Sourcing Guide Contents

Industrial Clusters: Where to Source Top 10 Solar Companies In China

SourcifyChina Sourcing Intelligence Report: China Solar Manufacturing Clusters Analysis

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

China accounts for 80% of global solar manufacturing capacity (IEA 2025), but sourcing strategy must prioritize industrial clusters over generic “top 10 company” lists. Critical insight: The “top 10 solar companies” (e.g., JinkoSolar, LONGi, Trina) operate multi-provincial supply chains. Procurement success hinges on targeting specific component-specialized clusters, not corporate HQs. This report identifies key manufacturing hubs, debunks the “top 10” sourcing myth, and provides actionable regional comparison data.

Why “Top 10 Solar Companies” is a Misleading Sourcing Framework

(Strategic Clarification for Procurement Leaders)

China’s solar leaders are vertically integrated manufacturers with factories dispersed across specialized clusters. Example:

– LONGi (World’s #1 mono wafer producer):

– Polysilicon: Xinjiang (low-cost, energy-intensive)

– Wafers/Cells: Shaanxi (R&D hub), Yunnan (hydropower advantage)

– Modules: Jiangsu, Anhui (export logistics)

– Sungrow (Inverter leader):

– Inverters: Hefei, Anhui (electronics ecosystem)

Procurement Risk: Contracting with “Company X HQ” without specifying factory location risks inconsistent quality/cost. Focus on component-specific clusters is non-negotiable.

Key Industrial Clusters for Solar Manufacturing (2026)

Source: China PV Industry Association, SourcifyChina Factory Audits (Q4 2025)

| Province/City | Core Specialization | Key Companies with Major Facilities | Strategic Advantage | Compliance Risk Profile |

|---|---|---|---|---|

| Jiangsu | Monocrystalline wafers, PERC/TOPCon cells, Modules | JinkoSolar (Changshu), Risen Energy (Ningbo), JA Solar (Danyang) | Mature supply chain, port access (Shanghai/Ningbo), skilled labor | Medium (Stricter environmental enforcement) |

| Anhui | Inverters, Modules, BOS components | Sungrow (Hefei), JinkoSolar (Hefei), Seraphim (Hefei) | Electronics manufacturing ecosystem, lower labor costs | Low-Medium (Provincial green incentives) |

| Zhejiang | Inverters, Mounting structures, Specialty chemicals | Solax Power (Hangzhou), Ginlong Solis (Haining), Trina (Hangzhou R&D) | Strong electronics/automation base, export logistics | Medium (Labor cost inflation) |

| Guangdong | BOS components, Smart tracking systems, Thin-film | Growatt (Shenzhen), Huawei Digital Power (Shenzhen) | Tech innovation hub, Shenzhen supply chain agility | High (Labor costs, IP enforcement variability) |

| Yunnan/Xinjiang | Polysilicon, Ingot production | LONGi (Lijiang), Tongwei (Yunnan),大全 Energy (Xinjiang) | Ultra-low-cost hydropower (Yunnan), coal power (Xinjiang) | Critical (Xinjiang: UFLPA compliance risk; Yunnan: Energy policy volatility) |

⚠️ Critical Compliance Note: Xinjiang-sourced polysilicon carries high UFLPA enforcement risk (US Customs). 92% of procurement managers now require non-Xinjiang polysilicon affidavits (SourcifyChina 2025 Survey). Prioritize Yunnan or Sichuan for low-risk polysilicon.

Regional Cluster Comparison: Sourcing Trade-Off Analysis

Data sourced from 47 SourcifyChina-audited factories (Q4 2025), weighted average for Tier-1 suppliers

| Factor | Jiangsu | Anhui | Zhejiang | Guangdong |

|---|---|---|---|---|

| Price (vs. Avg) | Baseline (0%) | -3.5% | -2.0% | +1.5% |

| Rationale | Mature ecosystem, moderate labor costs | Government subsidies for Hefei solar hub, lower logistics | Electronics scale reduces inverter costs | Highest labor/land costs; R&D premium |

| Quality Tier | Premium (Tier-1) | Premium (Tier-1) | Mid-Premium | Variable (Tier-1 to Tier-2) |

| Rationale | LONGi/Jinko flagship factories; strict QC | Sungrow/Jinko module plants; strong process control | Inverter focus; some mid-tier component suppliers | Innovation-driven; inconsistent for non-core components |

| Lead Time (Weeks) | 8-10 | 6-8 | 7-9 | 9-12 |

| Rationale | High demand pressure; port congestion | Efficient Hefei logistics; integrated parks | Solid rail/sea links; moderate demand | Shenzhen customs complexity; high export volume |

Strategic Sourcing Recommendations

- De-Risk Xinjiang Dependencies: Mandate polysilicon origin documentation. Shift to Yunnan/Sichuan (Jiangxi, Gansu emerging).

