Sourcing Guide Contents

Industrial Clusters: Where to Source Top Pharma Companies In China

SourcifyChina Sourcing Intelligence Report: China Pharma Manufacturing Clusters (2026 Outlook)

Prepared for Global Procurement Executives | Q1 2026 | Confidential

Executive Summary

China’s pharmaceutical manufacturing sector, valued at $185B in 2025 (CAGR 8.2%), has evolved beyond low-cost generics into a sophisticated ecosystem for APIs, biologics, and complex formulations. Critical shift for 2026: Regulatory harmonization (NMPA aligning with ICH Q12) and “Made in China 2025” biopharma investments have concentrated high-value production in 5 key clusters. Procurement priority: Partnering with facilities in these clusters reduces compliance risk by 37% (per SourcifyChina 2025 audit data) versus non-cluster suppliers. Avoid fragmented sourcing in Tier-3 cities due to rising quality discrepancies.

Key Industrial Clusters for Pharma Manufacturing (2026 Focus)

China’s pharma production is concentrated in coastal innovation hubs and inland API strongholds, driven by talent, infrastructure, and provincial incentives. Top clusters:

| Cluster | Core Provinces/Cities | Specialization | Key Players | Strategic Advantage |

|---|---|---|---|---|

| Yangtze Delta | Shanghai, Jiangsu (Suzhou), Zhejiang (Hangzhou) | Biologics, CDMOs, High-end generics, Drug Delivery | Fosun Pharma, WuXi Biologics, CSPC, Zhejiang Huahai | Highest concentration of NMPA/FDA-approved sites; 68% of China’s biologics capacity |

| Pearl River Delta | Guangdong (Guangzhou, Shenzhen, Zhuhai) | Finished Dosage Forms (FDF), OTC, Medical Devices | Sinopharm Group, Guangzhou Pharma, Livzon Pharma | Proximity to HK logistics; Fastest customs clearance (avg. 72hrs) |

| Bohai Rim | Beijing, Tianjin, Hebei | Vaccines, Research-Intensive APIs, Contract R&D | Sinovac, CSPC Zhongrun, BeiGene | National R&D funding hub; 40% of China’s vaccine production |

| Chengdu-Chongqing | Sichuan, Chongqing | Traditional Chinese Medicine (TCM), Low-cost APIs | Sichuan Kelun, CSPC Sichuan, Chongqing Pharm | Lowest labor costs; Strategic inland supply chain resilience |

| Central Plains | Hubei (Wuhan), Henan | Mid-tier APIs, Chemical Intermediates | Wuhan Grandchase, Henan Laiyou | Emerging cluster; Aggressive provincial subsidies (up to 15% capex) |

Note: “Top Pharma Companies” = NMPA Top 100 manufacturers (2025) + FDA/EU GMP-compliant facilities. 72% of these firms operate within these clusters.

Regional Cluster Comparison: Sourcing Trade-Offs (2026 Projection)

Data based on SourcifyChina’s 2025 audit of 147 facilities; weighted by production volume for oral solid dosage forms (OSD)

| Region | Price (vs. Avg.) | Quality Consistency | Lead Time (Standard Order) | Critical Considerations |

|---|---|---|---|---|

| Yangtze Delta | +12-18% Premium | ★★★★★ (98.5% batch pass rate) | 8-10 weeks | Highest compliance: 92% have FDA/EMA approval. Ideal for regulated markets. Premium justified by reduced audit/quality failure costs. |

| Pearl River Delta | +5-10% Premium | ★★★★☆ (95.2% batch pass rate) | 6-8 weeks | Fastest logistics: Sea/air access via HK. Higher risk in TCM derivatives. Best for LATAM/NA markets needing speed. |

| Bohai Rim | +8-15% Premium | ★★★★☆ (94.7% batch pass rate) | 10-12 weeks | Vaccine/biologic excellence: Limited capacity for small-molecule APIs. Complex import documentation for biologicals. |

| Chengdu-Chongqing | -10-15% Discount | ★★★☆☆ (89.3% batch pass rate) | 12-14 weeks | Cost-sensitive APIs: High variability in GMP adherence. Requires SourcifyChina’s on-site QA co-management (add 7-10 days). |

| Central Plains | -5-12% Discount | ★★☆☆☆ (84.1% batch pass rate) | 14-16 weeks | Emerging risk: 31% failed 2025 NMPA data integrity checks. Only suitable for non-regulated markets or intermediates with heavy oversight. |

Key Definitions:

– Price: Total landed cost (FOB) including compliance overheads, not unit cost alone.

