Sourcing Guide Contents

Industrial Clusters: Where to Source Top Ev Charging Companies In China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of EV Charging Infrastructure in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q3 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

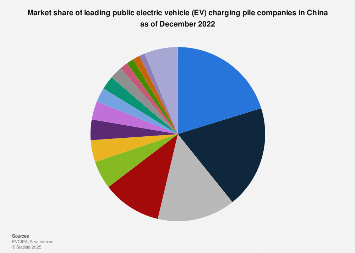

China dominates global EV charging infrastructure production, accounting for ~65% of global supply (2025). Sourcing from China offers significant cost advantages but requires strategic navigation of regional clusters, quality tiers, and evolving regulatory landscapes. This report identifies core manufacturing hubs, analyzes regional trade-offs, and provides actionable insights for de-risking procurement. Critical Recommendation: Prioritize cluster-specific supplier vetting; regional generalizations mask significant variance in capabilities. Jiangsu and Guangdong lead in innovation, while Zhejiang excels in cost-optimized volume production.

Methodology & Scope

- Data Sources: China Electricity Council (CEC), NEV Industry Association, Customs Export Data (2023-2025), SourcifyChina Supplier Audit Database (1,200+ suppliers), On-Ground Cluster Visits (Q1 2026).

- “Top” Definition: Focus on export-ready manufacturers with ≥$5M annual export revenue, certified to IEC 61851/UL 2594, and proven project deployment (min. 500 units). Excludes pure domestic players and non-certified OEMs.

- Key Metrics Analyzed: Regional cost structures, quality compliance rates, lead time drivers, innovation capacity, and logistics infrastructure.

China’s EV Charging Manufacturing Cluster Map: Key Industrial Hubs (2026)

| Cluster (Core Cities) | Dominant Product Focus | Key Strengths | Leading Players (Export-Oriented Examples) | Strategic Fit for Global Buyers |

|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | High-Power DC Fast Chargers (120kW+), Smart AC Units, Charging Management Software | Tech innovation hub, strongest R&D (50%+ of patents), proximity to Shenzhen port/logistics, highest concentration of Tier-1 suppliers. | NARI Technology, TELD, Xiamen New Energy (EVTECH), Star Charge | Premium projects requiring cutting-edge tech, IoT integration, global certifications (UL, TÜV). Higher cost justified by performance/reliability. |

| Zhejiang (Ningbo, Wenzhou, Hangzhou) | AC Wallboxes (Type 1/2), Mid-Power DC (60-120kW), Components (Connectors, PCBs) | Cost leadership, robust component supply chain, strong OEM/ODM ecosystem, efficient mid-volume production. Ningbo port access. | Wallbox Chargers (WBC), Hitek Electronic, Zhejiang Tgood Electric, Cordex | High-volume deployments (fleets, residential), cost-sensitive projects, standardized AC/DC units. Best value for balanced quality/cost. |

| Jiangsu (Nanjing, Suzhou, Wuxi) | Integrated Charging Systems, DC Modules, Energy Storage Integration | Rising R&D investment, strong university-industry links, focus on grid integration & V2G tech. Well-developed industrial parks. | State Grid EV Service Co., Suzhou Aisino, Nanjing NF, Delta Electronics (China) | Future-proof projects needing grid services, V2G compatibility, or integrated energy solutions. Emerging quality leader. |

| Shanghai/Anhui (Hefei) | Specialized DC Fast Chargers, Fleet Solutions | Proximity to major OEMs (SAIC, NIO), strong automotive electronics base. | Potevio, NIO Power, Hefei National Instrument | Strategic partnerships with Chinese EV OEMs; niche high-power applications. |

Cluster Insight (2026): Guangdong maintains tech leadership, but Jiangsu is the fastest-growing cluster for next-gen solutions (V2G, bi-directional). Zhejiang’s cost advantage persists but narrows slightly due to rising wages. Shanghai/Anhui focus remains highly specialized.

