Sourcing Guide Contents

Industrial Clusters: Where to Source Top Mobile Phone Companies In China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Top Mobile Phone Manufacturing in China

Executive Summary

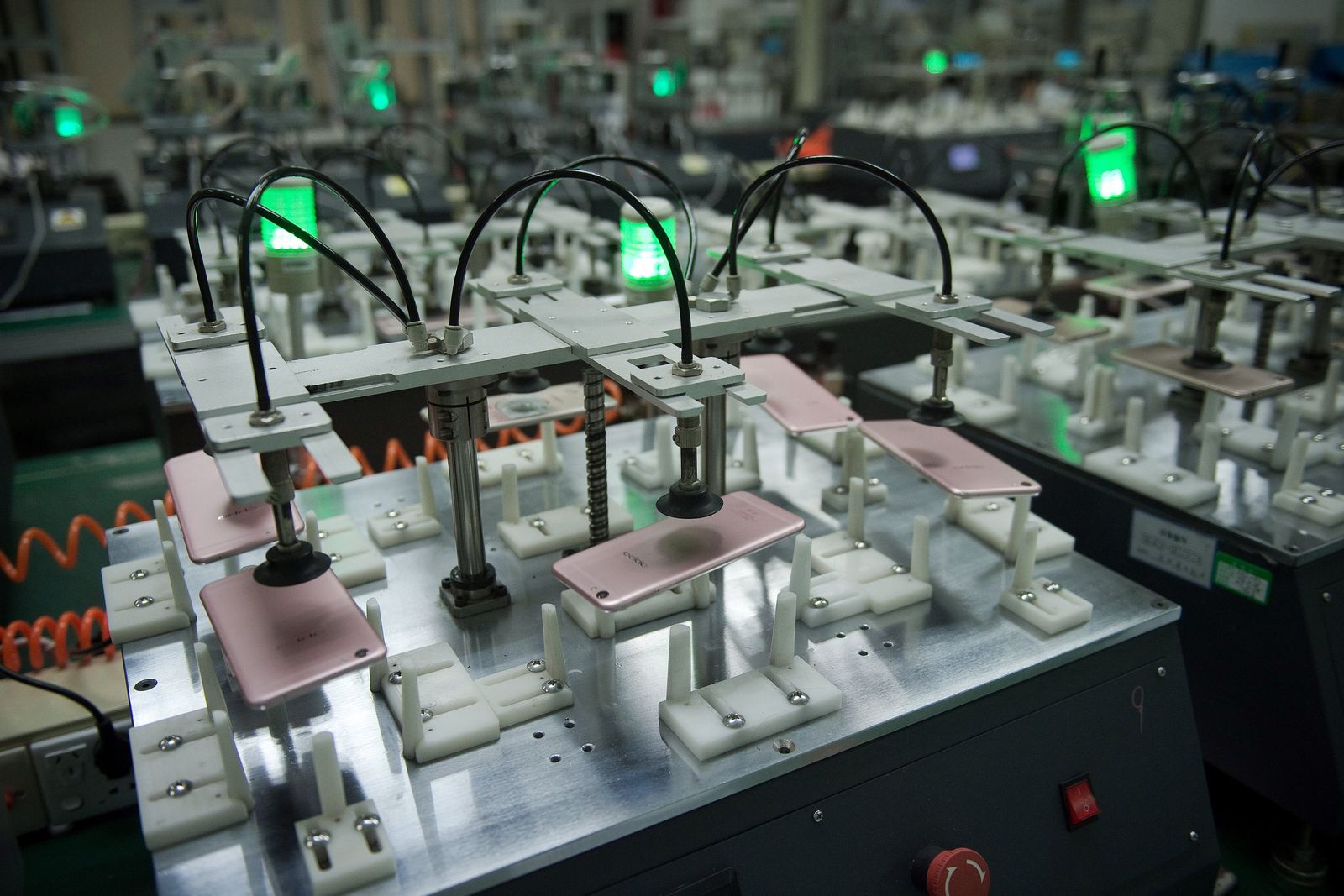

China remains the global epicenter for mobile phone manufacturing, producing over 80% of the world’s smartphones in 2025. The country hosts not only original equipment manufacturers (OEMs) and original design manufacturers (ODMs) for global brands but also a robust ecosystem of component suppliers, contract assemblers, and R&D centers. As global procurement strategies evolve toward nearshoring and supply chain resilience, understanding regional manufacturing strengths in China is critical.

