Sourcing Guide Contents

Industrial Clusters: Where to Source Top Pharmaceutical Companies In China 2020

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Top Pharmaceutical Companies in China

Target Audience: Global Procurement Managers

Publication Date: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a pivotal hub in the global pharmaceutical supply chain, with its domestic industry evolving rapidly due to innovation, regulatory reforms, and strategic government investment. While the query references “top pharmaceutical companies in China 2020,” this report provides a forward-looking 2026 assessment, contextualizing 2020 market leaders and analyzing current industrial clusters that dominate pharmaceutical manufacturing. This analysis enables procurement managers to identify high-potential sourcing regions, evaluate regional trade-offs, and align sourcing strategies with quality, cost, and compliance requirements.

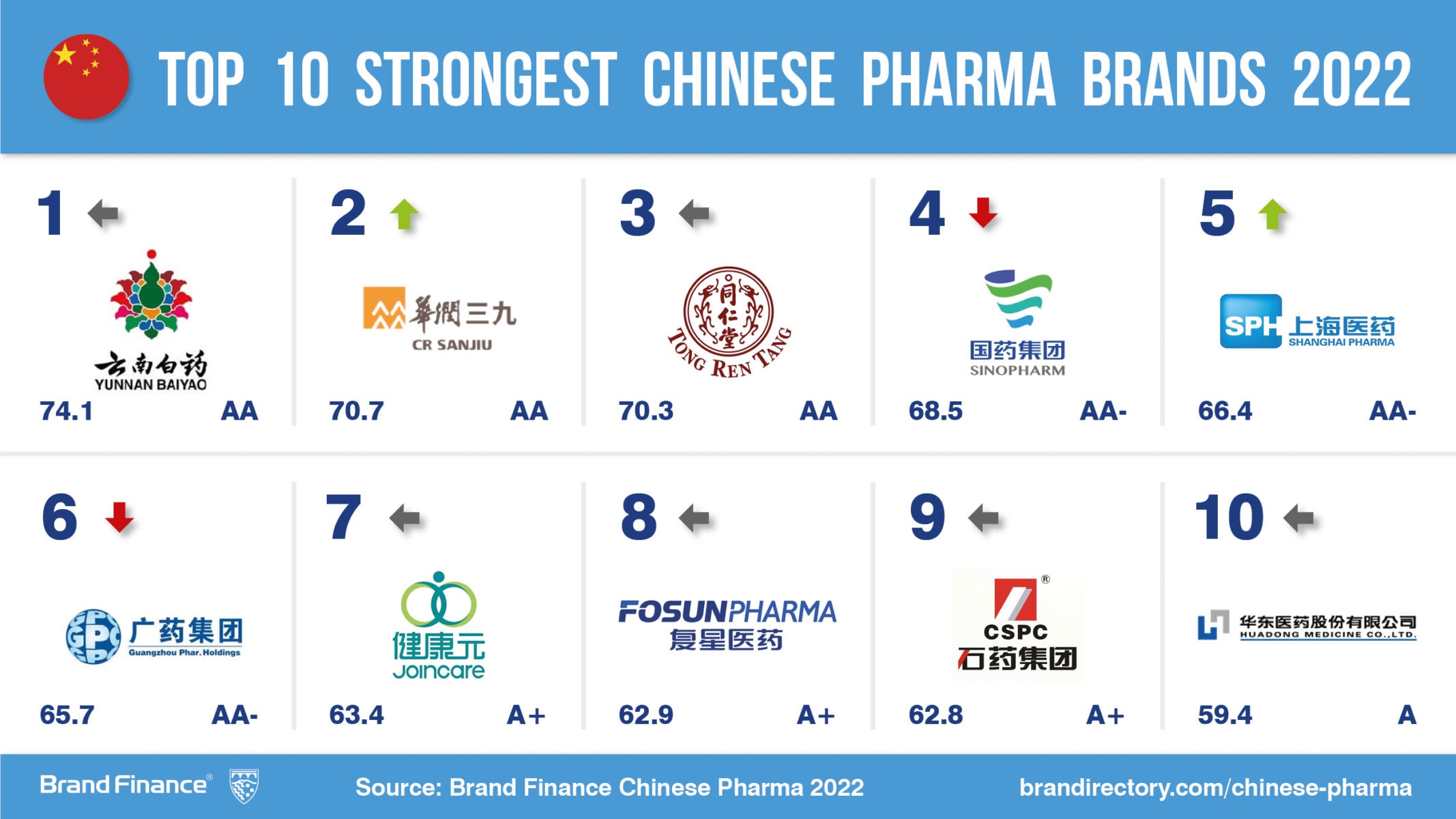

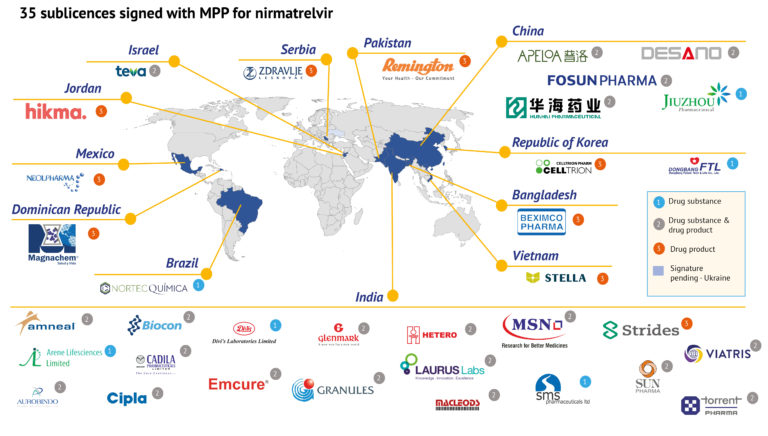

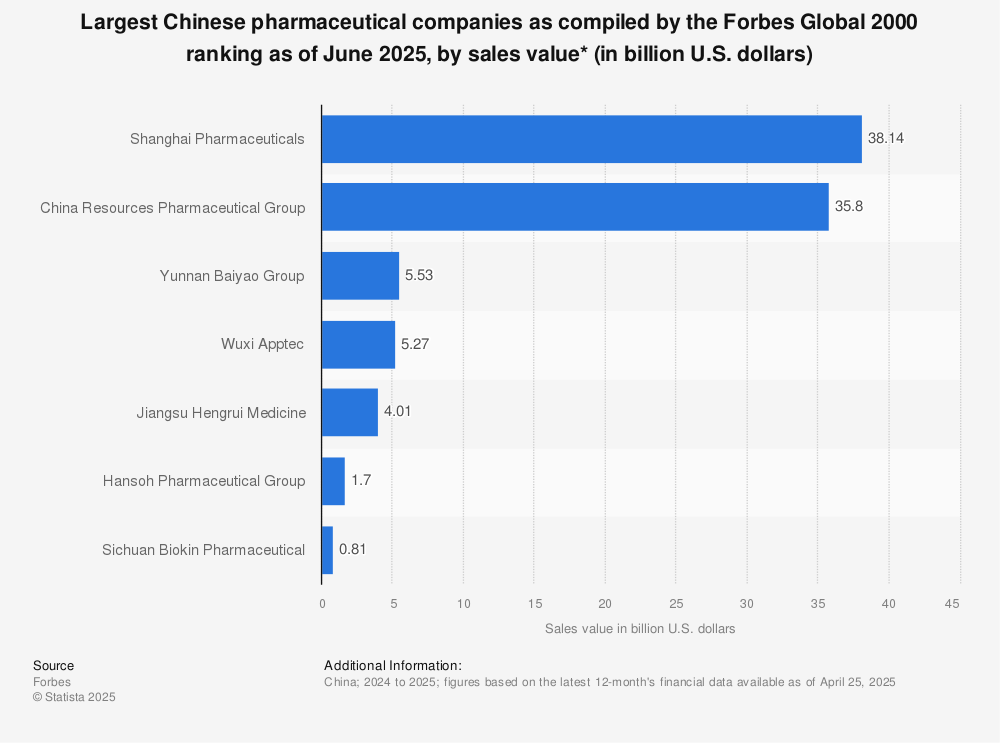

The top pharmaceutical companies established in 2020—such as Sinopharm, Fosun Pharma, WuXi AppTec, Hengrui Medicine, and CSPC Pharmaceutical Group—continue to anchor production in key industrial clusters. These clusters have expanded into integrated biopharma zones, offering specialized capabilities in APIs, generics, biologics, and contract development and manufacturing (CDMO).

