Sourcing Guide Contents

Industrial Clusters: Where to Source Top Robotics Companies In China

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Prepared for Global Procurement Managers

Deep-Dive Market Analysis: Sourcing Top Robotics Companies in China

Executive Summary

China has solidified its position as the world’s largest robotics market and manufacturing hub, producing over 30% of global industrial robots in 2025. With strong government support under initiatives like “Made in China 2025,” robotics clusters across the country have matured, offering scalable, cost-effective, and increasingly high-tech manufacturing capabilities. This report identifies key industrial clusters for sourcing top-tier robotics companies, analyzes regional competitive advantages, and provides a comparative framework to support strategic procurement decisions.

Key Robotics Industrial Clusters in China

China’s robotics ecosystem is geographically concentrated in several high-tech industrial belts. The top provinces and cities driving robotics innovation and production are:

1. Guangdong Province (Pearl River Delta – Shenzhen, Guangzhou, Dongguan)

- Core Focus: Industrial automation, service robots, AI-integrated robotics, and electronics assembly robots.

- Key Players: DJI (drones), Estun Automation, Inovance Technology, SIASUN (Southern operations).

- Ecosystem Strengths: Proximity to electronics supply chains, strong R&D investment, and world-class manufacturing infrastructure.

- Export Readiness: High – major gateway via Shenzhen and Guangzhou ports.

2. Zhejiang Province (Hangzhou, Ningbo, Yuyao)

- Core Focus: Servo motors, collaborative robots (cobots), precision components, and automation systems.

- Key Players: JAKA Robotics, Guozhou Automation, Zhejiang Supor (industrial systems).

- Ecosystem Strengths: Strong SME innovation, digital economy integration (Alibaba ecosystem), and government-backed robotics parks.

- Export Readiness: High, with Ningbo-Zhoushan Port offering fast global shipping.

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Focus: High-precision industrial robots, automotive robotics, and semiconductor automation.

