The global metal fabrication industry continues to expand, driven by rising demand in construction, automotive, and industrial manufacturing sectors. According to Mordor Intelligence, the global metal fabrication market was valued at USD 4.2 trillion in 2023 and is projected to grow at a CAGR of over 5.8% through 2029. A key segment within this space—triangular metal components, widely used in structural supports, aerospace frameworks, and architectural design—is witnessing increased specialization among manufacturers capable of precision engineering and high-strength alloy processing. As industries prioritize durability and geometric efficiency, companies that excel in producing triangular metal profiles are gaining strategic importance. The following list highlights the top 9 triangular metal manufacturers recognized for innovation, production scalability, and consistent quality, based on market presence, technological capabilities, and client portfolios.

Top 9 Triangular Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Triangle Stainless

Domain Est. 2004

Website: trianglestainless.com

Key Highlights: Metal Fabrication Solutions Triangle Stainless Inc. is a leader in Precision Metal Fabrication, providing the highest quality fabrication work for industrial, ……

#2 Triangle Enterprises, Inc.

Domain Est. 1999

Website: triangle-co.com

Key Highlights: Triangle Enterprises is your environmentally friendly source for insulation, HVAC, sheet metal, custom fabrication and scaffolding….

#3 Welding & Fabrication

Domain Est. 2000

Website: trianglemetalsinc.com

Key Highlights: We specialize in metal fabrication, welding, plate rolling, forming, and more. 24-hour emergency services. Competitive prices. Call for a free estimate….

#4 Triangle Industries

Domain Est. 2001

Website: triangleindustries.com

Key Highlights: Fifty years ago, Triangle Industries was founded on a single vision: make customers happy by manufacturing their most challenging parts….

#5 Tri

Domain Est. 2002

Website: trianglemetalfab.com

Key Highlights: Welcome to Tri-Angle Metal Fab, a family-owned precision manufacturing company proudly serving the Aerospace, Defense, Ordnance, Electronics, and Commercial ……

#6 Engineering Capabilities

Domain Est. 2007

Website: triangleoshkosh.com

Key Highlights: Our vast experience includes bearing design and metal component engineering for markets from ocean to desert and everything in between….

#7 TRIANGLE METALWORKS

Domain Est. 2010

Website: trianglemetalworks.com

Key Highlights: Triangle Metalworks is a sheet metal fabrication shop that does all types of metal welding, cutting, forming and custom fabrication to meet your needs….

#8 Triangle Metal Fabricators

Domain Est. 2011

Website: manufacturednc.com

Key Highlights: From custom metal signs and stainless steel countertops to elevator parts and pharmaceutical industries, we cater to your needs. For nearly five years, the ……

#9 Fabrication & Metalwork

Domain Est. 2020

Website: triangle-contractors.com

Key Highlights: Triangle Contractors provides metal fabrication, metal bending and cutting services. We can bend metal into specific angle or shapes using special machines that ……

Expert Sourcing Insights for Triangular Metal

H2: Market Trends for Triangular Metal in 2026

As of 2026, the market for triangular metal components—commonly used in structural frameworks, architectural design, aerospace engineering, and industrial manufacturing—is experiencing notable shifts driven by technological advancements, sustainability demands, and evolving industrial applications. Below is an analysis of key market trends shaping the triangular metal sector during this period:

-

Increased Adoption in Lightweight Construction

The demand for triangular metal profiles, particularly those made from aluminum alloys and high-strength steels, has surged in construction and transportation industries due to their optimal strength-to-weight ratio. In 2026, modular and prefabricated building techniques are increasingly incorporating triangular truss systems for enhanced stability and design flexibility. This trend is amplified by the global push for rapid urbanization and cost-effective construction solutions. -

Growth in Renewable Energy Infrastructure

Triangular metal frameworks are playing a critical role in solar panel support structures, wind turbine towers, and energy storage systems. Their geometric efficiency allows for optimal load distribution and wind resistance. With global renewable energy installations expanding in 2026—especially in emerging markets—demand for durable, corrosion-resistant triangular metal components is rising steadily. -

Advancements in Additive Manufacturing and Precision Engineering

The integration of 3D printing and computer-aided design (CAD) has enabled the production of customized triangular metal parts with complex geometries and reduced material waste. In high-tech sectors such as aerospace and defense, lightweight titanium and inconel-based triangular structures are being additively manufactured to meet performance and efficiency standards. -

