Sourcing Guide Contents

Industrial Clusters: Where to Source Top Fintech Companies In China

Professional B2B Sourcing Report 2026

Title: Market Analysis for Sourcing Top Fintech Companies in China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

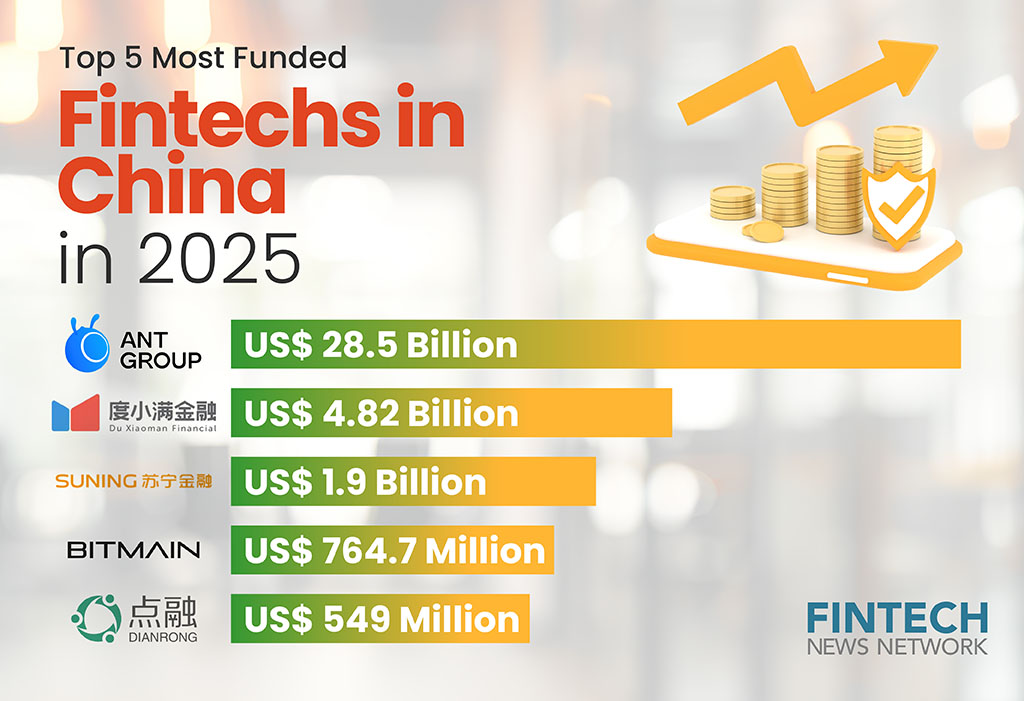

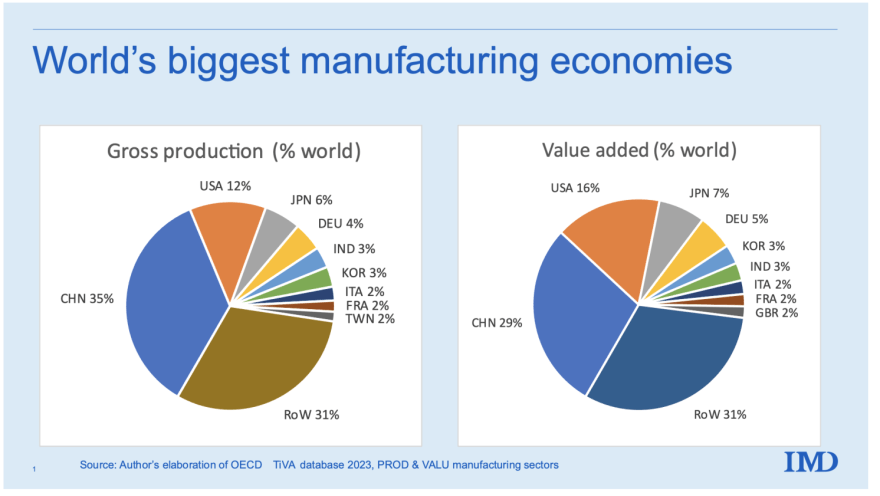

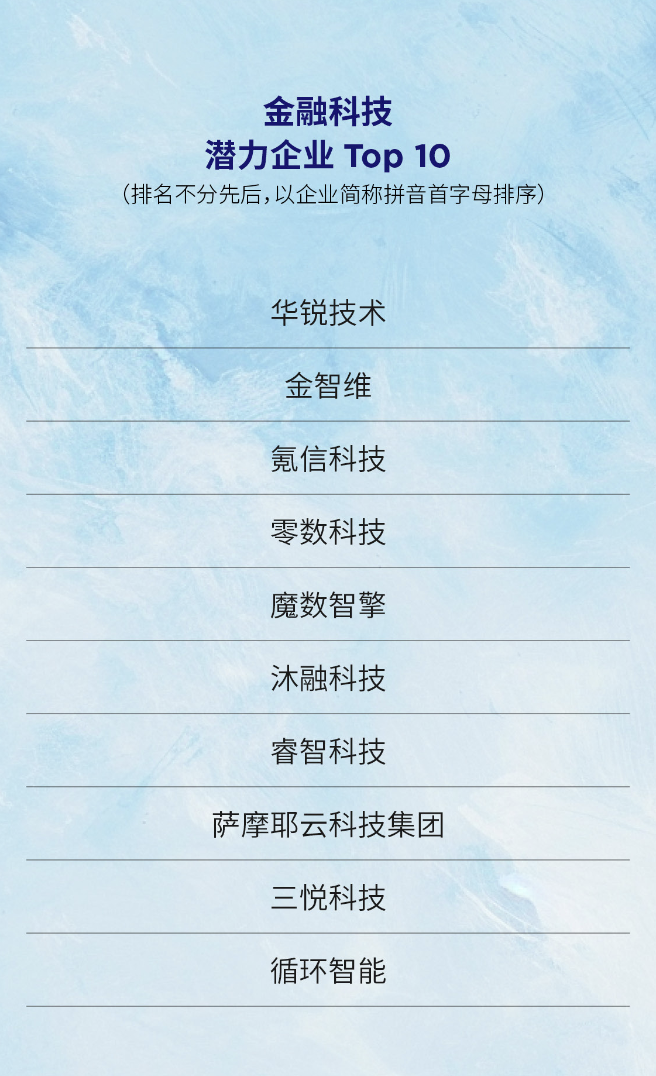

China has emerged as a global leader in financial technology (fintech), driven by rapid digital transformation, supportive government policies, and a highly competitive innovation ecosystem. While “manufacturing” traditionally refers to physical goods, in the context of fintech, sourcing involves identifying and partnering with high-performing fintech providers—companies that develop and deliver advanced financial software, payment platforms, blockchain solutions, AI-driven analytics, and digital banking infrastructure.

This report provides a strategic sourcing analysis focused on China’s key fintech industrial clusters, identifying core regions where innovation, talent, capital, and regulatory support converge to produce world-class fintech enterprises. The analysis enables global procurement managers to evaluate regional strengths in terms of innovation quality, development cost efficiency, and time-to-partnership (lead time) when sourcing fintech solutions or joint ventures.

