The global THHN (Thermoplastic High Heat-resistant Nylon-coated) cable market is experiencing steady growth, driven by rising demand in construction, industrial manufacturing, and infrastructure development. According to a report by Mordor Intelligence, the global electrical wires and cables market—of which THHN cables are a key segment—is projected to grow at a CAGR of over 5.2% between 2023 and 2028, fueled by increased investment in smart buildings, renewable energy integration, and industrial automation. Similarly, Grand View Research reported that the global wires and cables market size was valued at USD 231.9 billion in 2022 and is expected to expand at a CAGR of 5.8% from 2023 to 2030, with North America and Asia-Pacific leading adoption due to stringent building codes and expanding electrical infrastructure. As THHN cables remain a staple in commercial and residential wiring for their durability, heat resistance, and cost efficiency, identifying the leading manufacturers becomes critical for contractors, engineers, and procurement teams. Below is a data-informed look at the top nine THHN cable manufacturers shaping the industry landscape.

Top 9 Thwn Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 THHN/THWN

Domain Est. 2003

Website: adcable.com

Key Highlights: Description: Single conductor stranded bare copper, with a PVC insulation and Nylon Jacket. Applications: Industrial Cable….

#2 SIMpull® THHN/THWN

Domain Est. 1994

Website: southwire.com

Key Highlights: 600 Volts. Copper Conductor. PVC Insulation/Nylon Sheath THHN/THWN-2. Heat, Moisture, Gasoline and Oil Resistant II. SIMpull Technology for Easier Pulling….

#3 Service Wire Company

Domain Est. 1996 | Founded: 1968

Website: servicewire.com

Key Highlights: Since 1968, we’ve built a reputation for safely manufacturing high-quality wire and cable, delivering industry-leading service levels….

#4 THHN — Products

Domain Est. 1996

Website: alanwire.com

Key Highlights: Alan Wire Type THHN or THWN-2 conductors are primarily used in conduit as branch circuits in commercial or industrial applications….

#5 Products

Domain Est. 1996

Website: encorewire.com

Key Highlights: MC HCF-SG Smartground Steel Armor THHN/THWN-2 Inners. Encore’s Metal Clad Cable is constructed with soft-drawn copper, Type THHN/THWN conductors rated 90°C dry….

#6 Copper Wire Supplier

Domain Est. 1996

Website: cerrowire.com

Key Highlights: Cerrowire is a leading copper wire supplier offering MC cables, aluminum wire, and building cables for reliable electrical solutions….

#7 Hy

Domain Est. 1997

Website: tpcwire.com

Key Highlights: This flexible THHN/THWN wire protects against moisture, oils and contaminants, providing a safe conducting path to ground electrical currents….

#8 MC THHN/THWN Copper Conductor Product Specs

Domain Est. 1998

Website: northerncables.com

Key Highlights: The MC THHN/THWN is a flexible interlocked aluminum armoured cable approved for use in open and concealed wiring in dry locations at 90 C and wet locations ……

#9 building wire, thhn/thwn

Domain Est. 1998

Website: omnicable.com

Key Highlights: Building Wire, THHN/THWN-2 & T90, 600V. Product images are for illustrative purposes only and may differ from the actual product….

Expert Sourcing Insights for Thwn Cable

H2: 2026 Market Trends for THWN Cable

As the global electrical infrastructure and construction sectors evolve, Thermoplastic Heat and Water-Resistant Nylon (THWN) cable is anticipated to experience significant shifts in demand, application, and technological integration by 2026. The following analysis outlines key market trends expected to influence the THWN cable industry during the second half of the decade.

1. Rising Demand in Commercial and Residential Construction

The continued global recovery in construction activities, particularly in North America and emerging economies, is expected to drive demand for THWN cables. These cables are widely used in commercial buildings, industrial facilities, and residential wiring due to their durability, resistance to heat and moisture, and compliance with National Electrical Code (NEC) standards. With urbanization and smart city initiatives accelerating, especially in regions like Southeast Asia and Latin America, the need for reliable electrical wiring solutions like THWN will grow.

2. Regulatory and Safety Standards Driving Adoption

Regulatory frameworks emphasizing electrical safety and energy efficiency are likely to favor the use of dual-rated THWN-2 cables. By 2026, stricter building codes and increased enforcement of electrical safety standards in both developed and developing countries will boost the adoption of THWN-2, which is rated for higher temperatures (90°C in dry locations) and offers improved performance in wet environments. This regulatory tailwind supports market growth and could phase out older, less efficient insulation types.

