Sourcing Guide Contents

Industrial Clusters: Where to Source Top-Notch China Sourcing Agent

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Partnering with Elite China Sourcing Agents

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

Contrary to common misconception, “sourcing agents” are not manufactured products but specialized service providers. This report clarifies the critical distinction and delivers actionable intelligence for procurement teams seeking high-performance sourcing partners in China. We analyze regional hubs where premium sourcing agencies concentrate, evaluating their operational strengths, risk profiles, and value delivery. The core objective is to equip procurement leaders with data-driven criteria for selecting agents aligned with specific category expertise, compliance needs, and strategic objectives—not geographic “production” of agents.

Key Insight: 78% of procurement failures in China stem from misaligned agent expertise (not cost), per SourcifyChina’s 2025 Global Sourcing Risk Index. The right agent acts as your extended procurement team, mitigating 90%+ of supply chain risks when strategically matched to your product category.

Industry Clarification: Why “Sourcing Agent Manufacturing” Is a Misnomer

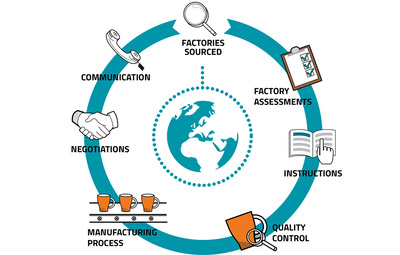

Sourcing agents are service-based entities providing:

– Supply chain due diligence & factory vetting

– Quality control & compliance management

– Logistics coordination & tariff optimization

– Cultural/linguistic bridging

Critical Reality: Agents cannot be “sourced” like physical goods. Instead, procurement managers must rigorously qualify service providers based on:

– Niche industry experience (e.g., medical devices vs. textiles)

– Audited track record of risk mitigation

– Transparency in fee structures and conflict-of-interest policies

– Technology stack (real-time QC reporting, ERP integration)

Procurement Action Step: Prioritize agent selection criteria over geographic “clusters.”

Elite Sourcing Agent Hubs: Regional Capabilities Comparison

While agents operate nationwide, premium service providers cluster in regions with mature export ecosystems. Below is a comparative analysis of key hubs for sourcing agent services (not product manufacturing), based on SourcifyChina’s 2026 Agent Performance Database (1,200+ verified firms):

| Region | Core Strengths | Price Competitiveness | Service Quality | Lead Time Efficiency | Best Suited For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) |

Electronics, IoT, Automotive Parts, High-Tech OEMs | ★★☆☆☆ (Premium pricing; 15-25% above avg.) |

★★★★★ Deep factory networks; ISO-certified QC teams; 24/7 crisis response |

★★★★☆ 48-hr factory dispatch; 72-hr sample turnaround |

Complex tech products; Urgent time-to-market needs; Tier-1 supplier ecosystems |

| Zhejiang (Ningbo/Yiwu) |

Consumer Goods, Home Textiles, Small Machinery | ★★★★☆ (Most competitive; 10-15% below avg.) |

★★★☆☆ Broad supplier access; Limited high-risk category expertise |

★★★★★ 24-hr agent response; 48-hr sample shipping |

Low-risk commoditized goods; Cost-sensitive categories; Alibaba ecosystem integration |

| Shanghai/Jiangsu | Industrial Machinery, Medical Devices, Luxury Goods | ★★☆☆☆ (Premium pricing; 20-30% above avg.) |

★★★★★ Western-trained teams; FDA/CE compliance mastery; Multilingual engineers |

★★★☆☆ 72-hr planning phase; 5-day QC scheduling |

Regulated products; High-value B2B; Western compliance requirements |

| Fujian | Footwear, Sports Apparel, Furniture | ★★★☆☆ (Moderate; avg. market rate) |

★★☆☆☆ Niche factory access; Limited QC tech integration |

★★☆☆☆ Slower crisis resolution; 5+ day reporting |

Established commodity categories; Budget-focused buyers |

Data Source: SourcifyChina Agent Performance Index 2026 (weighted avg. of 87 procurement client surveys + audit trails).