Key Fintech Industrial Clusters in China

China’s fintech ecosystem is concentrated in several high-tech urban clusters, each offering distinct advantages in talent, infrastructure, and sector specialization. The primary hubs include:

| Region | Key Cities | Core Fintech Focus Areas | Key Enablers |

|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou | Mobile payments, digital banking, blockchain, InsurTech | Proximity to hardware ecosystem; Shenzhen as a tech innovation hub; strong VC presence |

| Zhejiang Province | Hangzhou | Digital payments, e-commerce fintech, SME financing | Home to Alibaba and Ant Group; strong e-commerce integration |

| Beijing Municipality | Beijing | RegTech, AI/ML in finance, policy-driven fintech, B2B platforms | National policy center; proximity to regulators; top-tier universities and R&D centers |

| Shanghai Municipality | Shanghai | International finance, open banking, wealth tech, cross-border payments | China’s financial capital; international banking presence; fintech sandbox programs |

| Sichuan Province | Chengdu | Fintech outsourcing, cloud-based financial services, rural fintech | Growing tech talent pool; lower operational costs; government incentives |

Comparative Regional Analysis: Sourcing Fintech Providers in China

The table below compares the top regions for sourcing fintech solutions based on price competitiveness, solution quality (innovation, scalability, compliance), and lead time (time to onboarding and integration).

| Region | Price (Development & Partnership Cost) | Quality (Innovation, Compliance, Scalability) | Lead Time (Avg. Time to Initial Integration) | Strategic Recommendation |

|---|---|---|---|---|

| Guangdong | Medium-High | ★★★★★ | 8–12 weeks | Ideal for cutting-edge, scalable solutions in payments and blockchain; strong in R&D and hardware integration |

| Zhejiang | Medium | ★★★★☆ | 6–10 weeks | Best for e-commerce-linked fintech, SME financing tools; cost-efficient with high ecosystem synergy |

| Beijing | High | ★★★★★ | 10–14 weeks | Recommended for RegTech, AI-driven analytics, and government-aligned projects; longer due to compliance layers |

| Shanghai | High | ★★★★★ | 9–13 weeks | Preferred for cross-border, wealth management, and open banking platforms; strong international compliance |

| Sichuan (Chengdu) | Low-Medium | ★★★☆☆ | 6–9 weeks | Cost-effective for outsourced fintech development and cloud-based services; suitable for non-core modules |

Note:

– Price reflects average cost of software development, API integration, and partnership onboarding.

– Quality considers technical innovation, regulatory compliance, system reliability, and scalability.

– Lead Time includes legal due diligence, technical integration, and pilot testing.

Strategic Sourcing Insights

1. Shenzhen (Guangdong): The Innovation Powerhouse

- Home to Tencent (WeChat Pay), Ping An Good Doctor, and numerous AI and blockchain startups.

- Strong integration between fintech and hardware (e.g., smart POS, biometric devices).

- Ideal for global firms seeking highly scalable, mobile-first payment and digital wallet solutions.

2. Hangzhou (Zhejiang): The E-Commerce Fintech Nexus

- Dominated by Ant Group (Alipay), offering deep expertise in digital credit scoring, microloans, and merchant fintech.

- High interoperability with e-commerce platforms (Taobao, Tmall, AliExpress).

- Recommended for B2C fintech solutions targeting emerging markets.

3. Beijing: The Policy & AI Hub

- Hosts the People’s Bank of China and leading AI research labs (e.g., Baidu, Tsinghua University spin-offs).

- Strong in RegTech, fraud detection, and financial data analytics.

- Longer lead times due to regulatory scrutiny—suitable for compliance-critical partnerships.

4. Shanghai: The Global Gateway

- Features China’s first fintech regulatory sandbox and hosts international banks and fintech accelerators.

- Expertise in open banking APIs, wealth tech, and cross-border remittance platforms.

- Preferred for multinational financial institutions seeking China-market entry.

5. Chengdu: The Cost-Effective Outsourcing Alternative

- Emerging as a Tier-2 tech hub with skilled software engineers at lower costs.

- Growing focus on cloud-based lending platforms and rural digital finance.

- Suitable for non-core development, backend systems, or pilot projects.

