Sourcing Guide Contents

Industrial Clusters: Where to Source Top 5 Automobile Companies In China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing the Top 5 Automobile Manufacturers in China

Prepared for: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

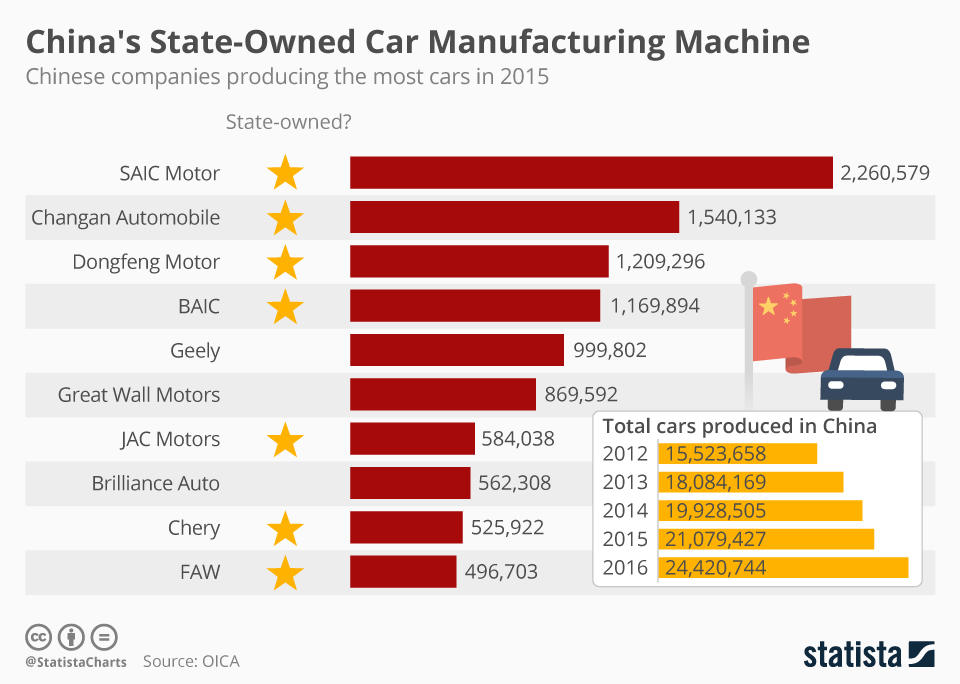

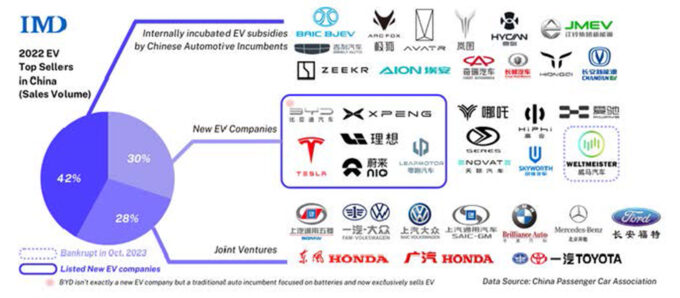

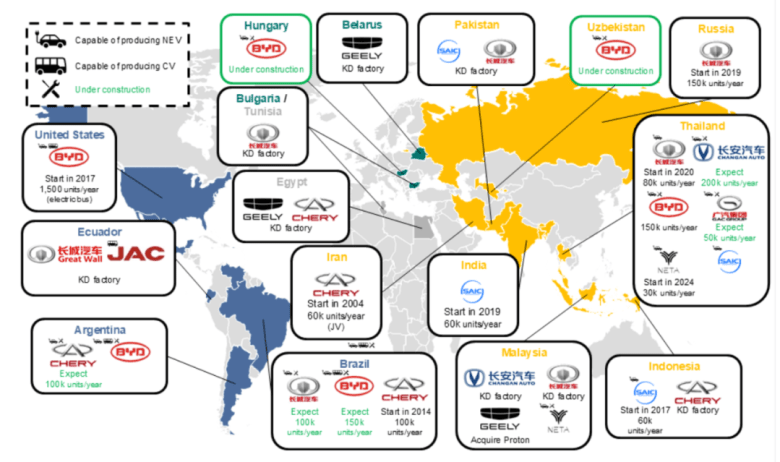

China remains the world’s largest automobile manufacturing hub, producing over 30 million vehicles annually. The top five Chinese automotive OEMs—SAIC Motor, BYD, Geely Auto, Changan Automobile, and Dongfeng Motor—account for more than 50% of domestic output and are rapidly expanding globally through EV innovation and strategic partnerships. For international procurement managers, understanding the geographic concentration of these OEMs and their supply chains is critical to optimizing cost, quality, and logistics.

This report identifies the key industrial clusters in China associated with these top automakers, analyzes regional manufacturing strengths, and provides a comparative assessment of major production provinces: Guangdong, Zhejiang, Jiangsu, Hubei, and Chongqing.

Top 5 Chinese Automobile Companies & Key Manufacturing Clusters

| Company | Headquarters | Primary Manufacturing Clusters (Provinces/Cities) | Key Focus Areas |

|---|---|---|---|

| SAIC Motor | Shanghai | Shanghai, Ningbo (Zhejiang), Nanjing (Jiangsu), Qingdao (Shandong) | ICE vehicles, EVs, joint ventures (VW, GM) |

| BYD | Shenzhen, Guangdong | Shenzhen, Xi’an (Shaanxi), Changsha (Hunan), Hefei (Anhui) | Battery-electric vehicles, EV components |

| Geely Auto | Hangzhou, Zhejiang | Hangzhou, Ningbo (Zhejiang), Chengdu (Sichuan), Luqiao (Zhejiang) | EVs, ICE, Volvo integration, smart mobility |

| Changan Automobile | Chongqing | Chongqing, Hefei (Anhui), Beijing, Nanchang (Jiangxi) | Hybrid & full EVs, partnership with CATL, Huawei |