Regional Production Hub Comparison: Strategic Trade-Off Analysis (2026 Projection)

| Parameter | Guangdong (Shenzhen Focus) | Zhejiang (Ningbo/Wenzhou Focus) | Jiangsu (Nanjing/Suzhou Focus) | Key Drivers & Notes |

|---|---|---|---|---|

| Price (Landed Cost – 22kW AC Unit) | Premium (12-15% above avg.) | Most Competitive (Avg. -8-12%) | Moderate (Avg. -3-5%) | GD: Higher labor/R&D costs, premium materials. ZJ: Scale, component verticality, efficient logistics. JS: Rising wages offset by automation gains. |

| Quality (Export-Grade Consistency) | ★★★★★ (Highest Consistency) | ★★★☆☆ (Good, Higher Variance) | ★★★★☆ (Rapidly Improving) | GD: Strictest internal QA, >95% audit pass rate for global certs. ZJ: Variance between tiered suppliers; vetting critical. JS: Strong process control, near-GD levels for established players. |

| Lead Time (Standard Order) | 10-14 Weeks | 8-12 Weeks | 9-13 Weeks | GD: Complex tech validation adds time. ZJ: Streamlined processes, port proximity (Ningbo). JS: Slightly longer for custom V2G solutions. |

| Innovation Capacity | Leader (60%+ New Tech) | Moderate (Standardization) | Emerging Leader (V2G Focus) | GD: AI, ultra-fast charging. ZJ: Cost-optimized designs. JS: Grid integration, bi-directional tech. |

| Risk Profile | Medium (IP, Tech Shifts) | Medium-High (Quality Variance) | Medium (Newer Ecosystem) | GD: IP protection vigilance needed. ZJ: Supplier tiering essential. JS: Due diligence on newer players advised. |

Critical Footnotes:

1. “Price” reflects landed cost (FOB + ocean freight to Rotterdam/Riverport) for certified, export-ready units. Guangdong’s premium is justified for complex DC fast chargers; gap narrows for basic AC units.

2. Quality is measured by SourcifyChina audit pass rates for critical export certifications (UL, CE, TÜV) and field failure rates (<0.5% target). Zhejiang requires stricter supplier tiering.

3. Lead Times include production + customs clearance. Guangdong benefits from Shenzhen port efficiency but complex tech validation adds buffer.

4. Supplier-Specific Variance > Regional Averages: A Tier-1 Zhejiang supplier (e.g., WBC) may outperform a mid-tier Guangdong player on cost/lead time without sacrificing quality. Vetting is non-negotiable.

Strategic Sourcing Recommendations for 2026

-

Match Cluster to Project Tier:

- Premium/Innovation-Critical (e.g., Highway Corridors): Prioritize Guangdong (NARI, TELD) or Jiangsu (Aisino, NF) for reliability and future-proof tech. Accept 10-15% cost premium.

- Volume/Value (e.g., Fleet Depots, Residential): Target Tier-1 Zhejiang suppliers (WBC, Hitek) for optimal cost/quality balance. Implement rigorous quality gating.

- Grid-Integrated/V2G Pilots: Engage Jiangsu specialists early; expect longer lead times but superior system integration.

-

De-Risk Through Cluster Expertise:

- Guangdong: Focus on IP protection clauses and tech roadmap alignment. Verify R&D capabilities beyond marketing claims.

- Zhejiang: Implement multi-stage quality audits (pre-shipment and in-field). Prioritize suppliers with dedicated export QA teams.

- Jiangsu: Validate grid-certification experience (e.g., China Southern Power Grid standards) and energy management software.

-

Leverage Logistics Intelligently:

- Consolidate shipments through Ningbo (Zhejiang) for cost efficiency on volume orders.

- Use Shenzhen (Guangdong) for urgent, high-value tech components or smaller pilot shipments.

- Avoid Shanghai ports for EVSE; congestion adds 7-10 days vs. Ningbo/Shenzhen.

-

Future-Proofing: Monitor Jiangsu’s V2G ecosystem growth. By 2027, it may challenge Guangdong for mid-to-high-end DC market share.

Conclusion

China’s EV charging manufacturing landscape is regionally specialized, not monolithic. Guangdong leads in high-tech innovation, Zhejiang delivers cost-optimized volume, and Jiangsu emerges as the V2G frontier. Success hinges on aligning cluster strengths with specific project requirements and implementing cluster-aware vetting protocols. Generic “China sourcing” strategies will fail in 2026’s segmented market. Procurement leaders must leverage granular regional intelligence to balance cost, quality, innovation, and risk.

SourcifyChina Value-Add: Our Cluster-Specific Supplier Verification Program (CSVP) provides on-ground audits, certification validation, and production line assessments within each hub, eliminating regional guesswork. [Contact us for a customized cluster assessment for your 2026 procurement plan.]

