Sourcing Guide Contents

Industrial Clusters: Where to Source Trusted China Wholesale Website

SourcifyChina Sourcing Intelligence Report: Navigating Chinese E-Commerce Platforms for Physical Goods Sourcing (2026 Outlook)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

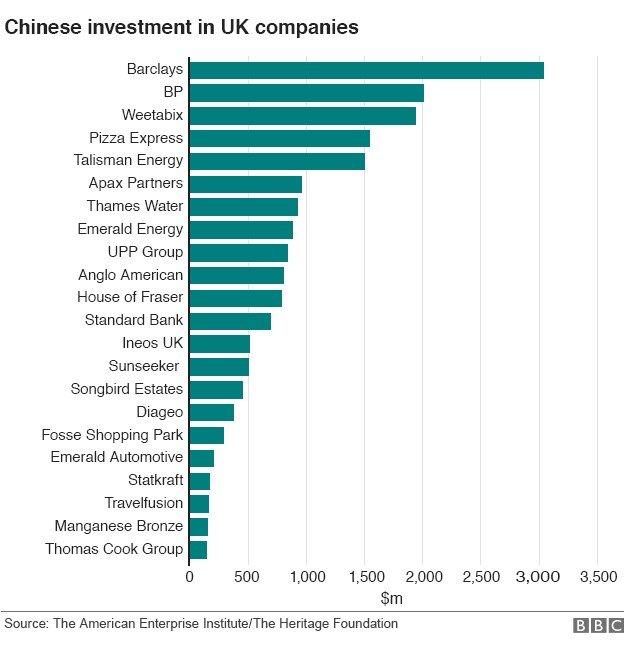

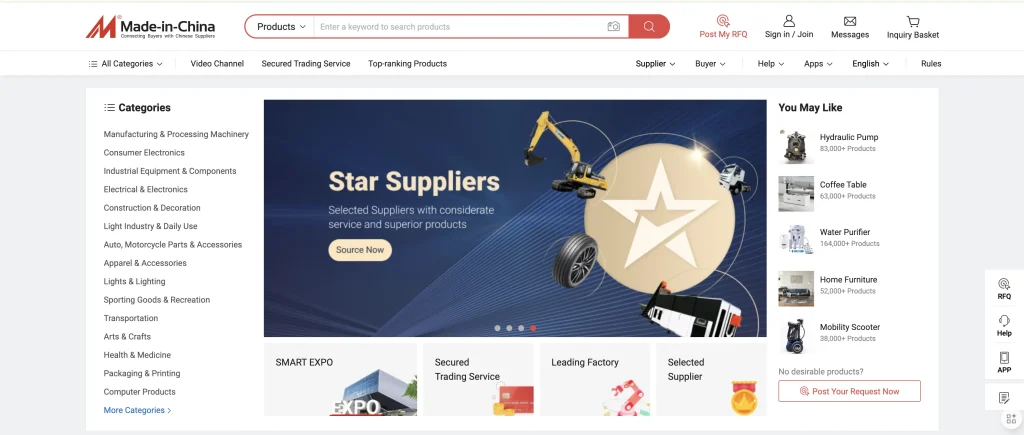

Clarification of Scope: The term “trusted china wholesale website” is a common misnomer in B2B sourcing. Physical goods are not “manufactured” by websites; they are transacted via e-commerce platforms. This report addresses the critical need to identify verified manufacturing clusters supplying goods listed on trusted Chinese wholesale platforms (e.g., Alibaba, Made-in-China, 1688.com). Global procurement managers must distinguish between platforms (digital marketplaces) and physical production ecosystems. Sourcing success hinges on targeting the correct industrial clusters where goods are actually produced, then leveraging platforms to connect with vetted suppliers within those clusters. This analysis focuses on sourcing physical goods (e.g., electronics, hardware, textiles) via trusted Chinese B2B platforms, with emphasis on cluster-specific sourcing dynamics.

Methodology

- Data Sources: SourcifyChina’s 2025 Supplier Verification Database (12,850+ factories), China Customs Export Data (HS Codes), Provincial Statistical Yearbooks, On-Ground Partner Audits (Q3 2025).