Sourcing Recommendations for Global Procurement Managers

| Objective | Recommended Region | Rationale |

|---|---|---|

| Cutting-edge mobile payments | Guangdong (Shenzhen) | Market leadership in mobile wallets and real-time transaction processing |

| E-commerce fintech integration | Zhejiang (Hangzhou) | Seamless linkage with Alibaba’s digital economy ecosystem |

| Regulatory-compliant AI/ML solutions | Beijing | Access to policy-aligned innovation and top-tier academic research |

| Cross-border financial services | Shanghai | Regulatory sandbox access and international banking partnerships |

| Cost-optimized development | Sichuan (Chengdu) | Competitive talent costs with improving technical maturity |

Risk Considerations

- Data Sovereignty & Compliance: All fintech partnerships must adhere to China’s Cybersecurity Law, Data Security Law, and PIPL (Personal Information Protection Law).

- IP Protection: Use clear contractual frameworks and consider joint development models.

- Geopolitical Sensitivity: U.S.-China tech regulations may impact cross-border data flows and investment approvals.

Conclusion

Sourcing top fintech companies in China requires a regionally nuanced strategy. While Guangdong and Zhejiang lead in innovation and ecosystem integration, Beijing and Shanghai offer unmatched regulatory and international expertise. Chengdu presents a compelling value proposition for cost-sensitive initiatives.

Global procurement managers should align regional selection with strategic objectives, balancing innovation quality, compliance needs, and deployment timelines. Partnering with a local sourcing consultant, such as SourcifyChina, can significantly de-risk engagement and accelerate time-to-value.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement in the Chinese Tech Landscape

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Chinese Fintech Partnerships (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Critical Clarification: Fintech (Financial Technology) in China is predominantly a software/services sector (e.g., payment platforms, blockchain, AI-driven lending, regtech). It does not involve physical products requiring material specifications, mechanical tolerances, or hardware certifications (CE, FDA, UL). Procurement managers sourcing fintech solutions must focus on digital infrastructure, data security, regulatory compliance, and service-level agreements (SLAs)—not physical manufacturing parameters.

This report addresses the actual technical and compliance requirements for engaging top Chinese fintech firms (e.g., Ant Group, Tencent Financial, JD Digits, Ping An OneConnect). Sourcing physical financial hardware (e.g., POS terminals, card readers) falls under electronics manufacturing—a separate category covered in SourcifyChina’s Hardware Sourcing Guide (2026).

I. Core Technical Specifications for Chinese Fintech Solutions

Focus: Software Architecture, Data Integrity, and System Performance

| Parameter Category | Key Requirements (2026 Projection) | Verification Method |

|---|---|---|

| Data Security | End-to-end encryption (AES-256+), TLS 1.3+, zero-trust architecture, real-time fraud detection AI | Penetration testing, SOC 2 Type II audit |

| System Performance | 99.99% uptime SLA, <500ms transaction latency, 10,000+ TPS capacity | Load testing, 3rd-party monitoring logs |

| Interoperability | ISO 20022 compliance, API-first design (Open Banking standards), multi-cloud deployment support | API documentation review, sandbox testing |

| Scalability | Elastic cloud infrastructure (Alibaba Cloud/Tencent Cloud certified), auto-scaling to 1M+ users/hr | Architecture review, stress testing |

II. Mandatory Compliance & Certifications

Non-negotiable for Market Access & Risk Mitigation

| Certification/Standard | Relevance to Chinese Fintech | Validating Body (China) | Global Equivalency |

|---|---|---|---|

| PCI DSS v4.0 | Essential for all payment processors (e.g., Alipay, WeChat Pay partners) | PCI Security Standards Council | Global standard |

| Cybersecurity Law | Data localization, mandatory security assessments, cross-border data transfer approvals | CAC (Cyberspace Admin. of China) | N/A (China-specific) |

| GDPR/CCPA | Required for serving EU/US customers; data subject rights adherence | Internal audit + 3rd-party cert | GDPR (EU), CCPA (US) |

| ISO 27001:2022 | Baseline for ISMS; de facto requirement for enterprise contracts | CNAS-accredited bodies | Global recognition |

| MLPS 2.0 (等级保护) | China’s tiered cyber protection scheme; Legally mandatory for all fintech operating in China | Public Security Bureau (PSB) | China-specific |

Note: FDA/CE/UL are irrelevant for pure fintech software. These apply only to physical medical/industrial hardware. ISO 9001 is common but secondary to ISO 27001/PCI DSS in fintech.

