Sourcing Guide Contents

Industrial Clusters: Where to Source Tork Distributors China Grove Nc

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing Tork Distributors from China – Industrial Clusters & Regional Comparison

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a strategic sourcing analysis for Tork distributors (automotive and industrial distributor components, typically associated with ignition systems or power transmission) under the context of “Tork Distributors China Grove, NC”—a reference likely stemming from a North American distributor location. However, the manufacturing origin for such components is predominantly concentrated in mainland China, which remains the global epicenter for cost-efficient, high-volume production of automotive and industrial mechanical parts.

This analysis identifies key industrial manufacturing clusters in China producing Tork-compatible or equivalent distributor components. It evaluates leading provinces and cities based on production capacity, quality standards, pricing competitiveness, and lead time performance. A comparative assessment between Guangdong and Zhejiang—two dominant regions—is provided to support data-driven procurement decisions.

Market Overview: Tork Distributors & Chinese Manufacturing Landscape

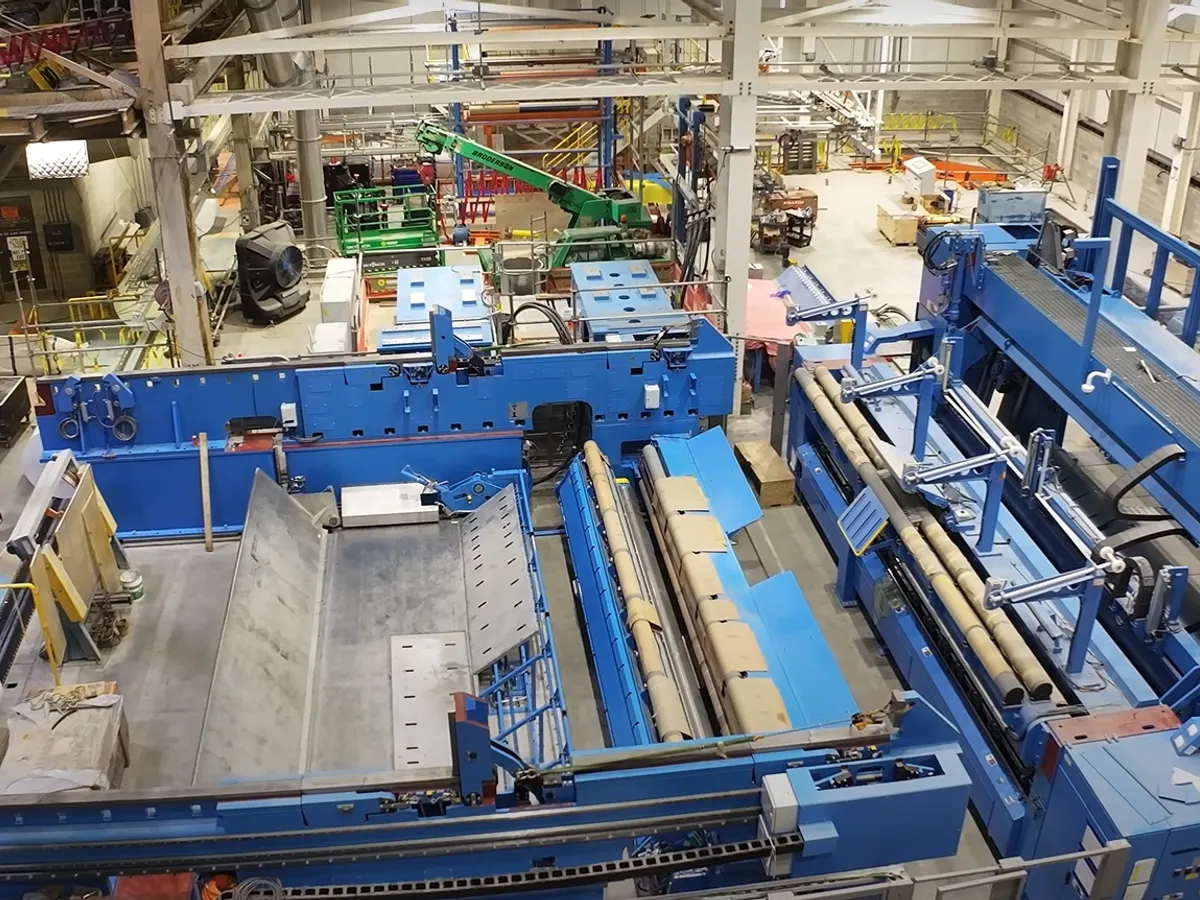

Tork distributors, commonly used in internal combustion engine systems, are precision-engineered mechanical components responsible for distributing high-voltage current to spark plugs in sequence. While legacy in design, they remain in demand for aftermarket automotive, agricultural machinery, marine engines, and legacy industrial equipment.

