The global automotive filter market is undergoing significant expansion, driven by rising vehicle production, stricter emission regulations, and increased consumer focus on vehicle maintenance and fuel efficiency. According to a report by Mordor Intelligence, the automotive filters market was valued at USD 14.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% from 2024 to 2029. This growth is particularly relevant for hybrid vehicles like the Toyota Prius, which rely on high-performance engine and cabin air filtration systems to maintain efficiency and longevity. As one of the most popular hybrid models worldwide, the Prius has cultivated a robust aftermarket ecosystem, including a competitive landscape of filter manufacturers specializing in OEM-equivalent and high-efficiency solutions. In this evolving market, nine standout manufacturers have emerged—combining innovative materials, rigorous testing standards, and wide distribution networks—to lead the segment in supplying reliable filtration solutions tailored specifically for the Toyota Prius.

Top 9 Toyota Prius Engine Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

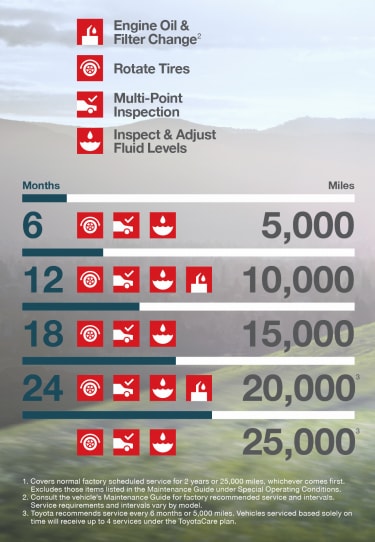

#1 Maintenance Plans

Domain Est. 1994

Website: toyota.com

Key Highlights: ToyotaCare. 2 Years or 25K Miles. A maintenance plan that covers normal factory scheduled maintenance with the purchase or lease of every new Toyota….

#2 Online Toyota Parts Superstore

Domain Est. 2015

Website: toyota.oempartsonline.com

Key Highlights: 3–6 day delivery · 30-day returnsSearch the entire Toyota OEM parts catalog by part name, part number, or your VIN, we are sure you will be able to find what you need….