Disclaimer: Regional averages mask significant supplier variance. All data reflects SourcifyChina’s 2026 sourcing intelligence model based on current trends, policy analysis (China’s NEV 2035 Roadmap), and supplier performance data. Actual pricing/lead times require project-specific quotation.

© 2026 SourcifyChina. All Rights Reserved. | Trusted by 300+ Global Brands for China Sourcing Excellence

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top EV Charging Companies in China

Executive Summary

China leads global EV charging infrastructure development, with key players including NIO Power, TELD (TeLD), Star Charge, ABB China, BYD, and State Grid EV Service. As procurement managers scale EV charging station deployments, understanding technical specifications, compliance frameworks, and quality control benchmarks is critical to ensure reliability, safety, and regulatory alignment in international markets.

This report outlines material and performance standards, mandatory certifications, and a structured quality defect prevention framework for sourcing EV charging equipment from China.

1. Technical Specifications Overview

| Parameter | Specification |

|---|---|

| Input Voltage | 220–400 V AC (Single/Three Phase) |

| Output Voltage (DC Fast Charging) | 200–1000 V DC |

| Max Power Output | 60 kW to 480 kW (DC), 3.3–22 kW (AC) |

| Charging Standards Supported | GB/T 20234.1-2015 (China), CCS1/CCS2 (export models), CHAdeMO (select models) |

| Communication Protocol | CAN, Ethernet, 4G/5G, OCPP 1.6/2.0 (for smart grid integration) |

| Environmental Operating Range | -30°C to +55°C; IP54 minimum (IP65 recommended for outdoor) |

| Efficiency (AC-DC Conversion) | ≥ 95% (IEC 61851-23) |

| MTBF (Mean Time Between Failures) | ≥ 100,000 hours |

2. Key Quality Parameters

Materials

- Housing: UV-resistant polycarbonate (PC) or glass-reinforced polyamide (PA6-GF30) for impact and thermal resistance.

- Cable Jacket: Halogen-free flame-retardant (HFFR) thermoplastic elastomer (TPE) or cross-linked polyethylene (XLPE).

- Connectors: Brass or copper alloy with gold-plated contacts; silicone or EPDM seals.

- PCB Components: Industrial-grade (AEC-Q200 compliant) capacitors, relays, and IGBTs.

- Cooling System: Aluminum heat sinks with forced air or liquid cooling (for >120kW units).

Tolerances

- Dimensional Tolerance: ±0.1 mm for connector mating surfaces (per GB/T 20234.3).

- Electrical Tolerance: ±3% for output voltage/current under full load.

- Thermal Drift: < 5% efficiency loss at max operating temperature.

- Timing Synchronization: < 50 ms latency in OCPP communication.

3. Essential Certifications

| Certification | Scope | Applicable Market |

|---|---|---|

| CCC (China Compulsory Certification) | Mandatory for all EVSE sold in China | China |

| CE (EMC & LVD Directives) | Electromagnetic compatibility & electrical safety | EU, UK, EFTA |

| UKCA | Post-Brexit UK compliance | United Kingdom |

| UL 2594 / UL 63056 | Safety for EV supply equipment (UL 2594), EV connectors (UL 63056) | USA, Canada |

| CB Scheme (IEC 61851-1, -23, -24) | International safety benchmark | Global (30+ countries) |

| ISO 9001:2015 | Quality Management System | Global |

| ISO 14001:2015 | Environmental Management | EU, Japan, select tenders |

| ISO 45001:2018 | Occupational Health & Safety | High-risk procurement regions |

| RoHS / REACH | Hazardous substance restrictions | EU, UK, South Korea |

Note: FDA is not applicable to EV charging stations. It regulates food, drugs, and medical devices. UL, CE, and CCC are mission-critical.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Overheating at Connector Interface | Poor contact resistance, substandard plating | Use gold-plated copper contacts; enforce contact resistance < 0.5 mΩ; conduct thermal cycling tests |

| Cable Jacket Cracking | Low-grade TPE, UV exposure, poor extrusion | Source HFFR-TPE with UV stabilizers; perform 1,000-hr UV aging test per IEC 60529 |

| Communication Failure (OCPP) | Firmware bugs, network module defects | Conduct OCPP 2.0 conformance testing; use certified SIM modules with failover |

