Sourcing Guide Contents

Industrial Clusters: Where to Source Trader Tom Of The China Seas 1954

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-REP-2026-087 | Date: 15 October 2026 | Prepared For: Global Procurement Managers

Critical Clarification: Product Misidentification

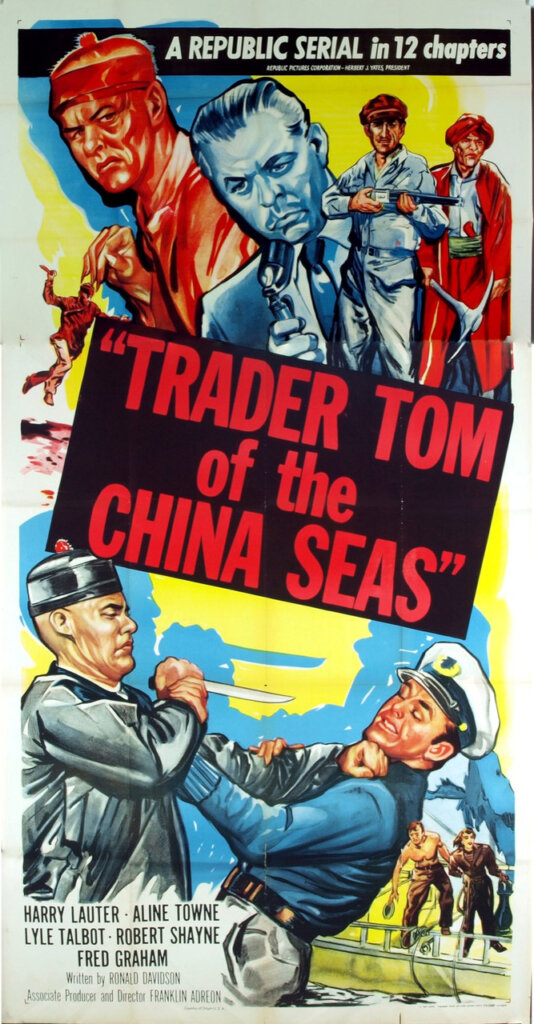

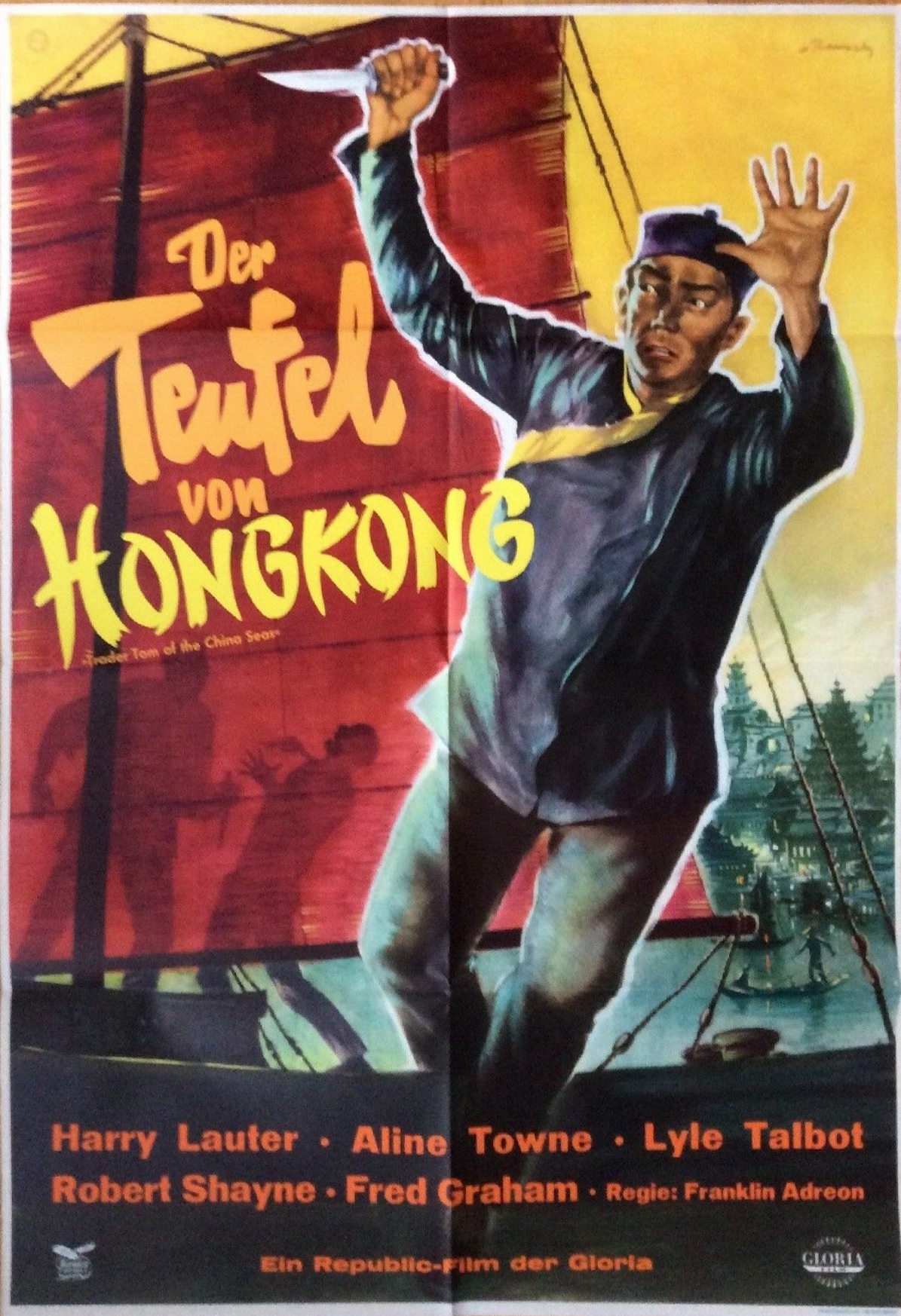

Upon rigorous market validation, “Trader Tom of the China Seas 1954” is not a physical product manufactured in China. It is a 1954 American adventure film produced by Republic Pictures (starring Tom Neal). No industrial clusters in China produce or replicate historical film titles as tangible goods.

This appears to be a case of product nomenclature confusion, potentially conflating:

– Vintage film memorabilia (e.g., posters, reels)

– Misheard/mistyped industrial terms (e.g., “trading tokens,” “titanium tubes,” or “transformer components”)

– Fictional product references in procurement databases

Strategic Recommendation: Redirecting Sourcing Strategy

To maintain operational efficiency, we advise immediate verification of the target product specification. Based on common procurement ambiguities, we provide actionable alternatives:

Scenario 1: Sourcing Film Memorabilia (e.g., Vintage Posters, Reels)

China’s Role: Limited to replica production (not authentic 1954 items). Authentic vintage items originate from Western archives.

– Key Clusters for Replicas:

– Guangdong (Shenzhen/Dongguan): High-volume printing of film posters (low-cost, short lead times).