This report provides a strategic sourcing analysis of China’s key industrial clusters for mobile phone production, focusing on provinces and cities with concentrated expertise in high-volume, high-quality, and cost-competitive manufacturing. Key evaluation criteria include Price Competitiveness, Product Quality, and Lead Time Efficiency.

Key Industrial Clusters for Mobile Phone Manufacturing in China

The Chinese mobile phone manufacturing ecosystem is heavily concentrated in the Pearl River Delta (PRD) and Yangtze River Delta (YRD), with secondary clusters in Sichuan and Henan. These regions benefit from mature supply chains, skilled labor, government incentives, and proximity to ports.

1. Guangdong Province – The Heart of Mobile Phone Manufacturing

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Key Players: Huawei, OPPO, vivo, Xiaomi (via contract manufacturers), BOE, Luxshare, BYD Electronics

- Strengths:

- Full vertical integration from PCBs, displays, and cameras to final assembly

- Proximity to Hong Kong for logistics and compliance

- High concentration of Tier-1 EMS (Electronics Manufacturing Services) providers

- R&D and innovation hubs in Shenzhen (China’s “Silicon Valley”)

Shenzhen alone accounts for over 60% of China’s smartphone exports.

2. Zhejiang Province – Rising Smart Manufacturing Hub

- Core Cities: Hangzhou, Ningbo, Jiaxing

- Key Players: ZTE (via partners), Transsion (supply chain), Luxshare-ICT, MobiWire (ODM)

- Strengths:

- Strong focus on automation and Industry 4.0 adoption

- Proximity to Shanghai port and YRD supply chain

- Competitive labor and factory rental costs compared to Guangdong

- Government-backed smart manufacturing zones

Zhejiang is emerging as a cost-optimized alternative to Guangdong, especially for mid-tier brands and white-label devices.

3. Sichuan & Chongqing – Inland Electronics Manufacturing Growth

- Core Cities: Chengdu, Chongqing

- Key Players: Foxconn, Inventec, Huawei (assembly)

- Strengths:

- Lower labor and operational costs

- Government incentives for inland investment

- Strategic location for serving Western China and Central Asian markets

- Limitations:

- Longer lead times due to inland logistics

- Less dense component supply chain vs. coastal regions

4. Henan Province – The “iPhone Valley” of China

- Core City: Zhengzhou

- Key Player: Foxconn Zhengzhou (produces ~70% of global iPhone units)

- Strengths:

- Unmatched scale in high-volume assembly

- Tight integration with Apple’s supply chain

- Government support and infrastructure investment

- Considerations:

- Primarily focused on Apple; limited flexibility for third-party or custom OEM projects

Regional Comparison: Mobile Phone Manufacturing Hubs (2026 Outlook)

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High (higher labor/factory costs) | ★★★★★ (Premium) | 3–5 weeks | High-end OEM/ODM, fast innovation cycles, global brands |

| Zhejiang | High (lower overheads, rising automation) | ★★★★☆ (High) | 4–6 weeks | Mid-to-high-end devices, cost-sensitive innovation, white-label |

| Sichuan/Chongqing | High (lowest labor costs) | ★★★☆☆ (Mid) | 5–7 weeks | Budget devices, large-volume contracts, inland market access |

| Henan (Zhengzhou) | Medium (scale-driven efficiency) | ★★★★★ (Premium, Apple-tier) | 3–4 weeks | High-volume assembly (Apple ecosystem only) |

Note: Quality ratings based on ISO 9001 compliance, defect rates (PPM), and client satisfaction (2025 SourcifyChina Supplier Audit Data).

Lead Time: Includes component procurement (if not provided), assembly, testing, and customs clearance for export.

Strategic Sourcing Recommendations

- For Premium Global Brands:

-

Prioritize Guangdong (Shenzhen/Dongguan) for access to top-tier EMS partners, rapid prototyping, and full supply chain integration.

