The global market for truck toolboxes and tool organizers has seen steady expansion, driven by increasing demand from commercial fleets, construction, and agricultural sectors for efficient, durable, and secure storage solutions. According to Grand View Research, the global tool storage market was valued at USD 5.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by rising industrialization, heightened workplace safety standards, and the growing popularity of organized, modular tool management systems. As demand intensifies, manufacturers are innovating with improved materials, lockable designs, and space-optimized interiors tailored to professional truck users. In this evolving landscape, identifying the top manufacturers offering high-performance truck tool box tool organizers is essential for businesses aiming to enhance operational efficiency and tool longevity.

Top 10 Truck Tool Box Tool Organizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 UWS: Truck Tool Boxes

Domain Est. 1997

Website: uwsta.com

Key Highlights: UWS is a leading US manufacturer of truck tool boxes, utility storage chests and truck accessories. Our products are engineered to be tough and reliable….

#2 Tool Boxes

Domain Est. 1994

#3 Truck Boxes

Domain Est. 1996

Website: weatherguard.com

Key Highlights: Offering the best in security, nothing is getting into a WEATHER GUARD® truck tool box….

#4 Truck Tool Boxes

Domain Est. 1997

Website: buyersproducts.com

Key Highlights: Durable truck tool boxes made in the USA. Find underbody, crossover, gullwing, backpack, trailer tongue boxes, and more….

#5 DECKED Truck Bed Storage, Tool Boxes & Truck Accessories

Domain Est. 1998

Website: decked.com

Key Highlights: Free delivery · 30-day returnsDECKED truck bed tool boxes and cargo van storage systems revolutionize organization with a heavy-duty in-vehicle storage system featuring slide out …

#6 Service Truck Toolbox Systems

Domain Est. 2003

Website: stellarindustries.com

Key Highlights: Stellar’s full line of custom-made service truck tool storage systems (formerly American Eagle branded) are the most rugged and dependable products available….

#7 Learn more about JOBOX Truck Boxes from Crescent Tools

Domain Est. 2004

Website: crescenttool.com

Key Highlights: Shop JOBOX truck boxes and all of Crescent Tool’s tool storage solutions made for professionals working in industry and construction….

#8 Chandler Truck Accessories

Domain Est. 2015

Website: chandlertruckaccessories.com

Key Highlights: Outfit your truck with work-ready tool boxes and accessories built to last. Shop Chandler Truck Accessories for durable, professional-grade gear that gets ……

#9 BoxoUSA Professional Tool Solutions

Domain Est. 2017

Website: boxousa.com

Key Highlights: 4-day deliveryExplore new precision tools, foam sets, and tool storage solutions. Engineered for durability and performance, they’re made to work as hard as you do….