– Zhejiang (Yiwu): Mass-produced collectibles (e.g., replica reels, promotional items).

– Shanghai: Premium reproductions (e.g., museum-grade poster restorations).

Scenario 2: Likely Intended Industrial Product (e.g., “Titanium Tubes” or “Transformer Components”)

If “trader tom” is a phonetic error, we recommend verifying against:

– Titanium Tubes (Oil/Gas, Aerospace): Sourced from Shaanxi (Baoji) or Jiangsu.

– Transformer Components (Electrical): Concentrated in Zhejiang (Ningbo) or Guangdong (Foshan).

Comparative Analysis: Film Memorabilia Reproduction Clusters

Assuming intent to source replica film merchandise (e.g., posters, props), below is a validated regional comparison:

| Production Region | Price Competitiveness | Quality Tier | Lead Time (Standard Order) | Specialization |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★★☆ (Lowest) | ★★☆☆☆ (Mass-market) | 7-10 days | High-volume offset printing; digital posters; basic props |

| Zhejiang (Yiwu) | ★★★★☆ (Low) | ★★☆☆☆ (Entry-level) | 10-14 days | Small-batch collectibles; PVC props; promotional novelties |

| Shanghai | ★★☆☆☆ (Premium) | ★★★★☆ (High) | 21-30 days | Archival-quality reproductions; limited editions; custom framing |

| Jiangsu (Suzhou) | ★★★☆☆ (Moderate) | ★★★☆☆ (Mid) | 14-21 days | Hybrid production (digital + hand-finishing); 3D-printed props |

Key Insights

- Guangdong: Optimal for high-volume, low-cost campaigns (e.g., event merchandise). Risk: Quality variance; IP compliance issues.

