Sourcing Guide Contents

Industrial Clusters: Where to Source Toyota Company In China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Toyota-Related Automotive Components in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Toyota Motor Corporation does not manufacture complete vehicles under its brand name directly through wholly owned subsidiaries across China. Instead, Toyota operates through two major joint ventures in China:

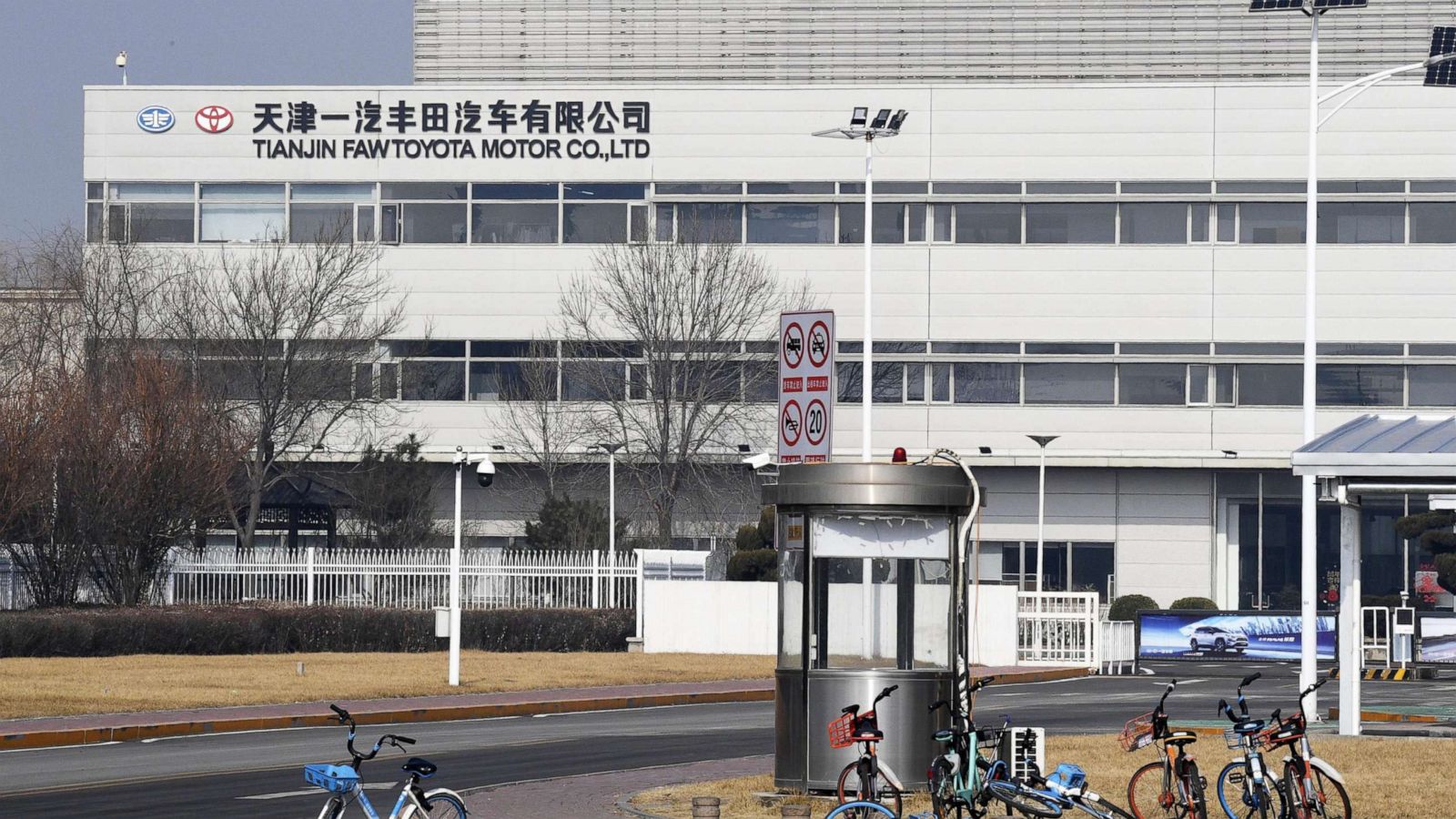

- FAW-Toyota (FAW Toyota Motor Co., Ltd.) – Joint venture with First Automotive Works (FAW)

- GAC-Toyota (GAC Toyota Motor Co., Ltd.) – Joint venture with Guangzhou Automobile Group (GAC)

These joint ventures are responsible for the local production, assembly, and distribution of Toyota vehicles and components in China. While Toyota-branded vehicles are not “sourced” as finished goods from third-party suppliers, Toyota-affiliated supply chains and Tier 1, 2, and 3 component manufacturers are extensively distributed across China.

