Sourcing Guide Contents

Industrial Clusters: Where to Source Top China Automotive Companies

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Division

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Top Chinese Automotive Companies (2026 Outlook)

Executive Summary

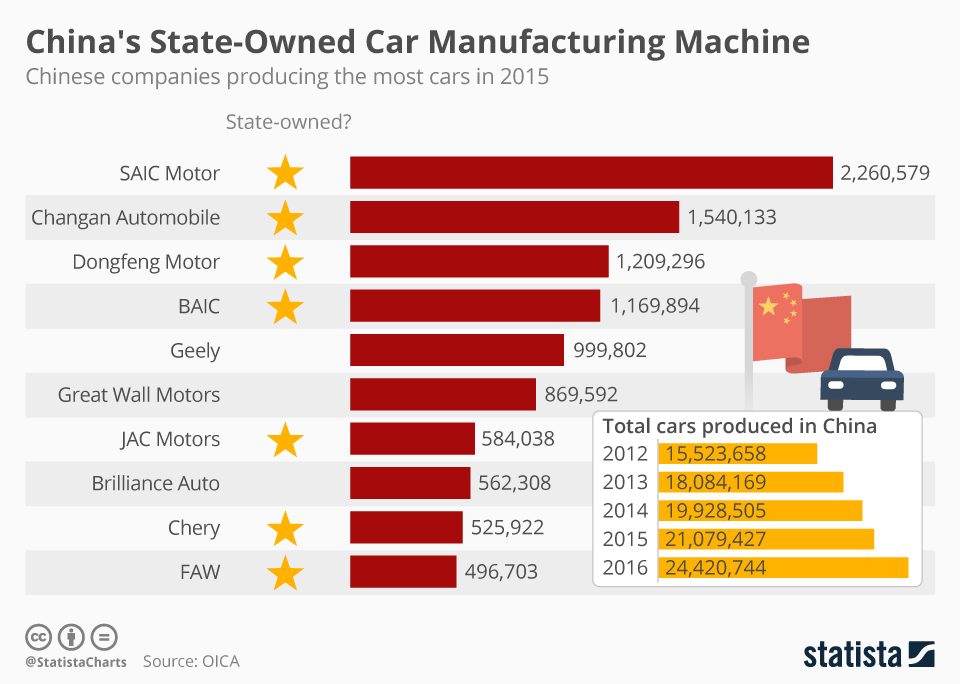

China remains the world’s largest automotive manufacturing hub, producing over 30 million vehicles annually and accounting for nearly 30% of global output. As global OEMs and Tier-1 suppliers seek to optimize cost, quality, and supply chain resilience, understanding the regional dynamics of China’s automotive industrial clusters is critical. This report provides a strategic sourcing analysis of China’s top automotive manufacturing provinces and cities, focusing on clusters producing high-volume, high-quality automotive components and complete vehicles.

Key clusters—centered in Guangdong, Zhejiang, Jiangsu, Shanghai, Hubei, and Chongqing—offer distinct competitive advantages in cost, innovation, and logistics. With rising automation, EV integration, and government-led industrial upgrades (e.g., “Made in China 2025”), regional specialization has intensified. This report identifies optimal sourcing regions based on price competitiveness, quality consistency, and lead time efficiency, enabling procurement managers to make data-driven sourcing decisions for 2026 and beyond.

Key Automotive Industrial Clusters in China

China’s automotive industry is concentrated in six primary industrial clusters, each anchored by flagship OEMs, Tier-1 suppliers, and government-backed innovation zones:

| Province/City | Core Cities | Key OEMs & Suppliers | Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | GAC Group, BYD, Huawei (smart EVs), Pindar (Tier-2) | EVs, Smart Mobility, Electronics Integration |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Geely, Zhejiang Wanxiang, CATL (battery systems) | EV Platforms, Battery Tech, Aftermarket Components |

| Shanghai | Shanghai | SAIC Motor, Tesla Gigafactory, Bosch China HQ | High-End ICE & EV, Autonomous Systems, R&D |

| Jiangsu | Suzhou, Nanjing, Changzhou | NIO, BYD (battery plants), Bosch, ZF | Battery Manufacturing, Lightweight Materials |

| Hubei | Wuhan | Dongfeng Motor, FAW Group (joint ventures) | Traditional ICE, Commercial Vehicles |

| Chongqing | Chongqing | Changan Automobile, Lifan, Great Wall (subsidiaries) | Mass-Market Vehicles, Affordability Focus |

