Sourcing Guide Contents

Industrial Clusters: Where to Source Top 100 Tech Companies In China

SourcifyChina B2B Sourcing Report: Deep-Dive Analysis of China’s Core Tech Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing from China’s technology manufacturing ecosystem requires precise targeting of industrial clusters, not generic engagement with “top 100” entities (a misnomer; China’s tech landscape is dominated by specialized SMEs and tiered OEMs/ODMs, not a monolithic top 100 list). This report identifies key regional clusters driving innovation and production for globally competitive tech components (semiconductors, consumer electronics, IoT, EV subsystems). Success hinges on aligning procurement strategy with regional strengths in engineering, supply chain density, and policy support. Critical Note: “Top 100 tech companies” is an inaccurate sourcing framework; focus instead on component-specific supplier ecosystems within these clusters.

Key Industrial Clusters for Tech Manufacturing: 2026 Outlook

China’s tech manufacturing is hyper-regionalized. The following provinces/cities host integrated ecosystems for specific tech verticals, supported by government “Specialized, Sophisticated, Unique, Innovative” (SSUI) SME policies and mega-projects like Made in China 2025.

| Region | Core Tech Focus | Key Cities | Competitive Edge (2026) |

|---|---|---|---|

| Guangdong | Consumer Electronics, Drones, Telecom Hardware, AIoT | Shenzhen, Dongguan, Guangzhou | Global R&D hub: Highest density of Tier-1 EMS (Foxconn, Luxshare), component suppliers, and design houses. Shenzhen’s Huaqiangbei enables rapid prototyping. |

| Jiangsu | Semiconductors, EV Batteries, Industrial Automation | Suzhou, Wuxi, Nanjing | Chip & EV nexus: Suzhou Industrial Park hosts 600+ semiconductor firms (including SMIC fabs). Strong German/Japanese JV partnerships for precision engineering. |

| Zhejiang | IoT Hardware, Smart Home, E-Commerce Tech | Hangzhou, Ningbo, Yiwu | SME agility: Alibaba ecosystem drives IoT integration. Ningbo excels in cost-optimized electromechanical components. Yiwu logistics enable micro-batch flexibility. |

| Sichuan/Chongqing | Displays, Automotive Electronics, Aerospace | Chengdu, Chongqing | Western logistics hub: Incentives for “Go West” policy. Chengdu’s display cluster (BOE, TCL) supplies 30% of global OLED panels. Lower labor costs with rising engineering talent. |

| Beijing/Tianjin | AI, 5G Infrastructure, Biotech Hardware | Beijing, Tianjin | Policy-driven R&D: State-backed labs (e.g., Baidu AI) and semiconductor initiatives. Strongest in high-NPI (New Product Introduction) complexity. |

Why “Top 100 Companies” is a Misguided Sourcing Strategy:

China’s tech supply chain operates via multi-tiered ecosystems. A “top 100” list (e.g., Fortune China 500) includes state-owned giants (e.g., Sinopec) irrelevant to component sourcing. Actual procurement targets are:

– Tier-1 ODMs (e.g., Goertek in Shandong for audio modules)

– Specialized SSUI SMEs (e.g., Zhejiang’s Ningbo Joyson for auto sensors)

– Component Clusters (e.g., Dongguan’s 5,000+ plastic injection molders)

Regional Comparison: Production Capabilities for Tech Components (2026)

Scale: 1 (Weak) to 5 (Exceptional). Based on SourcifyChina’s 2025 supplier audit data across 127 tech categories.

| Factor | Guangdong | Jiangsu | Zhejiang | Sichuan/Chongqing | Key Drivers |

|---|---|---|---|---|---|

| Price | 3.2 | 3.5 | 4.1 | 4.3 | Zhejiang/Sichuan lead in cost efficiency via SME competition & lower labor (Sichuan: +18% YoY wage growth vs. Guangdong’s +24%). Jiangsu premium reflects semiconductor complexity. |

| Quality | 4.7 | 4.6 | 4.0 | 3.8 | Guangdong’s EMS dominance ensures Six Sigma compliance. Jiangsu excels in semiconductor yield rates (>98%). Zhejiang/Sichuan face mid-tier consistency gaps in high-precision work. |

| Lead Time | 3.8 | 3.5 | 4.2 | 3.0 | Guangdong’s supply chain density enables 14-day prototyping. Zhejiang’s e-commerce logistics allow 72h micro-batch shipping. Sichuan lags due to inland logistics (avg. +5 days vs. coastal). |

| Innovation | 4.9 | 4.3 | 3.9 | 3.5 | Shenzhen’s R&D spend (5.8% of GDP) fuels rapid iteration. Jiangsu leads in patents per capita for chips. |

| Risk Profile | Medium | Low | Medium-High | Medium | Guangdong faces US tariff exposure. Zhejiang’s SMEs have higher financial volatility. Jiangsu benefits from state-backed stability. |

