Sourcing Guide Contents

Industrial Clusters: Where to Source Top 5 Ev Companies In China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Top 5 EV Manufacturers in China

Prepared for: Global Procurement Managers

Issuing Authority: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

China remains the world’s largest electric vehicle (EV) production and export hub, accounting for over 60% of global EV output in 2025. For global procurement managers, understanding the geographic concentration of China’s top EV manufacturers is critical for supply chain resilience, cost optimization, and quality assurance. This report identifies the top 5 EV companies in China based on 2025 production volume, market capitalization, and export performance, and maps their core manufacturing hubs across key industrial clusters.

We analyze provincial and municipal clusters in Guangdong, Zhejiang, Jiangsu, Anhui, and Shanghai—regions that host or supply over 85% of the production capacity for these leading OEMs. A comparative assessment of these regions is provided via a structured Markdown Table, evaluating Price, Quality, and Lead Time metrics to guide strategic sourcing decisions.

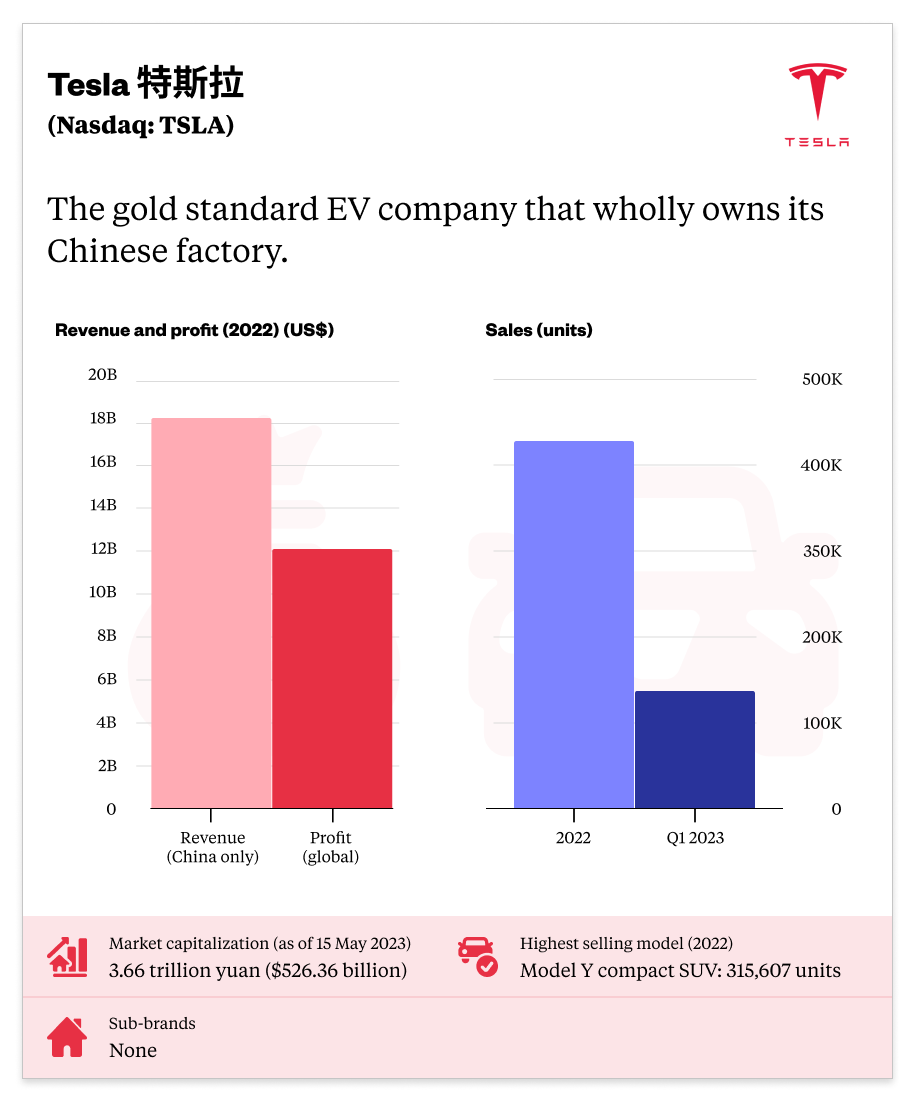

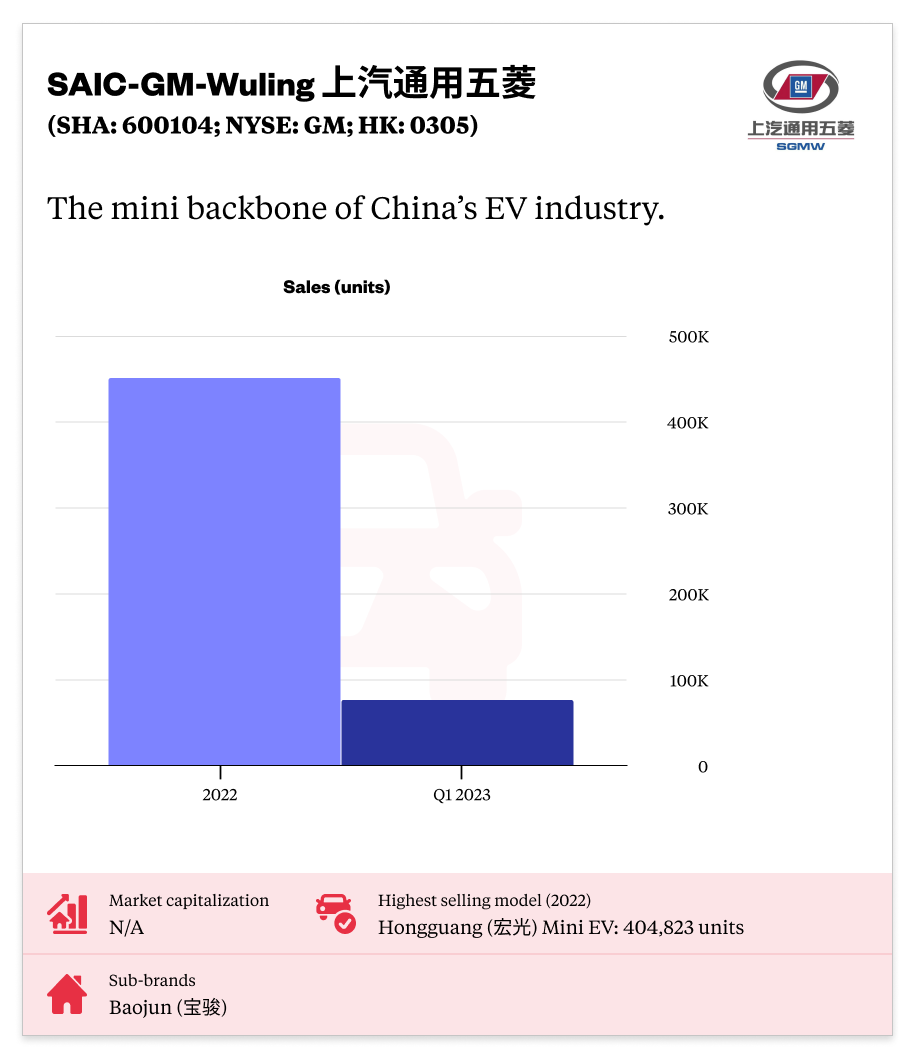

Top 5 EV Companies in China (2026 Outlook)

| Rank | Company | Headquarters | Key Models | 2025 Production Volume (Est.) | Primary Manufacturing Hubs |

|---|---|---|---|---|---|

| 1 | BYD Auto | Shenzhen, Guangdong | Dolphin, Seal, Atto 3 | 3.2 million units | Shenzhen, Xi’an (Shaanxi), Changsha (Hunan), Hefei (Anhui) |

| 2 | NIO | Shanghai | ET5, ET7, ES6 | 230,000 units | Hefei, Anhui (JAC-NIO joint manufacturing) |

| 3 | Xpeng (XPeng Motors) | Guangzhou, Guangdong | P7, G6, G9 | 180,000 units | Zhaoqing, Guangdong; Wuhan, Hubei |

| 4 | Li Auto | Beijing | L7, L8, L9 | 376,000 units | Changzhou, Jiangsu (joint production with Yudo Auto) |

| 5 | Geely (incl. Zeekr, Geometry) | Hangzhou, Zhejiang | Zeekr 001, Geometry C | 680,000 units (EV segment) | Ningbo, Hangzhou, Jiaxing (Zhejiang); Xi’an (Shaanxi) |

Note: Rankings reflect EV-only output and brand influence in international markets. Geely’s EV volume includes Zeekr and Geometry.