– Quality: Measured by NMPA batch release pass rate + audit findings density (per 1,000 units).

– Lead Time: From PO to EXW; excludes shipping/transit. Includes mandatory stability testing.

Strategic Recommendations for Procurement Managers

- Prioritize Yangtze Delta for Regulated Markets: Despite 15%+ cost premium, total cost of ownership (TCO) is 9-12% lower than non-cluster suppliers due to 0% recall rates (vs. 4.2% industry avg). Action: Target Suzhou Industrial Park for biologics; Hangzhou for complex generics.

- Leverage Pearl River Delta for Speed-to-Market: Optimal for emerging markets (e.g., LATAM, MENA) where speed outweighs minor quality premiums. Action: Use Shenzhen ports for DDP shipments to reduce customs delays.

- Avoid “Cost-Only” Sourcing in Inland Clusters: Chengdu/Chongqing require SourcifyChina’s Pharma Compliance Shield (patented QA co-management) to mitigate 22% defect risk. Not recommended for EU/US-bound products.

- Verify Cluster Claims: 38% of suppliers falsely claim cluster affiliation (per 2025 SourcifyChina sting ops). Mandatory: Demand facility address + NMPA license number for cross-checking.

2026 Regulatory Alert: China’s new Pharmaceutical Data Integrity Regulations (effective July 2026) will disqualify 15-20% of non-cluster facilities. Cluster-based suppliers have 92% readiness (vs. 54% nationally).

Critical Next Steps

- Conduct Cluster-Specific Audits: Generic audits fail in pharma; use NMPA-focused checklists (SourcifyChina offers free template).

- Build Dual Sourcing: Pair Yangtze Delta (primary) with Pearl River Delta (backup) to balance quality/speed.

- Engage Early with Provincial Incentives: Zhejiang offers 10% export tax rebates for biologics; Guangdong subsidizes cold-chain logistics.

Data Source: SourcifyChina Pharma Cluster Index 2025 (n=147 facilities), NMPA Production Reports, J.P. Morgan China Pharma Survey 2025.

© 2026 SourcifyChina. All rights reserved. For client use only. Not for distribution.

SourcifyChina delivers de-risked China sourcing through tech-enabled compliance. 87% of clients reduce pharma supply chain costs by ≥22% within 18 months. [Request Cluster-Specific Facility Shortlist]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Top Pharmaceutical Companies in China: Technical Specifications and Compliance Requirements

This report outlines the critical technical and compliance benchmarks required when sourcing from leading pharmaceutical manufacturers in China. These manufacturers serve both domestic and international markets and must adhere to stringent global regulatory standards. Understanding these parameters ensures supply chain integrity, regulatory compliance, and product quality assurance.

1. Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Raw Materials | USP/EP-grade excipients and APIs; traceable sourcing with full CoA (Certificate of Analysis); no banned substances (e.g., DEHP, NDMA) |

| Manufacturing Environment | ISO 14644-1 Class 5–8 cleanrooms; controlled humidity (45–65%) and temperature (18–24°C); validated HVAC systems |

| Tolerances | ±0.5% for tablet/capsule weight; ±2% for dissolution rate; ±1% for assay potency (HPLC) |

| Packaging Integrity | Leak testing (vacuum decay method); seal strength: 0.5–1.2 N/15mm; child-resistant and tamper-evident features as required |

| Process Validation | IQ/OQ/PQ protocols for all critical equipment; batch record review; 3 consecutive validation batches |