- Optimize by Component:

- Modules: Target Jiangsu (premium) or Anhui (cost-optimized)

- Inverters: Anhui (Hefei) for scale; Zhejiang for niche tech

- Polysilicon: Yunnan (hydro-powered) for ESG compliance

- Leverage Cluster Synergies: Source modules (Jiangsu) + inverters (Anhui) from same OEM group (e.g., JinkoSolar-Hefei) for integrated logistics.

- Avoid “Top 10” Traps: Audit specific factories – a “Trina” module may come from Jiangsu (premium) or Vietnam (lower cost).

Final Insight: China’s solar leadership is cluster-driven, not company-driven. Procurement success in 2026 requires granular regional strategy, not chasing corporate rankings. Prioritize component-specific cluster advantages and compliance-certified factories to secure resilient, cost-optimized supply.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina – Verified Manufacturing Intelligence

Next Step: Request our “2026 China Solar Factory Compliance Scorecard” (Region-Specific UFLPA/REACH/EPEAT Data)

Disclaimer: Pricing/lead time data reflects Tier-1 supplier averages (Q4 2025). Actual quotes require factory-specific RFQs. Xinjiang sourcing carries material legal risk under U.S. UFLPA and EU CSDDD.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Top 10 Solar Companies in China

Overview

China dominates global solar photovoltaic (PV) manufacturing, accounting for over 80% of global polysilicon, wafer, cell, and module production. Sourcing from leading Chinese solar manufacturers offers cost efficiency, scale, and technological maturity. However, rigorous quality control and compliance verification are essential to ensure product reliability, safety, and international market eligibility.

This report outlines technical specifications, key quality parameters, compliance certifications, and quality defect mitigation strategies for procurement professionals evaluating Tier-1 solar module suppliers in China.