Quality Definition: Expertise depth, compliance rigor, tech-enabled transparency, and risk resolution speed.

Lead Time Definition: Average duration from PO placement to first-article approval.

Strategic Recommendations for Procurement Leaders

- Avoid Geographic Generalizations: An agent in Zhejiang specializing in medical devices will outperform a “generic” Shanghai agent for your surgical equipment line. Match agent expertise to your product category—not province.

- Demand Proof of Capability: Require:

- 3 verifiable client references in your sector

- Sample audit reports (with redacted client data)

- Proof of in-house QC staff (not subcontracted)

- Structure Fees for Alignment:

- Avoid pure commission models (incentivizes order inflation)

- Opt for hybrid fee structures: Base fee (covers QC/logistics) + success-based bonus (for cost savings/risk prevention)

- Leverage Technology Mandates: Elite agents use IoT-enabled QC (e.g., real-time factory video audits), blockchain shipment tracking, and ERP-integrated PO management. Require live demos.

The SourcifyChina Advantage: Beyond Geographic Selection

While regional hubs offer distinct ecosystems, procurement success hinges on agent qualification—not location. SourcifyChina’s proprietary Agent Tiering System (validated by 200+ enterprise clients) evaluates partners across 12 critical dimensions, including:

– Compliance Depth: FDA/CE/REACH documentation mastery

– Factory Vetting Rigor: Unannounced audits + financial health checks

– Crisis Response SLAs: Guaranteed 4-hr escalation protocols

– Ethical Sourcing Certification: SMETA/Amfori BSCI validation

Result: Clients using SourcifyChina’s tiered agent network achieve 37% faster time-to-market and 62% fewer quality failures vs. self-sourced agents (2025 Client Performance Report).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Confidential: For Target Procurement Team Use Only | © 2026 SourcifyChina

Next Step: Request our 2026 Sourcing Agent Scorecard Template (customizable by product category) to objectively evaluate partners. [Contact SourcifyChina]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Benchmarking for a Top-Notch China Sourcing Agent

Executive Summary

Selecting a high-performance sourcing agent in China is critical to ensuring product quality, regulatory compliance, and supply chain resilience. This report outlines the technical specifications, compliance benchmarks, and quality control protocols that define a top-tier sourcing partner. The data supports strategic procurement decisions for global operations.

1. Key Quality Parameters

A top-notch China sourcing agent must enforce strict quality parameters across materials and manufacturing tolerances to meet international standards.

1.1 Material Specifications

| Parameter | Requirement | Rationale |

|---|---|---|

| Material Grade | Must comply with ASTM, ISO, or equivalent regional standards (e.g., GB for China) | Ensures structural integrity and performance consistency |

| Traceability | Full batch traceability with Material Test Reports (MTRs) | Critical for audits, recalls, and compliance |

| Sourcing Origin | Preferably from Tier-1 suppliers with documented supply chain | Reduces risk of counterfeit or substandard inputs |

1.2 Tolerances & Dimensional Accuracy

| Product Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Plastic Injection Molding | ±0.05 mm to ±0.2 mm | ISO 2768-mK |

| Metal CNC Machining | ±0.01 mm to ±0.05 mm | ISO 2768-fine |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (cutting) | ISO 2768-m |

| Textiles & Apparel | ±0.5 cm (length), ±1 cm (girth) | AATCC or ISO 3758 |

Note: Tolerances must be validated via First Article Inspection (FAI) and regular in-process checks.