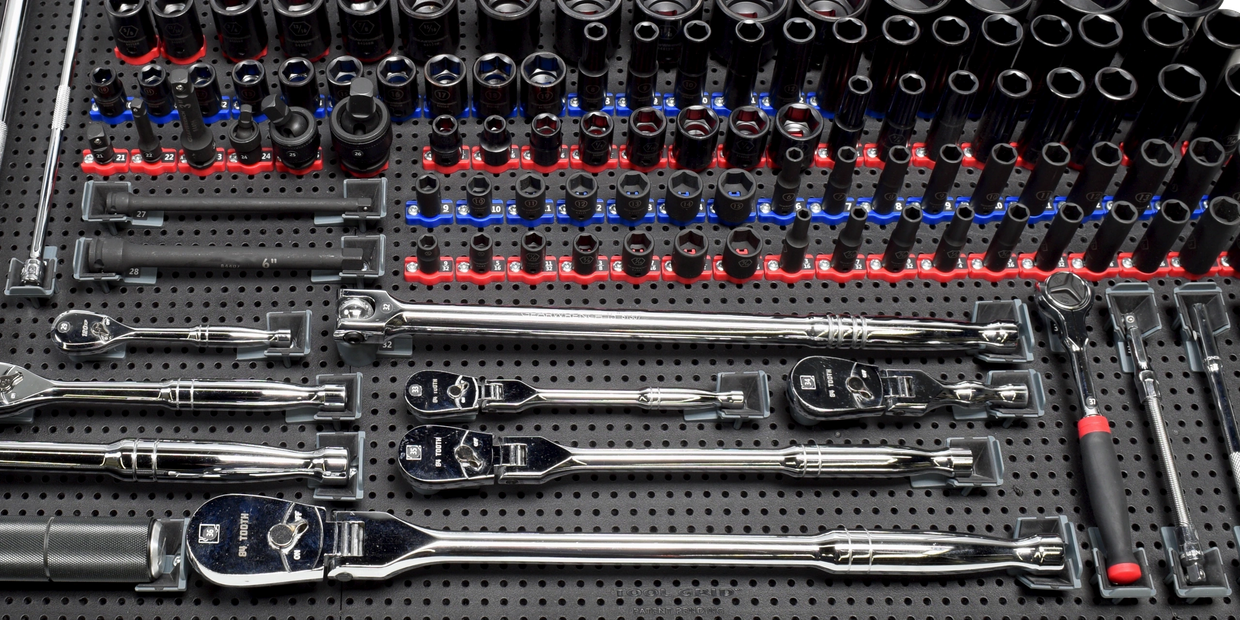

#10 Toolgrid

Domain Est. 2022

Website: toolgridsystem.com

Key Highlights: Toolgrid is a patented system of boards and tool holders designed to organize your tools with precision and flexibility….

Expert Sourcing Insights for Truck Tool Box Tool Organizer

H2: 2026 Market Trends for Truck Tool Box Tool Organizers

The global market for truck tool box tool organizers is poised for significant transformation by 2026, driven by technological advancements, evolving consumer demands, and industry-specific needs. As commercial fleets, construction sectors, and individual tradespeople increasingly prioritize efficiency, safety, and equipment protection, the demand for advanced tool storage solutions continues to grow. Below is an in-depth analysis of the key market trends expected to shape the truck tool box tool organizer industry through 2026.

-

Rising Demand from the Construction and Automotive Sectors

The construction, utility, and automotive repair industries remain the primary end-users of truck tool organizers. With infrastructure development accelerating globally—especially in emerging economies—there is a growing need for durable, organized, and secure tool storage. By 2026, this sustained demand is projected to drive market expansion, with North America and Asia-Pacific leading in adoption due to robust industrial activity. -

Integration of Smart Technology

A major emerging trend is the integration of smart features into tool organizers. By 2026, expect increased adoption of IoT-enabled tool boxes equipped with GPS tracking, access control via smartphone apps, and inventory monitoring systems. These features help prevent theft, streamline equipment management, and improve job site efficiency—particularly for fleet managers overseeing multiple technicians. -

Emphasis on Lightweight and Durable Materials

Manufacturers are shifting toward high-strength, lightweight materials such as aluminum alloys and reinforced polymers. These materials offer superior corrosion resistance and reduce vehicle payload, contributing to fuel efficiency. This trend aligns with broader transportation industry goals of sustainability and operational cost reduction. -

Customization and Modularity

Customizable, modular tool organizers are gaining popularity as users seek adaptable solutions tailored to specific tools and workflows. By 2026, modular designs with interchangeable trays, adjustable dividers, and configurable layouts are expected to dominate the premium segment. This trend is supported by advancements in 3D printing and CAD-based design, enabling cost-effective personalization. -

E-Commerce and Direct-to-Consumer Growth

Online retail platforms are becoming a key sales channel for truck tool organizers. Consumers increasingly rely on detailed product reviews, comparison tools, and fast shipping options. Brands that invest in digital marketing, user experience, and subscription-based restocking of organizer components will gain a competitive edge by 2026. -

