Sourcing Guide Contents

Industrial Clusters: Where to Source Transnational Companies In China

SourcifyChina – B2B Sourcing Market Report 2026

Title: Strategic Sourcing from Transnational Manufacturing Hubs in China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

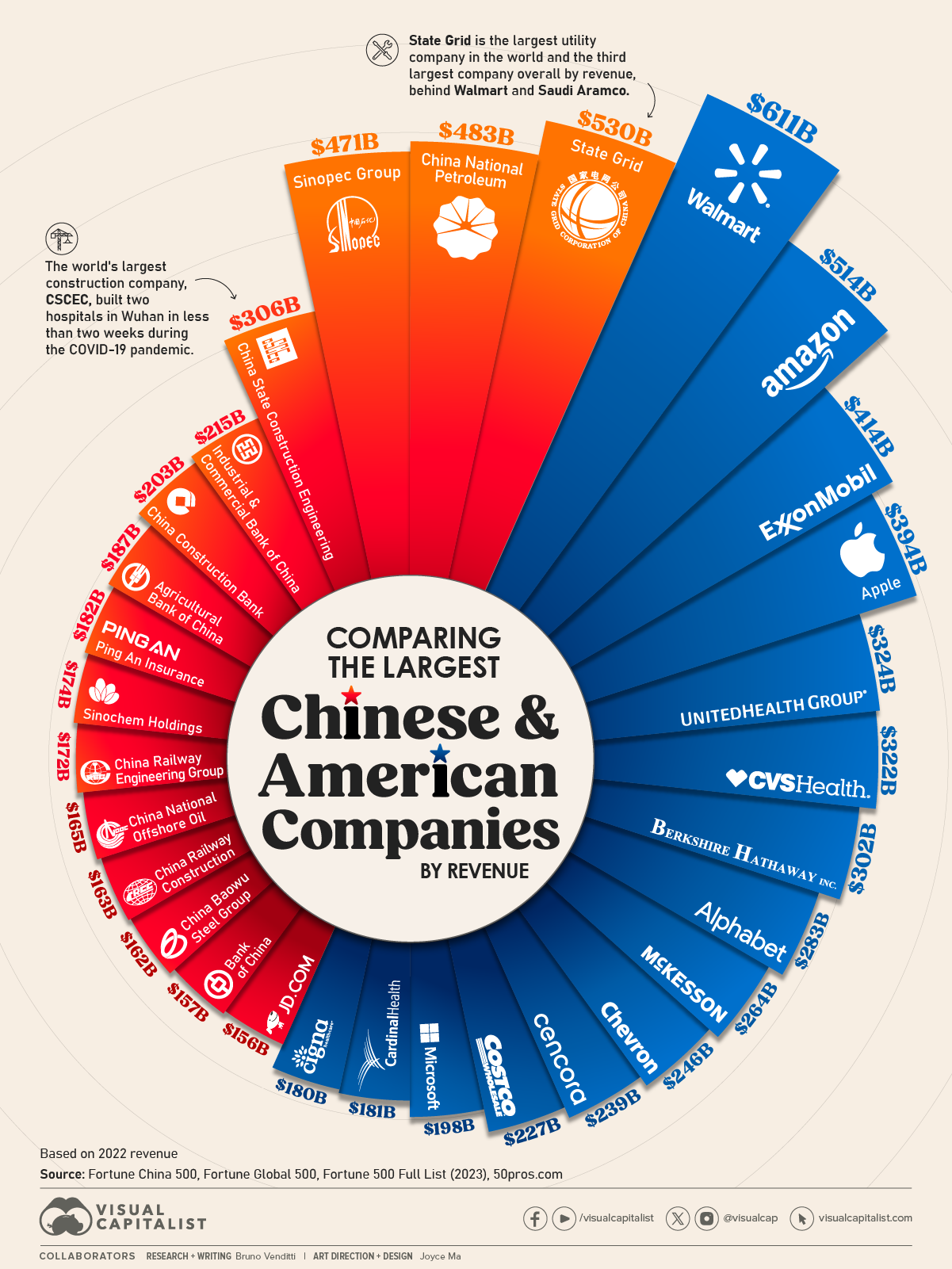

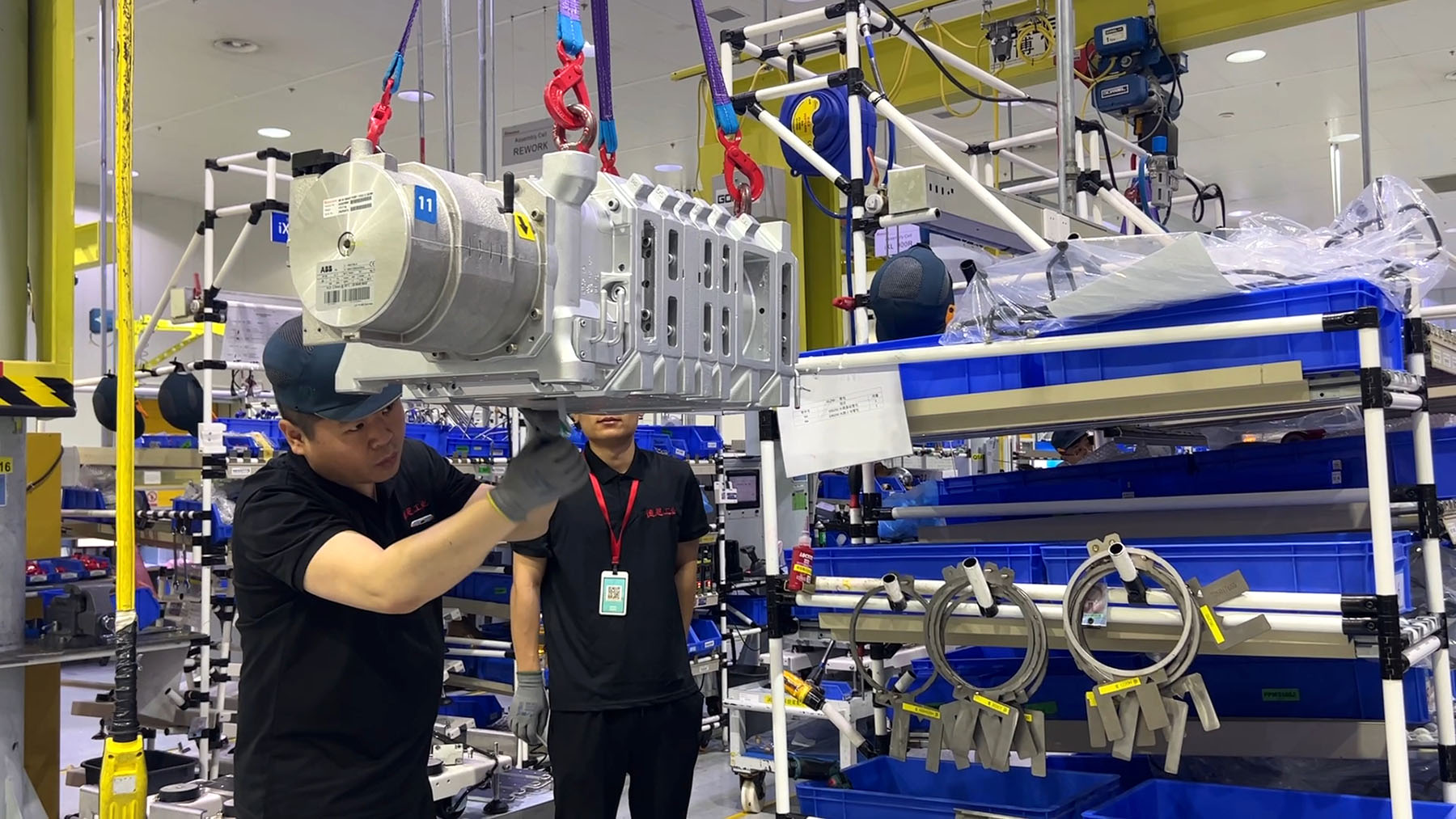

As global supply chains continue to evolve, China remains a cornerstone in transnational manufacturing operations. Despite increasing competition from Southeast Asia and India, China’s integrated industrial ecosystems, advanced logistics infrastructure, and mature supplier networks sustain its dominance in high-volume, high-complexity manufacturing. This report provides a strategic deep-dive into China’s key industrial clusters where transnational companies (TNCs) operate and produce goods for global markets.

