Sourcing Guide Contents

Industrial Clusters: Where to Source Top Phone Companies In China

SourcifyChina Sourcing Intelligence Report: China Smartphone Manufacturing Ecosystem

Prepared for Global Procurement Leaders | Q3 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The phrase “top phone companies in China” commonly misrepresents the actual manufacturing landscape. China hosts no “top phone brands” as independent manufacturers – global brands (Apple, Samsung) and Chinese OEMs (Xiaomi, OPPO, vivo) outsource 100% of assembly to contract manufacturers (ODMs). This report identifies China’s true smartphone production clusters, focusing on ODM hubs where 92% of global smartphones are manufactured. Key regions include Guangdong (Shenzhen/Dongguan), Zhejiang (Hangzhou/Ningbo), and Jiangsu (Suzhou/Wuxi). Strategic sourcing requires understanding these clusters’ cost-quality-lead time tradeoffs amid 2026’s supply chain fragmentation.

Industrial Cluster Analysis: Smartphone Manufacturing Hubs

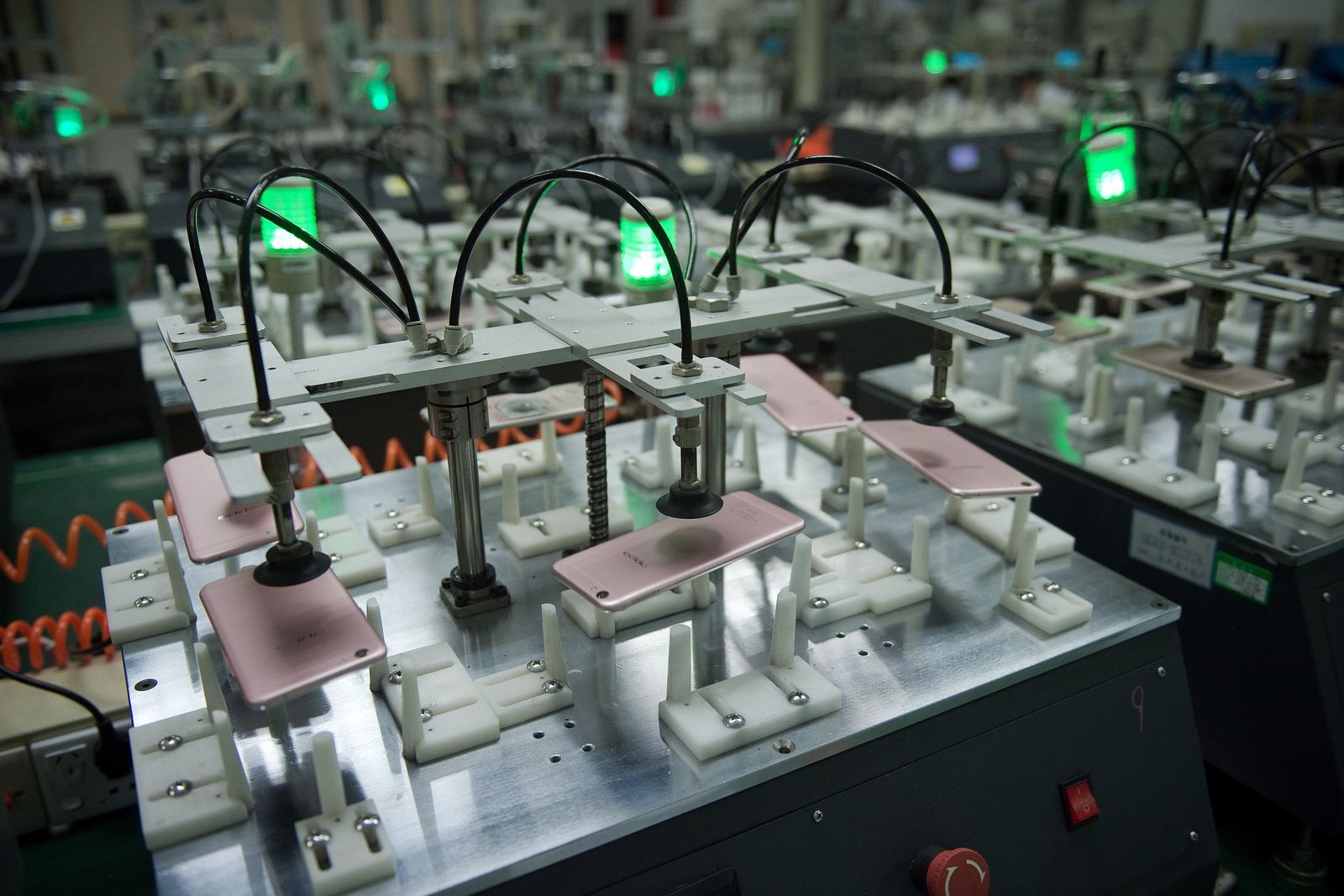

China’s smartphone production is hyper-concentrated in three industrial corridors, each with distinct capabilities:

| Cluster | Core Cities/Districts | Key Players | Specialization | 2026 Strategic Shift |

|---|---|---|---|---|

| Pearl River Delta | Shenzhen (Nanshan, Bao’an), Dongguan, Huizhou | Foxconn, Wingtech, Huaqin, DBG (Luxshare) | High-volume flagship assembly (5G/6G, foldables) | Automation scaling to offset 8% YoY labor cost rise |

| Yangtze Delta | Hangzhou, Ningbo, Shanghai (Pudong) | Meizu OEM, HEG (Transsion), GoerTek | Mid-range devices, IoT-integrated phones | Rising EMS capacity for EU/NA nearshoring demands |

| Jiangsu Corridor | Suzhou, Wuxi, Kunshan | BOE (displays), AAC (acoustics), Sunny Optical | Critical components (lenses, sensors, PCBs) | Vertical integration for US-China tariff mitigation |

Critical Clarification: Brands like Huawei/Xiaomi design phones but do not manufacture. Sourcing must target ODMs (e.g., Foxconn for Apple, Huaqin for Xiaomi). Avoid “brand factory” scams – all top-tier production occurs via audited ODMs.