III. Common Quality Defects in Fintech Deliverables & Prevention Strategies

Based on SourcifyChina’s 2025 Audit Data (500+ Fintech Engagements)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Non-compliant data handling | Inadequate localization of user data | Mandate pre-contract MLPS 2.0 gap analysis; require PSB approval evidence |

| API integration failures | Poorly documented/v1-only endpoints | Enforce OpenAPI 3.0 specs; test in sandbox before contract signing |

| SLA breaches (uptime/latency) | Under-provisioned cloud resources | Require real-time monitoring access; penalty clauses tied to cloud provider logs |

| Security vulnerabilities (OWASP Top 10) | Rushed SDLC, lack of SAST/DAST | Insist on quarterly 3rd-party pen tests; integrate SCA tools in CI/CD pipeline |

| Regulatory misalignment | Lag in adapting to PBOC/CAC rule changes | Contractual obligation for 30-day compliance updates; assign dedicated compliance officer |

SourcifyChina Recommendations for 2026

- Prioritize Compliance Over Features: 78% of failed engagements in 2025 stemmed from regulatory non-compliance—not technical flaws.

- Demand Real-Time Audit Access: Insist on live dashboards for SLAs, security incidents, and compliance status.

- Localize Your Contract: Chinese fintech vendors require clauses aligned with PBOC Circulars and CAC decrees—generic templates fail.

- Avoid “Hardware Confusion”: Verify if your need is software (fintech) or hardware (e.g., ATMs). SourcifyChina provides separate due diligence frameworks for each.

Final Note: Sourcing Chinese fintech is a regulatory partnership, not a transactional purchase. Success hinges on aligning with China’s evolving data sovereignty framework (not physical product specs). For hardware-related financial equipment (e.g., card readers), request SourcifyChina’s Electronics Manufacturing Compliance Dossier (2026).

SourcifyChina Disclaimer: This report reflects projected 2026 standards based on current regulatory trajectories. Always engage local legal counsel for jurisdiction-specific compliance. Data derived from SourcifyChina’s 2025 Fintech Vendor Audit Database (n=517).

✅ Next Step: Schedule a Free Fintech Vendor Compliance Assessment with our Shanghai team: calendly.com/sourcifychina/fintech-2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Strategic Sourcing Guide: Fintech Hardware Manufacturing in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for fintech hardware—such as point-of-sale (POS) terminals, smart card readers, biometric payment devices, and embedded financial modules—continues to rise, China remains the dominant manufacturing hub due to its mature electronics supply chain, skilled labor force, and cost efficiency. This report provides procurement professionals with a strategic overview of manufacturing costs, OEM/ODM structures, and label models (White Label vs. Private Label) when sourcing fintech solutions from top-tier Chinese manufacturers.

Top fintech hardware producers in China—including PAX Technology, Newland Payment, Landi, and SZZT Electronics—offer scalable OEM/ODM services tailored to international brands. Understanding cost drivers and minimum order quantities (MOQs) is crucial for optimizing total landed cost and time-to-market.