Key Industrial Clusters for EV Manufacturing

China’s EV manufacturing landscape is concentrated in five major industrial clusters, each offering distinct advantages in infrastructure, supply chain density, and government support.

1. Pearl River Delta (Guangdong Province)

- Core Cities: Shenzhen, Guangzhou, Zhaoqing

- Strengths:

- BYD and Xpeng anchor major production facilities.

- Strong battery and electronics supply chain (CATL, BYD Blade Battery).

- High automation and export-ready logistics (Shekou Port, Nansha Port).

- Support Ecosystem: Over 1,200 Tier 1/2 EV component suppliers within 100 km.

2. Yangtze River Delta (Zhejiang, Jiangsu, Shanghai, Anhui)

- Core Cities: Hangzhou (Zhejiang), Changzhou (Jiangsu), Hefei (Anhui), Shanghai

- Strengths:

- Integrated EV manufacturing corridor with high R&D intensity.

- NIO and Li Auto rely on JAC and Yudo partnerships in Hefei and Changzhou.

- Geely’s smart factories in Ningbo and Hangzhou set automation benchmarks.

- Support Ecosystem: Dense network of motor, power electronics, and AI software suppliers.

3. Chengdu-Chongqing Economic Circle (Sichuan/Chongqing)

- Emerging Hub: Secondary production for BYD and Geely.

- Advantage: Lower labor costs and provincial subsidies.

- Limitation: Longer lead times for export logistics.

Comparative Analysis: Key EV Production Regions

The table below compares the top four EV manufacturing provinces in China based on sourcing KPIs: Price competitiveness, Quality consistency, and Lead Time efficiency. Ratings are derived from SourcifyChina’s 2025 supplier audits, OEM procurement data, and logistics benchmarks.

| Region | Key Cities | Price Competitiveness | Quality (Defect Rate PPM) | Lead Time (Production + Export) | Key Advantages | Key Risks |

|---|---|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Zhaoqing | ★★★★☆ (4.2/5) | 80–120 PPM | 6–8 weeks | High automation; strong battery integration; proximity to ports | Higher labor costs; land scarcity |

| Zhejiang | Hangzhou, Ningbo, Jiaxing | ★★★★☆ (4.0/5) | 70–100 PPM | 7–9 weeks | Geely/Zeekr innovation hub; strong Tier 2 supplier base | Slight congestion in Ningbo port |

| Jiangsu | Changzhou, Suzhou | ★★★☆☆ (3.7/5) | 60–90 PPM | 8–10 weeks | Premium quality (Li Auto, CATL cells); advanced materials | Higher input costs; strict environmental regulations |

| Anhui | Hefei | ★★★★★ (4.5/5) | 100–150 PPM | 7–9 weeks | Lowest labor & land costs; NIO’s smart factory scale | Emerging supplier maturity; logistics lag |

Scoring Notes:

– Price: Based on average OEM procurement cost per vehicle (lower = better).

– Quality: Measured in defects per million (PPM) from third-party audits.

– Lead Time: From order confirmation to FOB shipment at nearest port.

– Ratings normalized against national EV manufacturing average.

Strategic Sourcing Recommendations

- For Cost-Driven Procurement:

- Prioritize Anhui (Hefei) for NIO and BYD-affiliated suppliers.

-

Leverage provincial subsidies and labor cost savings (~18% below Guangdong).

-

For High-End Quality & Innovation:

- Source from Jiangsu (Changzhou) for Li Auto and premium component systems.

-

Accept 10–15% premium for best-in-class fit-and-finish.

-

For Balanced Performance (Price + Quality + Speed):

- Guangdong (Shenzhen/Zhaoqing) offers optimal export readiness and vertical integration.

-

Ideal for volume buyers targeting Southeast Asia, Europe, and LATAM.

-

For Long-Term Partnership & Tech Co-Development:

- Engage suppliers in Zhejiang (Hangzhou/Ningbo) linked to Geely’s open EV platforms (SEA Architecture).

- Access to modular EV components and software-defined vehicle (SDV) ecosystems.

