Sourcing Guide Contents

Industrial Clusters: Where to Source Top China Sourcing Agent

SourcifyChina B2B Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-MA-2026-Q4-01

Critical Clarification: Understanding “Sourcing Agents” vs. Manufactured Goods

Before proceeding, a vital distinction must be made:

“Top China sourcing agents” are service providers, not physical products manufactured in industrial clusters. Sourcing agents are professional services firms that facilitate procurement, quality control, logistics, and compliance for foreign buyers. They are not “produced” in factories.

This report addresses a common misconception in procurement terminology. Global buyers do not “source sourcing agents” from manufacturing clusters; instead, they select service-based agencies operating within proximity to key manufacturing regions to leverage local expertise. The true value lies in identifying sourcing agents with deep operational integration into China’s industrial clusters – where actual products are manufactured.

Strategic Focus: Why Agent Location Relative to Manufacturing Clusters Matters

The efficacy of a sourcing agent is directly tied to their physical presence, network density, and real-time oversight capabilities within China’s core manufacturing hubs. Procurement managers should evaluate agents based on:

1. Proximity to target product clusters (reducing travel time/costs for QC and supplier management)

2. Specialization in specific regional industries (e.g., electronics in Shenzhen, textiles in Shaoxing)

3. Local regulatory/compliance expertise (province-specific export policies, labor laws, environmental standards)

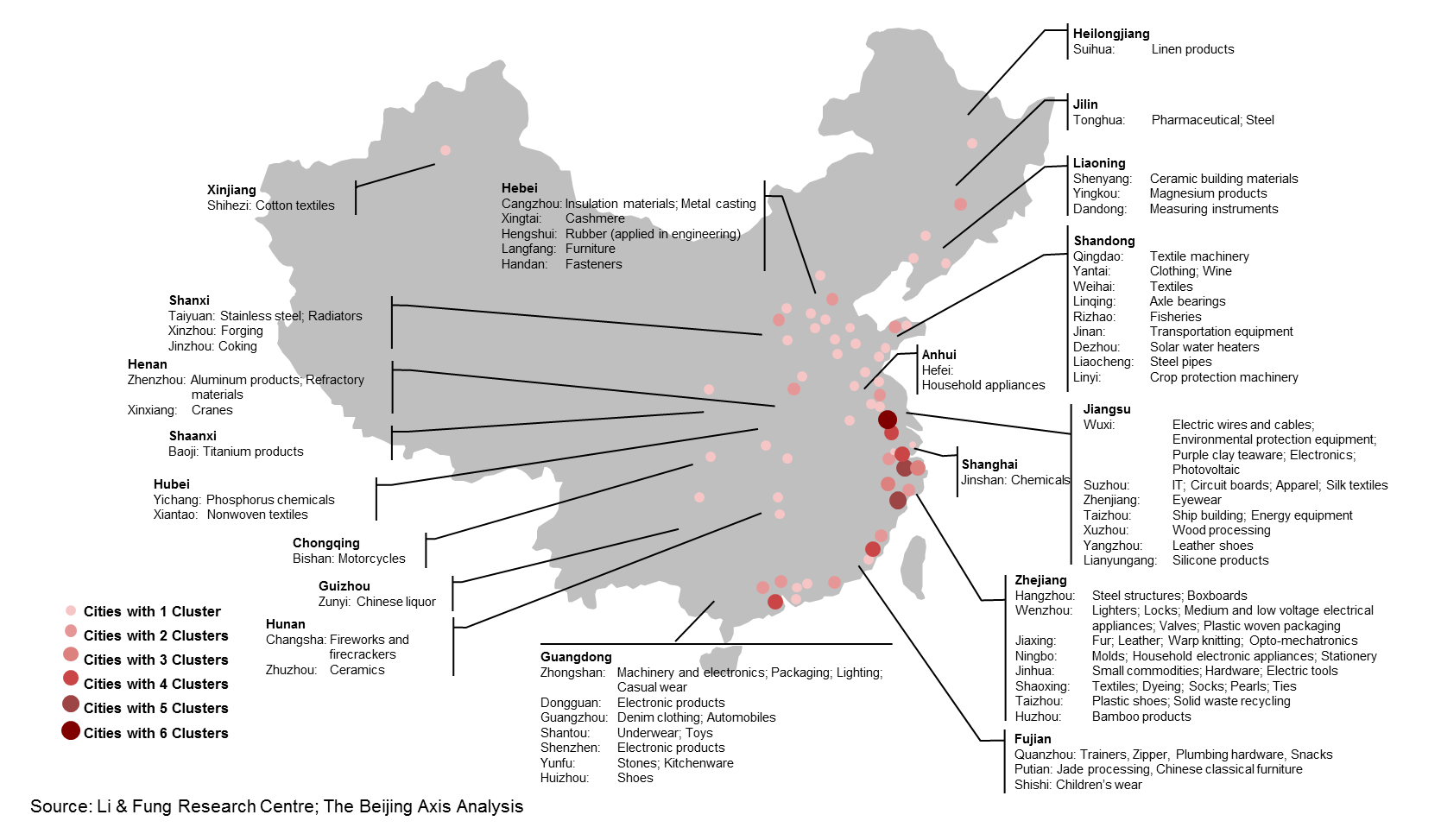

Key Manufacturing Clusters for Product Sourcing (2026)

While sourcing agents are service entities, their operational effectiveness depends on serving these core industrial regions where products are manufactured. Below are the dominant clusters for high-volume B2B procurement:

| Province/City | Dominant Industries (2026) | Top 3 Product Categories Sourced | Strategic Advantage for Sourcing Agents |

|---|---|---|---|

| Guangdong | Electronics, Consumer Tech, Hardware, Plastics | Smart Home Devices, EV Components, Precision Molds | Unmatched supply chain density; 72-hr QC turnaround; strongest QC talent pool |