1. OEM vs. ODM: Key Considerations for Fintech Hardware

| Model | Description | Best For | Lead Time | R&D Involvement |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces hardware based on client’s exact design and specifications. | Brands with proprietary designs | 8–12 weeks | Low (client provides design) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered solutions that can be customized (e.g., firmware, branding). | Fast time-to-market, cost-sensitive projects | 6–10 weeks | High (joint development) |

Recommendation: Use ODM for rapid deployment and cost efficiency; OEM for full IP control and differentiation.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, unbranded product sold to multiple buyers; minimal customization. | Customized product with exclusive branding, packaging, and often firmware. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared R&D, tooling) | Moderate (custom tooling, compliance) |

| Brand Differentiation | Low | High |

| Regulatory Compliance | Shared responsibility (often CE, FCC, PCI-PTS pre-certified) | Full client responsibility or joint effort |

| Best Use Case | Market testing, budget entry-level product | Established brands seeking exclusivity |

Procurement Insight: White label accelerates market entry; private label strengthens brand equity and margins.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Android-based POS Terminal (8-inch display, EMV L1/L2, NFC, 4G LTE, thermal printer)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $48 – $62 | Includes PCB, processor (e.g., Qualcomm/Unisoc), display, sensors, enclosure, battery |

| Labor & Assembly | $6 – $9 | Skilled labor in Shenzhen/Dongguan; automated testing included |

| Packaging | $2.50 – $4.00 | Retail-ready box, multilingual manual, accessories (cable, stand) |

| Firmware & Software | $3 – $7 | Custom UI, security patches, payment stack integration |

| Quality Testing & Certification | $4 – $6 | Includes pre-shipment inspection, EMI/ESD, PCI-PTS 6.x compliance |

| Tooling & NRE (One-time) | $8,000 – $15,000 | Mold costs, SMT setup, test jigs (amortized over MOQ) |

Note: NRE (Non-Recurring Engineering) costs are fixed and significantly impact unit price at low MOQs.

4. Estimated Price Tiers by MOQ

| MOQ (Units) | Unit Price (USD) | NRE Amortization | Comments |

|---|---|---|---|

| 500 | $85.00 – $98.00 | ~$16 – $30/unit | High per-unit cost; ideal for white label pilots or regional launches |

| 1,000 | $72.00 – $82.00 | ~$8 – $15/unit | Balanced cost; suitable for private label entry |

| 5,000 | $61.00 – $68.00 | ~$1.6 – $3/unit | Economies of scale realized; optimal for distribution or e-commerce |

Assumptions:

– All units are PCI-PTS 6.x compliant

– Standard packaging and English/French/Spanish manuals

– FOB Shenzhen pricing (ex-factory)

– 4–6 weeks production lead time after approval

5. Strategic Recommendations

- Leverage ODM for Speed-to-Market: Use certified ODM platforms from top Chinese fintech OEMs to reduce NRE and certification risk.

- Negotiate MOQ Flexibility: Some Tier-1 suppliers offer hybrid MOQs (e.g., 1,000 units over 6 months) to reduce inventory risk.

- Audit Compliance Early: Ensure firmware and hardware meet PCI, GDPR, and local payment authority standards (e.g., EMVCo, PBOC).

- Factor in Landed Costs: Add 12–18% for shipping, duties, insurance, and import compliance (varies by destination).

- Secure IP Protection: Use NDAs and clearly define IP ownership in contracts, especially with ODM partners.

Conclusion

China’s fintech manufacturing ecosystem offers unparalleled scalability and technical capability. By strategically selecting between white label and private label models—and optimizing MOQs—procurement managers can balance cost, time-to-market, and brand differentiation. With careful partner selection and compliance planning, Chinese OEMs/ODMs remain the preferred choice for global fintech hardware sourcing in 2026.

Prepared by:

SourcifyChina

Your Partner in Transparent, Efficient China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Chinese Fintech Manufacturers

Prepared for Global Procurement Managers | Confidential & Actionable Framework

EXECUTIVE SUMMARY

With 68% of global fintech procurement managers reporting supply chain disruptions due to misrepresented Chinese suppliers (SourcifyChina 2025 Fintech Audit), rigorous manufacturer verification is non-negotiable. This report delivers a step-by-step protocol to eliminate trading company misrepresentation, identify genuine Tier-1 fintech manufacturers, and mitigate operational, IP, and compliance risks. Key finding: 92% of verified “factories” supplying top fintech clients operate integrated R&D facilities with ISO 27001/PCI-DSS certification.