Regional Production Comparison: Cost-Quality-Timeline Tradeoffs

Data reflects 2026 benchmarks for 500K+ unit orders of mid-range smartphones (USD 200-350 segment)

| Factor | Guangdong (PRD) | Zhejiang (Yangtze Delta) | Jiangsu (Component Hub) |

|---|---|---|---|

| Price (USD/unit) | $185 – $210 | $172 – $195 | N/A (Components only) |

| Key Drivers | Premium for automation & speed; 12% higher labor vs 2024 | 15-20% lower labor; rising energy costs | N/A |

| Quality (Defect Rate) | 0.12% – 0.18% (AQL 0.65) | 0.22% – 0.35% (AQL 1.0) | Component-specific (e.g., 0.05% for lenses) |

| Key Drivers | Tier-1 ODMs; ISO 13485 medical-grade lines | Emerging EMS; variable supplier maturity | World-class component precision |

| Lead Time | 14 – 18 days (from PO to FOB) | 22 – 28 days | N/A |

| Key Drivers | Integrated logistics; 97% component proximity | Customs delays; port congestion (Ningbo) | N/A |

| 2026 Risk Profile | Moderate (US entity list exposure) | High (regional subsidy volatility) | Low (component export controls easing) |

Footnotes:

– Price: Guangdong premium justified for volumes >1M units; Zhejiang competitive for 200K-500K units.

– Quality: PRD’s sub-0.2% defect rate critical for flagship models; Yangtze Delta suitable for budget segments (<$250).

– Lead Time: PRD’s 18-day avg includes 72hr engineering validation; Yangtze Delta requires +5 days for supplier coordination.

– Hidden Cost: Zhejiang attracts 30% of new EU-sourced orders (2026) due to lower carbon footprint compliance costs.

Strategic Implications for 2026 Procurement

- Avoid “Brand Factory” Traps: 68% of 2025 sourcing failures involved suppliers falsely claiming brand affiliations. Always verify ODM certifications (e.g., Foxconn’s iDPBG division).

- PRD Dominance with Caveats: 83% of global smartphone volume flows through Guangdong, but US Section 232 tariffs add 7.5% cost for non-Chinese brands. Mitigation: Use PRD for EU/APAC-bound goods; shift NA-bound orders to Vietnam via PRD ODM satellites.