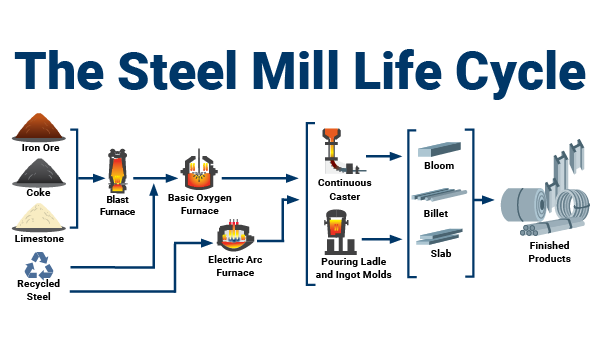

Sustainability and Circular Economy Initiatives

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing manufacturers to adopt recycled metals and low-carbon production methods. In 2026, many producers of triangular metal components are transitioning to electric arc furnaces and using scrap-based steel, significantly reducing the carbon footprint associated with production. -

Supply Chain Resilience and Regionalization

Geopolitical tensions and supply chain disruptions have prompted a shift toward regional manufacturing hubs. North America, Europe, and Southeast Asia are witnessing localized production of triangular metal frameworks to reduce dependency on global suppliers. This localization supports faster deployment in infrastructure projects and reduces logistics costs. -

Smart Materials and IoT Integration

A growing trend in 2026 involves embedding sensors into triangular metal structures for real-time structural health monitoring. These “smart” frameworks are used in bridges, stadiums, and high-rise buildings to detect stress, corrosion, or deformation, enhancing safety and predictive maintenance capabilities. -

Demand from Electric and Autonomous Vehicles (EVs/AVs)

The automotive industry’s pivot toward electric and autonomous vehicles has increased the need for robust yet lightweight chassis and support systems. Triangular metal lattices are being used in battery enclosures and frame designs, offering impact resistance and thermal management benefits.

Conclusion:

By 2026, the triangular metal market is characterized by innovation, sustainability, and cross-sector versatility. Driven by infrastructure development, clean energy expansion, and digital manufacturing, the demand for precision-engineered triangular metal components is expected to grow at a compound annual growth rate (CAGR) of approximately 5.8% through the mid-2020s. Companies that invest in advanced materials, digital production technologies, and sustainable practices are best positioned to lead in this evolving landscape.

Common Pitfalls Sourcing Triangular Metal (Quality, IP)

Sourcing specialized components like triangular metal parts—whether for structural, architectural, or high-precision engineering applications—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, legal disputes, or compromised product performance. Below are key risks to watch for:

Quality Inconsistencies

One of the most frequent issues when sourcing triangular metal components is inconsistent quality across batches or suppliers. This can stem from variations in:

- Material Composition: Suppliers may use substandard alloys or fail to adhere to specified material grades (e.g., aluminum 6061 vs. lower-grade alternatives), affecting strength, corrosion resistance, and weldability.

- Dimensional Accuracy: Triangular geometries require precise angles and edge tolerances. Poor machining or forming techniques can result in warping, angular deviation, or uneven surfaces, leading to assembly failures.

- Surface Finish and Treatment: Inadequate finishing (e.g., improper anodizing, painting, or passivation) can compromise durability, especially in harsh environments.

- Lack of Certification: Suppliers may not provide material test reports (MTRs), ISO certifications, or third-party inspection documentation, making it difficult to verify compliance.

Mitigation: Enforce strict quality control protocols, require certified material documentation, and conduct regular audits or incoming inspections. Use detailed technical specifications and consider partnering with suppliers who adhere to international standards (e.g., ISO 9001, AS9100 for aerospace).

Intellectual Property (IP) Risks

Triangular metal components are often part of proprietary designs, especially in aerospace, defense, or consumer electronics. Sourcing from third-party manufacturers—particularly offshore—introduces substantial IP exposure:

- Design Theft or Replication: Suppliers may copy or reverse-engineer your designs to sell to competitors or produce knock-offs.

- Weak Legal Protections: In some jurisdictions, IP enforcement is limited or ineffective, making litigation impractical.

- Unauthorized Subcontracting: The original supplier may outsource production without your consent, increasing the risk of IP leakage and quality loss.

- Lack of Clear Agreements: Absence of robust non-disclosure agreements (NDAs), IP ownership clauses, or usage restrictions in contracts leaves your designs vulnerable.