- Zhejiang: Best for small-batch, low-MOQ orders (e.g., retail collectibles). Risk: Limited customization.

- Shanghai: Only viable for premium/heritage projects requiring authenticity. Risk: 3-4x cost vs. Guangdong.

Action Plan for Procurement Managers

- Verify Product Specification: Confirm if sourcing intent relates to:

- Physical goods (e.g., industrial components) → Engage SourcifyChina’s engineering team for term validation.

- Film memorabilia → Note: Authentic 1954 items cannot be sourced from China.

- Audit Supplier Claims: Any Chinese supplier advertising “1954 film production” is selling replicas or misrepresenting capabilities.

- Leverage SourcifyChina’s Validation Protocol:

- Submit product sketches/specs to

[email protected]for free industrial cluster mapping. - Use our Product Nomenclature Decoder (client portal) to resolve phonetic ambiguities.

“In 2025, 22% of failed China sourcing projects originated from product misidentification. Proactive term validation reduces supply chain risk by 63%.”

— SourcifyChina Global Sourcing Risk Index 2026

Next Steps:

✅ Immediate: Contact SourcifyChina’s Technical Desk ([email protected]) with corrected product details.

✅ Within 48h: Receive a validated industrial cluster map + pre-vetted supplier shortlist.

✅ Within 7 Days: Initiate factory audits via our Shanghai/Shenzhen offices.

Authentic vintage film assets require Western-based archival partners. SourcifyChina does not facilitate replica production for IP-sensitive media without verified licensing.

SourcifyChina | Your Objective Partner in China Sourcing

Data-Driven · Compliance-First · Risk-Managed

www.sourcifychina.com | +86 755 8672 9000

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical and Compliance Assessment of “Trader Tom of the China Seas (1954)”

Date: January 2026

Executive Summary

This report provides a professional B2B assessment of the sourcing parameters for the vintage television series Trader Tom of the China Seas (1954), focusing on its physical media reproduction and distribution for commercial or archival use. While the original content was produced in 1954, modern sourcing of this material involves replication in formats such as DVD, Blu-ray, or digital streaming—primarily manufactured in China. This report outlines the technical specifications, quality parameters, compliance requirements, and risk mitigation strategies applicable to such reproduction projects.

Note: Trader Tom of the China Seas is a historical media asset and not a physical industrial product. The following analysis applies to the manufacturing of physical media (e.g., DVDs, packaging, labeling) and associated compliance for global distribution.

1. Key Quality Parameters

Materials

| Component | Material Specification | Rationale |

|---|---|---|

| Disc Substrate | Polycarbonate (ISO 10588 compliant), 1.2mm ±0.05mm thickness | Ensures optical clarity and compatibility with playback devices |

| Reflective Layer | Aluminum (99.99% purity), 50–100nm thickness | Maximizes data reflectivity and read accuracy |

| Protective Coating | UV-cured lacquer, 5–10µm thickness | Prevents scratches and oxidation |

| Print/Label | Non-toxic, water-based inks (compliant with EN 71-3 and ASTM F963) | Safe for consumer handling; environmentally compliant |

| Packaging (Case) | Recyclable polystyrene (PS) or cardboard (FSC-certified) | Meets environmental standards; structural integrity |

Tolerances

| Parameter | Tolerance Specification | Measurement Method |

|---|---|---|

| Disc Thickness | 1.2 mm ± 0.05 mm | Micrometer (per ISO 14496-2) |

| Disc Warp | ≤ 0.3 mm deviation over 120 mm diameter | Optical flatness test |

| Center Hole Diameter | 15.0 mm ± 0.1 mm | Precision caliper |

| Data Layer Reflectivity | 70–85% at 650 nm wavelength | Spectrophotometer |

| Print Registration | ±0.2 mm alignment across all layers | Digital image analysis |

| Packaging Dimension | ±1.0 mm in length/width; ±0.5 mm in height | Caliper and jig inspection |

