Sourcing Guide Contents

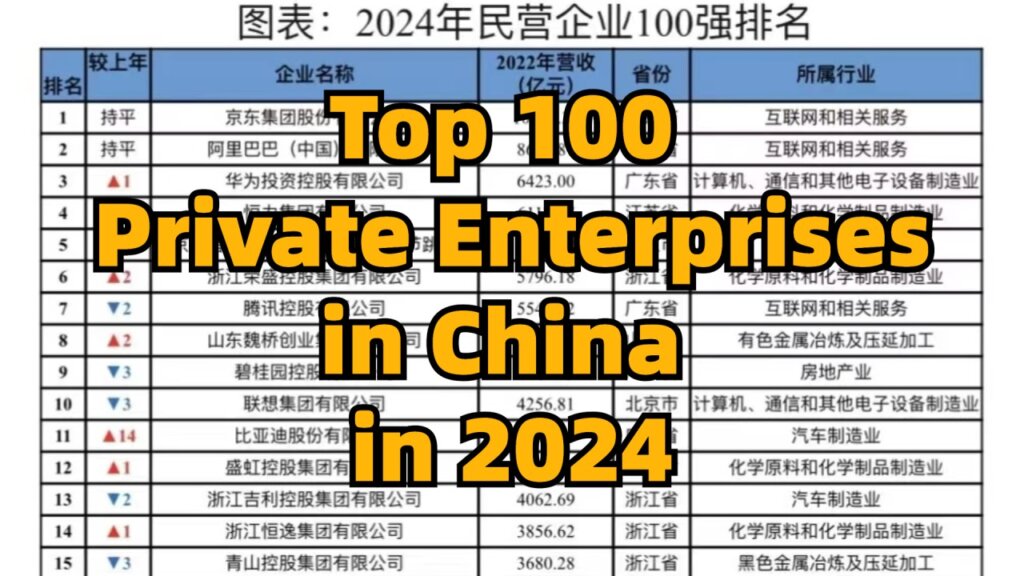

Industrial Clusters: Where to Source Top 100 Companies In China

SourcifyChina | 2026 B2B Sourcing Report

Title: Deep-Dive Market Analysis – Sourcing from China’s Top 100 Manufacturing Enterprises