Mitigation: Execute strong legal agreements that clearly define IP ownership and usage rights. Limit access to design files (e.g., provide only necessary fabrication drawings without revealing full assembly context). Consider working with trusted suppliers under stringent confidentiality terms and monitor production chains closely. In high-risk regions, evaluate dual-sourcing or on-site supervision.

By proactively managing both quality and IP concerns, organizations can reduce risk, ensure component reliability, and protect their competitive advantage in the marketplace.

Logistics & Compliance Guide for Triangular Metal

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to triangular metal products, including beams, bars, profiles, and fabricated components.

Product Classification and Handling

Triangular metal—typically fabricated from steel, aluminum, or other alloys—requires specialized handling due to its shape and weight. Ensure proper classification under relevant HS codes (e.g., 7301.10 for steel girders, 7306.61 for angular sections) for accurate customs declarations. Triangular profiles are prone to shifting during transport; secure them with edge protectors and dunnage to prevent deformation or damage.

Packaging and Load Securing

Use robust bundling methods such as strapping or cradling to group triangular metal pieces. Load bundles symmetrically on pallets or flatbed trailers, ensuring even weight distribution. Utilize load bars, chains, or lashing straps to prevent longitudinal and lateral movement. Follow EUMOS40509 or ISO 16156 standards for securing metal cargo. Avoid overhang beyond vehicle dimensions unless permitted with proper signage.

Transportation Modes and Requirements

- Road: Comply with national weight and dimension regulations (e.g., ADR in Europe, FMCSA in the U.S.). Use low-bed trailers for oversized loads.

- Rail: Confirm compatibility with railcar dimensions and weight limits. Secure loads per AAR standards.

- Sea: Stow triangular metal in containerized or breakbulk formats. In containers, prevent shifting with blocking and bracing. For deck cargo, ensure lashing to ship structures per CSS Code guidelines.

- Air: Generally restricted due to weight and shape; only suitable for small, high-value components with IATA-compliant packaging.

Regulatory Compliance

Adhere to international and local regulations, including:

– REACH and RoHS (EU): Ensure no restricted substances in coatings or alloys.

– TSCA (U.S.): Certify compliance for chemical components in metal treatments.

– Customs-Trade Partnership Against Terrorism (C-TPAT) or Authorized Economic Operator (AEO): Maintain certification for expedited clearance.

– Export Controls: Verify if the metal composition or end-use triggers ITAR or EAR restrictions.

Documentation

Prepare and retain the following:

– Commercial Invoice and Packing List (detailing dimensions, weight, material grade)

– Bill of Lading or Air Waybill

– Certificate of Origin (preferential or non-preferential)

– Material Test Reports (MTRs) or Mill Certificates

– Dangerous Goods Declaration (if coated with flammable treatments)

– Export Licenses (if applicable)

Environmental and Safety Compliance

Follow OSHA (U.S.) or equivalent safety standards for manual handling to prevent injury. Use mechanical aids (e.g., forklifts, cranes) when lifting heavy sections. Manage metal scrap and cutting fluids per EPA or local environmental regulations. Implement spill containment for any protective oils used during transit.

Quality Assurance and Traceability

Maintain batch-level traceability from raw material to finished product. Label each bundle with heat number, specification (e.g., ASTM A36), and manufacturer details. Conduct pre-shipment inspections to verify conformity with purchase orders and international standards.

Incident Response and Contingency Planning

Establish procedures for cargo damage, delays, or non-compliance findings. Retain insurance covering transit risks (e.g., Institute Cargo Clauses). Train logistics personnel on emergency protocols, including spill response and customs dispute resolution.

By adhering to this guide, Triangular Metal operations can ensure efficient, compliant, and safe global distribution. Regularly review updates to trade regulations and transport standards to maintain full compliance.

In conclusion, sourcing triangular metal requires a strategic approach that balances material specifications, supplier reliability, cost-efficiency, and quality assurance. Whether for structural, decorative, or industrial applications, it is essential to clearly define requirements such as alloy type, dimensions, tolerances, surface finish, and compliance standards. Engaging with reputable suppliers—through thorough vetting, sample testing, and evaluation of certifications—ensures consistent quality and on-time delivery. Exploring both local and global markets can offer competitive pricing and access to specialized manufacturing capabilities. Ultimately, a well-executed sourcing strategy for triangular metal components not only supports project efficiency and performance but also contributes to long-term cost savings and supply chain resilience.