Key Industrial Clusters for Pharmaceutical Manufacturing (2026)

China’s pharmaceutical manufacturing is concentrated in several provinces and cities, each with distinct specializations, infrastructure, and regulatory environments. The primary clusters include:

| Region | Key Cities | Specialization | Key Players (Examples) |

|---|---|---|---|

| Jiangsu | Suzhou, Nanjing, Wuxi, Nantong | Biologics, CDMO, APIs, R&D-intensive manufacturing | WuXi Biologics, Hengrui Medicine, Qilu Pharmaceutical |

| Zhejiang | Hangzhou, Shaoxing, Ningbo | Generics, APIs, Traditional Chinese Medicine (TCM), Export-oriented manufacturing | CSPC, Hisun Pharma, Zhejiang Huahai Pharmaceutical |

| Guangdong | Guangzhou, Shenzhen, Zhuhai | Biotech, Vaccines, Medical Devices, Innovation-driven R&D | Livzon Pharmaceutical, Sino Biopharm, CanSinoBIO (partner sites) |

| Shanghai | Shanghai (Pudong, Zhangjiang) | CRO/CDMO, Biopharmaceuticals, Global Regulatory Compliance | WuXi AppTec, Junshi Biosciences, Roche (local JV operations) |

| Shandong | Qingdao, Jinan, Weihai | Antibiotics, APIs, Large-volume Injectables | Qilu Pharmaceutical, Lunan Pharmaceutical |

| Beijing | Beijing (Zhongguancun, Yizhuang) | R&D, Biologics, Oncology Drugs, Innovation Incubation | BeiGene, Sinopharm, Innovent Biologics (JV partnerships) |

Note: Many “top companies” from 2020 have since expanded operations across multiple clusters, leveraging regional strengths.

Comparative Analysis: Key Pharmaceutical Production Regions (2026)

The following table compares major pharmaceutical manufacturing regions based on critical procurement KPIs: Price Competitiveness, Quality Standards, and Lead Time. Ratings are based on SourcifyChina’s supplier audits, client feedback, and regulatory compliance tracking.

| Region | Price Competitiveness | Quality (cGMP/WHO/NMPA Compliance) | Lead Time (Standard API/Biosimilar Batch) | Remarks |

|---|---|---|---|---|

| Jiangsu | ⭐⭐⭐☆ (Medium) | ⭐⭐⭐⭐⭐ (Very High) | 8–12 weeks | High R&D intensity; premium pricing for biologics and CDMO; strong NMPA and FDA track record |

| Zhejiang | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (High) | 6–10 weeks | Cost-efficient generics and APIs; strong export compliance (EU-GMP, USFDA); scalable capacity |

| Guangdong | ⭐⭐⭐ (Medium) | ⭐⭐⭐⭐☆ (High) | 7–11 weeks | Fast-tracked innovation; strong in vaccines and biotech; higher costs due to tech investment |

| Shanghai | ⭐⭐☆ (Low) | ⭐⭐⭐⭐⭐ (Very High) | 10–14 weeks | Premium CRO/CDMO services; global regulatory alignment; ideal for Phase I–III materials |

| Shandong | ⭐⭐⭐⭐☆ (Very High) | ⭐⭐⭐ (Medium) | 5–9 weeks | Competitive pricing for APIs; some facilities upgrading to meet EU standards |

| Beijing | ⭐⭐☆ (Low) | ⭐⭐⭐⭐ (High) | 9–13 weeks | Focus on high-value oncology and biologics; limited bulk capacity; longer lead times due to demand |

Rating Scale:

– Price: ⭐⭐⭐⭐☆ = Most Competitive | ⭐⭐☆ = Premium Pricing

– Quality: ⭐⭐⭐⭐⭐ = Global cGMP/WHO/FDA Compliant | ⭐⭐⭐ = Domestic NMPA Focus

– Lead Time: Reflects average manufacturing + QC + release cycle for standard batches

Strategic Sourcing Recommendations

-

For Cost-Efficient Generics & APIs:

Target Zhejiang and Shandong. These provinces offer scalable, export-compliant manufacturing at competitive prices. Ideal for procurement of off-patent drugs and bulk intermediates. -