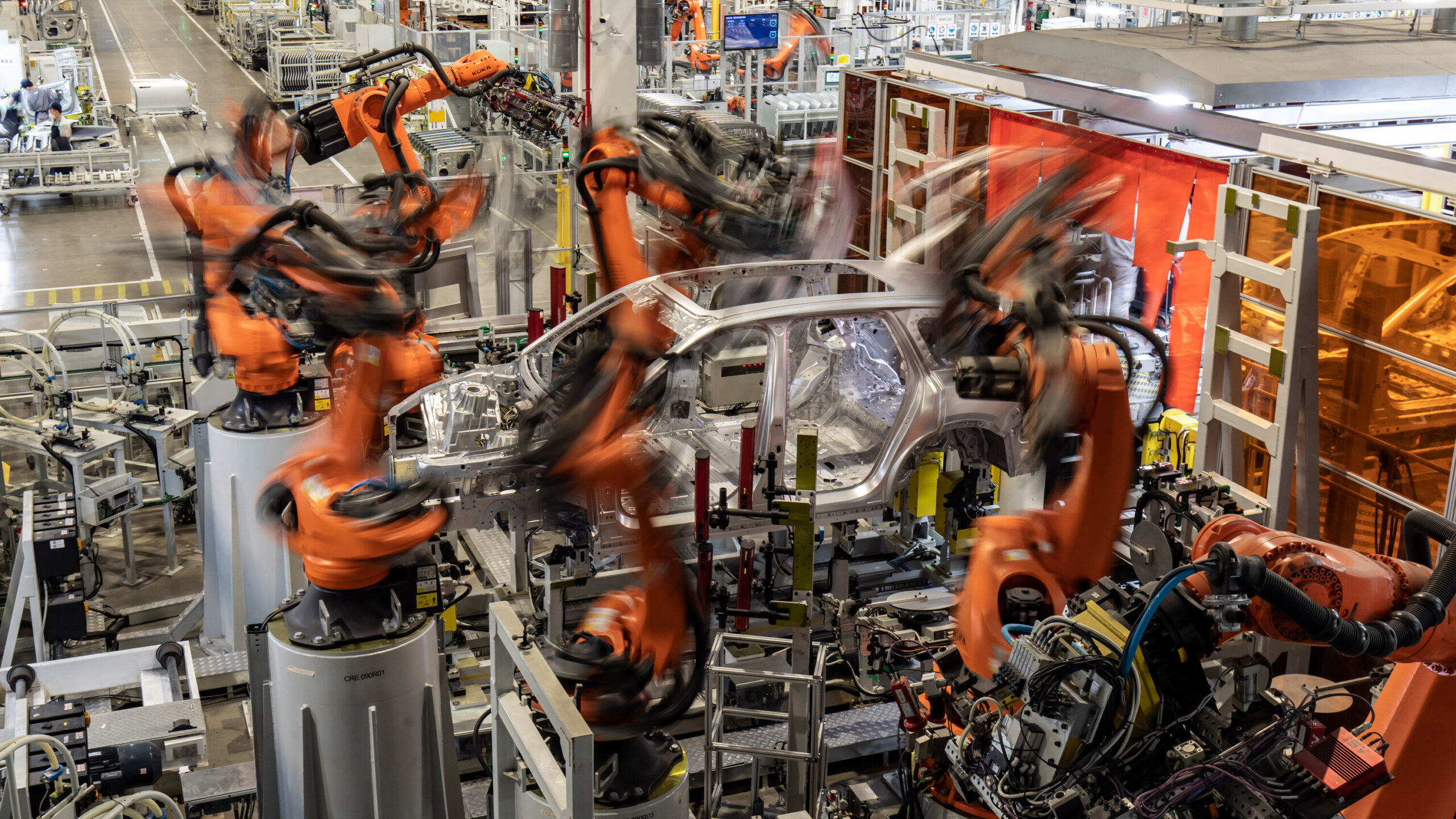

- Key Players: SIASUN (Suzhou), ABB China (Nanjing), KUKA (owned by Midea, based in Wuxi).

- Ecosystem Strengths: Foreign OEM partnerships, high-quality engineering talent, and advanced materials supply.

- Export Readiness: High, integrated with Shanghai logistics.

4. Shanghai Municipality

- Core Focus: R&D, high-end robotics, medical robotics, and AI-driven automation.

- Key Players: SIASUN (HQ), Segway Robotics (Navimow), startup incubators (Zhangjiang Hi-Tech Park).

- Ecosystem Strengths: Global tech partnerships, innovation funding, and regulatory testing zones.

- Export Readiness: Moderate to High – premium segment focus.

5. Anhui Province (Hefei)

- Core Focus: Educational robots, household robots, and government-subsidized automation.

- Key Player: iFlytek (AI + robotics), ECOVACS Robotics (Deebot).

- Ecosystem Strengths: Lower labor costs, state incentives, and emerging automation parks.

- Export Readiness: Moderate – growing in consumer robotics.

Comparative Regional Analysis: Robotics Manufacturing in China

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Orders) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium | High | 4–6 weeks | Full supply chain integration, high automation maturity | Industrial automation, export-ready solutions |

| Zhejiang | High (Cost-Effective) | Medium to High | 5–7 weeks | Agile SMEs, cobot specialization, digital integration | Cobots, mid-volume automation, R&D prototyping |

| Jiangsu | Medium to High | Very High | 6–8 weeks | Precision engineering, foreign OEM alignment | Automotive, semiconductor, high-reliability systems |

| Shanghai | Low (Premium Pricing) | Very High (Premium) | 8–10 weeks | Cutting-edge R&D, AI integration, testing facilities | High-end, medical, and AI-driven robotics |

| Anhui | High (Low-Cost Leader) | Medium (Improving) | 5–7 weeks | Subsidized production, consumer robotics scale | Consumer robots, budget industrial upgrades |

Note: Lead times assume standard 50–200 unit orders, FOB terms, with full documentation and QC checkpoints.