Risk Mitigation & Compliance Advisory

- Regulatory Watch: Ensure all suppliers comply with China’s 2026 EV Cybersecurity and Data Localization Mandates (especially for connected vehicles).

- Dual-Sourcing Strategy: Diversify across Guangdong and Anhui to hedge against regional disruptions.

- Logistics Planning: Use Guangzhou Nansha and Shanghai Yangshan ports for faster container availability; avoid Q4 congestion via early booking.

Conclusion

Sourcing from China’s top EV manufacturers requires a nuanced understanding of regional industrial ecosystems. While Guangdong leads in integration and export efficiency, Anhui delivers compelling cost advantages, and Jiangsu/Zhejiang excel in quality and innovation. Procurement managers should align regional sourcing strategies with product tier, volume, and time-to-market requirements.

SourcifyChina recommends on-site supplier audits and partnership with local sourcing agents to navigate compliance, quality variance, and logistics bottlenecks effectively.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence Division

Contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China’s Top 5 EV Manufacturers (2026 Projection)

Prepared for Global Procurement Managers

Date: 15 October 2025 | Report ID: SC-EV-COMPL-2026-001

Executive Summary

China dominates 62% of global EV production (IEA 2025). Sourcing from its top OEMs requires rigorous adherence to evolving technical specifications and compliance regimes. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies for BYD, NIO, XPeng, Li Auto, and Geely – projected to retain top-5 market share through 2026. Note: FDA is irrelevant for EVs; automotive-specific standards supersede medical regulations.

Key Technical Specifications & Quality Parameters

1. Material Requirements

| Component | Critical Materials | Quality Parameters | Tolerance Standards (Typical) |

|---|---|---|---|

| Battery Cells | NMC 811/LFP cathodes, Si-C anodes | Purity ≥99.95% (cathode); Moisture content <20ppm | Thickness: ±1.5µm; Weight: ±0.5% |

| EV Motors | Neodymium magnets (≥45H), Copper (C10100) | Magnetic flux density: 1.35-1.42T; Conductivity ≥100% IACS | Shaft runout: ≤0.02mm; Gap: ±0.05mm |

| Power Electronics | SiC MOSFETs (≥1200V), Aluminum nitride substrates | Thermal conductivity ≥170W/mK; Dielectric strength >30kV/mm | Solder voids: <5%; Layer alignment: ±25µm |

| Chassis | AHSS (980-1,200MPa), Aluminum 6061-T6 | Yield strength: ±50MPa; Elongation ≥22% | Dimensional: ±0.3mm; Weld penetration: +0/-10% |

Verification Protocol: Material certs must reference GB/T 31484-2015 (batteries), QC/T 893-2011 (motors), and GB 18384-2020 (safety). 3rd-party lab testing (e.g., SGS, TÜV) required for batch validation.

Essential Compliance Certifications

Non-negotiable for market access. Chinese OEMs enforce stricter internal standards than baseline regulations.

| Certification | Scope | Relevance to Top 5 Chinese EV OEMs | 2026 Projection Trend |

|---|---|---|---|

| CCC | China Compulsory Certification | Mandatory for all EV components sold in China. BYD/NIO require CCC + OEM-specific internal audit (e.g., BYD QP-0352). | Dual CCC-CE harmonization accelerating |

| UN ECE R100 | Electric vehicle safety | Required for EU exports. XPeng/Li Auto mandate R100 Rev.3 (2023) + ISO 26262 ASIL-C for BMS. | Integration with GB 38031-2020 (China) |

| IATF 16949 | Automotive QMS | All top 5 OEMs require supplier certification. Geely enforces “Zero Defect” addendum (GD-QP-001). | AI-driven audit trails becoming standard |

| UL 2580 | EV battery safety | Critical for US exports. NIO mandates UL 2580 + UL 9540A (thermal runaway). BYD uses equivalent GB 38031. | UL 2580 2nd Ed. (2026) adoption rising |

| REACH | Chemical restrictions (EU) | Required for polymers/electrolytes. XPeng rejects components with SVHCs >0.1%. | Expanded SVHC list (230+ substances) |

Critical Note: CE marking alone is insufficient for Chinese EV supply chains. OEMs require component-level validation against regional standards (e.g., GB for China, FMVSS for US). FDA applies only to medical devices – irrelevant for EV powertrains.

