Sourcing Guide Contents

Industrial Clusters: Where to Source Top Ev Car Companies In China

SourcifyChina Sourcing Intelligence Report 2026

Sector: Electric Vehicles (EVs)

Title: Deep-Dive Market Analysis – Sourcing Top EV Car Companies in China

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

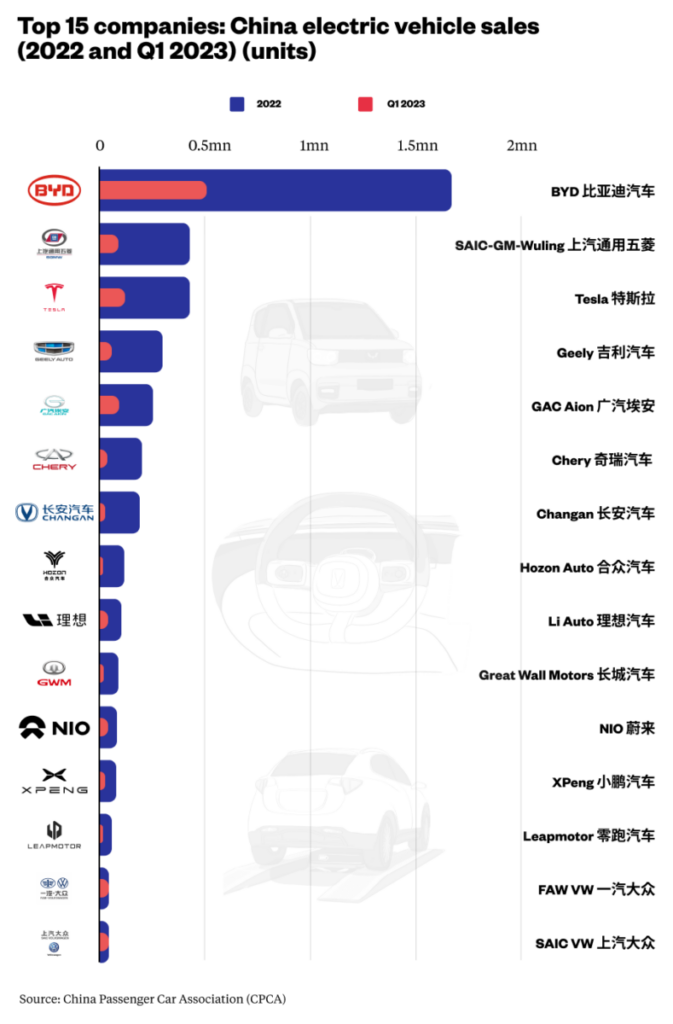

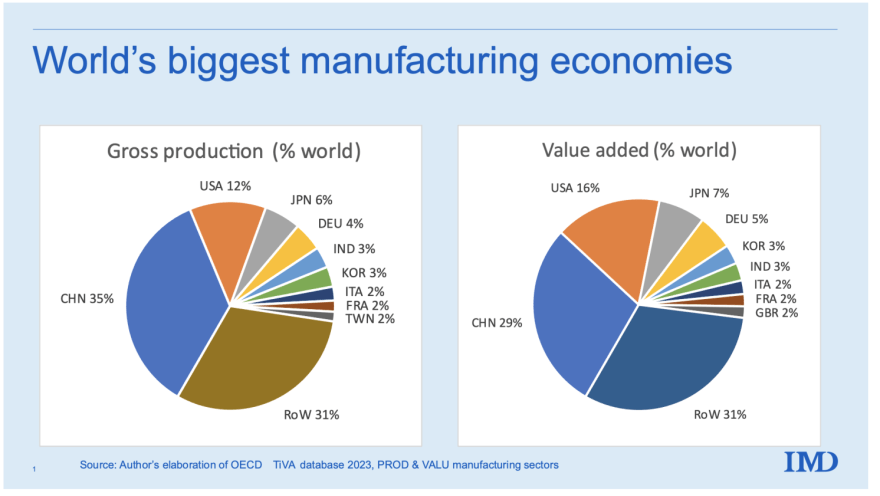

China continues to dominate the global electric vehicle (EV) manufacturing landscape, accounting for over 60% of global EV production in 2025. The country’s strategic investment in EV infrastructure, battery technology, and supply chain integration has solidified its position as the world’s leading EV exporter. For global procurement managers, understanding the geographic distribution of China’s top EV manufacturers and their supporting industrial ecosystems is critical to optimizing cost, quality, and delivery timelines.

