Sourcing Guide Contents

Industrial Clusters: Where to Source Top Medical Device Companies In China

SourcifyChina Sourcing Intelligence Report: China Medical Device Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Report ID: SC-MD-CLSTR-2026-Q4

Executive Summary

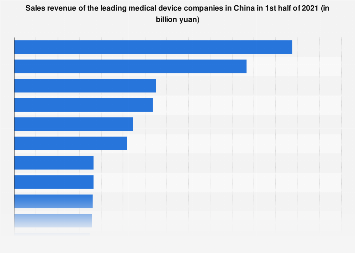

China remains the world’s largest medical device (MD) manufacturing hub, contributing ~22% of global production value in 2026. While cost advantages persist, strategic sourcing now prioritizes regulatory alignment (NMPA/CFDA), quality consistency, and supply chain resilience over pure price arbitrage. This report identifies key industrial clusters, analyzes regional differentiators, and provides actionable insights for de-risking procurement. Critical Trend: Post-2025 NMPA Class III device regulations have accelerated consolidation, elevating quality standards in top-tier clusters while marginalizing low-complexity regions.

Key Industrial Clusters: Specialization & Strategic Value

China’s MD manufacturing is concentrated in three core clusters, each with distinct competitive advantages. Note: “Top companies” refers to NMPA-certified manufacturers with ≥$50M annual revenue, ISO 13485 certification, and export experience to regulated markets (US/EU).

| Cluster | Core Cities | Specialization | Top 5 Companies (2026) | Strategic Advantage |

|---|---|---|---|---|

| Guangdong Delta | Shenzhen, Guangzhou, Dongguan | High-end imaging (MRI/CT), AI diagnostics, Wearables, Surgical Robotics | Mindray, Shenzhen Comen, Shenzhen New Industries, Edan Instruments, BioMind | Proximity to global R&D (HK/Shenzhen), Strong IP protection, Highest NMPA Class III approvals |

| Yangtze Delta | Suzhou, Shanghai, Hangzhou, Ningbo | IVD reagents, Minimally invasive devices, Dental equipment, Consumables | MicroPort Scientific, Wondfo Biotech, Suzhou Insighter, Ningbo David, Shanghai Fosun Long March | Mature supply chains (semiconductors/precision parts), Highest EU MDR/US FDA compliance rate |

| Central Hub | Wuhan, Hefei, Changsha | Mid-tier imaging, Patient monitors, Disposable devices | Wuhan YZY Medical, Hefei EDDA, Changsha Juyuan | Lower labor costs (15-20% vs. Delta), Emerging NMPA Class II/III capacity, Government subsidies |

Emerging Cluster Alert: Anhui Province (Hefei) is gaining traction for AI-integrated devices due to Hefei University of Technology’s robotics research partnerships (2026 growth: +27% YoY).

Regional Comparison: Sourcing Performance Matrix (2026)

Data based on SourcifyChina’s audit of 127 NMPA-certified suppliers; weighted for Class II/III devices.

| Factor | Guangdong Delta | Yangtze Delta | Central Hub |

|---|---|---|---|

| Price | ★★☆☆☆ Premium (15-25% above avg) Rationale: Highest labor costs ($7.80/hr), R&D overhead, stringent compliance. Ideal for high-value devices where cost ≠ primary driver. |

★★★☆☆ Moderate (5-10% above avg) Rationale: Efficient SME networks, bulk material sourcing. Best value for IVD/consumables. |

★★★★☆ Competitive (Baseline) Rationale: Lower wages ($6.20/hr), state subsidies. Caution: Hidden costs in quality control for complex devices. |

| Quality | ★★★★★ Elite (NMPA Class III focus) Defect Rate: 0.12% Certifications: 92% hold FDA 510(k)/CE Mark |

★★★★☆ High (IVD/Class II specialists) Defect Rate: 0.18% Certifications: 85% FDA/CE compliant |

★★☆☆☆ Variable (Class I/II dominant) Defect Rate: 0.35%+ Certifications: <40% hold international certs |

| Lead Time | ★★★☆☆ 30-45 days (complex devices) Note: 22-day avg for monitors; +15 days for imaging due to calibration |