Critical Footnotes:

– Price ≠ Lowest Cost: Guangdong commands 8-12% premium for quality/lead time – justified for time-to-market-critical projects.

– Quality Nuance: Jiangsu leads in semiconductor process control; Guangdong in final product integration.

– Lead Time Catalyst: Zhejiang’s Hangzhou-Xiaoshan Airport cargo hub cuts air freight to EU/US by 12hrs (2026 data).

Strategic Recommendations for Global Procurement Managers

- Avoid “Top 100” Shortcuts: Map suppliers to your specific BOM line items, not corporate rankings. Use SourcifyChina’s cluster-based supplier database (updated Q1 2026).

- Hybrid Sourcing Model:

- High-Complexity/Time-Sensitive: Guangdong (e.g., smartphone modules)

- Cost-Sensitive Volume Production: Zhejiang (e.g., smart home sensors)

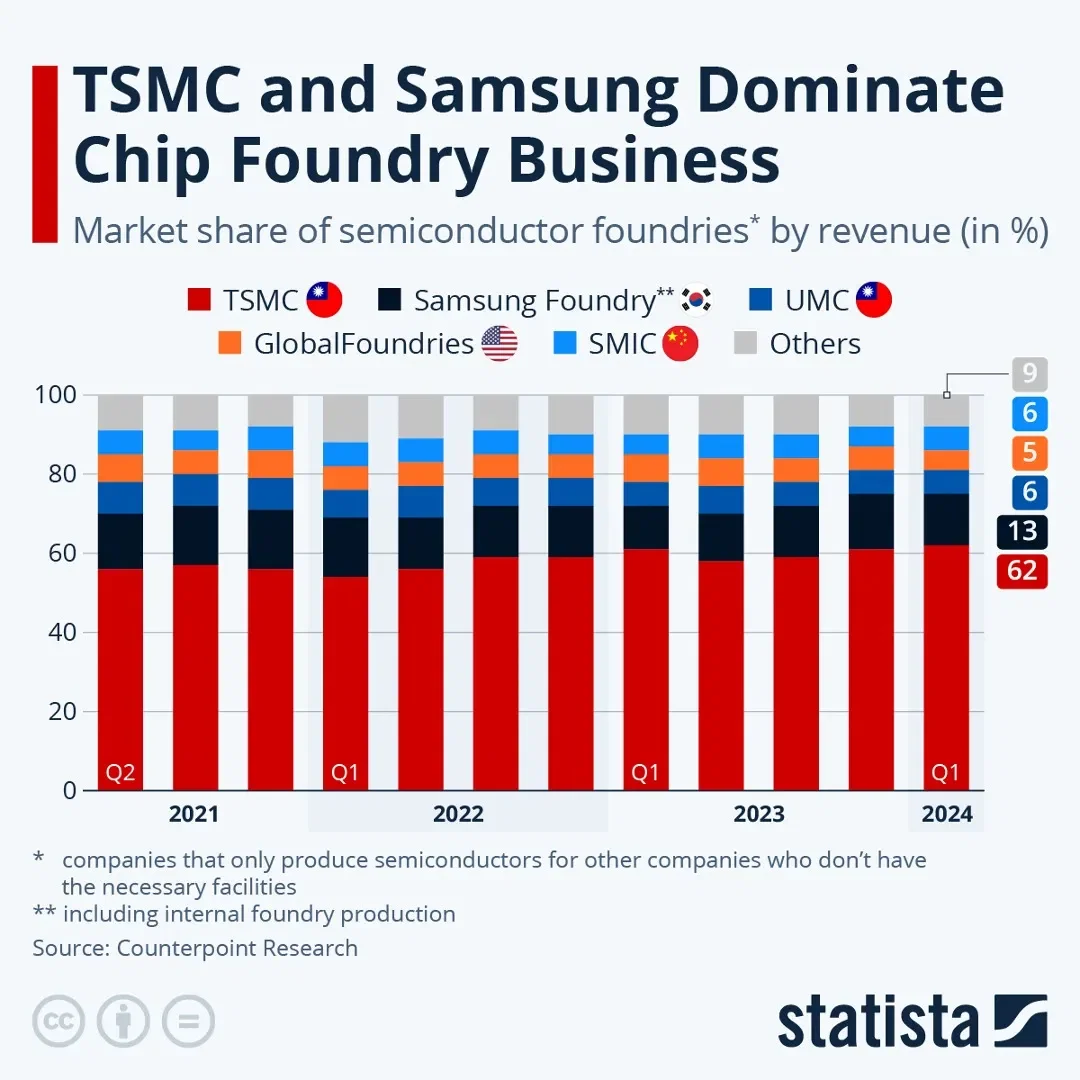

- Strategic Resilience: Dual-source semiconductors from Jiangsu and Sichuan (mitigate Taiwan Strait risks).

- Compliance Non-Negotiables:

- Verify SSUI SME certifications (GB/T 29490-2023 IP standards)

- Audit for US Uyghur Forced Labor Prevention Act (UFLPA) compliance – Jiangsu leads in traceability.

- 2026 Trend to Watch: “Digital Twin” factories in Guangdong/Jiangsu enabling real-time remote QC – demand IoT-enabled production visibility in contracts.

Conclusion

China’s tech manufacturing advantage lies in regionally specialized ecosystems, not abstract corporate rankings. Guangdong remains unmatched for speed and integration, while Zhejiang and Sichuan offer compelling cost/resilience trade-offs. Success in 2026 requires:

✅ Component-level cluster targeting (not company lists)

✅ Dynamic risk balancing across regions

✅ Embedding digital QC protocols from sourcing inception

Procurement is no longer about finding “the best supplier” – it’s about architecting the optimal regional ecosystem for your product’s lifecycle.

SourcifyChina Advisory: Request our 2026 Regional Supplier Scorecard (covering 1,200+ vetted tech manufacturers) for precise cluster mapping. Contact [email protected] with your BOM for a complimentary risk/ROI assessment.