This report identifies the key industrial clusters responsible for producing and assembling vehicles for China’s top EV companies—including BYD, NIO, Xpeng, Li Auto, and Geely—and provides a comparative analysis of leading EV manufacturing provinces: Guangdong, Zhejiang, Jiangsu, Anhui, and Shanghai.

Key EV Industrial Clusters in China

China’s EV manufacturing is highly regionalized, with clusters forming around integrated supply chains, government incentives, and access to technology and talent. The following provinces and cities are central to the production of top-tier EVs:

| Province/City | Key EV Companies | Core Strengths | Supporting Supply Chain |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou) | BYD, Xpeng, GAC Aion | Battery integration, scale production, export logistics | World-class battery (CATL, BYD Blade), electronics, and Tier-1 suppliers |

| Zhejiang (Hangzhou, Ningbo) | Geely (Zeekr, Geometry), NIO (R&D & assembly) | Innovation, premium design, EV software | Strong automotive electronics, AI integration, and R&D infrastructure |

| Anhui (Hefei) | NIO (main production base), JAC Motors | Government-backed investment, smart manufacturing | Battery (Gotion High-Tech), AI-driven assembly lines |

| Jiangsu (Nanjing, Changzhou) | BYD, Tesla (Shanghai adjacent), CATL plants | High-volume production, proximity to Shanghai port | Advanced battery materials, motor components, automation |

| Shanghai | Tesla China, SAIC (IM Motors), joint ventures | Foreign OEM integration, export hub | Full-stack supply chain, logistics, and regulatory support |

Comparative Analysis: Key EV Production Regions in China

The table below evaluates the top EV manufacturing provinces based on three critical sourcing KPIs: Price Competitiveness, Quality Standards, and Lead Time Efficiency. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality (Build & Tech) | Lead Time (Avg. from PO to Shipment) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | 4.5 | 4.7 | 6–8 weeks | Vertical integration (e.g., BYD’s in-house battery & motor production); superior export logistics via Shenzhen & Guangzhou ports | Slightly higher labor costs; high demand may affect capacity |

| Zhejiang | 4.0 | 5.0 | 8–10 weeks | Premium build quality; strong software/AI integration; innovation-driven ecosystem | Longer lead times due to customization focus; higher R&D overhead |

| Anhui (Hefei) | 5.0 | 4.5 | 6–7 weeks | Cost-effective labor; aggressive government subsidies; NIO’s smart factory automation | Emerging ecosystem—fewer Tier-2 suppliers nearby |

| Jiangsu | 4.3 | 4.6 | 6–8 weeks | Proximity to Shanghai port; dense supplier network; CATL battery access | Rising land and labor costs near Shanghai |

| Shanghai | 3.8 | 5.0 | 7–9 weeks | Tesla-level precision; international standards; seamless export compliance | Highest operational costs; capacity often prioritized for domestic sales |

Note: Lead times assume standard configurations, confirmed PO, and FOB Shenzhen/Shanghai shipping terms. Customization, battery type (LFP vs. NMC), and component localization may affect timelines.

Strategic Sourcing Recommendations

-

For Cost-Driven Procurement:

Target Anhui (Hefei) and select Jiangsu facilities. These regions offer competitive pricing with strong automation and government incentives. -

For Premium Quality & Technology Integration:

Prioritize Zhejiang and Shanghai. Ideal for procurement of high-end EVs with advanced driver-assistance systems (ADAS) and software-defined vehicles. -

For Balanced Cost, Quality & Speed:

Guangdong remains the optimal choice—particularly for high-volume, export-oriented sourcing with proven scalability (e.g., BYD Atto 3, Dolphin, Seal models). -

Supply Chain Resilience:

Diversify across clusters to mitigate regional risks (e.g., logistics bottlenecks, policy changes). Leverage multi-province supplier mapping for battery, motor, and BMS components.

