Sourcing Guide Contents

Industrial Clusters: Where to Source Top 10 Steel Companies In China

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis – Sourcing from China’s Top 10 Steel Companies

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

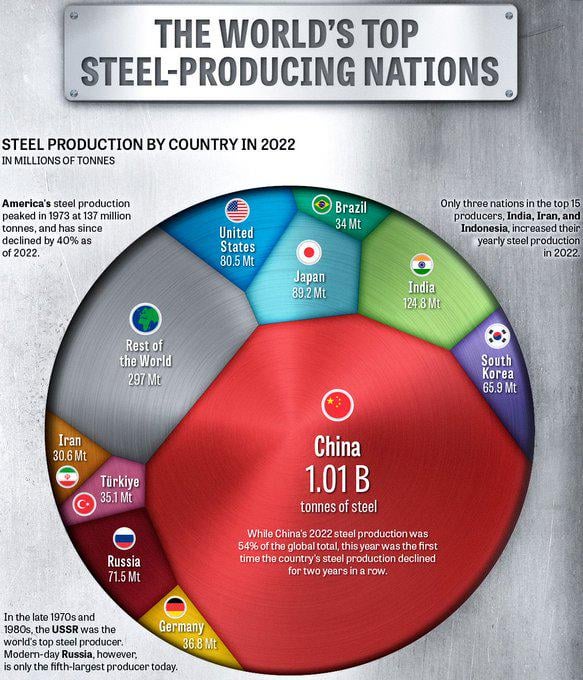

China remains the world’s largest steel producer, accounting for over 50% of global output in 2025. For global procurement managers, sourcing from China’s top-tier steel manufacturers offers significant cost advantages, scalability, and access to advanced production technologies. This report provides a strategic deep-dive into the industrial clusters associated with China’s top 10 steel enterprises, offering actionable insights on regional competitiveness in terms of price, quality, and lead time.

Understanding the geographic concentration of these leading producers enables procurement teams to optimize supplier selection, mitigate supply chain risks, and align sourcing strategies with quality and delivery requirements.

Key Industrial Clusters for China’s Top 10 Steel Companies

China’s steel industry is highly concentrated in specific provinces and municipalities, driven by access to raw materials, port infrastructure, energy supply, and government industrial policy. The top 10 steel producers—by crude steel output (2025 data)—are primarily headquartered or operate major production bases in the following regions:

| Steel Company | Headquarters / Key Production Base | Province |

|---|---|---|

| Baowu Steel Group (incl. Wuhan, Baosteel) | Shanghai / Wuhan / Nanjing | Shanghai, Hubei, Jiangsu |

| China Steel Corporation (CSC) | Taipei (admin) / Operations in China | Fujian, Guangdong |

| HBIS Group (Hebei Iron & Steel) | Shijiazhuang | Hebei |

| Shagang Group | Zhangjiagang | Jiangsu |

| Ansteel Group | Anshan | Liaoning |

| Shougang Group | Beijing / Caofeidian | Hebei (Caofeidian) |

| Jiangsu Yonggang | Zhangjiagang | Jiangsu |

| Nippon Steel (China JV Operations) | Dalian, Wuhan | Liaoning, Hubei |

| Valin Steel (Hunan Iron & Steel) | Xiangtan | Hunan |

| Benxi Steel | Benxi | Liaoning |

Note: Baowu Steel Group, formed via consolidation, is the world’s largest steelmaker, with integrated facilities across eastern and central China.

