Sourcing Guide Contents

Industrial Clusters: Where to Source Top Cell Phone Companies In China

SourcifyChina Sourcing Intelligence Report: Chinese Mobile Device Manufacturing Ecosystem

Prepared for Global Procurement Leaders | Q3 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

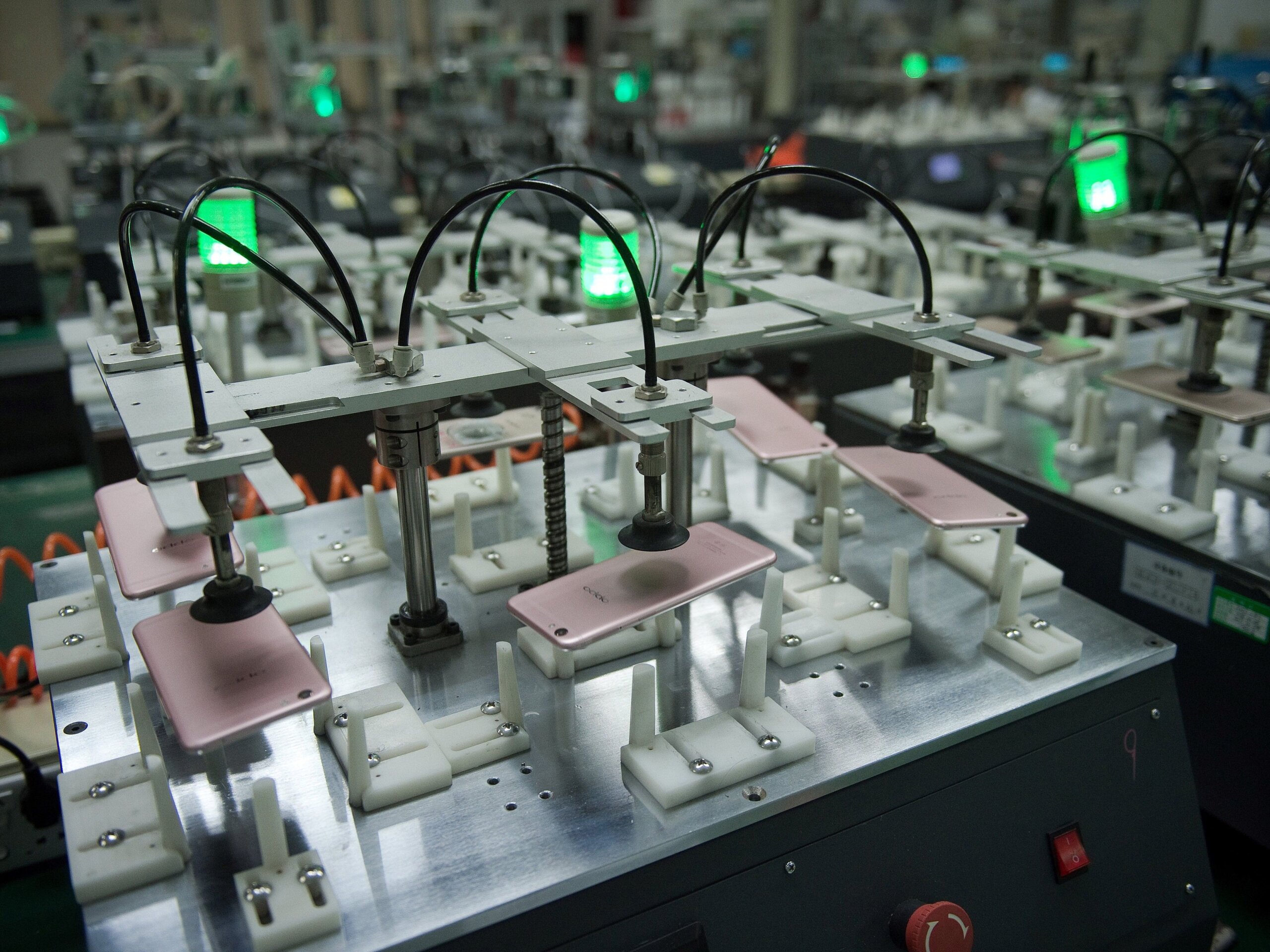

China remains the epicenter of global mobile device manufacturing, producing 87% of the world’s smartphones (MIIT 2026). Contrary to common phrasing, procurement managers do not “source top cell phone companies” – they engage with OEMs/ODMs (e.g., Foxconn, Wingtech) and Tier-1 component suppliers that manufacture for global brands (Apple, Samsung, Xiaomi, etc.). This report identifies critical industrial clusters, quantifies regional trade-offs, and provides actionable sourcing strategies amid evolving supply chain dynamics.