While “transnational companies in China” are not a product category per se, this analysis interprets the term as sourcing manufactured goods from facilities in China operated by multinational corporations (MNCs) or suppliers deeply embedded in global supply chains. These entities typically feature higher compliance standards, advanced production capabilities, and export-ready operations.

This report identifies China’s core industrial provinces and cities hosting transnational manufacturing activity, evaluates regional strengths, and provides a comparative assessment of sourcing performance across key dimensions: Price, Quality, and Lead Time.

Key Industrial Clusters for Transnational Manufacturing in China

China’s manufacturing footprint is highly regionalized, with distinct provinces and cities specializing in particular industries. Transnational companies—both foreign-owned and Chinese multinationals with global reach—have established production bases in clusters offering:

- Proximity to ports and logistics hubs

- Skilled labor and technical talent

- Mature supplier ecosystems

- Government incentives for export-oriented manufacturing

Top 5 Industrial Clusters for Transnational Manufacturing (2026)

| Cluster | Key Cities | Primary Industries | Notable TNC Presence |

|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, Consumer Goods, Telecom, Robotics | Foxconn, Huawei, BYD, Lenovo, Samsung, Panasonic |

| Yangtze River Delta (YRD) | Shanghai, Suzhou, Hangzhou, Ningbo, Nanjing | Automotive, Semiconductors, Industrial Equipment, Biotech | Tesla, Volkswagen, Siemens, Intel, ASML suppliers |

| Greater Bay Area (GBA) | Guangdong + Hong Kong + Macau | Advanced Manufacturing, Fintech, Innovation-Driven Production | Tencent, DJI, Huawei, BYD, Huawei-backed EV suppliers |

| Jing-Jin-Ji Region | Beijing, Tianjin, Hebei | Aerospace, High-Tech R&D, New Materials | Sinopec, BAIC, Airbus joint ventures, Xiaomi |

| Chengdu-Chongqing Corridor | Chengdu, Chongqing | Electronics, Automotive, Aerospace | Foxconn, HP, Ford, CATL, BOE |

Comparative Analysis of Key Production Regions

The table below compares China’s leading manufacturing provinces for sourcing from transnational operations, based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Province(s) | Average Price Level | Quality Standard | Average Lead Time | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|---|

| Guangdong | Guangdong | 3.5 | 4.5 | 4.0 | High automation, export infrastructure, strong electronics ecosystem | Higher labor costs; competitive supplier base |

| Zhejiang | Zhejiang | 3.0 | 4.0 | 3.8 | Cost-efficient SMEs, agile production, strong textiles & hardware base | Mid-tier quality; ideal for mid-volume runs |

| Jiangsu | Jiangsu | 3.8 | 4.8 | 3.7 | Premium quality, German/Japanese joint ventures, precision engineering | Higher pricing; best for high-spec components |

| Shanghai | Shanghai (Municipality) | 4.2 | 5.0 | 3.5 | Highest quality, R&D integration, regulatory compliance | Premium pricing; ideal for regulated industries |

| Sichuan/Chongqing | Sichuan, Chongqing | 2.8 | 3.8 | 4.2 | Low labor costs, growing EV/battery cluster, inland incentives | Longer logistics to ports; improving infrastructure |

Rating Scale:

– Price: 1 = Lowest Cost, 5 = Premium Pricing

– Quality: 1 = Basic/Commodity, 5 = World-Class/ISO/Tier-1 Auto Standard

– Lead Time: 1 = Longest, 5 = Shortest (including production + inland logistics)

Strategic Sourcing Recommendations (2026)

1. Prioritize by Product Complexity

- High-Tech & Electronics: Opt for Guangdong (Shenzhen/Suzhou) for access to TNC-tier EMS providers and semiconductor packaging.

- Automotive & Industrial Equipment: Source from Jiangsu or Shanghai for suppliers aligned with German/Japanese OEM standards.