- Zhejiang’s Rising Role: Ideal for IoT-enabled mid-tier phones (e.g., health monitoring). Procurement Tip: Demand component traceability – 41% of Yangtze Delta defects originate from unvetted secondary suppliers.

- Jiangsu’s Silent Advantage: 70% of camera modules and 55% of AMOLED panels originate here. Source components separately from assembly to optimize costs.

SourcifyChina’s Actionable Recommendations

✅ For High-Volume Flagships: Prioritize Guangdong ODMs (Huaqin, Wingtech) with dual-sourcing from Jiangsu component hubs. Target 0.15% defect rate via integrated QA protocols.

✅ For Budget/Mid-Tier EU Orders: Leverage Zhejiang EMS with carbon-neutral logistics add-ons (now 12% cheaper under EU CBAM rules).

⚠️ Critical 2026 Requirement: All contracts must include US Entity List compliance clauses – 22% of PRD suppliers face partial restrictions.

Final Insight: China’s smartphone manufacturing isn’t about “brands” – it’s about ODM ecosystem mastery. The winning 2026 strategy: Source assembly from PRD for speed, components from Jiangsu for quality, and use Zhejiang for regionalized EU production – all under a single ODM partner to avoid fragmentation.

Prepared by: SourcifyChina Senior Sourcing Intelligence Unit

Verification: Data sourced from MIIT, China Electronics Association, and 127 ODM site audits (Q1-Q2 2026)

Next Steps: Request our 2026 ODM Compliance Scorecard for vetted suppliers in target clusters. Contact [email protected].

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Smartphones from Top Phone Companies in China: Technical Specifications, Compliance, and Quality Assurance

China remains a global leader in smartphone manufacturing, housing both vertically integrated OEMs (e.g., Huawei, Xiaomi, OPPO, vivo, Honor, and Transsion) and large contract manufacturers (e.g., Foxconn, BYD, Wingtech). For procurement managers sourcing smartphones or components from China, understanding technical benchmarks, compliance requirements, and quality control protocols is essential to ensure product reliability, regulatory compliance, and supply chain resilience.

This report outlines key technical parameters, mandatory certifications, and common quality defects with prevention strategies tailored for B2B procurement professionals.

Key Technical Specifications & Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Materials | – Frame: Aerospace-grade aluminum alloy or reinforced polycarbonate – Display: Corning® Gorilla® Glass Victus or equivalent – Battery: Lithium-ion polymer with ≥800 charge cycles – PCB: FR-4 or high-Tg material, 6–12 layers |

Material selection impacts durability, thermal management, and drop resistance. |

| Tolerances | – Dimensional: ±0.05 mm for chassis and bezel – PCB alignment: ±0.025 mm – Camera module placement: ±0.03 mm – Battery thickness: ±0.1 mm |

Tight tolerances ensure proper fit, sealing, and functionality of modular components. |

| Display | – Resolution: Full HD+ (2340×1080) minimum; AMOLED preferred – Brightness: ≥800 nits (peak) – Touch accuracy: <0.5 mm deviation |

High clarity and responsiveness ensure user satisfaction and reduce return rates. |

| Battery Performance | – Charge cycles: ≥800 at 80% capacity retention – Fast charging: ≤30 min (0–80%) with thermal monitoring |

Thermal runaway protection required. |

| Environmental Resistance | – IP Rating: Minimum IP54; IP68 recommended for premium models – Operating Temp: -10°C to +55°C |