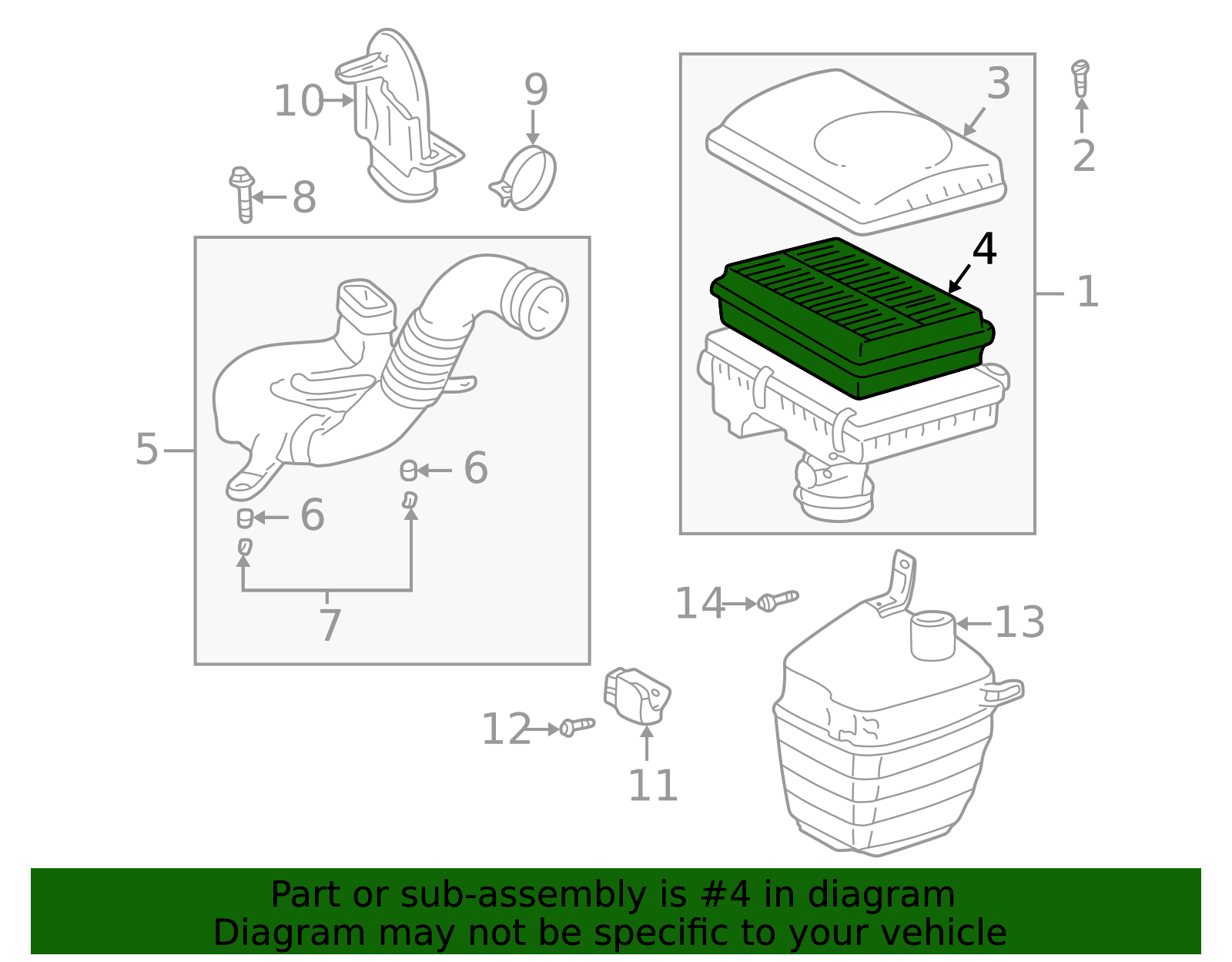

#3 Genuine Toyota Prius Air Filter

Domain Est. 2015

Website: toyotapartsdeal.com

Key Highlights: 1–4 day delivery · 30-day returnsWe own a wide range of the reduced-priced genuine Toyota Prius Air Filter. You can purchase in confidence as all parts come with a manufacturer’s …

#4 Toyota Genuine Parts & Accessories

Domain Est. 2015

Website: toyotapartsconnect.in

Key Highlights: Official Website for Toyota Genuine Parts & Accessories in India. Buy Genuine Parts Online directly from Toyota Dealers….

#5 Body Parts

Domain Est. 1994

Website: autoparts.toyota.com

Key Highlights: Shop Genuine Toyota body parts like bumpers, fenders and body panels. Add your vehicle. Add your vehicle to browse products that fit your vehicle….

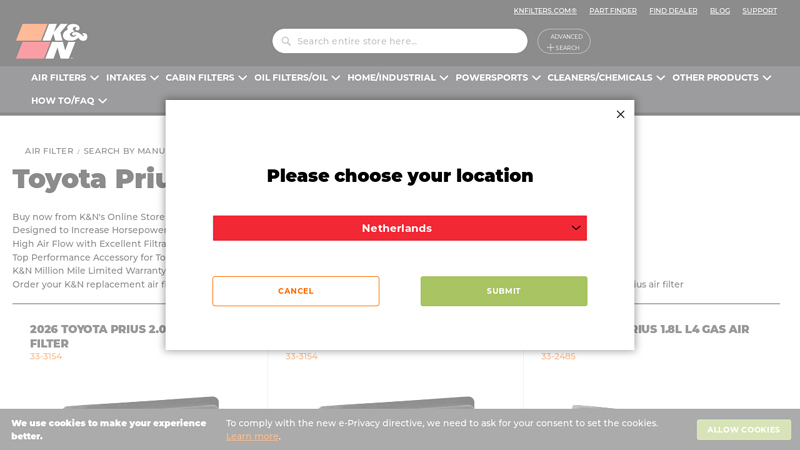

#6 Toyota Prius Replacement Air Filters

Domain Est. 1996

Website: knfilters.com

Key Highlights: Free delivery · 30-day returnsShop K&N replacement air filters for your Toyota Prius now from the official K&N online store. Free shipping available on orders over $25!…

#7 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: DENSO is a global choice for top automakers, with multiple vehicle models rolling off the assembly line with DENSO auto parts under the hood….