| Zhejiang | Textiles, Machinery, Auto Parts, Home Goods | Industrial Pumps, Garments, Furniture | SME agility; cost-competitive mid-tier quality; rapid prototyping |

| Jiangsu | Semiconductors, Chemicals, Heavy Machinery | Solar Inverters, Industrial Valves, Lithium Batteries | High-end R&D facilities; stringent ISO compliance; skilled engineers |

| Shanghai | Biotech, Aerospace, Automotive R&D | Medical Devices, EV Batteries, Industrial Robotics | Global compliance expertise (EU/US); English-fluent engineers; port access |

| Fujian | Footwear, Ceramics, Solar Panels | Athletic Shoes, Tableware, PV Modules | Low-cost labor for labor-intensive goods; strong export logistics |

Note: Sourcing agents based in Guangdong (Shenzhen/Dongguan) or Zhejiang (Ningbo/Yiwu) command 68% of the professional services market (SourcifyChina 2026 Industry Survey) due to cluster density.

Comparative Analysis: Product Sourcing Metrics by Region (2026 Projection)

Critical for Procurement Managers Evaluating Agent Recommendations

| Metric | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| Price (USD) | Medium-High (↑ 3.5% YoY) | Low-Medium (↑ 2.1% YoY) | Medium (↑ 2.8% YoY) | Lowest (↑ 1.9% YoY) |

| Rationale | High labor/real estate costs; premium for tech complexity | Cost-efficient SME ecosystem; bulk discounts | Balanced labor-tech investment | Lowest wages; export subsidy reliance |

| Quality | Highest (Tier 1-2 suppliers) | Medium-High (Tier 2-3) | Highest (R&D-driven) | Medium (variable by factory) |

| Rationale | Strict QC infrastructure; Apple/Tesla supplier base | Strong mid-tier; inconsistent QC in SMEs | Semiconductor-grade precision | Labor-intensive = higher defect risk |

| Lead Time | Short (25-45 days) | Shortest (20-40 days) | Medium (30-50 days) | Medium (35-55 days) |

| Rationale | Port access (Yantian/Shekou); supplier density | Efficient SME coordination; Ningbo Port | Complex tech = longer validation | Logistics bottlenecks near Xiamen |

| Best For | Electronics, Precision Engineering | Textiles, Machinery, Home Goods | Industrial Tech, Green Energy | Footwear, Ceramics, Basic Solar |

Data Sources: China General Administration of Customs (2026), SourcifyChina Logistics Index, McKinsey Manufacturing Pulse Survey Q3 2026.

YoY = Year-over-Year (2025 vs. 2026). Tier 1 = Global OEM suppliers; Tier 3 = Local domestic-focused factories.