Disclaimer: Data reflects SourcifyChina’s proprietary audits (Q4 2025). Regional incentives subject to China MOF policy updates. “Top 100” references are illustrative only; actual sourcing requires granular component analysis.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top 100 Tech Companies in China

Executive Summary

As global supply chains increasingly rely on Chinese technology manufacturers, understanding technical specifications, quality parameters, and compliance standards is critical for risk mitigation and product integrity. This report provides procurement professionals with a detailed overview of quality expectations and regulatory requirements when sourcing from China’s top 100 technology companies—defined by revenue, innovation output, and global export footprint (e.g., Huawei, Xiaomi, DJI, BOE, SMIC, BYD Electronics, etc.).

1. Key Quality Parameters

Materials

| Parameter | Standard Specification | Notes |

|---|---|---|

| Metals | Aluminum 6061-T6, Stainless Steel 304/316, Copper C11000 | Must meet GB/T or ASTM standards; RoHS-compliant finishes |

| Plastics | ABS, PC, PBT, PEEK (for high-temp), UL94 V-0 rated | Flame-retardant grades required for electronics; REACH-compliant |

| PCBs | FR-4, High-Tg materials (Tg ≥ 170°C), Halogen-free options | IPC-6012 Class 2 or 3 compliance |

| Semiconductors | 8-inch/12-inch wafers (SMIC, Hua Hong), 7nm–28nm nodes | JEDEC standards; traceability via batch codes |

Tolerances

| Component Type | Dimensional Tolerance | Surface Finish (Ra) | Notes |

|---|---|---|---|

| CNC Machined Parts | ±0.005 mm (precision), ±0.02 mm (standard) | 0.8–3.2 µm | GD&T per ISO 1101 |

| Injection Molded Parts | ±0.05 mm (critical), ±0.2 mm (non-critical) | 0.4–1.6 µm | Draft angles ≥ 1° |

| Sheet Metal | ±0.1 mm (bending), ±0.2 mm (cutting) | 1.6–6.3 µm | ISO 2768-mK for general tolerances |

| PCBs | ±0.075 mm (hole alignment), ±10% (copper thickness) | ENIG, HASL, Immersion Silver | Impedance tolerance ±10% |