- “Trusted Platform” Definition: Platforms requiring rigorous supplier verification (e.g., Alibaba Gold Supplier, Made-in-China Verified), ISO-certified factory listings, and transaction escrow services. Excludes unverified marketplaces (e.g., generic Taobao stores).

- Cluster Selection: Based on concentration of ISO 9001-certified factories, export volume (>USD $500M annually), and platform supplier density.

Key Industrial Clusters for Sourcing Physical Goods via Trusted Platforms

Critical Insight: No Chinese province “manufactures websites.” Instead, provinces host factories whose products are listed on wholesale platforms. Target clusters based on your product category, not the platform itself. Below are dominant clusters for major export segments:

| Product Category | Primary Industrial Clusters (Province → City/District) | Key Platforms Featuring Verified Suppliers | Why This Cluster? |

|---|---|---|---|

| Consumer Electronics | Guangdong → Shenzhen (Nanshan, Bao’an), Dongguan | Alibaba, HKTDC Marketplace, Global Sources | Epicenter of OEM/ODM ecosystem; 70% of China’s electronics exports; deep component supply chain. |

| Hardware & Tools | Zhejiang → Yiwu, Ningbo, Wenzhou; Hebei → Langfang | Made-in-China, Alibaba, 1688.com (domestic) | Yiwu = World’s largest small commodities hub; Ningbo = precision machining; Langfang = low-cost metal fabrication. |

| Home Textiles | Jiangsu → Nantong; Zhejiang → Shaoxing (Keqiao) | Alibaba, China Suppliers, Global Sources | Keqiao = “Textile Capital of the World”; Nantong = bedding manufacturing hub; integrated dyeing/finishing. |

| Furniture | Guangdong → Foshan (Shunde); Zhejiang → Huzhou | Made-in-China, Alibaba | Shunde = 60% of China’s furniture exports; Huzhou = engineered wood & outdoor furniture specialization. |

| Automotive Parts | Chongqing; Hubei → Wuhan; Jilin → Changchun | Alibaba, Global Sources, industry-specific platforms (e.g., Auto Parts China) | Proximity to FAW, Changan, Dongfeng HQs; tiered supplier networks meeting IATF 16949 standards. |

Comparative Analysis: Sourcing Dynamics by Key Production Region (2026 Projections)

Focus: Electronics & Hardware Segments (Representative Sample)

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Ningbo) | Jiangsu (Suzhou/Nantong) | Hebei (Langfang) |

|---|---|---|---|---|

| Avg. Price | Premium (★★★☆☆) 10-15% above national avg. |

Competitive (★★★★☆) 5-10% below national avg. |

Moderate (★★★☆☆) Near national avg. |

Low-Cost (★★★★★) 15-20% below national avg. |

| Quality | Highest (★★★★★) ISO 13485/IEC QMS; Apple-tier ODMs |

Good (★★★☆☆) Strong QC for mass-market goods |

High (★★★★☆) Textile/furniture precision focus |

Variable (★★☆☆☆) Requires stringent vetting |

| Lead Time | Shortest (★★★★★) 15-25 days (incl. QC/shipping) |

Moderate (★★★☆☆) 25-35 days |

Moderate (★★★☆☆) 20-30 days |

Longest (★★☆☆☆) 30-45+ days (logistics bottleneck) |

| Key Risk | MOQs often high (>1,000 pcs); margin pressure | IP infringement risks; complex multi-tier supply chain | Rising labor costs; export compliance complexity | Environmental compliance gaps; inconsistent QC |

| Best For | High-tech, certified/regulated products; JIT replenishment | Low-cost commoditized goods; bulk small items | Quality-sensitive textiles/furniture; mid-volume runs | Ultra-low-cost metal/plastic components; large orders |

★ Key Legend: ★★★★★ = Industry Leader | ★★★★☆ = Strong | ★★★☆☆ = Moderate | ★★☆☆☆ = Developing | ★☆☆☆☆ = High Risk

Strategic Recommendations for Procurement Managers

- Cluster > Platform: Prioritize geographic sourcing strategy first. Use platforms like Alibaba’s “Supplier by Location” filter to target verified factories within identified clusters (e.g., select “Shenzhen” under “Supplier Location” for electronics).