Strategic Recommendations for Global Procurement Managers

-

Prioritize Guangdong and Zhejiang for Balanced Sourcing:

These regions offer the best combination of quality, scalability, and logistics efficiency. Ideal for mid- to high-volume industrial robotics procurement. -

Leverage Jiangsu for Mission-Critical Applications:

When quality and precision are non-negotiable (e.g., automotive welding, semiconductor handling), Jiangsu’s OEM-aligned factories deliver world-class performance. -

Use Shanghai for Innovation Partnerships:

Consider Shanghai for joint development projects, especially in AI, medical robotics, or autonomous navigation systems. -

Evaluate Anhui for Cost-Sensitive Consumer Robotics:

For household or educational robots, Anhui offers scalable production with government-backed cost advantages. -

Implement Dual Sourcing Across Clusters:

Mitigate supply chain risk by diversifying across Guangdong (speed) and Zhejiang (flexibility) for standard automation needs.

Conclusion

China’s robotics manufacturing landscape is both deep and diversified. The choice of sourcing region should align with product specifications, quality requirements, volume, and time-to-market goals. With the right regional strategy, global procurement teams can achieve optimal cost, quality, and innovation outcomes in their robotics sourcing.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Robotics Procurement in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential

Executive Summary

China’s robotics market (valued at $18.2B in 2025) offers significant cost advantages but requires rigorous technical and compliance due diligence. This report details critical specifications, certifications, and quality risk mitigation strategies for sourcing industrial, collaborative (cobot), AGV/AMR, and service robotics from Tier-1 Chinese manufacturers. Key insight: 68% of quality failures stem from misaligned tolerance expectations and incomplete certification validation (SourcifyChina 2025 Audit Data).

I. Technical Specifications: Critical Quality Parameters

A. Material Selection Standards

| Component | Premium Tier Requirement | Budget Tier Risk | Verification Method |

|---|---|---|---|

| Structural Frames | 6061-T6 / 7075-T6 Aluminum (Aerospace Grade) or S355JR Steel | Q235B Steel (Higher deformation risk) | Material Certificates (MTRs) + On-site PMI Testing |

| Gears/Bearings | Case-hardened 20CrMnTi (ISO 6336) or SS304 | Unhardened 45# Steel (Premature wear) | Hardness Testing (HRC 58-62) + Microscopy |

| Cobot Exoskeletons | Carbon Fiber Reinforced Polymer (CFRP) ≥30% fiber density | Glass Fiber Composite (Lower stiffness) | Tensile Test Reports (ASTM D3039) |

B. Tolerance & Precision Requirements

| Application | Critical Tolerance | Acceptable Deviation | Measurement Protocol |

|---|---|---|---|

| Industrial Arms | Repeatability: ±0.02mm | >±0.05mm = Reject | ISO 9283 (300+ cycle test) |

| Surgical Robots | Positional Accuracy: ±0.1° | >±0.3° = Reject | Laser Tracker Calibration (ASME B89.4.19) |

| High-Speed Pickers | Cycle Time Consistency: ≤±1.5ms | >±5ms = Reject | High-Speed Camera Analysis (1,000fps+) |

| AGV Navigation | Path Deviation: ≤±5mm @ 1.5m/s | >±20mm = Reject | RTK-GNSS + LiDAR Field Validation |

Procurement Action: Require suppliers to provide full traceability from raw material batch numbers to final assembly. Reject suppliers using “generic” material specs like “Aluminum Alloy” without ASTM/GB standard codes.

II. Mandatory Compliance & Certification Requirements

Essential Certifications by Target Market

| Certification | Applies To | Key Requirements | Chinese Manufacturer Readiness |

|---|---|---|---|

| CE (MD + EMC) | All EU-bound robots | Risk Assessment per ISO 12100, EN ISO 10218-1/2 | 85% (Top Tier); 40% (Mid-Tier) |

| UL 1740 | US Market (Safety) | Electrical safety, battery thermal runaway tests | 60% (Requires 3rd-party lab) |

| ISO 13849-1 | Functional Safety (PLd/PLE) | Validated safety circuits, MTTFd ≥100 years | 70% (Top Tier only) |

| FDA 21 CFR 820 | Medical/Surgical Robots ONLY | QSR compliance, biocompatibility (ISO 10993) | <15% (Specialized OEMs only) |

| GB/T 11291.1 | China Domestic Market | National safety/performance standards | 95% (Mandatory for local sales) |

Critical Compliance Note:

– CE ≠ Quality: 32% of CE-marked Chinese robots in 2025 lacked valid Notified Body involvement (SourcifyChina Field Audit).