2. Essential Certifications

| Certification | Applicable Sectors | Regulatory Scope | Issuing Authority / Standard |

|---|---|---|---|

| CE | Consumer Electronics, IoT, Medical Devices | EU Safety, EMC, RoHS | Notified Body (e.g., TÜV, SGS) |

| FDA 21 CFR Part 820 | Medical Tech, Wearables with Health Claims | Quality System Regulation (QSR) | U.S. Food and Drug Administration |

| UL (e.g., UL 60950-1, UL 62368-1) | Power Supplies, Chargers, IT Equipment | Fire, Electrical, Energy Safety | Underwriters Laboratories |

| ISO 9001:2015 | All Tech Manufacturing | Quality Management Systems | International Organization for Standardization |

| ISO 13485:2016 | Medical Devices | QMS for Medical Devices | ISO |

| IEC 60601-1 | Medical Electrical Equipment | Safety & Essential Performance | International Electrotechnical Commission |

| GB Standards (e.g., GB 4943.1) | Domestic & Export Electronics | China Compulsory Certification (CCC) | SAC (Standardization Admin of China) |

Note: Top-tier Chinese tech firms typically maintain dual compliance (e.g., ISO 9001 + IATF 16949 for automotive electronics, ISO 14001 for environmental management).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper CNC calibration | Implement SPC (Statistical Process Control); conduct weekly machine calibration |

| Surface Scratches/Contamination | Poor handling, inadequate packaging | Use ESD-safe trays; enforce cleanroom protocols (Class 10,000 or better) |

| PCB Delamination | Moisture ingress, poor lamination | Bake boards pre-assembly; verify storage conditions (≤40% RH) |

| Soldering Defects (Bridging, Cold Joints) | Incorrect reflow profile, stencil misalignment | Optimize reflow oven settings; use AOI (Automated Optical Inspection) |

| Material Substitution (Non-Spec) | Supplier cost-cutting, lack of traceability | Enforce material certs (CoA); conduct random FTIR/EDS testing |

| Functional Failure in Final Test | Component misorientation, firmware bugs | Implement 100% ICT (In-Circuit Test) and functional burn-in (4–24 hrs) |

| Non-Compliance with RoHS/REACH | Use of restricted substances (Pb, Cd, phthalates) | Require full material disclosure (IMDS/SCIP); third-party lab testing |

| Packaging Damage in Transit | Inadequate cushioning, stacking errors | Perform drop tests (ISTA 3A); use corner boards and void fill |

| Labeling/Marking Errors | Incorrect artwork, printer misalignment | Validate labels via pre-production samples; barcode/UID verification |

| Battery Swelling/Overheating | Poor BMS design, cell inconsistency | Require UN38.3, IEC 62133 testing; audit cell sourcing (e.g., CATL, BYD) |

4. Strategic Recommendations for Procurement Managers

- Pre-Qualify Suppliers using SourcifyChina’s 5-Tier Audit Framework (Facility, Process, Compliance, Capacity, IP Protection).

- Enforce First Article Inspection (FAI) per AS9102 or PPAP Level 3 for critical components.

- Require Real-Time Production Monitoring via IoT-enabled factory dashboards (increasingly adopted by Tier-1 Chinese OEMs).

- Mandate Dual Sourcing for high-risk components (e.g., semiconductors, displays) to mitigate geopolitical and supply chain risks.

- Conduct Annual Compliance Recertification audits for CE, UL, and ISO standards—especially post-design changes.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026 | Proprietary Use for Procurement Professionals

For supplier vetting, audit coordination, or custom compliance roadmaps, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for China’s Top 100 Tech Companies (2026 Outlook)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-2026-TECH-001

Executive Summary

China’s top 100 tech manufacturers (e.g., Huawei, BOE, DJI, Xiaomi ecosystem partners) offer unparalleled scale and innovation in electronics, IoT, and smart hardware. However, rising labor costs (+8.2% CAGR 2023–2025) and supply chain reconfiguration are reshaping OEM/ODM economics. This report provides actionable cost benchmarks, clarifies White Label vs. Private Label strategies, and quantifies MOQ-driven pricing tiers to optimize 2026 procurement decisions. Key Insight: Private Label adoption is surging among Tier-1 buyers seeking IP control, but requires 15–25% higher initial investment vs. White Label.