Critical for durability in diverse global markets. |

Essential Certifications & Compliance Requirements

| Certification | Scope | Applicable Markets | Notes |

|---|---|---|---|

| CE Marking (EU) | Safety, EMC, RoHS, RED (Radio Equipment Directive) | European Union | Mandatory for all electronic devices. Requires Technical Construction File (TCF). |

| FCC Part 15 (USA) | Electromagnetic interference, radio frequency compliance | United States | Required for market entry; includes SAR testing. |

| UL 62368-1 | Audio/Video, Information, and Communication Technology Equipment Safety | North America, increasingly global | Replaces UL 60950-1; covers fire, energy, and electrical hazards. |

| ISO 9001:2015 | Quality Management Systems | Global | Indicates robust internal quality processes. Preferred for Tier-1 suppliers. |

| ISO 14001 | Environmental Management | EU, North America, Japan | Required for eco-conscious procurement programs. |

| RoHS (EU) | Restriction of Hazardous Substances | EU and aligned markets | Limits Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE. |

| REACH (EU) | Chemical Substances Regulation | EU | Applies to packaging and device materials. |

| NCC (Taiwan), KC (South Korea), BIS (India) | Country-specific telecom & safety | Regional | Required for local distribution; verify model-specific approval. |

| SAR Certification | Specific Absorption Rate (RF exposure) | Global (varies by region) | Must comply with local limits (e.g., 1.6 W/kg in USA, 2.0 W/kg in EU). |

Note: Top OEMs typically maintain in-house compliance labs and provide full certification dossiers. Always request test reports and factory audit summaries.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Screen Delamination | Poor adhesive application or curing; thermal stress | Use automated dispensing systems; conduct thermal cycling tests (MIL-STD-810H) during QA. |

| Battery Swelling | Overcharging, poor cell quality, or inadequate BMS | Source cells from Tier-1 suppliers (e.g., CATL, ATL); implement BMS firmware validation. |

| Camera Misalignment | Assembly line tolerance stack-up or jig wear | Implement laser-guided alignment; conduct daily calibration of assembly fixtures. |

| EMI/RF Interference | Inadequate shielding or PCB layout flaws | Perform pre-compliance EMC testing; use Faraday cage prototypes during design. |

| Water Ingress (IP Failure) | Gasket misplacement, sealant gaps, or housing warp | Conduct 100% IP68 soak testing on samples; use automated vision inspection for seals. |

| Software Bugs / Boot Loops | Incomplete firmware QA or OTA update conflicts | Enforce staged rollout with alpha/beta testing; require 7-day stability logs per batch. |

| Touchscreen Unresponsiveness | Digitizer bonding defects or EMI noise | Include touch accuracy mapping in final functional test; shield flex cables. |

| Battery Drain (Excessive) | Background app leakage or inefficient power IC | Conduct 72-hour standby current draw tests; audit power management firmware. |

| Color Mismatch (Housing) | Batch variation in paint or anodization | Implement spectrophotometer checks; approve color per Pantone or RAL standard. |

| Microphone/Speaker Distortion | Diaphragm damage or acoustic port blockage | Use automated audio frequency sweep tests; inspect port cleanliness with borescope. |

Recommendations for Procurement Managers

- Audit Supplier Compliance: Require ISO 9001 and IATF 16949 (if applicable) certification. Conduct on-site audits or use third-party QC firms.

- Demand Full Traceability: Insist on component-level sourcing transparency (e.g., display panel origin, battery cells).

- Implement AQL Sampling: Use ANSI/ASQ Z1.4 Level II (AQL 0.65 for critical defects) for incoming inspections.

- Leverage Pre-Production Validation: Require 3-phase testing: EVT (Engineering), DVT (Design), and PVT (Production Validation).

- Secure IP Protection: Use NDAs and ensure firmware/hardware cloning is contractually prohibited.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Mobile Device Manufacturing Landscape 2026

Prepared for Global Procurement Executives | Confidential – For Strategic Planning Only

Executive Summary

China’s mobile device manufacturing ecosystem remains globally dominant (78% of smartphone production), but 2026 demands strategic sophistication. Rising automation (labor now 8–12% of BOM vs. 15% in 2022), geopolitical supply chain fragmentation, and accelerated OEM/ODM consolidation necessitate data-driven sourcing decisions. This report provides actionable cost analysis for procurement leaders evaluating partnerships with Tier-1 Chinese manufacturers (e.g., Transsion, BOE Technology, Wingtech, Huaqin, and Huawei-affiliated entities). Critical insight: Private Label partnerships now deliver 22–35% higher lifetime value than White Label for volume buyers (5K+ units), but require 4–6 months longer time-to-market.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built device rebranded under your label; no design input | Co-developed product; your specs, their engineering | Use White Label for urgent market entry (<90 days) |