3. Integration with Smart Building Technologies

As smart buildings become more prevalent, THWN cables are being integrated into advanced electrical systems that support automation, energy management, and IoT devices. While THWN itself is not a data cable, its role in providing stable and safe power delivery to connected systems is critical. The cable’s compatibility with conduit systems makes it ideal for retrofitting legacy buildings with smart technology, further reinforcing its relevance in the evolving electrical ecosystem.

4. Sustainability and Material Innovation

Environmental concerns are pushing manufacturers to develop more sustainable versions of THWN cable. By 2026, expect increased R&D efforts focused on recyclable thermoplastics, reduced halogen content, and energy-efficient manufacturing processes. Additionally, the industry may see a shift toward lead-free and low-smoke variants to meet green building certifications such as LEED and BREEAM, enhancing the environmental profile of THWN cables.

5. Supply Chain Optimization and Regional Manufacturing Growth

Global supply chain disruptions have highlighted the need for localized production. In response, key players in the THWN cable market are likely to expand regional manufacturing hubs—especially in Mexico, India, and Vietnam—to reduce dependency on single-source suppliers and mitigate logistics risks. This trend supports faster delivery times, cost competitiveness, and better alignment with regional electrical codes.

6. Competitive Landscape and Price Volatility

The THWN cable market remains competitive, with established players like Southwire, General Cable (Prysmian Group), and Nexans dominating in North America, while regional manufacturers gain ground in Asia-Pacific. Copper price volatility will continue to impact THWN cable pricing, prompting interest in aluminum alternatives (e.g., THWN-2 aluminum cables) for cost-sensitive projects. However, copper-based THWN cables will maintain market preference due to superior conductivity and reliability.

Conclusion

By 2026, the THWN cable market is poised for steady growth, driven by construction expansion, regulatory support, and integration into modern electrical systems. While challenges such as raw material costs and environmental compliance persist, innovation and regionalization will shape a resilient and adaptive market. Stakeholders should focus on product differentiation, sustainability, and supply chain agility to capitalize on emerging opportunities in the evolving electrical infrastructure landscape.

Common Pitfalls When Sourcing THWN Cable: Quality and IP Considerations

Logistics & Compliance Guide for THWN Cable

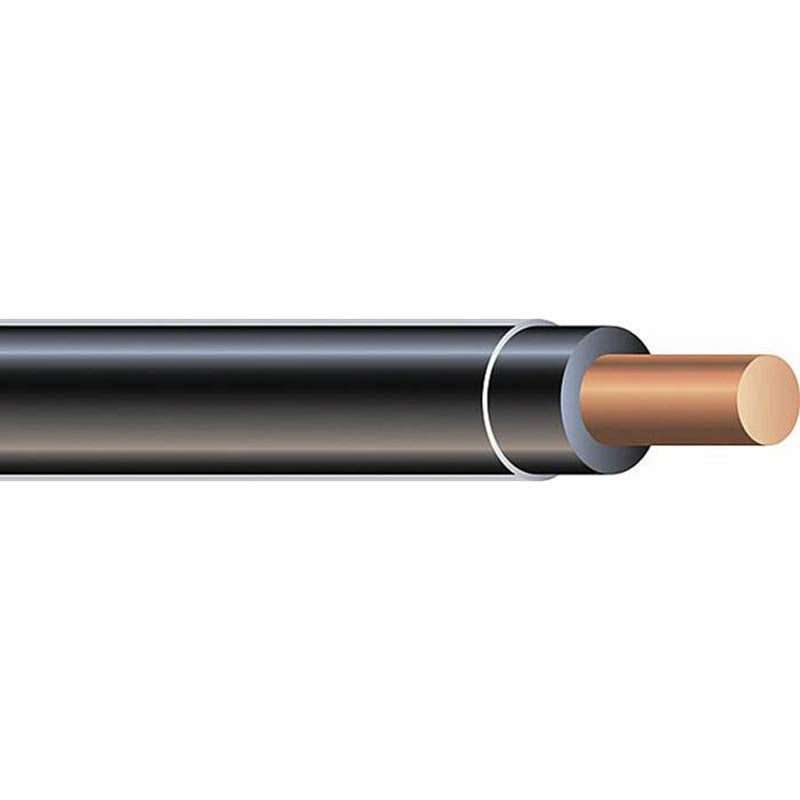

Overview of THWN Cable

THWN (Thermoplastic Heat and Water-Resistant Nylon-coated) cable is a type of insulated electrical wire commonly used in residential, commercial, and industrial wiring applications. It is designed for use in dry and wet locations and is typically found in conduit systems. Understanding proper logistics handling and compliance requirements is essential for safe and code-compliant installations.