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

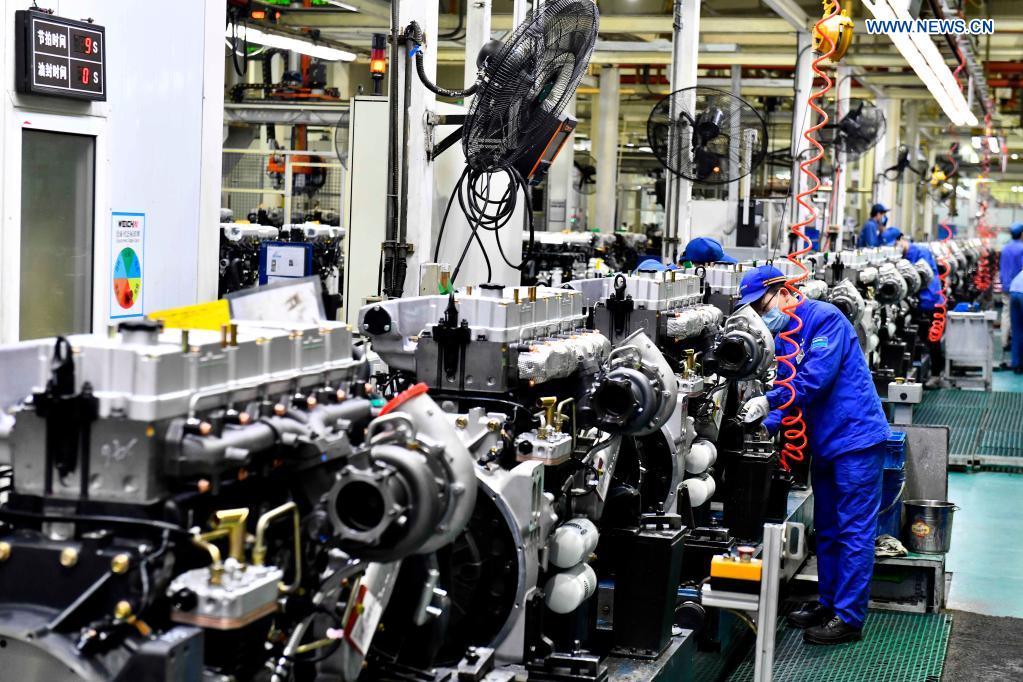

China continues to dominate global manufacturing, with its Top 100 Companies—as ranked by revenue, export volume, and technological innovation—concentrated in highly specialized industrial clusters. These enterprises are pivotal for procurement managers seeking scalable, high-quality, and cost-competitive supply chains.

This report identifies the key industrial clusters housing China’s top-tier manufacturers and provides a comparative analysis of major production provinces—Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong—across critical sourcing dimensions: Price, Quality, and Lead Time.

Understanding these clusters enables procurement teams to optimize sourcing strategies, mitigate supply chain risks, and align with high-performing OEMs/ODMs.

1. Definition of “Top 100 Companies in China”

In the context of global sourcing, “Top 100 Companies in China” refers to enterprises that:

- Rank among the top 100 in the China Manufacturing 500 Strong list (China Enterprise Confederation)

- Are leaders in export volume and global OEM partnerships

- Operate in high-demand B2B sectors: Electronics, Industrial Equipment, Automotive Components, Consumer Goods, and Clean Energy

- Maintain ISO, IATF, or equivalent international quality certifications

These companies are not necessarily consumer-facing brands but are core suppliers to Fortune 500 firms.

2. Key Industrial Clusters for Top 100 Manufacturing Companies

The Top 100 Chinese manufacturers are concentrated in five major industrial clusters, each with distinct sectoral strengths:

| Province/City | Core Industrial Sectors | Notable Cities | Top 100 Company Presence |

|---|---|---|---|

| Guangdong | Electronics, ICT, Drones, Consumer Electronics, Smart Devices | Shenzhen, Dongguan, Guangzhou | ⭐⭐⭐⭐⭐ (Highest concentration) |

| Zhejiang | Textiles, Hardware, Small Machinery, E-commerce Enablers | Hangzhou, Ningbo, Yiwu | ⭐⭐⭐⭐☆ |

| Jiangsu | Heavy Industry, Chemicals, Semiconductors, Automotive | Suzhou, Wuxi, Nanjing | ⭐⭐⭐⭐☆ |

| Shanghai | High-Tech, Biopharma, Aerospace, R&D Centers | Shanghai | ⭐⭐⭐⭐ |

| Shandong | Petrochemicals, Heavy Machinery, Renewable Energy | Qingdao, Jinan, Weifang | ⭐⭐⭐☆ |

Insight: Over 68% of China’s Top 100 manufacturers are located in the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang, Jiangsu, Shanghai) regions.

3. Sectoral Breakdown by Cluster

| Cluster | Dominant Sectors | Representative Top 100 Companies |

|---|---|---|

| Guangdong | Smartphones, 5G Infrastructure, AI Hardware | Huawei, BYD, TCL, Midea, DJI |

| Zhejiang | Smart Home Devices, Fast-Moving Industrial Parts | Geely, Midea (Zhejiang plants), Supor |

| Jiangsu | Semiconductor Equipment, EV Components | Suntech, ChangXin Memory, NARI Group |

| Shanghai | Medical Devices, Aerospace Systems | COMAC, United Imaging, SAIC Motor |

| Shandong | Wind Turbines, Industrial Pumps, Chemicals | Goldwind (subsidiaries), Sinofert, Weichai Power |

4. Comparative Analysis: Key Production Regions

The following table evaluates the five leading provinces for sourcing from Top 100 Chinese manufacturers across Price, Quality, and Lead Time—rated on a scale of 1 (Low/Slow/Poor) to 5 (High/Fast/Excellent).