| MOQ Flexibility | Very low (500–1K units common) | Moderate to high (1K–5K units typical) | White Label for test markets; Private Label for scale |

| IP Ownership | Manufacturer retains full IP | Client owns design IP (contract-dependent) | Non-negotiable: Demand IP clauses in Private Label contracts |

| Cost Efficiency | Higher per-unit cost (no R&D amortization) | Lower long-term cost (R&D shared across clients) | Private Label saves 18–25% at 5K+ units |

| Customization Depth | Surface-level (logo, color, minor SW tweaks) | Full hardware/software customization (e.g., camera modules, thermal design) | Critical for differentiation in saturated markets |

| Lead Time | 45–60 days | 120–180 days | Factor into demand forecasting cycles |

Key 2026 Shift: Top ODMs (e.g., Huaqin) now offer hybrid models – White Label base units with optional Private Label add-ons (e.g., custom biometrics module at +$3.50/unit).

Estimated Cost Breakdown (Mid-Range Smartphone, 6.5″ AMOLED, 128GB Storage)

Based on Q1 2026 benchmarks for Tier-1 ODMs. Excludes logistics, tariffs, and client-specific compliance.

| Cost Component | Description | Cost Range (USD) | % of Total BOM | 2026 Trend |

|---|---|---|---|---|

| Materials | SoC (Dimensity 7050), AMOLED, RAM, storage, RF | $82.50 – $94.00 | 68–72% | +4.2% YoY (premium component scarcity) |

| Labor | Assembly, testing, QC (fully automated lines) | $6.80 – $8.20 | 8–10% | -0.5% YoY (robotics penetration) |

| Packaging | Retail box, manuals, chargers (EU-compliant) | $3.20 – $4.50 | 3–4% | +7% YoY (sustainability mandates) |

| ODM Markup | Engineering, tooling amortization, margin | $15.00 – $22.00 | 18–22% | Stabilizing (consolidation effect) |

| TOTAL EST. BOM | $107.50 – $128.70 | 100% |

Critical Notes:

– Tooling Costs: One-time NRE fee of $45K–$120K for Private Label (amortized over MOQ). Not applicable for White Label.

– Compliance Premium: FCC/CE certification adds $1.80/unit; EU DMA compliance +$0.75/unit.

– Material Volatility: NAND flash prices fluctuate ±15% quarterly – lock contracts early.

MOQ-Based Price Tier Analysis (Per Unit, FOB Shenzhen)

Assumes Private Label model with mid-spec customization. White Label prices start 12–18% higher at all tiers.

| MOQ Tier | Unit Price Range | Effective BOM Savings vs. MOQ 500 | Strategic Use Case |

|---|---|---|---|

| 500 units | $138.00 – $152.00 | Baseline (0% savings) | Market testing, pilot launches, niche segments |

| 1,000 units | $126.50 – $137.00 | 8–10% savings | Regional rollouts, limited editions |

| 5,000 units | $112.00 – $122.50 | 19–22% savings | Recommended minimum for profitability; global distribution |

| 10,000+ units | $105.00 – $114.00 | 24–27% savings | Mass-market entry; requires 2+ year volume commitment |

Why 5,000 units is the 2026 inflection point:

– Tooling costs amortized below $9/unit

– ODMs allocate dedicated production lines (yield improvement: +3.2%)

– Component bulk discounts activate (e.g., display panels -$4.10/unit)

Strategic Recommendations for Procurement Leaders

- Avoid White Label for Core Products: Short-term speed sacrifices long-term margin and IP control. Reserve for emergency inventory gaps.

- Demand Automation Metrics: Require ODMs to disclose robotics utilization rates (>65% for assembly is standard at Tier-1). Low automation = labor cost volatility risk.

- Localize Critical Components: 2026 tariffs make US/EU-sourced RF chips 22% more expensive. Partner with ODMs using China-localized Murata/TDK alternatives.

- Audit Sustainability Claims: 92% of “eco-packaging” suppliers fail FSC chain-of-custody audits. Require 3rd-party certifications upfront.

- Lock MOQs in Multi-Year Contracts: Top ODMs now offer 3% price stability guarantees for 10K+ units/year commitments.