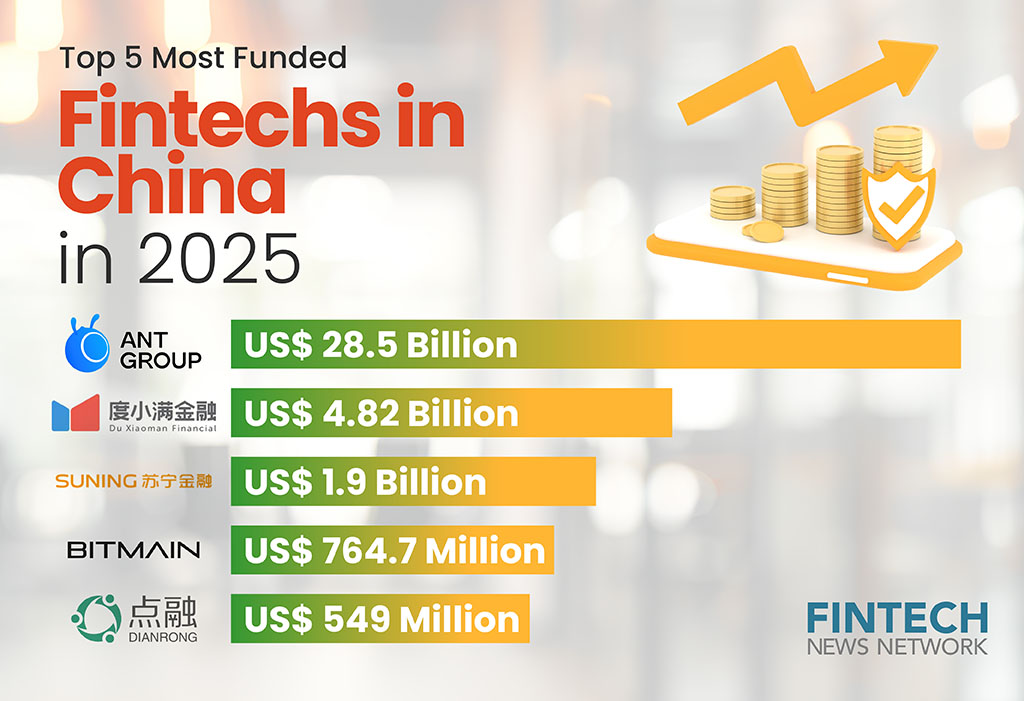

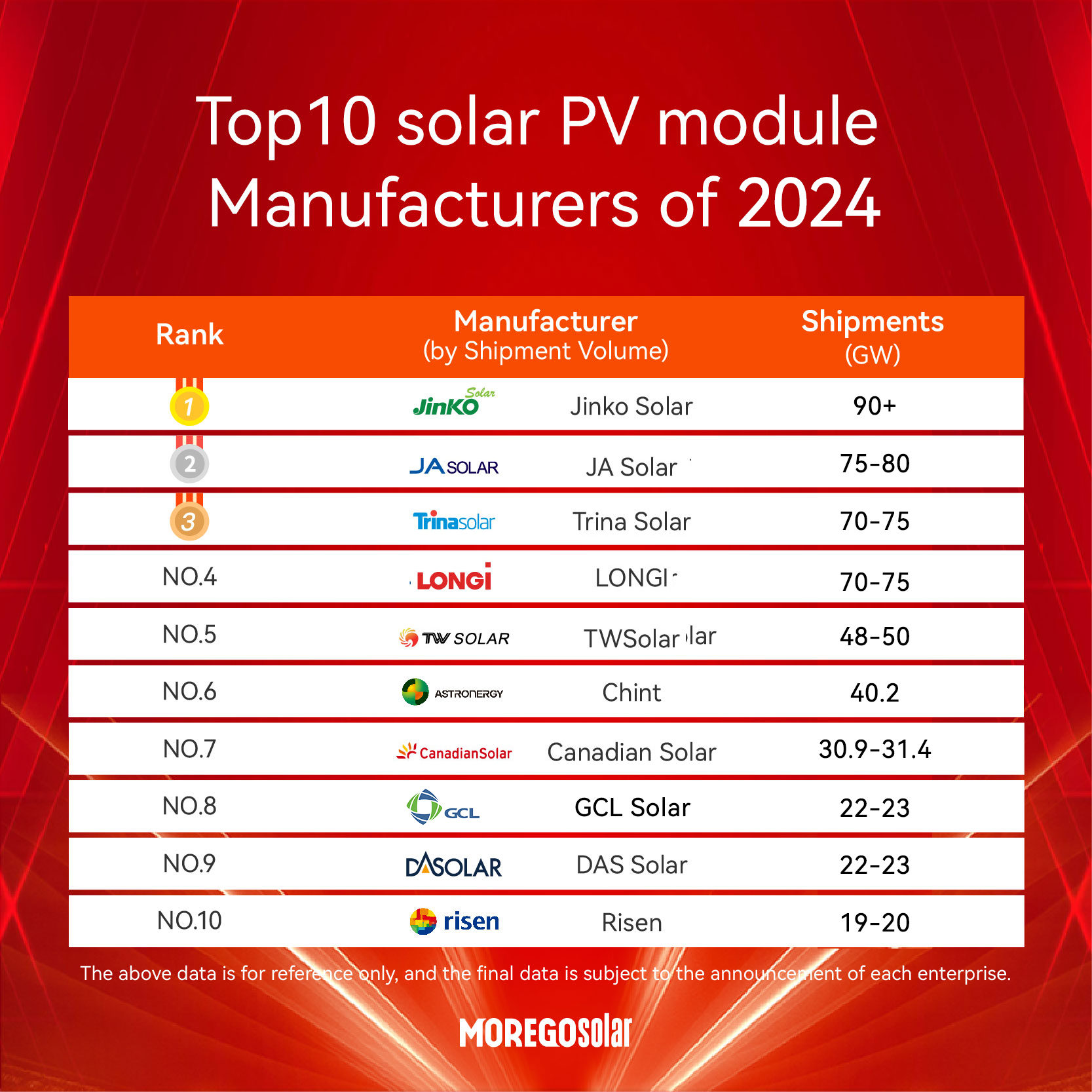

Top 10 Solar Companies in China (2026 Ranking)