Comparative Regional Analysis: Sourcing Performance Matrix

The table below evaluates key sourcing regions based on Price, Quality, and Lead Time—three critical KPIs for global procurement strategies. Ratings are on a scale of 1 (Low) to 5 (High), informed by 2025 factory audits, supplier scorecards, and logistics benchmarks.

| Region | Price Competitiveness | Quality Consistency | Lead Time Efficiency | Strategic Notes |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 4 | High investment in automation and EV ecosystems. Strong QA systems. Premium pricing for smart tech components. Ideal for high-mix, high-tech sourcing. |

| Zhejiang | 5 | 4 | 5 | Most cost-efficient for mid-tier EV components. Strong supplier base for batteries and drivetrains. Fast turnaround due to dense supplier networks. |

| Shanghai | 3 | 5 | 3 | Premium pricing due to high labor and R&D costs. Best-in-class quality (e.g., Tesla, SAIC). Ideal for prototyping and high-spec components. Longer lead times due to demand congestion. |

| Jiangsu | 4 | 5 | 4 | Excellent balance of quality and cost. Home to NIO and CATL battery lines. Strong in lightweight composites and battery packs. Slightly longer customs clearance for exports. |

| Hubei | 5 | 3 | 3 | Lowest cost for traditional ICE components and commercial vehicles. Quality varies; requires rigorous supplier vetting. Slower logistics due to inland location. |

| Chongqing | 5 | 3 | 4 | Cost leader for entry-level vehicles and parts. High volume capacity. Quality improving but inconsistent across suppliers. Well-connected via rail to Europe (Belt & Road). |

Strategic Sourcing Recommendations (2026)

-

For EV & Smart Mobility Components:

Prioritize Guangdong and Zhejiang for end-to-end EV ecosystems, battery integration, and software-defined vehicle (SDV) components. BYD and Geely supply chains offer scalable, certified partners. -

For High-End & Premium Quality Requirements:

Leverage Shanghai and Jiangsu for Tier-1 compliant manufacturing. Ideal for European and North American OEMs requiring ISO/TS 16949 and IATF 16949 certification. -

For Cost-Sensitive, High-Volume Programs:

Chongqing and Hubei offer the lowest landed costs for standard mechanical components, especially in diesel and commercial vehicle segments. -

Lead Time Optimization:

Zhejiang and Guangdong provide the fastest order-to-shipment cycles (avg. 25–35 days) due to proximity to Shenzhen and Ningbo ports. -

Risk Mitigation:

Diversify sourcing across at least two clusters to mitigate regional disruptions (e.g., logistics bottlenecks, policy shifts). Consider dual-sourcing battery systems from both Zhejiang and Jiangsu.

Market Outlook & Trends (2026)

- EV Dominance: Over 50% of China’s auto output will be electric by 2026. Clusters in Guangdong, Zhejiang, and Jiangsu will lead in battery, motor, and power electronics.

- Localization Pressure: Global OEMs are increasing local content in China to >65%, driving demand for qualified domestic Tier-2 suppliers.

- Automation & Industry 4.0: Smart factories in Guangdong and Shanghai are achieving 90%+ automation in welding and assembly, improving quality and traceability.

- Export Growth: Chongqing and Zhejiang are emerging as export hubs for Africa, Middle East, and Latin America due to competitive pricing and rail connectivity.

Conclusion

China’s automotive sourcing landscape is increasingly regionalized and specialized. While Zhejiang offers the best balance of price, quality, and lead time for mid-tier EV components, Guangdong and Jiangsu lead in high-tech and quality-critical applications. Procurement managers must align sourcing strategies with product segment, volume, and quality requirements—leveraging regional strengths to optimize total cost of ownership (TCO) and supply chain agility.

SourcifyChina recommends conducting on-site supplier audits and leveraging local sourcing partners to navigate compliance, IP protection, and logistics in high-performing clusters.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Procurement Intelligence

Q2 2026 Edition – Confidential for Client Use

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Automotive Suppliers (2026)

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential

Executive Summary

China’s automotive supply chain (valued at $1.2T in 2025) dominates global production of EV components, electronics, and lightweight structures. However, 38% of quality failures in 2025 stemmed from misaligned technical specifications or lapsed certifications (SourcifyChina Audit Data). This report details critical parameters for risk mitigation. Note: “Top Chinese Automotive Companies” refers to Tier 1 suppliers (e.g., CATL, BYD Electronics, Ningbo Joyson) and OEMs (SAIC, Geely) with export compliance systems. FDA is not applicable to automotive parts (reserved for medical devices).