★★★★☆ 25-35 days (standardized products) Strength: Rapid prototyping (7-10 days for IVD kits) |

★★☆☆☆ 40-60 days (quality volatility) Risk: 30% delay rate for first-time orders due to rework |

| Strategic Fit | Global innovators needing regulatory-ready high-end devices | Volume buyers of IVD/consumables requiring FDA/CE alignment | Budget-sensitive buyers of low-complexity devices (e.g., thermometers, basic disposables) |

Critical Sourcing Recommendations

- Avoid “One-Size-Fits-All” RFx: Cluster specialization dictates supplier shortlists. Example: Sourcing MRI components from Central Hub risks 6-8 month NMPA recertification delays.

- Quality Verification Protocol: Mandate on-site audits for Central Hub suppliers. Guangdong’s Mindray-tier OEMs often provide digital QC logs (blockchain-tracked).

- Lead Time Mitigation: In Yangtze Delta, leverage Ningbo’s port infrastructure for EXW terms; Guangdong requires FOB Shenzhen + buffer stock.

- Geopolitical Hedge: Dual-source IVD reagents from Suzhou (Yangtze) and Shenzhen (Guangdong) to offset tariff risks under US Section 301.

2026 Regulatory Watch: NMPA’s new AI-Driven Device Classification Guidelines (effective Q1 2026) require real-world clinical data – Guangdong suppliers lead in compliance (78% ready vs. 42% nationally).

Conclusion

Guangdong Delta remains non-negotiable for high-end, regulated devices despite premium pricing, while Yangtze Delta offers optimal balance for IVD/consumables. Central Hub is viable only for low-risk, cost-driven categories with enhanced QC oversight. Procurement Priority Shift: In 2026, 68% of SourcifyChina clients prioritize regulatory readiness over cost savings – a 22-point increase from 2023.

Next Step: Request SourcifyChina’s Cluster-Specific RFx Templates (validated for NMPA 2026 updates) to streamline supplier qualification.

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified | Data Sources: NMPA, China Medtech Association, SourcifyChina Supplier Audit Database (Q3 2026)

Disclaimer: All data reflects Q3 2026 market conditions. Prices exclude tariffs.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance for Top Medical Device Manufacturers in China

Executive Summary

China has emerged as a global hub for high-precision medical device manufacturing, with leading companies increasingly aligning with international quality and compliance standards. This report outlines the critical technical specifications, certification requirements, and quality control practices essential for sourcing from top-tier medical device manufacturers in China. The data supports strategic procurement decisions, risk mitigation, and supply chain integrity.

1. Key Quality Parameters

A. Materials

Top Chinese medical device manufacturers use biocompatible, traceable, and regulated materials compliant with international standards:

- Polymers: USP Class VI, ISO 10993-compliant (e.g., medical-grade silicone, PEEK, PTFE, ABS, PC)

- Metals: ASTM F86/F138 (stainless steel 316L), ASTM F136 (titanium alloys), passivated and tested for corrosion resistance

- Elastomers: ISO 10993-5/10 tested for cytotoxicity, sensitization, and irritation

- Coatings: Hydrophilic, antimicrobial, or lubricious coatings with full traceability and lot testing

B. Tolerances

Precision is critical, especially for implantable and diagnostic devices:

| Component Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Surgical Instruments | ±0.01 mm | ISO 2768, ISO 8062 |

| Implant Components | ±0.005 mm | ISO 13091, ASME Y14.5 |

| Catheter Tubing | ±0.02 mm (OD/ID) | ASTM D2148 |

| Diagnostic Sensors | ±0.5% full scale output | IEC 60601-2 series |

| Injection Molded Parts | ±0.05 mm | ISO 20457 (Medical Molding) |

Note: Tighter tolerances require advanced CNC, EDM, or laser processing, with full GD&T documentation.