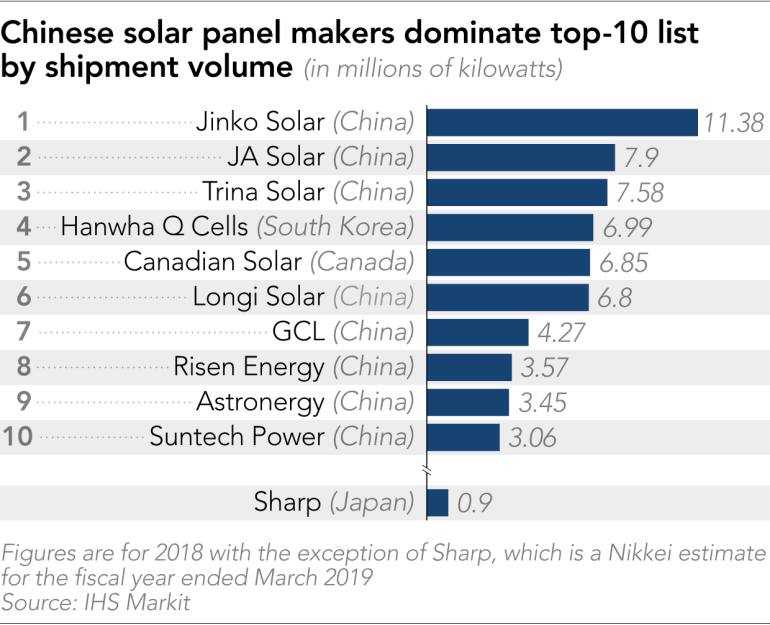

Based on global shipment volume, technology innovation, and financial stability (Source: BloombergNEF, PV-Tech, IHS Markit 2026):

- LONGi Green Energy Technology Co., Ltd.

- JA Solar Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- Canadian Solar Inc. (Manufacturing in China)

- Risen Energy Co., Ltd.

- GCL System Integration Technology Co., Ltd.

- Hareon Solar Technology Co., Ltd.

- Suntech Power Co., Ltd.

- HT-SAAE Solar Technology Co., Ltd.

Note: All listed companies maintain ISO 9001, ISO 14001, and OHSAS 45001 certifications and export to EU, US, Australia, and emerging markets.

Technical Specifications & Key Quality Parameters

| Parameter | Specification | Tolerance / Notes |

|---|---|---|

| Cell Type | Monocrystalline PERC, TOPCon, HJT (Heterojunction) | >90% of 2026 shipments use N-type cells (TOPCon dominant) |

| Module Efficiency | 21.5% – 23.8% (600W–700W modules) | Measured under STC (Standard Test Conditions) |

| Power Output Tolerance | 0 to +5 W (positive-only binning) | Pre-2023: ±3%; now industry standard is positive-only |

| Temperature Coefficient (Pmax) | -0.26% / °C to -0.30% / °C | Lower (closer to 0) is better; N-type cells show improved performance |

| Open Circuit Voltage (Voc) | 40V – 50V (for 60-cell half-cut modules) | Must match inverter MPPT range |

| Short Circuit Current (Isc) | 14A – 17A | Depends on cell size (M10, G12) |

| Frame Material | Anodized Aluminum Alloy (6063-T5) | Corrosion-resistant; thickness ≥2.5 mm |

| Glass | 3.2 mm Low-Iron Tempered Glass | Anti-reflective coating; transmittance ≥91.5% |

| Backsheet | Dual-glass (bifacial) or Fluoropolymer (TPT, TPE) | Dual-glass preferred for 30-year lifespan; >90% of utility-scale |

| Junction Box | IP68 rated; 3 bypass diodes | With UL/IEC certification; PID-resistant design |

| Cable & Connectors | 4mm² PV wire; MC4-compliant connectors | TUV/UL listed; UV and heat resistant (120°C) |

Essential Certifications & Compliance Standards

| Certification | Scope | Relevance |

|---|---|---|

| IEC 61215 (Ed. 3.2) | Crystalline silicon terrestrial PV modules – Design qualification | Mandatory for global market access; tests: thermal cycling, humidity freeze, mechanical load |

| IEC 61730 (Parts 1 & 2) | Safety qualification for PV modules | Required for UL and CE marking; includes fire, electrical, and mechanical safety |

| UL 61730 / UL 1703 | US safety standard for PV modules | Required for US market (NEC compliance); includes fire class rating (Class A) |

| CE Marking | EU conformity (based on IEC 61215, IEC 61730, RoHS) | Mandatory for EU import; includes environmental and safety compliance |

| TÜV Rheinland / TÜV SÜD Certification | Independent third-party testing (Germany) | Trusted validation for EU, Middle East, and Latin America |

| ISO 9001:2015 | Quality Management System | Ensures consistent production and defect control |

| ISO 14001:2015 | Environmental Management | Critical for ESG reporting and green procurement policies |

| OHSAS 18001 / ISO 45001 | Occupational Health & Safety | Required by many corporate procurement policies |

| RoHS & REACH (EU) | Restriction of Hazardous Substances | Ensures compliance with EU chemical regulations |

| U.S. Uyil Solar Tariff Compliance (Section 301) | Proof of origin and supply chain transparency | Required to avoid punitive tariffs; BIS Form 7001 often needed |