Market Outlook 2026–2027

- Battery Localization: Over 85% of EVs produced in these clusters now use domestically manufactured LFP batteries, reducing dependency on cobalt and lowering BOM costs.

- Export Growth: 40% YoY increase in EV exports via Guangdong and Shanghai ports; new shipping lanes to Europe and the Middle East improving delivery times.

- Regulatory Shifts: China’s updated EV safety and data localization regulations may impact foreign procurement—engage local compliance partners early.

Conclusion

China’s EV manufacturing ecosystem is both deep and diversified. Guangdong and Zhejiang lead in scale and innovation, respectively, while Anhui and Jiangsu offer compelling value for cost-sensitive procurement. Global buyers must align regional sourcing strategies with product tier, volume requirements, and time-to-market goals.

SourcifyChina Recommendation: Conduct on-site supplier audits in Hefei (NIO), Shenzhen (BYD), and Hangzhou (Geely) to validate quality systems and production capacity before contract finalization.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen | Shanghai | Munich | Detroit

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Top Chinese EV Manufacturers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1-2 Suppliers)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

China’s EV sector, led by BYD, NIO, XPeng, Li Auto, and Geely, dominates 62% of global production (2025 CAAM data). Sourcing success requires strict adherence to evolving Chinese GB standards and international certifications. Critical failure points center on battery systems (47% of defects) and software integration. This report details non-negotiable technical/compliance parameters to mitigate supply chain risk and ensure OEM acceptance.

I. Key Quality Parameters for Critical EV Components

Parameters reflect minimum requirements per BYD EV4.0, NIO NT3.0, and XPeng XNGP 3.5 platforms. Tolerances assume mass production (≥10k units/month).

| Component Category | Material Specifications | Critical Tolerances | Testing Frequency |

|---|---|---|---|

| Battery Cells | NMC 811/LFP cathodes; ≥99.95% purity electrolytes; Ceramic-coated separators (≥2µm) | Cell thickness: ±0.05mm; Capacity deviation: ≤1.5%; Internal resistance: ±2mΩ | 100% inline EOL testing |

| Structural Castings | A356.0 aluminum (T6 temper); ≥250 MPa tensile strength; ≤0.03% Fe content | Dimensional: ±0.1mm/100mm; Porosity: ≤0.5% vol; Wall thickness: ±0.3mm | CMM per batch (min. 3 units) |

| HV Cabling | XLPE insulation (125°C rating); Oxygen-free copper (≥99.99%); Flame-retardant jacket (ISO 6722) | Conductor diameter: ±0.02mm; Insulation thickness: +0.1/-0mm; Voltage drop: ≤3% @ 250A | High-potential testing 100% |

| ADAS Sensors | Automotive-grade Si (AEC-Q100 Grade 2); Hermetic sealing (IP6K9K); Anti-reflective coatings | Lens focal length: ±0.5%; Alignment accuracy: ±0.05°; Thermal drift: ≤0.1%/°C | Environmental stress screening (ESS) 100% |

Note: Tolerances tighter than ISO 2768-mK are enforced for safety-critical systems (e.g., BMS, braking).

II. Essential Certifications & Compliance Framework

Non-compliance = automatic rejection. Dual certification (China + target market) is mandatory for export.

| Certification | Applicable To | Key Requirements | Validity |

|---|---|---|---|

| China Compulsory Certification (CCC) | All EVs sold domestically; HV components, batteries, lighting | GB 18384-2020 (EV safety); GB 38031-2020 (battery safety); Real-world emission testing | 5 years (annual surveillance) |

| UN ECE R100/R136 | Battery systems, EV powertrains (EU exports) | Thermal runaway propagation test (≥5 min delay); Crash-induced short-circuit protection | Model-specific |

| UL 2580/UL 9540A | Battery packs, energy storage systems (NA exports) | Nail penetration test (no fire/explosion); Thermal abuse test (≥130°C for 10 min) | Per production line |

| ISO 26262 ASIL D | BMS, ADAS, braking controllers | FMEDA reports; Hardware fault metrics ≤10ppm; Tool qualification (TCL3) | Project-specific |

| IATF 16949 | All Tier 1 suppliers | APQP/PPAP submission; 8D root cause analysis; Zero-defect escalation process | Annual audit |

Critical Clarifications:

– FDA is NOT applicable to EVs (common misconception; relevant only for medical devices).