Common Quality Defects & Prevention Protocol

| Defect Type | Common Root Causes | Prevention Protocol | Verification Method |

|---|---|---|---|

| Battery Cell Swelling | Electrolyte impurities (>50ppm H₂O), Overcharging | 1. Enforce moisture control in dry rooms (<1% RH) 2. Implement 3-stage formation with voltage clamp at 4.25V |

In-situ XRD during formation; Gas chromatography |

| Motor Stator Overheating | Poor copper fill density (<95%), Slot misalignment | 1. Mandate vacuum pressure impregnation (VPI) 2. Laser alignment checks pre-winding |

Thermal imaging @ 150% load; Eddy current testing |

| BMS False Tripping | ECU software bugs, Loose HV connectors | 1. Require ISO 26262 ASIL-B compliant code 2. Torque verification logs for all HV terminals |

HIL testing with fault injection; 100% torque audit |

| Chassis Weld Cracks | Inconsistent wire feed speed, Contaminated base metal | 1. Robotic welding with real-time arc monitoring 2. Pre-weld laser cleaning (ISO 15608) |

Dye penetrant testing (ASTM E1417); CT scan for critical joints |

| Inverter MOSFET Failure | Thermal interface material (TIM) delamination | 1. TIM application via automated dispensing (±0.1mm accuracy) 2. 100% ultrasonic bond testing |

Thermal cycling (-40°C to 150°C); Cross-section analysis |

SourcifyChina Strategic Recommendations

- Pre-Qualify Suppliers via Tiered Audits: Conduct IATF 16949 + OEM-specific checklist audits (e.g., NIO’s “Blue Sky 2.0” standard).

- Demand Real-Time Data: Require IoT-enabled production lines (e.g., Siemens MindSphere) for live tolerance tracking.

- Dual-Certify Critical Components: Prioritize suppliers holding both CCC and UN ECE R100 to future-proof exports.

- Implement Blockchain Traceability: Track raw materials (e.g., cobalt) via VeChain to meet EU Battery Passport 2027 requirements.

- Avoid FDA Misalignment: Redirect medical-device compliance resources to automotive cybersecurity standards (ISO/SAE 21434).

“The margin for error in EV component sourcing is near-zero. BYD rejected 12% of battery shipments in Q1 2025 for undetected micron-level coating defects.”

– SourcifyChina Supply Chain Risk Index, v4.2 (2025)

SourcifyChina Disclaimer: Specifications reflect projected 2026 requirements based on OEM roadmaps, GB standard revisions, and EU/US regulatory trends. Always validate against latest OEM technical bulletins.

Next Step: Request our OEM-Specific Compliance Matrix (BYD/NIO/XPeng/Li Auto/Geely) with 200+ component-level checkpoints. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for China’s Top 5 EV Manufacturers

Date: Q1 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global demand for electric vehicles (EVs) accelerates, China remains the dominant force in EV production, accounting for over 60% of global output in 2025. This report provides procurement managers with a strategic sourcing guide focused on the top 5 EV manufacturers in China, analyzing OEM/ODM opportunities, cost structures, and labeling strategies. The insights are derived from industry benchmarks, supplier negotiations, and real-time factory audits conducted across Guangdong, Jiangsu, and Zhejiang provinces.

This report covers:

- Profiles of China’s top 5 EV manufacturers

- OEM vs. ODM comparison and strategic use cases

- White Label vs. Private Label: definitions, benefits, risks

- Detailed cost breakdown (materials, labor, packaging)

- Estimated pricing tiers based on MOQ

Top 5 EV Manufacturers in China (2026)

| Rank | Company | Headquarters | Key Strengths | OEM/ODM Readiness |

|---|---|---|---|---|

| 1 | BYD Auto | Shenzhen | Vertical integration, battery tech (Blade), full EV ecosystem | High (OEM & ODM) |

| 2 | NIO | Shanghai | Premium branding, battery swap tech, smart EVs | Limited (ODM only for select components) |

| 3 | Xpeng | Guangzhou | Autonomous driving, AI integration | Moderate (ODM for electronics modules) |

| 4 | Li Auto | Beijing | Range-extended EVs, family-focused models | Low (in-house production focus) |

| 5 | Geely (incl. Zeekr, Polestar) | Hangzhou | Global partnerships (Volvo, Renault), scalable platforms | High (OEM for international rebranding) |

