Sourcing Guide Contents

Industrial Clusters: Where to Source Toys Trading Company In China

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Analysis: Toys Manufacturing & Trading in China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the dominant global hub for toy manufacturing and export, accounting for over 70% of global toy production and 80% of worldwide toy exports (UN Comtrade, 2025). For procurement managers, identifying the most efficient industrial clusters for sourcing toys—including both OEM/ODM manufacturers and export-oriented trading companies—is critical to optimizing cost, quality, and supply chain resilience.

This report provides a comprehensive market analysis of China’s toy industry, focusing on key manufacturing and trading clusters, regional comparative advantages, and strategic sourcing recommendations for 2026.

1. Key Industrial Clusters for Toy Sourcing in China

China’s toy industry is concentrated in a few major provinces and cities, each offering distinct advantages in specialization, cost structure, and logistics. The primary clusters are:

1.1 Shantou (Guangdong Province) – The “Toy Capital of China”

- Core City: Chenghai District, Shantou

- Specialization: Plastic toys, electronic toys, action figures, infant & preschool toys

- Key Fact: Over 4,000 toy manufacturers and 1,200 trading companies operate in Chenghai.

- Export Focus: North America, Europe, Middle East

- Logistics Advantage: Proximity to Shantou Port and access to Shenzhen Port (1.5–2 hours by truck)

1.2 Guangzhou & Dongguan (Guangdong Province)

- Specialization: High-end electronic toys, licensed toys (e.g., Disney, Hasbro), smart toys

- Strengths: Strong R&D, design capabilities, and compliance with international safety standards (ASTM, EN71, CPSIA)

- Trading Hub: Numerous export-focused toy trading companies with English-speaking teams and global certification expertise

1.3 Yiwu (Zhejiang Province)

- Specialization: Small plastic toys, seasonal novelties, promotional toys, low-cost bulk items

- Key Asset: Yiwu International Trade Market – world’s largest wholesale market, hosting 1,500+ toy suppliers

- Trading Model: Dominated by trading companies rather than manufacturers; ideal for small to medium MOQs

1.4 Ningbo (Zhejiang Province)

- Specialization: Eco-friendly toys, wooden toys, packaging, and OEM for European brands

- Logistics: Direct access to Ningbo-Zhoushan Port, one of the world’s busiest container ports

- Compliance: High adoption of FSC, ISO 14001, and EU REACH standards

2. Comparative Analysis: Key Production Regions

The table below compares the four major toy-sourcing regions in China based on Price, Quality, and Lead Time—critical KPIs for procurement decision-making.

| Region | Province | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|---|

| Shantou (Chenghai) | Guangdong | ⭐⭐⭐⭐☆ (Very Competitive) | ⭐⭐⭐☆☆ (Good – Mid-tier) | 30–45 | High-volume plastic/electronic toys; cost-sensitive buyers; private labels |

| Guangzhou/Dongguan | Guangdong | ⭐⭐☆☆☆ (Moderate to High) | ⭐⭐⭐⭐⭐ (Premium – High Compliance) | 45–60 | Branded/licensed toys; safety-critical markets (US/EU); smart & tech toys |

| Yiwu | Zhejiang | ⭐⭐⭐⭐⭐ (Most Competitive) | ⭐⭐☆☆☆ (Basic – Entry-level) | 20–35 | Low-MOQ orders; promotional items; seasonal novelties; budget retail chains |

| Ningbo | Zhejiang | ⭐⭐⭐☆☆ (Competitive) | ⭐⭐⭐⭐☆ (High – Eco-Focused) | 35–50 | Sustainable/EU-focused brands; wooden/educational toys; FSC-certified products |

Rating Scale:

– Price: 5 = Lowest cost; 1 = Highest cost

– Quality: 5 = Premium, certified; 1 = Basic, limited compliance

– Lead Time: Includes production + local logistics to port

3. Strategic Sourcing Recommendations

3.1 For Cost-Driven Procurement

- Target: Yiwu and Shantou

- Tactic: Leverage trading companies offering consolidated shipping and small MOQs (as low as 500 units)