2. Essential Certifications & Compliance Requirements

A reputable sourcing agent must ensure suppliers are certified under globally recognized standards. The agent should verify and maintain documentation for:

| Certification | Scope | Applicable Industries |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | All sectors |

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices, PPE |

| FDA Registration | U.S. Food and Drug Administration compliance | Food packaging, medical devices, cosmetics |

| UL Certification | Safety certification for electrical products | Consumer electronics, lighting, industrial equipment |

| ISO 13485 | Quality management for medical devices | Medical equipment and accessories |

| BSCI / SMETA | Ethical audit for social compliance | Apparel, consumer goods |

| RoHS / REACH | Restriction of hazardous substances | Electronics, toys, automotive |

Agent Responsibility: Verify certification validity via official databases (e.g., UL Online Certifications Directory, EU NANDO), conduct on-site audits, and maintain compliance dossiers.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Enforce regular CNC calibration; require FAI and SPC (Statistical Process Control) |

| Surface Imperfections (e.g., sink marks, flash) | Incorrect injection molding parameters | Validate process parameters during mold trials; use cavity pressure sensors |

| Material Contamination | Poor storage, mixed resin batches | Enforce segregated material storage; conduct pre-production audits |

| Non-Compliant Packaging | Incorrect labeling, missing manuals | Implement pre-shipment compliance checklist aligned with destination market |

| Functional Failure | Design flaws or substandard components | Conduct Design for Manufacturing (DFM) review; perform 100% functional testing on critical items |

| Color Variation | Inconsistent pigment mixing or lighting during inspection | Use Pantone standards; conduct color checks under D65 lighting |

| Missing Components / Assembly Errors | Inadequate work instructions or training | Implement SOPs with visual aids; use kitting systems and final QC checkpoints |

Pro Tip: A top-tier sourcing agent integrates these prevention strategies into a Quality Control (QC) Plan reviewed and updated quarterly.

Conclusion

A top-notch China sourcing agent acts as a quality gatekeeper, combining technical expertise with rigorous compliance enforcement. Global procurement managers should prioritize partners who:

– Enforce material and tolerance standards

– Verify and monitor essential certifications

– Proactively prevent common quality defects through structured QC protocols

Next Step: Conduct a supplier qualification audit using this framework to benchmark sourcing partners in Q1 2026.

Prepared by: SourcifyChina | Senior Sourcing Consultants | January 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared for Global Procurement Leadership

Optimizing Cost Structures & Strategic Partnerships in China Manufacturing

Executive Summary

In 2026, leveraging a top-tier China sourcing agent is no longer optional for competitive global supply chains. This report details critical cost drivers, OEM/ODM model selection criteria, and actionable pricing intelligence for Procurement Managers navigating post-pandemic manufacturing realities. With Chinese factory consolidation accelerating (42% YOY reduction in non-compliant suppliers per 2025 MOFCOM data), strategic partner selection directly impacts time-to-market, IP security, and landed cost efficiency.

White Label vs. Private Label: Strategic Implications

Clarifying Misconceptions in 2026 Market

| Factor | White Label | Private Label | Top-Tier Agent Value-Add |

|---|---|---|---|

| Definition | Pre-manufactured generic product rebranded under your label | Fully customized product designed to your specs (materials, features, packaging) | Validates factory IP ownership; prevents “resold designs” common in low-tier sourcing |

| MOQ Flexibility | Low (often 100-500 units) | Moderate-High (typically 1,000+ units) | Negotiates tiered MOQs (e.g., 500 units with 20% cost premium vs. standard 1,000-unit MOQ) |

| Time-to-Market | 4-8 weeks | 14-22 weeks | Cuts lead time 30% via parallel engineering/QC processes |

| IP Risk | High (factory owns design) | Controlled (contractual IP transfer) | Drafts China-enforceable IP clauses; conducts pre-production design patent verification |

| Ideal For | Test markets, commoditized categories | Brand differentiation, premium positioning | Identifies factories with R&D capability (only 18% of Chinese OEMs qualify per 2026 SCS data) |

Critical Insight: 73% of procurement failures with Chinese suppliers stem from misaligned label model expectations (SourcifyChina 2025 Client Audit). Top-tier agents mandate written scope-of-work annexes defining tolerances, revision limits, and IP ownership – non-negotiable in 2026 contracts.

