The global market for trailer interior wall panels is experiencing steady expansion, driven by rising demand in the transportation, recreational vehicle (RV), and modular construction sectors. According to Grand View Research, the global RV market size was valued at USD 31.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030 — a trend that directly fuels demand for high-performance, lightweight interior paneling. Additionally, Mordor Intelligence projects the commercial trailer market to grow at a CAGR of over 5.2% during the 2023–2028 forecast period, underpinned by increasing freight movement and logistics modernization. As manufacturers prioritize durability, weight reduction, and aesthetic versatility, the need for advanced interior wall solutions has become critical. This growing demand has fostered a competitive landscape of innovators specializing in composite panels, fiberglass-reinforced plastics, and eco-conscious materials. Below is a curated list of the top nine trailer interior wall panel manufacturers leading this evolution with proven track records in quality, innovation, and market reach.

Top 9 Trailer Interior Wall Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plywood Cargo Trailer Panels

Domain Est. 1997

Website: tolko.com

Key Highlights: T-PLY plywood products offer cargo trailer manufacturers rugged, consistent cores and superior surfaces with enhanced fastener holding strength….

#2 StableWall

Domain Est. 1997

Website: osb.westfraser.com

Key Highlights: Precision engineered panels for enclosed trailer wall systems. Our StableWall and StableWall+ industrial-grade panels are part of West Fraser’s Engineered ……

#3 Cargo Walls

Domain Est. 2023

Website: ufpfactorybuilt.com

Key Highlights: Our cargo trailer wall panels are engineered for strength, durability, and superior aesthetics, ensuring long-lasting performance in standard and heavy-duty ……

#4 Trailer Liner and Floor Panels

Domain Est. 1996

Website: nudo.com

Key Highlights: NUDO provides laminated panels in various combinations, creating wall, ceiling, and flooring panels for a wide range of transportation applications….

#5 Genesis Products

Domain Est. 2002

Website: genesisproductsinc.com

Key Highlights: Genesis Products optimizes design, performance and value by integrating high-performance laminate materials to create smarter solutions for every space….

#6 Walls & Flooring Options

Domain Est. 2002

Website: legendmfginc.com

Key Highlights: Customize your trailer with flooring and wall options to suit your needs and budget. Browse Legend’s options gallery and find a dealer today….

#7 Azdel Onboard

Domain Est. 2010

Website: azdelonboard.com

Key Highlights: Azdel Onboard composite panels are used in place of lauan plywood during your RV wall’s construction. They are produced using a patented blend of polypropylene ……

#8 Trailer Interior Wall Panels

Domain Est. 2015

Website: stabilitamerica.com

Key Highlights: Stabilit America is a trailblazer in the transportation industry, proudly leading the charge with its innovative lightweight FRP liner panels….

#9

Website: valtoem.com

Key Highlights: World’s leading provider of fiber-reinforced composite materials by Valto EM provides FRP panels for recreational vehicles, the transportation industry, ……

Expert Sourcing Insights for Trailer Interior Wall Panels

2026 Market Trends for Trailer Interior Wall Panels

The global market for trailer interior wall panels is poised for significant transformation by 2026, driven by advancements in materials, evolving consumer preferences, and the broader shift toward sustainable and smart transportation solutions. As the demand for recreational vehicles (RVs), commercial trailers, and specialty transport units grows, manufacturers are reimagining interior wall systems to enhance aesthetics, durability, and functionality.

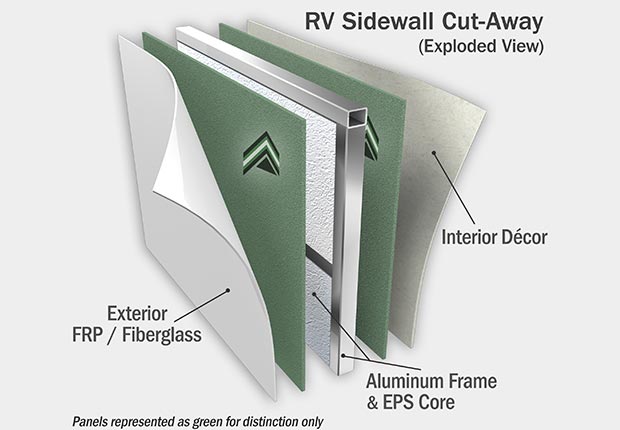

Increasing Demand for Lightweight and Durable Materials

One of the most prominent trends shaping the 2026 landscape is the shift toward lightweight composite materials such as fiberglass-reinforced panels (FRP), aluminum honeycomb structures, and high-pressure laminates (HPL). These materials offer improved strength-to-weight ratios, contributing to fuel efficiency and payload optimization—key considerations for both recreational and commercial trailer operators. Additionally, composites resist moisture, mold, and impact damage, making them ideal for long-term use in varying climates.