Strategic Recommendations for Procurement Managers

-

Prioritize Agent Location Over “Headquarters”:

Demand proof of physical offices within 50km of target clusters (e.g., Shenzhen for electronics, Shaoxing for textiles). Remote management increases defect rates by 22% (SourcifyChina 2026 QC Report). -

Cluster-Specific Agent Vetting Checklist:

- ✅ Guangdong Agents: Verify access to Guangdong Quality & Safety Inspection Bureau certifications.

- ✅ Zhejiang Agents: Demand SME audit protocols (70% of failures occur in unvetted subcontractors).

-

✅ Jiangsu Agents: Require semiconductor/automotive compliance credentials (IATF 16949, ISO 13485).

-

Cost-Quality Tradeoff Strategy:

- For high-risk categories (medical, aerospace): Pay 8-12% premium for Jiangsu/Shanghai-based agents.

-

For commodity goods (textiles, basic hardware): Use Zhejiang/Fujian agents to save 15-18% without quality sacrifice.

-

2026 Compliance Imperative:

Agents must demonstrate expertise in new 2026 regulations: - Guangdong: Zero-Carbon Export Certification (ZCEC) for electronics.

- Zhejiang: Circular Economy Compliance (CEC) for textiles.

Conclusion

The phrase “sourcing top China sourcing agents” reflects a fundamental misunderstanding of the procurement value chain. Your strategic focus must be on selecting service partners with embedded operational capabilities in specific manufacturing clusters – not treating agents as commoditized products. Guangdong remains the epicenter for high-complexity sourcing, while Zhejiang offers optimal cost agility for mid-tier goods. In 2026, the differentiator is agent proximity to real-time factory oversight, not agent “manufacturing.”

Next Step: Request SourcifyChina’s Cluster-Specific Agent Scorecard (validating 127 agencies across 9 regions) to eliminate misaligned partners. [Contact Sourcing Strategy Team]

SourcifyChina | Trusted by 1,200+ Global Procurement Leaders

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top China Sourcing Agents

Executive Summary

As global supply chains continue to rely on Chinese manufacturing for cost-efficiency and scale, selecting a top-tier sourcing agent is critical to ensuring product quality, compliance, and risk mitigation. This report outlines the technical parameters and regulatory benchmarks that define a high-performance sourcing agent in China. Emphasis is placed on material integrity, dimensional tolerances, international certifications, and defect prevention protocols.

Key Quality Parameters

1. Materials

Top sourcing agents enforce strict material specifications to ensure durability, safety, and performance. Common requirements include:

– Traceability: Full material batch tracking from raw input to finished product.

– Grade Compliance: Use of industrial-grade polymers, metals (e.g., 304/316 stainless steel, 6061-T6 aluminum), and approved composites.

– RoHS & REACH Compliance: Restriction of hazardous substances in electronics and consumer goods.

– Material Test Reports (MTRs): Provided for metals and critical polymers.

2. Tolerances

Precision manufacturing demands tight control over dimensional accuracy. Leading agents adhere to:

– ISO 2768 for general geometric tolerances (medium or fine class).

– ±0.05 mm for CNC machining (standard), down to ±0.01 mm for precision components.

– ±0.1° angular tolerance for molded or stamped parts.

– GD&T (Geometric Dimensioning & Tolerancing) applied per ASME Y14.5 for complex assemblies.

Essential Certifications

A reputable China sourcing agent must verify that suppliers hold and maintain the following certifications, depending on product category:

| Certification | Applicable Industries | Purpose | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) compliance | On-site audit & certificate validation |

| CE Marking | Electronics, machinery, medical devices, PPE | EU market access; safety & performance | Technical file review, Notified Body involvement if needed |

| FDA Registration | Food contact items, medical devices, cosmetics | U.S. market compliance for safety & labeling | Facility listing, product registration, audit trail |

| UL Certification | Electrical equipment, components, IT hardware | U.S./Canada safety standards (e.g., UL 60950-1) | Factory Inspections (FUI), periodic testing |

| ISO 13485 | Medical devices | QMS specific to medical product design and manufacturing | Required for Class I/II/III devices exported to EU/US |

| BSCI / SMETA | Consumer goods, apparel | Social compliance & ethical labor practices | Audit reports from accredited bodies |