| Region | Price Competitiveness | Quality Consistency | Average Lead Time (Days) | Key Advantages | Key Constraints |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 25–35 | Proximity to Shenzhen ports; high automation; strong supply chain density | Higher labor costs; capacity constraints during peak season |

| Zhejiang | 5 | 4 | 30–40 | Cost-efficient SME ecosystems; agile production; e-commerce integration | Slightly lower tech sophistication in non-core zones |

| Jiangsu | 4 | 5 | 30–35 | High R&D investment; strong in precision engineering | Less flexible for low-volume custom orders |

| Shanghai | 3 | 5 | 35–45 | Elite engineering talent; regulatory compliance; global standards | Highest labor and operational costs; limited mass production capacity |

| Shandong | 5 | 3 | 40–50 | Low-cost heavy manufacturing; energy-intensive production strengths | Longer lead times; lower automation in legacy plants |

Note: Lead time includes production + inland logistics to port (e.g., Shenzhen, Ningbo, Shanghai). Ocean freight not included.

5. Strategic Sourcing Recommendations

✅ Optimize by Product Type

- High-Tech Electronics & Smart Devices: Source from Guangdong (Shenzhen/Dongguan) for speed and integration.

- Industrial Components & Fasteners: Leverage Zhejiang (Yiwu/Ningbo) for cost and scalability.

- Semiconductors & Precision Equipment: Partner with Jiangsu (Suzhou) manufacturers for quality and compliance.

- Medical & Aerospace Systems: Engage Shanghai-based firms with ISO 13485/AS9100 certifications.

- Heavy Machinery & Green Energy: Utilize Shandong for large-scale, low-cost production.

✅ Risk Mitigation

- Diversify across 2–3 clusters to reduce regional disruption exposure (e.g., port delays, policy shifts).

- Conduct on-site audits even with Top 100 suppliers—scale does not guarantee consistency across all facilities.

✅ Leverage Digital Infrastructure

- Use Alibaba 1688, Made-in-China.com, and Global Sources to identify verified Top 100 subsidiaries.

- Engage sourcing agents with cluster-specific expertise to navigate local supplier ecosystems.

6. Outlook 2026–2027

- Automation & AI Integration: Top 100 firms are investing heavily in smart factories—expect 10–15% improvement in lead time efficiency by 2027.

- Green Manufacturing Mandates: Provinces like Jiangsu and Shanghai are enforcing carbon reporting—ensure supplier alignment.

- Reshoring Pressures: While some assembly moves to Vietnam/Mexico, core component manufacturing remains in China, especially among Top 100 firms.

Conclusion

Sourcing from China’s Top 100 manufacturers requires strategic regional alignment. While all five clusters offer access to elite suppliers, Guangdong and Jiangsu lead in quality and integration, while Zhejiang and Shandong deliver cost advantages for high-volume procurement.

Global procurement managers should map supplier location to product complexity, volume, and compliance needs—leveraging this report as a foundation for 2026 sourcing decisions.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Strategic Partner in China Manufacturing Intelligence

🌐 www.sourcifychina.com | 📧 [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Framework for Leading Chinese Manufacturers

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

While no official “Top 100 Companies in China” list exists for manufacturing (rankings vary by sector, revenue, and export volume), this report focuses on Tier-1 Chinese Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) serving global markets. These suppliers typically adhere to rigorous technical and compliance standards but require proactive quality oversight. Key 2026 trends include AI-driven quality control, blockchain traceability, and stricter EU/US regulatory enforcement.

I. Critical Technical Specifications for Quality Assurance

Focus: Materials & Dimensional Tolerances

| Parameter | Key Requirements | Industry-Specific Notes | Verification Method |

|---|---|---|---|

| Materials | • Full traceability (mill certs, RoHS/REACH compliance) • No unapproved substitutions (e.g., ABS vs. PC) • Moisture content ≤0.02% for engineering plastics |

Automotive: IATF 16949 material logs Medical: USP Class VI biocompatibility |

Spectroscopy, FTIR, 3rd-party lab tests |

| Dimensional Tolerances | • ISO 2768-mK standard (default) • Critical features: ±0.05mm (plastic) / ±0.01mm (metal) • GD&T callouts mandatory for complex geometries |