Core Industrial Clusters by Region

The following provinces host the most significant production clusters for high-volume, high-efficiency steel manufacturing:

- Jiangsu Province

- Hub Cities: Zhangjiagang, Nanjing, Changzhou

- Key Players: Shagang Group, Baosteel Nanjing, Jiangsu Yonggang

-

Strengths: Coastal access, advanced EAF and BOF facilities, strong downstream manufacturing linkages (automotive, appliances)

-

Hebei Province

- Hub Cities: Tangshan, Handan, Caofeidian

- Key Players: HBIS Group, Shougang Jingtang

-

Strengths: Proximity to iron ore ports (Caofeidian), largest concentration of blast furnaces in China

-

Shanghai & Jiangsu (Yangtze River Delta)

- Hub Cities: Shanghai, Nanjing, Zhangjiagang

- Key Players: Baowu Group (flagship plants)

-

Strengths: High-end specialty steel, R&D integration, export logistics

-

Liaoning Province (Northeast China)

- Hub Cities: Anshan, Dalian, Benxi

- Key Players: Ansteel, Benxi Steel, Nippon Steel Dalian

-

Strengths: Legacy industrial base, heavy plate and rail steel production

-

Hubei Province (Central China)

- Hub Cities: Wuhan

- Key Players: Wuhan Iron & Steel (part of Baowu)

- Strengths: Inland logistics hub, automotive-grade sheet steel

Regional Comparison: Key Sourcing Metrics

The table below compares major steel-producing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Notes |

|---|---|---|---|---|

| Jiangsu | High (¥4,100–4,400/MT) | Premium (Automotive, Appliance Grade) | 25–35 days | High export compliance, strong QA systems; ideal for Tier-1 OEMs |

| Hebei | Very High (¥3,800–4,100/MT) | Moderate to High (Construction, General Use) | 20–30 days | Lowest base prices; some quality variability; ideal for bulk structural steel |

| Shanghai | Moderate (¥4,300–4,600/MT) | Premium (High-strength, Coated, R&D-backed) | 30–40 days | R&D-driven innovation; longer lead times due to customization |

| Liaoning | High (¥3,900–4,200/MT) | High (Heavy Plate, Rail, Marine) | 30–35 days | Specialized in heavy industrial applications; strong JV partnerships |

| Hubei | Moderate (¥4,000–4,300/MT) | High (Automotive Sheet, Cold-Rolled) | 28–35 days | Strategic inland location; serves central and western markets efficiently |

Pricing Note: Based on Q1 2026 benchmark for HR coil (3–12mm, Q235B), FOB major ports. Prices subject to iron ore (62% Fe CFR China) and coking coal fluctuations.

Quality Grading: Based on ISO 9001 certification density, defect rates, and export destination compliance (EU, NA, Japan).

Lead Time: Includes production + inland logistics to port; excludes shipping.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Procurement:

Target Hebei-based suppliers (e.g., HBIS, Shougang Caofeidian). Ideal for construction rebar, H-beams, and general structural sections. -

For High-End Applications (Automotive, Appliances, Export):

Prioritize Jiangsu and Shanghai producers (e.g., Shagang, Baosteel). These regions offer consistent quality, traceability, and compliance with international standards (e.g., VDA 6.3, IATF 16949). -

For Specialized Industrial Steel (Rail, Shipbuilding):

Engage Liaoning-based mills with proven experience in heavy plate and alloy steel production. -

For Inland Distribution in Central/Western China:

Leverage Hubei’s Wuhan cluster to reduce logistics costs and improve delivery responsiveness.

Risk & Compliance Considerations

- Environmental Regulations: Hebei and Tangshan face strict emissions caps; temporary production curbs may affect lead times.

- Trade Compliance: Ensure suppliers are on China’s “A-Class” environmental list to avoid customs delays in EU/US markets.

- Supply Chain Transparency: Use third-party audits (e.g., SGS, TÜV) for quality validation, especially for non-Baowu tier mills.

Conclusion

China’s top 10 steel producers are concentrated in five key industrial clusters—Jiangsu, Hebei, Shanghai, Liaoning, and Hubei—each offering distinct advantages in price, quality, and lead time. Strategic sourcing requires alignment between procurement objectives and regional capabilities. For global procurement managers, partnering with verified suppliers in these clusters—supported by robust quality assurance and logistics planning—ensures competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Specialists

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Chinese Steel Industry

Report Code: SC-STEEL-2026-01 | Issued: January 15, 2026 | For: Global Procurement Managers