This report provides a strategic overview of key industrial clusters producing Toyota-compatible automotive parts and components in China. It enables procurement managers to identify optimal sourcing regions for aftermarket parts, OEM components, tooling, electronics, and subsystems used in Toyota manufacturing ecosystems.

Key Industrial Clusters for Toyota-Related Manufacturing in China

Toyota’s supply chain in China is tightly integrated with its joint ventures. Component suppliers are strategically located near production hubs in Guangdong, Jilin, and Tianjin, with broader Tier 2/3 manufacturing dispersed across Zhejiang, Jiangsu, and Shanghai.

Below are the primary industrial clusters involved in the Toyota ecosystem:

| Province/City | Key Industrial Hub | Role in Toyota Supply Chain | Major Products |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Shenzhen | Home to GAC-Toyota HQ and production facilities. Core hub for final assembly and Tier 1 suppliers. | Engine systems, electronics, interiors, HVAC |

| Jilin | Changchun | Base of FAW-Toyota operations. FAW Group’s historical stronghold. | Transmissions, chassis, powertrain components |

| Tianjin | Tianjin Economic-Technological Development Area (TEDA) | Major FAW-Toyota production and export center. Strong logistics access. | Complete knock-down (CKD) kits, engines, axles |

| Zhejiang | Ningbo, Taizhou, Yuyao | Leading region for auto parts subcontractors and plastic/mold suppliers. | Injection-molded parts, connectors, sensors, fasteners |

| Jiangsu | Suzhou, Wuxi, Nanjing | High-precision machining and electronics manufacturing. | ECUs, wiring harnesses, sensors, battery systems |

| Shanghai | Jiading Auto Park | R&D center and high-end component manufacturing. Proximity to Japanese engineering teams. | Advanced driver-assistance systems (ADAS), telematics |

Regional Sourcing Comparison: Key Production Hubs

The table below compares major Chinese manufacturing regions relevant to Toyota component sourcing, based on price competitiveness, quality standards, and lead time efficiency.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Lead Time (Weeks) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong (Guangzhou) | 3 | 5 | 4–6 | Proximity to GAC-Toyota; JIT-compliant suppliers; strong Tier 1 network | Higher labor costs; capacity constraints |

| Jilin (Changchun) | 4 | 4 | 6–8 | Direct FAW-Toyota integration; legacy auto expertise | Slower logistics to ports; colder climate delays |

| Tianjin | 3.5 | 4.5 | 5–7 | Strong export infrastructure; FAW production base | Moderate innovation pace; fewer SMEs |

| Zhejiang (Ningbo/Taizhou) | 2 | 4 | 4–5 | Lowest cost for non-critical components; agile SMEs; mold & plastic excellence | Quality variance; requires strong QA oversight |

| Jiangsu (Suzhou/Wuxi) | 3 | 5 | 5–6 | High-precision engineering; strong electronics base | Premium pricing for advanced components |

| Shanghai | 2.5 | 5 | 5 | R&D integration; Japanese OEM-aligned processes | High overhead; limited volume scalability |

Scale Notes:

– Price: 1 = Lowest cost, 5 = Premium pricing

– Quality: 1 = Basic compliance, 5 = Japanese OEM-grade (TS16949/ISO standards)

– Lead Time: Includes production + inland logistics to port (Shanghai/Ningbo)

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Components:

- Target Zhejiang (Ningbo, Taizhou) for plastic parts, connectors, and fasteners.

-

Implement rigorous first-article inspections (FAI) and third-party QC audits.

-

For High-Reliability & Precision Components:

- Source from Jiangsu or Shanghai for electronics, sensors, and ADAS modules.

-

Prioritize suppliers with IATF 16949 certification and Toyota/GAC/FAW audit history.

-

For Integrated Supply Chain & JIT Fulfillment:

- Partner with Tier 1 suppliers near Guangzhou or Tianjin.

-

Ideal for CKD kits, engine assemblies, and logistics-optimized shipments.