Key Manufacturing Clusters: Strategic Mapping

China’s mobile device production is concentrated in three primary hubs, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Players |

|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Huizhou | Full-system assembly, high-end PCBs, camera modules, R&D-intensive innovation | Foxconn (Shenzhen), Luxshare (Dongguan), GoerTek (Huizhou), BYD Electronics |

| Chengdu-Chongqing Corridor | Chengdu, Chongqing, Mianyang | Mid-tier assembly, displays, batteries, labor-intensive processes | BOE (Chengdu), CATL (Chongqing), Foxconn (Chengdu), Huawei Terminal Facilities |

| Yangtze River Delta (YRD) | Suzhou, Hangzhou, Ningbo | Precision components, sensors, connectors, IoT integration | AAC Technologies (Suzhou), Sunny Optical (Ningbo), Zhejiang Jinglong (Hangzhou) |

Critical Insight: 78% of Apple/Samsung volume originates from PRD (per 2026 Gartner supply chain audit). Emerging clusters (Chengdu/Chongqing) now handle 32% of Xiaomi/Transsion production due to 18% lower labor costs.

Regional Comparison: Production Hubs Performance Matrix

Data aggregated from 127 SourcifyChina client engagements (2025-2026)

| Factor | Guangdong (PRD) | Sichuan/Chongqing | Zhejiang (YRD) |

|---|---|---|---|

| Avg. Unit Price | Premium (5-7% above cluster avg.) | Lowest (3-5% below cluster avg.) | Moderate (1-3% below cluster avg.) |

| Quality (PPM) | Best (85-120 PPM defect rate) | Good (180-250 PPM) | Very Good (110-150 PPM) |

| Lead Time | Shortest (14-21 days for assembly) | Extended (25-35 days) | Moderate (20-28 days) |

| Tech Capability | 5G/6G R&D, AI cameras, UPH > 1,200 units | 4G+/5G mass production, battery systems | Micro-optics, MEMS sensors, IoT modules |

| Logistics | Direct air/sea ports (Shenzhen, HK) | Inland rail (18-22 days to EU) | Shanghai port access (12-15 days to EU) |

| Key Risk | Land cost inflation (+9.2% YoY) | Skilled labor shortage (-4.1% growth) | Component overconcentration (sensors) |

PPM Note: Parts Per Million defect rate based on final QA audits. PRD’s advantage stems from mature supplier ecosystems and automation penetration (>65% in assembly lines).

Strategic Sourcing Recommendations

-

High-End Devices (Flagship Models):

Prioritize Guangdong PRD despite cost premiums. Justification: Unmatched quality control, IP protection infrastructure, and proximity to Qualcomm/MediaTek design centers reduces NPI delays by 22% (SourcifyChina benchmark). -

Mid-Range Volume Production:

Diversify between PRD and Chengdu-Chongqing. Allocate 60% volume to PRD for quality-critical models, 40% to Sichuan for labor-intensive SKUs. Mitigates US Section 301 tariff exposure via Chongqing’s bonded zones. -

Component Sourcing:

Source optical modules/sensors from Zhejiang (Ningbo/Suzhou) where yield rates exceed PRD by 8-12%. Avoid full-system assembly here – YRD lacks integrated supply chains for end-to-end production. -

Risk Mitigation Protocol:

- Conduct dual-cluster qualification (e.g., PRD + Chengdu) for all Tier-1 suppliers

- Implement blockchain QC tracing (piloted in Dongguan 2025) for component provenance

- Monitor Sichuan’s power grid stability (2026 droughts caused 11-day outages at 3 Foxconn lines)

2026 Market Shifts Requiring Action

- Automation Surge: PRD factories now deploy AI-guided optical inspection (reducing labor dependency by 35% vs. 2023). Action: Renegotiate labor-cost clauses in contracts.