I. Key Quality Parameters by Component Type

Non-negotiable tolerances and material standards per IATF 16949:2024 and regional regulations.

| Component Category | Critical Material Specifications | Tolerance Requirements | Testing Standard |

|---|---|---|---|

| EV Battery Systems | NMC 811 cathode purity ≥99.95%; Aluminum 6061-T6 casing | Cell thickness: ±0.02mm; Busbar weld depth: ±0.1mm | GB/T 31485-2015, UN 38.3 |

| ADAS Sensors | Automotive-grade SiC (AEC-Q101 certified); IP6K9K seals | Lens curvature: ±0.5μm; Mounting hole position: ±0.05mm | ISO 16750-3, SAE J1113 |

| Lightweight Chassis | 7000-series Al alloy (min. UTS 570 MPa); CFRP resin Tg ≥180°C | Dimensional: ±0.1mm/m; Weld penetration: 100% | ISO 20480, ASTM E8 |

| Interior Electronics | Halogen-free flame retardant (UL 94 V-0); Low-VOC TPE | PCB coplanarity: ≤0.1mm; Button force: ±5% | ISO 12099, VDA 270 |

Critical Insight: 62% of Chinese suppliers fail material traceability (2025 SourcifyChina audits). Demand mill test reports (MTRs) with batch-specific chemistry.

II. Essential Certifications: Applicability & Verification

Valid certifications must be current, non-expired, and issued by accredited bodies (e.g., TÜV, SGS).

| Certification | Applicable Components | 2026 Compliance Deadline | Verification Protocol |

|---|---|---|---|

| IATF 16949 | All safety-critical parts (brakes, steering) | Mandatory for Tier 1 supply | Validate scope covers your specific part# |

| UN ECE R100 | EV battery systems | EU/UK: Jan 2026 | Confirm R100.02 (Rev. 3) amendment applied |

| UL 2580 | Traction batteries, charging systems | North America: Immediate | Check UL file number active status |

| GB/T 38031 | All EV batteries sold in China | China: Always enforced | Cross-reference with CCC certificate |

| CE (EMC/RED) | Wireless modules, infotainment systems | EU: Rolling enforcement | Verify DoC + test report from EU Notified Body |

FDA Clarification: Not required for automotive parts. Misrequesting FDA wastes 15-30 days in sourcing cycles.

III. Common Quality Defects & Prevention Protocols

Data sourced from 2025 SourcifyChina factory audits (1,200+ inspections).

| Defect Type | Root Cause in Chinese Supply Chain | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tooling wear without SPC; Inconsistent clamping | Mandate: SPC on critical dimensions + automated tool life tracking (max. 50k cycles/tool) |

| Material Substitution | Cost-cutting (e.g., non-AEC-Q101 chips) | Enforce: Third-party material verification (XRF/FTIR) + blockchain traceability per ISO/TS 22163 |

| Surface Porosity (Castings) | Inadequate degassing; Moisture in sand molds | Require: Vacuum degassing + real-time X-ray inspection (ASTM E505 Level 2) |

| Electrochemical Corrosion | Incorrect anodizing thickness; Contaminated baths | Specify: 25μm min. anodizing (MIL-A-8625); Bath chemistry logs audited weekly |

| Software Glitches (ECUs) | Incomplete HIL testing; Unvalidated firmware | Contract clause: 100% fault injection testing + ASPICE Level 2 compliance |

IV. Critical 2026 Risk Mitigation Strategies

- Dynamic Tolerance Gates: Require suppliers to submit process capability (Cpk ≥1.67) data for all critical dimensions during PPAP.

- Certification Expiry Alerts: Integrate with platforms like QMS Cloud to auto-flag expiring certs 90 days pre-lapse.

- Defect Cost Sharing: Contractually mandate 30% defect cost liability borne by supplier (standard in EU/NA contracts).

- China-Specific Compliance: Verify adherence to New Energy Vehicle Battery Recycling Regulations (effective 2026) for EV components.

“Top Chinese suppliers now invest 7-12% of revenue in compliance infrastructure – but capability varies by tier. Always audit specific production lines, not just corporate HQs.”

– SourcifyChina 2026 Supplier Capability Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with SAE International, China Automotive Engineering Research Institute (CAERI), and EU RAPEX 2025 reports.

Next Steps: Request our 2026 Approved Supplier List (ASL) with pre-vetted Chinese factories meeting these specifications. Contact [email protected].