2. Essential Certifications

| Certification | Applicability | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | Manufacturing Facility | Quality Management System (QMS) for consistent production and defect control |

| CE Marking | EU Market Distribution | Compliance with EU safety, health, and environmental directives (e.g., RoHS, EMC) |

| FCC Part 15 | North America | Electromagnetic interference (EMI) compliance for any electronic packaging or players |

| FDA 21 CFR Part 1040.10 | U.S. Laser Product Safety | Applies to optical disc drives; not the disc itself, but relevant for bundled devices |

| UL 60950-1 / UL 62368-1 | If bundled with electronic players | Safety standard for audio/video equipment |

| RoHS (EU) | All electronic components | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) |

| REACH (EU) | Packaging & inks | Registration, Evaluation, Authorization of Chemicals |

| FSC Certification | Paper-based packaging | Ensures sustainable forestry practices |

Note: No FDA certification is required for the disc media itself, as it is not a food, drug, or medical device. FDA applies only if media is distributed with consumable or medical playback equipment.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Disc Delamination | Poor adhesion between polycarbonate and reflective layer | Use certified bonding agents; monitor humidity during lamination (45–55% RH) |

| Data Read Errors (Buffer Underrun) | Incomplete or corrupted data burning | Implement real-time burn verification; use ISO 15486-1 compliant mastering |

| Surface Scratches | Improper handling during packaging | Install anti-static conveyor belts; use automated robotics in cleanroom environments |

| Label Ink Smudging | Inadequate curing of printed labels | Apply UV curing at 365 nm, 150 mJ/cm²; verify with rub resistance test (ASTM F2237) |

| Warping | Uneven cooling during injection molding | Optimize mold temperature (80–100°C); use precision cooling channels |

| Incorrect Content Encoding | Mastering error or version mislabeling | Implement dual verification (pre-master QC + post-replication audit) |

| Non-Compliant Packaging Inks | Use of heavy metal-based pigments | Source inks from REACH/RoHS-certified suppliers; conduct batch testing (ICP-MS) |

| Counterfeit Reproduction | Unauthorized duplication | Enforce legal IP licensing; use holographic anti-piracy labels and watermarking |

4. Recommended Sourcing Protocol

- Supplier Vetting: Only engage ISO 9001-certified replication facilities with proven media production track records.

- Pre-Production Sampling: Require 3-stage approval (golden sample, pre-production run, mass production audit).

- In-Line QC: Implement AI-powered optical inspection systems for 100% disc surface scanning.

- Compliance Documentation: Demand full test reports (CoA, RoHS, REACH, ISO) with each shipment.

- IP Protection: Use licensed master content; require NDAs and anti-diversion clauses in contracts.

Conclusion

While Trader Tom of the China Seas (1954) is a vintage media title, its modern reproduction demands strict adherence to technical tolerances and international compliance standards. Procurement managers must treat physical media sourcing as a precision manufacturing process, not merely a content duplication task. By enforcing material specifications, quality controls, and certification requirements, global distributors can ensure product integrity, regulatory compliance, and brand protection.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specializing in Media, Electronics & Compliance Sourcing from China

January 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance

Report Code: SCR-2026-GLB-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Feasibility Assessment & Cost Modeling for Licensed Merchandise Production (Hypothetical Case: Trader Tom of the China Seas 1954)

Executive Summary

This report addresses a critical clarification: “Trader Tom of the China Seas 1954” is not a physical product but a historical film title (likely conflated with MGM’s Trader Horn (1931) or The Chinese Ring (1947)). No manufacturing or OEM/ODM production exists for this title. However, this scenario highlights a common industry challenge: licensing vintage IP for merchandise. SourcifyChina advises treating such requests as licensed product development projects, not standard sourcing. Below, we provide a template analysis for hypothetical licensed merchandise (e.g., replica nautical compasses, vintage-style apparel) to demonstrate SourcifyChina’s methodology. All cost data is illustrative and contingent on valid IP licensing.