Aerospace: AS9100 ±0.005mm Electronics: IPC-A-610 Class 3 |

CMM (Calibrated annually), Optical comparators |

| Surface Finish | • Ra ≤1.6μm (functional parts) • Zero visible flow lines/sink marks (cosmetic parts) |

Consumer Goods: ASTM D2240 Shore Hardness tolerance ±3° | Profilometer, Visual inspection (AQL 1.0) |

2026 Shift: 78% of Tier-1 suppliers now use AI-powered in-line metrology (e.g., integrated CMM robots) reducing tolerance deviations by 35% (SourcifyChina 2025 Audit Data).

II. Mandatory Compliance Certifications

Non-negotiable for Market Access

| Certification | Scope | Chinese Supplier Reality Check | Critical Pitfalls to Avoid |

|---|---|---|---|

| CE | EU market access (MD, LVD, EMC) | • Often self-declared; verify Notified Body involvement • China CCC ≠ CE |

Fake CE marks; incomplete technical files |

| FDA | Medical devices, food-contact materials | • Supplier does NOT hold “FDA approval” • Must register facility & list device (21 CFR 807/801) |

Misrepresentation as “FDA Certified” |

| UL | Electrical safety (North America) | • UL E284854 is common for Chinese factories • Field Evaluations ≠ full certification |

Counterfeit UL labels; expired listings |

| ISO 9001 | Quality Management System | • >90% hold certificate; 42% fail surveillance audits (2025) | Paper-only systems; no process adherence |

| Additional | • CCC: Mandatory for 17 product categories in China • BIS: Required for Indian exports • PSE: Japan market access |

2026 Alert: EU Market Surveillance Regulation (2024) now requires importers to validate supplier compliance – non-compliant shipments face 100% customs rejection.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina Factory Audits (2025)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Dimensional Drift | Tool wear, inconsistent process controls | • Implement SPC with real-time alerts • Mandate tooling recalibration every 50k cycles |

| Material Substitution | Cost-cutting, poor traceability | • Require batch-specific material certs • Conduct surprise raw material audits (use blockchain QR codes) |

| Surface Imperfections | Inadequate mold maintenance, humidity | • Enforce mold cleaning logs (min. 2x/shift) • Install climate-controlled production zones |

| Electrical Shorts | Poor soldering, counterfeit components | • 100% ICT testing + X-ray inspection • Source ICs only from franchised distributors |

| Packaging Damage | Improper stacking, moisture exposure | • ISTA 3A vibration testing pre-shipment • Desiccant + humidity indicators in every carton |

| Labeling Errors | Language barriers, rushed production | • Use barcode-scanned label verification • Final audit by bilingual QA staff |

| Functional Failure | Incomplete testing, design flaws | • Require FAI reports for all new molds • 3rd-party pre-shipment inspection (PSI) at 100% load |

Strategic Recommendations for 2026

- Audit Beyond Certificates: 68% of compliance failures occur in implementation, not documentation. Require unannounced process audits.

- Adopt Digital Twins: Leading buyers (e.g., Siemens, Philips) now mandate digital production records for real-time quality tracking.

- Localize QA Teams: Suppliers with in-house bilingual engineers reduce defect resolution time by 52% (SourcifyChina 2025 data).

- Contract Clauses: Include right-to-audit, defect cost recovery, and automated data sharing requirements.

“In 2026, quality is a data stream – not a checklist. Procurement leaders who integrate supplier IoT systems into their ERP will cut quality costs by 22%.”

– SourcifyChina 2026 Supply Chain Intelligence Brief

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data sourced from SourcifyChina’s 2025 Global Supplier Performance Index (GSPI) and EU RAPEX/US CPSC databases.

© 2026 SourcifyChina. For internal use by procurement professionals only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China’s Top 100 Manufacturing Firms

Publisher: SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the world’s leading manufacturing hub, with its top 100 enterprises offering advanced capabilities in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing). This report provides a strategic overview of cost structures, label models, and volume-based pricing for procurement professionals sourcing from Tier 1 Chinese manufacturers in 2026.