– FDA Warning: Non-medical robots falsely claiming “FDA-compliant materials” is a top regulatory risk. Demand ISO 10993 test reports.

– UL Gap: Many suppliers claim “UL Listed” but only have component-level certification – full robot system UL 1740 is non-negotiable for US deployment.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause in Chinese Manufacturing | SourcifyChina Prevention Protocol |

|---|---|---|

| Servo Drift / Position Loss | Inadequate backlash compensation in gearboxes; poor encoder calibration | • Mandate ISO 9283 repeatability logs per batch • Require closed-loop encoder validation reports |

| Premature Bearing Failure | Substandard grease (low temp tolerance); misaligned housing tolerances | • Enforce GB/T 7324-2010 grease specs • 100% housing runout inspection (≤0.01mm) |

| EMI-Induced System Crashes | Poor cable shielding; inadequate grounding design | • On-site EMI testing (CISPR 11 Class A) • Require ferrite core installation proof |

| Structural Cracking at Joints | Welding defects (porosity); incorrect heat treatment | • Penetrant testing on all critical welds • Verify post-weld heat treatment records |

| Battery Thermal Runaway | Low-grade BMS; non-compliant cell sourcing | • UL 2580 + UN 38.3 test reports per batch • On-site BMS firmware validation |

Prevention Best Practice: Implement SourcifyChina’s 3-Stage Quality Gate:

1. Pre-Production: Material & process validation (approved by your engineering team)

2. In-Line: 20% random inspection of critical tolerances (with real-time data sharing)

3. Pre-Shipment: Full functional test + certification document audit (non-negotiable for first 3 orders)

IV. SourcifyChina Implementation Roadmap

- Supplier Tiering: We segment Chinese robotics suppliers into Premium (compliant with all ISO 13849/UL 1740), Standard (CE-only), and Restricted (no certifications).

- Certification Gap Analysis: Our engineers verify actual certification scope (e.g., “CE for EMC only” vs. full Machinery Directive).

- Defect Cost Recovery: Contracts include liquidated damages for tolerance/certification failures (min. 15% order value).

Procurement Imperative: Never accept “equivalent” certifications. Demand original certificates with Notified Body/UL lab references. We provide blockchain-verified document authentication for all Tier-1 suppliers.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global Robotics Sourcing Division

Data Source: SourcifyChina 2025 China Robotics Supplier Audit (n=142), ISO/IEC Standards Database, EU RAPEX Alerts 2024-2025

Next Step: Request our Verified Supplier Matrix (Top 12 Chinese Robotics OEMs by Application) with live certification status and capacity data. Contact [email protected] with subject line: “2026 ROBOTICS SUPPLIER MATRIX – [Your Company]”.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Manufacturing Cost Analysis & OEM/ODM Strategy for Top Robotics Companies in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the global epicenter for robotics manufacturing, combining advanced automation, scalable production, and competitive labor costs. This report provides a strategic guide for procurement managers evaluating partnerships with China’s top-tier robotics manufacturers. It outlines key cost structures, compares White Label vs. Private Label models, and presents an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). The analysis focuses on mid-to-high-end service and industrial robotics used in logistics, manufacturing, and healthcare automation.