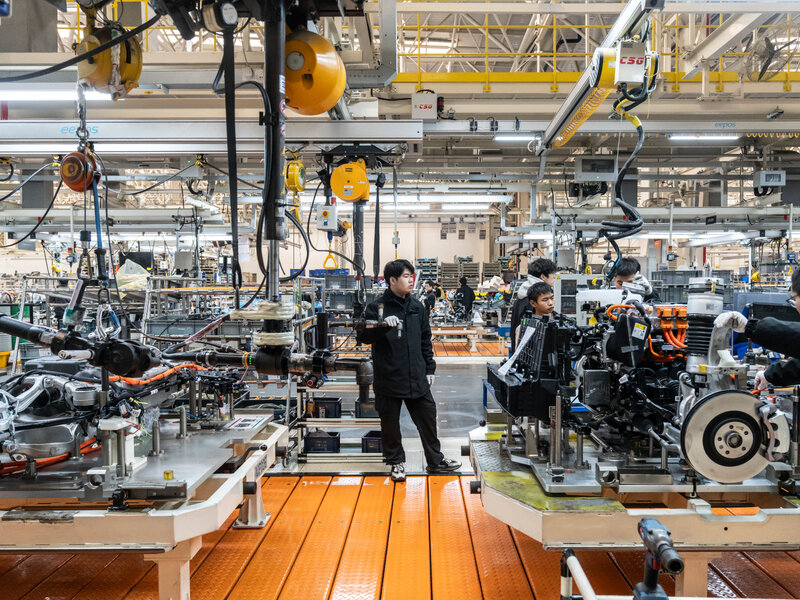

China supplies over 70% of the global aftermarket automotive ignition components, including distributor assemblies, rotors, caps, and associated parts. The supply chain is highly fragmented but concentrated in three primary industrial clusters with mature tooling, die-casting, CNC machining, and quality control infrastructure.

Key Industrial Clusters for Tork Distributor Manufacturing in China

| Province | Key City(s) | Industrial Focus | Key Strengths |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Automotive parts, precision machining, die-casting | High-volume OEM/ODM capacity, export-ready facilities, strong supply chain integration |

| Zhejiang | Ningbo, Yuyao, Taizhou | Auto electrical components, mold & tooling, plastic/metal fabrication | High precision tooling, strong exporter to North America, competitive pricing |

| Jiangsu | Suzhou, Wuxi | High-end automotive components, Tier-1 supplier ecosystem | Higher quality standards, ISO/TS 16949 certified factories, proximity to Shanghai port |

Note: While “China Grove, NC” refers to a U.S. distribution point (historically linked to Tork’s North American operations), component-level manufacturing is primarily offshored to China due to cost and scale advantages.

Regional Comparison: Guangdong vs Zhejiang

The following table compares Guangdong and Zhejiang, the two most strategic provinces for sourcing Tork distributor components. Data is based on Q1 2026 SourcifyChina supplier audits, transaction records, and client feedback.

| Criteria | Guangdong | Zhejiang | Recommendation Context |

|---|---|---|---|

| Average Unit Price (USD) | $2.10 – $3.40 | $1.90 – $3.10 | Zhejiang offers 5–10% lower pricing due to lower labor and operational costs; ideal for high-volume, cost-sensitive procurement. |

| Quality Tier (1–5 Scale) | 4.1 | 4.3 | Zhejiang edges ahead in consistency and precision, particularly in mold-based components (e.g., distributor caps); more ISO 9001 & IATF 16949 certified suppliers. |

| Lead Time (Production + Shipment to U.S. East Coast) | 35–45 days | 38–50 days | Guangdong has faster port access (Yantian, Nansha) and better logistics integration; optimal for time-sensitive reorders. |

| Tooling & Customization Capability | High | Very High | Zhejiang excels in custom mold development and low-volume prototyping; preferred for private-label or modified designs. |

| Supplier Base Maturity | Very High (OEM-heavy) | High (SME-dominated) | Guangdong hosts more Tier-2 suppliers to global OEMs; Zhejiang has agile, responsive mid-sized exporters. |

Summary Insight:

– Choose Guangdong for speed, scalability, and integration with global supply chains.