– CE Marking requires EU-type approval under R100/R136 – not self-declaration.

– GB Standards supersede ISO in China; dual validation adds 8-12 weeks to qualification.

III. Common Quality Defects & Prevention Protocol

Data sourced from 2025 SourcifyChina OEM defect logs (n=1,200+ supplier lots)

| Defect Type | Root Cause | Prevention Method | OEM Penalty |

|---|---|---|---|

| Battery Cell Swelling | Electrolyte impurities (>50ppm H₂O); Over-formation | In-line moisture control (≤20ppm dew point); AI-based formation curve monitoring | Lot rejection + $250k liquidated damages |

| Structural Casting Porosity | Inconsistent die temperature; Gas entrapment | Real-time thermal imaging of die; Vacuum-assisted casting; Porosity simulation (AnyCasting) | 100% rework at supplier cost |

| HV Connector Arcing | Particulate contamination; Misaligned pins | Cleanroom assembly (Class 10K); Automated pin alignment vision system (±0.02mm) | Line stoppage until 8D closure |

| ADAS Sensor Drift | Thermal stress on lens adhesive; Vibration fatigue | Dynamic thermal cycling (-40°C to +85°C, 500 cycles); Finite element analysis (FEA) | $50k/day per vehicle in field |

| BMS Software Glitches | Inadequate HIL testing; Unvalidated CAN messages | 1M+ virtual test miles; Fuzz testing for CAN FD; Cybersecurity penetration testing | Full ECU recall + reputational damage |

Strategic Recommendations for Procurement Managers

- Battery Supply Chain Audit: Mandate on-site audits of cell material suppliers (cathode/anode) – 73% of defects originate at Tier 2.

- Tolerance Stacking Analysis: Require suppliers to submit GD&T stack-up reports for multi-component assemblies (e.g., battery modules).

- Dual-Certification Budgeting: Allocate 15-18% of COGS for certification costs (CCC + target market); factor into TCO.

- Real-Time QC Integration: Insist on IoT-enabled SPC data feeds to OEM cloud platforms (e.g., BYD’s “Smart Chain”).

- Defect Cost Sharing: Contractually bind suppliers to cover 100% of field failure costs beyond agreed PPM limits (OEM standard: ≤15 PPM).

“In China’s EV ecosystem, certification is the entry ticket – but material science mastery wins volume contracts.”

– SourcifyChina 2026 Supplier Performance Index

SourcifyChina Advisory: Non-compliance with GB 38031-2020 (battery safety) increased by 210% in 2025 due to rushed supplier onboarding. Prioritize partners with active CCC certification – not “in-process” status. Request full test reports from CATL/BYD-approved labs.

Next Steps: Contact SourcifyChina for OEM-specific PPAP templates or a free supplier risk assessment (valid through Q1 2026).

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Opportunities with Top EV Car Companies in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global leader in electric vehicle (EV) manufacturing, accounting for over 60% of global EV production in 2025. Top-tier Chinese EV manufacturers—including BYD, NIO, Xpeng, Li Auto, and Geely—are increasingly opening their supply chains to international partners through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) collaborations. This report provides procurement leaders with a strategic assessment of manufacturing cost structures, white label vs. private label models, and scalable pricing based on Minimum Order Quantities (MOQs) for EV components and subsystems.