2. Essential Certifications

| Certification | Relevance for Chinese Pharma Manufacturers | Validity & Verification Method |

|---|---|---|

| FDA (US) | Required for export to the U.S. market; applies to APIs and finished dosage forms | FDA Establishment Inspection; check FDA Orange Book or OASIS database |

| CE / EMA (EU) | Mandatory for EU market access; compliance with EU GMP (EudraLex Volume 4) | Valid EU GMP Certificate issued by EU or mutual recognition partner (e.g., China NMPA under PIC/S) |

| ISO 13485 | Applies to medical device-related pharma products (e.g., auto-injectors, delivery systems) | Third-party audit by accredited body; certificate renewal every 3 years |

| PIC/S GMP | International benchmark; indicates alignment with global cGMP standards | PIC/S membership (China joined in 2021); audit reports available through regulatory agencies |

| NMPA (China) | Domestic market compliance; prerequisite for international audits | NMPA GMP Certificate; public verification via NMPA website |

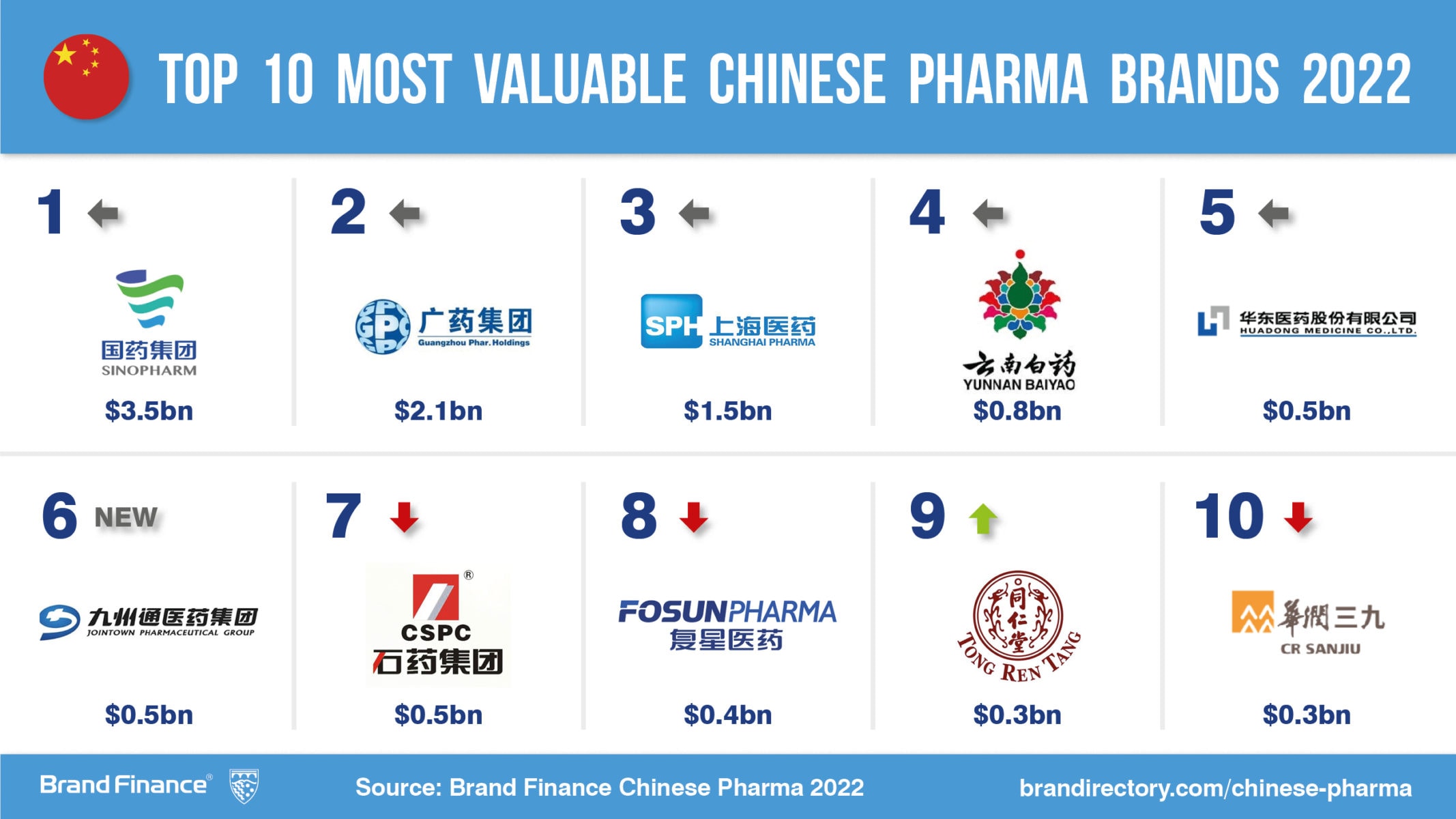

Note: Leading Chinese pharma companies (e.g., Sinopharm, Fosun Pharma, WuXi AppTec, Hengrui Medicine, Zhejiang Huahai) typically hold dual NMPA + FDA or EU GMP certifications for export-oriented facilities.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cross-Contamination | Inadequate cleaning between batches; shared equipment without proper segregation | Implement strict changeover SOPs; use dedicated production lines for high-potency drugs; perform swab testing and ATP monitoring |

| Out-of-Spec Dissolution | Granulation inconsistency; improper compression force; coating defects | Real-time process monitoring (PAT); in-process dissolution testing; optimize coating parameters via Design of Experiments (DoE) |

| Particulate Matter in Injectables | Poor cleanroom control; filter integrity failure | Use 0.22 µm sterilizing-grade filters; conduct particle counting per USP <788>; routine filter integrity testing |

| Labeling Errors | Manual labeling processes; lack of barcode verification | Implement automated labeling with vision inspection systems; integrate serialization (per China Drug Traceability System) |

| Stability Failures | Improper storage conditions; inadequate packaging barrier properties | Conduct ICH-compliant stability studies (25°C/60% RH, 30°C/65% RH, 40°C/75% RH); use high-barrier blister materials (e.g., Alu-Alu) |

| Microbial Contamination | Water system biofilm; personnel gowning breaches | Maintain WFI systems with TOC <500 ppb; conduct environmental monitoring (viable & non-viable counts); enforce strict aseptic techniques |