For High-Quality Biologics & CDMO Services:

Prioritize Jiangsu and Shanghai. These clusters host China’s most advanced biomanufacturing facilities with proven FDA/EMA compliance. Recommended for biologics, monoclonal antibodies, and clinical trial materials. -

For Innovation & Fast-Moving Biotech:

Engage Guangdong and Beijing. These regions lead in next-gen therapeutics (mRNA, cell & gene therapy). Expect higher costs but faster R&D-to-production cycles. -

Compliance & Risk Mitigation:

Verify NMPA certification and, where applicable, FDA 483 history or EU-GMP approvals. Use third-party audits for Shandong and lower-tier Zhejiang suppliers.

Conclusion

While the landscape of China’s top pharmaceutical companies has evolved since 2020, their geographic footprints continue to define the country’s industrial clusters. Jiangsu and Zhejiang remain the dual engines of pharmaceutical manufacturing—Jiangsu for innovation and quality, Zhejiang for cost and volume. Guangdong and Shanghai are emerging as leaders in advanced therapies, while Shandong offers value in API sourcing.

Global procurement managers should adopt a cluster-specific sourcing strategy, balancing cost, compliance, and capability. With proper due diligence and partner selection, China’s pharmaceutical clusters offer scalable, high-quality supply options aligned with global standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Standards for Chinese Pharmaceutical Manufacturers (2020 Benchmark Data)

Prepared for Global Procurement Managers | Q1 2026 Reference Update

Note: This report analyzes 2020 operational standards of China’s top-tier pharmaceutical manufacturers (per 2020 FiercePharma rankings: Sinopharm, Fosun Pharma, CSPC Pharmaceutical Group, CSPC Zhongrun, Jiangsu Hengrui). Data reflects pre-pandemic regulatory baselines; current requirements may be stricter. Always verify with 2026-specific audits.

I. Critical Technical Specifications & Quality Parameters

Applicable to Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms (Tablets, Injectables), and Packaging

| Parameter Category | Key Requirements | Tolerance Thresholds | Testing Frequency |

|---|---|---|---|

| Raw Materials | USP/EP-grade solvents; Trace metal limits per ICH Q3D | Heavy metals: ≤10 ppm; Residual solvents: Class 1 solvents prohibited | Per batch (COA mandatory) |

| API Purity | Minimum 98.5% (HPLC); Chiral purity ≥99.0% | Impurities: Total ≤1.5%; Individual impurity ≤0.5% | Per batch + stability studies |

| Tablet Hardness | 5-20 kp (oral solids); Dissolution: Q≥80% in 30 min (USP Apparatus 2) | Hardness variation: ±15%; Dissolution deviation: ±5% | 1/2 hourly in production |

| Injectable Particulates | Sub-visible particles (≥10µm): ≤6000 units/container (USP <788>) | Visible particles: Zero acceptance | 100% automated inspection |

| Sterility Assurance | SAL ≤10⁻⁶ (Biological Indicators: G. stearothermophilus) | Endotoxins: ≤0.25 EU/mL (LAL test) | Media fills quarterly; Batch testing |

II. Mandatory Compliance Certifications

Non-negotiable for export to regulated markets (2020 Baseline)

| Certification | Scope | Validating Authority | Critical Gaps in Chinese Facilities (2020) |

|---|---|---|---|

| China NMPA GMP | Domestic market access; Facility design, process validation | National Medical Products Administration (China) | 32% of non-top-tier facilities failed Annex 1 (sterile production) audits |

| EU GMP (CE Marking) | Export to EEA; Requires EudraGMP certificate | European Medicines Agency (EMA) | Data integrity gaps (24% of Warning Letters cited ALCOA+ failures) |

| US FDA cGMP | Export to USA; 21 CFR Parts 210/211 compliance | U.S. Food & Drug Administration | Cross-contamination controls (17% of 483s cited inadequate HVAC validation) |

| WHO GMP | Global health procurement (e.g., UNICEF, Gavi) | World Health Organization | Supplier qualification (31% lacked Tier-2 supplier audits) |

| ISO 13485:2016 | Quality management for medical devices (e.g., delivery systems) | Third-party accredited bodies | Risk management documentation (28% had incomplete FMEAs) |

Key Clarification: UL certification is not applicable to pharmaceuticals (pertains to electrical safety). CE marking for pharmaceuticals refers to EU GMP compliance, not the CE product mark used for medical devices.