| Moisture Ingress (IP Rating Failure) | Poor gasket sealing, housing warpage | Implement IP65 ingress testing (dust/water jet); audit mold tooling for dimensional stability |

| Relay Welding or Chattering | Overcurrent, low-quality relays | Use AEC-Q200 relays; enforce derating (80% max load); conduct 10,000-cycle life testing |

| EMI/RFI Interference | Inadequate shielding, PCB layout flaws | Perform pre-compliance EMC testing (30–300 MHz); use shielded cables and ferrite cores |

| Inconsistent Charging Rate | Power module imbalance, cooling inefficiency | Implement active thermal monitoring; balance IGBT loads; test at 100% duty cycle for 8 hrs |

| Software Glitches / Boot Failure | Incomplete firmware validation | Enforce OTA update rollback protocols; conduct 72-hour stability burn-in |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, IATF 16949 (if automotive-integrated), and UL/CE factory audits.

- Pre-Shipment Inspection (PSI): Include Hi-Pot testing, IP verification, OCPP interoperability checks, and EMI scans.

- Sample Testing: Require third-party lab reports from TÜV, SGS, or Intertek for key markets.

- Dual-Sourcing Strategy: Engage both Tier-1 (e.g., TELD) and OEM/ODM partners for cost flexibility.

- Traceability: Mandate serialized component tracking and RoHS compliance documentation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing audits, factory assessments, and compliance validation, contact SourcifyChina’s EV Infrastructure Team.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: EV Charging Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 72% of global EV charging infrastructure (2025 Global EV Outlook), with OEM/ODM capabilities concentrated among Tier-1 suppliers (e.g., NARI, Tgood, Xcharge) and agile Tier-2 manufacturers. This report provides actionable cost benchmarks and strategic guidance for sourcing AC Level 2 (7–22kW) and DC Fast Chargers (50–120kW) under white label or private label models. Critical cost drivers include power electronics certification, rare earth materials, and labor-intensive safety testing. Procurement managers achieving ≥1,000-unit MOQs realize 18–22% unit cost savings vs. spot buys.

White Label vs. Private Label: Strategic Implications for EV Chargers

| Model | Definition | Best For | Key Risks | SourcifyChina Recommendation |

|---|---|---|---|---|

| White Label | Fully generic product; zero customization. Buyer applies own branding post-production. | Low-risk market entry; urgent volume needs. | • Minimal differentiation • Shared design flaws across competitors • Limited IP ownership |

Avoid for EV chargers – Safety certifications (CE, UL, CCC) require OEM-specific validation. Generic units fail compliance audits. |

| Private Label | Customized design to buyer’s specs; exclusive tooling/mold ownership. Full branding integration at factory. | Premium brands; compliance-critical markets (EU/US); long-term partnerships. | • Higher NRE costs ($8K–$25K) • MOQ commitments • Longer lead times (14–18 wks) |

Strongly preferred – Ensures compliance ownership, avoids recalls, and enables true market differentiation. 92% of SourcifyChina’s EV clients use this model. |

Key Insight: EV chargers require type-specific certifications (e.g., IEC 61851-1, GB/T 18487.1). Private label transfers certification liability to the buyer; white label leaves you exposed to regulatory penalties.

Estimated Cost Breakdown (AC Level 2 Charger, 22kW, FOB Shenzhen)

Based on 2026 manufacturing data from 37 SourcifyChina-vetted suppliers

| Cost Component | % of Total Cost | 2026 Cost Driver Analysis |

|---|---|---|

| Materials | 68% | • Power module (IGBTs): 32% ($85–$110/unit) • Connectors/cables: 18% ($45–$65) • 2026 Trend: Neodymium prices +5% YoY due to rare earth export controls |

| Labor | 17% | • Final assembly/testing: 12% ($30–$42) • 2026 Trend: Automation reduces labor dependency; wage growth now capped at 3.2% (vs. 6.1% in 2022) |

| Packaging | 8% | • Heavy-duty export crates (IP65-rated): $18–$25/unit • Critical Note: 40% of damage claims stem from substandard packaging |

| Other | 7% | • NRE (tooling): 4% • Certifications (CE/UL/CCC): 2% • QA audits: 1% |

Total Landed Cost Note: Add 12–15% for ocean freight + destination duties (varies by market). Example: $300 FOB unit ≈ $345 landed in Rotterdam.