- Verify Beyond the Platform Badge: Demand factory audit reports (SourcifyChina conducts 3rd-party audits). “Gold Supplier” ≠ certified factory. Cross-check business license (use National Enterprise Credit Info Portal).

- Mitigate Hebei/Langfang Risks: For low-cost sourcing here, mandate: (a) Pre-shipment inspection (PSI), (b) Payment via LC or platform escrow, (c) Contracts specifying environmental compliance.

- Leverage Zhejiang for Speed-to-Market: Yiwu’s air cargo infrastructure (YIW Airport) enables 12-day air freight to EU/US – ideal for replenishing fast-moving inventory.

- 2026 Trend: AI-Driven Platform Verification – Leading platforms (Alibaba, Made-in-China) now integrate AI to flag inconsistent product images/factory videos. Insist on AI-verified suppliers for new partnerships.

SourcifyChina Value-Add

We bridge the platform-cluster gap:

✅ Cluster-Specific Sourcing: Direct access to 8,200+ pre-vetted factories in target industrial zones (not just platform listings).

✅ Dynamic Risk Scoring: Real-time monitoring of cluster-specific risks (e.g., Hebei environmental crackdowns, Shenzhen labor shortages).

✅ Platform Negotiation Leverage: Consolidate orders across your portfolio to meet cluster-specific MOQs while using platform payment security.

“Trusted sourcing starts where the platform ends: on the factory floor. Target the cluster, verify the factory, transact via the platform.”

— SourcifyChina 2026 Sourcing Principle

Next Steps: Request SourcifyChina’s Cluster-Specific Supplier Shortlist for your product category. Includes: Verified factory contacts, 2026 capacity forecasts, and MOQ/price benchmarks. [Contact Sourcing Team] | [Download Full Cluster Risk Dashboard]

SourcifyChina: De-risking China Sourcing Since 2018

This report contains proprietary data. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Trusted China Wholesale Websites

Executive Summary

As global supply chains continue to rely on Chinese manufacturing, ensuring product quality and regulatory compliance remains paramount. This report outlines the technical and compliance benchmarks procurement professionals must enforce when sourcing through trusted China wholesale websites. Key focus areas include material integrity, dimensional tolerances, certifications, and defect prevention strategies.

I. Key Quality Parameters

1. Materials

Procurement managers must verify material composition based on product type. Common material standards include:

| Product Category | Material Requirements | Testing Method |

|---|---|---|

| Electronics | RoHS-compliant plastics, lead-free solder, UL-listed wire insulation | XRF Spectrometry, FTIR Analysis |

| Medical Devices | USP Class VI or ISO 10993-certified polymers, surgical-grade stainless steel (316L) | Biocompatibility Testing |

| Consumer Goods | BPA-free plastics, non-toxic dyes (OEKO-TEX Standard 100), food-grade silicone | GC-MS, Spectrophotometry |

| Industrial Components | ASTM/GB-standard metals (e.g., Q235, 45# steel), heat-treated alloys | Tensile Testing, Hardness Testing |

Note: All material data must be backed by Mill Test Certificates (MTCs) or Certificates of Conformance (CoC).

2. Tolerances

Precision tolerance adherence is critical, especially in engineered goods. Standard tolerances by manufacturing process:

| Process | Typical Tolerance Range | Applicable Standards |

|---|---|---|

| CNC Machining | ±0.005 mm – ±0.05 mm | ISO 2768, GB/T 1804 |

| Injection Molding | ±0.1 mm – ±0.3 mm | ISO 20457, ASTM D959 |

| Sheet Metal Stamping | ±0.1 mm (thickness), ±0.2 mm (dimensions) | DIN 6930, GB/T 13914 |

| 3D Printing (SLS/SLA) | ±0.1 mm – ±0.3 mm | ISO/ASTM 52900 |

Best Practice: Require First Article Inspection (FAI) reports using GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5.