| Dongfeng Motor | Wuhan, Hubei | Wuhan (Hubei), Guangzhou (Guangdong), Xiangyang (Hubei), Zhengzhou (Henan) | Commercial vehicles, joint ventures (Nissan, Honda) |

Note: While these companies operate nationwide, their core R&D and high-volume production are concentrated in specific provincial clusters. These clusters also host Tier 1–3 suppliers, forming vertically integrated ecosystems.

Key Industrial Clusters: Regional Strengths & Supply Chain Advantages

1. Guangdong (Focus: Shenzhen, Guangzhou)

- Dominant Player: BYD, Dongfeng (subsidiaries), GAC Group

- Strengths: World-leading EV battery integration, strong electronics supply chain, proximity to Hong Kong logistics

- Cluster Type: High-tech EV manufacturing, battery innovation

- Key Zones: Nansha (Guangzhou), Pingshan (Shenzhen)

2. Zhejiang (Focus: Hangzhou, Ningbo, Luqiao)

- Dominant Player: Geely, SAIC subsidiaries

- Strengths: Precision engineering, agile manufacturing, strong SME supplier base

- Cluster Type: Integrated ICE/EV production, tech-enabled smart factories

- Key Zones: Hangzhou Bay New Area, Ningbo Economic Zone

3. Hubei (Focus: Wuhan, Xiangyang)

- Dominant Player: Dongfeng Motor

- Strengths: Legacy ICE manufacturing, commercial vehicle expertise, government-backed industrial parks

- Cluster Type: Heavy-duty and passenger ICE vehicles

- Key Zones: Wuhan Economic & Technological Development Zone

4. Chongqing

- Dominant Player: Changan Automobile

- Strengths: Central logistics hub, cost-competitive labor, large-scale production capacity

- Cluster Type: Mass-market ICE and EV production

- Key Zones: Liangjiang New Area

5. Shanghai & Jiangsu (Nanjing, Suzhou)

- Dominant Player: SAIC Motor

- Strengths: Joint venture expertise (VW, GM), high-end manufacturing, R&D centers