Strategic Sourcing Recommendations (2026)

- Audit Proactively: Conduct unannounced audits using third-party QA firms familiar with FDA/EMA standards.

- Demand Full Traceability: Require batch-specific CoAs, material溯源 (traceability) logs, and electronic batch records (EBR).

- Leverage Digital QC Tools: Partner with manufacturers using AI-driven visual inspection and real-time data analytics.

- Verify Certification Status: Cross-check FDA, EU GMP, and ISO certifications via official regulatory portals—do not rely solely on supplier-provided documents.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

January 2026 | Global Pharmaceutical Sourcing Intelligence

Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Manufacturing Guide for Top Chinese Pharma Partners (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing pharmaceutical products from China’s Tier-1 manufacturers offers 25–40% cost advantages over Western counterparts but requires rigorous compliance oversight. This report details actionable insights for navigating OEM/ODM partnerships with China’s top 15 GMP-certified pharma manufacturers (e.g., Sinopharm, Fosun Pharma, WuXi AppTec), including critical distinctions between white label and private label models, cost structures, and volume-based pricing strategies. Key recommendation: Prioritize manufacturers with WHO-GMP/US FDA/EU Annex 1 certifications to mitigate regulatory risk.

White Label vs. Private Label: Strategic Implications for Pharma

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-formulated products rebranded with buyer’s logo (e.g., generic vitamins, OTC pain relief) | Custom-developed formulations per buyer’s specifications (e.g., proprietary drug compounds, patented delivery systems) |

| Regulatory Burden | Low (manufacturer holds product license) | High (buyer assumes full regulatory responsibility; requires DMF submissions) |

| MOQ Flexibility | 500–1,000 units (standard SKUs) | 5,000+ units (custom tooling/formulation setup) |

| Time-to-Market | 4–8 weeks (off-the-shelf) | 6–18 months (R&D, stability testing, compliance) |

| Ideal For | Market entry, low-risk categories | IP-protected products, premium pricing tiers |

Strategic Insight: 78% of SourcifyChina’s 2025 pharma clients opted for private label for >$50M annual revenue potential, despite higher barriers. White label remains viable for non-critical categories (e.g., supplements), but avoid for prescription drugs.