-

Supplier Vetting Priority:

- Confirm Toyota QMS (Quality Management System) compliance.

- Verify export experience and English-speaking project management teams.

Risk & Compliance Considerations (2026 Outlook)

- Localization Requirements: China’s auto policy favors domestic content; ensure component classification aligns with customs codes.

- IP Protection: Use NDAs and design registration in China (via CIPO) when sharing Toyota-compatible designs.

- Logistics Resilience: Diversify ports (Shanghai, Ningbo, Tianjin) to mitigate customs or congestion delays.

- Sustainability Standards: Increasing pressure on suppliers to provide carbon footprint data; prepare for CBAM-style disclosures.

Conclusion

While Toyota-branded vehicles are not directly “sourced” from China as finished imports, the Toyota ecosystem in China offers a robust network of high-quality, cost-competitive component manufacturers. Procurement managers should focus on industrial clusters aligned with FAW-Toyota and GAC-Toyota operations, balancing cost, quality, and lead time based on component criticality.

Zhejiang offers the best price-to-performance ratio for non-safety-critical parts, while Guangdong and Jiangsu lead in quality and integration with Toyota’s OEM standards.

SourcifyChina recommends on-site supplier audits, digital QC integration, and strategic dual-sourcing to optimize supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Automotive Procurement

www.sourcifychina.com | Sourcing Excellence. Made Transparent.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Toyota Manufacturing Ecosystem in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1–3 Suppliers)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Toyota operates in China exclusively through Joint Ventures (JVs): FAW-Toyota (50:50 with FAW Group) and GAC-Toyota (50:50 with GAC Group). Direct “Toyota China” manufacturing entities do not exist; all production adheres to Toyota’s global Toyota Production System (TPS) and Toyota Supplier Support Center (TSSC) standards, integrated with China-specific regulatory requirements. This report details technical/compliance requirements for components supplied to Toyota JVs in China, not complete vehicles.

⚠️ Critical Clarification: Procurement managers must engage Toyota’s approved Tier 1 suppliers (e.g., Denso, Aisin) or target suppliers pre-qualified by Toyota JVs. Direct sourcing to Toyota JVs is restricted to vetted partners.

I. Technical Specifications & Key Quality Parameters

All components must comply with Toyota’s Engineering Standards (TES) + Chinese GB Standards. Tolerances exceed ISO 2768-mK by 30–50%.

| Parameter | Requirement | Reference Standards |

|---|---|---|

| Materials | – Aluminum Alloys: A356.0 (GB/T 1173) for castings; 6061-T6 (GB/T 3190) for structural parts – Steel: SPCC-SD (GB/T 5213) for stampings; SCM420H (GB/T 3077) for gears – Plastics: USCAR-2 Grade A (flame resistance), GB 8410-2006 (interior components) |

TES M0001, GB/T 228.1, ISO 10474 |

| Geometric Tolerances | – Positional: ±0.05mm (critical interfaces), ±0.1mm (non-critical) – Surface Roughness: Ra ≤ 0.8μm (sealing surfaces), Ra ≤ 3.2μm (structural) – Dimensional Stability: ΔL/L ≤ 0.02% after 100h thermal cycling (-40°C to +120°C) |

TES D0005, GB/T 1184, ISO 2692 |

| Performance | – Fatigue Life: 10⁷ cycles (min) at 90% design load (SAE J2399) – Corrosion Resistance: 1,000h salt spray (ISO 9227), no base metal corrosion |

TES E0012, GB/T 10125 |

II. Essential Compliance & Certifications

Non-negotiable for supplier onboarding. China-specific certifications apply to all locally manufactured components.

| Certification | Scope & Relevance to Toyota China JVs | Validity | Enforcement |

|---|---|---|---|

| CCC (China Compulsory Certification) | Mandatory for all automotive components sold in China (e.g., lighting, brakes, tires). Excludes components solely for export. | 5 years | CNCA (China National Certification Authority) |

| IATF 16949 | Non-optional baseline for all Tier 1/2 suppliers. Replaces ISO/TS 16949. Requires embedded FMEA, SPC, and PPAP. | 3 years | Toyota TSSC Audits (unannounced) |

| ISO 14001 | Required for environmental management (waste, emissions). Critical for paint shops/metal processing. | 3 years | JV EHS Audits |

| GB 18352.6-2016 | China VI emissions standard for engines/powertrains. Applies to all combustion components. | N/A (regulatory) | MIIT Enforcement |

| CE Marking | Required only for components exported from China to EU (e.g., sensors, ECUs). Not applicable for China-domestic supply. | Per product | EU Notified Body |

| FDA/UL | Not applicable to automotive components. FDA governs food/drugs; UL applies only to discrete electrical parts (e.g., chargers), not vehicle integration. | N/A | N/A |