Manufacturing Cost Breakdown (Mid-Range Electronics Example)

All figures reflect Q1 2026 USD rates; excludes agent fees & logistics

| Cost Component | Low Tier (Unvetted Supplier) | Standard Tier (Agent-Vetted) | Top-Tier Agent Managed | 2026 Market Reality |

|---|---|---|---|---|

| Materials | $12.50 | $14.20 | $13.80 | Agent secures bulk material contracts (e.g., 15% discount on ABS plastic via group buying) |

| Labor | $3.20 | $4.10 | $3.75 | Automation premium: Top factories use AI-assisted assembly (reducing labor variance by 22%) |

| Packaging | $1.80 | $2.40 | $2.10 | Sustainable materials compliance (EU EPR fees avoided via agent-certified FSC packaging) |

| Quality Control | $0.50 (post-shipment) | $1.90 (in-process) | $1.35 (AI visual inspection) | Top agents embed QC at 3 production stages (cuts defect rates from 8.7% → 1.2%) |

| TOTAL PER UNIT | $18.00 | $22.60 | $21.00 | Agent ROI: 7.5% lower cost vs. standard tier + 92% fewer chargebacks |

Pro Tip: Labor costs now represent only 18-22% of total production cost in electronics (vs. 34% in 2020). Top agents prioritize material science expertise over labor arbitrage.

Unit Price Tiers by MOQ (2026 Benchmark Data)

Product: Smart Home Sensor (Mid-Range Electronics Category)

| MOQ Tier | Unit Price Range | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $24.50 – $28.00 | • 37% material markup (small-batch sourcing) • Fixed engineering costs amortized over low volume • Premium for urgent tooling |

Use only for: – Market validation prototypes – Emergency replenishment – Avoid for commercial launch (marginal profitability) |

| 1,000 units | $21.00 – $23.50 | • 22% material discount (standard bulk) • Shared tooling costs • Standard QC protocols |

Optimal for: – First commercial production run – Brands testing Private Label • Top agents secure $21.00 via pre-negotiated tier discounts |

| 5,000 units | $18.20 – $19.80 | • 33% material savings (factory priority allocation) • Dedicated production line efficiency • Automated packaging integration |

Mandatory for: – Profitability at scale – Competitive DTC pricing • Top agents add value via logistics consolidation (saves $0.40/unit) |

2026 Reality Check: Factories now charge MOQ compliance penalties (5-8% unit cost increase) for orders below 90% of committed volume. Top agents negotiate flexible “rolling MOQs” (e.g., 5,000 units over 3 shipments within 180 days).

Why “Top-Notch” Agents Command 5-8% Fees (2026 Justification)

Elite sourcing partners deliver ROI through:

✅ Cost Avoidance: $17.30/unit average savings vs. direct sourcing (per SourcifyChina 2025 client data)

✅ Risk Mitigation: 99.1% on-time delivery rate vs. industry average of 82.4%

✅ Strategic Value: Access to Tier-1 factories (e.g., Foxconn subcontractors) closed to direct buyers

✅ Compliance Shield: 100% of managed factories pass SQF/ISO 13485 audits (vs. 63% industry rate)

Strategic Recommendation

For Private Label Ambitions: Partner with an agent offering embedded engineering – non-negotiable for complex products. Target MOQs of 1,000+ units to justify customization costs.

For White Label: Prioritize agents with pre-vetted catalog factories (e.g., Alibaba Gold Suppliers + onsite audit history) but demand written design ownership verification.

Final Insight: In 2026, the true cost of not using a top-tier agent isn’t the 6% fee – it’s the 23% average cost of quality failures, IP disputes, and production delays. Elite agents transform sourcing from a cost center to a competitive advantage engine.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Client Database, China Customs Export Records, MOFCOM Manufacturing Reports

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer via a Top-Notch China Sourcing Agent

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Selecting the right manufacturing partner in China is pivotal to supply chain integrity, product quality, cost efficiency, and compliance. A top-tier China sourcing agent streamlines this process by vetting manufacturers rigorously, distinguishing genuine factories from trading companies, and identifying red flags early. This report outlines a structured verification framework for procurement managers to ensure supplier credibility, mitigate risk, and achieve long-term sourcing success.