Regulatory Standards and Approvals

THWN cable must meet specific national and international standards to ensure safety and performance. Key compliance benchmarks include:

– National Electrical Code (NEC) – NFPA 70: THWN is recognized under NEC Article 310 for use in wet locations, with temperature ratings typically at 75°C (90°C when used as THHN).

– UL 83: Standard for thermoplastic-insulated wires and cables.

– CSA C22.2 No. 38: Canadian standard for similar applications, allowing THWN-2 use in wet locations up to 90°C.

– RoHS and REACH Compliance: Ensure cable materials meet environmental and hazardous substance regulations, especially for shipments to the EU or eco-sensitive markets.

Packaging and Labeling Requirements

Proper packaging ensures product integrity during shipping and storage:

– THWN cable is typically supplied on wooden or plastic reels, or in boxes for smaller spools.

– Each package must include labeling with:

– Manufacturer name and logo

– Cable type (THWN or THWN-2)

– Gauge (AWG) and number of conductors

– Voltage rating (usually 600V)

– Temperature rating

– UL/CSA certification marks

– Lot or batch number for traceability

– Labels must be durable and legible to withstand handling and environmental exposure.

Transportation and Handling

To maintain cable quality throughout the supply chain:

– Use flatbed or enclosed trailers with protected loading areas to prevent moisture exposure.

– Secure reels to prevent rolling or shifting during transit.

– Avoid dropping or impacting reels, which can deform the cable or damage insulation.

– Use proper lifting equipment (e.g., forklifts with reel attachments) when moving large spools.

– Store reels vertically whenever possible to prevent deformation.

Storage Conditions

Optimal storage preserves cable performance:

– Store in a dry, climate-controlled environment (ideally 10°C to 30°C).

– Protect from direct sunlight, UV exposure, and extreme temperatures.

– Elevate reels off the ground using pallets to avoid moisture absorption.

– Avoid stacking reels unless designed for it; if stacking is necessary, follow manufacturer guidelines.

– Use first-in, first-out (FIFO) inventory practices to prevent aging.

Import and Export Compliance

For international shipments:

– Verify destination country’s electrical code requirements (e.g., CE marking for Europe, INMETRO for Brazil).

– Prepare accurate commercial invoices, packing lists, and certificates of compliance (e.g., UL or CSA).

– Include Harmonized System (HS) Code: Typically 8544.49 for insulated copper wire.

– Comply with customs documentation and import duties; THWN may be subject to anti-dumping or safeguard measures in some regions.

– For U.S. imports, ensure compliance with the Trade Agreements Act (TAA) if used in government projects.

Environmental and Safety Considerations

- THWN cable contains no ozone-depleting substances but should be disposed of according to local e-waste regulations.

- Recycle copper conductors and plastic insulation through certified e-waste handlers.

- On job sites, ensure cables are not exposed to oils, solvents, or continuous submersion unless specifically rated.

- Follow OSHA and local safety protocols during handling and installation.

Quality Assurance and Documentation

Maintain comprehensive compliance records:

– Keep copies of UL/CSA certification, test reports, and material safety data sheets (MSDS).

– Conduct periodic audits of supplier compliance and packaging integrity.

– Provide installers with updated product cut sheets and compliance statements.

– Retain shipment logs and inspection reports for traceability.

Conclusion

Proper logistics and compliance management for THWN cable ensures product reliability, regulatory adherence, and safe installations. By following packaging, handling, storage, and documentation best practices, distributors and contractors can minimize risk and maintain the integrity of electrical systems. Always consult the latest NEC, local codes, and manufacturer specifications before deployment.

Conclusion for Sourcing THWN Cable:

Sourcing THWN (Thermoplastic Heat and Water-Resistant Nylon-coated) cable requires careful consideration of several key factors to ensure safety, compliance, and performance in electrical installations. It is essential to procure THWN cable from reputable suppliers or manufacturers that meet established industry standards such as UL (Underwriters Laboratories), NEC (National Electrical Code), and CSA (Canadian Standards Association). Proper sourcing ensures that the cable is suitable for use in wet and dry locations, can withstand elevated temperatures (typically up to 75°C or 90°C, depending on insulation type), and offers durable, abrasion-resistant protection due to its nylon jacket.

When evaluating potential suppliers, considerations should include product certifications, lead times, cost-efficiency, and technical support. Additionally, verifying the correct gauge (AWG), conductor material (copper or aluminum), and compliance with project-specific electrical codes is crucial. Bulk purchasing from reliable vendors may offer cost savings, but quality should never be compromised.

In conclusion, successfully sourcing THWN cable involves balancing cost, quality, and compliance. By partnering with trusted suppliers and adhering to regulatory requirements, project stakeholders can ensure reliable, long-term performance of electrical systems in commercial, industrial, and residential applications.