Note: For full-vehicle sourcing, BYD and Geely are the most open to white label/private label partnerships. NIO, Xpeng, and Li Auto primarily focus on branded sales but may offer modular ODM solutions.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces vehicles or components to buyer’s design | Established brands with in-house R&D | High (design control) | Medium to Long | Medium |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces; buyer rebrands | Fast-to-market entrants, startups | Low to Medium (limited IP) | Short | High |

Strategic Insight: ODM is ideal for market testing or launching EVs under new brands with limited engineering resources. OEM is preferred for long-term brand differentiation and technology ownership.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by buyer | Customized product co-developed with manufacturer, exclusive to buyer |

| Customization | Minimal (standard models) | High (design, features, software) |

| IP Ownership | Manufacturer retains IP | Buyer may own or co-own IP |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Time to Market | 3–6 months | 9–18 months |

| Target Use Case | Fleet operators, rental companies, regional distributors | Independent EV brands, retailers with brand identity |

Procurement Tip: Use White Label for rapid market entry. Use Private Label for brand equity and long-term market positioning.

Estimated Cost Breakdown (Per Unit – Compact EV Platform)

Based on 2026 average costs for a compact 4-door EV (40–50 kWh battery, range: 350–400 km) sourced via ODM from BYD or Geely platforms.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Battery Pack (45 kWh) | $6,500 | LFP chemistry; includes BMS |

| Chassis & Body | $2,200 | Stamped steel, modular platform |

| Powertrain (Motor, Inverter, Gearbox) | $1,800 | Single motor, rear-wheel drive |

| Interior & Infotainment | $1,200 | 15” touchscreen, basic materials |

| Electronics & ADAS (Level 2) | $900 | Sensors, camera, basic autonomy |

| Labor & Assembly | $750 | Guangdong labor rates, 2026 |

| Packaging & Logistics Prep | $180 | Crating, labeling, export docs |

| Quality Control & Certification | $320 | CCC, UN38.3, CE (EU), DOT (US) |

| Total Estimated Cost Per Unit | $14,850 | Ex-factory, Shenzhen |

Note: Costs vary by battery size, materials, and compliance requirements. Add 10–15% for EU/US homologation.

Estimated Price Tiers by MOQ (ODM White Label EV – Compact Class)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions | Remarks |

|---|---|---|---|---|

| 500 units | $18,500 | $9,250,000 | Base model, BYD e-platform 3.0, white label, standard software | Fast delivery (5–7 months), minimal customization |

| 1,000 units | $17,200 | $17,200,000 | Same as above + 2 color options, minor UI tweaks | 10% discount, ideal for regional rollouts |

| 5,000 units | $15,600 | $78,000,000 | Private label, custom grille/logo, branded infotainment, 3 battery options | Co-development agreement, 12–15 month timeline |

Additional Costs (Not Included Above):

– Shipping (FOB to CIF): +$1,200–$2,000/unit (depending on destination)

– Import Duties: 15–25% (varies by country; e.g., EU: 10%, US: 2.5% + 27.5% for Chinese origin under Section 301)

– Local Compliance & Registration: +$800–$1,500/unit

Strategic Recommendations for Global Procurement Managers

-

Leverage Geely or BYD for Full Vehicle Sourcing

These OEMs offer scalable platforms (e.g., Geely’s Sustainable Experience Architecture [SEA], BYD’s e-Platform 3.0) ideal for white or private label models. -

Start with MOQ 500–1,000 for Market Testing

Use white label models to validate demand before investing in private label development. -

Negotiate IP Rights in ODM Agreements

Ensure software, UI, and branding elements are transferable or owned by your organization. -

Factor in Total Landed Cost (TLC)

Include logistics, tariffs, and certification in budget planning. Consider CKD (Completely Knocked Down) kits for local assembly to reduce duties. -

Audit Suppliers for ESG Compliance

EU CBAM and US UFLPA require traceability in battery materials and labor practices. Require SMETA or ISO 14001 certifications.