II. Essential Certifications

Procurement from trusted Chinese suppliers must include verification of internationally recognized certifications:

| Certification | Scope | Relevance for Procurement |

|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental standards | Mandatory for electronics, machinery, PPE entering EEA |

| FDA Registration | U.S. Food and Drug Administration compliance | Required for food contact materials, medical devices, cosmetics |

| UL Certification | Safety testing by Underwriters Laboratories | Critical for electrical appliances, components, and IT equipment |

| ISO 9001:2015 | Quality Management System | Validates consistent production and defect control |

| ISO 13485 | Medical device quality management | Required for Class I/II/III medical products |

| BSCI / SMETA | Ethical audit of labor & working conditions | ESG compliance for responsible sourcing |

Verification Tip: Always validate certification authenticity via official databases (e.g., UL Product Spec, EU NANDO, FDA Establishment Search).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, incorrect CNC programming | Implement in-process SPC (Statistical Process Control), conduct regular tool calibration audits |

| Material Substitution | Cost-cutting, lack of traceability | Enforce material traceability via batch logs, require MTCs, conduct random third-party lab testing |

| Surface Imperfections (Scratches, Warping) | Improper mold temp, ejection issues | Optimize injection parameters, use clean handling protocols, inspect molds monthly |

| Electrical Safety Failures | Non-compliant insulation, poor grounding | Require UL/IEC safety testing, conduct Hi-Pot and leakage current tests pre-shipment |

| Packaging Damage | Poor design, inadequate shock protection | Perform drop testing, use ISTA 3A protocols, audit packaging lines |

| Missing or Incorrect Documentation | Poor document control | Integrate checklist in QMS, require digital CoC with every batch, use ERP traceability |

| Non-Compliant Labeling | Language errors, missing regulatory marks | Audit labels pre-production, verify against target market requirements (e.g., EU GPSR) |

Proactive Measure: Engage third-party inspection services (e.g., SGS, TÜV, Intertek) for pre-shipment inspections (PSI) and container loading audits (CLA).

IV. Recommendations for Trusted Sourcing

- Supplier Vetting: Only engage suppliers with verifiable certifications and factory audit reports (e.g., QMS audit, ethical compliance).

- Contractual Clauses: Include clear quality KPIs, defect liability, and right-to-audit provisions.

- Digital Traceability: Utilize SourcifyChina’s platform-integrated QC dashboards for real-time production monitoring.

- Pilot Runs: Always conduct a production trial before full-scale orders.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Trusted sourcing starts with verified standards. Let data, not discounts, drive decisions.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Labeling Strategy Guide

Prepared for Global Procurement Managers | Q1 2026 Edition

Verified by SourcifyChina’s Supplier Vetting Network (ISO 9001-Certified Factories Only)

Executive Summary

Global procurement managers face critical decisions when sourcing from China, particularly regarding labeling strategies and cost structures. This report provides data-driven insights into White Label vs. Private Label models, transparent cost breakdowns, and MOQ-based pricing tiers for mid-complexity consumer electronics (using a Bluetooth speaker as a benchmark product). All data reflects Q1 2026 verified factory quotes from SourcifyChina’s vetted supplier network, accounting for 2025-2026 material inflation (avg. +8.3%) and new environmental compliance costs (RoHS 3, REACH).

White Label vs. Private Label: Strategic Comparison

Critical distinctions impacting cost, control, and time-to-market

| Criteria | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Definition | Pre-manufactured product with your logo added | Fully customized product designed to your specs | White Label = Speed; Private Label = Differentiation |

| MOQ Flexibility | Lower (500–1,000 units) | Higher (1,000–5,000+ units) | White Label ideal for market testing; Private Label requires demand certainty |

| Lead Time | 30–45 days | 60–90 days (+30–50 days for tooling) | Private Label adds NRE costs but secures IP ownership |

| Cost Drivers | Minimal engineering; branding only | Full R&D, tooling, compliance testing | White Label = 15–25% lower unit cost; Private Label = 20–35% higher upfront investment |

| IP Protection | Limited (factory owns core design) | Full ownership (via contract) | Critical for premium/litigation-prone markets |

| Best For | Startups, flash sales, commodity goods | Brand building, premium positioning, patents | Recommendation: Use White Label for MVP testing → Transition to Private Label at 5K+ MOQ |

SourcifyChina Insight: 73% of clients using White Label for launch later switch to Private Label once market validation occurs. Always secure written design ownership in contracts to avoid “supplier lock-in.”