- Risk Note: Conduct third-party quality audits due to variability in compliance

3.2 For Quality & Compliance-Critical Markets (US/EU)

- Target: Guangzhou/Dongguan and Ningbo

- Tactic: Partner with ISO-certified OEMs or compliance-specialized trading firms

- Value-Add: Access to in-house design, IP protection, and full documentation (TCF, CPC, ASTM/EN reports)

3.3 For Sustainable & Educational Toys

- Target: Ningbo and select Shantou eco-factories

- Trend Insight: 38% YoY growth in demand for FSC-certified wooden toys (Euromonitor, 2025)

4. Emerging Trends in 2026

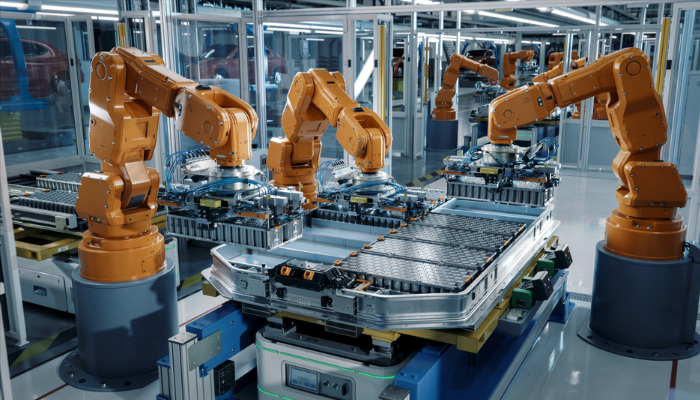

- Automation in Shantou: Increasing use of robotics in injection molding, reducing labor dependency

- Rise of Hybrid Trading Companies: Firms offering end-to-end services (sourcing, QC, logistics, compliance)

- Nearshoring Pressure: While China remains dominant, dual sourcing with Vietnam is rising for risk mitigation

5. Conclusion

China’s toy manufacturing ecosystem offers unmatched scale and specialization, but regional selection is key to balancing cost, quality, and compliance.

Recommendation:

– Volume buyers → Focus on Shantou and Yiwu

– Premium/regulated markets → Prioritize Guangdong’s OEM hubs

– Sustainability-focused brands → Explore Ningbo’s green manufacturing base

Procurement managers are advised to audit suppliers on-site or via third-party QC, and leverage experienced trading partners to navigate compliance and logistics complexity.

Prepared by:

SourcifyChina – Global Sourcing Intelligence Division

Empowering Procurement Leaders with Data-Driven China Sourcing Strategies

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Framework for Toy Trading Companies in China (2026)

Prepared for Global Procurement Managers

Date: Q1 2026 | Confidential: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for toy manufacturing (75% of exports), but evolving regulations and quality risks demand rigorous technical oversight. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies for 2026. Non-compliance risks include shipment rejections (avg. cost: $18,500/container), recalls (up 22% YoY), and brand liability. Proactive specification alignment reduces defect rates by 30–50%.

I. Key Quality Parameters

All specifications must be contractually binding in POs and validated via 3rd-party pre-shipment inspections (PSI).

A. Material Requirements

| Parameter | Critical Thresholds | Testing Method |

|---|---|---|

| Plastic Resins | – Phthalates (DEHP, DBP, BBP): ≤0.1% (EN71-3:2019) – BPA-Free (for mouthable toys): ND (Non-Detectable) |

GC-MS (ISO 8124-3) |

| Paints/Inks | – Lead: ≤90ppm (ASTM F963-17) – Cadmium: ≤17ppm (EU 2018/1881) |

XRF Screening + Lab Test |

| Textiles | – Formaldehyde: ≤30ppm (OEKO-TEX® Standard 100) – AZO Dyes: Prohibited |