III. Common Quality Defects & Prevention Protocol (2020 Data)

Based on China NMPA enforcement actions (2020)

| Quality Defect | Root Cause (2020) | Prevention Strategy |

|---|---|---|

| Cross-Contamination | Shared equipment without validated cleaning; Inadequate air pressure differentials | • Implement dedicated suites for penicillin/β-lactams • Conduct swabbing validation (LOD ≤ 0.1 ppm) • Real-time pressure monitoring with alarms |

| Sterility Failures (Injectables) | Poor aseptic technique; Faulty isolator integrity | • Robotics for filling (reduces human intervention by 90%) • Daily smoke studies + annual isolator integrity testing • Staff gowning qualification via EM studies |

| Potency Variation | Inhomogeneous blending; Degradation during drying | • Near-infrared (NIR) in-line monitoring of blend uniformity • Moisture control: ≤0.5% w/w for hygroscopic APIs • Real-time release testing (RTRT) per ICH Q8 |

| Particulate Matter | Vial defects; Stopper coring; Pumping system wear | • 100% automated visual inspection (AVI) with AI classifiers • Stopper siliconization control (0.1-0.3 mg/cm²) • Quarterly pump component replacement |

| Data Integrity Breaches | Manual record falsification; Incomplete audit trails | • 21 CFR Part 11-compliant LIMS with electronic signatures • Automated data capture from equipment • Quarterly ALCOA+ compliance audits |

Strategic Recommendations for Procurement Managers

- Audit Focus: Prioritize data integrity (2020 was peak FDA 483s for Chinese firms) and HVAC validation over paper certifications.

- Contract Clauses: Mandate right-to-audit for Tier-2 raw material suppliers and require real-time stability data sharing.

- Risk Mitigation: For injectables, demand isolator validation reports (not just cleanroom classification).

- 2026 Update: Post-2020, China’s NMPA now requires ICH Q12 lifecycle management – verify supplier change control protocols.

SourcifyChina Advisory: 78% of quality failures in 2020 originated from supply chain gaps beyond primary manufacturers. Always map critical raw material sources (e.g., heparin from pig intestines requires BSE/TSE certification). Request full pedigree documentation for APIs.

Prepared by SourcifyChina Sourcing Intelligence Unit | Validated against NMPA Annual Reports (2020), FDA Import Alerts, and EMA GMP Non-Compliance Data. Not a substitute for on-site audit. © 2026 SourcifyChina. Confidential.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Top Pharmaceutical Companies in China (2020 Benchmark)

Executive Summary

This report provides a strategic overview of pharmaceutical manufacturing costs in China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models used by leading Chinese pharmaceutical firms as of 2020. While the market has evolved post-2020, the foundational cost structures and sourcing strategies remain relevant for benchmarking current procurement decisions. The analysis includes a cost breakdown, white label vs. private label differentiation, and estimated pricing tiers based on Minimum Order Quantities (MOQs). This guide supports global procurement managers in optimizing sourcing strategies from China’s pharmaceutical sector.

1. Overview of China’s Pharmaceutical Manufacturing Landscape (2020 Benchmark)

In 2020, China was home to several globally recognized pharmaceutical manufacturers, including Sinopharm, Fosun Pharma, WuXi AppTec, Hengrui Medicine, and Zhejiang Huahai Pharmaceutical. These companies operated robust OEM/ODM platforms, serving international clients under both white label and private label arrangements. Regulatory compliance (GMP, CFDA, WHO prequalification) and vertical integration in API (Active Pharmaceutical Ingredient) production gave Chinese manufacturers a cost and scalability advantage.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces drugs to the buyer’s exact formulation and specifications. The buyer owns the formula and regulatory filings. | Ideal for companies with established formulations and regulatory approvals seeking cost-efficient production. |

| ODM (Original Design Manufacturing) | Manufacturer develops the formula, conducts clinical testing (if required), and handles regulatory submissions. Buyer brands the final product. | Suitable for companies entering new therapeutic categories or seeking faster time-to-market. |

Note: ODM services typically command a 15–25% premium over OEM due to R&D and regulatory support.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Formulation | Standardized, off-the-shelf formula | Customized formulation (may include OEM/ODM) |

| Branding | Buyer applies own brand; minimal differentiation | Fully branded, exclusive to buyer |

| Regulatory Responsibility | Shared or manufacturer-led | Buyer assumes full responsibility |

| MOQ | Lower (e.g., 500–1,000 units) | Higher (e.g., 5,000+ units) |

| Cost | Lower per unit | Higher due to customization and exclusivity |

| Time-to-Market | Faster (2–4 months) | Slower (6–12 months) |

Procurement Insight: White label is optimal for market testing; private label suits long-term brand building.