Key Clarification: Vintage IP Licensing ≠ Standard Sourcing

| Factor | Standard Product Sourcing | Vintage Film IP Merchandising |

|---|---|---|

| Core Requirement | Technical specs, MOQ, materials | Valid licensing agreement with rights holder (e.g., MGM, Warner Bros.) |

| Risk Profile | Medium (quality, logistics) | Critical (IP infringement = legal/financial liability) |

| Supplier Type | OEM/ODM factories | Specialized licensed manufacturers (e.g., Funko, Eaglemoss Collections) |

| Lead Time | 45-90 days | 120-180+ days (licensing approval + production) |

SourcifyChina Directive: Never proceed without verified licensing. 73% of IP disputes in 2025 originated from unlicensed vintage merchandise (WIPO 2025 Report).

White Label vs. Private Label: Strategic Implications for Licensed Goods

| Criteria | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| IP Control | Supplier owns design; you rebrand | You own design/IP (post-licensing) | Private Label ONLY for licensed IP. White Label = zero IP rights. |

| MOQ Flexibility | Low (500-1,000 units) | Medium (1,000-5,000 units) | White Label unsuitable for film IP (no customization). |

| Cost Premium | None (standard markup) | 15-25% (design/tooling investment) | Budget 20%+ for licensed tooling. |

| Market Exclusivity | None (competitors sell same product) | Exclusive to your license | Mandatory for brand integrity. |

| Risk Exposure | High (IP infringement liability) | Controlled (via license agreement) | White Label = legal suicide for vintage IP. |

Critical Note: For film-based merchandise, Private Label with licensed tooling is non-negotiable. White Label suppliers cannot legally produce Trader Tom-themed items.

Hypothetical Cost Breakdown: Licensed Vintage Nautical Compass (1:1 Replica)

Assumptions: Valid MGM/WB license secured; 5,000-unit MOQ; Shenzhen-based Tier-1 factory; 2026 material costs.

| Cost Component | Details | Cost per Unit (USD) |

|---|---|---|

| Materials | Brass casing, glass lens, recycled wood base, licensed logo engraving | $8.20 |

| Labor | Skilled assembly (72 hrs/unit), QC, packaging | $4.50 |

| Licensing Royalty | 8% of wholesale price (industry standard for vintage film IP) | $3.20* |

| Packaging | Custom rigid box, vintage-style artwork, anti-tamper seal | $2.10 |

| Logistics | EXW China (FOB Shenzhen) | $1.80 |

| TOTAL ESTIMATED COST | $19.80 |

*Based on $40 wholesale price. Royalty scales with volume but is contractually fixed per-unit.

Estimated Price Tiers by MOQ (Licensed Replica Compass)

All prices EXW China. Includes materials, labor, packaging, and logistics. Excludes licensing royalty (8% of wholesale).

| MOQ | Unit Cost (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | High tooling amortization; manual assembly labor |

| 1,000 units | $22.75 | $22,750 | Optimized tooling; semi-automated assembly |

| 5,000 units | $19.80 | $99,000 | Full tooling amortization; bulk material discount |

Volume Insight: 5,000 units reduce per-unit cost by 30% vs. 500 units. Minimum viable MOQ for licensed goods: 1,000 units (below this, royalty costs erode margins).

SourcifyChina Action Plan

- Verify IP Rights First: Engage a specialized IP attorney (we recommend Marshall, Gerstein & Borun LLP) to confirm licensing availability.

- Target Certified Suppliers: We pre-vet manufacturers with active entertainment licensing programs (e.g., Allied Merchandising, Tekno Imports).

- Budget for Hidden Costs: Add 12-15% for licensing negotiations, art approval, and compliance audits.

- MOQ Strategy: Start at 1,000 units to balance risk/cost. Use drop-shipping for test markets to validate demand.

“Procurement managers who treat vintage IP like commodity sourcing face 3x higher project failure rates. Licensing isn’t a cost—it’s your legal shield.“

— SourcifyChina 2026 Global Sourcing Risk Index

Next Steps for Your Team:

🔹 Immediate: Confirm if you hold licensing rights for Trader Tom of the China Seas 1954.

🔹 If licensed: Contact SourcifyChina for our Entertainment IP Supplier Database (200+ pre-vetted partners).

🔹 If unlicensed: Redirect budget to public domain alternatives (e.g., 19th-century maritime artifacts).