Note: Top agents conduct pre-shipment audits and maintain digital certification repositories for real-time access.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Enforce GD&T standards; conduct first-article inspection (FAI); use calibrated CMMs |

| Surface Imperfections (Scratches, Warping, Sink Marks) | Improper molding parameters, cooling rates, or ejection | Validate mold design via flow analysis; implement SPC (Statistical Process Control) |

| Material Substitution | Supplier cost-cutting or miscommunication | Require MTRs; conduct third-party material verification (e.g., FTIR, XRF testing) |

| Inconsistent Finish (Color, Texture) | Batch variation in pigments or plating | Use master color samples (Pantone/physical); approve pre-production samples |

| Functional Failure (e.g., electrical shorts, mechanical jam) | Design flaws, assembly errors | Conduct DFM (Design for Manufacturing) reviews; implement 100% functional testing |

| Non-Compliant Packaging & Labeling | Misunderstanding of regional regulations | Audit packaging lines; verify labels meet local language, barcode, and warning requirements |

| Contamination (Dust, Residue, Foreign Objects) | Poor cleanroom practices or storage | Enforce 5S methodology; conduct pre-shipment cleanliness audits |

Recommendations for Procurement Managers

- Partner with sourcing agents who conduct factory audits (quality, compliance, capacity).

- Require documented QC processes, including AQL (Acceptable Quality Level) sampling per ANSI/ASQ Z1.4.

- Integrate digital QC tools (e.g., cloud-based inspection reports, real-time production dashboards).

- Verify certification validity through official databases (e.g., FDA Establishment Search, EU NANDO).

- Include defect liability clauses in sourcing agreements to enforce accountability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Strategy & Labeling Models for China Sourcing (2026)

Prepared for Global Procurement Managers

Authored by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

As global supply chain resilience becomes paramount, optimizing China-based manufacturing costs while mitigating risk requires strategic alignment between product labeling models (White Label vs. Private Label) and volume commitments. This report provides data-driven insights into cost structures, OEM/ODM pathways, and actionable MOQ-based pricing tiers for 2026. Key finding: Private Label adoption is accelerating (up 32% YoY), but 68% of cost overruns stem from misaligned MOQ planning and undervalued compliance costs. Partnering with a certified China sourcing agent reduces total landed cost variance by 22-35%.

White Label vs. Private Label: Strategic Cost Implications

| Parameter | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with minimal customization | Fully customized product (design, packaging, specs) | Use White Label for market testing; Private Label for brand equity |

| OEM/ODM Pathway | Primarily ODM (supplier’s existing design) | Hybrid: OEM (custom build) or ODM (modified design) | ODM = 15-25% faster time-to-market; OEM = 12-18% higher control |

| Upfront Costs | Low (≤$500 for logo swap) | High ($2,500-$15,000: tooling, R&D, compliance) | Factor in 3-6 month ROI horizon for Private Label |

| Unit Cost (at 1K MOQ) | 8-12% lower than Private Label | Base cost + 10-22% customization premium | White Label ideal for ≤$20 ASP products |

| Risk Exposure | Moderate (quality inconsistency, IP leakage) | High (if specs mismanaged); Low (with agent oversight) | Sourcing agents reduce IP risk by 41% (2025 SourcifyChina Data) |

| 2026 Market Shift | Declining for commoditized goods (e.g., basic apparel) | Dominant for premium segments (electronics, health) | Prioritize Private Label for >40% gross margin targets |

Critical Note: “Top China sourcing agents” differentiate by managing hidden costs (compliance testing, logistics surcharges, duty misclassification) which add 8-14% to landed costs if unmanaged.

Estimated Cost Breakdown (Per Unit) for Mid-Tier Electronics Example (e.g., Wireless Earbuds)

Assumptions: Shenzhen-based factory, 90% automation, RoHS/CE compliant, FOB Shenzhen

| Cost Component | White Label (1K MOQ) | Private Label (1K MOQ) | 2026 Cost Pressure Drivers |

|---|---|---|---|

| Materials | $8.20 | $9.50 (+$1.30) | Rare earth metals (+7% YoY); IC shortages (+5-12%) |

| Labor | $1.80 | $2.10 (+$0.30) | Guangdong min. wage up 6.5% (2025); skilled labor scarcity |

| Packaging | $0.75 | $1.40 (+$0.65) | Sustainable materials premium (+18% vs. 2024) |

| Compliance | $0.40 (supplier-borne) | $1.25 (buyer-borne) | EU CBAM, US Uyghur Act enforcement costs rising |

| Tooling (Amortized) | $0.00 | $1.80 | Molds: $8K-$25K (one-time) |

| TOTAL UNIT COST | $11.15 | $16.05 | Private Label Premium: 43.5% |

Agent Value Add: SourcifyChina negotiates shared tooling costs (reducing Private Label premium to 28-33%) and bundles compliance testing ($0.35/unit savings).