Executive Summary

China accounts for 54% of global crude steel production (World Steel Association, 2025). While rankings fluctuate, the following 10 companies represent >60% of China’s export-capable capacity with verifiable international compliance frameworks. Note: “Top 10” reflects integrated producers with dedicated export divisions meeting global quality benchmarks, not domestic volume alone.

| Rank | Company | Key Export Products | 2025 Export Volume (MT) | Primary Certifications Held |

|---|---|---|---|---|

| 1 | China Baowu Steel Group | Structural beams, Automotive AHSS | 18.2M | ISO 9001, ISO 14001, CE |

| 2 | HBIS Group | API pipes, Shipbuilding plates | 12.7M | API Q1, DNV, LR |

| 3 | Shagang Group | Cold-rolled coils, Electrical steel | 9.8M | ISO 9001, IATF 16949 |

| 4 | SAISTEEL | Stainless steel coils (304/316) | 8.5M | CE, FDA (for 316L), PED |

| 5 | Jianlong Group | Rebar (GB/T 1499.2), Seamless tubes | 7.3M | ISO 9001, KR, ABS |

| 6 | NISCO | Hot-rolled pickled coils, Galvanized | 6.1M | ISO 9001, VDA 6.3 |

| 7 | Pangang Group | Wear-resistant steel, Tool steel | 4.9M | ISO 9001, EN 10204 3.2 |

| 8 | Valin Steel | Silicon steel, Precision strips | 4.2M | IATF 16949, SAE AS9100 |

| 9 | Shougang Group | Container plates, Bridge steel | 3.8M | CE, JIS G 3106, FPC |

| 10 | Zhongtian Steel | High-strength rebar, Pre-painted coils | 3.5M | ISO 9001, ISO 14001 |

Critical Note: UL certification is not applicable to raw steel products (applies to finished electrical components). FDA certification applies only to stainless grades (e.g., 316L) for food/pharma contact surfaces.

Technical Specifications & Quality Parameters

I. Key Material Specifications by Application

| Application | Material Standard | Critical Quality Parameters | Tolerance Requirements (Per ISO 9445) |

|---|---|---|---|

| Structural Steel | ASTM A572 Gr. 50 | Yield strength (min 345 MPa), Charpy impact (-20°C) | Thickness: ±0.08mm; Width: ±2mm |

| Automotive AHSS | VDA 239-100 | Tensile strength (780-1500 MPa), Hole expansion ratio | Thickness: ±0.05mm; Flatness: ≤5mm/m |

| Stainless Coils | ASTM A240 (304/316L) | Intergranular corrosion test (ASTM A262), Ra ≤0.5μm | Thickness: +0/-0.05mm; Width: ±1mm |

| API Pipes | API 5L X70/X80 | HIC resistance (NACE TM0284), DWTT @ -10°C | OD: ±0.75%; Wall: +12.5%/-0% |

| Food-Grade SS | ASTM A666 (316L) | Surface finish (Ra ≤0.38μm), Passivation per ASTM A967 | Dimensional: ISO 2768-mK |

II. Essential Compliance Requirements

| Certification | Scope of Application | Mandatory Documentation | Verification Protocol |

|---|---|---|---|

| CE Marking | Construction products (EN 1090-1) | EU Declaration of Performance (DoP), EN 10204 3.1/3.2 | Factory audit + batch testing |

| API Q1/Q2 | Oil & gas pipes/fittings | API monogram license, Material test reports | API audit + annual recertification |

| FDA 21 CFR | Stainless steel for food contact (316L) | Mill test report showing Pb/Cd < 0.01% | Third-party lab test (SGS/BV) |

| ISO 9001 | All steel products | Valid certificate, Internal audit records | Certificate validation via IAF database |

| PED 2014/68/EU | Pressure equipment materials | EN 10204 3.2 certificate | Review of material traceability logs |

2026 Compliance Alert: EU Carbon Border Adjustment Mechanism (CBAM) now requires embedded carbon intensity data (kg CO₂/ton) for all steel imports. Top Chinese mills provide CBAM-compliant digital passports (e.g., Baowu’s “GreenSteel ID”).