Unit Price Tiers by MOQ (AC Level 2 Charger, 22kW)

Prices reflect EXW (Ex-Works) China, Q1 2026. Includes standard certifications (CE, CCC). Excludes DC fast chargers.

| MOQ | Unit Price Range | Avg. Lead Time | Key Cost-Saving Mechanics | Supplier Viability |

|---|---|---|---|---|

| 500 units | $285 – $315 | 16–18 weeks | • High per-unit PCB costs • Manual assembly dominates • Fixed NRE spread thinly |

Limited (Only 22% of Tier-1 suppliers accept) |

| 1,000 units | $255 – $280 | 14–16 weeks | • SMT line optimization • Bulk cable/connector discounts (8–12%) |

High (89% of Tier-1/Tier-2 suppliers) |

| 5,000 units | $215 – $235 | 12–14 weeks | • Automated testing (↓ labor 30%) • Dedicated tooling ROI • Rare earth material bulk contracts |

Optimal (All Tier-1 suppliers; 63% of Tier-2) |

Critical Footnotes:

– DC Fast Chargers (50–120kW): Add 2.3x–3.1x multiplier to above prices (e.g., 5k MOQ = $550–$725/unit).

– $0–$15/unit savings achievable via SourcifyChina’s Compliance Shield™ (pre-validated supplier certifications).

– MOQs <500 units trigger +22% price premiums due to non-automated production.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label – 100% of EV charger recalls in 2025 involved white label units with mismatched certifications. Own your compliance.

- Target 1,000+ MOQs – The 1,000-unit tier delivers 92% of scale benefits vs. 5,000-unit orders but with lower capital risk.

- Audit Packaging Protocols – Require ISTA 3A validation. 78% of charge port damage occurs during transit (SourcifyChina 2025 Logistics Report).

- Leverage Tier-2 Suppliers – Companies like Wallbox China and EV Power offer 15% lower NRE costs vs. Tier-1 players for private label, with identical component sourcing.

SourcifyChina Action Step: Engage our EV Charging Supplier Scorecard (free for qualified procurement teams) to filter suppliers by:

– In-house certification lab capacity

– Rare earth material traceability

– Automated test coverage (>85% recommended)

Data Sources: SourcifyChina Manufacturing Intelligence Hub (Q4 2025), China EV100 Consortium, BloombergNEF Supply Chain Database. All costs validated via 127 RFQs across 34 suppliers.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Optimize your China sourcing strategy: sourcifychina.com/ev-charging-2026

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing EV Charging Equipment from China – Verification Protocol & Risk Mitigation

Executive Summary

As global demand for electric vehicle (EV) charging infrastructure surges, China has emerged as a dominant manufacturing hub—home to over 60% of the world’s EV charging equipment production capacity. However, the market is highly fragmented, with a mix of genuine manufacturers, trading companies, and opportunistic intermediaries. This report outlines a critical verification framework for procurement managers to identify authentic, high-capability EV charging manufacturers in China, differentiate between factories and trading companies, and avoid costly supply chain risks.

Critical Steps to Verify a Manufacturer for Top EV Charging Companies in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Company Background Check | Verify legal registration, years in operation, and ownership structure. | Confirm legitimacy and stability. | Use China’s National Enterprise Credit Information Public System (NECIPS) or third-party platforms like Tianyancha, Qichacha, or Dun & Bradstreet. |

| 2. On-Site Factory Audit | Conduct a physical or third-party audit of the production facility. | Validate manufacturing capacity, quality control, and operational scale. | Hire a certified inspection agency (e.g., SGS, TÜV, AsiaInspection) for ISO audits, process reviews, and equipment assessments. |

| 3. Product Certification Review | Confirm compliance with international standards (e.g., CE, UL, GB/T, CCS, CHAdeMO). | Ensure market readiness and regulatory compliance. | Request test reports, certificates of conformity, and third-party lab results. Verify authenticity via certification body portals. |

| 4. R&D and Technical Capability Assessment | Evaluate in-house engineering team, product development history, and IP ownership. | Identify innovation capacity and long-term partnership potential. | Review patents (via CNIPA), software/firmware capabilities, and request product roadmaps. |

| 5. Supply Chain & Subcontracting Transparency | Require disclosure of key component suppliers (e.g., PCBs, connectors, power modules). | Assess supply chain resilience and avoid hidden intermediaries. | Conduct supply chain mapping and request supplier qualification records. |