#8 Air Filter

Domain Est. 2023

Website: toyotaparts.ourismantoyotaofrichmond.com

Key Highlights: Rating 5.0 (1) · 30-day returnsSave Time and Money get your Genuine Toyota Air Filter (1780121060) For Your 2012-2025 Toyota When You Shop With Ourisman Toyota Parts!…

#9 Toyota Motor Corporation Official Global Website

Website: global.toyota

Key Highlights: Toyota Motor Corporation Official Global Website―company, ir, newsroom, mobility, sustainability….

Expert Sourcing Insights for Toyota Prius Engine Filter

H2: Projected 2026 Market Trends for Toyota Prius Engine Air Filters

As the automotive industry evolves toward electrification and sustainability, the market for internal combustion engine (ICE) components—including engine air filters for hybrid vehicles like the Toyota Prius—faces both challenges and opportunities. By 2026, the demand for Toyota Prius engine air filters is expected to reflect broader shifts in consumer behavior, vehicle longevity, and hybrid technology adoption.

-

Stable Demand Due to Hybrid Longevity

Despite the rise of fully electric vehicles (EVs), the Toyota Prius remains a dominant player in the hybrid segment. With many Prius models expected to remain on the road well beyond their initial purchase date, demand for maintenance parts—including engine air filters—will remain steady. The durability and reliability of the Prius contribute to extended vehicle lifespans, supporting ongoing replacement part sales through 2026. -

Shift Toward Premium and High-Efficiency Filters

Consumers are increasingly prioritizing air quality and engine performance. This trend is driving demand for high-efficiency particulate air (HEPA) or synthetic media filters that offer improved filtration and longer service intervals. By 2026, aftermarket suppliers are expected to expand their offerings of eco-friendly, reusable, or extended-life engine air filters tailored for the Prius, appealing to environmentally conscious and cost-sensitive owners alike. -

Growth in the Aftermarket and Online Sales Channels

The automotive aftermarket is projected to grow significantly by 2026, particularly in regions with high Prius ownership such as North America, Japan, and parts of Europe. Online retail platforms and e-commerce marketplaces will continue to dominate filter sales, offering competitive pricing, subscription-based replacement services, and direct-to-consumer delivery. This trend will empower DIY maintenance and reduce reliance on dealership services. -

Impact of Declining ICE Production

While the Prius continues to use a gasoline engine in its hybrid powertrain, Toyota’s long-term strategy includes phasing out traditional ICE vehicles. However, since hybrid models like the Prius are expected to remain in production through 2026, engine filter demand will not decline sharply. Instead, the market will gradually transition, with hybrid-specific filters maintaining relevance even as EV adoption accelerates. -

Regional Market Variations

Demand for Prius engine filters will vary by region. Markets with strong hybrid adoption—such as California, Japan, and Western Europe—will see sustained demand. In contrast, regions with aggressive EV incentives may experience slower growth in filter replacements. Additionally, emerging markets may see increased used Prius imports, indirectly boosting aftermarket filter sales. -

Sustainability and Recycling Initiatives

Environmental regulations and consumer preferences are pushing manufacturers to develop more sustainable filtration solutions. By 2026, expect to see increased use of recyclable materials in filter construction and take-back programs from leading suppliers. Toyota and its partners may also promote OEM filters with lower environmental impact, aligning with corporate carbon neutrality goals.

In summary, the 2026 market for Toyota Prius engine air filters will be shaped by the enduring popularity of hybrid vehicles, advancements in filtration technology, and shifting consumer preferences toward convenience and sustainability. While long-term electrification may eventually reduce reliance on traditional engine components, the Prius’s legacy and hybrid relevance ensure continued demand for high-quality air filters through the mid-2020s.