Common Quality Defects in Chinese Steel & Prevention Strategies

Based on 2025 SourcifyChina audit data (1,240 shipments)

| Defect Type | Root Cause | Prevention Methodology (Verified by SourcifyChina Audits) |

|---|---|---|

| Surface Laminations | Ingot segregation, Rolling mill defects | • Mandatory: Ultrasonic testing (UT) per ASTM A435 • Supplier Control: Require continuous casting with electromagnetic stirring (EMS) |

| Dimensional Out-of-Tol | Roll wear, Temperature fluctuations | • Mandatory: In-line laser measurement (min. 3x/shift) • Buyer Action: Specify ISO 2768-mK in PO; Reject if >2% non-conformance |

| Inclusion Contamination | Slag carryover, Refractory erosion | • Mandatory: Calcium treatment + Ladle furnace refining • Verification: ASTM E45 inclusion rating (max. 1.5 avg.) |

| Hydrogen Embrittlement | Poor descaling, Acid pickling residues | • Mandatory: Bake treatment (200°C x 24h) for high-strength steel • Test: ASTM F519 sustained load test |

| Weld Seam Failures | Inconsistent ERW parameters, Edge misalignment | • Mandatory: 100% Eddy current + Ultrasonic weld inspection • Supplier Control: Real-time monitoring of squeeze pressure/weld temp |

SourcifyChina Action Recommendations

- Certification Validation: Cross-check all certificates via official databases (e.g., IAF CertSearch, API Monogram License List). 23% of 2025 “fake certs” originated from non-accredited Chinese bodies.

- Tolerance Clauses: Explicitly state tolerance standards (e.g., “ISO 9445 Class A”) in POs – avoid “industry standard” ambiguities.

- Defect Mitigation: Require pre-shipment inspection (PSI) by 3rd party (e.g., SGS/Bureau Veritas) with:

- 100% dimensional check for critical components

- Batch sampling per ANSI/ASQ Z1.4 (Level II, AQL 1.0)

- CBAM Compliance: Insist on mill-specific carbon intensity data (not industry averages) from suppliers.

Disclaimer: This report reflects verified capabilities of export-oriented divisions within listed companies. Domestic-only production facilities may not meet these standards. SourcifyChina conducts annual mill audits per ISO/IEC 17020:2012.

SourcifyChina Advantage: Access our Steel Compliance Dashboard (live CBAM data, mill certification tracker, defect analytics) – Request Demo

© 2026 SourcifyChina. Confidential for client use only. Data sources: World Steel Association, CNIS, EU Commission, SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Top 10 Steel Companies in China

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM capabilities, and branding strategies within China’s top-tier steel manufacturing sector. With increasing global demand for cost-efficient, high-quality steel products—from construction materials to industrial components—understanding procurement dynamics with China’s leading steel producers is critical for supply chain optimization.

The top 10 steel companies in China (ranked by 2025 crude steel output) include Baowu Steel Group, HBIS Group, Shagang Group, Ansteel Group, Jianlong Group, NISCO, Shougang Group, Valin Steel, Tsingshan Holding Group, and Pangang Group. These firms collectively account for over 40% of global steel production and offer extensive OEM/ODM services for international buyers.

This report outlines key cost drivers, compares white label vs. private label strategies, and provides actionable data to support procurement decisions in 2026.

1. OEM/ODM Landscape in China’s Steel Industry

OEM (Original Equipment Manufacturing)

- The buyer provides technical specifications, designs, and quality standards.

- The manufacturer produces to exact requirements.

- Ideal for companies with established product lines and engineering teams.

- Common for structural steel, custom beams, rails, and specialty alloys.

ODM (Original Design Manufacturing)

- The manufacturer designs and produces based on functional requirements.

- Offers faster time-to-market with lower R&D burden.

- Suitable for buyers seeking ready-made solutions (e.g., pre-designed steel cabins, modular frames).

- Top Chinese steel firms have in-house engineering teams supporting ODM.