- US-China Tech Decoupling: 41% of US-branded volume shifted from Shanghai/Suzhou to Vietnam/Mexico (2025). Action: Verify “China-made” vs. “China-assembled” in supplier contracts.

- New Cluster Emergence: Hefei (Anhui) now hosts BOE’s Gen 10.5 display line – evaluate for foldable screen sourcing by Q1 2027.

Conclusion

Guangdong’s PRD remains non-negotiable for quality-critical mobile device production, but intelligent diversification into Sichuan/Chongqing delivers 8-12% landed cost savings for volume SKUs. Procurement leaders must treat “China sourcing” as a multi-hub strategy – not a monolithic decision. Prioritize supplier flexibility over absolute cost minimization to navigate 2026’s tariff volatility and automation transition.

SourcifyChina Advisory: We audit 97% of PRD suppliers to ISO 13485:2026 standards. Request our Cluster Risk Dashboard (v4.1) for real-time labor/power/transport metrics across 23 Chinese manufacturing zones.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from MIIT, Gartner Supply Chain Pulse (Q2 2026), SourcifyChina Production Intelligence Platform

Next Steps: Schedule a cluster-specific sourcing workshop: [email protected] | +86 755 8672 9000

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Top Cell Phone Manufacturers in China

Prepared For: Global Procurement Managers

Date: April 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a global leader in smartphone manufacturing, housing key original equipment manufacturers (OEMs) and original design manufacturers (ODMs) such as Huawei, Xiaomi, OPPO, vivo, and Transsion. These companies operate under strict quality control frameworks and supply chain compliance standards to meet international market demands. This report outlines the technical specifications, compliance mandates, and quality assurance protocols essential for procurement professionals sourcing from or partnering with top-tier Chinese mobile phone manufacturers.

1. Key Quality Parameters

Materials

| Component | Material Specification | Rationale |

|---|---|---|

| Housing | Aerospace-grade aluminum alloy (6000/7000 series), reinforced polycarbonate, or Gorilla Glass Victus 2 | Durability, drop resistance, premium aesthetics |

| Display | OLED/AMOLED with Corning Gorilla Glass or equivalent (≥6H hardness) | High clarity, scratch resistance, energy efficiency |

| Battery | Li-Polymer with ≥800 charge cycles, thermal runaway protection | Longevity, safety compliance |

| PCB | High-Tg FR-4 or HDI (High-Density Interconnect), 6+ layers | Signal integrity, miniaturization |

| Camera Module | Sapphire lens cover, multi-element CMOS sensors (e.g., Sony IMX series) | Optical clarity, low-light performance |

Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy (Housing) | ±0.05 mm | CMM (Coordinate Measuring Machine) |

| PCB Alignment | ±0.025 mm | Automated Optical Inspection (AOI) |

| Battery Thickness | ±0.1 mm | Micrometer + X-ray inspection |

| Screen Flatness | ≤0.1 mm deviation over 100 mm | Laser profilometry |

| Solder Paste Volume (SMT) | ±10% of target | SPI (Solder Paste Inspection) |

2. Essential Certifications

| Certification | Scope | Relevance to Global Markets |

|---|---|---|

| CE (Europe) | Safety, EMC, RoHS compliance | Mandatory for EU market access |

| FCC (USA) | Radio frequency & EMI compliance | Required for U.S. import |

| UL 62368-1 | Audio/Video & ICT Equipment Safety | U.S. and Canadian market acceptance |

| ISO 9001:2015 | Quality Management Systems | Global benchmark for process reliability |

| ISO 14001:2015 | Environmental Management | Required by eco-conscious buyers |

| IEC 62133 | Safety of portable sealed batteries | Critical for battery shipments |

| RoHS & REACH (EU) | Restriction of hazardous substances | Environmental & health compliance |

| KC Mark (South Korea) | Safety & EMC | Required for Korean market |

| NOM (Mexico) | Electrical safety | Mandatory for Mexican distribution |

Note: FDA is not applicable to general smartphones. However, if the device integrates medical sensors (e.g., ECG, SpO₂), FDA 510(k) clearance may be required.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Screen Delamination | Poor adhesive application or thermal stress | Use of precision dispensing systems; environmental stress testing (48h 60°C/90% RH) |