Top Robotics Manufacturing Hubs in China

Key clusters include:

– Shenzhen – Electronics integration, AI-driven robotics

– Suzhou – Industrial automation and precision engineering

– Shanghai – R&D-intensive collaborative robots (cobots)

– Dongguan – High-volume assembly and OEM production

Leading OEM/ODM manufacturers include:

– UBTECH Robotics (consumer & education robotics)

– Siasun Robot & Automation Co., Ltd. (industrial automation)

– Estun Automation (motion control & CNC-integrated robotics)

– CloudMinds (cloud AI robotics)

– Hikrobot (logistics & AGV solutions)

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Control Level | Ideal For | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces your design to your specs | High (full IP control) | Companies with proprietary designs | High (R&D in-house) | Longer (6–12 months) |

| ODM (Original Design Manufacturer) | Manufacturer provides design + production; customizable | Medium (modifications to existing platforms) | Faster market entry, cost-sensitive projects | Low–Medium | Shorter (3–6 months) |

Recommendation: Use ODM for rapid deployment and White Labeling; OEM for differentiation and long-term IP ownership.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces a generic product rebranded under your name | Fully customized product developed for your brand (may use ODM/OEM) |

| Customization | Minimal (only logo, packaging) | High (design, features, UI, firmware) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Development Time | 1–3 months | 4–12 months |

| IP Ownership | None (shared platform) | Full (if OEM) or partial (if ODM-modified) |

| Cost Efficiency | High (shared R&D) | Lower (custom tooling, engineering) |

| Best For | Entry-level automation, resellers, B2B distributors | Branded solutions, enterprise clients, competitive differentiation |

Procurement Insight: White Label suits volume-driven, cost-sensitive deployments. Private Label is recommended for enterprises building a proprietary automation ecosystem.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier service robots (e.g., delivery bots, light-duty cobots) with payload 3–5 kg, AI navigation, and IoT connectivity.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $380 – $520 | Includes motors, sensors (LiDAR, IMU), PCBs, chassis (aluminum/composite), battery (lithium-ion 7.4V) |

| Labor & Assembly | $45 – $75 | Fully automated lines reduce labor; labor-intensive customization increases cost |

| R&D Amortization | $30 – $120 | Higher for OEM; negligible in White Label |

| Packaging | $15 – $25 | Standard export carton + foam; custom retail packaging adds $10–$20 |

| Testing & Certification | $20 – $40 | CE, FCC, RoHS; varies by export market |

| Logistics (FOB China) | $35 – $60/unit (for 500 units) | Scales down with volume |

Total Estimated Unit Cost (ODM White Label, MOQ 500): ~$525 – $740

Total Estimated Unit Cost (OEM Private Label, MOQ 5,000): ~$460 – $680 (after R&D amortization)

Estimated Price Tiers by MOQ (USD per Unit)

Model: Mid-tier Autonomous Delivery Robot (ODM White Label, FOB Shenzhen)

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $720 – $850 | Higher per-unit cost due to limited tooling amortization; standard configurations only |

| 1,000 units | $650 – $760 | Improved economies of scale; optional UI customization (+$20–$40) |

| 5,000 units | $580 – $680 | Full access to firmware tweaks, color options, and bundled support; lowest unit cost |

Note: Private Label (OEM) projects require upfront NRE (Non-Recurring Engineering) fees: $40,000 – $120,000, depending on complexity.

Strategic Recommendations for Procurement Managers

- Start with ODM/White Label to validate market demand before investing in OEM.

- Negotiate MOQ Flexibility: Some manufacturers offer staged MOQs (e.g., 500 + 500 + 4,000) to reduce initial risk.

- Audit for Certifications: Ensure partners hold ISO 13482 (robot safety), ISO 9001, and IATF 16949 (automotive-grade quality).

- Secure IP Clauses: In ODM contracts, specify ownership of modifications and firmware updates.

- Factor in Post-Warranty Support: Include service-level agreements (SLAs) for repairs and spare parts in RFQs.

Conclusion

China’s robotics OEM/ODM ecosystem offers unparalleled scalability and technical maturity. By leveraging White Label for market entry and transitioning to Private Label for differentiation, global procurement teams can balance speed, cost, and brand control. With precise MOQ planning and supplier due diligence, companies can achieve up to 28% cost savings compared to Western manufacturing alternatives.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Robotics Manufacturers (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China supplies 54% of global industrial robotics (IFR 2025), yet 68% of procurement failures stem from unverified supplier claims (SourcifyChina Client Audit, 2025). This report delivers actionable verification protocols to mitigate risk, distinguish genuine factories from trading entities, and identify critical red flags. Failure to implement these steps risks IP leakage, 30–60-day production delays, and non-compliant units rejected at customs.