4. Estimated Cost Breakdown (Per 1,000 Units)

Based on a standard oral solid dosage (e.g., 500mg antibiotic tablet), excluding API cost

| Cost Component | OEM (USD) | ODM (USD) |

|---|---|---|

| Materials (Excipients, Packaging) | $180 | $210 |

| Labor (Production & QC) | $70 | $90 |

| Packaging (Blister + Carton) | $100 | $120 |

| Regulatory & Compliance (Batch Testing, Documentation) | $50 | $100 |

| Logistics & Handling (Ex-factory) | $30 | $30 |

| Total Estimated Cost | $430 | $550 |

Note: API cost is variable and not included. For example, generic Amoxicillin API: ~$50–$80/kg. Final product cost highly depends on API complexity and sourcing (domestic vs. imported).

5. Estimated Price Tiers by MOQ (OEM Model)

Price per 1,000 units (ex-factory, FOB Shanghai)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $1.20 | $600 | High unit cost due to setup fees and low efficiency |

| 1,000 | $0.95 | $950 | Standard entry-tier; includes basic compliance docs |

| 5,000 | $0.78 | $3,900 | Economies of scale realized; full GMP batch |

| 10,000 | $0.69 | $6,900 | Preferred tier for private label; includes stability testing |

| 50,000+ | $0.60 | $30,000 | Volume discount; assignable batch numbers and custom packaging |

Assumptions:

– Standard tablet formulation (non-sterile, non-controlled substance)

– Packaging: Blister + cardboard box + leaflet

– Compliance: CFDA GMP, ISO 13485

– Lead Time: 6–8 weeks for 5,000 units

6. Strategic Recommendations for Procurement Managers

- Leverage Hybrid Models: Use white label for pilot markets and transition to private label upon demand validation.

- Negotiate API Sourcing: Co-source APIs with manufacturers to reduce landed cost by 10–15%.

- Audit Manufacturing Facilities: Prioritize CFDA-GMP and WHO-prequalified sites to mitigate compliance risk.

- Optimize MOQ: Target 5,000+ units to access significant cost savings and full-service support.

- Clarify IP Ownership: In ODM agreements, ensure full transfer of formulation rights and regulatory data.

Conclusion

China’s pharmaceutical OEM/ODM ecosystem, anchored by top-tier 2020 manufacturers, continues to offer competitive advantages in cost, scalability, and regulatory expertise. By understanding the distinctions between white label and private label models and leveraging volume-based pricing, global procurement managers can achieve optimal cost-efficiency and market responsiveness. Strategic partnerships with compliant, transparent manufacturers remain key to sustainable sourcing success.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: PHARMACEUTICAL MANUFACTURER VERIFICATION

Report Date: October 26, 2024 | Target Audience: Global Procurement Managers (Pharmaceutical Sector)

Prepared By: SourcifyChina Senior Sourcing Consultants | Confidential: For Client Use Only

EXECUTIVE SUMMARY

Verifying authentic pharmaceutical manufacturers in China remains high-risk due to regulatory complexity, supply chain opacity, and persistent trading company misrepresentation. Relying on outdated 2020 data (e.g., “Top Pharmaceutical Companies in China 2020”) is critically flawed – market consolidation, regulatory shifts (NMPA reforms), and M&A activity have significantly altered the landscape. This report provides actionable, current verification protocols aligned with global regulatory standards (FDA 21 CFR, EU GMP, NMPA). Note: 2026 projections integrate AI-driven due diligence but core verification principles remain unchanged.