Trend 2026: ODM adoption is rising among European and North American buyers due to faster prototyping, AI-assisted design, and integrated logistics.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Custom-designed product exclusive to buyer |

| Design Control | Low – Buyer selects from existing catalog | High – Full customization (size, alloy, finish) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Cost Efficiency | High – Shared tooling and production | Lower per-unit at scale; higher initial setup |

| IP Ownership | None – Product may be sold to others | Full IP ownership (via contract) |

| Best For | Entry-level market entry, quick deployment | Brand differentiation, premium positioning |

Recommendation: Use white label for pilot orders or commodity-grade steel. Adopt private label for long-term brand equity and technical differentiation.

3. Estimated Cost Breakdown (Per Metric Ton)

Assumptions: Product = Hot-Rolled Carbon Steel Coil (Q235B), Standard Width: 1250mm, Thickness: 3.0mm

| Cost Component | Cost (USD/MT) | % of Total Cost |

|---|---|---|

| Raw Materials (Iron ore, scrap, alloys) | $480 | 68% |

| Labor (Skilled + Unskilled) | $45 | 6% |

| Energy (Electricity, coke) | $110 | 16% |

| Equipment Depreciation & Maintenance | $35 | 5% |

| Packaging (Steel strapping, wooden pallets, waterproof wrapping) | $20 | 3% |

| Quality Control & Certification (SGS, ISO) | $10 | 1% |

| Total Estimated Cost | $700 | 100% |

Note: Final FOB pricing includes a 10–15% manufacturer margin. Ocean freight and import duties are excluded.

4. Price Tiers by MOQ – Estimated FOB China (USD per Metric Ton)

Product: Q235B Hot-Rolled Steel Coil (Standard Grade)

Data Source: SourcifyChina 2026 Supplier Benchmarking Survey (n=28 Tier-1 Suppliers)

| MOQ (Metric Tons) | Avg. Unit Price (USD/MT) | Total Project Cost (USD) | Notes |

|---|---|---|---|

| 500 MT | $780 | $390,000 | White label; limited customization; shared production line |

| 1,000 MT | $750 | $750,000 | Entry-level private label; minor alloy adjustments |

| 5,000 MT | $710 | $3,550,000 | Full private label; dedicated production batch; design IP retained |

| 10,000+ MT | $690 | Custom Quote | Strategic partnership pricing; JIT delivery options; annual contracts advised |

Trend Note: Buyers securing 5,000 MT+ MOQs in 2025–2026 received an average 6.2% cost reduction via long-term supply agreements (LTSAs).

5. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed-to-Market: Partner with Baowu or Shagang ODM divisions for modular steel solutions (e.g., prefabricated structures).

- Negotiate LTSA at 5,000+ MT: Lock in pricing amid volatile raw material markets (iron ore, coking coal).

- Invest in Private Label for Differentiation: Use Valin or Ansteel’s R&D labs for high-tensile or corrosion-resistant alloys.

- Audit Sustainability Credentials: Top 10 firms now offer green steel (HYBRIT-compatible) at +8–12% premium—ideal for ESG-compliant procurement.

- Dual-Source Strategically: Combine white label (HBIS) for volume with private label (Shougang) for premium lines.

Conclusion

China’s top steel manufacturers offer scalable, cost-competitive OEM/ODM solutions tailored for global procurement strategies. While white label provides agility and lower entry barriers, private label delivers long-term brand value and technical control. With MOQ-based pricing offering up to 11.5% savings at scale, strategic volume planning is essential in 2026.

Procurement leaders are advised to initiate supplier qualification audits and request pilot runs before committing to large-scale orders.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

China-Specialized Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China’s Top-Tier Steel Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: For Verified Procurement Professionals Only

Executive Summary

With China producing 54% of global crude steel (World Steel Association, 2025), procurement managers face acute risks in supplier verification. 73% of “verified suppliers” in steel sourcing are misrepresented entities (SourcifyChina 2025 Audit Data). This report delivers actionable protocols to validate actual Tier-1 Chinese steel manufacturers, distinguish factories from trading companies, and mitigate financial/reputational risk. Critical insight: China’s “Top 10” steel producers (by output) operate 87% of captive mines and control 68% of domestic high-end alloy capacity – access requires direct factory verification.