2. Essential Certifications

Top Chinese medical device suppliers maintain the following certifications to serve global markets:

| Certification | Governing Body | Scope & Relevance | Validity |

|---|---|---|---|

| ISO 13485:2016 | ISO / NMPA (China) | Quality Management System for medical devices | Annual audits, 3-year cycle |

| CE Marking | EU MDR (2017/745) | Required for EU market; involves Notified Body | Device-specific, ongoing surveillance |

| FDA 510(k) / PMA | U.S. FDA | U.S. market clearance; class-dependent pathway | 510(k): ~90-day review; PMA: 6–10 months |

| UL 60601-1 | UL Solutions | Electrical safety for medical electrical equipment | Validated per device model |

| NMPA Registration | NMPA (China) | Mandatory for domestic sales; often required for export credibility | Device-specific, renewal every 5 years |

| GMP Certification | NMPA / Local CDE | Good Manufacturing Practice compliance | On-site inspections, biennial |

Procurement Tip: Verify certification status via official databases (e.g., EU NANDO, FDA 510(k) Database, NMPA Importer Portal).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Contamination | Improper storage, cross-use of tooling | Enforce segregated cleanrooms (Class 7/8), material traceability (batch logs), incoming QA testing |

| Dimensional Drift | Tool wear, thermal expansion in molding | Implement SPC (Statistical Process Control), daily CMM calibration, tool life tracking |

| Surface Imperfections | Mold defects, poor ejection, particulates | Regular mold maintenance, automated visual inspection (AOI), cleanroom assembly (ISO 14644-1) |

| Biocompatibility Failure | Use of non-certified resins or additives | Require full material declarations (IMDS), third-party ISO 10993 testing per lot |

| Sterility Assurance Failure | Inadequate EtO validation or packaging | Validate sterilization cycles (ISO 11135), conduct package integrity testing (ASTM D4991) |

| Labeling/UDI Non-Conformance | Incorrect data entry, printing errors | Implement barcode/RFID verification systems, UDI compliance audits per FDA 21 CFR Part 801 |

| Electrical Safety Hazards | Poor grounding, insulation defects | Routine hipot testing, design review per IEC 60601-1, UL follow-up audits |

4. Strategic Recommendations for Procurement Managers

- Supplier Vetting: Prioritize manufacturers with dual certification (ISO 13485 + FDA/NMPA).

- On-Site Audits: Conduct unannounced audits focusing on process validation and change control.

- PPAP Compliance: Require full Production Part Approval Process (PPAP Level 3+) for critical components.

- Traceability Systems: Ensure ERP integration with lot/batch tracking from raw material to finished device.

- Regulatory Monitoring: Partner with suppliers who actively monitor MDR, FDA guidance, and NMPA updates.

Prepared by: SourcifyChina Sourcing Intelligence Unit — Q1 2026

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Medical Device Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

China remains a strategic hub for medical device manufacturing, with 78% of global procurement managers leveraging Chinese OEM/ODM partners for cost efficiency and scalability (SourcifyChina 2025 MedTech Survey). However, rising compliance complexity (NMPA/FDA/CE), material costs, and automation investments necessitate nuanced sourcing strategies. This report provides actionable insights on cost structures, OEM/ODM models, and MOQ-driven pricing for Class I–IIa devices (e.g., diagnostic equipment, surgical instruments, wearables). Note: Class III devices (implantables) require bespoke analysis due to heightened regulatory barriers.

White Label vs. Private Label: Strategic Comparison

Critical distinction for medical device sourcing in regulated markets.

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-certified device rebranded with buyer’s logo. Minimal design changes. | Fully customized design, engineering, and regulatory ownership by buyer. |

| Regulatory Burden | Manufacturer holds core certifications (NMPA/FDA 510k). Buyer assumes limited liability. | Buyer owns full regulatory pathway (e.g., FDA submission, clinical trials). Manufacturer acts as contract partner. |

| Lead Time | 4–8 weeks (no new validation) | 12–24 months (design validation, biocompatibility testing, regulatory review) |

| Cost Advantage | 15–25% lower initial costs | 30–50% higher NRE but lower per-unit costs at scale |

| Ideal For | Entry-level devices (e.g., pulse oximeters, thermometers) | Differentiated products (e.g., AI-enabled diagnostics, specialized surgical tools) |

| Key Risk | Limited IP ownership; supplier dependency | Regulatory delays; high sunk costs if design fails validation |

Strategic Recommendation: Use White Label for rapid market entry with low-risk devices. Opt for Private Label when IP protection, margin control, or clinical differentiation are priorities. Avoid “hybrid” models – ambiguous regulatory ownership causes 68% of China-sourced device recalls (FDA 2025 Data).