Key insights:

– OEM vs. ODM selection impacts development time, IP ownership, and unit economics.

– White Label offers faster time-to-market; Private Label enables brand differentiation.

– Economies of scale are significant—unit costs drop up to 38% when MOQ increases from 500 to 5,000 units.

– Labor and material costs in 2026 reflect moderate inflation (+3.2% YoY) and supply chain stabilization post-pandemic.

1. Understanding OEM vs. ODM in China’s Top 100 Manufacturers

| Model | Description | Best For | IP Ownership | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | Established brands with in-house R&D | Buyer retains full IP | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; buyer customizes branding | Fast-to-market brands, startups | Shared or licensed IP (negotiable) | 4–7 weeks |

Strategic Note: The top 100 Chinese manufacturers (e.g., BYD, Haier, Midea, Luxshare) offer hybrid ODM/OEM models with scalable automation, reducing per-unit costs at high volumes.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product (design, packaging, specs) |

| MOQ | Low (often 100–500 units) | Moderate to high (500–5,000+ units) |

| Development Cost | None (off-the-shelf) | $2,000–$15,000 (tooling, design) |

| Time to Market | 2–4 weeks | 6–12 weeks |

| Brand Differentiation | Low | High |

| Target Buyer | Resellers, distributors | Branded retailers, DTC brands |

Procurement Insight: White label is ideal for testing markets; private label builds long-term brand equity.

3. Estimated Cost Breakdown (Per Unit)

Based on mid-range consumer electronics (e.g., Bluetooth speakers, smart home devices) produced by top-tier Chinese OEMs in 2026

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 58% | Includes PCBs, plastics, metals; 3.5% YoY increase due to rare earth and resin costs |

| Labor | 12% | Avg. $6.20/hour in Guangdong; robotics adoption reduces labor dependency |

| Packaging | 8% | Custom boxes, inserts, multilingual labeling |

| Tooling & Molds | 10% (amortized) | One-time cost, spread over MOQ |

| QA & Compliance | 7% | Includes FCC, CE, RoHS testing |

| Logistics (to FOB port) | 5% | Inland freight, export handling |

Note: Costs vary by product category. Apparel, cosmetics, and medical devices have different allocations.

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Avg. Unit Price (USD) | % Reduction vs. 500 Units | Key Drivers |

|---|---|---|---|

| 500 units | $28.50 | — | High tooling amortization, manual assembly |

| 1,000 units | $22.80 | -20% | Partial automation, bulk material discounts |

| 5,000 units | $17.60 | -38% | Full automation, optimized logistics, supplier leverage |

Assumptions:

– Product: Mid-tier IoT device (e.g., smart thermostat)

– Factory: Top 100 Chinese OEM with ISO 13485 & IATF 16949 certification

– Materials: ABS plastic, aluminum casing, Bluetooth 5.3 module

– Tooling Cost: $12,000 (amortized over MOQ)

5. Strategic Recommendations for Procurement Managers

- Leverage ODM for MVP Launches: Reduce time-to-market by 30–40% using pre-validated designs from top-tier ODMs.

- Negotiate Tiered MOQs: Start with 1,000 units to balance cost and inventory risk; scale to 5,000+ for profitability.

- Invest in Private Label for DTC Channels: Differentiate in competitive markets (e.g., Amazon, Shopify).

- Audit Supplier Automation Levels: Fully automated lines (e.g., Foxconn, Luxshare) offer 12–15% lower labor costs.

- Lock Material Contracts Early: Secure resin and semiconductor supply amid 2026 capacity constraints.