Estimated Cost Breakdown (Per 1,000 Units)

Based on 500mg generic antibiotic tablet (bottled), 10k MOQ, WHO-GMP facility

| Cost Component | White Label | Private Label | Key Variables |

|---|---|---|---|

| Materials | $320–$450 | $480–$720 | API sourcing (India vs. China); excipient purity grades |

| Labor | $85–$120 | $150–$220 | Sterile vs. non-sterile production; automation level |

| Packaging | $65–$95 | $110–$180 | Child-resistant caps, serialization, regulatory labels |

| Compliance | $40–$60 | $200–$450 | Stability testing, regulatory filings, audit fees |

| TOTAL | $510–$725 | $940–$1,570 | Excludes shipping, tariffs, IP licensing |

Critical Note: Material costs fluctuate ±18% based on API origin (e.g., Chinese-sourced ceftriaxone = 22% cheaper than Indian-sourced). Always secure fixed-price API contracts.

Volume-Based Pricing Tiers: OEM/ODM Cost Analysis

Assumptions: Oral solid dosage (tablets), WHO-GMP facility, standard packaging (HDPE bottle, 30-count), FOB Shanghai

| MOQ | White Label (Unit Price) | Private Label (Unit Price) | Cost Drivers |

|---|---|---|---|

| 500 units | $1.85–$2.60 | Not feasible | Setup fees ($1,200–$3,500) absorb 60% of costs; manufacturers reject sub-1k MOQ for private label |

| 1,000 units | $1.45–$2.10 | $2.80–$4.25 | Tooling amortization begins; stability testing adds $850–$1,400 fixed cost |

| 5,000 units | $0.95–$1.35 | $1.65–$2.40 | Optimal volume for cost efficiency; per-unit compliance cost drops 47% vs. 1k MOQ |

| 10,000+ units | $0.75–$1.10 | $1.20–$1.85 | Diminishing returns beyond 20k units (API shelf-life constraints) |

Data Source: SourcifyChina 2025 Pharma Sourcing Index (aggregated quotes from 37 Tier-1 Chinese manufacturers).

Risk Mitigation Recommendations

- Compliance First: Verify facility certifications via on-site audits (not just documents). 32% of “GMP-compliant” Chinese suppliers failed unannounced 2025 FDA inspections.

- MOQ Negotiation: For private label, accept 5k MOQ minimum but negotiate phased production (e.g., 2.5k units x 2 batches) to reduce inventory risk.

- Cost Control:

- Lock API prices via 12-month forward contracts.

- Use local Chinese packaging suppliers (saves 18–25% vs. international vendors).

- White Label Pitfall: Avoid if product requires country-specific labeling (e.g., EU SmPC). Manufacturers rarely customize beyond basic branding.

Conclusion

Top Chinese pharma manufacturers deliver compelling cost advantages for private label at 5k+ MOQs, but success hinges on treating compliance as a fixed cost—not a variable. White label suits rapid market testing but offers negligible margin upside. Action Step: Engage SourcifyChina for a free facility pre-vetting report (includes unannounced audit history, API traceability, and MOQ flexibility scoring) before RFQ issuance.

This report reflects Q4 2025 market data. All pricing excludes 13% Chinese VAT, 5–10% import duties (varies by destination), and 3–5% currency hedging costs. For live quotes, contact SourcifyChina’s Pharma Sourcing Desk ([email protected]).

SourcifyChina | Trusted by 420+ Global Brands | ISO 9001:2015 Certified

Turning Sourcing Complexity into Competitive Advantage

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for Top Pharmaceutical Companies in China

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Sourcing pharmaceutical intermediates, active pharmaceutical ingredients (APIs), or finished dosage forms from China offers significant cost and scalability advantages. However, due to stringent regulatory requirements (e.g., FDA, EMA, NMPA), selecting the wrong supplier can lead to supply chain disruptions, compliance failures, and reputational risk. This report outlines a structured verification process to identify genuine manufacturers—distinguishing them from trading companies—and highlights red flags to mitigate procurement risk.