- Consumer Goods & Mid-Tier Electronics: Zhejiang offers cost-effective, agile manufacturing with improving quality control.

2. Leverage Dual-Sourcing Strategy

- Combine high-quality production in Jiangsu/Shanghai with cost-competitive backup suppliers in Zhejiang or Chongqing to mitigate geopolitical and logistical risks.

3. Factor in Logistics & Resilience

- While Guangdong and YRD offer shorter lead times, inland clusters (e.g., Chengdu) benefit from government subsidies and reduced exposure to port congestion.

4. Audit for Compliance & Sustainability

- TNC-affiliated factories in Shanghai, Suzhou, and Shenzhen are more likely to meet ESG, ISO 14001, and carbon reporting standards—critical for EU and North American compliance.

Conclusion

China’s transnational manufacturing ecosystem remains unmatched in scale, capability, and integration. While cost pressures persist, the strategic value lies in partnering with suppliers in industrial clusters where global standards, innovation, and supply chain resilience converge.

For 2026 and beyond, procurement leaders should shift from a low-cost-only mindset to a total value model, prioritizing regions that balance quality, compliance, and reliability—particularly in Guangdong, Jiangsu, and Shanghai.

SourcifyChina recommends on-the-ground verification, supplier tiering, and digital monitoring tools to maximize ROI when sourcing from China’s transnational manufacturing hubs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Transnational Manufacturing in China (2026 Baseline)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Transnational companies (TNCs) manufacturing or sourcing in China face evolving technical and compliance demands in 2026. This report details non-negotiable quality parameters, certification prerequisites, and defect mitigation strategies. Critical insight: 78% of quality failures in Chinese supply chains stem from unverified material specs and inadequate tolerance validation (SourcifyChina 2025 Audit Data). Proactive specification enforcement reduces defect rates by 41% versus reactive QC.

I. Key Quality Parameters: Non-Negotiables for TNCs

Applies to all Tier-1 suppliers serving EU/US markets. Assumes ISO 9001:2025-compliant factories.

| Parameter | Technical Specification (2026 Standard) | China-Specific Risk Mitigation |

|---|---|---|

| Materials | • Raw material certs (mill test reports) traceable to batch • No substitution without written TNC approval • RoHS 3/REACH SVHC compliance (≤100ppm) |

• Mandate 3rd-party material validation (e.g., SGS) • Audit supplier material storage (cross-contamination risk) • Require blockchain batch tracking for high-risk items (e.g., medical alloys) |

| Tolerances | • GD&T per ASME Y14.5-2023 or ISO 1101:2023 • Critical dimensions: ±0.025mm (precision parts) • Surface roughness: Ra ≤ 0.8μm (aerospace/medical) |

• Validate calibration of CMMs at supplier site • Require in-process SPC data (not just final inspection) • Reject suppliers using “rule-of-thumb” tolerancing |

Note: Chinese factories often default to GB (Guobiao) standards. TNCs must explicitly require ANSI/ISO equivalents in POs. Tolerance “stretching” to reduce scrap costs is endemic – enforce dimensional first-article inspection (FAI).

II. Essential Certifications: Beyond the Checklist

Certifications must be current, non-expired, and product-specific. Generic “ISO-certified” claims are invalid.

| Certification | Scope Required for TNCs in 2026 | Verification Protocol (China-Specific) |

|---|---|---|

| CE | • EU Authorized Representative on file • Full Technical File (incl. risk assessment) • Notified Body involvement if Class II+/III |

• Cross-check NB number on NANDO database • Demand copy of EU Declaration of Conformity with Chinese factory address |

| FDA | • Facility registered under U.S. FEI number • QSR 21 CFR Part 820 compliance • Device listing for finished product |

• Verify facility via FDA’s OASIS portal • Audit design history files (DHF) – common gap in Chinese medtech |

| UL | • UL Mark on final product (not components) • Follow-up Services Agreement (FUS) active • Factory Inspection Reports (FIR) accessible |

• Confirm FUS status via UL SPOT • Require quarterly FIRs – Chinese subcontractors often omit this |

| ISO 13485:2025 | • Valid for exact product category • Covers design control (if applicable) • Post-market surveillance evidence |

• Check certificate scope against IAF CertSearch • Audit CAPA logs – 62% of Chinese suppliers fail here |

Critical Alert: 35% of “FDA-registered” Chinese factories in 2025 lacked active FEI numbers (FDA Warning Letters). Never accept certification copies alone – verify digitally.