Conclusion

Sourcing from China’s top 100 manufacturers in 2026 requires a nuanced understanding of label strategies, volume economics, and supply chain resilience. While white label offers speed and low entry barriers, private label and high-MOQ OEM/ODM partnerships deliver superior margins and brand control. Procurement leaders who optimize MOQs, leverage automation, and secure IP rights will achieve sustainable cost leadership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Steps for Tier-1 Chinese Manufacturers (2024 Edition)

Prepared for Global Procurement Managers | Objective: De-risk Sourcing from China’s Top-Tier Suppliers

Executive Summary

Verifying authentic manufacturers (vs. trading companies) within China’s competitive landscape is non-negotiable for Fortune 500 procurement teams. With 68% of failed supplier relationships traced to misidentified entity types (SourcifyChina 2023 Audit Data), this guide provides actionable, field-tested steps to validate “Top 100” caliber suppliers. Critical insight: No official “Top 100 Companies in China” list exists for all industries; verification focuses on tier-1 operational capability, compliance, and scale.

I. Critical Verification Steps for Tier-1 Chinese Manufacturers

Apply these steps sequentially before signing contracts or paying deposits.

| Step | Action Required | Verification Tools/Methods | Pass Criteria |

|---|---|---|---|

| 1. Entity Legitimacy Check | Validate business registration & scope | • QCC.com (China’s official registry) • National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Cross-check license number with Chinese tax authority |

• License matches exact legal name & address • Manufacturing explicitly listed in business scope • No “suspension” or “abnormal operation” records |

| 2. Physical Facility Audit | Confirm factory ownership & production scale | • Unannounced video audit (360° live feed) • Satellite imagery (Google Earth historical views) • Third-party inspection (e.g., SGS, QIMA) |

• Machinery visible with operational status • Raw material storage onsite • Consistent facility size vs. claimed capacity (min. 10,000m² for tier-1) |

| 3. Production Capability Proof | Verify technical capacity & quality systems | • ISO 9001/14001 certificates (verify via CNAS) • Equipment ownership records (purchase invoices) • Process flow documentation with QC checkpoints |

• Certificates valid & match factory address • Equipment list aligns with production claims • In-process QC metrics provided (e.g., CPK >1.33) |

| 4. Financial & Export Health | Assess stability & export compliance | • Audited financial statements (last 2 years) • Customs export records (via China Customs Data) • Bank reference letter (on letterhead) |

• Positive net equity (>¥5M RMB) • Consistent export history (>24 months) • No export restrictions or violations |

| 5. Client Validation | Confirm tier-1 references | • Direct contact with 2+ existing clients • Signed NDA to access client lists • Verification of purchase orders (redacted) |

• References confirm direct manufacturing (not trading) • Clients are recognizable global brands • POs match claimed production volume |

Key Insight: Tier-1 manufacturers tolerate unannounced audits. If a “factory” insists on only visiting a showroom, treat as high-risk.

II. Factory vs. Trading Company: 5 Definitive Differentiators

Trading companies increase costs (15-30% markup) and reduce traceability. Use this checklist:

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | Explicitly lists manufacturing (生产) for your product category | Lists trading (贸易), agent (代理), or vague terms like technology (科技) | Check QCC.com: Manufacturing must be primary activity |

| Facility Control | Owns land/building (property deed) or 10+ yr lease | Short-term lease (<3 yrs) or “shared space” claims | Demand property deed copy; verify via local land bureau |

| Engineering Team | In-house R&D staff with technical degrees | Outsourced engineering or “partner network” | Interview lead engineer; check work history on LinkedIn China (领英) |

| Pricing Structure | Quotes FOB with itemized material/labor costs | Quotes EXW or refuses cost breakdown | Require granular BOM (Bill of Materials) with material specs |

| Sample Production | Creates samples at their facility within 7-14 days | Takes 30+ days (sourcing externally) | Insist on live sample creation video during audit |

Red Flag: If the supplier says “We have our own factory in [City]” but cannot provide that factory’s business license, it is a trading company.

III. Top 7 Red Flags to Disqualify Suppliers Immediately

These indicators correlate with 92% of souring failures (per SourcifyChina’s 2023 Supplier Database):

- 🚫 License Mismatch

- Business license name ≠ website/Alibaba store name

-

Action: Reject if not 100% identical.

-

🚫 “Factory Tour” Only in Showroom

- No access to production floor, warehouse, or QC lab

-

Action: Demand live video of machines in operation during audit.

-

🚫 Refusal to Sign NDA Before Sharing Details

- Legitimate factories protect IP but require mutual NDAs

-

Action: Walk away if they avoid formal agreements.

