The global threadlockers and industrial adhesives market is experiencing robust growth, driven by increasing demand across automotive, aerospace, electronics, and manufacturing sectors. According to Grand View Research, the global industrial adhesives market was valued at USD 68.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. A significant segment of this growth is attributed to threadlocking adhesives—engineered formulations designed to prevent loosening, vibration, and corrosion in threaded fasteners. Mordor Intelligence further corroborates this trajectory, forecasting steady demand for high-performance adhesives, particularly in emerging economies where industrialization and infrastructure development are accelerating. With performance reliability and cost-efficiency becoming critical in assembly processes, manufacturers are increasingly turning to premium thread glue solutions. In this competitive landscape, seven key players have emerged as leaders, combining innovation, global reach, and technical expertise to dominate the market.

Top 7 Thread Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Jet

Domain Est. 1996

Website: jetlube.com

Key Highlights: Jet-Lube focuses strongly on producing high-quality anti-seizes & thread lubricants, cleaners & degreasers, drilling compounds, extreme pressure greases, ……

#2 Permatex®

Domain Est. 1995

Website: permatex.com

Key Highlights: Proven and Reliable OEM Partner. As a leader in supplying automotive sealants, Permatex offers superior R&D, production, distribution capabilities and more….

#3 Sealants & Adhesives

Domain Est. 1996

Website: crcindustries.com

Key Highlights: Professional sealants & adhesives for industrial applications. Gasket makers, thread lockers, structural adhesives & sealing compounds from CRC….

#4 Weld

Domain Est. 2002

Website: weldon.com

Key Highlights: Weld-On products are globally- recognized as the premium products for joining plastic pipes and fittings. © 2026 Weld-On Adhesives, Inc. Weld-On Adhesives, Inc….

#5 Loctite Threadlocker Blue

Domain Est. 1999

Website: loctiteproducts.com

Key Highlights: Loctite Threadlocker Blue 242 is designed to lock and seal threaded fasteners and prevent loosening from vibration. Ideal for 6-19mm fasteners….

#6 Thread sealing solutions

Domain Est. 2000

Website: next.henkel-adhesives.com

Key Highlights: LOCTITE thread sealants are the preferred solution for many different applications across industries to secure threaded pipes, hydraulic systems, and other ……

#7 Vibra

Domain Est. 2006

Website: vibra-tite.com

Key Highlights: Vibra-Tite S121 is a medium strength, anaerobic thread locking compound stick designed for locking threaded fasteners that require disassembly with standard ……

Expert Sourcing Insights for Thread Glue

H2: Projected 2026 Market Trends for Thread Glue

The thread glue market (also known as threadlocking adhesives or anaerobic adhesives) is poised for continued evolution in 2026, driven by industrial demands, technological advancements, and shifting global dynamics. Key trends shaping the market include:

-

Sustained Growth in High-Performance Sectors: Demand will remain robust in industries requiring extreme reliability and resistance to vibration, shock, and temperature fluctuations. Key drivers include:

- Electric Vehicles (EVs): The rapid expansion of EV manufacturing fuels demand for threadlockers in battery packs, power electronics, and electric motors, where preventing loosening under high vibration is critical. Demand for non-conductive, thermally stable grades will surge.

- Renewable Energy: Wind turbine maintenance and installation require high-strength, corrosion-resistant threadlockers for critical bolted joints exposed to harsh environments.

- Advanced Manufacturing & Automation: Increased use of robotics and automated assembly lines demands consistent, reliable adhesives with predictable cure times and application characteristics.

-

Accelerated Shift Towards Sustainability:

- Bio-based & Recyclable Formulations: Pressure for greener supply chains will push major players to invest in and commercialize threadlockers derived from renewable raw materials and adhesives compatible with end-of-life part recycling processes.

- Reduced VOC (Volatile Organic Compounds): Regulatory pressure (especially in Europe and North America) and corporate ESG goals will drive the adoption of low-VOC or VOC-free formulations, even if they require slight adjustments in application or cure profiles.