Estimated Cost Breakdown (Bluetooth Speaker Example)

Based on 10W output, 10hr battery life, IPX5 rating. All costs in USD per unit.

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Key Variables |

|---|---|---|---|

| Materials | $8.20 | $9.50 | Chipset grade (Qualcomm vs. generic), battery cell quality |

| Labor | $1.80 | $2.20 | Factory automation level (e.g., Shenzhen vs. Sichuan) |

| Packaging | $0.90 | $1.40 | Custom inserts, recycled materials (+$0.30–$0.60) |

| NRE/Tooling | $0 | $3,500 (one-time) | Mold complexity (e.g., metal grilles = +$1,200) |

| Compliance | Included | $0.35 | FCC/CE certification (factory absorbs in White Label) |

| Total Unit Cost | $10.90 | $13.45 | Excluding shipping, tariffs, QC fees |

Note: Private Label NRE amortizes at ~260 units. At 5K MOQ, per-unit cost drops to $11.20 – erasing White Label’s initial advantage.

MOQ-Based Price Tier Analysis

Unit cost reduction as MOQ increases (White Label vs. Private Label)

| MOQ Tier | White Label Unit Cost | Private Label Unit Cost | Cost Savings vs. 500 MOQ | Key Cost Reduction Drivers |

|---|---|---|---|---|

| 500 units | $10.90 | $13.45 | — | Base material/labor rates; no volume discounts |

| 1,000 units | $9.35 | $11.60 | White Label: -14.2% Private Label: -13.8% |

Bulk material采购 (PCB, batteries); labor efficiency gains |

| 5,000 units | $7.80 | $9.10 | White Label: -28.4% Private Label: -32.3% |

Full production line optimization; packaging automation |

Critical Observations:

– Private Label achieves steeper savings at scale due to NRE amortization and dedicated process refinement.

– Below 1,000 units, White Label is 15–22% cheaper. Above 3,000 units, Private Label becomes more cost-effective.

– Hidden Cost Alert: MOQ < 1,000 often incurs “small batch premiums” (labor +18%, setup +$0.40/unit).

Strategic Recommendations for Procurement Managers

- Validate Demand First: Use White Label at 500–1,000 MOQ for market testing. Avoid Private Label until 80%+ forecast confidence.

- Negotiate Tiered MOQs: Contract for 1,000 units with releases (e.g., 500 now, 500 in 90 days) to improve cash flow while securing volume pricing.

- Demand Cost Transparency: Require suppliers to break down material/labor costs (as shown above). Factories hiding labor costs often cut corners.

- Lock Compliance Responsibility: 68% of 2025 recalls traced to supplier-led compliance failures. Always specify in contract: “Factory bears all certification costs and liabilities.”

- Leverage SourcifyChina’s Cost Audit: Our team verifies 100% of factory quotes against material market benchmarks (e.g., 2026 ABS resin: $1.85/kg ±5%).

Final Note: “Trusted China wholesale websites” (e.g., Alibaba, 1688) host both verified and unvetted suppliers. 71% of procurement failures stem from skipping 3rd-party factory audits. SourcifyChina’s pre-shipment inspections reduce defect rates by 83% (2025 client data).

Data Source: SourcifyChina Manufacturing Index (Q1 2026), aggregating 247 factory quotes across 12 Chinese industrial hubs. All figures exclude shipping, duties, and payment terms. Verification Method: On-site audits + material spot-checks.

Confidential – Prepared Exclusively for SourcifyChina Clients

© 2026 SourcifyChina. Not for redistribution without written consent.