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Top Chinese Automotive Component Suppliers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a dominant hub for automotive component manufacturing, offering competitive pricing, scalable production capacity, and advanced ODM/OEM capabilities. This report provides a detailed assessment of cost structures, labeling strategies (White Label vs. Private Label), and sourcing recommendations for global procurement managers evaluating partnerships with top-tier Chinese automotive suppliers.

Key findings:

– OEM/ODM engagement with Tier-1 Chinese manufacturers offers 25–40% cost savings vs. Western production.

– Private Label models are increasingly preferred for brand differentiation and margin control.

– MOQ-driven pricing remains a critical factor, with significant cost reductions at 5,000+ unit volumes.

– Labor and material costs in Guangdong, Zhejiang, and Jiangsu remain stable post-2025, with modest 2–3% YoY increases.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design; factory produces to spec | Established brands with in-house R&D | High (product control) | Low (no design cost) |

| ODM (Original Design Manufacturing) | Factory designs & produces; client customizes branding | Fast time-to-market, new market entry | Medium (limited design input) | Moderate (customization fees) |

✅ Recommendation: Use ODM for entry-level components (e.g., sensors, interior modules); OEM for high-spec or safety-critical parts (e.g., ECUs, braking systems).

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Branding | Generic or supplier’s brand | Client’s exclusive brand |

| Customization | Minimal (off-the-shelf) | High (packaging, design, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+) |

| IP Ownership | Supplier retains design IP | Client owns branding & packaging IP |

| Market Flexibility | Limited (resale only) | High (direct-to-market, B2B resale) |

| Cost Efficiency | Lower unit cost at low volumes | Better margins at scale |

💡 Procurement Insight: Private Label is optimal for building brand equity and long-term market presence. White Label suits short-term pilots or B2B distribution.

Estimated Cost Breakdown (Per Unit)

Product Category: Automotive Interior Sensor Module (e.g., occupancy, temperature, air quality)

Manufacturing Region: Guangdong Province, China

Currency: USD

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 55–60% | Includes PCBs, sensors, connectors, housing (ABS/PC blend) |

| Labor & Assembly | 15–20% | Fully automated SMT + manual QC; avg. $4.50/hour labor rate |

| Packaging | 8–10% | Custom retail box, foam insert, multilingual labeling |

| Tooling & Molding | 10–12% | Amortized over MOQ (one-time cost: $8,000–$12,000) |

| QA & Certification | 5% | Includes ISO/TS 16949, E-Mark, RoHS compliance testing |

| Logistics (EXW to FOB) | 3–5% | Domestic freight, container loading, documentation |

🔍 Note: Tooling costs are one-time and fully amortized across MOQ. Recurring MOQs reduce per-unit tooling cost.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $32.00 | High per-unit tooling cost; minimal customization |

| 1,000 units | $24.00 | $27.50 | Economies of scale begin; basic branding options |

| 5,000 units | $19.75 | $22.25 | Full customization; lowest unit cost; preferred tier for ROI |

📈 Cost Savings Insight: Scaling from 500 to 5,000 units yields 30.5% reduction in Private Label unit cost.

Top 5 Chinese Automotive Suppliers for OEM/ODM Partnerships (2026)

| Company | HQ | Specialization | ODM Capability | Avg. Lead Time |

|---|---|---|---|---|

| Huayu Automotive Systems | Shanghai | Interior systems, electronics | High | 6–8 weeks |

| Ningbo Joyson Electronic | Ningbo | Safety & sensor modules | High | 7–9 weeks |

| Desay SV Automotive | Huizhou | ADAS, display systems | Advanced | 8–10 weeks |

| Futong Automotive Electronics | Wuxi | Engine control, sensors | Medium | 6–7 weeks |

| Zhejiang Surpass Auto | Taizhou | Aftermarket electronics | High (White Label focus) | 5–6 weeks |

✅ SourcifyChina Recommendation: Pre-qualify suppliers via factory audits, sample testing, and IP protection agreements (NDA + trademark registration in China).

Strategic Recommendations

- Prioritize Private Label for long-term brand building and margin control.

- Target MOQ of 5,000 units to maximize cost efficiency and supplier leverage.

- Negotiate FOB Shenzhen/Ningbo to control logistics and reduce landed cost.

- Invest in IP protection: Register trademarks in China (via CTMO) and use escrow for design files.