Common Pitfalls When Sourcing Toyota Prius Engine Air Filters (Quality & Intellectual Property)

Sourcing replacement engine air filters for the Toyota Prius—especially outside of authorized dealerships—can expose buyers to several risks related to quality and intellectual property (IP). Being aware of these pitfalls is crucial for maintaining vehicle performance, longevity, and legal compliance.

Poor Quality and Performance

One of the most frequent issues when sourcing aftermarket or generic Toyota Prius engine air filters is inconsistent or substandard quality. While some aftermarket brands meet OEM specifications, many low-cost alternatives use inferior materials such as low-density paper or weak adhesives. These filters may appear visually similar but fail to effectively trap fine particulates, allowing contaminants to enter the engine. Over time, this can lead to reduced fuel efficiency, increased engine wear, and potential damage to sensitive hybrid system components, such as the air intake sensors. Additionally, poorly constructed filters may not fit securely, leading to air bypass and compromised filtration.

Misrepresentation of OEM Compatibility

Many third-party suppliers falsely advertise their filters as “OEM-equivalent” or “direct fit” without rigorous testing or certification. This misleading labeling can cause consumers to believe they are purchasing a product that meets Toyota’s engineering standards, when in reality, the filter may deviate in critical dimensions, airflow characteristics, or filtration efficiency. Without proper verification (e.g., ISO standards or independent testing), such claims are often unsubstantiated and may void warranties or impact vehicle diagnostics.

Intellectual Property Infringement

A significant but often overlooked pitfall involves intellectual property (IP) violations. Toyota holds design patents, trademarks, and technical specifications related to genuine OEM parts, including engine air filters. When suppliers replicate the exact form, fit, and branding of Toyota’s original filter—especially using logos, part numbers, or packaging that mimics Toyota—they may infringe on Toyota’s IP rights. Purchasing such counterfeit or imitation products, even unknowingly, can expose businesses (e.g., repair shops or fleet operators) to legal liability, particularly in regions with strict IP enforcement. Furthermore, these counterfeit parts often lack quality control and traceability.

Lack of Traceability and Certification

Many off-brand filters—especially those sourced from unverified online marketplaces—lack proper documentation, batch traceability, or industry certifications (e.g., ISO 5011). This absence makes it difficult to verify performance claims or hold suppliers accountable in case of part failure. Genuine Toyota filters or reputable aftermarket brands typically provide test data and compliance information, which is essential for professional and commercial applications.

Conclusion

To avoid these pitfalls, buyers should source engine air filters from authorized dealers, certified aftermarket manufacturers (e.g., Bosch, Mann-Filter, K&N), or suppliers with transparent quality assurance processes. Always verify part numbers, check for independent certifications, and avoid products that mimic Toyota’s branding too closely. Prioritizing quality and IP compliance ensures optimal engine performance and protects against legal and mechanical risks.

Logistics & Compliance Guide for Toyota Prius Engine Filter

This guide outlines essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to the Toyota Prius engine air filter. Proper adherence ensures product integrity, supply chain efficiency, and legal compliance.

Product Identification and Specifications

- Part Number(s): Vary by model year and region (e.g., 17801-53150, 17801-53020). Confirm OEM or aftermarket equivalents.

- Compatibility: Specific to Toyota Prius model years and engine types (e.g., 1.8L 2ZR-FXE). Verify fitment before distribution.

- Material Composition: Typically non-woven synthetic or cellulose media with a rubber or foam sealing gasket. Confirm material safety data sheets (MSDS/SDS) are available.

- Packaging: Sealed polybag within a corrugated cardboard box. Must protect against dust, moisture, and physical damage.

Regulatory Compliance

- Emissions and Environmental Regulations:

- Engine filters are not emission control devices themselves but support engine efficiency. No EPA or CARB certification required for replacement filters unless marketed as performance-enhancing.

-

Ensure packaging and documentation do not make unsubstantiated environmental claims (e.g., “improves fuel economy by X%”) without certification.

-

REACH and RoHS Compliance (EU & International):

- Confirm filter materials are compliant with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives.

-

Suppliers must provide compliance documentation upon request.

-

Labeling Requirements:

- Include part number, vehicle compatibility, manufacturer name, and country of origin.