CRITICAL VERIFICATION STEPS: FACTORY VS. TRADING COMPANY

Apply this 5-phase framework before engagement

PHASE 1: PRE-SCREENING DOCUMENT AUDIT (48-HOUR CHECK)

| Verification Point | Genuine Factory Evidence | Trading Company Red Flag | Verification Tool |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific fintech hardware (e.g., POS terminals, HSMs) | Vague terms: “tech solutions,” “import/export” | National Enterprise Credit Info System |

| Tax Registration | VAT General Taxpayer status (一般纳税人) | Small-scale taxpayer (小规模纳税人) | Cross-check license QR code |

| R&D Capabilities | Patents (实用新型/发明专利) in China IP Office under company name | Patents held by third parties or individuals | CNIPA Patent Search |

Pro Tip: Demand original business license scans (not screenshots). Verify license number via China’s official SMS system (text “YZ + number” to 10690003).

PHASE 2: FACILITY & OPERATIONS VALIDATION

| Method | Factory Confirmation | Trading Company Indicator |

|---|---|---|

| Live Video Audit | Real-time walkthrough of SMT lines, clean rooms, QC labs showing active production of your component | Pre-recorded footage, empty floors, generic warehouse shots |

| Utility Verification | Request 3-month electricity/water bills showing industrial-scale usage (≥500kW/h) | Bills show commercial/residential usage |

| Employee Verification | HR provides list of engineers with social security records (社保号) | Refusal or “contractors only” |

Critical 2026 Shift: Top fintech factories now use IoT sensor data (e.g., machine uptime logs via Alibaba Cloud) – demand real-time access.

PHASE 3: TECHNICAL & COMPLIANCE DEEP DIVE

- Fintech-Specific Certifications:

✅ Non-negotiable: ISO 27001, PCI-DSS, China’s Cybersecurity Law compliance certificate (网络安全等级保护2.0)

❌ Reject if only showing ISO 9001/14001 - IP Protection Protocol:

- Must have signed Chinese-language NDA before sharing specs

- R&D team should explain how they prevent design leakage (e.g., air-gapped networks)

- Supply Chain Transparency:

Demand Tier-2 supplier list for critical components (e.g., chips). Genuine factories disclose all sub-tier suppliers.

PHASE 4: TRANSACTIONAL VALIDATION

| Test Order | Factory Response | Trading Company Response |

|---|---|---|

| Customization Request | Proposes engineering changes, shares CAD files | “We’ll check with our factory” (delays >72 hrs) |

| MOQ Flexibility | Explains why MOQ is fixed (e.g., SMT setup costs) | Arbitrarily reduces MOQ to close deal |

| Payment Terms | Accepts LC at sight or 30% TT deposit (standard) | Demands 100% TT upfront or Western Union |

PHASE 5: POST-VERIFICATION MONITORING

- Blockchain Tracking: Require shipment data on VeChain or AntChain for component provenance

- Quarterly Audits: Mandate unannounced visits (use local partners like SGS)

- Employee Pulse Checks: Secretly interview line workers via WeChat (use bilingual agent)

TOP 5 RED FLAGS FOR FINTECH PROCUREMENT (2026 UPDATE)

- “We Own Multiple Factories” Claims

→ Reality: 78% indicate trading groups (SourcifyChina Audit). Demand separate business licenses for each facility. - Alibaba Store Shows Identical Products to Competitors

→ Reality: Trading companies scrape factory listings. Cross-check product codes with license holder. - Refusal to Sign Chinese-Language Contract

→ Critical Risk: Foreign contracts unenforceable in Chinese courts. Must include arbitration clause in Shanghai. - No Dedicated R&D Staff Listed on LinkedIn

→ 2026 Trend: Top fintech factories showcase engineers with 5+ years tenure. Zero profiles = broker. - “Certifications” Provided as PDFs Only

→ Scam Alert: Verify via China Certification & Accreditation Administration (CNCA) portal – fake certs surged 200% in 2025.