Sustainability and Eco-Friendly Manufacturing

Environmental concerns are influencing product design and manufacturing processes. By 2026, manufacturers are expected to adopt more sustainable practices, including recycling programs, reduced packaging waste, and the use of recyclable materials. Regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals will accelerate this shift. -

Expansion in Aftermarket and OEM Partnerships

Original Equipment Manufacturers (OEMs) are beginning to collaborate with tool organizer brands to offer integrated storage solutions in new truck models. This trend is expected to grow by 2026, particularly in medium- and heavy-duty commercial vehicles, enhancing resale value and user convenience.

Conclusion

The truck tool box tool organizer market in 2026 will be defined by innovation, customization, and connectivity. As industries demand smarter, more efficient ways to manage tools and equipment, manufacturers that embrace technology, sustainability, and user-centric design will lead the market. Stakeholders should focus on R&D, digital engagement, and strategic partnerships to capitalize on these evolving trends.

Common Pitfalls When Sourcing Truck Tool Box Tool Organizers (Quality & IP)

Sourcing truck tool box tool organizers can be challenging, especially when balancing cost, quality, and intellectual property (IP) concerns. Avoiding these common pitfalls ensures you get a reliable, compliant, and effective product.

Overlooking Material Quality and Durability

Many suppliers use low-grade plastics, thin-gauge metals, or subpar finishes to cut costs. These materials degrade quickly under heavy use, extreme temperatures, or exposure to moisture—common conditions in truck environments. Always verify material specifications, such as UV resistance, rust-proof coatings, and load-bearing capacity, to avoid premature failure.

Ignoring Structural Integrity and Fitment

Poorly designed organizers may not fit securely within specific tool box models or shift during transit, risking tool damage or safety hazards. Avoid generic designs without compatibility testing. Confirm precise dimensions and mounting mechanisms with your tool box make and model to ensure a snug, vibration-resistant fit.

Compromising on Functional Design and Usability

An organizer that looks good on paper may fail in real-world use. Watch for inefficient layouts, inadequate tool retention, or difficult access. Prioritize ergonomic design, customizable compartments, and ease of reconfiguration. User feedback and prototypes can help identify usability flaws before mass production.

Failing to Verify Intellectual Property Compliance

Using designs that mimic patented or trademarked products—such as those from established brands like DeWalt, Craftsman, or Mac Tools—can lead to legal action, shipment seizures, or forced product recalls. Conduct thorough IP due diligence, including patent searches and design registration checks, and ensure suppliers provide original or licensed designs.

Relying on Unverified Supplier Claims

Suppliers may exaggerate product performance or certifications. Always request third-party test reports, material certifications (e.g., RoHS, REACH), and physical samples. Conduct on-site factory audits to assess manufacturing capabilities and quality control processes firsthand.

Skipping Long-Term Testing and Prototyping

Without real-world testing under load, vibration, and environmental stress, hidden flaws may emerge post-launch. Insist on durability testing protocols and pilot runs to validate performance before full-scale sourcing.

Underestimating Packaging and Logistics Impact

Poor packaging can lead to damage during shipping, increasing returns and customer dissatisfaction. Ensure organizers are protected against impact and moisture, especially for international shipments. Consider modular packaging to reduce freight costs and environmental impact.

By addressing these pitfalls proactively, you can source high-quality, legally compliant truck tool box organizers that meet user needs and withstand demanding conditions.

Logistics & Compliance Guide for Truck Tool Box Tool Organizer

Product Classification & Harmonized System (HS) Code

Identify the correct HS code for your truck tool box tool organizer to ensure accurate international shipping and customs clearance. Common classifications include:

– HS Code 8302.50: Base metal mountings, fittings, and similar articles suitable for tool boxes.

– HS Code 7326.90: Other articles of iron or steel, possibly applicable for metal tool organizers.