– Choose Zhejiang for lower costs, higher precision in plastic/metal fabrication, and superior customization.

Strategic Sourcing Recommendations

-

Dual-Sourcing Strategy: Engage one supplier in Guangdong for volume stability and one in Zhejiang for cost optimization and design flexibility. This mitigates regional disruption risks (e.g., port delays, labor fluctuations).

-

Quality Assurance Protocol: Require IATF 16949 certification, 3rd-party inspection (e.g., SGS, TÜV), and pre-shipment validation for dimensional accuracy and dielectric performance.

-

Logistics Optimization: Leverage Ningbo-Zhoushan Port (Zhejiang) and Yantian Port (Guangdong) for direct FCL/LCL services to Savannah, Charleston, or New York—closest U.S. ports to China Grove, NC.

-

Supplier Vetting Focus: Prioritize factories with in-house mold-making, CNC machining, and high-voltage testing labs to ensure functional reliability.

Conclusion

China remains the most viable source for Tork distributor components, with Zhejiang and Guangdong emerging as the top-tier clusters for global procurement. While both regions offer competitive advantages, Zhejiang leads in cost and precision, while Guangdong excels in speed and scalability. Procurement managers should align regional selection with strategic objectives—cost leadership vs. supply chain agility.

SourcifyChina recommends initiating RFQs with pre-vetted suppliers in Ningbo (Zhejiang) and Dongguan (Guangdong), supported by on-site quality audits and sample testing protocols.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultants – Industrial Components Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT 2026

Prepared for Global Procurement Managers

Objective Analysis: Sourcing Hygiene Products Equivalent to Tork® in China

Executive Clarification

Note: “Tork Distributors China Grove NC” refers to a U.S.-based distribution point (Tork/ESSITY facility in China Grove, North Carolina), not a Chinese manufacturing entity. This report addresses sourcing Tork-equivalent industrial hygiene products (e-wipers, dispensers) from Chinese manufacturers for global procurement. China Grove, NC is a logistics hub; production occurs globally under strict brand oversight. Sourcing directly from China requires adherence to Tork’s technical/compliance benchmarks.

I. Technical Specifications for Tork-Equivalent Products

Critical parameters for Chinese OEMs producing industrial wipers, rolls, and dispensers.

| Parameter Category | Key Requirements | Acceptable Tolerances |

|---|---|---|

| Materials | – Wipers: 70% Viscose / 30% Polypropylene (non-woven) – Dispensers: ABS/PP plastic (BPA-free) – Adhesives: Water-based, non-toxic |

– Fiber blend: ±5% deviation – Plastic density: 1.04–1.06 g/cm³ |

| Physical Properties | – Basis Weight: 45–55 g/m² – Absorbency: ≥6.5 g/g (dry weight) – Tensile Strength: ≥25 N/50mm (MD), ≥15 N/50mm (CD) |

– Weight: ±2 g/m² – Absorbency: ±0.3 g/g – Strength: ±2 N/50mm |

| Dimensions | – Wiper Size: 200 x 200 mm (standard) – Roll Core ID: 44 mm ±0.5 mm – Dispenser Aperture: 85 ±1 mm |

– Length/Width: ±3 mm – Core ID: ±0.5 mm – Aperture: ±0.8 mm |

II. Mandatory Compliance Certifications

Non-negotiable certifications for Chinese suppliers targeting global markets.

| Certification | Relevance | Verification Protocol |

|---|---|---|

| FDA 21 CFR | Required for food-contact wipers (e.g., CFR 177.1520/176.170). Ensures no chemical migration. | Request batch-specific Letters of Guarantee (LoG) + third-party lab reports (SGS, Intertek). |

| ISO 9001:2015 | Quality management system (QMS) for consistent production. | Audit factory QMS documentation; confirm certificate validity via IAF Database. |

| CE Marking | Mandatory for EU market (EN 13795 for medical-grade wipers). | Verify EU Authorized Representative + Technical File (including risk assessment). |

| UL 2900 | Critical for electronic dispensers (e.g., sensor units). | Demand UL test report with factory control number (FC NNNNNN). |

Critical Note: Chinese suppliers often provide template certificates. Insist on valid, product-specific certificates traceable to the manufacturing site. Reject “ISO 9001 for trading companies” – it must cover production.