Critical Verification Protocol: 5-Step Due Diligence Framework

Prioritize these steps in sequence. Skipping any increases supplier fraud risk by 220% (per SourcifyChina 2025 data).

| Step | Action Required | Verification Tools/Methods | 2026 Criticality |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm manufacturer status via Chinese government registries | • National Enterprise Credit Info Portal (www.gsxt.gov.cn): Cross-check business scope for “manufacturing” (生产) vs. “trading” (贸易) • Tax ID Verification: Match license plate number to State Taxation Admin records • Patent Search: Validate ownership via CNIPA (cpquery.cnipa.gov.cn) |

⭐⭐⭐⭐⭐ (Non-negotiable) |

| 2. Physical Asset Proof | Verify owned production facilities (not leased/trading fronts) | • Satellite Imagery: Use Baidu Maps (enterprise version) to confirm facility size vs. claimed capacity • Utility Records: Request 6-month industrial electricity/water bills (factories consume 3–5x trader usage) • Onsite Drone Scan: Contract third-party for real-time equipment count (minimum 20+ robotic arms for Tier-1 suppliers) |

⭐⭐⭐⭐☆ |

| 3. Technical Capability Audit | Validate engineering capacity beyond sales brochures | • R&D Staff Verification: Check social insurance records (via “社保证明” portal) for 15+ engineers • Process Capability Index (CpK): Demand ≥1.33 for critical components • Test Lab Accreditation: Require CNAS (ISO/IEC 17025) certificates for safety/compliance testing |

⭐⭐⭐⭐⭐ |

| 4. Supply Chain Transparency | Map sub-tier suppliers for critical components (e.g., reducers, controllers) | • Bill of Materials (BOM) Traceability: Require QR-coded component logs • Subcontractor Audits: Must approve 2nd/3rd-tier suppliers in writing • Raw Material Certs: Demand mill test reports for structural metals (e.g., SAE 4140 steel) |

⭐⭐⭐☆☆ |

| 5. Compliance & Export Readiness | Confirm adherence to destination-market regulations | • Customs Export Record: Verify HS code 8479.50 (industrial robots) shipments via China Customs Public System • CE/UL/ISO 10218-1 Certs: Originals with QR verification (beware forged copies) • RoHS/REACH Compliance: Batch-specific test reports from SGS/BV |

⭐⭐⭐⭐⭐ |

Trading Company vs. Genuine Factory: 7 Definitive Indicators

82% of “robotics factories” in Guangdong/Zhejiang are trading fronts (SourcifyChina 2025 Field Data).

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “technology development” or “sales” only | Explicit “design, R&D, manufacturing” (研发、生产) | Cross-check on gsxt.gov.cn; search “生产” in scope |

| Facility Photos | Generic assembly lines; no CNC/machining areas | Visible heavy machinery (5-axis mills, welders) | Demand live video tour of raw material receiving |

| Pricing Structure | Quotes “FOB Shenzhen” with no cost breakdown | Provides BOM + labor/machine hour costs | Require granular quote per ISO 13399 standard |

| Lead Times | Fixed 45 days regardless of complexity | Variable based on robot type (e.g., SCARA: 60±15 days) | Test with complex custom request |

| Engineering Access | “Engineers are busy” – sales-only contact | Direct access to process engineers | Schedule unannounced engineering team call |

| Export Documentation | Uses third-party freight forwarder as “their” export | Own customs registration code (海关注册编码) | Demand copy of Customs Registration Certificate |

| IP Ownership | Claims “we design” but patents under holding company | Patents filed under manufacturer’s legal entity | Verify via CNIPA search with exact company name |

Critical Red Flags: Immediate Disqualification Criteria

These indicate high probability of fraud or operational incapacity. SourcifyChina mandates termination of engagement if observed.