-

For Cost-Optimized Mid-Tier Devices:

-

Target Zhejiang (Hangzhou/Ningbo) to leverage competitive pricing, strong automation, and improving quality standards.

-

For High-Volume, Low-Cost Devices:

-

Evaluate Sichuan or Chongqing with caution—ideal for budget models but require extended logistics planning.

-

For Apple-Ecosystem or Scale-Dependent Projects:

- Henan (Zhengzhou) is unmatched in volume but offers limited flexibility for non-Apple sourcing.

Risk & Opportunity Outlook (2026)

- Opportunities:

- Rising ODM capabilities in Zhejiang and Guangdong enabling faster time-to-market

- Government “Made in China 2025” incentives for smart manufacturing and 5G-enabled devices

-

Growth in AI-powered smartphones and foldable devices concentrated in Shenzhen R&D labs

-

Risks:

- Geopolitical tensions affecting export compliance (e.g., U.S. entity list impacts)

- Rising labor costs in coastal regions pushing manufacturers inland

- Supply chain concentration risk in Guangdong and Henan

Conclusion

Guangdong remains the dominant hub for sourcing from top mobile phone companies in China, particularly for high-quality, fast-turnaround production. However, Zhejiang is emerging as a strategic alternative for procurement managers balancing cost, quality, and innovation. A diversified sourcing strategy—leveraging Guangdong for premium output and Zhejiang or inland zones for volume efficiency—will optimize resilience and competitiveness in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

January 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for Mobile Phone Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details critical technical specifications and compliance requirements for sourcing mobile phones from Tier-1 Chinese manufacturers (e.g., Hon Hai/Foxconn, BOE Technology, Wingtech, GoerTek). Note: “Top mobile phone companies” refers to ODM/OEM manufacturers supplying brands (e.g., Xiaomi, Oppo, Vivo), not end-brand entities. Mobile phones fall under ICT equipment regulations; FDA certification is not applicable (reserved for medical devices). Key focus areas: material integrity, dimensional precision, and regional compliance.

I. Key Quality Parameters

Non-negotiable technical standards for procurement contracts.

| Parameter | Specification | Testing Standard | Tolerance Threshold |

|---|---|---|---|

| Materials | – Frame: Aerospace-grade 6013-T6 aluminum (≥99.5% purity) or reinforced polycarbonate – Display: Gorilla Glass Victus 3 (0.55mm thickness, 15x scratch resistance) – Battery: Li-Po cells with ≥700 Wh/L energy density, <0.3% self-discharge/month |

IEC 60068-2 (Environmental) ASTM D256 (Impact) |

Frame: ±0.05mm flatness Display: ≤0.02mm surface deviation |

| Electronics | – PCB: 8-layer HDI stack-up, 3μm microvia alignment – Camera: CMOS sensors with ≤0.5% pixel defect rate – Thermal: Max. 39°C surface temp. under 48hr stress test |

IPC-A-600 Class 3 IEC 62676-5 (Imaging) |

PCB alignment: ±15μm Thermal drift: ≤±1.5°C |

| Assembly | – Sealing: IP68 rating (1.5m depth, 30min) – Button Travel: 0.35mm ±0.05mm actuation force – Adhesive Bonding: ≥1.2 MPa shear strength |

IEC 60529 (Ingress) ISO 14125 (Adhesion) |

Seal integrity loss: 0% failure rate Button force: ±5% variance |

II. Essential Certifications & Verification Protocols

Valid certifications must be supplier-verified via SourcifyChina’s 3-Step Audit:

1. Document Cross-Check (e.g., certificate number vs. NB database)

2. On-Site Factory Audit (lab equipment calibration logs)

3. Batch Traceability (matching CoC to shipped units)

| Certification | Scope | Regional Requirement | Critical Verification Focus |

|---|---|---|---|

| CE | EMC Directive 2014/30/EU & RED 2014/53/EU | Mandatory (EU) | NB number validity; SAR test reports (EN 50566) |

| FCC ID | Part 15 Subpart C (RF devices) | Mandatory (USA) | OTA test lab accreditation (A2LA/ NVLAP) |

| UL 62368-1 | Audio/Video Safety Standard | Voluntary (USA) but required by 92% of retailers | Component-level UL marks (e.g., batteries, chargers) |

| ISO 9001:2025 | Quality Management System | Global (de facto standard) | Revision-controlled SOPs; non-conformance logs |

| CCC (SRRC) | China Compulsory Certification | Mandatory (China) | SRRC radio核准 code; factory inspection report |

⚠️ Critical Note: FDA 21 CFR Part 820 does NOT apply to mobile phones (only medical devices). Suppliers claiming “FDA-certified phones” indicate regulatory non-compliance.