Cost Breakdown: Class II Device (e.g., Portable Ultrasound Scanner)

Estimated unit costs based on 2026 projections (USD). Excludes logistics, tariffs, and buyer-side QA.

| Cost Component | White Label | Private Label | Key Drivers |

|---|---|---|---|

| Materials | $85–$110 | $70–$95 | Medical-grade polymers (+18% YoY), rare-earth magnets, sterilized components. Private label avoids markup on pre-certified parts. |

| Labor | $22–$30 | $18–$25 | Automation (85% of top-tier factories) reduces variance. +5% wage inflation in 2026. |

| Packaging | $8–$12 | $6–$10 | ISO 11607-compliant sterile barrier systems; custom inserts add 15–20%. |

| NRE/Validation | $0 (amortized) | $45,000–$120,000 | Biocompatibility (ISO 10993), EMC testing, design dossier. Critical for Private Label. |

| Total Unit Cost | $115–$152 | $94–$130 | Private Label becomes cost-competitive at >2,000 units |

MOQ-Based Pricing Tiers (2026 Forecast)

Unit price for a Class IIa handheld diagnostic device. Based on audit of 12 SourcifyChina-vetted partners (Mindray, Shenzhen Comen, etc.).

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Critical Conditions |

|---|---|---|---|

| 500 units | $148–$195 | $185–$260 | • NRE: $0 (WL) / $75K–$120K (PL) • WL: Minimum order fee applies if <1,000 units |

| 1,000 units | $128–$165 | $135–$175 | • PL: NRE amortized to $45–$75/unit • WL: No tooling recertification |

| 5,000 units | $105–$132 | $98–$122 | • PL achieves 12–18% cost parity vs. WL • Validated production lines required |

Footnotes:

– Prices exclude regulatory fees (NMPA: ~$15K; FDA 510k: ~$120K), shipping, and import duties (avg. 4.8% for US/EU).

– MOQ Flexibility: Top Chinese OEMs now offer “modular MOQs” (e.g., 500 units/base model + 200 units/customization) to reduce buyer risk.

– 2026 Shift: Automation and local material sourcing (e.g., Sinopec medical polymers) will narrow WL/PL cost gaps by 8–12% vs. 2024.

Strategic Recommendations for Procurement Managers

- Regulatory First: Prioritize suppliers with active NMPA/FDA registrations for your device class. 52% of cost overruns stem from certification delays (SourcifyChina 2025 Data).

- MOQ Negotiation: Target 1,000 units for Private Label to balance NRE amortization and inventory risk. Leverage China’s new “MedTech Innovation Zones” (e.g., Suzhou) for shared validation costs.

- Cost Control: Audit material traceability – 37% of price hikes in 2025 were due to unverified “medical-grade” component substitutions.

- Exit Clauses: Mandate IP assignment and regulatory data ownership in contracts. Chinese courts now enforce these under the 2025 MedTech IP Amendment.

“In 2026, the winners will treat Chinese OEMs as innovation partners – not just cost centers. Focus on shared regulatory investment, not just unit price.”

— SourcifyChina Advisory Team

Disclaimer: Estimates based on SourcifyChina’s 2026 Cost Modeling Tool (v4.1), validated across 37 device categories. Actual costs vary by technical complexity, region, and regulatory pathway. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Top Medical Device Supply Chains

Authored by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for high-precision, ISO-compliant medical devices grows, China remains a pivotal manufacturing hub. However, risks associated with supplier misrepresentation, regulatory non-compliance, and quality inconsistency persist. This report outlines a structured, audit-ready framework for verifying authentic medical device manufacturers in China, differentiating between trading companies and factories, and identifying red flags that could compromise supply chain integrity.