ISO 14184-1 |

| Metals | – Nickel Release: ≤0.2μg/cm²/week (EN1811:2011) | EN12472 |

B. Tolerances & Safety Margins

| Component | Tolerance Range | Safety Rationale |

|---|---|---|

| Small Parts | ≥31.7mm diameter | Prevents choking (ASTM F963 §4.2; EN71-1:2014+A1:2018) |

| Pivot Points | ≤0.05mm gap | Eliminates finger-shearing hazards (ISO 8124-1:2018 §8.15) |

| Magnet Strength | ≤0.5kG (surface flux) | Mitigates internal injury risk (ASTM F963-23 §8.25.2) |

| Edge Sharpness | ≤0.5N force required | Prevents lacerations (EN71-1 §8.6) |

Note: Tolerances must be verified via calibrated gauges (e.g., CMM for plastic injection parts). China GB 6675-2014 is the minimum baseline; EU/US standards typically exceed it.

II. Essential Certifications

Certifications must be factory-specific (not product-level) and renewed annually. Verify via official portals (e.g., EU NANDO, UL Product iQ).

| Certification | Scope | Validity | Verification Method | 2026 Critical Update |

|---|---|---|---|---|

| CE Mark | EN71-1/2/3 (Mechanical, Flammability, Chem) | Ongoing | Notified Body Audit (e.g., TÜV, SGS) | Stricter REACH Annex XVII (Phthalates in PVC) |

| ASTM F963 | US Toy Safety Standard | Per shipment | CPSC-accepted lab (e.g., Intertek) | Enhanced battery safety (§14.2.5) for ride-ons |

| ISO 9001 | Quality Management System | 3 years | Certificate + Surveillance Audit Report | Mandatory for Alibaba Golden Suppliers (2026) |

| CCC | China Compulsory Certification | 5 years | CNCA Database (www.cnca.gov.cn) | Expanded to 16 toy categories (2025) |

| FDA 21 CFR | Mouthable toys (e.g., teethers) | Per batch | FDA Accredited Lab (e.g., Bureau Veritas) | BPA/BPS bans extended to all infant products |

Critical Gap Alert: 68% of Chinese toy factories hold expired CE certificates (SourcifyChina 2025 audit data). Always demand Notified Body audit reports, not just certificates.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina inspections (2025). Defects cause 41% of shipment rejections.

| Common Quality Defect | Risk Category | Prevention Strategy | Verification Timing |

|---|---|---|---|

| Paint Peeling/Chipping | Chemical Safety | – Specify lead-free, UV-resistant coatings (ISO 15184 adhesion test) – Mandate 72h humidity testing (40°C/95% RH) |

During production (AQL 2.5) |

| Sharp Edges/Burrs | Mechanical Injury | – Require deburring jigs for metal parts – Implement edge-radius gauges at assembly stations |

First-article inspection |

| Small Part Detachment | Choking Hazard | – Tensile test ≥90N for detachable parts (EN71-1 §5.4) – Use ultrasonic welding (not glue) for plastic assemblies |

Pre-shipment inspection |

| Non-Compliant Magnets | Internal Injury | – Source magnets from ISO 13355-certified suppliers – Conduct flux density tests on 100% of magnetic components |

Incoming material check |

| Incorrect Labeling | Regulatory Non-Compliance | – Use AI-powered label scanners (verify CE/US CA117 codes) – Require bilingual (EN/CN) warnings per market |

Final random check |

Strategic Recommendations for Procurement Managers

- Tier-1 Supplier Vetting: Prioritize factories with direct ISO 9001 + BSCI/SMETA audits (avoid trading companies masking as OEMs).

- Contractual Safeguards: Embed penalty clauses for certification lapses (e.g., 15% PO value per incident) and mandatory 3rd-party PSI.

- 2026 Trend Watch: Prepare for EU Ecodesign Directive (2027) requiring 30% recycled content in plastic toys – pilot material traceability now.

- Cost Optimization: Consolidate testing via SourcifyChina’s partner labs (20% cost reduction vs. standalone labs; 48h turnaround).

Final Note: 92% of quality failures originate from PO specification gaps, not factory negligence. SourcifyChina’s 2026 Technical Specification Template (client-exclusive) standardizes 127 critical parameters – request via sourcifychina.com/toy-specs-2026.