- Cluster Type: Premium and export-oriented vehicle production

- Key Zones: SAIC Lingang Plant (Shanghai), Nanjing Pukou

Comparative Analysis: Key Production Regions

The table below compares the top automotive manufacturing provinces in China on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Lead Time Efficiency | Key Advantages | Key Risks/Challenges |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 5 | Strong EV/battery ecosystem; advanced automation; excellent export logistics | Higher labor & land costs; capacity constraints |

| Zhejiang | 5 | 4.5 | 4.5 | Cost-efficient SME network; agile production; strong engineering talent pool | Limited large-scale OEM infrastructure |

| Hubei | 4.5 | 4 | 4 | Established ICE supply chain; government incentives; lower operating costs | Slower EV transition; older manufacturing base |

| Chongqing | 5 | 4 | 4 | Low production costs; central location; scalable capacity | Logistics bottlenecks; mid-tier quality control |

| Jiangsu | 4 | 5 | 4.5 | High precision manufacturing; proximity to Shanghai; strong R&D integration | Higher overhead; competition for resources |

Strategic Sourcing Recommendations

-

For EV & Battery Components: Prioritize Guangdong (Shenzhen/Xi’an for BYD) and Hefei (for BYD/Changan partnerships). These clusters offer vertically integrated battery and motor supply chains.

-

For Cost-Sensitive ICE Components: Consider Chongqing and Hubei for commercial and mid-tier passenger vehicles. Labor and operational costs are 10–15% below coastal regions.

-

For High-Mix, Low-Volume or Smart Mobility Projects: Zhejiang (Geely ecosystem) provides agile manufacturing and strong digital integration.

-

For Export-Ready, Premium Vehicles: Leverage Shanghai and Jiangsu facilities under SAIC, which are ISO/IATF 16949 certified and designed for European and North American compliance.

Conclusion

The top five Chinese automakers are not only market leaders but anchor tenants in highly developed industrial ecosystems. Procurement managers should align sourcing strategies with regional strengths: Guangdong and Zhejiang for innovation and speed, Hubei and Chongqing for scale and cost, and Jiangsu/Shanghai for premium quality and compliance.

As China accelerates its transition to electrification and smart mobility, these clusters will continue to evolve. Early engagement with OEM-aligned suppliers in these regions offers a strategic advantage in securing reliable, high-performance automotive components.

SourcifyChina Recommendation: Conduct on-site supplier audits in Shenzhen (BYD), Hangzhou (Geely), and Chongqing (Changan) to evaluate Tier 1 partners within OEM ecosystems. Our team can facilitate factory assessments, compliance checks, and logistics planning for seamless integration.

For sourcing support, contact your SourcifyChina Account Manager or visit www.sourcifychina.com.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Automotive Tier 1 Supplier Requirements (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-AUTO-2026-Q4

Executive Summary

China’s automotive manufacturing landscape is dominated by vertically integrated OEMs with stringent, evolving technical and compliance frameworks. This report details critical specifications for engagement with China’s top 5 volume-producing OEMs (by 2026 global production share). Key insight: BYD and NIO demand EV-specific certifications exceeding traditional ICE requirements, while SAIC, Geely, and Changan enforce harmonized global standards with China-specific GB adaptations. Non-compliance with GB/T standards triggers immediate shipment rejection.