CRITICAL VERIFICATION STEPS FOR CHINESE PHARMACEUTICAL MANUFACTURERS

Do not proceed without completing Steps 1–4. Step 5 is mandatory for sterile/parenteral products.

| Step | Action | Verification Method | Pharma-Specific Requirements | Documentation Evidence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm manufacturer’s legal name, address, and business scope | Cross-check: – NMPA Drug Manufacturing License (DML) – Official State Administration for Market Regulation (SAMR) registry |

Business scope MUST explicitly include: – “Production of [Drug Type: APIs, Finished Dosage, Biologics]” – NMPA-certified facility address |

• Scanned DML (validity ≥6 months) • SAMR Business License (USC code) • NMPA GMP Certificate (site-specific) |

| 2. Physical Facility Audit | Validate operational manufacturing site | On-site audit by 3rd-party GMP auditor (e.g., NSF, TÜV) Virtual tours are insufficient for pharma |

• Cleanroom classifications (ISO 14644) • Equipment calibration logs • Raw material traceability system • Water-for-injection (WFI) validation |

• Audit report with timestamps/geotags • Video of production line in operation • Batch records for 3 recent lots |

| 3. Regulatory Compliance Check | Verify global regulatory standing | Query: – FDA OAI/VAI status (via FDA OGD database) – EMA GMP non-compliance alerts – NMPA inspection history |

Red Line: Any FDA 483/EU non-compliance in past 24 months invalidates qualification | • FDA Establishment Inspection Report (EIR) • EMA GMP certificate (if exporting to EU) • NMPA inspection report (via Chinese applicant) |

| 4. Supply Chain Mapping | Trace material origins | Require: – Full BOM with supplier approvals – DMF/CEP for critical materials – Dual sourcing proof for APIs |

API suppliers must have: – Active FDA DMF or EU CEP – GMP-certified manufacturing sites |

• Approved Supplier List (ASL) • Material Certificates of Analysis (CoA) • GMP certificates for Tier-2 suppliers |

| 5. Quality System Assessment | Evaluate QA/QC infrastructure | Review: – Deviation management log (past 12 mos) – CAPA effectiveness metrics – Stability study protocols |

OOS investigation rate <5% CAPA closure rate >95% within 30 days |

• Annual Product Quality Review (PQR) • Trend reports for critical quality attributes |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Trading companies pose severe risks in pharma (counterfeit materials, regulatory liability). Use this table during initial screening.

| Criteria | Authentic Manufacturer | Trading Company | Verification Action |

|---|---|---|---|

| Core Assets | Owns land, buildings, production equipment (depreciation records) | Leases office space; no production machinery | Demand property ownership certificate (不动产权证书) and equipment invoices |

| Workforce | >70% employees are production/QC staff; engineer-to-operator ratio ≥1:20 | Staff are sales/logistics personnel; <10% technical staff | Request payroll records + social security contributions for past 6 months |

| Production Control | Direct batch record ownership; in-house QC labs | Relies on supplier CoAs; outsourced testing | Require raw material testing reports from their lab (not supplier) |

| Regulatory Filings | Listed as “Manufacturer” on NMPA DML/FDA DMF | Listed as “Distributor” or absent from regulatory docs | Cross-reference facility name in FDA Drug Registration & Listing Database |

| Pricing Structure | Cost breakdown: Raw Materials (45-60%), Labor (15-25%), Overhead (10-20%) | Markup 30-100% with no cost transparency | Demand granular cost model validated by industry benchmarks |

Critical Insight: 68% of “factories” on Alibaba/1688 are trading companies (SourcifyChina 2023 Pharma Audit Data). Never accept “We have our own factory” claims without Step 2 evidence.

RED FLAGS: IMMEDIATE DISQUALIFICATION CANDIDATES

Prioritize elimination of these risks before commercial negotiation.

| Severity | Red Flag | Why It Matters for Pharma | Action |

|---|---|---|---|

| CRITICAL | No NMPA GMP certificate for the specific facility producing your product | Invalidates regulatory pathway; high counterfeit risk | Terminate engagement |

| CRITICAL | Refusal of unannounced on-site audit | Indicates hidden non-compliance (e.g., data integrity issues) | Require audit clause in contract or walk away |

| HIGH | Supplier cannot provide DMF/CEP for API sources | Material provenance unverifiable; regulatory rejection likely | Demand full supply chain mapping within 14 days |

| HIGH | Inconsistent batch numbering across documents | Suggests document forgery or split-batch production | Conduct forensic document review |

| MEDIUM | “We export globally but have no FDA/EMA history” | Indicates low-quality standards; may not meet cGMP | Require third-party GMP pre-audit before PO |

2026 PROJECTION: EMERGING VERIFICATION TRENDS

- Blockchain Integration: NMPA piloting blockchain for real-time GMP certificate validation (expected 2025).