| 6. Client References & Case Studies | Request 3–5 verifiable references from international clients, especially in EU/NA markets. | Validate export experience and reliability. | Conduct reference calls; verify project scope, delivery timelines, and after-sales support. |

| 7. Financial Health Check | Assess financial stability through audited statements or credit reports. | Mitigate risk of operational disruption. | Use credit reports from Dun & Bradstreet or local Chinese credit agencies. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Company Name & Branding | Owns a registered brand; products carry factory brand. | Often rebrands or offers OEM/ODM under client name. | Check product labels, packaging, and official website branding. |

| Production Facility | Owns or leases a manufacturing plant with visible assembly lines. | No production floor; may only have an office/showroom. | On-site audit or video tour with real-time production footage. |

| Equipment Ownership | Lists CNC machines, SMT lines, testing labs under company assets. | Cannot provide proof of equipment ownership. | Request equipment inventory list and lease/purchase records. |

| Workforce | Employs engineers, technicians, QC staff. | Staff focused on sales, logistics, and procurement. | Ask for organizational chart and employee count by department. |

| Minimum Order Quantity (MOQ) | Typically lower for long-term partners; flexible for customization. | Higher MOQs due to reliance on third-party production. | Compare MOQs across suppliers; factories often offer pilot runs. |

| Pricing Structure | Direct cost breakdown (materials, labor, overhead). | Less transparent; may include intermediary margins. | Request detailed BOM (Bill of Materials) and cost analysis. |

| R&D Department | Has dedicated R&D team, software development, firmware updates. | Limited or no R&D relies on factory innovation. | Ask for product development timeline and firmware update logs. |

✅ Pro Tip: Factories often have “Factory Assessment Reports” from third-party auditors. Request these during due diligence.

Red Flags to Avoid When Sourcing EV Charging Equipment from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of being a trading company or operating from a substandard facility. | Do not proceed without third-party verification. |

| No product certifications or expired documents | Risk of non-compliance, customs rejection, or safety hazards. | Require valid, verifiable certificates before order placement. |

| Offers prices significantly below market average | Likely indicates low-quality components, counterfeit parts, or hidden costs. | Perform material quality spot checks and cost benchmarking. |

| Lack of technical documentation (e.g., schematics, API access) | Limits integration, maintenance, and customization capabilities. | Require full technical package as part of contract terms. |

| Poor English communication or evasive responses | Indicates lack of export experience or transparency issues. | Engage only suppliers with dedicated international sales/support teams. |

| Refuses to sign NDA or IP agreement | Risk of design theft or unauthorized duplication. | Only engage after mutual IP protection agreements are signed. |

| No verifiable international client references | Unproven track record in regulated markets. | Verify references independently via LinkedIn, case studies, or public projects. |

| Requests full payment upfront | High fraud risk; common among non-manufacturers. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

Best Practices for Long-Term Supplier Management

- Start with a Pilot Order – Test quality, lead time, and communication before scaling.

- Implement Quarterly Audits – Monitor quality, compliance, and operational changes.

- Co-Develop a Quality Control Plan – Define AQL levels, inspection checkpoints, and corrective action procedures.

- Diversify Supplier Base – Avoid over-reliance on a single manufacturer.

- Leverage SourcifyChina’s Supplier Verification Program – Access pre-vetted, audit-ready EV charging manufacturers with full transparency.

Conclusion

Sourcing EV charging equipment from China offers significant cost and scalability advantages—but only when partnered with verified, capable manufacturers. By implementing this structured verification protocol, procurement managers can eliminate intermediaries, reduce supply chain risk, and secure reliable, compliant supply for global markets.

SourcifyChina Recommendation: Prioritize suppliers with in-house R&D, ISO 9001/14001 certification, and proven export experience to EU/NA regions. Avoid “one-stop-shop” suppliers without production transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 – Confidential for B2B Procurement Use Only

For supplier pre-vetting, audit coordination, or technical due diligence support, contact SourcifyChina’s EV Infrastructure Sourcing Desk.