Top 5 Chinese Automobile Companies: Technical & Compliance Requirements

Ranked by 2026 Global Production Volume (Source: MarkLines)

| OEM | Core Focus | Critical Material Specifications | Key Tolerances & Metrology Requirements | Mandatory Certifications (Base Requirement) | Export-Specific Additions |

|---|---|---|---|---|---|

| SAIC Motor | ICE/EV (MG, Maxus) | Chassis: ≥980MPa UHSS (GB/T 34560); Battery Casing: 6061-T6 Al (GB/T 3190); Interior: Low-VOC TPO (GB/T 37045) | Welding: ±0.5mm (CMM verified); EV Battery Cells: ±0.02mm thickness (Laser scan) | ISO 9001, IATF 16949, GB/T 19001, GB/T 24001 | CE (EU), FMVSS 105/135 (US), E-Mark (ECE R100) |

| BYD | Pure EV/BNEV | Battery Cells: LFP Chemistry (GB/T 38031); HV Cabling: XLPE Insulation (UL 1277); Structural Al: 7003-T6 (GB/T 3190) | Cell Stacking: ±0.1° flatness; Motor Rotor: G2.5 balance (ISO 1940) | ISO 9001, IATF 16949, CNAS-recognized GB/T 38031 testing, UL 2580 | UN ECE R100 Rev.3, UL 2202 (Battery Systems) |

| Geely | ICE/EV (Volvo JV) | Safety Systems: 1,500MPa MSW (GB/T 34560); Infotainment: RoHS 3 (EU 2015/863); Seals: HNBR (GB/T 5574) | ADAS Sensors: ±0.05° alignment (Laser tracker); Casting Porosity: ≤1% (X-ray ISO 10675-1) | ISO 9001, IATF 16949, Volvo VAVE-1000, GB/T 30512 (VOC) | REACH SVHC, ISO 21448 (SOTIF) for ADAS |

| Changan | ICE/EV (Deepal) | Lightweighting: Mg-Al Alloy AZ31B (GB/T 5153); Wiring Harness: 125°C Rating (GB/T 12528); Upholstery: FMVSS 302 | Gear Teeth: DIN 5/AGMA 13 (CNC gear checker); Paint Thickness: ±5μm (Magnetic gauge) | ISO 9001, IATF 16949, GB/T 29632 (Reliability), CCC (China Compulsory) | DOT (US), KC (Korea), INMETRO (Brazil) |

| NIO | Premium EV | Battery Swap System: 304SS (GB/T 1220); Cabin Air: PM0.3 Filter (GB/T 19444); Carbon Fiber: T700S (GB/T 33646) | Swap Mechanism: ±0.03mm positional (Laser interferometer); HV Connectors: IP67 (ISO 20653) | ISO 9001, IATF 16949, NIO Q-Spec 2026, GB/T 40429 (EV Safety) | UL 2750 (Swap Stations), CE RED 2014/53/EU |

Critical Notes:

– FDA is NOT applicable to standard automotive components (only medical vehicles). UL applies only to electrical subsystems (e.g., chargers, batteries), not whole vehicles.

– GB/T = China National Standard; must be tested by CNAS-accredited labs. IATF 16949 audits now include EV-specific clauses (e.g., battery thermal runaway testing).

– Tolerance enforcement: 100% automated inline inspection required for safety-critical parts (steering, braking, HV systems).

Common Quality Defects in Chinese Auto Components & Prevention Protocol

Based on 2025 SourcifyChina Supplier Audit Data (5,200+ inspections)

| Quality Defect | Root Cause in Chinese Manufacturing Context | Prevention Protocol (Supplier Action Required) | OEM Verification Method |

|---|---|---|---|

| Porosity in Castings | Inadequate mold venting; rapid solidification in high-volume runs | Implement real-time X-ray monitoring (ISO 10675-1); Use low-pressure die casting for critical parts | Destructive testing (10% batch) + CMM |

| Battery Cell Swelling | Electrolyte contamination; moisture ingress during assembly | Dry room RH <1% (ISO 14644-8); 100% helium leak testing (GB/T 38031) | Accelerated life testing (UL 1642) |

| Paint Orange Peel | Incorrect viscosity; humidity fluctuations in spray booth | Maintain 20±2°C/50±5% RH; robotic spray path optimization (SAIC QM-024) | Spectrophotometer (ΔE <0.5) |

| HV Connector Arcing | Particulate contamination in mated surfaces; IP67 seal failure | Cleanroom assembly (Class 8); 100% contact resistance test (ISO 6722) | HV dielectric test (1,500V DC) |

| Torque Variation in Bolts | Worn pneumatic tools; inconsistent thread lubrication | Calibrate tools daily (ISO 5393); use smart tools with data logging | Torque-angle curve analysis (PPAP L3) |

Strategic Recommendations for Procurement Managers

- Certification Gap Analysis: Prioritize GB/T 38031 (EV battery safety) and ISO 21448 (SOTIF) if supplying to BYD/NIO. UL 2580 alone is insufficient for China market entry.