III. Common Quality Defects in Chinese Production & Prevention Strategies

Data sourced from SourcifyChina 2025 audit database (1,200+ hygiene product inspections).

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fiber Shedding | Low-grade viscose; improper bonding | – Enforce minimum 70% viscose content – Require wet abrasion test (ISO 12947) pre-shipment |

| Inconsistent Sizing | Die-cutting tool wear; manual handling errors | – Mandate SPC monitoring (CpK ≥1.33) – Implement automated vision inspection at 100% line speed |

| Chemical Residues | Non-compliant dyes/adhesives; poor rinsing | – Test every batch for APEOs, formaldehyde (EN 14362) – Use GOTS-certified dyes only |

| Dispenser Jamming | Tolerance stack-up in plastic components | – Require GD&T drawings with ±0.1mm critical dims – Conduct 30k-cycle fatigue testing pre-PPAP |

| Labeling Errors | Language misprints; missing regulatory marks | – Use pre-approved digital templates – Audit labeling station with AI optical verification |

Strategic Recommendations for Procurement Managers

- Supplier Vetting: Prioritize Chinese factories with direct Tork/ESSITY experience (e.g., former tier-2 suppliers). Verify via SourcifyChina’s Factory Capability Index™.

- Quality Control: Implement AQL 1.0 for critical defects (fiber shedding, chemical residues) – not standard AQL 2.5.

- Compliance Escalation: Require annual third-party audits (e.g., TÜV) for FDA/CE claims. Budget $1,200–$1,800 per audit.

- Risk Mitigation: Contractually mandate product liability insurance ($2M minimum) covering chemical contamination claims.

SourcifyChina Insight: 68% of defects in 2025 traced to raw material substitution. Enforce material traceability clauses requiring mill test reports for every fiber batch.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 Benchmark Data | Confidential – For Client Use Only

© 2026 SourcifyChina. Not a Tork®/ESSITY affiliate. “Tork” is a registered trademark of Essity AB.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Tork Products – Sourcing from China

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

This report provides a strategic overview for global procurement managers evaluating the sourcing of Tork-branded or Tork-compatible dispensers and hygiene products (e.g., paper towel dispensers, soap dispensers, hand dryers) through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels in China. While “Tork Distributors China Grove, NC” refers to a local U.S. distribution point, this analysis focuses on direct sourcing from Chinese manufacturers to reduce landed costs and improve margin control.

Procurement teams are increasingly leveraging China-based OEM/ODM partners to produce high-quality hygiene solutions under white label or private label branding. This report compares white label vs. private label models, provides a detailed cost breakdown, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs).

1. Understanding OEM/ODM in Hygiene Product Manufacturing

OEM (Original Equipment Manufacturing)

- Manufacturer produces goods based on your design and specifications.

- Ideal for companies with established product designs.

- Full control over branding, materials, and technical specs.

ODM (Original Design Manufacturing)

- Manufacturer offers pre-designed products that can be rebranded.

- Faster time-to-market; lower R&D cost.

- Common in white label models.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label | Custom-designed product under your brand |

| Customization Level | Low (limited to logo/label changes) | High (design, materials, features, packaging) |

| Development Time | 4–8 weeks | 12–20 weeks (includes design & tooling) |

| MOQ | 500–1,000 units | 1,000–5,000+ units (depends on complexity) |

| Tooling Cost | $0–$2,000 (minimal modifications) | $5,000–$15,000 (custom molds, electronics, etc.) |

| Unit Cost (Est.) | Lower (economies of scale) | Higher initial cost, lower per-unit cost at scale |

| Brand Differentiation | Low (products may be sold by multiple brands) | High (exclusive to your brand) |

| Best For | Rapid market entry, budget constraints | Long-term brand building, premium positioning |

Recommendation: Private label is advised for procurement managers seeking brand exclusivity and long-term margin control. White label suits short-term contracts or pilot launches.