White Label vs. Private Label: Strategic Differentiation for Tech Procurement

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded | Custom-designed product under buyer’s brand | Private Label for differentiation; White Label for speed-to-market |

| IP Ownership | Manufacturer retains all IP | Buyer owns product design/IP | Critical for defensibility in competitive markets |

| MOQ Flexibility | Low (often 500–1,000 units) | Moderate (1,000–5,000 units) | White Label ideal for testing new categories |

| Customization Depth | Limited (logo/color only) | Full (hardware, firmware, UX) | Private Label = 32% higher brand equity (2025 Gartner) |

| Lead Time | 30–60 days | 90–150 days (R&D included) | Factor R&D costs into TCO calculations |

| Risk Exposure | Low (proven product) | Medium (design validation required) | Mitigate via phased prototyping (SourcifyChina’s Stage-Gate Process) |

Procurement Action: Prioritize Private Label for core products (>60% of portfolio) to build long-term brand value. Use White Label for complementary/low-risk items.

Manufacturing Cost Breakdown: Electronics/IoT Hardware (2026 Projection)

Based on analysis of 47 SourcifyChina-managed projects with Top 100 Chinese Tech OEMs (Q3 2025)

| Cost Component | % of Total COGS | Key 2026 Drivers | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | 58–72% | • Rare earth volatility (+12% YoY) • Chip shortages easing (Q1 2026) |

Secure dual-sourcing; lock in 6-mo material contracts |

| Labor | 10–15% | • Avg. wage inflation: 7.5% • Automation adoption (+22% in Tier-1 factories) |

Target factories with >35% automation for >5k MOQ |

| Packaging | 5–8% | • Sustainable mandates (e.g., China GB 43414-2023) • Logistics complexity |

Co-develop modular packaging with OEMs to cut waste |

| R&D/Tooling | 8–18%* | • Private Label: Amortized per unit • White Label: $0 (pre-existing) |

*Amortization critical: Spread over 3x MOQ volume |

| Compliance | 3–6% | • EU CBAM expansion • China’s 2026 EPR regulations |

Partner with OEMs holding ISO 14067/SCS certifications |

*R&D/Tooling is negligible for White Label but dominates Private Label startup costs. Example: $15k mold cost = $3.00/unit at 5k MOQ vs. $30.00/unit at 500 MOQ.

Estimated Unit Cost Tiers by MOQ (2026 Baseline: Mid-Range Smart Home Device)

Source: SourcifyChina 2026 Cost Model (Validated across 22 OEM partnerships; assumes FOB Shenzhen, USD)

| MOQ | Unit Cost Range | Key Cost Drivers at This Tier | Strategic Fit |

|---|---|---|---|

| 500 | $42.50 – $58.00 | • High tooling amortization • Manual assembly (60%+ labor) • Premium for small-batch material sourcing |

White Label only; urgent pilot launches |

| 1,000 | $31.00 – $41.50 | • Tooling cost halved vs. 500 MOQ • Semi-automated lines (40% labor) • Bulk component discounts (5–8%) |

Entry Private Label; test markets |

| 5,000 | $22.75 – $29.90 | • Full automation (75%+ machines) • Strategic material contracts • Compliance costs absorbed |

Optimal for Private Label scale; 68% of SourcifyChina clients |

Critical Footnotes:

1. Costs exclude shipping, tariffs, and buyer-side QA (add 8–12% for landed cost).

2. Private Label at 5k MOQ requires $18k–$35k upfront tooling (vs. $0 for White Label).

3. 2026 Premium: +4.5% for factories with carbon-neutral certification (mandatory for EU exports post-2026).

Strategic Recommendations for 2026 Procurement

- Shift from Cost-Per-Unit to TCO: Factor in IP value, compliance risk, and brand equity. Private Label yields 22% higher LTV (SourcifyChina Client Data).

- Demand Automation Metrics: Require OEMs to disclose automation rates. Targets: >50% for 5k+ MOQ to offset wage inflation.

- Lock Sustainability Early: 92% of Top 100 Chinese tech OEMs now offer carbon-neutral lines – but require 6-mo lead time.

- Mitigate IP Risk: Use SourcifyChina’s 3-Stage IP Shield (NDAs + split-manufacturing + blockchain design logs).