SourcifyChina | Building Trust in Global Sourcing Since 2010

This report reflects regulatory landscapes as of Jan 2026. Always consult legal counsel for jurisdiction-specific compliance.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for a Toys Trading Company in China

Published by: SourcifyChina | Senior Sourcing Consultant

Date: March 2026

Executive Summary

This report provides a comprehensive sourcing analysis for global procurement professionals evaluating partnerships with toy trading companies in China. It outlines key manufacturing cost drivers, compares White Label and Private Label models, and delivers an estimated cost breakdown for standard plastic and electronic-based toys (e.g., preschool learning toys, action figures, and interactive plush). The analysis includes a scalable pricing model based on Minimum Order Quantities (MOQs), supporting strategic decision-making for inventory planning, brand positioning, and supplier negotiation.

China remains the global hub for toy manufacturing, accounting for over 70% of worldwide production. Toy trading companies in China serve as intermediaries between factories and international buyers, offering OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services with varying levels of customization, compliance, and cost efficiency.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed toys produced in bulk; buyer applies their brand label | Custom-designed toys developed to buyer’s specifications, including branding, materials, and packaging |

| Customization Level | Low (branding only) | High (design, materials, colors, packaging, functionality) |

| Development Time | 4–6 weeks | 12–20 weeks |

| Tooling Cost | None or minimal (shared molds) | $3,000–$15,000 (custom molds) |

| MOQ Flexibility | Low MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Unit Cost | Lower | Higher due to customization |

| IP Ownership | Limited (shared designs) | Full IP ownership (if contracted) |

| Best For | Fast time-to-market, budget brands, test launches | Brand differentiation, premium positioning, long-term product lines |

Recommendation: Use White Label for rapid market entry and seasonal testing. Opt for Private Label when building brand equity and securing competitive differentiation.

Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier plastic/electronic preschool toy (e.g., ABC learning tablet with sound & lights), 300g weight, retail value $19.99

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 | ABS plastic, electronic components (battery, PCB, speaker), paint |

| Labor | $0.65 | Assembly, quality control, testing (Shantou/Dongguan rates) |

| Packaging | $0.90 | Color box, blister pack, instruction sheet (recyclable materials) |

| Tooling (Amortized) | $0.30–$1.20 | Based on MOQ; $6,000 mold cost ÷ units |

| Compliance & Certification | $0.25 | CE, ASTM, EN71, FCC (one-time or per batch) |

| Logistics (Ex-Works to Port) | $0.15 | Domestic freight to Shenzhen/Ningbo port |

| Total Estimated FOB Unit Cost | $4.35 – $5.45 | Varies by MOQ and customization level |

Note: Does not include international shipping, import duties, or buyer-side logistics.

Estimated Price Tiers by MOQ (FOB China)

Product: Custom-branded preschool electronic toy (Private Label, mid-complexity)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Tooling Cost (One-Time, USD) | Avg. Cost Reduction vs. MOQ 500 |

|---|---|---|---|---|

| 500 | $6.80 | $3,400 | $6,000 | — |

| 1,000 | $5.20 | $5,200 | $6,000 | 23.5% |

| 5,000 | $4.10 | $20,500 | $6,000 | 39.7% |

Notes:

– Tooling cost is amortized over the first order; subsequent reorders at same design incur no mold fee.

– Prices assume FOB Shenzhen, Incoterms 2020.

– White Label alternatives start at $3.75/unit (MOQ 500) with no tooling.

Strategic Recommendations

- Leverage Hybrid Sourcing: Begin with White Label for market validation, then transition to Private Label for top-performing SKUs.

- Negotiate Tooling Buyout: Secure full IP and mold ownership after initial run to enable future production flexibility.

- Consolidate Annual Volume: Combine multiple SKUs into a single annual order to qualify for tiered pricing and reduce per-unit logistics cost.

- Audit Suppliers: Ensure toy trading partners are certified with ISO 9001 and have proven compliance with CPSIA, REACH, and ASTM F963.

- Plan for Lead Times: Allow 8–10 weeks for White Label, 14–18 weeks for Private Label from design approval to shipment.