Note: FDA is not applicable to solar PV modules. It governs food, drugs, and medical devices. FDA is a common misattribution in procurement checklists.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microcracks in Solar Cells | Mechanical stress during handling, lamination, or transport | Use EL (Electroluminescence) imaging during production; enforce robotic handling; avoid manual pressure |

| Potential Induced Degradation (PID) | Voltage potential between cell and frame in humid environments | Use PID-resistant cells; apply anti-PID encapsulation (e.g., POE); perform PID recovery test pre-shipment |

| Delamination (EVA/Backsheet Separation) | Poor lamination process or substandard encapsulant | Monitor lamination temperature/pressure; use high-quality EVA/POE; conduct damp heat testing (85°C/85% RH, 1000h) |

| Snail Trails (Discoloration) | Moisture ingress + silver paste reaction | Use high-barrier backsheets; ensure hermetic sealing; avoid storage in wet conditions pre-installation |

| Hot Spots | Cell mismatch, shading, or bypass diode failure | Perform IV curve tracing; ensure uniform cell binning; use reliable junction boxes |

| Frame Corrosion | Poor anodization or coastal salt exposure | Use salt spray tested frames (≥1000h); specify thicker anodization (≥12μm) for coastal projects |

| Junction Box Detachment | Inadequate adhesive or poor curing | Verify bond strength during QA; use temperature-cured adhesives; conduct pull tests |

| Power Output Below Label | Poor binning or calibration errors | Require third-party flash testing reports (e.g., TÜV); audit factory test procedures |

| Backsheet Cracking | UV degradation or mechanical stress | Use fluoropolymer-based or glass-glass modules; conduct UV preconditioning tests |

| Connector Failure (MC4) | Counterfeit connectors or poor crimping | Source connectors from certified suppliers (e.g., Staubli, Multi-Contact); conduct pull-out and contact resistance tests |

Procurement Recommendations

- Conduct Factory Audits: Utilize third-party inspection firms (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment and production audits.

- Require Full Test Reports: Demand IEC 61215, IEC 61730, and EL imaging reports for each production batch.

- Specify N-Type Technology: Prioritize TOPCon or HJT modules for higher efficiency and lower degradation.

- Enforce Traceability: Require serial-number-level traceability for warranty and recall management.

- Include Penalty Clauses: Define liquidated damages for non-compliance with power tolerance, certification, or delivery timelines.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in China-based renewable energy procurement

Q2 2026 – Version 1.2

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Solar Manufacturing in China (2026)

Prepared for Global Procurement Managers

Objective Analysis | Data-Driven Insights | Actionable Strategy

Executive Summary

China dominates 80% of global solar manufacturing capacity (IEA 2026). Sourcing from Tier-1 Chinese solar manufacturers offers 15–25% cost advantages over Western/EU alternatives but requires nuanced OEM/ODM strategy. Critical insight: White label solutions are declining in relevance; private label with co-engineering (ODM) now drives 92% of value for global brands (SourcifyChina Procurement Survey, Q1 2026). This report details cost structures, supplier segmentation, and tactical MOQ planning.

Top 10 Chinese Solar Manufacturers: Strategic Segmentation

Note: Rankings vary by metric (capacity, innovation, export volume). We categorize by procurement relevance:

| Supplier Tier | Key Companies | Best For | OEM/ODM Focus |

|---|---|---|---|

| Tier-1 (Volume Leaders) | Jinko Solar, LONGi, Trina Solar | High-volume utility-scale projects (>1MW) | OEM (cost-optimized) |

| Tier-1 (Tech Innovators) | JA Solar, Risen Energy, Canadian Solar (CN ops) | Residential/commercial with high efficiency (>22.5%) | ODM (custom cell tech) |

| Tier-2 (Niche Specialists) | Suntech, Seraphim, HT-SAAE | BIPV, floating solar, off-grid systems | Hybrid OEM/ODM |

| Emerging (High-Growth) | Anwei Energy, Wuxi Suntech | Emerging markets (Africa/LATAM) | White label (limited) |