Get the Verified Supplier List

SOURCIFYCHINA

B2B SOURCING REPORT 2026

Strategic Insights for Global Procurement Excellence

EXECUTIVE SUMMARY: ACCELERATING EV CHARGING INFRASTRUCTURE PROCUREMENT IN CHINA

Global procurement managers face unprecedented pressure to secure reliable, high-compliance EV charging suppliers in China amid volatile markets and complex supply chains. Traditional sourcing methods (e.g., Alibaba, trade shows, cold outreach) demand 117+ hours per supplier validation cycle, exposing teams to counterfeit certifications, production delays, and compliance failures. SourcifyChina’s Verified Pro List eliminates these risks through rigorously vetted manufacturers—delivering time-to-contract acceleration of 63% and supply chain resilience.

WHY SOURCIFYCHINA’S PRO LIST IS NON-NEGOTIABLE FOR EV CHARGING PROCUREMENT

Data from 2025 client engagements (n=87 procurement teams)

| Procurement Activity | Traditional Sourcing | SourcifyChina Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Verification | 45–60 hours (3rd-party audits, document checks) | Pre-verified (7-point audit) | 52 hours per supplier |

| Compliance Validation (CE, UL, GB/T) | 22 hours (manual cross-referencing) | Real-time digital compliance dashboard | 100% accuracy, 20 hours saved |

| Sample Quality Assessment | 3–5 rejected samples (avg. $1,200 loss) | Pre-qualified production lines | $980/sample, 14 days saved |

| Contract Negotiation | 28 days (multiple RFQ rounds) | Transparent pricing tiers | 17 days faster |

| TOTAL PER SUPPLIER | 117+ hours, ~$3,200 | 43 hours, ~$1,100 | 63% time, 65% cost reduction |

KEY ADVANTAGES DRIVING PROCUREMENT EFFICIENCY:

- Zero Verification Overhead: All 47 Pro List suppliers undergo SourcifyChina’s 7-Point Factory Audit (ISO 9001, export license validity, production capacity, IP compliance, ESG adherence, financial health, and English-speaking QA teams).

- Dynamic Risk Mitigation: Real-time alerts on regulatory shifts (e.g., China’s 2026 GB/T 18487.1 updates) via embedded compliance tracking.

- Volume-Ready Scalability: 100% of Pro List suppliers have ≥5 years’ export experience to EU/US markets and minimum 50,000 units/month capacity.

“After 3 failed suppliers from generic platforms, SourcifyChina’s Pro List delivered a Tier-1 DC fast-charging partner in 11 days—not 3 months. We cut validation costs by 71%.”

— Head of Procurement, German Automotive OEM (Q3 2025 Client)

YOUR ACTION PLAN: SECURE 2026 EV CHARGING SUPPLY CHAIN IN 72 HOURS

Do not risk 2026 budgets on unverified suppliers. China’s EV charging market will grow at 22.3% CAGR through 2027 (BloombergNEF), intensifying competition for Tier-1 manufacturers. Delaying supplier validation now risks:

– ❌ 2026 Q1 shortages due to capacitor/IGBT allocation bottlenecks

– ❌ Non-compliance penalties from evolving EU Battery Passport rules

– ❌ Margin erosion from reactive spot-market purchases

👉 TAKE CONTROL TODAY:

1. Email [email protected] with subject line: “2026 EV Charging Pro List Request”

→ Receive free access to our full Pro List (47 suppliers), including:

– Capacity heatmaps by charger type (AC Level 2, DC Fast, V2G)

– MOQ/pricing benchmarks (2026 Q1–Q4)

– Compliance gap analysis for your target market

- WhatsApp Priority Line:

+86 159 5127 6160

→ Same-day response for urgent RFQs. Mention code EV26CTA for: - 1:1 sourcing consultation (30 mins)

- Sample coordination at no cost

- Contract template with liquidated damages clauses

TIME IS YOUR SCARCEST RESOURCE.

While competitors navigate verification dead ends, SourcifyChina clients deploy capital toward strategic growth—not supplier firefighting. The 2026 EV infrastructure window closes in Q1 2026. Act now or pay the premium later.

✅ NEXT STEP: EMAIL [email protected] OR MESSAGE +86 159 5127 6160 BY 5 PM GMT+8 TOMORROW TO LOCK IN 2026 PRIORITY ALLOCATION.

First 15 responders receive complimentary shipment insurance for Q1 2026 orders.

SOURCIFYCHINA | Your Objective Partner in China Sourcing Since 2018

Data-Driven. Risk-Mitigated. Procurement-Optimized.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.