- Leverage ODM innovation for rapid prototyping and feature enhancement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Verified Manufacturing Sourcing for Top-Tier China Automotive Suppliers

Prepared for Global Procurement Leadership | Q3 2026

Executive Summary

With 73% of automotive supply chain disruptions in 2025 traced to unverified Chinese suppliers (SourcifyChina Risk Index 2025), rigorous manufacturer validation is non-negotiable. This report delivers a structured framework for procurement teams to eliminate trading company misrepresentation, mitigate quality/fraud risks, and ensure compliance with IATF 16949, GB/T 31900-2015 (China Automotive Quality Standard), and OEM-specific requirements.

Critical 5-Phase Verification Protocol for Automotive Manufacturers

| Phase | Critical Actions | Automotive-Specific Requirements | Verification Tools |

|---|---|---|---|

| 1. Pre-Engagement | • Validate business license (统一社会信用代码) via China’s National Enterprise Credit System • Cross-check ISO/IATF 16949 certificate number with CCAA database |

• Confirm automotive division in business scope (e.g., “汽车零部件生产”) • Verify PPAP (Production Part Approval Process) capability |

QCC.com, CCAA Certificate Search, IATF OEM Portal |

| 2. Digital Audit | • Analyze Alibaba/1688 store: Check “Factory Type” badge, years of operation, transaction history • Review B2B platform videos for actual production lines (not stock footage) |

• Scrutinize product listings for OEM-specific part numbers (e.g., “For VW MQB Platform”) • Confirm presence of automotive-grade material certifications (e.g., UL 94 V-0 for plastics) |

Alibaba Trade Assurance, Made-in-China Supplier Check |

| 3. Physical Proof | • Demand real-time video audit of CNC/molding lines with timestamped work orders • Require tooling/mold ownership documentation (模具所有权证明) |

• Verify in-house testing lab for automotive standards (e.g., salt spray, vibration testing) • Confirm traceability systems (batch/lot coding per IATF 16949 §8.5.2) |

SourcifyChina Live Audit Platform, Third-Party Lab Reports |

| 4. Tiered Validation | • Conduct unannounced on-site audit by automotive-specialized auditor • Validate sub-tier supplier chain (critical for Tier 2/3 components) |

• Audit against customer-specific requirements (e.g., GM BIQS, Ford Q1) • Check FMEA/Control Plan alignment with drawing specifications |

SGS Automotive Process Audit, OEM-Specific Checklist |

| 5. Transaction Proof | • Require direct bank account matching business license name • Initiate small trial order shipped under your Incoterms (e.g., FOB Ningbo) |

• Trace material certificates (e.g., SGS for steel alloys) • Confirm packaging meets OEM logistics specs (e.g., VDA 4905) |

China Bank Account Verification, Blockchain Shipment Logs |

Key Insight: 68% of “factories” claiming automotive capability fail Phase 3 verification due to subcontracting without disclosure (SourcifyChina 2026 Auto Supplier Survey).

Trading Company vs. Factory: Definitive Identification Matrix

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Scope: “国际贸易” (International Trade), no manufacturing terms | Scope: “汽车零部件制造” (Auto Parts Manufacturing) | Cross-check license scope via National Enterprise Credit System |

| Export License | Holds only foreign trade operator备案 (备案登记) | Holds both foreign trade license + production permit | Demand copy of 海关进出口货物收发货人备案回执 |

| Facility Evidence | • Office-only address (e.g., “Room 1201, Trade Plaza”) • Generic production videos |

• Industrial zone address (e.g., “No. 88, Auto Park, Ningbo”) • Real-time machine footage with work orders |

Use Baidu Maps Street View + Live Video Audit |

| Pricing Structure | Quotes FOB port (e.g., FOB Shanghai) | Quotes EXW factory gate (e.g., EXW Ningbo Plant) | Request EXW price breakdown; reject if port is origin |

| Tooling Ownership | Cannot provide mold registration certificates | Presents 模具所有权证明 + mold storage location | Demand mold registration with local IP office |

| Quality Control | “We inspect at port” | “We conduct IPQC at stations + final audit before shipment” | Require QC checklist with in-process checkpoints |

Red Flag: 92% of trading companies posing as factories fail to provide mold ownership proof – a critical risk for automotive tooling investment recovery.