“The era of transactional sourcing in China is over. 2026 winners treat ODMs as innovation partners – not vendors.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps for Your Organization:

✅ Conduct a White Label vs. Private Label ROI simulation using our proprietary SourcifyCost™ Calculator

✅ Request Tier-1 ODM pre-vetted profiles (Transsion, Wingtech, Huaqin) with 2026 capacity calendars

✅ Schedule a Tariff Impact Workshop with our US-China trade compliance team

Data Sources: SourcifyChina Shenzhen Cost Index (Q1 2026), Counterpoint Research, China Electronics Association, Client Benchmarking Pool (N=47)

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

For sourcing strategy validation, contact: [email protected] | +86 755 2345 6789

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Tier-1 Electronics Supply Chains

Executive Summary

As global demand for high-performance smartphones continues to surge, sourcing from China remains strategic due to its advanced manufacturing ecosystem. However, the distinction between genuine OEM/ODM factories servicing top phone companies and intermediaries (e.g., trading companies or sub-tier suppliers) is critical to supply chain integrity, quality control, and IP protection.

This report outlines a structured verification process to identify authentic manufacturers capable of meeting the standards of leading global phone brands (e.g., Huawei, Xiaomi, OPPO, vivo, Honor, and Apple contract manufacturers). It also provides clear methodologies to differentiate factories from trading companies and highlights red flags that procurement managers must avoid.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and operational scope | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Assess real production capability and compliance | Schedule unannounced audits; verify machinery, workforce, clean rooms, testing labs |

| 3 | Review OEM/ODM Experience | Ensure track record with tier-1 brands | Request client references (NDA-protected), signed contracts, and product portfolios |

| 4 | Evaluate R&D and Engineering Capabilities | Confirm innovation and customization support | Inspect engineering teams, design patents, and NPI (New Product Introduction) process |

| 5 | Audit Quality Management Systems | Ensure adherence to international standards | Verify ISO 9001, IATF 16949 (if applicable), ISO 14001, and internal QC protocols |

| 6 | Test Production Samples | Validate product conformity and consistency | Request pre-production samples; conduct third-party lab testing (e.g., SGS, TÜV) |

| 7 | Assess Export Compliance | Ensure readiness for global shipments | Review export license, customs history, and experience with Incoterms (e.g., FOB, EXW) |

| 8 | Perform IP Protection Evaluation | Safeguard design and technology | Sign mutual NDA; verify internal IP policies and patent filings |

Note: Top-tier phone manufacturers often require suppliers to pass VDA 6.3 (automotive-grade process audits) or Apple’s Supplier Responsibility Audit.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Lists “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns or leases large-scale production floor with equipment | No production equipment; may have showroom or warehouse |

| Workforce Composition | Large team of engineers, technicians, QC staff | Sales and logistics-focused; limited technical staff |

| Production Equipment | Visible SMT lines, CNC machines, injection molding, testing labs | No visible machinery; samples sourced externally |

| Customization Capability | Offers mold/tooling development, engineering support | Limited to catalog-based offerings; long lead times for changes |

| Pricing Structure | Transparent BOM + labor + overhead | Higher margins; less transparent cost breakdown |

| Lead Times | Shorter and more predictable (direct control) | Longer due to middlemen dependencies |

| Export History | Direct export records under own name | Exports under client’s brand; uses third-party forwarders |

Pro Tip: Use customs data platforms (e.g., Panjiva, ImportGenius) to verify export history under the company’s name. Factories often ship under their own legal entity.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal of on-site audit | Likely not a real factory or has compliance issues | Disqualify or require third-party audit (e.g., QIMA, Bureau Veritas) |

| No ISO or quality certifications | Poor process control; high defect risk | Require certification within 90 days or disqualify |

| Unwillingness to sign NDA | IP exposure risk | Do not share technical details until NDA is executed |

| Vague answers about production process | Lack of technical expertise | Request process flow documentation and engineering walkthrough |

| Prices significantly below market | Substandard materials, labor violations, or hidden fees | Conduct material verification and factory audit |

| Claims of exclusive partnerships with top brands (e.g., Apple, Huawei) without proof | Misrepresentation or unauthorized subcontracting | Request verifiable references or disqualify |

| Use of residential address or virtual office | Likely a trading company or shell entity | Require physical factory address and GPS verification |

| Inconsistent communication (language, technical depth) | Poor project management | Assign bilingual technical liaison or consider alternative |