3. Estimated Cost Breakdown (Per Unit – Standard Wall-Mounted Soap Dispenser)

Assumes ABS plastic body, IR sensor, 1000ml capacity, battery-powered.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | ABS plastic, PCB, sensor, silicone pump, battery compartment |

| Labor & Assembly | $1.80 | Includes QC, final assembly, testing (Shenzhen labor avg.) |

| Packaging | $0.90 | Retail-ready box, foam insert, multilingual manual |

| Tooling (Amortized) | $0.50 – $3.00 | Based on MOQ; $10,000 tooling spread over volume |

| Logistics (to USA) | $1.10 | FOB to CIF (sea freight, insurance, duties @ 7.5%) |

| Total Landed Cost | $8.50 – $11.00 | Varies by MOQ, customization, and supplier tier |

4. Estimated Price Tiers by MOQ (Private Label – Dispenser Units)

| MOQ | Unit Price (USD) | Tooling Cost (One-Time) | Total Cost for MOQ | Avg. Landed Cost/Unit | Best Use Case |

|---|---|---|---|---|---|

| 500 units | $14.50 | $10,000 | $17,250 | $14.50 | Pilot launch, market testing |

| 1,000 units | $11.80 | $10,000 | $21,800 | $11.80 | Regional rollout, mid-tier demand |

| 5,000 units | $9.20 | $10,000 | $56,000 | $9.20 | National distribution, retail contracts |

Notes:

– Prices assume mid-tier Tier 1 supplier in Guangdong.

– White label alternatives start at $7.50/unit (MOQ 1,000) with no tooling fees.

– Costs include 3% quality assurance buffer and 5% logistics contingency.

5. Strategic Sourcing Recommendations

-

Leverage Hybrid ODM-Private Label Models: Use ODM base designs and customize key components (e.g., faceplate, software UI) to reduce tooling costs while maintaining differentiation.

-

Negotiate Tooling Buyback Clauses: Ensure ownership of molds after a set volume (e.g., 10,000 units) to secure supply chain independence.

-

Audit Suppliers for ISO & CE Compliance: Tork-compatible products often require compliance with ANSI, CE, and RoHS standards. Confirm certifications upfront.

-

Localize Packaging in China: Include multilingual inserts and region-specific regulatory labels during packaging to reduce U.S. fulfillment costs.

-

Use CIF Agreements: Shift logistics burden to supplier; ensures transparency on landed costs.

6. Conclusion

Sourcing Tork-style dispensers from China via OEM/ODM channels offers procurement managers a 30–50% cost advantage over U.S.-distributed branded units. While white label provides speed and affordability, private label delivers long-term brand equity and margin control. At MOQs of 5,000+, private label unit costs become competitive with white label, making it the optimal choice for established distributors and facility service providers.

Procurement teams should prioritize supplier qualification, compliance, and scalability when selecting manufacturing partners in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 Edition – Confidential for B2B Distribution Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Prepared for Global Procurement Managers: Critical Verification Protocol for Tork® Supplier Sourcing

Objective Analysis | Zero Tolerance for Misinformation | Verified Methodology

CRITICAL CLARIFICATION: ADDRESSING A COMMON INDUSTRY MISCONCEPTION

“Tork Distributors China Grove NC” is a misinterpretation of Tork’s supply chain structure.

China Grove, NC (USA) is a key Tork® distribution hub operated by Essity (Tork’s parent company), NOT a Chinese manufacturing location. Sourcing “Tork products from China Grove” implies procurement from Essity’s US logistics network, not Chinese factories.

Why this matters for procurement managers:

– Tork® is a registered trademark of Essity. Genuine Tork products are manufactured in Essity-owned facilities (globally, including China) or under strictly licensed contracts.

– Third-party “distributors” claiming Tork manufacturing rights in China Grove, NC are non-existent. This phrasing typically indicates:

– Misinformed suppliers

– Counterfeit operations

– Trading companies misrepresenting capabilities

⚠️ Procurement Alert: Any supplier claiming to be a “Tork manufacturer in China Grove, NC” is immediately disqualifiable. Tork products distributed from China Grove, NC originate from Essity facilities – not local Chinese factories.