- Improved Packaging: Increased use of recyclable materials (e.g., PET instead of LDPE) and innovations like refillable cartridges or bulk dispensing systems to minimize plastic waste.

-

Technological Innovation & Performance Enhancement:

- “Smart” Adhesives: Development of threadlockers with embedded indicators (e.g., color-changing upon cure or exposure to excessive heat/stress) for easier quality control and predictive maintenance.

- Faster Cure & Higher Strength: Ongoing R&D will focus on formulations offering faster fixture times (crucial for high-speed production) and even higher ultimate strengths, particularly for large or critical fasteners.

- Improved Disassembly & Reparability: While high strength is key, there’s growing demand for high-strength grades that still allow for controlled disassembly using standard tools when maintenance is required, balancing security with serviceability.

- Enhanced Surface Tolerance: Formulations that cure more reliably on passive surfaces (like plated, anodized, or contaminated metals) without requiring primers will gain market share, simplifying processes.

-

Supply Chain Resilience & Regionalization:

- Lessons from recent disruptions will lead to greater diversification of supply sources and potential regional manufacturing hubs to mitigate geopolitical and logistical risks.

- Strategic partnerships between adhesive suppliers and major OEMs in key sectors (automotive, aerospace, energy) will strengthen to ensure supply security and co-development of customized solutions.

-

Digitalization & Application Optimization:

- Increased integration of adhesive application data (dispense volume, location, time) into manufacturing execution systems (MES) for traceability and quality assurance.

- Growth in automated precision dispensing systems, driven by the need for consistency and material savings, particularly in electronics and medical devices.

- Use of AR/VR for training technicians on proper application techniques.

-

Consolidation & Competitive Landscape:

- The market will likely see continued consolidation among smaller players, while major chemical companies (Henkel/Loctite, 3M, Sika, Master Bond, Permabond) leverage their R&D, global reach, and technical service networks to maintain dominance.

- Competition will intensify on performance differentiation, sustainability credentials, and total cost of ownership (including waste reduction and reliability).

In summary, the 2026 thread glue market will be characterized by strong demand from advanced industries (especially EVs and renewables), a significant push towards sustainable and lower-impact products, continuous performance innovation focused on strength, speed, and ease of use, and an emphasis on supply chain robustness and digital integration. Success will depend on manufacturers’ ability to innovate sustainably while meeting the increasingly stringent performance and reliability demands of modern engineering.

Common Pitfalls Sourcing Thread Glue (Quality, IP)

Sourcing thread glue—especially in contexts involving technical textiles, protective gear, or performance apparel—can present significant challenges related to both product quality and intellectual property (IP). Overlooking these aspects can lead to production delays, safety risks, compliance issues, and legal exposure.

Poor Quality Control and Inconsistent Performance

One of the most frequent pitfalls is receiving thread glue that fails to meet required performance standards. Low-quality adhesives may lack sufficient bonding strength, heat resistance, or durability under stress, leading to seam failure in end products. Variability between batches, often due to lax manufacturing controls at supplier facilities, can result in inconsistent application and unreliable performance. Additionally, improper formulation may cause premature curing, clogging of application equipment, or incompatibility with specific fabric types, undermining product integrity.

Counterfeit or Substandard Materials Masquerading as Branded Products

Suppliers may offer thread glue labeled as a well-known branded product (e.g., Bemis, 3M, or Tex-Art) but deliver counterfeit or imitation materials. These knock-offs often fall short in performance and safety testing. Relying on such materials exposes the buyer not only to quality defects but also to reputational damage if end products fail in the field. Verification of authenticity—through batch traceability, certification, and third-party testing—is essential but often overlooked in cost-driven sourcing decisions.

Intellectual Property Infringement Risks

Using or sourcing thread glue formulations that replicate patented technologies without proper licensing is a serious IP risk. Many high-performance adhesives are protected by patents covering chemical composition, application methods, or bonding processes. Unintentional use of such protected IP—especially when sourcing from generic manufacturers in regions with weak IP enforcement—can lead to legal disputes, import bans, or costly litigation. Buyers may also be held liable if their products incorporate infringing materials, even if they were unaware of the violation.