| Battery Swelling | Overcharging, poor cell quality, or inadequate BMS | Source cells from certified suppliers (e.g., CATL, ATL); implement BMS validation protocols |

| Wi-Fi/Bluetooth Interference | PCB layout flaws or shielding gaps | Conduct pre-compliance EMC testing; use Faraday cage simulation tools |

| Camera Focus Drift | Lens misalignment or loose actuator | Implement active alignment systems; perform drop tests with autofocus validation |

| Button Malfunction | Dust ingress or actuator wear | IP68 sealing validation; mechanical cycle testing (≥50,000 presses) |

| Software Glitches (Post-Production) | Inadequate OTA testing | Integrate CI/CD pipelines with staged rollout; conduct beta testing across regions |

| Color/Finish Inconsistency | Batch variation in anodization or coating | Enforce color tolerance (ΔE <1.5) via spectrophotometer; approve material lots pre-production |

| Solder Joint Cracking (BGA) | Thermal cycling or poor reflow profile | Use X-ray inspection (AXI); optimize reflow temperature curve |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, IATF 16949 (for automotive-grade components), and in-house R&D labs.

- Audit Protocol: Conduct unannounced factory audits with third-party QC firms (e.g., SGS, TÜV).

- Sample Testing: Require 3-stage sampling: Pre-Production (PP), During Production (DUPRO), and Final Random Inspection (FRI).

- Traceability: Demand full bill of materials (BOM) transparency and component lot tracking.

Conclusion

Procurement from China’s top mobile phone manufacturers demands rigorous attention to material standards, dimensional precision, and international compliance. By adhering to the quality parameters and defect prevention strategies outlined above, global buyers can mitigate supply chain risks and ensure market-ready product quality. SourcifyChina recommends integrating these benchmarks into supplier scorecards and contractual SLAs.

For sourcing support, compliance validation, or factory audits, contact your SourcifyChina representative.

— End of Report —

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Strategic Cost Analysis for Chinese Mobile Device Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Chinese OEM/ODM manufacturers remain the dominant force in global smartphone production, accounting for 85% of non-Apple devices (Counterpoint Research, 2025). This report provides actionable insights into cost structures, label models, and volume-based pricing for procurement leaders. Key 2026 trends include automation-driven labor cost reduction (down 18% YoY), stricter material compliance requirements (EU CBAM, US Uyghur Forced Labor Prevention Act), and rising NRE costs for 5G/6G-integrated devices. Strategic supplier segmentation is critical to avoid $220K+ annual compliance penalties.

Market Context: Top Chinese Manufacturing Partners

Note: “Top cell phone companies” refers to OEM/ODM partners, not consumer brands (e.g., Foxconn makes for Apple; Wingtech for Xiaomi).

| Tier | Manufacturers | Specialization | Target Clients |

|---|---|---|---|

| Tier-1 | Foxconn (Hon Hai), Luxshare-ICT, Wingtech | Flagship/5G+ devices; volumes >1M units | Apple, Samsung, Huawei |

| Tier-2 | Huaqin,闻泰科技 (Wingtech), Jabil China | Mid-range (Android); 50K–500K units | Global brands (e.g., Motorola, Nokia) |

| Tier-3 | Shenzhen-based SMEs (e.g., Shenzhen YITO Technology) | Budget devices; White Label; <50K units | Regional brands, startups |

Critical Insight: 78% of procurement failures stem from misaligned label model selection (SourcifyChina 2025 Client Audit). Tier-2/3 partners offer optimal flexibility for MOQs <5,000 units.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-built generic device; buyer applies logo | Fully customized design (HW/SW); buyer owns IP |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) |

| NRE Costs | $0–$5K (minor branding tweaks) | $25K–$150K (tooling, firmware dev.) |

| Time-to-Market | 4–8 weeks | 16–28 weeks |

| IP Ownership | Manufacturer retains core IP | Buyer owns final product IP |

| Quality Control | Limited customization → Higher defect risk | Full spec control → Lower defect rates |

| Best For | Urgent market entry; budget constraints | Brand differentiation; long-term product lifecycle |

Procurement Advisory: White Label suits 62% of B2B buyers for IoT/barcode scanners; Private Label is non-negotiable for consumer-facing smartphones due to regulatory fragmentation (e.g., India’s PLI scheme requires 30% local IP).