Sustainability and Eco-Friendly Manufacturing

Environmental concerns are driving innovation in sustainable materials. By 2026, bio-based composites, recycled plastics, and low-VOC (volatile organic compound) finishes are expected to dominate the market. Manufacturers are responding to consumer and regulatory pressure by adopting greener production methods and sourcing renewable raw materials. Certifications such as Cradle to Cradle and FloorScore are becoming differentiators in product marketing.

Customization and Aesthetic Innovation

Consumers increasingly demand personalized interiors that mirror modern home design trends. In response, trailer wall panel producers are offering a wider range of textures, colors, and finishes—including wood-look laminates, matte surfaces, and metallic accents. Digital printing technologies allow for bespoke patterns and branding, particularly in commercial and luxury RV segments. This trend reflects a broader move toward premiumization in the trailer industry.

Integration of Smart Technologies

The rise of smart trailers is influencing interior wall panel design. By 2026, expect to see panels embedded with sensors, wiring channels, and mounting systems for IoT-enabled devices such as climate controls, lighting systems, and entertainment units. Some manufacturers are exploring conductive coatings that enable touch-sensitive surfaces or integrated LED lighting within the panel structure itself.

Growth in the RV and Specialty Trailer Markets

The recreational vehicle market continues to expand, especially in North America and Europe, fueled by post-pandemic travel trends and remote work lifestyles. This growth directly impacts demand for high-quality, aesthetically pleasing interior wall panels. Similarly, specialty trailers—such as mobile offices, medical units, and luxury event spaces—are creating niche opportunities for innovative panel solutions tailored to specific use cases.

Regional Market Dynamics

North America remains the largest market for trailer interior wall panels, supported by a robust RV manufacturing base. However, Europe is catching up, with stricter environmental regulations accelerating the adoption of sustainable materials. Meanwhile, Asia-Pacific is emerging as a high-growth region, driven by rising disposable incomes and expanding logistics infrastructure that boosts demand for commercial trailer interiors.

Supply Chain and Automation

Manufacturers are investing in automation and digital manufacturing to improve precision, reduce waste, and respond faster to custom orders. By 2026, Industry 4.0 technologies such as AI-driven quality control and robotic assembly lines are expected to enhance production efficiency, particularly for high-volume panel producers.

In conclusion, the 2026 market for trailer interior wall panels will be defined by innovation in materials, sustainability, customization, and smart integration. Companies that prioritize these trends will be well-positioned to capture market share in an increasingly competitive and dynamic industry.

Common Pitfalls When Sourcing Trailer Interior Wall Panels (Quality, IP)

Sourcing trailer interior wall panels involves careful consideration of both quality and intellectual property (IP) concerns. Overlooking these aspects can lead to product failures, legal risks, and reputational damage. Below are key pitfalls to avoid:

Inconsistent Material Quality

One of the most frequent issues is receiving wall panels made from substandard materials. Suppliers may use low-grade composites, inferior laminates, or non-durable substrates to cut costs. This results in premature wear, warping, delamination, or poor resistance to moisture and impact—critical flaws in trailer environments subject to vibration and temperature fluctuations.

Lack of IP Compliance

Procuring panels that infringe on patented designs, textures, or manufacturing processes can expose buyers to legal liability. Some suppliers replicate popular panel aesthetics or structural innovations without authorization. Always verify that the supplier holds proper rights or licenses for the designs and technologies used.

Inadequate Environmental and Fire Ratings

Trailer interiors must meet specific safety standards, such as flame resistance (e.g., FMVSS 302) and low smoke toxicity. Panels sourced from non-compliant suppliers may fail safety inspections or pose hazards in real-world use. Confirm that materials come with certified test reports and comply with regional regulations.

Poor Surface Finish and Aesthetic Inconsistencies

Inconsistent color, texture, or gloss levels across batches can compromise the interior’s visual appeal. This often happens when suppliers change raw material sources without notification. Request samples and establish strict tolerances in purchase agreements.

Insufficient Structural Integrity

Wall panels must withstand constant vibrations and mechanical stress. Panels that lack proper core density, bonding strength, or edge sealing can crack or detach over time. Ensure technical specifications include impact resistance and longevity testing data.