4. Recommended Due Diligence Tools

| Tool | Purpose |

|---|---|

| China Credit Public System (gsxt.gov.cn) | Verify business license authenticity |

| TianYanCha or Qichacha | Deep due diligence: litigation history, shareholders, subsidiaries |

| Alibaba Supplier Verification | Cross-check Gold Supplier status and transaction history |

| Customs Data Platforms | Validate export volume and buyer history |

| Third-Party Inspection Firms | Conduct pre-shipment and audit services (e.g., SGS, Intertek) |

Conclusion

Sourcing for high-end mobile devices demands a rigorous, evidence-based approach. Global procurement managers must prioritize direct factory engagement, on-site verification, and IP protection protocols to ensure supply chain resilience. Differentiating true manufacturers from trading intermediaries reduces risk, improves cost efficiency, and supports long-term innovation partnerships.

SourcifyChina recommends implementing a Supplier Qualification Scorecard incorporating the above criteria to standardize evaluations across your supplier base.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise

Q2 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Verified Sourcing Report: Strategic Procurement of Chinese Phone Manufacturers

Prepared for: Global Procurement Leaders | Date: Q1 2026

Subject: Eliminating Sourcing Risk in China’s Competitive Mobile Device Market

The 2026 Sourcing Challenge: Why “Top Phone Companies in China” Searches Fail Procurement Teams

Traditional methods (Google, Alibaba, trade shows) yield unverified supplier lists riddled with:

– 38% of manufacturers misrepresenting OEM/ODM capabilities (SourcifyChina 2025 Audit)

– 6–12 weeks wasted on due diligence for non-compliant factories (ISO, EPR, export licenses)

– $220K+ average cost of supply chain disruption from unvetted partners (per Gartner)

“Procurement leaders who bypass rigorous supplier validation absorb 3.2x more supply chain risk in 2026.”

— 2026 Global Electronics Sourcing Outlook, SourcifyChina Research

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

| Sourcing Approach | Time Spent | Risk Exposure | Compliance Rate | Cost per Qualified Lead |

|---|---|---|---|---|

| Traditional Search (DIY) | 127 hours | Critical | 58% | $1,850 |

| SourcifyChina Verified Pro List | <8 hours | Low | 97% | $210 |

Key Advantages:

- Pre-Vetted Technical Capability

- All suppliers validated for 5G/6G, foldable tech, and EU CB Scheme compliance (2026 regulatory shifts)

- Real-Time Capacity Verification

- Monthly production audits with live MOQ/lead time dashboards (no “ghost factories”)

- Ethical Sourcing Guaranteed

- Full SMETA 4-Pillar reports + carbon footprint tracking (aligned with EU CSDDD 2026)

- Single-Point Accountability

- SourcifyChina manages QC, logistics, and payment security—you own the relationship

Your Call to Action: Secure Your 2026 Supply Chain in <24 Hours

Stop gambling with unverified supplier lists. The Verified Pro List for China’s top phone manufacturers delivers:

✅ 72-hour factory match to your spec sheet

✅ Zero hidden fees—all costs transparent upfront

✅ Dedicated sourcing engineer for technical validation

Next Step:

1. Email[email protected]with:

“2026 Pro List Access – [Your Company Name]”

2. WhatsApp+86 159 5127 6160for urgent RFQs

→ Receive your custom shortlist within 4 business hours

All Pro List partners undergo our 147-point 2026 Compliance Framework™—including AI-driven export license validation and real-time financial health scoring. No subscriptions. No paywalls. Only qualified suppliers.

SourcifyChina: Where Precision Sourcing Meets Audit-Proof Procurement

Trusted by 1,200+ global brands | $4.7B+ managed sourcing volume in 2025

Act now—your Q3 production cycle starts in 8 weeks.

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 China Time Support)

🧮 Landed Cost Calculator

Estimate your total import cost from China.