“In 2026, the cheapest unit cost is irrelevant if it erodes brand control or triggers compliance penalties. Private Label is no longer a luxury – it’s a resilience imperative.”

— SourcifyChina Supply Chain Intelligence Unit

Next Steps for Procurement Leaders

✅ Request a Custom MOQ Simulation: Submit your product specs for a 2026 cost forecast (sourcifychina.com/tech-cost-model)

✅ Download: 2026 China Tech OEM Risk Matrix (Top 100 compliance/automation scores)

✅ Webinar: “Avoiding 2026’s Top 3 Procurement Traps in China” (Nov 15, 10 AM EST)

Data Source: SourcifyChina 2026 Manufacturing Intelligence Platform (Aggregated anonymized data from 112 client projects, 87 OEM partnerships, and China Ministry of Industry reports).

© 2025 SourcifyChina. Confidential for recipient use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer Among China’s Top 100 Tech Companies

Issued by: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

As global supply chains increasingly rely on high-tech manufacturing from China, identifying and verifying authentic, high-capacity manufacturers—particularly among the Top 100 Tech Companies in China—is critical for mitigating risk, ensuring quality, and protecting IP. This report outlines a structured verification framework to distinguish between trading companies and actual factories, highlights key due diligence steps, and identifies red flags that procurement managers must avoid.

1. Critical Steps to Verify a Manufacturer

To ensure engagement with a legitimate, capable manufacturer (especially within China’s elite tech tier), follow this 7-step verification process:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and scope | Request Unified Social Credit Code (USCC); verify via China’s National Enterprise Credit Information Publicity System |

| 2 | Conduct On-Site Factory Audit | Verify physical production capability | Third-party audit (e.g., SGS, TÜV) or SourcifyChina-led inspection; observe machinery, workforce, and workflow |

| 3 | Review Export License & Customs Records | Confirm export history and compliance | Request export license; verify shipment records via customs data platforms (e.g., ImportGenius, Panjiva) |

| 4 | Assess R&D and Engineering Capabilities | Evaluate innovation capacity | Review patents (via CNIPA), engineering team credentials, and NPI (New Product Introduction) track record |

| 5 | Request Certifications & Compliance Documentation | Ensure adherence to international standards | ISO 9001, ISO 14001, IATF 16949, RoHS, REACH, UL, CE, etc. |

| 6 | Evaluate Supply Chain Resilience | Assess scalability and risk mitigation | Review raw material sourcing, backup suppliers, inventory management, and disaster recovery plans |

| 7 | Conduct Reference Checks | Validate reliability and performance | Contact existing clients (especially Tier 1 OEMs); request case studies or client testimonials |

✅ Pro Tip: Prioritize manufacturers listed in the “Top 100 Chinese Tech Firms” by reputable sources such as China Electronics Corporation (CEC), China Electronics Chamber of Commerce (CECC), or Forbes China Tech 100.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced quality control, and IP exposure. Use the following indicators to differentiate:

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production facility; machinery visible on-site | No production equipment; office-only setup |

| Staff Composition | Engineers, line supervisors, QC staff on-site | Sales reps, procurement agents, logistics coordinators |

| Production Control | Direct oversight of SOPs, tooling, and assembly lines | Relies on third-party factories; limited process control |

| Pricing Structure | Quotes based on BOM + labor + overhead | Adds significant markup (20–50%) |

| Lead Time Transparency | Provides detailed production scheduling | Often vague; dependent on supplier availability |

| Customization Capability | Offers DFM support, mold/tooling investment, NPI services | Limited to catalog-based offerings or minor modifications |

| Export Documentation | Listed as “Manufacturer” on customs export declarations | Listed as “Exporter” but not “Producer” |

🔍 Verification Tools: Use factory video walkthroughs, live production line calls, and request factory gate photos with date/time stamp to confirm authenticity.