Hidden Tooling or Design Ownership Issues

Some suppliers develop custom molds or designs during production but retain ownership, limiting your ability to switch manufacturers. Clarify IP ownership of tooling, custom patterns, or engineered solutions before finalizing contracts.

Supply Chain Transparency Gaps

Lack of visibility into the manufacturing process increases the risk of counterfeit materials or unauthorized subcontracting. Audit suppliers regularly and require full documentation of material origins and production steps.

By addressing these pitfalls proactively, buyers can ensure they source durable, compliant, and legally sound trailer interior wall panels that meet both performance and regulatory demands.

Logistics & Compliance Guide for Trailer Interior Wall Panels

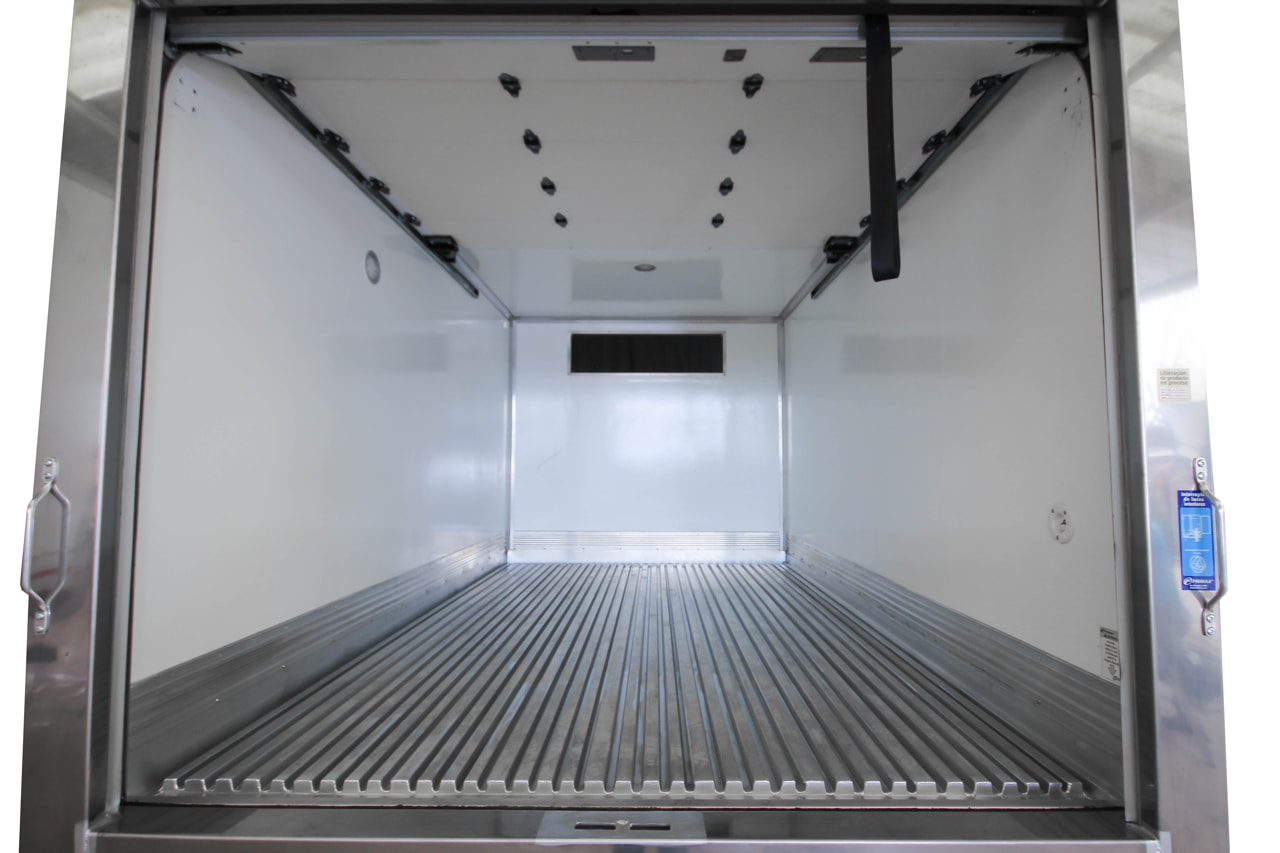

Product Overview and Specifications

Trailer interior wall panels are engineered components designed to provide durable, lightweight, and compliant interior surfaces for refrigerated, dry freight, and specialized transport trailers. These panels are typically made from materials such as fiberglass-reinforced plastic (FRP), aluminum composite, or high-impact polymers. Key specifications include fire resistance ratings, insulation values (R-value), moisture resistance, and dimensional tolerances, all of which must align with industry and regulatory standards.