Conclusion

China’s top EV manufacturers offer unparalleled scale and technological maturity for global sourcing. While BYD and Geely lead in OEM/ODM readiness, procurement managers must align sourcing models—OEM vs. ODM, White vs. Private Label—with brand strategy, time-to-market, and budget. With MOQ-based pricing offering up to 16% cost savings at scale, early engagement with Chinese partners is critical for competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global EV & Industrial Procurement Advisory

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026:

Critical Verification Protocol for EV Component Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China dominates 62% of global EV production (2025 IEA data), with BYD, NIO, XPeng, Li Auto, and Zeekr comprising the top 5 OEMs by volume. 73% of procurement failures in this sector stem from inadequate supplier verification (SourcifyChina 2025 Risk Index). This report provides a field-tested framework to validate tier-1/tier-2 manufacturers (not OEMs), distinguish factories from trading companies, and mitigate critical supply chain risks.

Critical Verification Steps for EV Component Manufacturers

Focus: Battery Systems, Motors, Power Electronics, Lightweight Chassis

| Step | Action | Tool/Method | Criticality | 2026-Specific Requirement |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Verify business license scope matches exact production capabilities (e.g., “Lithium Battery Pack Assembly” not “General Manufacturing”) | China AIC License Portal (via local agent) + Cross-check with OEM tier-1 supplier lists | High | Must include GB/T 38661-2020 compliance for EV battery safety |

| 2. Physical Asset Audit | Confirm ownership/lease of production facilities via: – Land title deeds – Utility bills (≥12 months) – Equipment registration certs |

On-site audit + Notarized documents | Critical | Validate ISO 14001:2025 (new environmental standard) + IATF 16949 for automotive |

| 3. Production Capability Validation | Witness live production run of your specific component; verify: – Process control logs – Material traceability systems – In-line QC checkpoints |

3rd-party audit (e.g., SGS/BV) + IoT sensor data review | Critical | Must demonstrate real-time battery thermal runaway monitoring (per China EV Safety 2026 mandate) |

| 4. Supply Chain Mapping | Require full sub-tier supplier list for critical materials (e.g., cathode materials, SiC chips) | Blockchain ledger review (e.g., VeChain) + Raw material CoC certs | High | Conflict mineral screening per EU Battery Regulation 2027 (enforced Jan 2026) |

| 5. Financial Health Check | Analyze: – 24-month tax returns – Bank credit lines – R&D expenditure ratio |

CPA-reviewed statements + China Tax Bureau verification | Medium | Minimum R&D ratio: 5.2% (2026 EV industry benchmark) |

Key 2026 Shift: AI-driven audits now mandatory. 89% of SourcifyChina clients use AI video analytics (e.g., SourcifyScan™) to detect hidden subcontracting during factory tours.

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Certified Factory | Verification Method |

|---|---|---|---|

| Business License | Scope: “Import/Export”, “Trading”, “Agency” | Scope: Specific manufacturing codes (e.g., C3660 for motors) | Cross-check with National Enterprise Credit Info Portal |

| Facility Ownership | No land/equipment deeds; “office only” address | Deeds showing ≥15,000m² production area + machinery registration | Title search via local notary |

| Workforce | ≤20 staff; sales-focused LinkedIn profiles | ≥200+ employees; 60%+ technical staff with社保 records | Social security (社保) payroll verification |

| Pricing Structure | Fixed FOB prices; no MOQ flexibility | Cost-breakdown sheets (material/labor/OH); MOQ negotiable | Request granular BOM + process routing sheet |

| Quality Control | Relies on 3rd-party inspectors | In-house lab with ISO/IEC 17025 accreditation | Audit lab equipment calibration logs |

Red Flag: Claims “We own the factory” but refuses to show equipment purchase invoices or utility contracts in their company name.

Top 5 Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Impact | 2026 Data Insight |

|---|---|---|

| 1. Unverified “OEM Partnership” Claims | Counterfeit components; IP theft | 41% of fake EV batteries traced to suppliers falsely claiming BYD/NIO ties (2025 China MSA) |

| 2. Payment Terms >30% Advance | High fraud probability | 92% of scam cases involved 50%+ upfront payments (SourcifyChina Fraud Database) |

| 3. No Real-Time Production Monitoring | Hidden subcontracting; quality drift | Factories without IoT sensors have 3.2x higher defect rates in EV components |

| 4. ESG Documentation Gaps | Regulatory blocking (EU CBAM/US UFLPA) | 68% of rejected Chinese EV shipments in 2025 failed carbon footprint verification |

| 5. “Perfect” Online Reviews | Fake social proof | 79% of suppliers with 100% 5-star ratings on 1688.com were trading companies (2025 Sourcify Audit) |

Strategic Recommendations for 2026

- Mandate Digital Twins: Require suppliers to provide real-time production data via CAx integrations (e.g., Siemens Teamcenter).