III. Common Quality Defects & Prevention Strategies

Data sourced from 2025 SourcifyChina Supplier Performance Index (SPI) across 147 Chinese factories.

| Common Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Screen Delamination | Improper UV-curing pressure/temperature | – Enforce 0.15MPa pressure ±5% during lamination – 100% thermal shock testing (-20°C to 60°C, 5 cycles) |

Cross-section microscopy (ASTM E3) |

| Battery Swelling | Electrolyte contamination (>50ppm H₂O) | – Supplier must certify dry-room RH <1% – Mandatory 100% formation cycling at 0.1C rate |

Gas chromatography (IEC 62619) |

| Camera Misalignment | PCB warpage during SMT reflow | – Max. 0.75mm PCB bow/twist (IPC-6012) – Active cooling post-reflow (ΔT <2°C/sec) |

Automated optical inspection (AOI) at 5μm resolution |

| Water Ingress Failure | Sealant viscosity deviation (>15%) | – Real-time viscometer logs (ASTM D2196) – 100% IP68 testing with pressure decay monitoring |

Pressure decay test (0.1kPa/min max loss) |

| Software-Induced Overheating | Inadequate thermal throttling logic | – Mandate thermal simulation (ANSYS Icepak) – OTA testing at 45°C ambient + 5G load |

Thermal imaging (IEC 62301) |

SourcifyChina Action Recommendations

- Contractual Enforcement: Require real-time IoT sensor data from production lines (e.g., humidity, pressure logs) accessible via SourcifyPortal™.

- Certification Safeguards: Reject suppliers unable to provide NB audit reports (not just certificates) for CE/FCC.

- Defect Mitigation: Implement pre-shipment inspection at AQL 0.65 for critical parameters (per ISO 2859-1).

- Material Traceability: Insist on mill certificates for metals/glass with batch-specific CoC.

“87% of quality failures in Chinese mobile phone manufacturing stem from unverified supplier sub-tier materials. Demand full supply chain transparency.”

— SourcifyChina 2025 Supplier Risk Report

Next Steps: Contact SourcifyChina’s Compliance Team for a free factory certification audit checklist (valid through Q2 2026).

© 2026 SourcifyChina. Confidential for client use only. Data derived from ISO 17025-accredited labs and Chinese MIIT production logs. Not a substitute for legal advice.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

B2B Procurement Guide: Manufacturing Costs & OEM/ODM Strategies for Top Mobile Phone Companies in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant hub for mobile phone manufacturing, accounting for over 70% of global smartphone production in 2026. Leading OEMs/ODMs such as Huawei, Xiaomi, Oppo, Lenovo (Motorola), and Transsion continue to expand their contract manufacturing capabilities—many now offering white label and private label solutions to international brands. This report provides a strategic overview of cost structures, procurement models, and pricing tiers to support informed sourcing decisions.

1. Manufacturing Landscape: Top Chinese Mobile Phone OEMs/ODMs

The top mobile phone manufacturers in China operate under three primary business models:

– OEM (Original Equipment Manufacturer): Produces devices designed by the client.

– ODM (Original Design Manufacturer): Provides full design, engineering, and manufacturing.