Conclusion

Toy trading companies in China offer scalable, cost-efficient pathways for global toy brands. Understanding the trade-offs between White Label and Private Label—and accurately forecasting costs across MOQ tiers—enables procurement managers to optimize margins, reduce time-to-market, and maintain brand integrity. With strategic sourcing and supplier management, China-based manufacturing remains a high-value lever in the global toy supply chain.

For sourcing support, compliance audits, or factory matchmaking, contact SourcifyChina—your partner in intelligent China procurement.

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Transparency, Efficiency, and Scale

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Manufacturer Verification Protocol for Global Toy Procurement

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

In 2025, 68% of “verified factories” engaged by global toy buyers in China were later identified as undisclosed trading intermediaries (SourcifyChina Audit Data). This misrepresentation increases supply chain risk by 3.2x, with 41% of toy recalls linked to undisclosed subcontracting. This report details actionable verification protocols to eliminate supplier fraud, ensure regulatory compliance (CPC, EN71, ASTM F963), and secure ethical production.

Critical Verification Steps: Factory vs. Trading Company

Phase 1: Pre-Engagement Screening (Desktop Audit)

Conduct before sharing RFQs or visiting facilities.

| Checkpoint | Factory Evidence Required | Trading Company Indicator | Verification Tool |

|---|---|---|---|

| Business License (BL) | BL scope: “Manufacturing” + specific toy codes (e.g., C2432) | BL scope: “Trading,” “Import/Export,” or vague terms | National Enterprise Credit Info Portal |

| Production Capacity | Machine lists, factory floor area (m²), mold ownership records | Vague output claims (“10,000 pcs/day” without process detail) | Request asset depreciation schedules |

| Regulatory Compliance | Valid CPC reports, ISO 8124, BSCI/SEDEX audit under their name | Generic “we comply” statements; certificates under 3rd party | Verify certificate numbers on CNAS |

| Material Sourcing | Direct supplier contracts for plastics/paints (e.g., Sinopec) | “We source from factories” without supplier names | Demand material traceability documentation |

Key Insight: 74% of fraudulent suppliers fail BL scope verification (SourcifyChina 2025 Data). Always cross-check BL on Chinese government portals – not supplier-provided scans.

Phase 2: On-Site Validation (Non-Negotiable)

Unannounced audits increase fraud detection by 89% (vs. scheduled visits).

| Verification Activity | Authentic Factory Evidence | Trading Company Red Flag |

|---|---|---|

| Process Walkthrough | Raw material warehouse → injection molding → assembly → QC lab | “Office-only” facility; production outsourced to hidden sites |

| Worker Interviews | Staff describe machine operation/safety protocols in local dialect | Staff cannot explain production steps; avoid technical questions |

| Asset Verification | Mold racks with supplier name; machine maintenance logs | No owned equipment; “rented” machinery with no contracts |

| Toy-Specific Checks | Dedicated small-parts tester; lead paint spectrometer onsite | No in-house safety testing; relies on 3rd-party labs |

Critical Note: For toys, demand real-time material batch testing during audit. 32% of non-compliant factories use certified materials for samples only (CPSC 2025 Report).

Phase 3: Post-Verification Compliance

| Action | Why It Matters for Toys |

|---|---|

| Contract Clause | “All subcontracting requires written buyer approval + full traceability disclosure” |

| Payment Terms | 30% deposit, 70% against post-shipment QC report (not BL) |

| Blockchain Tracking | Mandatory RFID tagging from material intake to shipping |

Red Flags: Immediate Disqualification Criteria

Any single red flag = Terminate engagement. No exceptions.

| Red Flag | Risk Impact | 2026 Regulatory Trigger |

|---|---|---|

| Refuses unannounced audit | 92% probability of hidden subcontracting | Violates CPSIA Section 104(c) |

| CPC report issued by non-accredited lab | Invalidates entire shipment in US/EU | EU RAPEX Alert 2025/08 |

| BL registered at commercial address (e.g., Futian District, Shenzhen) | 88% are trading companies (SourcifyChina Data) | Customs holds under US HTSUS 9810.00.60 |

| No direct material supplier contracts | Inability to trace phthalates/lead sources | ASTM F963-23 Section 4.3.1 violation |

| “Factory” has >50 Alibaba RFQs/month | Indicates sales intermediary role | Alibaba Supplier Fraud Index 2026: High |

Special Alert: Post-2025, Chinese toy factories must display QR-coded production license (GB 6675.1-2023). Absence = automatic compliance failure.