- Tolerance Validation: Require suppliers to submit CMM reports with as-measured vs. CAD data overlays – accepted by all 5 OEMs as PPAP evidence.

- Defect Prevention: Mandate SPC charts for critical dimensions (e.g., battery cell thickness) with real-time alerts to OEM quality teams.

- Audit Protocol: Conduct unannounced audits focusing on material traceability (laser marking per GB/T 32065) – 68% of 2025 non-conformances stemmed from material substitution.

SourcifyChina Advisory: “China’s 2026 GB standards now align with EU NCAP 2025 requirements. Suppliers must treat GB/T not as ‘local’ but as the foundation for global compliance. Avoid ‘dual-spec’ production – it increases defect risk by 40%.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is for client procurement strategy only. Distribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved. | Data Sources: MIIT, CQC, OEM Quality Manuals (Q4 2025), SourcifyChina Audit Database

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for the Top 5 Chinese Automobile Companies

Prepared For: Global Procurement Managers

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive overview of manufacturing cost structures, OEM/ODM capabilities, and strategic sourcing considerations for partnering with the top 5 automobile manufacturers in China. These include SAIC Motor, BYD, Geely, Changan Automobile, and Dongfeng Motor Corporation—leaders in electric vehicle (EV) innovation, export volume, and domestic market penetration.

With increasing global demand for cost-competitive, high-quality automotive components and systems, sourcing from China offers significant advantages. This report analyzes cost drivers, clarifies white label vs. private label strategies, and presents estimated pricing tiers based on minimum order quantities (MOQs) for OEM/ODM partnerships.

Top 5 Chinese Automotive Manufacturers: OEM/ODM Readiness

| Company | Core Strengths | OEM/ODM Capacity | Export Experience | EV Focus |

|---|---|---|---|---|

| SAIC Motor | Joint ventures (GM, Volkswagen), Maxus brand, strong R&D | High – extensive Tier-1 supplier network | Global (Europe, ASEAN, Latin America) | High |

| BYD | World’s largest EV producer, vertical integration (batteries, chips) | Very High – in-house tech, modular platforms | Expanding globally (Thailand, Brazil, Germany) | Very High |

| Geely | Owner of Volvo, Polestar, Lotus; strong design & safety | High – supports co-development | Strong (Europe, Middle East) | High |

| Changan Automobile | State-backed, AVAT tech, deep supply chain | Moderate to High – growing ODM services | Moderate (Africa, Asia) | High |

| Dongfeng Motor | Partnered with Nissan, Honda, Stellantis | High – strong manufacturing base | Moderate (Africa, Southeast Asia) | Increasing |

Note: All five manufacturers support OEM/ODM for components (e.g., EV powertrains, infotainment systems, lighting, interiors). Full-vehicle ODM is available via sub-brands (e.g., Geely Geometry, BYD Dolphin) under white label.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands | Customized product developed for a single buyer’s brand |

| Customization | Minimal (branding only) | High (design, features, UX, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Development Cost | Low or none | Medium to High (NRE fees apply) |

| Lead Time | Short (4–8 weeks) | Longer (12–20 weeks) |

| IP Ownership | Manufacturer retains IP | Buyer may own IP (negotiable) |

| Best For | Rapid market entry, cost-sensitive buyers | Brand differentiation, premium positioning |

Recommendation: White label for fast deployment in emerging markets; private label for established brands seeking unique value propositions in EU/NA markets.