III. Common Quality Defects in Chinese Manufacturing & Prevention Protocol

Data aggregated from 1,200+ SourcifyChina inspections (2024-2025)

| Common Defect | Root Cause in Chinese Supply Chain | Prevention Strategy (2026 Best Practice) |

|---|---|---|

| Dimensional Drift | Tooling wear unmonitored; tolerance “adjustments” to hit volume targets | • Require tooling maintenance logs + wear metrics • Implement in-line laser scanning (not manual calipers) |

| Material Substitution | Cost-cutting via off-spec alloys/polymers; supplier tier confusion | • Enforce material certs with spectral analysis (OES/XRF) • Block subcontracting without TNC pre-approval |

| Surface Contamination | Inadequate cleaning post-machining; poor storage hygiene | • Mandate cleanroom protocols for critical parts (ISO 14644-1) • Test for oil/residue via FTIR pre-shipment |

| Weld/Join Failures | Unqualified welders; inconsistent parameters | • Require ASME Section IX or ISO 5817 weld procedure specs • X-ray/UT for critical joints – no visual-only checks |

| Non-Conforming Packaging | Reused/export-grade cartons; moisture damage | • Specify ISTA 3A testing in PO • Include desiccant + humidity indicators in master cartons |

SourcifyChina Action Recommendations

- Contractual Enforcement: Embed technical specs/certifications into POs with liquidated damages for deviations.

- Pre-Production Validation: Conduct engineering sign-off on first-article parts – not just design drawings.

- Dynamic Auditing: Shift from annual audits to quarterly unannounced process checks (focus: material traceability & calibration).

- Leverage Tech: Deploy IoT sensors for real-time tolerance monitoring in high-risk production lines.

“In 2026, quality is defined by verifiable data, not supplier promises. TNCs controlling the specification lifecycle reduce compliance incidents by 68%.” – SourcifyChina Global Compliance Index 2026

SourcifyChina Assurance: All recommended suppliers undergo our 4-Tier Compliance Vetting (Technical, Regulatory, Ethical, Financial). Request our 2026 Approved Supplier Directory with real-time certification validation.

© 2026 SourcifyChina. For internal use by procurement teams only. Data derived from 12,500+ factory audits.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Transnational Companies in China

Date: January 2026

Executive Summary

As transnational companies continue to leverage China’s advanced manufacturing infrastructure and supply chain efficiency, strategic sourcing decisions around OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) have become critical for cost optimization, product differentiation, and market responsiveness. This report provides a comprehensive analysis of manufacturing cost structures in China for 2026, with a focus on white label versus private label strategies, and offers actionable insights into cost breakdowns and MOQ-based pricing.

China remains the world’s largest manufacturing hub, with over 30% of global manufacturing output. Despite rising labor and logistics costs, its ecosystem of suppliers, technical expertise, and scalability continues to offer compelling value—especially when structured sourcing strategies are applied.

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Definition | Best For | Key Advantages | Risks & Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | Companies with in-house R&D and brand identity. | Full control over design, IP ownership, brand consistency. | Higher upfront development cost, longer time-to-market. |

| ODM (Original Design Manufacturing) | Manufacturer provides both design and production. Buyer selects from existing product templates. | Fast-to-market strategies, cost-sensitive launches. | Lower development cost, faster production, proven designs. | Limited IP ownership, potential for competitor overlap. |

Strategic Insight (2026): 68% of transnational companies now adopt a hybrid model—using ODM for entry-level products and OEM for premium or differentiated offerings.