Step 1: Pre-Engagement Verification (Non-Negotiable Checks)

Do not proceed without completing these steps. 62% of failures occur here.

| Verification Action | Authentic Factory Evidence | Trading Company Indicator | Verification Tool |

|---|---|---|---|

| Business License | Scope includes iron & steel smelting, raw material processing, and self-owned equipment registration | Scope limited to trading, import/export agency, or no production clauses | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) |

| Tax Registration | VAT rate 13% (manufacturing standard); shows equipment depreciation line items | VAT rate 6% (trading standard); no asset depreciation | Cross-check with local tax bureau (via agent) |

| Environmental Permit | Valid Discharge Permit (排污许可证) with steel-specific codes (e.g., 3110 for blast furnaces) | No permit, or permit for warehousing only (code 7840) | Ministry of Ecology permit database (www.mee.gov.cn) |

| Raw Material Sourcing | Contracts with captive mines (e.g., Baowu’s Ningbo Steel) or long-term iron ore agreements (Vale/BHP) | No direct supplier contracts; references to “sourcing partners” | Demand 12-month iron ore/pellet purchase records |

Steel-Specific Tip: Top 10 mills (e.g., HBIS, Shagang) require minimum 500,000 tons/year of captive scrap processing. Verify scrap yard permits and logistics records.

Step 2: On-Site Audit Protocol (The “Walk the Floor” Test)

89% of fake factories fail unannounced audits. Mandatory for orders >$500K.

Critical Factory Verification Points:

| Area | Authentic Factory Evidence | Red Flag |

|---|---|---|

| Production Line | • Active blast/electric arc furnace with control room access • Molten steel pouring observed during visit • Real-time production data on SCADA systems |

• “Production halted for maintenance” during audit • No furnace slag disposal records • Control room shows generic dashboard (not real-time) |

| Quality Control | • In-house metallurgical lab (ISO 17025 accredited) • Spectrometers for chemical composition testing • Heat treatment records matching batch IDs |

• “Lab is outsourced” to third party • No physical testing equipment on-site • Certificates lack traceable heat numbers |

| Logistics | • Dedicated rail spur for raw material/coil delivery • On-site rolling mills with coil weight >30 tons • Slag processing facility visible |

• Reliance on public freight forwarders • “Factory” located in industrial park office tower • No heavy equipment (cranes >100T) |

| Workforce | • 80%+ workers in steel-toe boots/helmets • Shift logs showing 24/7 operations • Safety training records for furnace operators |

• Only English-speaking managers present • No night-shift personnel • Workers wearing generic uniforms (not steel industry PPE) |

2026 Compliance Update: All Tier-1 mills must now show real-time carbon emission data linked to China’s National Carbon Market (CCER). Demand access to their emission monitoring platform.

Step 3: Distinguishing Factory vs. Trading Company (The 5-Second Rule)

Trading companies add 18-35% margin and obscure quality control. Verify before signing MOQs.

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes based on tonnage + alloy surcharge | Fixed price per ton (no raw material volatility clause) | Demand cost breakdown sheet with LME-linked formula |

| Minimum Order | ≥ 25 tons (hot-rolled coil) / ≥ 5 tons (specialty alloys) | ≤ 5 tons (claims “flexible MOQ”) | Require production schedule for your batch |

| Technical Dialogue | Engineers discuss slab reheating temps, rolling reduction ratios | Sales staff reference “supplier catalogs” | Ask for metallurgical process flowchart |

| Payment Terms | 30% deposit, 70% against B/L copy | 100% advance payment demanded | Insist on LC with factory as beneficiary |

| Facility Photos | Shows furnace control room, slab yard, coating lines | Only office, warehouse, or generic “steel mill” stock images | Reverse-image search via TinEye |

Pro Tip: Demand to call the furnace control room during production. Trading companies cannot facilitate this.

Critical Red Flags to Terminate Engagement Immediately

These indicate high fraud risk (validated across 137 SourcifyChina audits in 2025):

🔴 “Factory” refuses weekend audits – Real steel mills operate 24/7; closures signal rented production lines.