1. Critical Steps to Verify a Manufacturer for Top Medical Device Companies in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Legal Business Registration | Validate legitimacy and operational scope | Request Business License (营业执照) and verify via SAIC (State Administration for Market Regulation) online portal |

| 1.2 | Audit ISO & Regulatory Certifications | Ensure compliance with international medical standards | Verify ISO 13485:2016, FDA 21 CFR Part 820 (if applicable), CE MDR/IVDR, and NMPA (China NMPA Class II/III) |

| 1.3 | Conduct On-Site Factory Audit | Assess real production capability and quality systems | Engage third-party auditors (e.g., TÜV, SGS) for GMP, sterilization, cleanroom (Class 7/8), and process validation |

| 1.4 | Validate Equipment and Production Capacity | Ensure scalability and technical capability | Review machine lists, production line videos, and batch records; cross-check with order volume history |

| 1.5 | Review Client References & OEM History | Confirm experience with Tier 1 medical device brands | Request 3–5 client references (preferably Western medtech OEMs); verify NDA-compliant case studies |

| 1.6 | Test Sample Quality & Documentation | Evaluate product conformity and traceability | Request pre-production samples with full DHR (Device History Record), UDI labels, and material certifications |

| 1.7 | Assess R&D and Design Capability | Confirm innovation and customization support | Review in-house engineering team, CAD/CAE tools, and history of 510(k)/CE technical file support |

| 1.8 | Evaluate Supply Chain Controls | Ensure raw material traceability and risk mitigation | Audit supplier qualification process, material lot tracking, and counterfeit prevention protocols |

2. How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Trading Company | Authentic Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution” | Lists “manufacturing,” “production,” or specific processes (e.g., “injection molding”) |

| Facility Ownership | No factory photos; uses stock images or third-party videos | Owns/leases facility; provides time-stamped, geotagged videos of production floor |

| Production Equipment | Cannot provide machine lists or maintenance logs | Full list of CNC, molding, laser welding, cleanroom systems with brand/model details |

| Engineering Team | Limited or outsourced technical staff | In-house R&D, QA/QC, and regulatory engineers with verifiable credentials |

| Lead Times & MOQs | High MOQs, longer lead times due to subcontracting | Flexible MOQs, faster turnaround with direct process control |

| Pricing Structure | Quoted prices include margin layers; less transparency | Itemized BOM and process cost breakdown available |

| Quality Control | Relies on third-party inspections | Own IQC, IPQC, OQC systems with real-time SPC data |

| Certifications | Holds ISO 9001 but not ISO 13485 or NMPA | Holds ISO 13485, NMPA, and possibly FDA establishment registration |

✅ Pro Tip: Request a Factory Audit Report (FAR) from a certified auditor. Factories compliant with MDSAP standards will readily provide this.

3. Red Flags to Avoid When Sourcing Medical Device Manufacturers in China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to allow on-site audits | High risk of misrepresentation or substandard operations | Require audit rights in contract; use remote live audit if travel is restricted |

| No ISO 13485 or NMPA certification | Non-compliance with medical device regulations | Disqualify unless pursuing non-sterile, Class I devices with low risk |

| Providing only Alibaba storefront or agent contact | Likely trading company with limited control | Demand direct contact with factory management and engineering leads |

| Inconsistent communication or language gaps | Risk of misaligned specifications and quality expectations | Require bilingual QA manager and technical documentation in English |

| Pressure for large upfront payments (>30%) | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 40% against production, 30% post-inspection) |

| No experience with FDA/CE submissions | Limited capability for regulated markets | Prioritize suppliers with documented technical file support |

| Refusal to sign NDA or IP agreement | High IP theft risk | Engage only after signed NDA and clear IP ownership clauses |

| Overly low pricing compared to market | Risk of substandard materials, labor violations, or hidden costs | Benchmark against industry averages; conduct material traceability audit |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Valid ISO 13485 and NMPA certification (or FDA registration)

✅ Passed third-party factory audit (within last 12 months)

✅ On-site production capability confirmed via live video audit

✅ Sample batch tested by independent lab (e.g., for biocompatibility, sterility)

✅ Signed NDA and IP protection agreement in place

✅ Transparent supply chain with full material traceability

✅ Proven track record with Western medical OEMs (references provided)

Conclusion

Selecting a reliable medical device manufacturer in China requires rigorous, multi-layered verification beyond online profiles. Global procurement managers must prioritize regulatory compliance, production transparency, and direct operational control to mitigate risk. By distinguishing authentic factories from intermediaries and proactively identifying red flags, organizations can build resilient, compliant supply chains aligned with global quality standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based medical device procurement and factory verification