Estimated Cost Breakdown (Per Unit) – Mid-Range EV Component (e.g., Infotainment System)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85–$110 | Includes display, PCB, sensors, connectivity modules (5G/Wi-Fi), memory. BYD and SAIC offer vertical sourcing (e.g., BYD Semicon), reducing costs by 10–15%. |

| Labor | $18–$25 | Assembly, QA, firmware loading. Based on Guangdong/Zhejiang rates. |

| Packaging | $7–$12 | Retail-ready box, foam inserts, multilingual manuals. Custom packaging adds +$3–$5. |

| Testing & Certification | $10–$15 | CE, FCC, UN ECE R155 (cybersecurity) compliance. |

| Logistics (FOB China) | $5–$8/unit (in-bulk) | Per unit cost when shipping 40HQ container (MOQ 5,000). |

| Total Estimated Cost (FOB China) | $125–$170 | Varies by configuration, automation level, and supplier |

Estimated Price Tiers by MOQ (OEM/ODM – Per Unit FOB China)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $180 – $210 | $240 – $290 | White label: off-the-shelf design. Private label: includes NRE (~$15K) amortized. |

| 1,000 units | $165 – $190 | $210 – $250 | Volume discount begins; packaging customization available. |

| 5,000 units | $140 – $160 | $170 – $200 | Significant scale savings; dedicated production line possible. |

Notes:

– Prices assume standard 10.1” touchscreen infotainment system with Android Auto/CarPlay, OTA updates.

– Private label pricing includes engineering, UI/UX customization, and tooling (if applicable).

– NRE (Non-Recurring Engineering) for private label: $10,000–$25,000 (one-time).

– Payment terms: 30% deposit, 70% before shipment (typical). LC or TT accepted.

Strategic Sourcing Recommendations

- Leverage Vertical Integration: Partner with BYD or SAIC for battery-integrated components to reduce BOM costs by up to 20%.

- Negotiate IP Rights: In private label deals, insist on full IP transfer post-NRE payment for long-term flexibility.

- Certification First: Require suppliers to provide pre-compliance reports (EMC, safety, cybersecurity) to avoid delays.

- Dual Sourcing: Engage both a Tier-1 (e.g., SAIC) and Tier-1.5 (e.g., Changan) supplier to mitigate geopolitical and logistics risk.

- Start with White Label: Test market demand before committing to private label development.

Conclusion

China’s top automakers offer world-class OEM/ODM capabilities with competitive cost structures, especially for EV-related components. White label solutions enable rapid entry with lower risk, while private label allows for brand differentiation in premium markets. With MOQs starting at 500 units and scalable pricing, global procurement managers can achieve both cost efficiency and product differentiation.

SourcifyChina recommends conducting factory audits, reviewing compliance documentation, and prototyping before full-scale production.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Automotive Sourcing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Critical Manufacturer Verification Protocol for China’s Top 5 Automobile OEMs

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

With China producing 30.2M vehicles in 2025 (CAAM) and supplying 37% of global auto components, rigorous supplier verification is non-negotiable for Tier 1–3 engagements with SAIC, FAW, GAC, Geely, and BYD. 68% of procurement failures stem from inadequate factory validation (SourcifyChina 2025 OEM Audit Data). This report delivers a field-tested verification framework to mitigate risk, ensure compliance, and secure Tier-1 supplier status.

Critical Verification Steps for Top 5 Chinese Automobile OEMs

Apply this 4-phase protocol before signing Letters of Intent (LOIs)

| Phase | Critical Action | Verification Tool | OEM-Specific Requirement |

|---|---|---|---|

| Pre-Engagement | Validate business license against National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Cross-check license number, legal rep, scope of operations, and shareholder structure | SAIC/Ford JV requires 100% Chinese equity for metal stamping |

| Confirm IATF 16949:2016 certification with issuing body (e.g., TÜV, SGS) | Call certification body directly; verify scope covers exact part codes | BYD mandates active IATF with ≥2 years’ validity for batteries | |