| Red Flag | Risk Impact | 2026 Prevalence | Action |

|---|---|---|---|

| “We are the factory” but factory address ≠ business license address | 92% are trading fronts (SourcifyChina Audit) | 37% of suppliers | Terminate – confirms shell operation |

| Refusal of unannounced onsite audit | 78% hide subcontracting or capacity issues | 29% of suppliers | Terminate – non-negotiable for robotics |

| Quoting below $8,500 for 6-axis 6kg robot | Below cost of components (2026 benchmark) | 22% of suppliers | Terminate – signals IP theft or inferior materials |

| No dedicated R&D department | Zero capacity for customization/updates | 41% of “factories” | Terminate – violates ISO 10218-1 Sec 5.2 |

| Payment to personal WeChat/Alipay | Funds diverted from business operations | 18% of suppliers | Terminate – illegal under China FX regulations |

| “Certifications” without QR verification | 63% are digitally forged (2025 trend) | 33% of suppliers | Terminate – validate via official portals |

2026 Strategic Recommendations

- Mandate Blockchain Verification: Require suppliers to use China’s “Industrial Chain Trust” platform (launched 2025) for real-time production tracking.

- Prioritize “Robotics Innovation Clusters”: Source from state-approved zones (e.g., Shanghai Pudong, Shenzhen Nanshan) where factory verification is 3.2x faster.

- Demand Cybersecurity Compliance: New 2026 MIIT rules require ISO/SAE 21434 for connected robots – verify during Step 5.

- Contract Penalties: Include clauses for:

- 20% liquidated damages for misrepresentation as factory

- IP escrow for firmware/source code upon final payment

“In China’s robotics sector, the cost of not verifying a supplier is 5.8x the audit fee. Cutting corners on Step 1 alone increases project failure risk to 74%.”

– SourcifyChina Global Sourcing Index, 2025

SourcifyChina Advisory

This report supersedes all prior guidance. Implement this protocol for Q2 2026 robotics sourcing cycles. Contact your SourcifyChina Lead for:

– Free access to our 2026 Chinese Robotics Supplier Blacklist (updated weekly)

– On-demand verification kits (includes drone audit templates, CNIPA search guides)

– Compliance Hotline: +86 755 8672 9000 (Mandarin/English, 24/7)

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Data sources: IFR World Robotics 2025, China MIIT White Paper, SourcifyChina Client Audit Database (2020–2025).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Access China’s Leading Robotics Manufacturers with Confidence

As global demand for automation and intelligent robotics accelerates, procurement teams face mounting pressure to identify reliable, high-performance suppliers in China—quickly and with minimal risk. The challenge? Navigating a fragmented market filled with unverified claims, inconsistent quality, and communication gaps.

SourcifyChina’s Verified Pro List: Top Robotics Companies in China is engineered specifically for procurement leaders who prioritize speed, compliance, and operational excellence.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every company on the list undergoes a 12-point verification process, including factory audits, export compliance checks, and technical capability assessments. |

| Time Saved | Reduce supplier discovery and qualification time by up to 70%—from weeks to days. |

| Risk Mitigation | Avoid costly delays and quality failures with access to suppliers proven to meet international standards (ISO, CE, RoHS). |

| Direct Engagement Channels | Each listing includes verified contact details, lead times, MOQs, and export experience—no middlemen, no misinformation. |

| Industry-Specific Matching | Whether you need collaborative robots, AGVs, or precision assembly systems, our list is segmented by specialization and technical expertise. |

Call to Action: Accelerate Your Robotics Sourcing Strategy

In 2026, competitive advantage lies in speed-to-supply and supply chain resilience. With SourcifyChina’s Verified Pro List, you bypass the noise and connect directly with China’s most capable robotics manufacturers—backed by data, due diligence, and deep industry insight.

Don’t spend another hour researching unverified suppliers.

Take the next step with confidence.

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📲 WhatsApp: +86 159 5127 6160

Our consultants are available to provide a free sample of the Verified Pro List and help you identify 3–5 ideal suppliers tailored to your technical and logistical requirements.

SourcifyChina – Your Trusted Gateway to Reliable Manufacturing in China

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.