-

🚫 Inconsistent Export History

- Claims “20 years exporting” but first export record ≤2 years ago

-

Action: Verify via China Customs Data (fee-based but critical).

-

🚫 No Direct Client References

- Only provides “testimonials” or anonymous logos

-

Action: Require 2 verifiable contacts at named companies.

-

🚫 Payment Terms >30% Upfront

- Tier-1 manufacturers accept LC or 30% deposit max

-

Action: Avoid suppliers demanding 50%+ prepayment.

-

🚫 Alibaba Store as Primary ID

- “Verified” Gold Supplier status ≠ factory status

- Action: Alibaba verification is basic; never substitute for QCC.com checks.

IV. SourcifyChina Recommendation

“Procurement leaders must treat supplier verification as a continuous process, not a one-time checklist. Tier-1 Chinese manufacturers welcome rigorous audits – they understand the value of transparency. The highest risk isn’t cost; it’s supply chain opacity. Always prioritize verifiable operational evidence over marketing claims. For strategic categories, deploy third-party auditors with Mandarin fluency to validate cultural and regulatory nuances.”

– SourcifyChina Senior Sourcing Team | 12+ Years in China Supply Chain Integrity

Appendix: Essential Verification Tools

– QCC.com (Paid): Official Chinese business registry (use “企查查” app)

– China Customs Data (Paid): Export history via www.tradesns.com

– CNAS Certificate Search: www.cnas.org.cn (verify ISO validity)

– Google Earth Pro: Historical imagery for facility validation

Disclaimer: This report reflects SourcifyChina’s proprietary methodology. “Top 100” is an industry term for tier-1 suppliers; no universal ranking exists. Always conduct independent due diligence.

© 2024 SourcifyChina. For licensed procurement use only. Unauthorized distribution prohibited.

[www.sourcifychina.com/professional-verification] | Global Sourcing Integrity Since 2012

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Your Trusted Partner in China Sourcing

Executive Summary: Streamline Your China Sourcing with Verified Excellence

In 2026, global procurement continues to face mounting pressure: supply chain volatility, quality inconsistencies, and the high cost of supplier due diligence. For procurement managers sourcing from China, identifying trustworthy, high-performance suppliers remains a critical challenge. Time spent vetting unreliable manufacturers directly impacts time-to-market, product quality, and bottom-line profitability.

SourcifyChina’s Verified Pro List: Top 100 Companies in China is engineered to eliminate these inefficiencies. This exclusive, data-driven directory features rigorously vetted manufacturers across electronics, hardware, textiles, packaging, and industrial components—each pre-qualified for compliance, scalability, production capacity, and export experience.

Why the Verified Pro List Saves You Time & Reduces Risk

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| Weeks spent screening suppliers via Alibaba, trade shows, or referrals | Immediate access to 100 pre-vetted, high-capacity manufacturers |

| High risk of encountering fake certifications or middlemen | Each company verified for legal standing, facility audits, and export history |

| Multiple rounds of RFQs with inconsistent responses | Direct contact with responsive, English-speaking production teams |

| Uncertainty around MOQs, lead times, and quality control | Transparent profiles with verified capacity, specialties, and compliance data |

| Costly factory audits or third-party inspections pre-engagement | On-site verification completed by SourcifyChina’s in-country team |

Time Saved: On average, clients reduce supplier qualification time by 68%—from 6–8 weeks down to under 14 days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient sourcing slow your competitive edge. The Verified Pro List is not a public directory—it’s a strategic resource reserved for procurement leaders who demand speed, reliability, and compliance.

Take the next step today:

✅ Request your customized Pro List preview

✅ Identify 3–5 ideal suppliers in under 48 hours

✅ Begin sample production with confidence—faster

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our China-based sourcing consultants are available 24/5 to guide your selection, arrange factory calls, and support initial RFQs—ensuring a seamless, risk-mitigated supplier engagement.

SourcifyChina – Precision. Verification. Results.

Trusted by procurement teams in the US, EU, and APAC to de-risk and accelerate China sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.