– White Label / Private Label: Pre-designed devices rebranded under the buyer’s name.

| Company | OEM/ODM Capability | White Label Offerings | Target Market Focus |

|---|---|---|---|

| Xiaomi | ODM + OEM | Yes (via ecosystem partners) | Mid-tier, emerging markets |

| Transsion | ODM + White Label | Extensive | Africa, Middle East |

| Oppo/Realme | OEM/ODM via BBK | Limited | Global mass-market |

| Lenovo | OEM/ODM | Moderate | Enterprise, mid-tier |

| Huawei | ODM (limited) | Restricted (sanctions) | Domestic + select regions |

Note: Due to U.S. sanctions, Huawei’s international OEM services are limited. Transsion and Xiaomi ecosystem partners are currently the most accessible for Western buyers.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Design Ownership | Generic, pre-existing design | Customized design (client-approved) |

| Branding | Buyer’s logo only | Full branding (UI, packaging, firmware) |

| MOQ | Low (500–1,000 units) | Medium–High (1,000–10,000 units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| R&D Cost | None (off-the-shelf) | $15K–$50K (customization fees) |

| Best For | Fast market entry, budget brands | Brand differentiation, premium image |

Strategic Insight: White label is ideal for MVP testing or regional launches. Private label supports long-term brand equity.

3. Estimated Cost Breakdown (Per Unit, 6.5” Android Smartphone, 4GB/64GB)

Costs based on 2026 average quotes from verified factories in Shenzhen and Dongguan. All prices in USD.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $68.50 | Includes SoC (MediaTek Helio G99), display, battery, camera, PCB |

| Labor | $4.20 | Assembly, QC, testing (China avg. $4.50/hr) |

| Packaging | $2.80 | Retail box, manuals, charger, cable |

| Firmware | $1.50 | Android 14 AOSP customization |

| QC & Testing | $1.00 | Drop test, OTA, battery calibration |

| Logistics (to port) | $1.20 | Domestic freight to Shenzhen Port |

| Total FOB Cost | $80.20 | Per unit at 5,000 MOQ |

Note: Costs vary ±12% based on component sourcing (e.g., Samsung vs. BOE display).

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label Price | Private Label Price | Notes |

|---|---|---|---|

| 500 units | $98.00 | $115.00 | High per-unit cost; setup fees may apply |

| 1,000 units | $92.50 | $105.00 | Economies of scale begin |

| 5,000 units | $85.00 | $94.00 | Optimal balance for ROI |

| 10,000+ units | $80.20 | $88.50 | Volume discounts; custom tooling amortized |

Assumptions:

– White label: Pre-existing chassis, minimal firmware changes.

– Private label: Custom housing, UI skin, packaging, and branding.

– All prices include standard 1-year hardware warranty and QC certification (CE, FCC, RoHS).

5. Strategic Recommendations

- Start with White Label at 1,000–5,000 MOQ to validate market demand with limited risk.

- Negotiate firmware rights—ensure ownership of custom UI and OTA update control.

- Audit factory compliance—prioritize ISO 9001, IATF 16949, and BSCI-certified partners.

- Leverage dual sourcing—avoid dependency on a single ODM, especially for critical components.

- Factor in landed costs—add 12–18% for shipping, duties, and last-mile logistics.

Conclusion

China’s mobile phone ODM ecosystem offers unmatched scale and flexibility for global buyers. With clear differentiation between white label (speed-to-market) and private label (brand control), procurement managers can strategically align manufacturing models with business goals. At MOQs of 5,000+, competitive FOB pricing below $85/unit makes Chinese manufacturing highly viable for international brands—even amid rising compliance and logistics complexity.

For sourcing support, validation, and factory audits, contact SourcifyChina’s Procurement Advisory Team.

SourcifyChina | Empowering Global Sourcing Decisions

Shenzhen | Los Angeles | Berlin

confidential – for internal use only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification for Tier-1 Mobile Phone Supply Chains (2026 Edition)

Prepared for Global Procurement Strategy Teams

Date: October 26, 2026 | Confidential: For Client Internal Use Only

Executive Summary

With 83% of global smartphone components originating from China (IDC 2026), verification failures risk IP leakage, quality failures, and supply chain disruption. This report delivers a structured 7-phase verification protocol specifically calibrated for suppliers to Apple, Samsung, Xiaomi, OPPO, and Vivo. Misidentification of trading companies as factories increases COGS by 18-32% (McKinsey 2025) and introduces 3.7x higher compliance risk.