- For international shipments, labels must be in the destination country’s official language(s) where required.

- Barcode (UPC/EAN) must be present for retail and inventory tracking.

Packaging and Handling

- Packaging Standards:

- Use sturdy, recyclable corrugated boxes with internal support to prevent crushing.

- Avoid over-packing; standard unit packs typically contain 1–5 filters.

-

Clearly mark “Fragile” and “This Side Up” if applicable.

-

Handling Procedures:

- Store and handle filters in clean, dry environments to prevent contamination.

- Avoid exposure to oils, solvents, or extreme temperatures during storage and transport.

- Use gloves to prevent skin oils from contaminating filter media.

Storage Conditions

- Temperature: Store between 15°C and 30°C (59°F to 86°F).

- Humidity: Maintain relative humidity below 65% to prevent mold or material degradation.

- Shelf Life: Typically 5 years from manufacture date if stored properly. Rotate stock using FIFO (First In, First Out) inventory management.

- Stacking: Max stack height of 1.5 meters (5 feet) to avoid crushing lower boxes.

Transportation and Shipping

- Domestic Shipping (US/Canada):

- Comply with DOT regulations for general freight. No hazardous material classification.

- Use parcel services (e.g., FedEx, UPS) or LTL freight depending on volume.

-

Ensure proper insurance coverage for high-value shipments.

-

International Shipping:

- Comply with IATA/IMDG if part of mixed cargo, though filters are generally non-hazardous.

- Prepare commercial invoice, packing list, and bill of lading/air waybill.

-

Verify import regulations in destination country; some may require conformity assessment or local agent representation.

-

Cold Chain or Special Handling: Not required.

Customs and Import/Export Documentation

- HS Code (Harmonized System): Typically 8421.39.00 (Air filtering equipment). Confirm based on exact product classification.

- Country of Origin: Must be clearly declared. Impacts tariffs and trade agreements (e.g., USMCA, EU-Japan EPA).

- Import Duties and Taxes: Vary by country. Check local tariff schedules; may be duty-free in some jurisdictions.

- Export Controls: No ITAR or EAR restrictions apply to standard engine filters.

Returns and Warranty Logistics

- Warranty Period: Standard manufacturer warranty (e.g., 1 year or as specified).

- Return Process: Accept returns only if unopened and undamaged. Provide RMA (Return Merchandise Authorization) numbers.

- Defective Product Handling: Isolate and report to supplier; do not resell. Maintain logs for compliance audits.

Sustainability and Disposal

- End-of-Life Disposal: Filters are typically disposed of as general waste. Recommend recycling cardboard packaging.

- Waste Management: Used filters may contain engine contaminants; advise end-users to dispose of per local environmental regulations.

- Sustainability Practices: Source from suppliers with ISO 14001 certification and recyclable packaging.

Supplier and Quality Assurance

- Approved Suppliers: Only source from Toyota-authorized or ISO/TS 16949 certified manufacturers.

- Quality Checks: Perform incoming inspection for damage, correct part numbers, and packaging integrity.

- Documentation Retention: Keep compliance certificates, test reports, and shipping records for minimum of 7 years.

Adherence to this guide ensures safe, efficient, and legally compliant handling of Toyota Prius engine filters across the supply chain. Regular audits and updates to comply with evolving regulations are recommended.

In conclusion, sourcing a Toyota Prius engine filter requires careful consideration of compatibility, quality, and reliability. Ensuring the correct filter model for your specific Prius year, engine type, and market region (e.g., North America, Europe, or Asia) is essential for optimal performance and fuel efficiency. Whether purchasing from authorized dealers, reputable auto parts retailers, or trusted online platforms, prioritizing OEM (Original Equipment Manufacturer) or high-quality aftermarket filters ensures durability and proper filtration. Additionally, verifying supplier credibility, reading customer reviews, and comparing prices can lead to a cost-effective and reliable procurement decision. Regular maintenance and timely replacement of the engine filter contribute significantly to the longevity and efficiency of the hybrid powertrain, reinforcing the importance of sourcing the right component.