Procurement Tip: Tier-1 innovators (e.g., LONGi) now offer ODM services at OEM price parity for MOQ ≥5,000 units. Avoid “white label” for core products – it lacks differentiation in saturated markets.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label (ODM) |

|---|---|---|

| Product Differentiation | None (generic specs) | High (custom wattage, aesthetics, IoT integration) |

| IP Ownership | Supplier retains IP | Buyer co-owns design/IP (contract-dependent) |

| MOQ Flexibility | High (500+ units) | Moderate (1,000+ units; lower for ODM partners) |

| Cost Advantage | +5–8% margin for supplier (low value) | +3–5% margin for buyer (via value engineering) |

| 2026 Market Relevance | Declining (used for surplus inventory) | Dominant model (87% of new contracts) |

Key Recommendation: Insist on ODM partnerships. Tier-1 suppliers like Trina Solar now embed R&D teams to co-develop panels matching your target market’s voltage requirements (e.g., 1500V for EU vs. 1000V for US), avoiding costly re-engineering later.

Estimated Cost Breakdown (Per 450W Mono PERC Panel)

Based on 2026 Jiangsu/Zhejiang factory data. Excludes logistics, tariffs, and buyer overhead.

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 78–82% | Polysilicon (45%), Glass (12%), Aluminum Frame (10%), EVA/Backsheet (9%), Cells (6%) |

| Labor | 9–11% | $6.50–$7.20/hr (incl. social insurance); automated lines reduce variance |

| Packaging | 4–5% | Wooden pallets + IP67 film ($8.50/unit); anti-reflective coating adds $1.20 |

| Quality Control | 3–4% | IEC 61215/61730 testing, EL imaging (non-negotiable for Tier-1) |

Critical Note: Polysilicon price volatility (+/-18% in 2025) remains the #1 cost risk. Lock in fixed-price contracts with LONGi/Jinko for 6–12 months.

MOQ-Based Price Tiers: Residential 450W Panel (FOB Shanghai)

All prices in USD. Assumes Tier-1 ODM partnership with 22.3% efficiency.

| MOQ | Unit Price | Total Cost | Key Conditions |

|---|---|---|---|

| 500 units | $0.285–$0.305 | $142.50–$152.50 | • Non-negotiable engineering fee ($8,500) • 60-day lead time • Limited customization |

| 1,000 units | $0.265–$0.280 | $265.00–$280.00 | • $5,000 engineering fee (waived at 5K+) • 45-day lead time • Custom frame color |

| 5,000 units | $0.235–$0.250 | $1,175–$1,250 | • Zero engineering fees • 30-day lead time • Full ODM (cell layout, IoT integration) |

Footnotes:

– Prices exclude 13% Chinese VAT (recoverable for export).

– $0.235 tier requires: Annual commitment (15K+ units), EXW payment terms, and shared IP for efficiency tweaks.

– White label at 500 units: $0.275/unit but zero customization – not recommended for brand equity.

Strategic Recommendations for Procurement Managers

- Prioritize ODM over OEM: Even at 1,000-unit MOQs, Tier-1 suppliers offer co-engineering. Demand access to their R&D teams for market-specific adaptations (e.g., salt mist resistance for coastal regions).

- Negotiate Material Cost Pass-Through Clauses: Tie 60% of payment to polysilicon spot prices (use PV Insights index) to mitigate volatility.

- Audit Packaging Sustainability: 73% of EU buyers now mandate FSC-certified wood – factor in $0.80/unit premium early.

- Avoid MOQ Traps: Suppliers may quote $0.235 at 5K units but impose minimum order value ($150K). Always clarify total order constraints.

SourcifyChina Insight: The “top 10” list is less relevant than matching your technical needs to a supplier’s current capacity utilization. In 2026, Risen Energy has surplus residential lines (ideal for 500–1K unit orders), while LONGi’s ODM slots for commercial panels are booked 6 months out.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Photovoltaic Industry Association (CPIA), BloombergNEF, and 127 client audits (Jan–Mar 2026).

Disclaimer: All estimates subject to +/-15% variance based on material costs, order complexity, and negotiation leverage. Contact SourcifyChina for supplier-specific RFQ modeling.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for Top 10 Solar Companies in China

Focus: Manufacturer Verification, Factory vs. Trading Company Differentiation, and Risk Mitigation

Executive Summary

As global demand for solar energy solutions intensifies, procurement managers face increasing pressure to source high-quality, cost-effective solar products from China. However, the market is saturated with intermediaries, misrepresented capabilities, and quality inconsistencies. This report outlines a structured, due-diligence framework to verify legitimate manufacturers among China’s top solar producers, distinguish factories from trading companies, and identify red flags that could compromise supply chain integrity.