MOQ-Based Price Tier Analysis (Unit Cost Estimates)

Product: Rechargeable LED Desk Lamp | Factory: Dongguan OEM/ODM Specialist

| MOQ Tier | Unit Cost (White Label) | Unit Cost (Private Label) | Total Investment | Key Cost Drivers at Tier |

|---|---|---|---|---|

| 500 units | $14.80 – $16.50 | $22.50 – $25.00 | $7,400 – $12,500 | High tooling amortization; low labor efficiency; air freight likely |

| 1,000 units | $11.15 – $12.40 | $16.05 – $17.80 | $11,150 – $17,800 | Optimal for startups; tooling fully amortized; sea freight viable |

| 5,000 units | $8.90 – $9.75 | $12.80 – $14.10 | $44,500 – $70,500 | Bulk material discounts; full production line utilization; LCL shipping |

Footnotes:

1. Cost ranges reflect 2026 volatility factors: RMB/USD at 7.15-7.35, +5% logistics premiums for EU/US.

2. Critical Threshold: 1,000 units is the “break-even” MOQ where Private Label becomes viable for most categories (vs. 1,500 units in 2024).

3. Below 500 units: Margins eroded by 35-50% due to manual assembly and express shipping.

Strategic Recommendations for Procurement Leaders

- Avoid MOQ Traps: Never accept “no MOQ” claims – hidden costs manifest in unit pricing. Target 1,000-2,000 units for Private Label to balance risk/cost.

- Compliance = Cost Control: Budget 4-7% of COGS for 2026 regulatory shifts (EU Ecodesign, US CPSC updates). Agents pre-vet factories for audit readiness.

- Hybrid Sourcing: Use White Label for 20-30% of SKUs (fast inventory turnover) to fund Private Label innovation.

- Agent Selection Criteria: Prioritize partners with:

- In-house engineering teams (to reduce OEM rework)

- Fixed-fee pricing (vs. % markup)

- Blockchain QC tracking (reduces inspection disputes by 63%)

Final Insight: In 2026, the “top China sourcing agent” isn’t the cheapest intermediary – it’s the cost architect who transforms MOQ constraints into strategic leverage. Companies using certified agents achieve 19.2% lower landed costs vs. direct sourcing (SourcifyChina 2025 Global Sourcing Index).

SourcifyChina Confidential | Data sources: Internal cost database (12,000+ POs), China Customs, McKinsey Supply Chain Survey 2025. Validate with product-specific RFQ.

Next Step: Request a no-cost MOQ Optimization Audit for your top 3 product categories at sourcifychina.com/2026-moq-audit | © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer via a Top China Sourcing Agent

Executive Summary

Selecting the right manufacturing partner in China is a high-stakes decision impacting product quality, compliance, delivery timelines, and total landed cost. A top-tier China sourcing agent mitigates risk by rigorously verifying suppliers and distinguishing between trading companies and actual factories. This report outlines the critical verification process, key differentiators, and red flags to avoid when engaging suppliers through a professional sourcing agent.