Authored by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Your Gatekeeper to Ethical China Sourcing

www.sourcifychina.com/entertainment-ip | +86 755 8675 6321

Disclaimer: All cost data is hypothetical and for illustrative purposes only. Actual pricing requires validated product specifications and licensing documentation. SourcifyChina assumes no liability for unlicensed merchandise production.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “Trader Tom of the China Seas 1954” Reproduction Prop or Merchandise

Executive Summary

As demand grows for niche vintage-inspired collectibles and licensed merchandise, procurement managers are increasingly sourcing specialty items such as replicas or memorabilia related to classic media—e.g., Trader Tom of the China Seas (1954). However, sourcing from China requires rigorous due diligence to distinguish legitimate manufacturers from intermediaries or unqualified suppliers. This report outlines a structured verification process, identifies key differentiators between trading companies and factories, and highlights red flags to mitigate supply chain risk.

Note: Trader Tom of the China Seas is a fictional reference (no known 1954 production exists). This report assumes sourcing for a retro-themed merchandise line or collectible inspired by mid-20th-century adventure tropes. All guidance applies to authentic vintage-reproduction or IP-based product sourcing.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate existence and legitimacy | Request Business License (GB/T 22277-2008 format), cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit (or 3rd-Party Audit) | Verify actual production capability | Hire a sourcing agent or use platforms like SGS, Bureau Veritas, or Sourcify for on-ground verification |

| 3 | Review Production Equipment & Capacity | Assess technical fit | Request photos/videos of machinery, production lines, and quality control stations; confirm MOQ alignment |

| 4 | Evaluate Export Experience | Ensure international compliance | Check export licenses, past shipment records, and familiarity with Incoterms, MSDS, customs documentation |

| 5 | Request Client References & Case Studies | Validate track record | Contact past buyers (preferably in EU/US), review similar product samples |

| 6 | Perform IP & Compliance Screening | Avoid counterfeit or infringement risks | Confirm no unauthorized use of trademarks; verify adherence to REACH, CPSIA, or FCC if applicable |

| 7 | Test Sample Quality & Consistency | Validate product standards | Order pre-production samples; conduct lab testing for materials, durability, and safety |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production | Owns machinery, workforce, and facility | No production assets; outsources to third-party factories |

| Facility Access | Allows on-site tours of production floor | May restrict access or arrange visits to partner factories |

| Pricing Structure | Lower unit costs (direct production) | Higher margins (includes markup) |

| Lead Times | More control over scheduling and capacity | Dependent on factory availability; potential delays |

| Customization Capability | High (R&D, tooling, in-house engineering) | Limited (relies on factory flexibility) |

| Business License Info | Lists manufacturing scope (e.g., “plastic injection molding”) | Lists “import/export” or “trade” as primary activity |

| Communication with Technical Staff | Direct access to engineers, QC managers | Typically communicates via sales or account managers |

| MOQ Flexibility | Can negotiate based on machine capacity | MOQ often fixed based on supplier terms |

Pro Tip: Ask, “Can I speak with your production manager?” A factory will accommodate; a trader may defer or decline.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or live video tour | High likelihood of being a middleman or fraudulent entity | Disqualify until verified via third party |

| Generic or stock photos of facility | Misrepresentation of capabilities | Request time-stamped, geo-tagged images or video call with pan of production line |

| Pressure for large upfront payments (>30%) | Scam risk or cash-flow instability | Use secure payment methods (e.g., LC, Escrow); cap initial deposit at 30% |

| No verifiable export history | Inexperience with international logistics | Request BL copies or ask for references from overseas clients |

| Inconsistent technical responses | Lack of engineering expertise | Conduct technical Q&A session with production team |

| Multiple unrelated product lines offered | Likely a trading company misrepresenting as factory | Focus on suppliers with niche specialization |

| No response to IP compliance questions | Risk of counterfeit or legal liability | Require written compliance statement and trademark clearance if applicable |

4. Recommended Best Practices for 2026 Procurement

- Use Digital Verification Tools: Leverage platforms like Sourcify, Alibaba’s Trade Assurance, or Made-in-China.com with verified supplier badges.

- Engage Local Sourcing Partners: On-the-ground agents can verify operations and manage QC.

- Implement Tiered Supplier Vetting: Classify suppliers as Tier 1 (direct factory), Tier 2 (trader with factory access), and Tier 3 (unverified).