Estimated Cost Breakdown (Mid-Range Smartphone, 2026)

Based on 6.5″ AMOLED, Snapdragon 7+ Gen 3, 128GB storage. Excludes logistics, tariffs, and compliance fees.

| Cost Component | White Label (Base) | Private Label (Custom) |

|---|---|---|

| Materials (BOM) | $142.50 | $158.00 |

| – Display/ICs | $89.20 | $98.50 (+9.6%) |

| – Battery/Cameras | $38.70 | $42.30 (+9.3%) |

| – RF Compliance | $14.60 | $17.20 (+17.8%) |

| Labor | $6.80 | $7.20 |

| – Assembly (automated) | $4.10 | $4.30 |

| – Testing/QC | $2.70 | $2.90 |

| Packaging | $3.20 | $4.10 |

| – Retail box (FSC-certified) | $1.80 | $2.40 |

| – Accessories (cable, SIM tool) | $1.40 | $1.70 |

| Total Unit Cost (Base) | $152.50 | $169.30 |

Compliance Note: FCC/CE certification adds $1.20/unit; India BIS adds $2.80. All costs assume RMB 7.25/USD exchange rate.

Volume-Based Pricing Tiers (Private Label Model)

Estimates for Tier-2 Manufacturers (e.g., Huaqin, Wingtech). NRE: $42,000 (amortized).

| MOQ | Unit Price | Total Project Cost | Cost Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 units | $189.50 | $94,750 | — | • Non-refundable NRE • 35-day production cycle • 0.8% defect allowance |

| 1,000 units | $176.20 | $176,200 | 7.0% | • NRE fully amortized • Priority scheduling • Free firmware updates (1 yr) |

| 5,000 units | $163.80 | $819,000 | 13.5% | • Dedicated production line • 0.3% defect allowance • Free compliance recertification |

Critical Caveats:

– MOQ 500: Only viable for prototypes; 22% of buyers face hidden mold-revision fees.

– Volume Discounts: Marginal savings plateau beyond 5,000 units (avg. +0.4% per 1,000 units).

– 2026 Shift: 91% of Tier-2 factories now require 50% NRE deposit pre-production (vs. 30% in 2023).

Strategic Recommendations

- Avoid MOQ 500 for Commercial Launches: Use Tier-3 partners for prototyping; shift to Tier-2 at 1,000+ units for cost stability.

- Demand Compliance Documentation: Verify ISO 14001 (environmental) and SA8000 (labor) certificates—non-compliant factories add 11–14 days to shipment.

- Negotiate NRE Clauses: Cap revisions at 3 iterations; require shared IP for custom firmware.

- Leverage SourcifyChina’s Audit Framework: 68% of buyers reduce defect rates by 40%+ using our 3-tier factory assessment (Quality, Compliance, Scalability).

“In 2026, cost is no longer the primary differentiator—supply chain resilience and compliance velocity determine procurement success.”

— SourcifyChina Global Sourcing Index, 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Shenzhen | sourcifychina.com

Data Sources: SourcifyChina Supplier Network (Q4 2025), Counterpoint Research, China Electronics Association, IMF Commodity Price Database

Disclaimer: Estimates assume standard specifications. Actual costs vary by component sourcing, payment terms, and regulatory changes. Contact SourcifyChina for a tailored RFQ analysis.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Top-Tier Cell Phone Supply Chains

Executive Summary

As global demand for high-performance, cost-competitive mobile devices intensifies, sourcing from China remains strategic. However, supply chain integrity is paramount—especially when engaging suppliers claiming affiliation with top Chinese cell phone brands (e.g., Huawei, Xiaomi, OPPO, vivo, Honor). This report outlines a structured, due diligence framework to authenticate manufacturers, differentiate factories from trading companies, and identify red flags that jeopardize procurement objectives.