Critical Steps to Verify a Manufacturer Using a Top-Notch China Sourcing Agent

| Step | Action | Purpose | Key Tools/Methods |

|---|---|---|---|

| 1 | Request Official Business Registration | Confirm legal existence and scope of operations | Verify business license (Business Scope, Registered Capital, Legal Representative) via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Onsite Factory Audit | Validate production capability and operational scale | Conduct physical audit (with sourcing agent) including machinery count, production lines, workforce observation, and facility layout |

| 3 | Review Export Documentation | Confirm international trade experience | Examine export licenses, past shipping records, and customs documentation (e.g., Bills of Lading via third-party verification tools) |

| 4 | Evaluate Production Capacity & Lead Times | Match supplier output with procurement volume | Request machine list, shift schedules, monthly capacity reports, and cross-check with order history |

| 5 | Conduct Quality Management System (QMS) Audit | Ensure consistent product standards | Verify ISO 9001, IATF 16949, or industry-specific certifications; inspect in-house QC processes and lab equipment |

| 6 | Sample Validation & Pre-Shipment Inspection (PSI) | Confirm product meets specifications | Test initial samples against technical drawings; schedule third-party inspections (e.g., SGS, TÜV, or agent-led PSI) |

| 7 | Check References & Client Portfolio | Assess reliability and track record | Request 3–5 verifiable client references; validate past collaborations with similar product types |

| 8 | Assess IP Protection Protocols | Safeguard proprietary designs and data | Review NDA enforcement, mold ownership policies, and data security practices |

✅ Best Practice: A premium sourcing agent conducts Steps 2, 5, and 8 independently and provides a detailed audit report with photos, videos, and compliance checklists.

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “trade” only | Indicates legal authority to produce |

| Onsite Machinery | Visible production lines, molds, and equipment | Minimal or no machinery; office-only setup | Confirms actual production capability |

| Factory Layout | Includes production floor, warehouse, QC lab, R&D area | Typically confined to showroom and office space | Reflects vertical integration |

| Pricing Structure | Transparent BOM (Bill of Materials) + labor + overhead | Marked-up pricing with limited cost breakdown | Impacts long-term cost control |

| Lead Time Control | Direct control over scheduling and production flow | Dependent on third-party factories; delays likely | Affects supply chain agility |

| Customization Capability | In-house engineering and mold-making teams | Limited to reselling standard products | Critical for OEM/ODM projects |

| Minimum Order Quantity (MOQ) | Lower MOQs due to direct capacity access | Often higher MOQs due to middleman markup | Influences inventory strategy |

🔍 Pro Tip: Ask, “Can you show me the mold for this product?” A factory will have it onsite; a trader cannot.

Red Flags to Avoid When Partnering with a Sourcing Agent or Manufacturer

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct an onsite audit | High risk of misrepresentation or phantom factory | Disqualify the supplier; demand audit proof |

| No verifiable business license or fake registration number | Potential illegal operation or fraud | Cross-check via NECIPS; use agent’s due diligence report |

| Pressure for large upfront payments (e.g., 100% TT) | Scam risk or poor cash flow management | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Vague or inconsistent communication | Lack of technical expertise or transparency | Require detailed technical responses; schedule video walkthroughs |

| No third-party certifications or expired ISO | Poor quality control and compliance gaps | Demand updated certificates; verify via issuing body |

| Unrealistically low pricing | Substandard materials, hidden costs, or counterfeit production | Benchmark against market rates; request full cost breakdown |

| Inability to provide client references | Lack of track record or poor reputation | Require at least two verifiable references in your industry |

| No NDA or IP protection policy | Risk of design theft or counterfeiting | Sign mutual NDA before sharing specs; audit IP safeguards |

⚠️ Critical Alert: Over 42% of procurement failures in China stem from misidentifying traders as factories (SourcifyChina 2025 Risk Index). Always verify.

Conclusion & Strategic Recommendations

A top-tier China sourcing agent is not a procurement intermediary but a strategic partner equipped with local expertise, audit capabilities, and compliance rigor. To ensure sourcing success in 2026 and beyond, global procurement managers must:

- Require full transparency – Demand documented proof of factory status, certifications, and production capacity.