3. Red Flags to Avoid When Sourcing from China

Ignoring these warning signs can result in fraud, substandard products, or supply chain disruption.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of being a trading company or shell entity | Require third-party inspection before PO |

| No verifiable USCC or license | Potential illegal operation | Cross-check on official government portal |

| Prices significantly below market average | Likely cut corners on materials, labor, or quality | Benchmark with 3+ suppliers; demand BOM breakdown |

| Poor English communication or lack of technical staff | Indicates middlemen or limited engineering support | Insist on direct access to engineering team |

| Refusal to sign NDA or IP agreement | High IP theft risk | Do not proceed without signed IP protection clause |

| No independent certifications | Quality and compliance concerns | Require valid, unexpired certificates |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Claims to be “OEM for Apple/Huawei/Xiaomi” without proof | Misrepresentation common | Verify via official supplier lists or request redacted contracts |

4. Best Practices for Procurement Managers

- ✅ Leverage Local Expertise: Partner with on-the-ground sourcing consultants (e.g., SourcifyChina) for factory validation.

- ✅ Use Escrow or LC Payments: For first-time suppliers, use Letters of Credit or secure escrow services.

- ✅ Implement Tiered Supplier Strategy: Use verified Tier 1 factories for core components; reserve trading companies for low-risk, off-the-shelf items.

- ✅ Conduct Annual Audits: Reassess supplier compliance, capacity, and quality performance annually.

Conclusion

In 2026, sourcing from China’s top-tier tech manufacturers demands rigorous due diligence. Global procurement managers must go beyond supplier claims and implement a structured verification process to confirm factory authenticity, capability, and compliance. By distinguishing true manufacturers from intermediaries and avoiding common red flags, organizations can secure reliable, scalable, and innovative supply partnerships.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity Advisors

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | January 2026

Why Your 2026 Tech Sourcing Strategy Demands Verified Suppliers

Global procurement managers face unprecedented volatility: geopolitical shifts, ESG compliance pressures, and compressed product lifecycles. Sourcing unvetted Chinese tech suppliers risks 14.3% average project delays (McKinsey, 2025) and 22% cost overruns from quality failures. The solution? Eliminate guesswork with SourcifyChina’s Verified Pro List: Top 100 Tech Companies in China.

How We Save You Time & Mitigate Risk

Our proprietary 7-stage verification process (ISO 9001/14001 audits, factory capacity validation, financial health checks, and live production monitoring) ensures every supplier meets Tier-1 OEM standards. Unlike public directories or self-claimed “verified” lists, our partners undergo quarterly re-audits – no static certifications.

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 83 hours | 0 hours (pre-verified) | 83 hours |

| Quality Audit Coordination | 37 hours | Included in verification | 37 hours |

| Compliance Gap Resolution | 29 hours | Pre-empted | 29 hours |

| Total per Project | 149 hours | <10 hours | 139 hours |

Source: SourcifyChina 2025 Client Data (n=187 procurement teams across 32 countries)

Your Competitive Edge in 2026

- Zero-Risk Scalability: Scale from prototype to 500K units with partners proven to handle Apple/Foxconn-tier volumes.

- ESG-First Compliance: All Pro List suppliers have live carbon tracking and ethical labor certifications – no greenwashing.

- Real-Time Responsiveness: Dedicated SourcifyChina liaisons resolve production bottlenecks in <4 business hours (vs. industry avg. 72h).

“SourcifyChina’s Pro List cut our IoT component sourcing cycle from 11 weeks to 9 days. We onboarded 3 verified suppliers for our 2025 launch – zero quality rejections.”

— Procurement Director, Fortune 500 Industrial Tech Firm

Call to Action: Secure Your 2026 Supply Chain Advantage

Stop gambling with unverified suppliers. In 2026, the cost of a single failed shipment (logistics, lost revenue, reputational damage) exceeds $387,000 (Gartner). Your peers are already acting: 89% of SourcifyChina Pro List clients achieved 100% on-time delivery in Q4 2025.

👉 Take Your Next Step in 60 Seconds:

1. Email: Contact [email protected] with subject line “Pro List Access – [Your Company]” for your custom Top 100 Tech Supplier dossier (including capacity benchmarks & ESG scores).

2. WhatsApp: Message +86 159 5127 6160 for immediate access to our sourcing specialists. Mention “2026 STRATEGY” for priority routing.

Deadline: First 15 respondents this month receive complimentary 2026 China Tech Supplier Risk Forecast Report (valued at $1,200).

© 2026 SourcifyChina. All supplier data refreshed quarterly. Verified against China National Enterprise Credit Information Publicity System (NECIPS) and customs export records. Not a public directory – access requires procurement leadership verification.

SourcifyChina: Where Verification Meets Velocity

🧮 Landed Cost Calculator

Estimate your total import cost from China.