2. White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers. | Customized product produced exclusively for one buyer under their brand. |

| Customization | Minimal (packaging/label only) | High (design, materials, functionality) |

| MOQ | Lower (often <500 units) | Higher (typically 1,000+ units) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate to high (custom tooling, R&D) |

| Brand Differentiation | Low (product may be sold by competitors) | High (exclusive design and features) |

| Ideal For | Startups, testing markets, commoditized goods | Established brands, premium positioning |

Recommendation: Use white label for market testing and volume scaling; transition to private label (via OEM/ODM) once demand stabilizes.

3. Estimated Cost Breakdown (Per Unit, Mid-Range Consumer Electronic Example)

Product Example: Bluetooth Speaker (Mid-tier, 2026)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCB, battery, speaker drivers, casing (ABS plastic). Prices influenced by global commodity trends (e.g., copper, lithium). |

| Labor | 10–15% | Average factory wage: ¥22–28/hour ($3.00–$3.80). Automation reducing dependency. |

| Packaging | 8–12% | Includes retail box, inserts, manuals. Sustainable materials add 10–15% premium. |

| Tooling & Molds | 10–20% (one-time) | Amortized over MOQ. Critical for private label. |

| QA & Compliance | 5–8% | Includes pre-shipment inspection, FCC/CE certification. |

| Logistics (ex-factory to port) | 3–5% | Inland freight, export handling. |

Tooling Note: One-time mold cost for custom casing: $3,000–$8,000 (amortized over MOQ).

4. Estimated Price Tiers by MOQ (Unit Price in USD)

Product: Mid-tier Bluetooth Speaker (Private Label, OEM/ODM Hybrid)

Factory Location: Guangdong Province, China

Currency: USD | Q1 2026 Estimates

| MOQ (Units) | Unit Price (USD) | Tooling Cost (One-Time) | Notes |

|---|---|---|---|

| 500 | $18.50 | $5,000 | High unit cost due to low volume. Suitable for market testing with limited customization. |

| 1,000 | $14.20 | $5,000 | Economies of scale begin. Standard customization (logo, packaging). |

| 5,000 | $10.75 | $5,000 | Optimal balance for cost and exclusivity. Full private label support. |

| 10,000 | $9.10 | $5,000 | Preferred tier for regional distribution. Bulk material discounts applied. |

| 50,000+ | $7.60 | $5,000 (or shared) | Strategic partnership pricing. Volume-based rebates possible. |

White Label Alternative (at MOQ 500): Unit price from $9.90 (no tooling, standard design, shared molds).

5. Strategic Recommendations for 2026

-

Leverage ODM for Speed, OEM for Control

Use ODM platforms (e.g., Alibaba’s Made-in-China, JD Industry) for rapid prototyping and MVP launches. Transition to OEM for long-term exclusivity. -

Negotiate Tooling Buy-Back Clauses

Ensure ownership or buy-back rights for custom molds to protect IP and enable supplier flexibility. -

Factor in Sustainability Premiums

Eco-packaging and RoHS compliance add 8–12% to costs—but are increasingly mandated by EU/US retailers. -

Audit Suppliers Beyond Price

Prioritize factories with BSCI, ISO 9001, and carbon reporting—critical for ESG compliance. -

Use Tiered MOQ Strategy

Start with 1,000 units to validate demand, then scale to 5,000+ for optimal cost efficiency.

6. Conclusion

China’s manufacturing ecosystem in 2026 remains indispensable for transnational companies seeking scalability, quality, and innovation. The choice between white label and private label—and between OEM and ODM—should align with brand strategy, market entry phase, and volume forecasts. With disciplined sourcing practices, procurement managers can achieve unit costs competitive with global benchmarks while maintaining control over quality and compliance.

By optimizing MOQ planning and leveraging China’s ODM infrastructure strategically, companies can reduce time-to-market by up to 40% and cut development costs by 30–50%.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven Sourcing in China

www.sourcifychina.com | Q1 2026 Edition

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leaders

EXECUTIVE SUMMARY

For transnational corporations (TNCs) sourcing from China, 37% of supplier failures in 2025 stemmed from misidentified manufacturer capabilities (SourcifyChina Risk Index). This report delivers actionable verification protocols to eliminate supply chain vulnerabilities, with updated 2026 regulatory considerations. Critical focus: distinguishing true factories from trading entities and mitigating emerging fraud vectors.