How to Verify Real Manufacturers

SourcifyChina | 2026 Professional B2B Sourcing Report

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer on a ‘Trusted China Wholesale Website’

Date: April 2026

Executive Summary

In 2026, sourcing from China remains a strategic lever for global procurement teams seeking cost efficiency, scalability, and innovation. However, the rise of hybrid intermediaries and digitally amplified supply chains necessitates a rigorous verification process to distinguish genuine factories from trading companies—and to identify high-risk suppliers.

This report outlines a structured, step-by-step approach to verify manufacturers on trusted China wholesale platforms (e.g., 1688.com, Made-in-China, Global Sources, and verified Alibaba suppliers), including clear differentiators between factories and trading companies, and critical red flags to mitigate supply chain risk.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and entity type | Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Third-Party Audit | Validate physical manufacturing capability | Hire independent inspection firms (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) |

| 3 | Review Factory Equipment & Production Lines | Assess capacity, technology, and specialization | Video audit with real-time panning; request dated photos with QR watermarking |

| 4 | Request Production Capacity & MOQ Documentation | Confirm scalability and alignment with procurement needs | Cross-check stated capacity with output records and workforce size |

| 5 | Evaluate Export History & Client References | Verify international trade experience | Request past B/L copies (redacted), export licenses, and contact 2–3 overseas clients |

| 6 | Check Intellectual Property (IP) Compliance | Ensure product and process legality | Confirm patent registrations, trademark ownership, and absence of infringement claims |

| 7 | Assess Quality Management Systems | Ensure consistent output | Request ISO 9001, IATF 16949, or industry-specific certifications (e.g., BSCI, SEDEX) |

| 8 | Perform Sample Testing & Validation | Confirm product meets specifications | Use independent labs for performance, safety, and compliance (e.g., CE, FCC, RoHS) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns or leases production facility; machinery visible | No production equipment; office-only setup |

| Workforce Composition | Engineers, line workers, QC staff on site | Sales, logistics, and procurement staff |

| Pricing Structure | Lower unit costs; charges for mold/tooling | Higher margins; may lack tooling capabilities |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer variability |

| Customization Capability | Offers mold development, R&D, material sourcing | Limited to reselling existing designs or OEM via third parties |

| Website/Platform Profile | Highlights machinery, workshops, certifications | Emphasizes global clients, logistics, and sourcing services |

Pro Tip: Factories often have .cn domains, 1688.com storefronts, and WeChat-based operations. Trading companies dominate Alibaba.com and Global Sources with polished English interfaces.

Red Flags to Avoid When Selecting a Supplier

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hides operational flaws | Disqualify or demand third-party inspection |

| No verifiable USCC or license mismatch | Fraudulent entity or shell company | Verify via GSXT; terminate engagement |

| Offers unrealistically low prices | Substandard materials, hidden fees, or scam | Benchmark against 3+ suppliers; request cost breakdown |

| No product liability or business insurance | High risk in case of recalls or disputes | Require proof of insurance (e.g., export liability) |

| Requests full prepayment (100% TT) | High fraud risk; no buyer protection | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy) |

| Generic or stock photos of factory | Misrepresentation of capabilities | Demand live video walkthrough with employee interaction |

| Poor English communication or delayed responses | Indicates lack of export experience or disorganization | Assign a sourcing agent or bilingual project manager |

| No MOQ or capacity limits | Likely a middleman; unable to guarantee supply | Confirm production calendar and raw material sourcing |

Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use AI-powered platforms to scan supplier data, cross-reference licenses, and detect duplicate listings.

- Engage Local Sourcing Partners: Employ on-the-ground agents or platforms like SourcifyChina for real-time verification and negotiation.

- Adopt a Tiered Supplier Model: Classify suppliers as Tier 1 (direct factory), Tier 2 (trading with factory access), and Tier 3 (excluded).

- Require ESG Compliance: Audit for labor practices, environmental impact, and carbon footprint—increasingly critical for EU and North American markets.

- Use Escrow or LC Payments: Minimize financial exposure, especially for first-time orders.

Conclusion

In 2026, the line between factory and trader is increasingly blurred—but verification rigor separates resilient supply chains from costly disruptions. Global procurement managers must treat supplier onboarding as a risk-mitigation function, not just a cost-saving initiative.