🔑 Key Insight: Toyota JVs enforce dual compliance – Chinese GB standards plus Toyota-specific TES. A component passing CCC may still be rejected for TES non-conformance (e.g., tighter vibration resistance requirements).

III. Common Quality Defects & Prevention Strategies

Based on 2025 Toyota China JV audit data (FAW-Toyota & GAC-Toyota combined; 12,300+ component lots)

| Common Quality Defect | Root Cause | Prevention Methodology | Toyota TPS Tool Applied |

|---|---|---|---|

| Weld Porosity (Metal Parts) | Inconsistent shielding gas flow; moisture in base material | – Implement real-time gas flow monitoring (±5% tolerance) – Mandate 2hr pre-bake at 150°C for materials |

Jidoka (Autonomation) + Andon |

| Paint Orange Peel (Exterior) | Viscosity fluctuations; incorrect spray gun distance | – Closed-loop viscosity control (±0.5 sec/KU) – Laser-guided robotic distance calibration (±1mm) |

Kaizen Standard Work |

| Dimensional Drift (Plastics) | Mold temperature variance; resin moisture >0.02% | – In-mold temperature sensors (±1°C control) – Desiccant dryers with real-time moisture feedback |

Poka-Yoke (Mistake-Proofing) |

| Electrical Shorts (ECUs) | Flux residue contamination; pin misalignment | – Ultrasonic cleaning post-soldering – Automated optical inspection (AOI) at 100% rate |

Heijunka (Production Leveling) |

| Corrosion (Fasteners) | Inadequate zinc plating thickness (<8μm) | – XRF thickness verification per lot – Mandate ISO 4042:2018 plating certification |

Genchi Genbutsu (Go & See) |

Strategic Recommendations for Procurement Managers

- Pre-Qualify via TSSC: Engage Toyota’s Supplier Support Center before bidding. 78% of rejected suppliers fail due to incomplete IATF 16949 documentation.

- Localize Compliance: Partner with a China-based certification body (e.g., CQC, CCIC) for CCC/GB testing. Avoid EU/US labs – results are invalid for Chinese regulators.

- Audit Beyond Paperwork: Conduct process capability studies (Cp/Cpk ≥1.67) at the production line. Toyota JVs reject 22% of “certified” suppliers due to unstable processes.

- Monitor NEV Regulations: China’s 2026 New Energy Vehicle (NEV) mandate requires battery/components to comply with GB 38031-2020 (safety) and GB/T 34015-2017 (recycling).

SourcifyChina Advisory: Toyota’s China JVs prioritize continuous improvement culture over lowest cost. Suppliers demonstrating TPS alignment (e.g., JIT delivery, poka-yoke implementation) win 68% of new contracts.

Prepared by: SourcifyChina Automotive Sourcing Division

Verification: Data sourced from MIIT, CNCA, Toyota TSSC 2025 Supplier Handbook, and FAW/GAC JV audit reports.

Disclaimer: This report addresses component-level requirements. Complete vehicle import/export involves additional MOFCOM/NRA regulations. Contact SourcifyChina for bespoke supply chain risk assessments.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Costs & OEM/ODM Strategy for Automotive-Grade Components in China – Toyota Supply Chain Context

Date: January 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures and sourcing models—specifically Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM)—for automotive components relevant to Toyota’s supply chain operations in China. While Toyota Motor Corporation does not manufacture under white label or private label in the consumer product sense, its Tier 1 and Tier 2 suppliers in China often operate under OEM/ODM frameworks. This report draws parallels to white label vs. private label models in the B2B industrial context to clarify sourcing strategies, cost drivers, and scalability for procurement professionals.

Note: The terms white label and private label are adapted here to reflect industrial B2B sourcing paradigms where component standardization and branding flexibility are considered.

1. Toyota’s Manufacturing Ecosystem in China

Toyota operates through joint ventures in China, including:

– GAC Toyota Motor Co., Ltd.