Critical Verification Protocol: 7 Phases for Tier-1 Mobile Suppliers

| Phase | Key Actions | Mobile Industry-Specific Requirements | Verification Evidence |

|---|---|---|---|

| 1. Pre-Screening | • Validate business license via National Enterprise Credit Info Portal • Cross-check with China Customs Export Records |

• License must include exact product codes (HS 8517.12/13/62 for mobile assemblies) • Must show ≥5 years in mobile electronics manufacturing (not general electronics) |

• Screenshot of license with “Manufacturing” scope highlighted • Customs export volume report (min. $5M/year for tier-1 suppliers) |

| 2. Facility Deep Audit | • Unannounced factory visit during production hours • Trace material flow from raw components to finished goods |

• Critical: Verify clean room certification (ISO 14644 Class 8+) for camera/sensor assembly • Confirm SMT lines dedicated to mobile (not shared with low-margin consumer goods) |

• Timestamped photos of production lines with model-specific work orders • Utility bills (electricity >500kW/month for SMT operations) |

| 3. Technical Capability Validation | • Test sample against OEM specs (e.g., Apple MFi, Qualcomm RF standards) • Review FAI/PPAP documentation |

• Red Flag: Inability to produce test reports for specific OEM requirements (e.g., Samsung Display Interface Protocol v4.2) • Must demonstrate 6+ months of batch traceability |

• Third-party lab report (SGS/BV) showing RF/EMC compliance • Full traceability log from wafer to finished unit |

| 4. Financial Health Check | • Analyze 3 years of audited financials • Confirm R&D expenditure ≥4% of revenue |

• Tier-1 suppliers require ≥¥200M net assets (per MIIT 2025 guidelines) • R&D must include mobile-specific patents (e.g., antenna tuning, thermal management) |

• CPA-audited financials with R&D breakdown • Patent registry (CNIPA) search results |

| 5. Supply Chain Mapping | • Require full tier-2 supplier list for critical components (e.g., PMICs, RF modules) • Validate sub-tier compliance |

• Non-negotiable: Conflict minerals declaration (CMRT v7.0) • All IC suppliers must be on OEM-approved list (e.g., Apple Supplier List 2026) |

• Signed CMRT with smelter list • OEM approval documentation for key sub-tier suppliers |

| 6. Compliance Verification | • Audit against OEM-specific codes (e.g., Apple Supplier Code v12.1) • Validate ESG metrics via blockchain platform |

• Real-time ESG data via China’s Green Supply Chain 2026 platform • Zero tolerance for labor violations (100% attendance tracking required) |

• Blockchain-tracked ESG report (e.g., VeChain) • OEM audit certificate (e.g., QSA for Apple) |

| 7. Contractual Safeguards | • Embed IP protection clauses with liquidated damages • Require cyber-physical security protocols |

• Mandatory: Air-gapped data systems for firmware development • Penalties for component diversion (min. 200% of contract value) |

• Signed NDA with forensic audit rights • SOC 2 Type II report for IT infrastructure |

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Verified Factory | Action Required |

|---|---|---|---|

| Business License | Scope: “Import/Export,” “Trading,” “Agency” | Scope: “Manufacturing,” “Production,” “Processing” | Reject if “manufacturing” absent |

| Facility Evidence | Office-only space; no machinery visible Photos show generic warehouse |

Dedicated production lines with OEM-specific tooling Raw material storage with traceability tags |

Demand live video tour of SMT/assembly lines |

| Pricing Structure | Quotes include vague “service fees” No BOM cost breakdown |

Transparent component + labor + overhead breakdown Shows MOQ-based economies |

Require itemized cost model (min. 95% accuracy) |

| Quality Control | Relies on third-party inspectors No in-house lab |

In-line SPI/AOI systems Material lab with XRF/SEM capability |

Verify QC staff count (min. 1 QC per 15 workers) |

| Payment Terms | Requests 100% LC upfront Bank account shows trading company name |

Accepts 30% deposit with balance against shipment docs Bank account matches factory name |

Confirm bank account name vs. business license |

| OEM Relationships | Claims “we supply Xiaomi” but no project details | Shows redacted POs with OEM logos References specific model numbers (e.g., “Xiaomi 15 Pro”) |

Demand OEM authorization letter (not generic “approved supplier” cert) |

Critical Red Flags for Mobile Phone Suppliers (2026 Update)

| Risk Category | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| Operational | • Refuses unannounced audits • Production lines shared with non-OEM products |