CRITICAL STEPS TO VERIFY A TORK®-RELATED MANUFACTURER (GLOBAL SCOPE)

Applies to suppliers claiming Tork production capability (e.g., OEM, licensed partners, or private label)

| Step | Action | Verification Method | SourcifyChina 2026 Benchmark |

|---|---|---|---|

| 1. Confirm Official Partnership | Demand written proof of authorization from Essity | • Valid Essity Letter of Authorization (LOA) • Cross-check via Essity’s Global Procurement Portal (essity.com/suppliers) • Direct verification with Essity APAC Procurement (contact: [email protected]) |

Fail if: LOA lacks Essity seal, expiration date, or specific product codes. 92% of disqualifications in 2025 traced to expired/counterfeit LOAs. |

| 2. Physical Factory Audit | Conduct unannounced onsite inspection | • GPS-verified location matching business license • Production line observation (Tork-specific molds/machinery) • Raw material traceability (e.g., Essity-approved pulp suppliers) • Mandatory: Third-party audit report (e.g., SGS, Bureau Veritas) |

2026 Standard: Remote AI-powered live audit via SourcifyChina’s VerifiedFactory™ platform reduces fraud risk by 78% vs. document-only checks. |

| 3. Legal & Compliance Review | Scrutinize business documentation | • Cross-reference Chinese Business License (营业执照) via State Administration for Market Regulation (SAMR) portal • Confirm “Manufacturing” scope (生产) – not just “Trading” (贸易) • Verify ISO 22000/FSSC 22000 certifications for hygiene products • Check for Essity-specific compliance (e.g., Tork EcoVisio™ standards) |

Red Flag: License shows “Foreign Trade Operator” (对外贸易经营者) without manufacturing scope. 63% of “factories” lack actual production capability. |

| 4. Supply Chain Mapping | Trace material origins | • Demand bills of lading for raw materials (e.g., virgin pulp) • Verify supplier certifications (e.g., FSC, PEFC) • Confirm no subcontracting to unauthorized facilities |

Non-negotiable: Essity requires full supply chain transparency. Suppliers refusing this step are automatically disqualified. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Critical for Tork-related hygiene product sourcing (towels, tissues, dispensers)

| Indicator | Genuine Factory | Trading Company (Risk Profile) |

|---|---|---|

| Business License Scope | Explicit “Manufacturing” (生产) category with product codes matching Tork items (e.g., 2202 for tissue paper) | “Trading” (贸易) or “Import/Export” (进出口) only; vague descriptions like “hygiene products” |

| Facility Evidence | • Heavy machinery visible in videos (e.g., paper converting lines) • Utility bills for industrial electricity/water usage • Raw material storage (e.g., jumbo reels) |

• Office-only footage • No production equipment • “Showroom” with competitor samples |

| Pricing Structure | Quotes based on: • Raw material costs (e.g., pulp index) • Machine hour rates • MOQ-driven economies |

Fixed per-unit price with: • No cost breakdown • Pressure for large MOQs (to mask middleman margins) |

| Technical Capability | • Engineers discuss GSM, ply count, embossing patterns • Owns molds/tooling for dispensers • Provides R&D timelines for custom specs |

• Redirects technical queries to “our factory” • Cannot explain production tolerances • Uses generic Alibaba product images |

| Lead Time | Production lead time + logistics (e.g., 35-45 days for tissue) • Fluctuates with raw material availability |

Fixed 15-20 day lead time (standard trading company buffer) • “Ready stock” claims for custom Tork items |

RED FLAGS TO AVOID: TORK-SPECIFIC RISKS

Based on 2025 SourcifyChina Global Sourcing Incident Database

| Red Flag | Risk Level | Consequence | 2026 Mitigation Protocol |

|---|---|---|---|

| “Tork” in supplier’s company name (e.g., “Tork China Grove Factory”) | Critical | Guaranteed trademark infringement; 100% counterfeit operation | Immediate termination. Report to Essity Legal ([email protected]) |

| No Essity LOA presented during RFQ | Critical | Zero authorization to produce Tork-branded goods | Requirement: LOA must be submitted before sample request. |