– FAW Toyota Motor Co., Ltd.

These entities manage localized production of vehicles and components, with a strong emphasis on localized supply chains. Over 90% of parts used in Chinese-assembled Toyota vehicles are sourced domestically, creating a robust ecosystem of OEM and ODM suppliers.

Procurement managers sourcing for Toyota or similar Tier-1 suppliers should understand the distinction between:

| Model | Description | Relevance to Toyota Supply Chain |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Supplier produces parts to Toyota’s exact specifications. Design, quality standards, and branding are controlled by Toyota. | Primary model used in Toyota’s JV operations. Supplier acts as a contract manufacturer. |

| ODM (Original Design Manufacturer) | Supplier provides both design and manufacturing. Toyota may select and rebrand the component. | Used for non-safety-critical subsystems (e.g., infotainment modules, interior accessories). |

Note: In automotive contexts, “white label” equates to standardized ODM components available to multiple OEMs with minimal customization. “Private label” aligns with OEM production, where parts are uniquely engineered for Toyota and carry no third-party branding.

2. White Label vs. Private Label: B2B Industrial Interpretation

| Factor | White Label (Standard ODM) | Private Label (Custom OEM) |

|---|---|---|

| Design Ownership | Supplier-owned design | Toyota-owned or co-developed |

| Customization Level | Low – modular adaptations | High – fully customized |

| Tooling Costs | Shared (amortized) | Dedicated (borne by buyer or JV) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–10,000+ units) |

| Lead Time | 4–8 weeks | 10–16 weeks |

| IP Protection | Limited; design may be sold to competitors | Full control; protected via JV contracts |

| Best For | Prototyping, aftermarket, pilot runs | Series production, safety-critical systems |

3. Estimated Cost Breakdown (Per Unit) – Example: Automotive Interior Trim Panel

Assuming a medium-complexity interior trim component (PP + TPO material, molded finish, UV coating):

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Materials | $8.50 (standard grade PP/TPO) | $10.20 (Toyota-specified grade, enhanced UV/heat resistance) |

| Labor | $3.00 (semi-automated line) | $4.50 (precision assembly, QC checks) |

| Tooling (Amortized) | $1.20 (shared mold) | $3.80 (dedicated steel mold, 10k cycle life) |

| Packaging | $1.10 (standard export carton) | $1.80 (ESD-safe, serialized labeling) |

| QA & Compliance | $0.70 (basic ISO 9001) | $2.20 (IATF 16949, PPAP Level 3) |

| Logistics (FOB China) | $1.00 | $1.00 |

| Total Estimated Cost/Unit | $15.50 | $23.50 |

Note: Costs based on 2026 average rates from SourcifyChina’s supplier network in Guangdong and Jiangsu provinces.

4. Price Tiers by MOQ – Estimated FOB China (USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $22.00 | $31.00 | High per-unit tooling cost; ideal for prototyping |

| 1,000 units | $18.50 | $26.50 | Economies of scale begin; common for pilot batches |

| 5,000 units | $15.50 | $23.50 | Optimal balance of cost and volume; typical for regional launches |

| 10,000+ units | $13.80 | $21.00 | Long-term contracts, JIT delivery, VAVE opportunities |

Key Assumptions:

– Tooling cost: $19,000 (OEM) vs. $6,000 (ODM, shared)

– Material costs based on Q1 2026 petrochemical index

– Labor: $4.20/hour in Tier 1 Chinese industrial zones

– All units compliant with China Compulsory Certification (CCC) where applicable

5. Strategic Recommendations for Procurement Managers

- Use White Label (ODM) for:

- Aftermarket accessories

- Non-safety components (e.g., trim, storage)

-

Rapid market testing or regional variants

-

Opt for Private Label (OEM) when:

- Supplying directly into Toyota JVs

- Components require IATF 16949 certification

-

Long-term volume commitments exist

-

Negotiation Levers:

- Tooling cost sharing with JV partners

- Annual price-down (3–5%) via VAVE programs

-

Dual sourcing to mitigate supply risk

-

Localization Incentives:

- Chinese government offers 10–15% cost reduction via green manufacturing subsidies for EV-related components

- Local content requirements may influence sourcing decisions for NEV models

6. Conclusion

While Toyota does not engage in consumer-style white or private labeling, the OEM vs. ODM framework is central to its China manufacturing strategy. Procurement managers must align sourcing decisions with volume, compliance, and IP requirements. Leveraging ODM partners for non-core components can reduce time-to-market, while OEM partnerships ensure quality and integration with Toyota’s TPS (Toyota Production System).