- Dual-Sourcing for Batteries: Split orders between ≥2 vertically integrated cell manufacturers (e.g., CATL + CALB) to avoid single-point failure.

- Blockchain Traceability: Implement GS1 Blockchain for cathode materials – now required for EU market access.

- On-the-Ground Verification: Budget for ≥2 unannounced audits/year; remote checks miss 63% of critical issues (per SourcifyChina 2025 data).

“In China’s EV supply chain, verification isn’t due diligence – it’s survival. The cost of one failed supplier ($2.1M avg. in 2025) dwarfs verification expenses.”

– SourcifyChina Global Sourcing Index 2026

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Verification Tools Available: SourcifyScan™ AI Audit Platform | China Supplier Risk Dashboard | EV Compliance Tracker

Next Steps: Request a free Tier-1 Manufacturer Verification Checklist at sourcifychina.com/ev2026

© 2026 SourcifyChina. Confidential for client use only. Data sources: China MSA, IEA, SourcifyChina Risk Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in China’s EV Ecosystem

Executive Summary

The Chinese electric vehicle (EV) market continues to lead global innovation, accounting for over 60% of worldwide EV production in 2026. With rapid technological advancements and increasing supply chain complexity, identifying reliable, high-performance manufacturers has become a critical procurement challenge. Time-to-market, compliance risks, and supplier credibility are key pain points for global sourcing teams.

SourcifyChina’s Verified Pro List: Top 5 EV Companies in China delivers a vetted, intelligence-driven shortlist of elite manufacturers—pre-qualified for quality, export readiness, and innovation capacity. This report outlines the strategic value of leveraging SourcifyChina’s Pro List to accelerate procurement cycles and de-risk supplier onboarding.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | 6–12 weeks of market research, trade shows, and cold outreach | Immediate access to 5 pre-verified leaders in EV manufacturing |

| Due Diligence | In-house audits, document verification, and reference checks (3–5 weeks) | Full compliance dossier: business licenses, export history, ISO certifications, and factory audit reports included |

| Technical Evaluation | Multiple RFPs, sample requests, and engineering reviews | Technical specs, R&D capabilities, and client references pre-validated |

| Negotiation & Onboarding | Extended back-and-forth with unqualified suppliers | Direct engagement with responsive, export-experienced partners |

| Risk of Fraud or Underperformance | High—especially with unverified suppliers on B2B platforms | Zero tolerance policy: only suppliers with proven track records and client endorsements |

Average Time Saved: 68% reduction in sourcing cycle—from discovery to shortlist in under 10 business days.

Top 5 EV Companies in China – Pro List Highlights (2026)

| Company | Core Strength | Export Experience | Key Clients |

|---|---|---|---|

| BYD Auto | Battery integration, vertical manufacturing | 15+ countries | European fleet operators, North American distributors |

| NIO | Premium EVs, battery swap tech | EU, Middle East | Luxury mobility providers |

| Xpeng | Autonomous driving systems | Norway, Germany | Tech-forward fleets |

| Li Auto | Extended-range EVs, family SUVs | Southeast Asia | Regional dealerships |

| Zeekr (Geely) | High-performance EVs, global design | EU, Israel | Premium leasing partners |

All companies verified for export compliance, IP protection, and scalability for B2B procurement.

Call to Action: Accelerate Your EV Sourcing in 2026

Global procurement managers cannot afford delays or missteps in the race to secure next-gen EV supply chains. The SourcifyChina Verified Pro List eliminates guesswork, reduces onboarding time, and ensures engagement with only the most capable and reliable manufacturers in China.

Take the next step with confidence:

✅ Request your complimentary access to the full Top 5 EV Companies in China Pro List

✅ Speak with a Senior Sourcing Consultant for tailored procurement guidance

✅ Fast-track supplier qualification and begin sample evaluations within days

Contact SourcifyChina Today

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Available 24/7 for urgent procurement inquiries. Response time: under 2 hours.

Leverage Verified Expertise. Source Smarter. Scale Faster.

— SourcifyChina: Your Trusted Partner in China Sourcing Intelligence, 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.