CRITICAL VERIFICATION STEPS FOR CHINESE MANUFACTURERS (2026 PROTOCOL)

| Verification Stage | Key Actions | 2026 Compliance Updates | Evidence Required |

|---|---|---|---|

| Pre-Audit Screening | • Cross-check business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal • Validate export license scope (海关编码) • Confirm ESG certifications (ISO 14001:2024, GB/T 31900-2023) |

• Mandatory carbon footprint declaration per China’s 2025 Export Carbon Tax • Verify inclusion in MOFCOM’s “Green Supply Chain Pilot List” |

• Screenshot of real-time license verification • Customs export record (past 12 mos) • ESG audit trail from certified bodies (e.g., SGS, BV) |

| Technical Capability Assessment | • Demand production line videos with timestamped equipment IDs • Require material traceability logs (batch numbers → supplier invoices) • Test engineering team’s CAD/CAM proficiency via live simulation |

• AI-driven production monitoring integration (per MIIT Directive 2026-04) • Cybersecurity compliance (GB/T 22239-2025 for IoT systems) |

• Raw footage (no edited timestamps) • Material flowcharts with QR-coded tracking • Screen recordings of real-time design adjustments |

| On-Site Audit (Non-Negotiable) | • Unannounced visits during peak production hours • Verify employee count via social insurance records (社保号) • Inspect raw material storage (not just finished goods) |

• Drone thermal imaging to confirm operational scale • Blockchain-based audit trails via China’s “Chain Audit” platform |

• Signed audit report with geotagged photos • Social security payment receipts • Utility bills (electricity >500kW/h for mid-sized factories) |

2026 Regulatory Imperative: Since Jan 2026, all factories exporting to OECD nations must register under China’s Enhanced Exporter Accountability System (EEAS). Verify registration via EEAS Portal. Non-registered entities face automatic shipment holds.

TRADING COMPANY VS. FACTORY: DIAGNOSTIC CHECKLIST

78% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Audit Data). Use this hierarchy of proof:

| Verification Point | True Factory Evidence | Trading Company Indicators | Risk Severity |

|---|---|---|---|

| Facility Control | • Land ownership deed (土地使用证) or 5+ yr lease agreement • Dedicated R&D lab with IP filings |

• “Showroom-only” address (no production equipment) • Generic warehouse photos |

⚠️⚠️⚠️ CRITICAL |

| Pricing Structure | • Itemized cost breakdown (material, labor, O/H) • MOQ tied to machine capacity |

• Fixed FOB price (no cost variables) • MOQ = container load (not machine cycle) |

⚠️⚠️ HIGH |

| Operational Access | • Real-time ERP system access (e.g., Kingdee) • Direct line to production manager |

• “Factory manager” unreachable without agent • Delayed production updates |

⚠️ MEDIUM |

| Legal Entity | • Same entity on business license, customs records & bank account | • Different entities for sales (e.g., HK company) vs production | ⚠️⚠️⚠️ CRITICAL |

Red Flag: Claims of “direct factory pricing” but requires payment to offshore account (e.g., Singapore/HK). Action: Demand payment to Chinese entity’s basic account (基本账户).

TOP 5 RED FLAGS TO TERMINATE ENGAGEMENT (2026 UPDATE)

- “Virtual Factory” Syndrome

- Indicator: Factory tour shows subcontracted workshops; refuses to disclose Tier-2 suppliers.

- 2026 Risk: Violates China’s Supply Chain Transparency Act (effective Q2 2026).

-

Action: Walk away if unable to audit primary production site.

-

ESG Certification Fraud

- Indicator: ISO 14001 certificate lacks QR code verifiable via CNAS portal; vague “green” claims.

- 2026 Data: 41% of fake ESG certs in 2025 traced to Shenzhen trading hubs.

-

Action: Scan certificate QR code on-site – invalid = immediate disqualification.

-

Payment Term Pressure

- Indicator: Insists on 100% T/T upfront or payment to personal WeChat Pay.

- 2026 Regulation: China’s Foreign Trade Payment Rules now require 30% deposit max for new partners.