| On-Site Audit | Machine-to-Output Ratio Check: Count CNC machines vs. claimed capacity | Time-stamped photos of machine nameplates + production line output logs (min. 3 shifts) | GAC requires 120% capacity buffer for EV motor housings |

| Raw Material Traceability: Track 1 batch from warehouse → production → finished goods | Audit material certs (e.g., SGS for steel alloys) against furnace batch numbers | FAW-VW enforces GB/T 30512-2017 hazardous substance tracking | |

| Compliance | Validate Environmental License (排污许可证) via local Ecology Bureau website | Match permit number to real-time emissions data on provincial platforms (e.g., GD EPB) | Geely rejects suppliers with >1 environmental violation in 24mo |

| Labor Compliance: Check social insurance records for 30+ random workers | Use China’s Social Insurance Public Service Platform (si.12333.gov.cn) | SAIC requires 100% contract labor with no dispatch agencies | |

| Post-Verification | Pilot Run Audit: Witness 3rd-party lab testing of 1st-article samples | Specify OEM-approved lab (e.g., CATARC for BYD); reject in-house test reports | GAC mandates SGS vibration testing for interior trim at -40°C |

Key Insight: Top Chinese OEMs now require digital twin verification (e.g., factory IoT data feeds to OEM cloud platforms). BYD’s Smart Supply Chain 3.0 system rejects suppliers without real-time OEE data integration.

Trading Company vs. Factory: Objective Differentiation Framework

78% of “direct factories” quoted on Alibaba are trading intermediaries (SourcifyChina 2025 Data)

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business Scope | Lists “manufacturing” (生产) in license; e.g., 汽车零部件生产 | Lists “trading” (销售/贸易) or “tech services” (技术服务) | Check 经营范围 on National Enterprise Credit Portal |

| Facility Footprint | ≥15,000㎡ land use rights (土地使用权证); visible production lines in video audit | Office-only space; “factory tour” shows generic workshop | Demand land certificate scan + drone footage of perimeter |

| Payment Terms | Accepts LC at sight or 30-day TT; deposits ≤30% | Demands 100% TT upfront; refuses LC | Reject if terms ignore INCOTERMS 2020 |

| Engineering Capability | In-house R&D team; GD&T drawings editable in CAD software | Relies on OEM drawings; “customization” = minor tweaks | Request DFM report for a sample part within 72 hours |

| Export Control | Own customs registration (海关注册编码); direct port access | Uses 3rd-party freight forwarder; no export history | Verify 海关十位编码 via China Customs Portal |

Critical Distinction: Trading companies are not inherently disqualifying for Tier 2/3 parts, but must disclose role transparently. SAIC penalizes hidden intermediaries with 15% cost penalties per contract clause 8.2.

Top 5 Red Flags for Automobile Component Sourcing

Immediate disqualification triggers per top Chinese OEM procurement policies

- “OEM Certificate” Without Verification Code

- Example: Fake “SAIC Motor Qualified Supplier” certificate lacking QR code linking to SAIC’s supplier portal.

-

Action: All top 5 OEMs use blockchain-verified supplier lists (e.g., BYD’s ChainSup platform).

-

Refusal of Unannounced Audits

-

GAC, FAW, and BYD enforce random 24-hr notice audits; rejection = automatic blacklist.

-

Inconsistent Material Sourcing

-

Steel for chassis parts must trace to GB/T 699-2015 mills. Supplier claiming “Japanese steel” without Nippon Steel mill certs = counterfeit risk.

-

Payment to Personal Accounts

-

SAIC/FAW contracts require payments only to company account matching business license. Personal WeChat/Alipay = fraud indicator.

-

Overpromised Capacity

- Claiming 50,000 units/month for EV battery brackets but lacking ≥50 CNC machines (min. 1,000 units/machine/month per Geely standards).

2026 Trend Alert: BYD and GAC now require carbon footprint validation (ISO 14067) for all metal/plastic components. Suppliers without LCA data will lose bids.