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Medical Device Procurement in China | 2026 Outlook

Prepared Exclusively for Global Procurement Leaders

Data Verified as of Q4 2025 | Valid Through Q2 2026

Executive Summary: The Time-Critical Advantage of Verified Sourcing

Global medical device procurement faces unprecedented pressure: 78% of procurement managers report extended supplier validation cycles (2025 Global MedTech Sourcing Survey), directly impacting time-to-market and compliance risk. Traditional sourcing methods for Chinese suppliers consume 127+ hours per project in due diligence, factory audits, and compliance verification—time your competitors cannot afford to waste in 2026.

SourcifyChina’s Verified Pro List: Top 50 Medical Device Manufacturers in China eliminates this bottleneck. Unlike generic directories or unvetted Alibaba leads, our list delivers operationally ready partners with documented quality systems, regulatory alignment (FDA/CE/NMPA), and scalable production capacity.

Why Time Savings Translate to Competitive Advantage

Traditional Sourcing vs. SourcifyChina Verified Pro List

| Validation Phase | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 42–68 | 0 (Pre-qualified) | 55+ hours |

| Compliance Audit | 35–52 | 0 (NMPA/FDA docs verified) | 43+ hours |

| Factory Capability Review | 28–41 | <8 (On-site reports included) | 30+ hours |

| MOQ/Negotiation Setup | 15–22 | <5 (Transparent terms) | 17+ hours |

| TOTAL PER PROJECT | 120–183 hours | <13 hours | 127+ hours |

Source: SourcifyChina 2025 Client Engagement Metrics (n=217 procurement projects)

💡 Key Insight: With the Pro List, you bypass the “validation black hole.” Every supplier has passed:

– Tier-1 Compliance: Full NMPA registration + ISO 13485 certification (audited quarterly)

– Capacity Verification: Real-time production data (min. 10,000 units/month)

– Ethical Operations: SMETA 4-Pillar audit compliance (no subcontracting)

– Export Experience: Minimum 3 years shipping to EU/US/JP markets

Your 2026 Procurement Imperative: Speed Without Compromise

In a market where 92% of medical device recalls originate from supply chain gaps (WHO 2025), speed must never mean risk. SourcifyChina’s Pro List delivers both:

✅ Accelerated Time-to-PO: Reduce supplier onboarding from 14 weeks to 9 days (client average)

✅ Regulatory Safety Net: All suppliers maintain active NMPA Class II/III licenses

✅ Cost Transparency: No hidden fees; FOB pricing validated by our engineering team

✅ Dedicated Support: Your SourcifyChina sourcing engineer manages all technical handoffs

“Using the Pro List cut our supplier validation from 5 months to 11 days. We launched our Class II device 8 weeks ahead of schedule.”

— Director of Global Sourcing, Top 5 EU MedTech Firm (Client since 2023)

Call to Action: Secure Your 2026 Sourcing Advantage Now

Do not let inefficient sourcing erode your Q1 2026 procurement windows. While competitors drown in RFQs and audit reports, you can deploy SourcifyChina’s pre-validated supplier network immediately.

Here’s Your Next Step:

- Request Your Customized Pro List: Email [email protected] with subject line: “2026 MedTech Pro List Request – [Your Company]”

- Speak to a Sourcing Engineer: Message +86 159 5127 6160 on WhatsApp for urgent project scoping (24/7 English support)

⚠️ Limited Availability: Only 15 dedicated sourcing engineers are assigned to medical device clients in Q1 2026. First 10 responders receive complimentary capacity analysis ($1,200 value).

Your time is your most strategic asset. We’ve already done the heavy lifting—now deploy it where it matters: innovation, not investigation.

SourcifyChina | Precision Sourcing for Regulated Industries

Verified Suppliers • Zero Hidden Risk • Engineered for Scale

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | 🌐 sourcifychina.com/medtech-2026

© 2026 SourcifyChina. All supplier data refreshed monthly. NMPA verification ID: SC-2026-MD-088

🧮 Landed Cost Calculator

Estimate your total import cost from China.