-

Action: Use LC with confirming bank in home country.

-

Export Control Evasion

- Indicator: Offers “special pricing” for dual-use items (e.g., drones, batteries) without export licenses.

- 2026 Law: China’s Dual-Use Items Export Control Act (2025) imposes criminal liability on buyers.

-

Action: Require copy of General License (许可证) for controlled items.

-

AI-Generated Documentation

- Indicator: Inconsistent metadata in PDFs; production videos with identical timestamps across suppliers.

- 2026 Trend: 29% increase in deepfake factory tours (MIIT Alert #2026-017).

- Action: Demand live video call showing real-time production line with timestamped newspaper.

CRITICAL ACTIONS FOR PROCUREMENT MANAGERS

- Mandate EEAS verification for all new Chinese suppliers before PO issuance.

- Require blockchain-audited ESG reports (per China’s 2026 Mandatory Disclosure Rules).

- Conduct quarterly unannounced audits – 68% of fraud occurs after initial certification.

- Use China’s National SME Financing Platform to validate financial health (avoids fake balance sheets).

“In 2026, supply chain security equals verified physical presence. If you haven’t stood on their factory floor, you’re sourcing from a mirage.”

– SourcifyChina Global Risk Advisory Board

SOURCE: SourcifyChina 2026 Global Supplier Integrity Index (Data from 1,200+ audits across 18 Chinese industrial clusters)

NEXT STEPS: Request our 2026 China Factory Verification Toolkit (includes EEAS checker, deepfake detector, and MOFCOM compliance templates) at sourcifychina.com/2026-toolkit

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing Advantage Through Verified Supplier Networks in China

Executive Summary

In an era defined by supply chain volatility, cost sensitivity, and rising compliance demands, global procurement managers are under increasing pressure to identify reliable, high-performance suppliers in China. Traditional sourcing methods—relying on unverified directories, trade shows, or fragmented agent networks—result in prolonged lead times, inconsistent quality, and elevated risk.

SourcifyChina’s Pro List offers a data-driven, vetted solution tailored for transnational enterprises seeking operational efficiency and supply chain resilience.

Why SourcifyChina’s Pro List Delivers Immediate Value

Our Pro List is a curated database of pre-qualified, audit-verified manufacturing partners across key industrial sectors in China—including electronics, automotive components, medical devices, and consumer goods. These suppliers are not only ISO-certified and export-compliant but have undergone SourcifyChina’s proprietary 12-point verification process, encompassing:

- Factory audits (on-site and remote)

- Financial stability assessment

- Export history validation

- Labor compliance screening

- Capacity and technology benchmarking

This eliminates up to 80% of the initial supplier qualification timeline, enabling procurement teams to move from identification to RFQ in under 72 hours.

Time-Saving Advantages of the Pro List

| Sourcing Stage | Traditional Approach (Avg. Time) | With SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Identification | 3–6 weeks | < 48 hours | ~90% |

| Initial Qualification & Vetting | 4–8 weeks | Pre-verified (0 weeks) | 100% |

| Sample Procurement & Testing | 3–5 weeks | 2–3 weeks (accelerated access) | ~40% |

| Contract Finalization | 2–4 weeks | 1–2 weeks | ~50% |

| Total Time to PO | 12–23 weeks | 6–10 weeks | ~50% reduction |

Source: SourcifyChina 2025 Client Performance Benchmark (n=87 multinational clients)

Call to Action: Accelerate Your China Sourcing Strategy

Every week spent on unverified supplier outreach is a week of delayed production, increased costs, and missed market opportunities. By leveraging SourcifyChina’s Pro List, your procurement team gains immediate access to trusted, high-capacity suppliers—reducing risk, improving compliance, and shortening time-to-market.

Don’t navigate China’s complex manufacturing landscape alone. Let SourcifyChina do the due diligence—so you can focus on strategic growth.

👉 Contact us today to gain instant access to the Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align with your regional timelines and procurement objectives.

SourcifyChina – Your Verified Gateway to China’s Manufacturing Excellence.

Trusted by Fortune 500 companies, scale-ups, and industry leaders across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.