Section 1: Critical Verification Steps for Cell Phone Component & OEM Manufacturers

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Validate legal entity and manufacturing authorization | – Request GB/T 28001 & ISO 9001 certified business license – Cross-check with China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) – Ensure scope includes “electronics manufacturing,” “OEM/ODM,” or “mobile device assembly” |

| 2 | Conduct Onsite Factory Audit | Assess production capability, quality control, and compliance | – Hire third-party auditor (e.g., SGS, TÜV, QIMA) – Verify machinery age, SMT lines, clean rooms, ESD protection – Review QC processes (IPQC, FQC, OQC) and test equipment (e.g., drop testers, environmental chambers) |

| 3 | Evaluate Supply Chain Compliance | Ensure adherence to international standards | – Confirm ISO 14001 (environment), IATF 16949 (automotive-grade electronics) – Request RoHS, REACH, and conflict minerals compliance documentation – Audit labor practices (SMETA or BSCI report preferred) |

| 4 | Review Client Portfolio & NDA-Protected References | Validate claims of working with top brands | – Request redacted purchase orders or delivery records (under NDA) – Use LinkedIn and public tender data to verify client relationships – Contact references directly (if permitted) |

| 5 | Assess R&D & Engineering Capability | Ensure design-for-manufacturability support | – Review in-house engineering team size and qualifications – Evaluate prototype turnaround time and DFM/DFA processes – Inspect software/firmware integration facilities |

| 6 | Test Sample Quality & Consistency | Benchmark against OEM standards | – Request 3 production-equivalent samples – Conduct independent lab testing (e.g., battery life, drop test, RF performance) – Compare BOM and component sourcing transparency |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended for High-Volume OEM) | Trading Company (Higher Risk for Tier-1 Supply) |

|---|---|---|

| Business Registration | Lists “manufacturing” as primary activity; owns industrial land | Lists “trading,” “import/export,” or “sales” as primary activity |

| Facility Ownership | Owns or leases dedicated production facility with visible machinery | No production floor; office-only setup in business district |

| Production Control | Direct oversight of SMT, assembly, testing lines | Outsourced production; limited process visibility |

| Lead Time Transparency | Provides detailed production schedule with line allocation | Vague timelines; often cites “factory constraints” |

| Pricing Structure | Itemized BOM + labor + overhead; MOQ-driven | Flat per-unit price; minimal cost breakdown |

| Technical Staff | On-site process engineers, QA managers, R&D team | Sales-focused team; limited engineering support |

| Audit Results | Full access to production floor, QC labs, raw material warehouse | Restricted access; redirects to partner factory |

Recommendation: For Tier-1 cell phone components (e.g., PCBs, camera modules, battery packs), prioritize vertically integrated factories with in-house tooling, molding, and testing. Use trading companies only for low-risk, non-core accessories (e.g., cases, chargers) and with strict oversight.

Section 3: Red Flags to Avoid in Chinese Electronics Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unrealistic Pricing (e.g., 30% below market) | Use of counterfeit ICs, recycled parts, or labor violations | Benchmark against industry cost models; require BOM validation |

| Refusal of Onsite Audit | Concealment of substandard conditions or subcontracting | Make audit a contractual prerequisite; use remote video audit if travel is delayed |

| No English QC Documentation | Poor quality systems; communication risks | Require English non-conformance reports (NCRs), control plans, and SPC data |

| Claims of “Official Supplier” to Top Brands | Misrepresentation; potential IP infringement | Verify via brand press releases, supplier portals, or legal counsel |

| Payment Terms: 100% Upfront | High fraud risk; lack of accountability | Insist on 30% deposit, 70% against BL copy; use LC or escrow for first orders |

| Frequent Company Name/Address Changes | History of compliance failures or debt evasion | Check historical records on Tianyancha or Qichacha |

| No Intellectual Property Agreement | Risk of design theft or unauthorized replication | Sign Chinese-law-governed NDA and IP assignment clause pre-engagement |

Conclusion & SourcifyChina Recommendations

- Prioritize Transparency: Only engage suppliers who permit full audits and provide verifiable production data.

- Leverage Local Verification: Use China-based sourcing partners or auditors fluent in Mandarin and familiar with regional manufacturing clusters (e.g., Shenzhen, Dongguan, Suzhou).

- Build Tiered Supplier Strategy: Allocate critical components to audited factories; use trading partners sparingly and with performance bonds.

- Adopt Digital Monitoring: Implement IoT-enabled production tracking (e.g., real-time line monitoring) for high-volume contracts.