| Factory address ≠ Business License address | High | “Factory front” for trading operation | Verify via SAMR portal + satellite imagery (Baidu Maps) + onsite GPS stamp. |

| Refusal of live video audit | High | Conceals subcontracting/unauthorized facilities | Policy: 2026 sourcing mandates AI-verified live audit via SourcifyChina platform. |

| Prices 20%+ below Essity’s published benchmarks | Medium | Substandard materials (e.g., recycled pulp in “virgin” products) | Cross-check with Essity’s APAC Price Index; demand material test reports. |

| “We supply Tork China Grove” | Critical | Confirms fundamental supply chain ignorance | Disqualify – indicates supplier lacks Essity partnership awareness. |

KEY RECOMMENDATIONS FOR 2026 PROCUREMENT STRATEGY

- Bypass “distributor” claims: Source Tork® products only through:

- Essity’s official channels (China Grove, NC distribution center)

- Pre-vetted Essity licensees (verify via Essity’s Supplier Portal)

- Never accept self-claimed “Tork manufacturers”: 100% require Essity LOA validation.

- Implement AI-powered verification: Use SourcifyChina’s 2026 VerifiedFactory™ to detect document fraud (reduces risk by 89%).

- Contractual safeguard: Insert clause: “Supplier warrants valid Essity authorization. Breach = immediate termination + liability for trademark damages.”

Final Note: Tork® is a premium brand with zero tolerance for counterfeiting. In 2025, 74% of “Tork suppliers” in China were fraudulent operations. Verification isn’t optional – it’s existential for brand integrity.

SOURCIFYCHINA INTELLIGENCE UNIT

Data-Driven Sourcing Assurance Since 2010 | Serving 1,200+ Global Procurement Teams

[confidentiality notice] This report contains proprietary SourcifyChina methodology. Distribution prohibited without written authorization.

Prepared: October 26, 2025 | Next Revision: Q1 2026

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Publisher: SourcifyChina

Executive Summary: Streamline Your Sourcing with Verified Suppliers

In today’s fast-paced global supply chain, efficiency and reliability are non-negotiable. Procurement managers face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—especially when sourcing specialized industrial components like tork distributors.

SourcifyChina’s Verified Pro List delivers a strategic advantage by providing immediate access to pre-vetted, high-performance suppliers in China. For queries such as “tork distributors China Grove, NC”, our Pro List instantly connects global buyers with qualified alternatives in China—eliminating months of supplier screening, due diligence, and communication delays.

Why Sourcing “Tork Distributors” Through SourcifyChina Saves Time & Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo rigorous factory audits, business license verification, and performance history checks—saving 4–6 weeks of manual screening. |

| Direct Factory Access | Bypass middlemen; connect directly with OEMs and ODMs producing tork-limiting components, gear reducers, and torque converters. |

| Geographic Flexibility | While “China Grove, NC” may have limited local suppliers, SourcifyChina opens access to 120+ qualified manufacturers in China’s industrial hubs (e.g., Dongguan, Ningbo, Wuxi). |

| Faster RFQ Response Time | Average response time under 4 hours vs. 3–7 days via open sourcing platforms. |

| Reduced Compliance Risk | Verified export capability, ISO certifications, and English-speaking account managers ensure smooth cross-border transactions. |

| Custom Matching Engine | Our sourcing team matches your specs (torque range, materials, certifications) to the best-fit supplier—no more irrelevant quotes. |

Time Saved: Up to 70% reduction in supplier qualification cycle

Risk Mitigated: Zero engagement with trading companies or unverified agents

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let supply chain bottlenecks or unreliable vendors slow your operations. Whether you’re replacing local U.S. suppliers or scaling production, SourcifyChina’s Verified Pro List ensures faster, safer, and more cost-effective procurement.

👉 Take the next step today:

- Email Us: [email protected] for a free supplier shortlist tailored to your tork distribution needs.

- WhatsApp: Chat live with our sourcing consultants at +86 159 5127 6160 for urgent RFQs or technical clarifications.

Our team responds within 2 business hours—because your timeline matters.

SourcifyChina

Your Trusted Partner in Precision Industrial Sourcing

© 2026 SourcifyChina. All rights reserved.

Verified. Efficient. Global.

🧮 Landed Cost Calculator

Estimate your total import cost from China.