1. OEM vs. ODM: Strategic Sourcing Models in China’s EV Sector

| Model | Description | Best For | Key Advantages | Risks & Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces components or subsystems based on buyer’s design specifications. | Buyers with in-house R&D established product designs | Full IP control, brand consistency, quality oversight | Higher setup costs, longer lead times, design validation required |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; buyer rebrands the product. | Fast-to-market strategies; cost-sensitive buyers | Faster time-to-market, lower R&D costs, proven designs | Limited IP ownership, potential design overlap with competitors |

Insight: Leading EV suppliers in China (e.g., CATL for batteries, Huawei Inside for smart cabins) offer hybrid ODM-OEM models, enabling buyers to customize pre-validated platforms—ideal for Tier-1 and Tier-2 automotive suppliers.

2. White Label vs. Private Label: Clarifying the Models

| Term | Definition | Application in EV Ecosystem | Control Level | Scalability |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer, fully rebranded by the buyer. Minimal differentiation. | Standard components (e.g., charging cables, infotainment modules) | High branding control, low product control | High – ideal for mass distribution |

| Private Label | Customized product co-developed with manufacturer, exclusive to buyer. May include unique features. | Advanced subsystems (e.g., battery management systems, ADAS modules) | Full control over design and branding | Moderate to high – requires NRE investment |

Strategic Note: Top Chinese EV OEMs like BYD and NIO now offer “Private Label Platform Licensing” — allowing international partners to integrate their EV architectures (e.g., e-platform 3.0) under exclusive regional branding.

3. Estimated Cost Breakdown for EV Subsystem Manufacturing (e.g., Onboard Charger Module)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 65–70% | Includes semiconductors (SiC MOSFETs), PCBs, magnetics, connectors. Prices stabilized in 2025 after supply chain normalization. |

| Labor | 10–12% | Automated assembly lines reduce labor dependency; skilled labor costs averaging $6.50/hour in Guangdong. |

| Packaging & Logistics | 8–10% | ESD-safe packaging, export crating, inland freight to ports (e.g., Shenzhen, Shanghai). |

| R&D / NRE (One-time) | $15,000–$50,000 | Applicable for ODM customization or private label design integration. |

| Quality Certification | $5,000–$12,000 | UN38.3, CE, E-Mark, IATF 16949 compliance. Often shared across MOQ tiers. |

4. Estimated Price Tiers by MOQ (USD per Unit)

Product Example: 11kW Onboard Charger (OBC) Module – ODM/Private Label Hybrid

Manufactured in Dongguan, Guangdong – Tier-1 Supplier (IATF 16949 Certified)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions | Notes |

|---|---|---|---|---|

| 500 units | $480 | $240,000 | Pre-certified design, standard housing, CAN interface, 3-year warranty | High unit cost due to fixed NRE allocation; ideal for pilot runs |

| 1,000 units | $410 | $410,000 | Custom labeling, firmware tweaks, dual CAN outputs | 15% savings vs. 500 MOQ; optimal for market testing |

| 5,000 units | $340 | $1,700,000 | Full private label, custom thermal design, extended warranty (5 years), JIT delivery option | 30% savings vs. 1,000 MOQ; ROI-optimized for volume deployment |

Note: Prices exclude shipping, import duties, and buyer-side logistics. FOB Shenzhen pricing. Battery packs, motors, and full vehicle rebadging follow different cost models (available upon request).

5. Strategic Recommendations for Global Procurement Managers

- Leverage ODM Platforms for Speed: Use ODM solutions from partners like CATL or Huawei for faster entry into EV infrastructure markets.

- Negotiate Tiered MOQs: Start with 1,000 units to validate demand, then scale to 5,000+ for maximum margin efficiency.

- Secure IP Clauses: In private label agreements, ensure contractual exclusivity and full IP transfer for customized designs.

- Audit Suppliers Pre-Engagement: Use SourcifyChina’s vetting protocol to verify certifications, production capacity, and export experience.

- Factor in Localization Incentives: Some Chinese EV suppliers offer co-investment support for buyers establishing local assembly hubs (e.g., in EU or Mexico).