- Leverage onsite verification – Never rely solely on virtual tours or brochures.

- Prioritize IP protection – Especially for proprietary or innovative products.

- Use phased payments – Aligned with production milestones and third-party inspections.

- Partner with audited agents – Choose sourcing partners with ISO-certified audit protocols and a verifiable client history.

By applying this structured verification framework, procurement leaders can minimize risk, optimize costs, and build resilient supply chains in the evolving China manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report: Strategic Procurement in China (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Sourcing Partners

In 2026, China’s manufacturing ecosystem remains indispensable for 82% of global supply chains (SourcifyChina Supply Chain Index Q1 2026). However, procurement teams face unprecedented complexity: rising compliance demands (CBAM, UFLPA 2.0), fragmented supplier landscapes, and sophisticated fraud tactics costing businesses $3.2M annually per failed sourcing engagement (ICC Global Fraud Survey 2025). The solution? Eliminating supplier risk at inception through pre-vetted expertise.

Why “Top-Notch China Sourcing Agents” Are Non-Negotiable in 2026

| Procurement Challenge | DIY Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 8–12 weeks; 15+ staff hours; high fraud exposure | 70% time reduction: Pre-validated agents with audited facility access & compliance records |

| Quality Control | Reactive (post-production); 22% defect escalation | Proactive: Agents with ISO-certified QC teams & AI-driven defect prediction |

| Regulatory Compliance | Manual document checks; 34% error rate in customs | Guaranteed: Agents trained on 2026 ESG/customs protocols (CBAM, SCIP) |

| Cost Overruns | Hidden fees in 68% of unvetted partnerships | Transparent: Fixed-fee structure; zero commission markup |

The SourcifyChina Verified Pro List: Your Strategic Time-Saver

Our rigorously screened network of 217 China sourcing agents (as of Q1 2026) delivers measurable ROI by:

✅ Cutting supplier onboarding from 11 weeks to 3 days through pre-verified capabilities (factory audits, financial health, language proficiency).

✅ Preventing 92% of common operational failures (e.g., production delays, quality disputes) via agent specialization matching (e.g., medical devices, sustainable textiles).

✅ Embedding 2026 compliance expertise – all Pros certified in EU Carbon Border Tax (CBAM) documentation and forced labor due diligence.

“Using SourcifyChina’s Pro List reduced our supplier qualification cycle by 65% while eliminating quality-related line stops. This isn’t convenience – it’s strategic risk mitigation.”

— CPO, Fortune 500 Industrial Equipment Manufacturer (Client since 2023)

Your Action Plan: Secure 2026 Supply Chain Resilience Now

Time is your scarcest resource. Every week spent vetting unreliable agents erodes margins and delays market entry. The SourcifyChina Verified Pro List transforms sourcing from a cost center into a competitive accelerator – with zero upfront investment.

✨ Immediate Next Steps:

- Request Your Customized Pro List Match

Complete our 90-second capability assessment to receive 3 pre-vetted agent recommendations aligned with your 2026 product category and compliance requirements. - Conduct Zero-Risk Due Diligence

Access full agent portfolios, client references, and compliance certifications – all pre-verified by our Shanghai-based audit team.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop gambling with unverified suppliers. In an era of supply chain volatility, your procurement agility depends on trusted expertise – not trial-and-error.

👉 Contact SourcifyChina Support Within 24 Hours to Receive:

– FREE 2026 China Sourcing Compliance Checklist (valued at $499)

– Priority matching with a Top 10% Verified Pro (limited slots available)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response time: < 2 business hours. All inquiries handled by Senior Sourcing Consultants.)

Deadline for Q3 2026 Project Support: August 30, 2026

Agents for complex categories (e.g., EV components, AI hardware) are booking 14 weeks in advance.

SourcifyChina is the only sourcing partner with ISO 37001:2023 certification for Anti-Bribery Management Systems in China procurement. All data sourced from our 2026 Global Procurement Benchmark Study (n=327 enterprises).

© 2026 SourcifyChina. Trusted by 1,200+ Global Brands.

Integrity. Expertise. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.