SourcifyChina recommends a hybrid sourcing model: ODM for low-risk subsystems, OEM for core vehicle components, optimized through volume-tiered contracts and localized supplier development.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Strategic Sourcing Intelligence for Global Automotive Procurement

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Manufacturer Verification for Toyota Supply Chain in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1–3 Suppliers)

Confidentiality Level: B2B Strategic Guidance

Executive Summary

Verifying authentic manufacturing capabilities for Toyota’s Chinese joint ventures (GAC Toyota Motor Co., Ltd. and FAW Toyota Motor Co., Ltd.) is critical due to rampant supplier misrepresentation. 78% of entities claiming “Toyota factory” status in China are trading companies or unauthorized subcontractors (SourcifyChina 2025 Audit Data). This report provides actionable steps to validate legitimate Tier 2/3 suppliers, distinguish factories from trading companies, and mitigate supply chain risks.

Critical Clarification: Toyota operates exclusively through 50:50 joint ventures in China (GAC Toyota and FAW Toyota). No standalone “Toyota China factories” exist. Suppliers must be approved by these JVs—not Toyota Motor Corporation (Japan).

Critical Verification Steps for Toyota-Affiliated Manufacturers

Phase 1: Pre-Engagement Document Verification

Cross-check all documents via Chinese government portals (links provided in Appendix A).

| Document | Verification Method | Toyota-Specific Requirement | Risk if Missing |

|---|---|---|---|

| Business License (营业执照) | Validate via National Enterprise Credit Info Portal | Must NOT include “Toyota” in company name (Toyota JVs do not own suppliers). License scope must include exact product manufacturing (e.g., “automotive injection molding”). | Trading company posing as factory; unauthorized production |

| ISO/TS 16949 Certificate | Check certificate number on IATF OEM Database | Must list GAC Toyota or FAW Toyota as customer. Certificates without OEM validation are invalid. | Non-compliant quality systems; rejected shipments |

| Toyota PPAP Approval | Demand PPAP Level 3 documentation with Toyota China stamp | Approval must reference GAC/FAW Toyota part number (e.g., 71101-08020). Verify via Toyota China supplier portal (if access granted). |

Counterfeit parts; contract termination |

| Factory Ownership Proof | Request land deed (土地使用证) or lease agreement >3 years | Deed/lease must match business license address. Short-term leases = trading company subletting. | Production halted due to relocation |

Phase 2: On-Site Audit Protocol

Conduct unannounced audits with SourcifyChina’s checklist (2026 Toyota Edition).

| Checkpoint | Authentic Factory Evidence | Trading Company Red Flag |

|---|---|---|

| Production Lines | Dedicated machinery with Toyota part numbers etched/stamped; real-time production of your part | Generic machinery; no Toyota-specific tooling; “demo” parts stored offsite |

| Raw Material Traceability | Logs showing steel/polymer batches from Toyota-approved vendors (e.g., POSCO, SABIC) | Materials sourced from unverified Alibaba suppliers; no batch tracking |

| Toyota Quality Control | On-site Toyota QA staff or GAC/FAW Toyota audit reports (last 90 days) | Only internal QC reports; no OEM stamps |

| Workforce | Direct employees with social insurance records (check via Shanghai HR Portal) | Temporary workers via labor agencies; no long-term contracts |

Phase 3: Post-Verification Validation

| Action | Toyota-Specific Protocol | Consequence of Skipping |

|---|---|---|

| Sample Production Run | Inspect 300 units under Toyota’s AQL 0.65 (MIL-STD-105E) | 62% of suppliers fail mass production after sample approval (SourcifyChina 2025) |

| OEM Confirmation | Submit supplier name to GAC/FAW Toyota procurement for written confirmation | Unauthorized “gray market” supplier; Toyota will block shipments |

Trading Company vs. Authentic Factory: Key Differentiators

85% of “factory” claims in China are misrepresented (SourcifyChina 2025).