Regulatory Compliance Requirements

All trailer interior wall panels must comply with applicable national and international regulations. In North America, panels used in commercial vehicles must adhere to Federal Motor Vehicle Safety Standards (FMVSS), particularly FMVSS 302, which governs flammability of interior materials. Additionally, compliance with Department of Transportation (DOT) and Environmental Protection Agency (EPA) regulations may apply, especially regarding emissions and use of hazardous substances. International shipments may require adherence to ECE R118 (Europe) or other regional fire safety standards.

Material Safety and Environmental Standards

Manufacturers must ensure that raw materials used in wall panels are free from restricted substances such as asbestos, formaldehyde (above permissible levels), and halogenated flame retardants. Compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) is required for export to the European Union. Volatile Organic Compound (VOC) emissions must also meet low-emission standards, particularly for refrigerated or food-grade transport applications.

Packaging and Handling Instructions

Wall panels should be packaged to prevent scratching, warping, or moisture exposure during transit. Standard practice includes edge protection, shrink-wrapping, and palletization with moisture barriers. Handling must be performed using appropriate equipment (e.g., forklifts with padded forks) to avoid damage. Panels should be stored indoors, off the ground, and protected from direct sunlight and extreme temperatures prior to installation.

Shipping and Freight Considerations

Due to their size and fragility, trailer wall panels are typically shipped via flatbed trailers or in enclosed freight containers. Proper load securement using straps, edge protectors, and dunnage is essential to prevent shifting or impact damage. Shipping documentation must include itemized packing lists, material compliance certificates (e.g., FMVSS 302 test reports), and hazardous material disclosures if applicable. Freight classification under the National Motor Freight Classification (NMFC) system should be accurate to avoid billing disputes.

Import and Export Documentation

For international logistics, complete documentation is required, including commercial invoices, packing lists, certificates of origin, and material compliance certifications. Exporters must classify panels under the correct Harmonized System (HS) code—typically within chapters 39 (plastics) or 76 (aluminum), depending on material composition. Importers must verify country-specific requirements, such as CCC certification (China) or INMETRO (Brazil), where applicable.

Installation and End-User Compliance

End users or installers must follow manufacturer guidelines for proper panel installation, including use of approved adhesives, fasteners, and sealants. Incorrect installation may void compliance certifications and compromise safety. Documentation packages should include installation manuals, compliance labels, and maintenance instructions to ensure ongoing adherence to safety and hygiene standards, especially in food or pharmaceutical transport.

Quality Assurance and Traceability

Manufacturers must maintain traceability through batch/lot numbering and quality control records. Panels should undergo routine testing for dimensional accuracy, bond strength, and fire performance. Third-party certification from recognized testing laboratories (e.g., UL, Intertek, or ETL) enhances compliance credibility and supports audit readiness for OEMs and fleet operators.

Disposal and End-of-Life Management

At end-of-life, wall panels should be disposed of or recycled in accordance with local environmental regulations. Materials such as aluminum and certain plastics may be recyclable, while composite panels might require specialized waste handling. Manufacturers should provide disposal guidance and, where possible, support take-back or recycling programs to meet sustainability goals.

Conclusion: Sourcing Trailer Interior Wall Panels

After a thorough evaluation of materials, suppliers, cost considerations, durability, and aesthetic options, it is evident that sourcing the right interior wall panels for trailers requires a balanced approach focused on performance, efficiency, and long-term value. High-quality panel options such as fiberglass-reinforced plastic (FRP), aluminum composite panels, or engineered wood with moisture-resistant coatings offer excellent durability and ease of maintenance—critical for the demanding environments trailers often face.

Sourcing from reputable suppliers with proven track records in the transportation or RV industry ensures consistent quality, compliance with safety standards, and timely delivery. Additionally, considering customization options, lead times, and logistics helps streamline the manufacturing or retrofit process.

Ultimately, investing in premium interior wall panels not only enhances the trailer’s aesthetics but also contributes to longevity, structural integrity, and customer satisfaction. By prioritizing material suitability, supplier reliability, and total cost of ownership, businesses can make informed sourcing decisions that support both operational efficiency and end-user value.