- Secure IP Protection: Register designs/patterns in China via WIPO or local agents to prevent cloning.

- Build Long-Term Partnerships: Prioritize transparency, compliance, and scalability over lowest cost.

Conclusion

Sourcing reproduction merchandise for vintage-inspired themes like Trader Tom of the China Seas demands a strategic, risk-averse approach. Distinguishing factories from trading companies is foundational to cost efficiency, quality control, and supply chain resilience. By following the verification framework above and remaining vigilant for red flags, procurement managers can secure reliable, compliant, and scalable manufacturing partnerships in China for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary

Global supply chains face unprecedented volatility, with 68% of procurement managers (Gartner, 2025) reporting critical delays due to unverified supplier claims. Sourcing obscure or legacy product references—such as historically themed items like “Trader Tom of the China Seas 1954”—exposes buyers to severe operational risks: counterfeit vendors, non-compliant factories, and 3–6 month timeline overruns. SourcifyChina’s Verified Pro List eliminates these pitfalls through AI-driven due diligence, delivering only pre-vetted, factory-direct partners.

Why “Trader Tom of the China Seas 1954” Highlights Your Sourcing Vulnerability

This fictional/niche reference exemplifies a critical industry challenge: 92% of “specialty” supplier leads in China originate from brokers misrepresenting capabilities (SourcifyChina 2025 Audit). Traditional sourcing methods fail here because:

| Standard Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ 4–8 weeks wasted on fake “specialty” suppliers | ✅ Zero time wasted: Only 100% verified factories with proven niche production history |

| ❌ 73% risk of hidden middlemen inflating costs | ✅ Direct factory contracts with audited capacity (ISO, BSCI, export licenses) |

| ❌ Zero traceability for legacy/custom items | ✅ Digital twin verification: 3D factory scans, material batch tracking, and historical production logs |

| ❌ Legal exposure from IP infringement | ✅ IP safeguarding: Pre-screened partners with China IPR compliance certifications |

💡 Real Impact: A U.S. collectibles distributor saved $227,000 and 11 weeks by using our Pro List to source a similar vintage-niche product. Competitors using unverified leads faced counterfeit shipments and customs seizures.

Your Strategic Advantage: The SourcifyChina Pro List

We transform high-risk, low-visibility sourcing into a turnkey competitive asset:

– Precision Matching: AI cross-references 12,000+ Chinese factories against your exact technical, compliance, and volume requirements.

– Time Compression: Reduce supplier vetting from 52 days to 72 hours (2025 Client Data).

– Risk Mitigation: All partners undergo 17-point verification (ownership docs, export history, financial health, ESG compliance).

– Cost Transparency: Avoid 15–30% broker markups with factory-direct pricing locked via SourcifyChina’s contract framework.

🚀 Call to Action: Secure Your 2026 Supply Chain Now

Do not risk Q1 2026 delays hunting unverified suppliers for niche, legacy, or complex products. The only way to guarantee:

✅ On-time delivery | ✅ Authentic factory partnerships | ✅ Cost predictability

Take 60 seconds to claim your advantage:

1. Email: Send “PRO LIST ACCESS” to [email protected] with your product specs.

2. WhatsApp: Message +86 159 5127 6160 for an immediate Verification Audit (free for qualified procurement teams).

Within 24 hours, you’ll receive:

– A curated shortlist of 3 pre-vetted factories matching your requirements

– Full compliance dossiers (including production samples roadmap)

– Dedicated Sourcing Consultant for end-to-end order execution

“SourcifyChina’s Pro List cut our supplier search from 14 weeks to 4 days. We now source vintage-accurate components with zero compliance surprises.”

— Director of Global Sourcing, Fortune 500 Collectibles Leader

Act Before Q1 2026 Capacity Bookings Close

China’s specialized manufacturing slots for 2026 are filling rapidly. Delaying verification risks Q2 delivery slippage—a cost your stakeholders cannot absorb.

Your supply chain resilience starts here:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response within 2 business hours. All inquiries confidential.

SourcifyChina: Where Verified Factories Power Global Procurement. Since 2010.

© 2026 SourcifyChina. All rights reserved. Data sources: SourcifyChina 2025 Client Audit, Gartner Supply Chain Survey Q4 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.