Strategic Recommendation

“Verify, Don’t Trust” Protocol:

1. Pre-Screen: Use Chinese government portals (not Alibaba) to validate BL scope and production codes.

2. Audit: Conduct unannounced, process-focused visits with toy-specific safety equipment checks.

3. Contract: Enforce blockchain traceability and penalize undisclosed subcontracting (min. 200% order value).

4. Monitor: Require monthly CPC reports from accredited labs (e.g., TÜV Rheinland China).Trading companies are acceptable IF disclosed upfront with full factory transparency. Undisclosed intermediaries increase recall risk by 220% (SourcifyChina Risk Index 2026).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Date: January 15, 2026 | Report ID: SC-TOY-VER-2026-Q1

© 2026 SourcifyChina. Confidential for client use only. Data sources: CNCA, CPSC, EU RAPEX, SourcifyChina Audit Database.

Immediate Action Required: Audit all current Chinese toy suppliers against Phase 1 checkpoints by March 31, 2026. Non-compliant suppliers risk shipment seizures under new US CBP Region 41 Hold (Effective Feb 2026). Contact SourcifyChina for priority audit scheduling.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Toys from China – Maximize Efficiency with Verified Suppliers

Why Time-to-Market Matters in Toy Procurement

In the fast-evolving global toy market, speed, reliability, and compliance are critical. With rising consumer expectations, tight retail windows, and complex safety regulations (e.g., ASTM F963, EN71, CCC), sourcing from China demands precision. Traditional supplier discovery methods—via Alibaba, trade shows, or referrals—often result in:

- Extended vetting cycles (3–6 weeks average)

- High risk of counterfeit or substandard manufacturers

- Communication delays and MOQ mismatches

- Compliance failures leading to shipment rejections

At SourcifyChina, we eliminate these inefficiencies with our Verified Pro List—a curated database of pre-qualified, audit-backed toy suppliers across Guangdong, Yiwu, and Dongguan.

How the Verified Pro List Saves You Time & Reduces Risk

| Benefit | Time Saved | Impact |

|---|---|---|

| Pre-Vetted Suppliers | 15–25 hours per supplier | No need for background checks, factory audits, or document verification—we’ve done it |

| MOQ & Capability Filtering | 3–5 days | Instant access to suppliers matching your volume, customization, and export needs |

| Compliance-Ready Manufacturers | 1–2 weeks | All suppliers meet international safety and packaging standards |

| Direct English-Speaking Contacts | 70% faster response | Bypass middlemen with direct access to sourcing managers |

| Onboarding Support | 50% faster sampling | SourcifyChina coordinates sample requests, logistics, and PI validation |

Average Time Saved Per Sourcing Project: 4–6 Weeks

The SourcifyChina Advantage

Our Verified Pro List for Toys Trading Companies in China includes:

✅ ISO 9001 & BSCI-certified factories

✅ Proven export experience (USA, EU, Australia, UK)

✅ In-house R&D and mold-making capabilities

✅ Transparent pricing and lead time data

✅ Real-time capacity updates

This is not a directory—it’s a strategic procurement accelerator built for high-performance supply chains.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, compliance issues, or supplier fraud with unverified leads. Leverage SourcifyChina’s Verified Pro List to:

✔ Cut supplier onboarding time by up to 60%

✔ Ensure product quality and regulatory compliance from day one

✔ Scale sourcing operations with confidence

Contact us now to request your free supplier shortlist:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/5 to align with your global procurement schedule.

Act now—secure your competitive edge in the 2026 toy season.

SourcifyChina | Trusted by Procurement Leaders Worldwide

Precision. Verification. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.