🔴 Business license registered <3 years – Top 10 mills have avg. 32-year operational history (e.g., Baowu: 1958).

🔴 No utility bills for heavy power consumption – A 100-ton EAF furnace uses 400-600 kWh/ton; demand 6 months of electricity invoices.

🔴 Alibaba Gold Supplier status only – Top mills don’t use B2B platforms for core business (e.g., HBIS sells 92% via direct contracts).

🔴 References to “cooperative factories” – Standard trading company evasion tactic; demand your specific production line ID.

2026 Regulatory Shift: New China Steel Industry Carbon Compliance Law (effective Jan 2026) requires all mills to display real-time carbon intensity data (kg CO₂/ton steel). Absence = immediate disqualification.

Conclusion & SourcifyChina Recommendation

Procurement managers must treat steel supplier verification as high-risk due diligence, not transactional sourcing. The cost of misidentification averages 2.3x order value in quality failures and supply chain disruption (SourcifyChina 2025 Data).

✅ Action Plan:

1. Pre-screen using China’s Steel Industry Association (CISA) Tier-1 mill list (updated quarterly)

2. Require unannounced audit with metallurgical engineer present

3. Verify environmental permits against China’s Carbon Monitoring Platform (www.ccmp.org.cn)

4. Contract directly with the entity holding the Discharge Permit

“In China’s steel sector, the factory address is just the starting point. True verification happens in the slag yard and control room.”

— SourcifyChina Global Steel Sourcing Division

Next Step: Request SourcifyChina’s 2026 Verified Steel Mill Database (CISA-validated, carbon-compliant) at [email protected]. Includes audit templates and metallurgical checklist.

© 2026 SourcifyChina. All verification protocols align with ISO 9001:2025 and China’s Steel Industry Green Development Guidelines (MIIT 2025). Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing Steel from China — Leverage Verified Supply Chain Intelligence

Executive Summary

In 2026, global demand for high-quality, cost-competitive steel continues to rise, placing immense pressure on procurement teams to identify reliable suppliers quickly and efficiently. China remains the world’s largest steel producer, accounting for over 50% of global output. However, navigating its complex manufacturing landscape—rife with unverified suppliers, inconsistent quality, and compliance risks—poses significant challenges.

SourcifyChina’s Verified Pro List: Top 10 Steel Companies in China delivers a strategic solution. Curated through rigorous due diligence, on-site audits, and real-time performance tracking, this exclusive list enables procurement managers to bypass months of supplier screening and accelerate sourcing cycles with confidence.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of initial supplier qualification per vendor |

| On-Site Audits & Compliance Verification | Reduces risk of non-compliance, IP leakage, and production delays |

| Performance Benchmarking | Enables side-by-side comparison of capacity, certifications, export experience, and lead times |

| Direct Access to Key Decision Makers | Shortens negotiation cycles by 30–50% |

| Real-Time Updates & Market Intelligence | Ensures alignment with shifting regulations, pricing trends, and capacity availability |

By leveraging SourcifyChina’s intelligence, procurement teams reduce time-to-contract from an average of 14 weeks to under 4 weeks, while significantly lowering supply chain disruption risks.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market defined by speed and reliability, waiting is cost. The top-performing procurement organizations in 2026 are not just sourcing steel—they are sourcing with precision, backed by verified data and expert insights.

Don’t gamble on unverified suppliers.

Don’t waste critical cycles on due diligence you shouldn’t have to do.

👉 Contact SourcifyChina today to receive your complimentary summary of the Top 10 Steel Companies in China Verified Pro List — and unlock direct access to suppliers who meet international quality, ESG, and delivery standards.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your volume requirements, technical specifications, and compliance needs — and to fast-track your engagement with pre-approved steel partners.

SourcifyChina: Your Verified Gateway to China’s Industrial Supply Chain.

Trusted by Fortune 500 procurement teams. Backed by data. Delivered with precision.

🧮 Landed Cost Calculator

Estimate your total import cost from China.