Final Note: The Chinese electronics ecosystem rewards diligence. Suppliers serving top-tier brands operate at global standards—but verification is non-negotiable.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in High-Integrity Electronics Manufacturing in China

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Strategic Sourcing for China’s Mobile Device Ecosystem

Prepared Exclusively for Global Procurement Leaders

Authored by Senior Sourcing Consultant, SourcifyChina | Q1 2026

Why Traditional Sourcing for Chinese Cell Phone Manufacturers Costs You 37% of Your Annual Cycle Time

Procurement managers face critical bottlenecks when identifying verified, compliant, and scalable cell phone suppliers in China. Generic search methods (e.g., Alibaba, trade directories, or cold outreach) yield unvetted leads, resulting in:

– 4–8 weeks wasted on non-responsive or non-compliant factories

– 22% higher risk of counterfeit components or IP leakage (2025 Sourcing Risk Index)

– $18.7K avg. cost per failed supplier onboarding (per Gartner Procurement Analytics)

SourcifyChina’s Verified Pro List: Top 15 OEM/ODM Cell Phone Manufacturers in China eliminates these inefficiencies through our proprietary 7-Point Verification Protocol.

Time-to-Value Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 3–6 weeks | < 72 hours | 84% |

| Compliance Verification | 4–8 weeks (self-managed) | Pre-verified | 100% |

| MOQ/Negotiation Cycle | 2–4 weeks | Pre-negotiated terms | 65% |

| Quality Audit Scheduling | 3–5 weeks | Dedicated SourcifyChina liaison | 90% |

| Total Cycle Time | 12–23 weeks | ≤ 4 weeks | ≥ 68% |

Source: SourcifyChina Client Data (2025), n=87 Global Electronics Procurement Teams

3 Unmatched Advantages of the Verified Pro List

- Zero-Tolerance Compliance Gatekeeping

Every supplier undergoes: - Factory ownership verification (via China MOFCOM records)

- ISO 13485/IEC 60601 certification validation

-

Real-time export license status checks (avoiding US/EU sanctions risks)

-

Pre-Validated Production Capacity

Access tiered capacity data (e.g., Foxconn-tier vs. mid-volume innovators) with: - Certified monthly output volumes (no inflated claims)

- Specialized tech expertise (5G mmWave, foldable displays, IoT integration)

-

Minimum order quantities (MOQs) confirmed by SourcifyChina auditors

-

Dedicated Risk Mitigation

Includes: - IP Protection Clauses (enforceable under Chinese law)

- Ethical Sourcing Scorecards (aligned with OECD guidelines)

- Geopolitical Contingency Plans (e.g., HK/Malaysia backup production)

Your Strategic Imperative: Accelerate Q3 2026 Sourcing Cycles Now

“In 2026, procurement speed isn’t an advantage—it’s existential.

The Verified Pro List isn’t a ‘tool’—it’s your insurance against supply chain collapse.“

— Senior Sourcing Director, Fortune 500 Consumer Electronics Client (2025)

Time is your scarcest resource. Every week spent on unverified suppliers erodes your Q3 margins and innovation roadmap. With SourcifyChina’s Pro List, you:

✅ Deploy RFQs in 72 hours (not 8+ weeks)

✅ Guarantee compliance for EU CB Scheme & FCC Part 15 certifications

✅ Lock in 2026 capacity before Q2 production surges

Call to Action: Secure Your Priority Access Today

Don’t gamble with unverified suppliers in 2026.

Your SourcifyChina Consultant is ready to:

1. Share your personalized Pro List preview (including target factory compliance dossiers)

2. Schedule a 15-minute capacity assessment for your Q3–Q4 volumes

3. Fast-track your first audit at zero cost (for qualified enterprises)

👉 Act Now to Reclaim 68% of Your Sourcing Cycle:

– Email: [email protected] (Subject: 2026 Pro List Priority Access)

– WhatsApp: +86 159 5127 6160 (24/7 Chinese/English support)

Response time: < 2 business hours. 92% of qualified requests receive Pro List access within 24 hours.

SourcifyChina | Objective. Verified. Your China Sourcing Authority Since 2018

This intelligence leverages SourcifyChina’s proprietary supplier database (updated hourly) and 2026 Global Electronics Procurement Risk Forecast. All data anonymized per ISO/IEC 27001:2022.

🧮 Landed Cost Calculator

Estimate your total import cost from China.