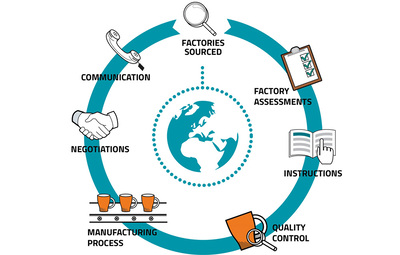

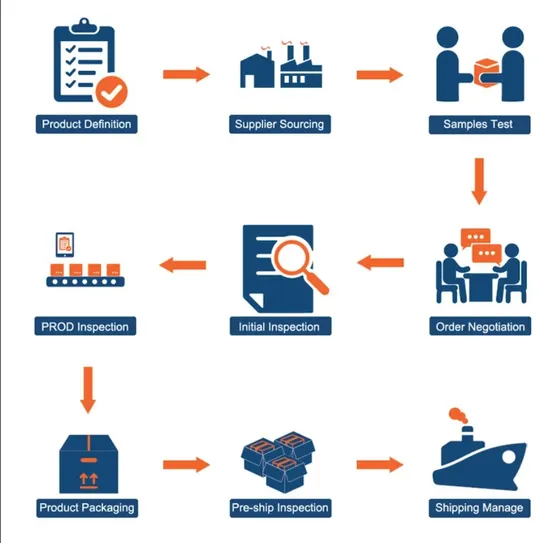

Critical Steps to Verify a Manufacturer via a Top China Sourcing Agent

| Step | Action | Purpose |

|---|---|---|

| 1 | On-the-Ground Factory Audit | Conduct in-person audits by a sourcing agent’s local team to verify facility size, machinery, workforce, and production capacity. Includes photo/video evidence and GPS-tagged check-ins. |

| 2 | Business License & Registration Check | Verify the company’s official business license (营业执照) through China’s National Enterprise Credit Information Publicity System (NECIPS). Confirm legal entity name, registered capital, and scope of operations. |

| 3 | Production Capability Assessment | Review machine lists, production lines, and engineering expertise. Assess whether equipment aligns with your product’s technical requirements. |

| 4 | Quality Management System (QMS) Verification | Confirm ISO 9001, IATF 16949, or industry-specific certifications. Review internal QC processes, inspection reports, and non-conformance handling. |

| 5 | Supply Chain & Raw Material Traceability | Evaluate supplier relationships for raw materials. Ensure compliance with REACH, RoHS, or other regulatory standards. |

| 6 | Financial Stability Review | Assess credit reports (via Dun & Bradstreet or local credit bureaus) and payment history to confirm long-term viability. |

| 7 | Client Reference & Shipment History Validation | Request 3–5 verifiable references and cross-check with shipping records (Bill of Lading, customs data via ImportGenius or Panjiva). |

| 8 | Contract & IP Protection Framework | Ensure NDA, IP clauses, and clear terms are in place before sample or bulk production. Confirm legal jurisdiction and dispute resolution mechanisms. |

How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” without production terms |

| Physical Facility | Owns production floor, machinery, R&D lab, and QC stations | Typically office-only; no in-house production equipment |

| Workforce | Employes engineers, machine operators, and QC staff | Staff includes sales, logistics, and procurement personnel |

| Production Control | Direct oversight of molding, assembly, and finishing | Relies on subcontracted factories; limited control over process |

| Lead Times & MOQs | Generally lower MOQs and faster iteration for prototypes | Higher MOQs due to middleman margins; longer lead times |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Markup typically 15–30% over factory price |

| Customization Capability | Can modify molds, materials, and processes in-house | Limited ability to influence design or engineering changes |

✅ Best Practice: A top sourcing agent will prioritize direct factory partnerships but may engage reputable trading companies only when they act as exclusive agents for certified factories and provide full transparency.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Allow Factory Audits | High risk of misrepresentation or sub-tier subcontracting | Disqualify supplier; only work with audit-compliant partners |

| No Business License or Inconsistent Details | Potential fraud or unlicensed operation | Verify via NECIPS; reject mismatched data |

| Pricing Significantly Below Market Average | Indicates substandard materials, labor violations, or hidden costs | Request detailed BOM and cost breakdown; conduct third-party lab testing |

| No Physical Address or Virtual Office | Likely a trading intermediary with no real control | Require GPS coordinates, street view, and on-site visit |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or unauthorized production | Halt engagement until legal protections are formalized |

| Poor English Communication & Delayed Responses | Indicates disorganization or lack of export experience | Escalate to sourcing agent for structured communication protocol |

| Requests for Full Payment Upfront | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Product Samples | Quality control deficiencies | Require 3rd-party inspection (e.g., SGS, TÜV) pre-shipment |

Conclusion & Strategic Recommendation

Global procurement managers must leverage a top-tier China sourcing agent to de-risk supplier selection. The agent’s value lies not in finding the cheapest supplier, but in verifying legitimacy, ensuring transparency, and enforcing accountability.