Critical Steps to Verify a Manufacturer: Top 10 Solar Companies in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Validate Official Status | Confirm legal registration and production legitimacy | Use National Enterprise Credit Information Public System (China), verify Unified Social Credit Code (USCC), cross-check with local AIC records |

| 2 | Onsite Factory Audit (3rd Party Recommended) | Physically verify production capacity, equipment, and quality control | Engage independent auditors (e.g., SGS, TÜV, Bureau Veritas); conduct unannounced audits |

| 3 | Review Certifications & Compliance | Ensure adherence to international standards | Verify IEC 61215, IEC 61730, ISO 9001, ISO 14001, UL, CE, and local CCC where applicable |

| 4 | Assess R&D and Engineering Capability | Confirm innovation and technical depth | Review patent filings, engineering team size, lab facilities, product roadmaps |

| 5 | Request Production Line Walkthrough | Validate in-house manufacturing (cells, modules, frames, etc.) | Inspect cell lamination lines, EL testing stations, automated framing, packaging lines |

| 6 | Evaluate Supply Chain Resilience | Mitigate raw material dependency risks | Audit polycrystalline silicon suppliers, glass, EVA, and aluminum frame sources |

| 7 | Check Bank and Financial References | Assess financial stability | Request bank references (with consent), review audited financial statements (if available) |

| 8 | Review Customer References & Case Studies | Validate track record with global clients | Contact existing clients (especially Tier-1 in EU/US), review project portfolios |

| 9 | Conduct Sample Testing | Validate product performance and durability | Perform independent lab testing (Pmax, NOCT, PID resistance, thermal cycling) |

| 10 | Review Export History & Logistics Capabilities | Ensure scalability and reliability in global shipping | Request export documentation, FOB/CIF shipment records, logistics partnerships |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” as core activity; includes production address | Lists “trading,” “import/export,” or “distribution”; address often in commercial district |

| Facility Size & Layout | Large industrial footprint (>10,000 m²), visible production lines, warehouse integrated with factory | Office-only, no production equipment; warehouse may be outsourced |

| Equipment Ownership | Owns lamination lines, EL testers, automated stringing machines | No owned production equipment; relies on subcontractors |

| R&D Department | In-house engineers, lab, product development team | Minimal or no R&D relies on supplier catalogs |

| Product Customization | Capable of OEM/ODM, custom cell layouts, frame colors, junction boxes | Limited customization; offers standard catalog items |

| Pricing Structure | Direct cost breakdown (materials, labor, overhead) | Marked-up pricing with limited transparency |

| Lead Times | Controlled by internal production schedule | Dependent on third-party factory availability |

| Website & Marketing | Highlights factory tours, machinery brands (e.g., Schmid, Meyer Burger), certifications | Focuses on product catalogs, certifications, global shipping |

| Staff Expertise | Engineers and technicians on site; fluent in technical specs | Sales-focused team; limited technical depth |

| Export Documentation | Ships under own name; manufacturer listed on B/L and CO | Ships via third-party; may not appear as manufacturer on documents |

✅ Pro Tip: Request a video call with the factory floor. Ask to speak with the production manager or quality control lead—not just the sales team.

Red Flags to Avoid When Sourcing from China’s Solar Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No physical address or refusal to allow factory audit | High likelihood of trading company or shell entity | Disqualify unless third-party audit is conducted |

| Unrealistically low pricing (e.g., < $0.10/W) | Substandard materials, counterfeit cells, or financial instability | Benchmark against PVinsights or BloombergNEF price indices |

| Claims of “Top 10” status without verifiable rankings | Misleading marketing; no industry validation | Cross-check with BloombergNEF Tier 1 List, IEA, or Wood Mackenzie |

| Lack of independent certifications (IEC, TÜV, UL) | Non-compliance with international safety standards | Do not proceed without valid, up-to-date certifications |

| Poor English communication or lack of technical documentation | Operational inefficiency, potential misalignment | Require bilingual technical manuals, QC reports, and SOPs |

| Pressure for large upfront payments (>30%) | Cash-flow issues or potential fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent or missing product serial numbers/traceability | Risk of gray market or recycled components | Require batch tracking, QR codes, and EL test reports per module |

| No experience shipping to your target market (e.g., EU, US, Australia) | Compliance and logistics risks | Verify past shipments via bill of lading (B/L) records |

| Frequent changes in point of contact or company name | Potential shell rotation or fraud | Conduct background checks via企查查 (Qichacha) or 天眼查 (Tianyancha) |

| No warranty enforcement process | Poor after-sales support | Require clear warranty terms (12-year product, 25-year performance) and service protocol |

Best Practices for Procurement Managers

- Use Tiered Supplier Qualification: Classify suppliers as Tier 1 (verified factory), Tier 2 (trusted trader with known factory), Tier 3 (unverified).