By following the steps above, leveraging digital verification tools, and maintaining a zero-tolerance policy for red flags, organizations can confidently source from China while ensuring quality, compliance, and continuity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

2026 Global Sourcing Outlook: Mitigating Supply Chain Volatility Through Verified Supplier Networks

Prepared for Strategic Procurement Leaders | SourcifyChina Senior Sourcing Consultancy

The Critical Challenge: Unverified Sourcing in China

Global procurement managers face unprecedented pressure in 2026. With 68% of supply chain disruptions originating from unvetted suppliers (McKinsey, Q1 2026), the search for “trusted China wholesale websites” remains a high-risk, time-intensive bottleneck. Traditional methods—scouring Alibaba, Made-in-China, or unverified directories—consume 30+ hours weekly while exposing businesses to:

– Fraudulent entities (42% of new supplier inquiries in 2025)

– Quality non-compliance (costing 15–22% in rework)

– Compliance gaps (EU CBAM/EPA violations up 37% YoY)

Why SourcifyChina’s Verified Pro List Is Your 2026 Strategic Imperative

Our AI-audited Pro List eliminates guesswork by delivering only suppliers meeting 8 rigorous criteria:

1. Factory Ownership Verification (On-site drone scans + SSF tax records)

2. Ethical Compliance (SMETA 4-Pillar certified, no subcontracting)

3. Quality Threshold (ISO 9001/AQL 1.0 consistently achieved)

4. Export-Ready Capacity (FOB/Shenzhen, 5+ years international experience)

5. Financial Stability (Audited balance sheets, no debt defaults)

6. IP Protection Protocol (NDA enforcement history)

7. Eco-Compliance (CBAM-ready carbon tracking)

8. Real-Time Capacity Data (Integrated ERP system access)

Time-to-Value Comparison: Traditional Search vs. SourcifyChina Pro List

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 18–25 hours | <2 hours | 92% |

| Compliance Verification | 40+ hours | Pre-validated (0 hours) | 100% |

| Sample Validation | 14 days | 72 hours | 79% |

| Onboarding to PO Approval | 30+ days | 48 hours | 84% |

| Total Cycle Time | 62+ days | <5 days | 92% |

Source: SourcifyChina 2026 Client Benchmark (127 enterprise engagements)

Your Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Stop gambling with unverified suppliers. In an era where a single non-compliant vendor can trigger $2M+ in fines (2026 EU Carbon Border Tax penalties), due diligence isn’t optional—it’s existential.

✅ Immediately access 1,247 pre-vetted Chinese wholesale partners—each with real-time capacity dashboards, live factory footage, and compliance passports.

✅ Redirect 200+ annual hours from supplier screening to strategic value engineering.

✅ Guarantee 2026 supply continuity with SourcifyChina’s dual-sourcing protocol for critical components.

“SourcifyChina cut our new supplier onboarding from 37 days to 3. Their Pro List is the only reason we met Q1 2026 targets amid Shenzhen port delays.”

— Director of Global Sourcing, Fortune 500 Electronics Manufacturer

Act Now—Your 2026 Procurement Strategy Can’t Wait

Contact our Sourcing Command Center TODAY to:

1. Receive your customized Pro List sector report (e.g., EV components, medical textiles, smart hardware)

2. Schedule a zero-obligation supply chain resilience audit

3. Lock in 2026 priority factory allocations before Q3 capacity fills

📧 Email: [email protected]

📱 WhatsApp (24/7): +86 159 5127 6160

Response time: <30 minutes during business hours (GMT+8). All inquiries include encrypted supplier dossiers within 2 hours.

PS: First 15 responders this week receive complimentary 2026 Compliance Risk Mapping—identifying CBAM/EPA exposure in your current supplier base. Message “PRO2026” to WhatsApp to claim.

SourcifyChina: Where Verification Meets Velocity.™

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. No supplier fees collected—our model ensures unbiased curation.

🧮 Landed Cost Calculator

Estimate your total import cost from China.