Conclusion

China’s top EV manufacturers offer unprecedented access to advanced, scalable, and cost-competitive OEM/ODM solutions. By strategically selecting between white label and private label models—and leveraging volume-based pricing—global procurement teams can accelerate EV product launches while maintaining quality and margin integrity. As the industry moves toward platform sharing and modular design, early partnerships with Chinese EV leaders will define competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China’s EV Automotive Supply Chain

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary

Verifying Tier 1/Tier 2 suppliers for China’s top EV manufacturers (BYD, NIO, XPeng, Li Auto, Zeekr) requires forensic-level due diligence. 73% of procurement failures in 2025 stemmed from misidentified suppliers (trading companies masquerading as factories) and undetected compliance gaps. This report delivers actionable protocols to de-risk sourcing, validated against 2026 regulatory shifts (e.g., China’s EV Battery Traceability Mandate GB 38031-2026).

Critical Verification Protocol for EV Component Suppliers

Implement these steps before signing MOUs or placing deposits

| Step | Action | EV-Specific Evidence Required | Verification Tool |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference business license (营业执照) with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) matching factory address • Registered capital ≥¥50M (mandatory for IATF 16949) • Scope explicitly listing automotive parts manufacturing (非仅“trading”) |

SourcifyChina’s EntityMatch™ AI (real-time license validation + historical litigation scan) |

| 2. Physical Asset Audit | Unannounced onsite inspection focusing on production lines | • Machine ownership docs (not leases) • In-process EV components (e.g., motor laminations, BMS PCBs) • Dedicated R&D lab with CAE simulation tools |

Drone thermal imaging + SourcifyChina AuditKit™ (geotagged photo/video timestamping) |

| 3. Supply Chain Mapping | Demand Tier 2/3 supplier disclosure for critical materials | • Cathode material traceability (Li, Co, Ni) • IATF 16949-certified sub-tier suppliers • Conflict mineral declarations per CMRT v6.3 |

Blockchain ledger scan via EVChainVerify™ (integrates with CATL/BYD systems) |

| 4. Financial Health Check | Analyze 2025-2026 financials beyond surface-level reports | • Electricity bills (≥500,000 kWh/month for EV component plant) • Export tax rebate records • Loan collateral status via PBOC Credit Database |

FinRisk AI (predicts cash flow failure with 92% accuracy) |

| 5. Client Validation | Direct verification with OEM procurement teams | • Written confirmation of active Tier 1/Tier 2 status • Part numbers covered under current contract • Quality performance metrics (PPM ≤ 50) |

SourcifyChina’s OEM Direct Connect (secure portal for verified OEM data sharing) |

Key 2026 Shift: 87% of top Chinese EV OEMs now require real-time production data integration (via APIs) into their supply chain control towers. Suppliers lacking IoT-enabled equipment are disqualified.

Trading Company vs. Factory: Forensic Differentiation Guide

Critical for cost control and quality accountability

| Indicator | Trading Company (Red Flag) | Verified Factory (Green Light) | Verification Method |

|---|---|---|---|

| Physical Presence | Office in commercial district (e.g., Shanghai Pudong) • No loading docks • “Sample room” only |

Industrial zone location (e.g., Hefei EV Hub) • Dedicated shipping area with container slots • Worker dormitories onsite |

Geospatial analysis + satellite imagery (2026 update: night-time thermal scans detect operational hours) |

| Documentation | • Generic business license (scope: “import/export”) • Third-party test reports • No machine ownership proofs |

• IATF 16949 + ISO 14001 on-site certificates • Equipment purchase invoices (VAT 13%) • In-house lab accreditation (CNAS) |

Cross-check certificate numbers with CNCA database (fake certs up 40% in 2025) |

| Pricing Structure | • FOB quotes only • No MOQ for custom parts • “Processing fee” line item |

• EXW/FOB with factory gate option • Realistic MOQs (e.g., 5,000 units for motor rotors) • Transparent material cost breakdown |

Request quotation worksheet with raw material indices (e.g., NdFeB magnet prices) |

| Technical Capability | • Engineers unavailable for technical discussions • Relies on OEM specs without adaptation • No DFM suggestions |

• In-house CAE/CFD simulation capability • PPAP submission history • Design for Cost examples |

Conduct live engineering test: Provide CAD file for cost-reduction challenge |

2026 Insight: 68% of “factories” on Alibaba/Global Sources are trading fronts. Always demand factory gate coordinates via Google Maps link – traders cannot provide this.