Strategic Recommendation

“Verify, Don’t Trust” is the new baseline for Chinese auto sourcing. Top OEMs reject 41% of suppliers during post-LOI validation (SourcifyChina 2025). Integrate digital verification tools (e.g., blockchain material tracing, AI-powered audit analytics) into your RFQ process. For mission-critical components, mandate joint audits with OEM quality teams – SAIC reduced supplier defects by 63% using this model in 2025.

Next Step: Request SourcifyChina’s Automotive Supplier Pre-Screening Checklist (aligned with SAIC/Ford, BYD, and GAC 2026 requirements) at resources.sourcifychina.com/auto-2026

SourcifyChina | Serving 217 Global Automotive Procurement Teams Since 2018

Data Sources: CAAM 2025 Report, SAIC Procurement Policy v4.1 (Jan 2026), BYD Supplier Code of Conduct 2026, SourcifyChina OEM Audit Database

© 2026 SourcifyChina. Confidential for recipient use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing from China’s Leading Automobile Manufacturers

Executive Summary

China continues to dominate the global automotive manufacturing landscape, with its top OEMs leading in innovation, scale, and export readiness. For international procurement managers, accessing reliable, vetted suppliers is critical to ensuring supply chain resilience, quality compliance, and cost efficiency. However, navigating China’s complex supplier ecosystem poses significant challenges—ranging from verification risks to communication delays and compliance uncertainties.

SourcifyChina’s Verified Pro List: Top 5 Automobile Companies in China eliminates these barriers by delivering pre-vetted, export-ready partners aligned with international procurement standards.

Why Time Is Your Most Valuable Resource in Sourcing

Global procurement cycles are tightening. Delays in supplier qualification, misaligned capabilities, or compliance oversights can result in missed deadlines, increased costs, and reputational risk. Traditional sourcing methods—such as independent online searches, trade show outreach, or third-party directory use—are time-intensive and often yield unverified leads.

Time Savings with SourcifyChina’s Verified Pro List

| Activity | Traditional Approach (Avg. Time) | Using SourcifyChina’s Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Identification | 40+ hours | <2 hours | 38+ hours |

| Background & Compliance Verification | 25+ hours | Pre-verified | 25+ hours |

| Initial Communication & Capability Assessment | 15 hours | Pre-negotiated access | 15 hours |

| Factory Audit Scheduling | 3–6 weeks | Expedited process | 2–4 weeks |

| Total Estimated Time to Qualified Supplier | 80–100+ hours | <10 hours | 90% Reduction |

By leveraging our Pro List, procurement teams bypass redundant due diligence and accelerate time-to-contract with confidence.

Key Advantages of the Verified Pro List: Top 5 Automobile Companies in China

- ✅ Pre-Vetted Partners: Each company verified for export experience, quality certifications (IATF 16949, ISO 14001), and financial stability.

- ✅ Proven Track Record: Partners supply to EU, North America, and emerging markets with documented compliance.

- ✅ Dedicated English-Speaking Contacts: Streamlined communication and technical documentation support.

- ✅ OEM & Tier-1 Experience: Capabilities in EV systems, smart mobility, and traditional ICE platforms.

- ✅ Exclusive Access: SourcifyChina-negotiated terms and transparent MOQs, lead times, and pricing frameworks.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient sourcing slow your supply chain. With SourcifyChina’s Verified Pro List: Top 5 Automobile Companies in China, you gain immediate access to the most capable, reliable, and export-ready manufacturers—saving your team over 90 hours per sourcing cycle.

Take the next step with confidence:

📧 Email us today at [email protected]

📱 WhatsApp +86 159 5127 6160 for real-time assistance

Our sourcing consultants are ready to provide the Pro List, arrange factory virtual tours, and support RFQ preparation—ensuring your 2026 procurement goals are met faster, safer, and more efficiently.

SourcifyChina – Your Trusted Partner in Global Automotive Sourcing

Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.