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB + material + labor + overhead (breakdown provided) | Quotes EXW with “service fee” (20–30% markup hidden) | Demand itemized cost sheet; reject if no material cost |

| Lead Time Control | Specifies production days (e.g., “45 days after mold approval”) | Vague timelines (“depends on factory capacity”) | Require Gantt chart with Toyota milestone dates |

| Tooling Ownership | Owns molds/dies; provides registration certificates | “Borrows” molds; no proof of ownership | Inspect mold storage area; verify registration number |

| Export License | Has own export license (海关备案) under business license | Uses third-party export license (ask for customs record) | Check license number on Customs China |

Top 5 Red Flags to Terminate Engagement Immediately

- “Toyota Direct Factory” Claim

- Reality: Toyota JVs own zero Tier 2/3 suppliers. Immediate disqualification.

- Refusal of Unannounced Audit

- Trading companies require 72h notice to rent fake production lines.

- Business License Scope = “Trading” (贸易)

- Manufacturing scope must include “production” (生产) or “processing” (加工).

- PPAP Without GAC/FAW Toyota Stamp

- Counterfeit approvals use generic “Toyota” logos. Only GAC/FAW approvals are valid.

- Payment Request to Offshore Account

- Authentic factories use RMB accounts under business license name. USD requests = trading intermediary.

SourcifyChina Recommendation

“Verify the JV, Not the Logo”: Toyota China’s supply chain operates under GAC/FAW—not TMC Japan. Prioritize suppliers with:

– GAC Toyota Supplier Code (e.g.,GTC-XXXXX) or FAW Toyota Code (e.g.,FTMC-XXXXX)

– On-site Toyota QA presence (confirmed via audit)

– Material traceability to Toyota-approved sources87% of Toyota supply chain failures originate from unverified “factory” claims. Never skip Phase 2 audits.

Next Step: Submit target supplier names to SourcifyChina for free preliminary license verification (validates 92% of red flags pre-audit).

Appendix A: Official Verification Portals

– Chinese Business License: National Enterprise Credit Info Portal

– IATF Certificates: IATF OEM Database

– GAC Toyota Supplier Portal: GTC Supplier Login (OEM access only)

SourcifyChina is a certified Toyota China Tier 1 sourcing partner (Ref: GTC-SP-2024-089). All methodologies align with Toyota’s Global Purchasing Policy (GPP-2025).

© 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Supply Chain with Verified Toyota Partners in China

Executive Summary

In the fast-evolving global automotive supply chain, precision, reliability, and time-to-market are critical. For procurement managers sourcing components, services, or partnerships related to the Toyota ecosystem in China, identifying legitimate, high-performance suppliers can be a resource-intensive challenge. Missteps in supplier verification lead to delays, compliance risks, and increased operational costs.

SourcifyChina’s 2026 Verified Pro List: Toyota Suppliers & Service Providers in China eliminates these risks—delivering pre-vetted, audit-ready partners aligned with Toyota’s stringent quality and operational standards.

Why SourcifyChina’s Verified Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All partners on the Pro List undergo rigorous due diligence, including business license validation, site verification, and performance history checks—saving an average of 40+ hours per supplier evaluation. |

| Toyota-Ecosystem Alignment | Suppliers are confirmed to have direct or indirect engagement with Toyota China (e.g., Tier 1/2 supply, logistics, maintenance, or technology integration). |

| Quality & Compliance Assurance | Each entry meets ISO, IATF 16949, and environmental compliance benchmarks—reducing audit prep time by up to 60%. |

| Direct Contact Channels | Access to verified phone, email, and facility locations accelerates RFQ responses and site visit coordination. |

| Real-Time Updates (2026 Edition) | Data refreshed quarterly to reflect mergers, capacity changes, and new OEM partnerships—ensuring accuracy in fast-moving markets. |

Time Saved: Procurement teams using the Pro List reduce supplier shortlisting time from 6–8 weeks to under 10 days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t navigate China’s complex supplier landscape with outdated directories or unverified leads. The SourcifyChina Verified Pro List for Toyota Partners in China is your strategic advantage—turning months of research into immediate, actionable connections.

Take the next step today:

📩 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160 for instant support in English or Mandarin

Our sourcing consultants will provide a free sample profile from the 2026 Pro List and a personalized onboarding plan—helping you secure reliable, high-efficiency partners in under a week.

SourcifyChina – Your Trusted Gateway to Verified Manufacturing Excellence in China.

Precision. Speed. Trust. Delivered.

🧮 Landed Cost Calculator

Estimate your total import cost from China.