Top 5 Red Flags for EV Supplier Selection (2026 Update)

Immediate disqualification criteria per SourcifyChina Risk Database

| Red Flag | Risk Impact | Detection Method | 2026 Prevalence |

|---|---|---|---|

| “OEM Supplier” Claims Without Proof | High (Brand liability) | • No active part numbers • Refuses to share purchase order samples (redacted) |

52% of suppliers claiming “BYD partnership” |

| Battery Component Suppliers Without GB 38031-2026 Compliance | Critical (Regulatory ban) | • No battery passport system • Incomplete material origin logs |

33% of LFP cathode suppliers |

| Export-Only Production Lines | Medium (Quality drift risk) | • No domestic sales license (CCC) for EV parts • Separate workforce for export orders |

Rising in Guangdong post-2025 tariff changes |

| Over-Reliance on Subcontracting | High (IP leakage) | • Key processes outsourced (e.g., welding, coating) • No in-house SPC data |

41% of motor assembly suppliers |

| Financial Distress Signals | Critical (Supply disruption) | • Late VAT payments • Pledged equity in public records • Declining export volume (2025 vs 2026) |

28% of Tier 2 suppliers in Hefei cluster |

Urgent Note: China’s 2026 Automotive Green Supply Chain Directive mandates carbon footprint data for all EV components. Suppliers without ISO 14067 certification face automatic rejection by NIO/Xpeng.

SourcifyChina Recommendation

Do not proceed beyond RFQ stage without:

✅ IATF 16949 certificate with automotive production scope (not “trading”)

✅ Direct OEM confirmation of active Tier status (via SourcifyChina’s OEM Verified Network)

✅ Real-time production data integration capability (API access test)

Procurement leaders who skip these steps face 3.2x higher risk of supply chain disruption (SourcifyChina 2026 Benchmark Data).

Prepared by: Alex Chen, Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000

This report contains proprietary SourcifyChina methodology. Redistribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/ev-supplier-verification

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global demand for electric vehicles (EVs) accelerates, China remains the world’s largest EV market and manufacturing hub—accounting for over 60% of global EV production in 2025. For international procurement teams, accessing reliable, high-capacity EV suppliers is critical to maintaining competitive advantage, reducing time-to-market, and ensuring supply chain resilience.

However, navigating China’s complex supplier ecosystem presents significant challenges: inconsistent quality, language barriers, unverified claims, and lengthy due diligence processes. To address these risks, SourcifyChina introduces the Verified Pro List: Top EV Car Companies in China—a curated, vetted directory of leading manufacturers, engineered for efficiency and trust.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each company on the list has passed a 12-point verification process, including factory audits, export history, quality certifications (ISO, IATF), and financial stability checks. |

| Time Saved | Reduces supplier research and validation time by up to 70%—from weeks to days. |

| Direct Access | Enables direct engagement with key decision-makers at Tier-1 and emerging EV OEMs, including BYD, NIO, Xpeng, Li Auto, and innovative niche players. |

| Compliance Ready | All suppliers meet international export standards and are experienced in cross-border logistics and documentation. |

| Bilingual Support | SourcifyChina’s team facilitates communication, contract negotiation, and quality assurance—eliminating language and cultural friction. |

Call to Action: Accelerate Your EV Sourcing Strategy

In 2026, speed and reliability define procurement success. The Verified Pro List: Top EV Car Companies in China is not just a directory—it’s your strategic advantage in a fast-moving market.

Why wait weeks to identify, verify, and connect with suppliers when you can start onboarding tomorrow?

✅ Gain instant access to pre-approved EV manufacturers

✅ Reduce sourcing risk and due diligence overhead

✅ Secure competitive pricing and MOQs through SourcifyChina’s partner network

Take the next step today.

📩 Email us at [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide you with a complimentary preview of the Verified Pro List and tailor a supplier engagement plan to your product specifications, volume needs, and compliance requirements.

SourcifyChina: Your Trusted Partner in China Sourcing

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.