination country regulations:

- Emissions and Environmental Standards: Ensure turbochargers meet applicable emissions regulations (e.g., EPA in the U.S., Euro standards in the EU). Replacement parts should not compromise vehicle emissions compliance.

- Safety Standards: Comply with regional safety and performance standards (e.g., DOT in the U.S., ECE in Europe).

- Aftermarket Part Regulations: Confirm whether the turbocharger is sold as an OEM-equivalent or performance aftermarket part, as regulations may differ.

Transportation and Freight Options

Choose the appropriate mode of transport based on cost, speed, and destination:

- Air Freight: Recommended for urgent shipments or high-value turbochargers.

- Sea Freight: Cost-effective for bulk shipments; use FCL (Full Container Load) or LCL (Less than Container Load) depending on volume.

- Ground Transport: Use regional carriers for domestic or cross-border land transport (e.g., trucking within North America or Europe).

Duties, Taxes, and Incoterms

Clarify financial responsibilities using internationally recognized Incoterms:

- Select appropriate Incoterms (e.g., FOB, CIF, DDP) to define who pays for shipping, insurance, and duties.

- Calculate applicable import duties and VAT/GST based on destination country tariffs.

- Consider duty drawbacks or free trade agreements (e.g., USMCA, RCEP) that may reduce tariffs.

Quality Assurance and Traceability

Maintain quality control and traceability throughout the supply chain:

- Implement lot numbering and serial tracking for each turbocharger.

- Provide warranties and product certifications upon request.

- Retain documentation for audits and compliance verification.

Returns and Warranty Logistics

Establish a clear process for handling returns and warranty claims:

- Define return authorization (RMA) procedures.

- Specify return shipping responsibilities based on warranty terms.

- Inspect returned units for compliance and failure analysis.

Environmental and Disposal Compliance

Follow environmental regulations for end-of-life components:

- Comply with WEEE (Waste Electrical and Electronic Equipment) directives in the EU, if applicable.

- Recycle or dispose of defective turbochargers according to local environmental laws.

Adhering to this logistics and compliance guide ensures that turbochargers for Toyota vehicles are handled efficiently, legally, and sustainably across global markets.

Conclusion: Sourcing a Turbocharger for a Toyota

Sourcing a turbocharger for a Toyota vehicle requires careful consideration of several factors to ensure optimal performance, reliability, and compatibility. After evaluating original equipment manufacturer (OEM) parts, aftermarket options, remanufactured units, and third-party suppliers, it becomes clear that the best choice depends on the specific model, engine type, intended usage, and budget.

OEM turbochargers offer the highest level of reliability and compatibility, ensuring seamless integration with the vehicle’s existing systems. However, they come at a higher cost. Aftermarket and remanufactured turbochargers can provide cost-effective alternatives without significantly compromising quality, especially from reputable brands that adhere to strict manufacturing standards.

When sourcing, it is essential to verify the turbocharger’s specifications—such as part number, boost pressure, and fitment—to ensure it matches the Toyota model and engine. Purchasing from authorized distributors or trusted suppliers helps avoid counterfeit products and ensures warranty coverage. Additionally, considering factors like installation support, return policies, and customer reviews can further guide the decision-making process.

In summary, while cost is an important factor, prioritizing quality, compatibility, and supplier reputation will lead to a more durable and efficient turbocharger solution. Whether restoring performance, upgrading, or replacing a failed unit, a well-researched sourcing strategy ensures that the Toyota continues to deliver reliable and efficient performance on the road.