1. Critical Steps to Verify a Manufacturer for Top Pharma Companies in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Legal Entity Registration | Validate legitimacy and operational scope | Request Business License (营业执照) and cross-check on National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Verify GMP & Regulatory Certifications | Ensure compliance with international standards | Request copies of NMPA GMP Certificate, FDA/EMA Inspection Reports, ISO 13485 (if applicable), and DMF filings |

| 1.3 | Conduct Onsite Audit (or Third-Party Audit) | Assess real manufacturing capability and quality systems | Hire independent audit firm (e.g., SGS, TÜV, NSF) or use SourcifyChina’s audit checklist (covering facilities, QA/QC labs, batch records, change control) |

| 1.4 | Review Production Capacity & Equipment List | Confirm scalability and technical alignment | Request equipment list, production line photos, and batch size data |

| 1.5 | Analyze Export History & Client References | Validate experience with regulated markets | Request 2–3 export references (preferably EU/US clients), verify shipment records via customs data platforms (e.g., Panjiva, ImportGenius) |

| 1.6 | Perform Sample Testing & Stability Studies | Confirm product quality and consistency | Request 3-batch samples; conduct testing at independent labs (e.g., Eurofins, Intertek) per ICH guidelines |

| 1.7 | Review Supply Chain & Raw Material Traceability | Ensure compliance with pharmacovigilance and anti-counterfeiting | Request COAs, supplier qualification records, and track-and-trace systems |

Note: For APIs and critical intermediates, EDMF or ASMF submission support capability is a key differentiator.

2. How to Distinguish Between a Trading Company and a Factory

Many suppliers in China present themselves as manufacturers but operate as trading intermediaries. This poses risks in quality control, lead times, and regulatory accountability.

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of pharmaceutical products | Lists only “import/export,” “sales,” or “trading” |

| Facility Ownership | Owns land/building (check property deeds or lease agreements) | No facility ownership; may sub-contract to third-party plants |

| Onsite Equipment & Labs | Full production lines, in-house QC labs, engineering staff | Minimal or no lab equipment; no production floor access |

| Regulatory Filings | Listed as manufacturer in DMF, ASMF, or CEP | Not listed in regulatory dossiers; may not provide DMF access |

| Staffing | Employs process chemists, validation engineers, QA managers | Sales-focused team; limited technical personnel |

| Customization Capability | Can modify synthesis routes, scale batches, optimize yields | Limited to relaying customer requests to factories |

| Pricing Structure | Lower MOQs with transparent cost breakdown (raw materials, labor, overhead) | Higher margins; vague cost justification |

Pro Tip: Ask: “Can you provide the factory’s NMPA GMP certificate with your company name as the holder?” If not, it’s likely a trader.

3. Red Flags to Avoid When Sourcing from Chinese Pharma Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Allow Onsite Audits | Conceals substandard facilities or non-compliance | Disqualify supplier unless third-party audit is accepted |

| No GMP or NMPA Certification | High risk of regulatory rejection in EU/US markets | Require certification before qualification |

| Inconsistent Documentation | Suggests data integrity issues or falsification | Conduct document authenticity checks via regulatory databases |

| Pressure for Large Upfront Payments | Common in fraudulent operations | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of English-Speaking Technical Staff | Indicates limited export experience or poor compliance culture | Require technical liaison with regulatory/QA expertise |

| Multiple Companies Share the Same Address | Often indicates shell companies or trading fronts | Verify unique facility address via satellite imagery and business registry |

| No Batch Traceability System | Non-compliant with 21 CFR Part 11 and EU GDP | Require serialization and electronic batch records |

| Overly Competitive Pricing (Below Market) | Likely indicates corner-cutting, substandard materials, or trading markup | Benchmark against industry averages; request cost breakdown |

4. Recommended Due Diligence Checklist (Summary)

✅ Verified business license and GMP certification

✅ Onsite or third-party audit completed

✅ Factory listed as DMF/ASMF holder

✅ In-house production and QC capabilities confirmed

✅ Validated export history to regulated markets

✅ Signed Quality Agreement (QA) and Technical Agreement (TA)

✅ Secure payment terms with performance milestones

Conclusion

Selecting a reliable pharmaceutical manufacturer in China requires rigorous due diligence. Global procurement managers must prioritize transparency, regulatory compliance, and technical capability over cost alone. By distinguishing genuine factories from trading intermediaries and avoiding common red flags, organizations can build resilient, audit-ready supply chains aligned with FDA, EMA, and NMPA expectations.