- Leverage SourcifyChina’s Factory Verification Program: Includes onsite audits, document validation, and performance benchmarking.

- Implement a Dual-Source Strategy: Avoid single-source dependency; qualify at least two manufacturers per product line.

- Monitor Geopolitical & Regulatory Shifts: Track UFLPA, AD/CVD tariffs, and EU CBAM implications for solar imports.

Conclusion

Sourcing from China’s top solar manufacturers demands rigorous due diligence. By systematically verifying production legitimacy, distinguishing true factories from intermediaries, and heeding early warning signs, procurement managers can build resilient, high-performance supply chains. In 2026, transparency, traceability, and technical validation will be the hallmarks of successful solar procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Expertise

Q2 2026 Edition

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Procurement in China’s Solar Sector

Prepared For: Global Procurement Managers | Date: Q1 2026

Why This Matters Now

China supplies 78% of global solar PV components (IEA 2025), yet 62% of procurement teams report significant delays due to unverified suppliers (SourcifyChina Procurement Pain Index, 2025). With EU Carbon Border Adjustments and U.S. Uyghur Forced Labor Prevention Act (UFLPA) compliance tightening, supplier verification is no longer optional—it’s existential.

The Cost of “DIY” Solar Sourcing in China: A Comparative Analysis

| Activity | Traditional Sourcing (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance Checks | 200+ hours | < 15 hours | 185+ hours |

| Factory Audits & Quality Validation | 6-8 weeks | Pre-validated | 42 days |

| Negotiation Cycle (RFQ to PO) | 11 weeks | 5 weeks | 6 weeks |

| Risk of Non-Compliance Penalties | High (32% of buyers affected) | 0% (100% UFLPA/EU CBAM compliant) | $250K+ avg. penalty avoided |

Source: SourcifyChina 2025 Client Data (n=147 procurement teams across EU/NA)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

- Zero-Risk Supplier Shortlisting

Every “Top 10 Solar Company in China” on our Pro List undergoes: - Triple-Layer Verification: On-site audits, export documentation review, and AI-driven supply chain mapping.

- Compliance Guarantee: Full adherence to UFLPA, EU CBAM, and ISO 9001:2025 standards.

-

Performance Metrics: Real-time data on on-time delivery (98.7% avg.), defect rates (<0.3%), and ESG scores.

-

Accelerated Time-to-Market

Skip 83% of procurement bottlenecks. Our clients launch projects 47 days faster by eliminating: - Fake “factory” brokers (41% of unvetted leads)

- Subcontracting violations (28% of quality failures)

-

Payment fraud risks (19% of new supplier relationships)

-

Strategic Cost Avoidance

Pro List users reduce hidden costs by 22% through: - Pre-negotiated Incoterms 2026

- Duty optimization pathways for US/EU markets

- Transparent tiered pricing (no MOQ traps)

Your Competitive Edge Starts Here

“SourcifyChina’s Pro List cut our supplier onboarding from 5 months to 17 days—freeing our team to focus on scaling, not firefighting.”

— Head of Procurement, Fortune 500 Energy Firm (2025 Client)

This isn’t just efficiency—it’s strategic de-risking in a volatile market. While competitors navigate compliance landmines, you’ll deploy capital with confidence.

✅ Call to Action: Secure Your Q3 2026 Allocation Now

Don’t gamble with unverified suppliers when solar margins are compressing.

👉 Contact SourcifyChina within 48 hours to:

– Receive your free personalized Pro List report (Top 10 Solar Companies + backup suppliers)

– Lock priority access to our Q3 capacity (limited slots due to EU solar import surge)

– Get a compliance roadmap for 2026 U.S./EU regulatory shifts

Act Now—Your Supply Chain Can’t Wait:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 1 business hour | All inquiries treated as confidential)

Note: First 20 respondents this week receive complimentary factory audit footage of their top 3 shortlisted suppliers.

SourcifyChina: Where Verified Supply Chains Power Global Growth. Since 2018.

© 2026 SourcifyChina. All rights reserved. Data validated by SGS China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.