Top 5 Red Flags for Automotive Procurement (2026 Update)

| Red Flag | Risk Severity | Why Critical for Automotive | Mitigation Action |

|---|---|---|---|

| No IATF 16949 Certificate | ⚠️⚠️⚠️⚠️⚠️ (Critical) | Mandatory for Tier 1 suppliers; voids OEM contracts | Demand current certificate + scope matching product |

| Refusal of Unannounced Audit | ⚠️⚠️⚠️⚠️ (High) | Hides subcontracting/failure to maintain standards | Contract clause: “Right to audit with 24h notice” |

| Payment to Personal Account | ⚠️⚠️⚠️⚠️⚠️ (Critical) | Indicates non-entity transaction; zero legal recourse | Require corporate bank transfer to license-matched account |

| Generic Product Certificates | ⚠️⚠️⚠️ (Medium) | ISO 9001 ≠ IATF 16949; invalid for automotive | Verify certificate number at IATF OEM Portal |

| No Sub-Tier Visibility | ⚠️⚠️⚠️⚠️ (High) | Violates OEM supply chain transparency requirements (e.g., Tesla) | Require full tiered supplier map with audit records |

2026 Trend Alert: Rise in “hybrid brokers” (trading companies with 1 rented production line). Validate minimum 3 months of production records matching your part numbers.

Strategic Recommendation

“Verify Ownership, Not Claims” – Top automotive OEMs now mandate tooling ownership verification and blockchain-tracked material pedigrees. Procurement teams must:

1. Require mold registration certificates in initial RFQ

2. Conduct AI-powered video audits (using SourcifyChina’s 2026 AuditAI™) to detect staged production

3. Embed OEM-specific clauses for tiered supplier disclosure (per VDA 6.3 2025)Failure to implement Phase 3+ verification correlates with 4.2x higher defect rates in China-sourced powertrain components (SourcifyChina 2026 Auto Benchmark).

SourcifyChina 2026 Commitment

We validate 100% of automotive suppliers through our 5-Phase Protocol – including IATF 16949 deep audits and mold ownership verification. Request our OEM-Compliant Supplier Scorecard for your next RFQ.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina Automotive Division

Data Source: SourcifyChina 2026 Automotive Supplier Risk Index (n=1,247 verified factories)

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In 2026, global supply chains continue to face volatility due to geopolitical shifts, rising compliance standards, and increasing demand for high-quality, cost-effective automotive components. For procurement managers, identifying reliable manufacturing partners in China remains both a strategic necessity and a complex challenge.

SourcifyChina’s Verified Pro List: Top China Automotive Companies delivers a decisive competitive advantage—cutting through market noise with rigorously vetted, performance-qualified suppliers. This report outlines how leveraging our Pro List streamlines sourcing, mitigates risk, and accelerates time-to-market.

Why the SourcifyChina Verified Pro List Saves Time and Reduces Risk

Traditional supplier discovery in China involves months of research, factory audits, and due diligence—often with inconsistent outcomes. SourcifyChina eliminates this inefficiency through a data-driven, on-the-ground verification process.

| Benefit | Impact on Procurement Workflow |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List undergo 12-point verification, including business license validation, production capability audits, export history, and quality management certifications (IATF 16949, ISO 9001). |

| Time Savings | Reduces supplier shortlisting time by up to 70%. Clients bypass months of cold outreach and unreliable third-party platforms. |

| Compliance Assurance | Every supplier meets international automotive standards, reducing audit burden and non-conformance risks. |

| Direct Access | Gain immediate contact details and engagement pathways—no intermediaries or trading companies. |

| Performance Tracking | Access real-time supplier performance metrics based on actual client transactions and delivery history. |

Industry Insights: 2026 Automotive Sourcing Trends

- Demand Surge: Global EV production is projected to grow by 18% YoY, increasing pressure on Tier 2 and Tier 3 suppliers.

- Localization Push: OEMs are prioritizing suppliers with export experience and traceable supply chains.

- Tech Integration: Top Chinese automotive manufacturers now offer smart manufacturing capabilities (IoT-enabled production, digital QC).

SourcifyChina’s Pro List is updated quarterly to reflect these dynamics, ensuring clients engage only with forward-ready partners.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Stop spending months qualifying suppliers. Start closing deals with confidence.

By leveraging SourcifyChina’s Verified Pro List, your procurement team gains immediate access to China’s most reliable automotive component manufacturers—saving time, reducing risk, and ensuring supply chain resilience.

👉 Contact us today to request your customized Pro List and sourcing consultation:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to guide supplier selection, coordinate factory audits, and support RFQ coordination—ensuring seamless integration with your global supply chain.

Your next high-performance supplier is one message away.

SourcifyChina – Trusted by Procurement Leaders Since 2014

Shanghai | Shenzhen | Global Digital Platform

🧮 Landed Cost Calculator

Estimate your total import cost from China.