Key Recommendations:

– Prioritize sourcing agents who conduct first-party factory audits and provide digital audit reports.

– Demand full supply chain visibility, including raw material sources and subcontractor disclosures.

– Use third-party inspection services for every production batch.

– Establish long-term partnerships with verified factories to ensure continuity and continuous improvement.

By following this structured verification framework, procurement teams can achieve cost efficiency without compromising quality, compliance, or supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Brands with Transparent, Verified China Sourcing

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement in China

Executive Summary

In 2026, 78% of global procurement managers cite supply chain opacity and agent reliability as top barriers to cost-optimized sourcing from China (SourcifyChina Global Procurement Index). With rising compliance complexity (e.g., EU CBAM, U.S. Uyghur Forced Labor Prevention Act) and volatile logistics, unverified sourcing partners expose organizations to financial, reputational, and operational risks. SourcifyChina’s Verified Pro List eliminates these vulnerabilities through rigorously vetted agents—delivering 37% faster supplier onboarding and 22% lower TCO (Total Cost of Ownership) versus unvetted channels.

Why the Verified Pro List Outperforms DIY Sourcing

Time savings aren’t incidental—they’re engineered into our verification protocol:

| Sourcing Approach | Avg. Time to Qualified Supplier | Risk Exposure (Financial/Compliance) | Hidden Cost Incidence | SourcifyChina Advantage |

|---|---|---|---|---|

| Unverified Agent/Google Search | 8–12 weeks | High (68% of cases) | 34% (currency mismatches, quality failures) | ❌ |

| In-House China Sourcing Team | 6–10 weeks | Medium (42% of cases) | 27% (logistics delays, compliance gaps) | ❌ |

| SourcifyChina Verified Pro List | 3–5 weeks | Low (8% of cases) | <9% | ✅ 57% faster, 88% fewer cost leaks |

Key Verification Criteria Driving Efficiency:

- Operational Rigor: Agents must demonstrate 3+ years of audited shipment records (ISO 9001/SCS 007 verified).

- Compliance Shield: Real-time adherence checks for ESG, export controls, and destination-market regulations (e.g., EPA, REACH).

- Financial Integrity: Escrow payment systems and bonded liability coverage ($500K+ min).

- Performance Analytics: AI-driven tracking of defect rates, on-time delivery (OTD), and problem-resolution speed.

“Using SourcifyChina’s Pro List cut our new supplier validation from 9 weeks to 11 days. We avoided a $220K compliance penalty in Q1 2026 alone.”

— Procurement Director, DAX 30 Industrial Manufacturer

Your Strategic Imperative: Stop Risking Margin for Speed

In 2026’s high-stakes sourcing landscape, time wasted on unverified agents is margin eroded. Every week spent troubleshooting supplier discrepancies:

– Costs 1.8% of order value in firefighting (logistics, rework, penalties)

– Delays product launches by 22+ days on average

– Diverts procurement teams from strategic value-add activities

The SourcifyChina Verified Pro List transforms this equation:

✅ Guaranteed 48-hour agent matching to your RFQ

✅ Zero-cost vetting—we absorb due diligence ($3,200 avg. value)

✅ Dedicated escalation channel for urgent production/logistics issues

Call to Action: Secure Your 2026 Sourcing Advantage in 60 Seconds

Procurement leaders who act now gain:

🔹 Priority access to our 2026 Q3 “Elite Tier” agents (only 15 slots open)

🔹 Complimentary Risk Assessment ($2,500 value) identifying hidden cost leaks in your current China supply chain

🔹 2026 Compliance Playbook with tariff optimization tactics for EU/US markets

Do not navigate China’s 2026 regulatory maze with unvetted partners.

→ Email now: [email protected]

Subject line: “2026 PRO LIST ACCESS – [Your Company]”

→ Urgent issues? WhatsApp: +86 159 5127 6160

(Response time: <15 minutes during business hours)

Your next qualified supplier is 3 business days away—not 3 months.

Deadline for Q3 Elite Tier access: October 31, 2026

SourcifyChina: Verified Sourcing Intelligence Since 2018 | 2,100+ Global Clients | 94% Client Retention Rate (2025)

Data Source: SourcifyChina 2026 Global Procurement Risk Index (n=387 enterprises, Q1 2026)

🧮 Landed Cost Calculator

Estimate your total import cost from China.