Consult local customs authorities or a licensed customs broker to confirm the most accurate classification based on material composition and design.

Packaging & Labeling Requirements

Ensure packaging meets durability and safety standards for transportation:

– Use sturdy, impact-resistant materials (e.g., corrugated cardboard with internal foam or molded inserts) to prevent damage.

– Label each package with:

– Product name and model number

– Quantity per carton

– Net and gross weight

– Handling symbols (e.g., “Fragile,” “This Side Up”)

– Country of origin (e.g., “Made in China”) — required for customs in most markets.

Import/Export Documentation

Prepare essential shipping documents to comply with international trade regulations:

– Commercial Invoice: Includes buyer/seller details, product description, value, currency, and Incoterms (e.g., FOB, DDP).

– Packing List: Details package count, dimensions, and weight.

– Bill of Lading (BOL) or Air Waybill (AWB): Contract between shipper and carrier.

– Certificate of Origin: May be required for tariff determination or trade agreements.

– Import Licenses or Permits: Check destination country requirements—typically not required for tool organizers, but verify.

Regulatory & Safety Compliance

Adhere to regional safety and environmental standards:

– REACH (EU): Ensure no restricted substances (e.g., lead, phthalates) exceed allowable limits in materials.

– RoHS (EU): Applies if the organizer includes electronic components (e.g., LED lighting).

– Proposition 65 (California, USA): If products contain listed chemicals (e.g., certain metals), include appropriate warning labels.

– CPSC Guidelines (USA): Though not typically regulated as consumer products, ensure no sharp edges or safety hazards.

Transportation & Freight Considerations

Optimize logistics for cost and reliability:

– Choose between air, ocean, or ground freight based on volume, urgency, and cost.

– Use palletized shipping for bulk orders to improve handling efficiency.

– Consider Incoterms carefully (e.g., EXW, FCA, DDP) to define responsibilities for shipping, insurance, and customs.

– Insure high-value shipments against loss or damage.

Destination Country Import Duties & Taxes

Research duty rates and tax implications:

– Duty rates vary by country and HS code (e.g., 4.5% in the U.S. under HTS 8302.50).

– Value Added Tax (VAT) or Goods and Services Tax (GST) may apply upon import (e.g., 20% VAT in the UK).

– Leverage Free Trade Agreements (e.g., USMCA, EU-South Korea) if applicable to reduce or eliminate tariffs.

Quality Control & Pre-Shipment Inspection

Implement quality assurance protocols:

– Conduct pre-shipment inspections to verify product conformity, packaging integrity, and labeling accuracy.

– Use third-party inspection services (e.g., SGS, Intertek) for high-volume orders.

– Address non-conformities before shipment to avoid customs delays or rejections.

Aftermarket & Warranty Compliance

Support post-sale logistics:

– Provide clear warranty terms and return logistics process for defective units.

– Comply with local consumer protection laws regarding returns and repairs.

– Maintain spare parts inventory to support long-term customer service.

Recordkeeping & Audit Preparedness

Retain shipping and compliance documents for minimum periods (typically 3–5 years):

– Customs declarations

– Test reports (e.g., REACH, RoHS)

– Certificates of origin

– Commercial correspondence

Ensures readiness for customs audits or regulatory inquiries.

In conclusion, sourcing a high-quality truck tool box tool organizer is a strategic investment that enhances efficiency, safety, and productivity for professionals on the go. By carefully evaluating factors such as durability, storage capacity, customization options, weather resistance, and ease of access, businesses and individuals can select an organizer that meets their specific operational needs. Additionally, choosing a reputable supplier ensures reliable materials, consistent quality, and potential long-term cost savings through reduced tool loss and damage. Whether for construction, maintenance, or emergency services, a well-designed tool organizer not only keeps equipment secure and easily accessible but also optimizes workspace utilization in the truck bed. Ultimately, the right tool organization solution contributes to smoother workflows and improved job site performance.