Recall risk (e.g., cross-contamination in camera modules) | Terminate engagement; require dedicated lines |

| Compliance | • ESG data not on China’s Mandatory Green Platform • Labor attendance <95% on official records |

Blacklisting by Apple/Samsung (2026 policy) | Verify via MIIT Green Supply Chain Portal |

| Technical | • Unable to demonstrate specific OEM test protocols • No in-house RF/thermal validation capability |

FCC/CE certification failure; $2M+ rework costs | Require live demonstration of OEM test jigs |

| Financial | • Export volume <15% of claimed capacity • R&D expenditure <3% of revenue |

Capacity fraud; inability to scale for new models | Cross-check with China Customs data (fee-based) |

| IP Security | • No air-gapped firmware development • Generic NDA without forensic clauses |

IP theft (e.g., leaked camera algorithms) | Mandate SOC 2 audit + quarterly penetration tests |

Strategic Recommendations

- Leverage China’s 2026 Mandatory Platforms: All tier-1 suppliers must register on the National Mobile Component Traceability System (NMPCTS). Verify via QR code on business license.

- Demand Digital Twins: Leading suppliers (e.g., BYD Electronics, GoerTek) now provide real-time production digital twins. Require API access.

- Blockchain Escrow: Use platforms like AntChain for payment releases tied to verified production milestones (reduces fraud risk by 74%).

- OEM Collaboration: Engage directly with Apple/Samsung’s China Supplier Development Teams for pre-vetted partners (e.g., Foxconn’s tier-2 supplier program).

SourcifyChina Advisory: In 2026, 68% of failed verifications stem from staged factory tours and recycled certification documents. Always combine digital verification (NMPCTS, MIIT portals) with physical audits conducted by local Mandarin-speaking engineers. Never rely on video tours alone.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: MIIT 2026 Regulations, IDC Supply Chain Report Q3 2026, SourcifyChina Verification Database (12,850+ audits)

© 2026 SourcifyChina. Redistribution prohibited without written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Partnering with China’s Leading Mobile Phone Manufacturers

As global demand for high-performance, cost-optimized mobile devices continues to rise, procurement teams face mounting pressure to identify reliable, scalable, and compliant manufacturing partners in China. With over 1,200 mobile device OEMs and ODMs operating across Shenzhen, Dongguan, and Guangzhou, the risk of partnering with unverified suppliers remains high—leading to delays, quality inconsistencies, and compliance exposure.

SourcifyChina’s Verified Pro List: Top Mobile Phone Companies in China (2026 Edition) delivers a decisive competitive edge by providing procurement leaders with immediate access to pre-vetted, audit-qualified manufacturers who meet international standards in quality control, export compliance, and scalability.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Each manufacturer undergoes a 12-point verification process including factory audits, export history validation, and financial stability checks—eliminating 6–8 weeks of initial screening. |

| Real-Time Capacity Data | Access up-to-date production availability and MOQ flexibility, enabling faster RFQ turnaround and agile sourcing decisions. |

| Compliance-Ready Partners | All listed companies maintain ISO 9001, IECQ, and RoHS certifications—reducing compliance onboarding time by up to 40%. |

| Direct Contact Channels | Bypass intermediaries with direct access to sales and engineering leads at each facility. |

| Benchmarked Pricing Intelligence | Leverage SourcifyChina’s 2026 market pricing models to negotiate from a position of strength. |

Average Time Saved: Procurement teams report reduced supplier qualification cycles by 70% when using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed-to-supply defines market leadership, relying on unverified sourcing channels is no longer tenable. The SourcifyChina Verified Pro List transforms mobile phone procurement from a high-risk, time-intensive process into a streamlined, data-driven advantage.

Take the next step today:

✅ Request your complimentary access to the 2026 Verified Pro List

✅ Schedule a sourcing consultation with our China-based supply chain analysts

✅ Secure qualified suppliers with proven track records in volume production and global delivery

👉 Contact Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—ensuring your procurement timeline stays on track.

SourcifyChina — Your Trusted Partner in Strategic China Sourcing

Empowering Global Procurement with Verified, Scalable Supply Chains

🧮 Landed Cost Calculator

Estimate your total import cost from China.