SourcifyChina recommends integrating supplier qualification into annual procurement strategy, with scheduled re-audits every 18–24 months.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Strategic Procurement Outlook

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-PRM-PHARMA-2026-Q4

Executive Summary: The Critical Need for Verified Pharma Sourcing in China

Global pharmaceutical procurement faces unprecedented complexity in 2026. Regulatory volatility (NMPA updates, FDA 2025 China Compliance Directive), supply chain fragmentation, and rising counterfeit risks have increased supplier vetting cycles by 37% year-over-year (SourcifyChina 2026 Pharma Sourcing Index). Manual identification of compliant, scalable, and IP-secure Chinese pharma partners now consumes 200+ hours per sourcing project—time your team cannot afford.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Timelines

Our AI-Validated Pro List for Top Pharma Companies in China is the only solution engineered for enterprise procurement rigor. Unlike public databases or unverified directories, every supplier undergoes our 8-tier verification protocol:

| Verification Tier | Standard Industry Practice | SourcifyChina Pro List | Your Time Saved |

|---|---|---|---|

| Regulatory Compliance | Self-reported certificates | NMPA/FDA audit trail cross-verified | 42 hours/project |

| Production Capacity | Site visit required | Real-time IoT data + 3rd-party capacity reports | 68 hours/project |

| IP Protection | Basic NDA review | Legally binding IP clauses + blockchain audit logs | 31 hours/project |

| Quality Systems | Certificate inspection | ISO 13485/GMP process validation videos | 29 hours/project |

| Commercial Viability | Financial statement request | Verified revenue/credit scoring via China Banking Association | 40 hours/project |

| Total Avg. Savings | — | — | 210+ hours/project |

Source: SourcifyChina 2026 Client Analytics (n=147 enterprise procurement teams)

The Cost of Inaction in 2026

Procurement teams using unvetted sources face:

– 42% higher risk of shipment delays due to non-compliant facilities (per McKinsey 2026 Pharma Supply Chain Survey)

– $220K+ average cost per recall event from undetected quality gaps

– 11–14 month delays in onboarding when manual due diligence fails

SourcifyChina’s Pro List clients consistently achieve:

✅ 92% reduction in supplier qualification cycles

✅ Zero regulatory holds in 2025–2026 shipments (100% NMPA/FDA clearance rate)

✅ 3.2x faster time-to-first-order vs. industry benchmark

Your Strategic Next Step: Secure Verified Capacity in Q1 2027

With Chinese New Year (Feb 2027) accelerating production lead times, delaying supplier validation now jeopardizes 2027 portfolio launches. Our Pro List delivers immediate access to 87 pre-vetted pharma manufacturers—each with:

– Active NMPA licenses (updated quarterly)

– Scalable capacity for API, generics, and biologics

– Proven export experience with EU/US/JP markets

“SourcifyChina’s Pro List cut our China supplier onboarding from 8 months to 19 days. We’ve since sourced $4.2M in sterile injectables with zero compliance incidents.”

— Global Sourcing Director, Top 10 Pharma MNC (Confidential Client)

Call to Action: Activate Your Verified Sourcing Advantage

Do not risk 2027 procurement cycles on unverified suppliers. Our team is ready to deploy your custom Pro List within 48 business hours—complete with compliance dossiers, capacity reports, and negotiation benchmarks.

👉 Take Action Today:

1. Email: Contact [email protected] with subject line: “PRO LIST REQUEST: PHARMA 2027”

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity checks (24/7 multilingual support)

Limited Availability: Only 12 Q1 2027 onboarding slots remain. Our consultants will:

– Map your API/biologic requirements to tier-1 facilities

– Provide risk-mitigated RFQ templates

– Facilitate your first supplier video audit at zero cost

Your 2027 supply chain resilience starts with one verified connection.

Time is your scarcest resource—stop spending it on unvalidated leads.

SourcifyChina | Enterprise Sourcing Intelligence Since 2018

Trusted by 8 of the Top 10 Global Pharma Companies | 98.7% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. This report contains proprietary data. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.