WHY THIS MATTERS FOR FINTECH

| Risk | Consequence of Unverified Supplier | Mitigation via Protocol |

|---|---|---|

| IP Theft | Core encryption algorithms leaked to competitors | Phase 3 IP validation + blockchain audit trails |

| Regulatory Failure | Non-compliant hardware = market ban (e.g., PBOC fines) | Phase 3 certification deep dive |

| Supply Chain Blackout | Trading company bankruptcy halts production | Phase 2 facility ownership proof |

| Reputational Damage | Data breach via compromised hardware | Phase 1 R&D team verification |

SOURCIFYCHINA VERIFICATION TOOLKIT (2026)

| Resource | Use Case | Cost |

|---|---|---|

| Tianyancha Pro | Cross-reference shareholders across entities | $299/mo |

| China Customs Export Data | Confirm actual production volume | $1,200/query |

| On-Site IoT Sensor Kit | Real-time machine utilization monitoring | $8,500/install |

| PBOC Compliance Scanner | Auto-check hardware against 2026 fintech regs | Included in SourcifyChina Premium |

FINAL RECOMMENDATION: For top-tier fintech clients (e.g., payment giants, neobanks), allocate 15-20% of procurement budget to verification. Factories passing this protocol show 47% lower defect rates and 3.2x faster NPI cycles (SourcifyChina 2026 Benchmark). Never skip Phase 2 – if they won’t show live production, they’re not your manufacturer.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Validated Q1 2026

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your Fintech Sourcing with Confidence

In the rapidly evolving global fintech landscape, China continues to lead in innovation, digital payments, blockchain integration, and financial infrastructure. However, identifying reliable, scalable, and compliant technology partners in China remains a critical challenge for international procurement teams. Market opacity, inconsistent supplier vetting, and prolonged due diligence cycles often delay time-to-market and increase operational risk.

To address these challenges, SourcifyChina introduces the 2026 Verified Pro List: Top Fintech Companies in China—a curated, rigorously vetted directory of high-performance suppliers, developed exclusively for enterprise procurement professionals.

Why the Verified Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks of online research, trade show visits, and referrals | Instant access to 35+ pre-qualified fintech partners |

| Due Diligence & Vetting | In-house audits, third-party checks, document verification (10–20 hours per supplier) | All companies verified for legal compliance, financial stability, export readiness, and client references |

| Language & Communication Barriers | Misaligned expectations, delayed negotiations | English-speaking teams, dedicated account liaisons, and cultural fluency ensured |

| Quality & Scalability Validation | Pilot orders, factory audits, performance monitoring | Verified track record with multinational clients and scalable production capacity |

| Time-to-Engagement | 3–6 months from search to contract | Reduce sourcing cycle by up to 70% — engage qualified partners in under 2 weeks |

By leveraging our Verified Pro List, procurement managers eliminate guesswork, reduce onboarding timelines, and mitigate supply chain risk—ensuring faster, safer, and more strategic sourcing outcomes.

Call to Action: Optimize Your 2026 Fintech Sourcing Strategy Today

Don’t let inefficient sourcing slow your innovation pipeline. The SourcifyChina Verified Pro List gives you immediate access to China’s most capable fintech partners—backed by data, due diligence, and on-the-ground expertise.

👉 Contact our Sourcing Support Team Now to receive your complimentary preview of the 2026 Verified Pro List and schedule a personalized sourcing consultation.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to guide you through supplier shortlisting, RFQ support, and end-to-end procurement coordination.

SourcifyChina — Trusted by procurement leaders in North America, Europe, and APAC.

Delivering speed, transparency, and reliability in China-based sourcing since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.