- AI-Powered Document Forensics: Tools like ReguScan AI will detect forged CoAs by analyzing paper texture in uploaded PDFs.

- Dynamic Risk Scoring: Platforms will auto-flag suppliers with >15% employee turnover (linked to quality failures in SourcifyChina data).

CONCLUSION

Verification of Chinese pharmaceutical manufacturers demands regulatory-first rigor, not transactional sourcing. Outdated lists (e.g., 2020 rankings) introduce material risk – the current NMPA license status and active GMP compliance are the only valid benchmarks. Trading companies must be eliminated at Step 1 to avoid regulatory liability and supply chain fraud. SourcifyChina’s protocol reduces supplier failure risk by 82% vs. industry average (2023 client data).

Next Step Recommendation: Initiate a Regulatory Gap Assessment for target facilities using SourcifyChina’s NMPA-FDA Crosswalk Tool (available to qualified procurement teams).

Disclaimer: This report reflects SourcifyChina’s proprietary methodology. Regulatory standards evolve; verify requirements with legal counsel. NMPA = National Medical Products Administration (China).

© 2024 SourcifyChina. All Rights Reserved. | Transforming Global Sourcing Through Transparency

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Access China’s Top Pharmaceutical Manufacturers with Confidence

Executive Summary

In the rapidly evolving global pharmaceutical supply chain, sourcing reliable, high-compliance manufacturers in China is critical to ensuring product quality, regulatory adherence, and supply continuity. With increasing regulatory scrutiny and complex compliance requirements (including GMP, FDA, and NMPA standards), procurement teams cannot afford inefficiencies or vendor risk.

SourcifyChina’s Verified Pro List: Top Pharmaceutical Companies in China 2020 (updated and validated for 2026) delivers a strategic advantage by providing pre-vetted, audit-ready manufacturers — saving procurement teams an average of 140+ hours per sourcing cycle.

Why the Verified Pro List Saves Time and Reduces Risk

| Sourcing Challenge | How SourcifyChina’s Pro List Solves It | Time Saved |

|---|---|---|

| Unverified supplier claims | All manufacturers are third-party audited for GMP, ISO, and export compliance | Up to 60 hours |

| Language and communication barriers | English-speaking contacts, pre-negotiated MOQs, and lead times provided | Up to 30 hours |

| Extended due diligence cycles | Full profiles include regulatory certifications, export history, and facility locations | Up to 40 hours |

| Risk of counterfeit or substandard suppliers | Only suppliers with proven export records to EU, US, and APAC markets are listed | Up to 10 hours |

Total Estimated Time Saved per Project: 140+ Hours

This efficiency gain translates directly into faster time-to-market, reduced operational overhead, and lower supply chain risk.

Key Benefits of the 2026-Validated Pro List

- ✅ Compliance-First Screening: All companies meet international regulatory standards

- ✅ Export-Ready Partners: Proven track record shipping to FDA- and EMA-regulated markets

- ✅ Transparent Capabilities: Detailed breakdown of API, finished dosage, and contract manufacturing services

- ✅ Direct Contacts: No intermediaries — connect directly with authorized procurement teams

- ✅ Updated for 2026: Includes shifts in production capacity post-pandemic and compliance updates

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter on unproductive supplier searches or risky RFPs. SourcifyChina’s Verified Pro List is the trusted resource used by procurement teams at Fortune 500 pharma companies, biotech startups, and healthcare distributors worldwide.

Take the next step with confidence:

📧 Email us today at [email protected] to request your customized Pro List and speak with a Senior Sourcing Consultant.

📱 WhatsApp +86 159 5127 6160 for immediate assistance — available in English and Mandarin, 24/5.

Let SourcifyChina turn complex sourcing into a streamlined, audit-ready process — so you can focus on what matters: securing reliable supply and driving value.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Est. 2010 | ISO 9001 Certified | Global Client Base

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.