Lack of Transparency in Supply Chain and Formulation

Suppliers may be unwilling or unable to disclose full material composition or manufacturing processes, citing proprietary concerns. This lack of transparency makes it difficult to assess compliance with regulatory standards (e.g., REACH, RoHS) or to verify claims about performance and sustainability. Without access to Safety Data Sheets (SDS), technical specifications, or audit rights, buyers remain vulnerable to hidden risks, including the use of hazardous substances or environmentally non-compliant materials.

Inadequate Regulatory and Compliance Verification

Thread glue used in technical or safety-critical applications must often meet specific industry standards (e.g., NFPA, ISO, or military specs). Sourcing without verifying compliance documentation—such as test reports, certifications, or conformity declarations—can result in non-compliant products entering the market. This is particularly problematic when suppliers provide falsified or outdated certificates, a common issue in global supply chains with limited oversight.

To mitigate these pitfalls, buyers should conduct thorough due diligence, including supplier audits, independent lab testing, IP clearance reviews, and contractual protections around quality and compliance. Establishing long-term partnerships with reputable, transparent suppliers is key to ensuring both quality and legal safety in thread glue sourcing.

Logistics & Compliance Guide for Thread Glue

Overview

Thread glue, commonly used in manufacturing and assembly processes to secure threaded fasteners, requires careful handling, storage, transportation, and regulatory compliance due to its chemical composition. This guide outlines best practices and regulatory considerations to ensure safe and compliant logistics operations.

Classification and Hazard Identification

Thread glues typically contain cyanoacrylate or anaerobic resin compounds, which may be classified as hazardous materials under transportation regulations. Key classifications include:

– UN Number: Often UN3065 (Adhesives, flammable) or UN1866 (Cyanoacrylate, stabilized), depending on formulation.

– Hazard Class: Usually Class 3 (Flammable Liquids) or Class 8 (Corrosive Substances).

– Packing Group: II or III, based on flammability and reactivity.

Always consult the Safety Data Sheet (SDS) for accurate classification.

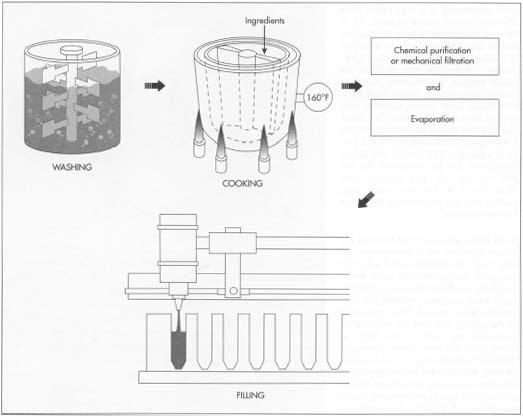

Packaging Requirements

Proper packaging is critical to prevent leaks, contamination, and chemical reactions:

– Use UN-certified packaging designed for adhesive or flammable liquid transport.

– Ensure containers are tightly sealed with leak-proof caps.

– Use inner liners or secondary containment for added protection.

– Label packages with appropriate hazard labels (e.g., flammable, corrosive) and orientation arrows.

Labeling and Documentation

Compliance with international and national regulations requires:

– Proper Shipping Name clearly displayed on packages (e.g., “FLAMMABLE LIQUID, N.O.S.”).

– Hazard Labels: Diamond-shaped GHS or DOT labels indicating flammability, health risks, and environmental hazards.

– Shipping Papers: Include accurate descriptions, UN number, hazard class, and emergency contact information.

– Safety Data Sheet (SDS): Must accompany shipments and be readily accessible to handlers.

Storage Guidelines

To maintain product integrity and safety:

– Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources.

– Keep temperature below 25°C (77°F) to prevent premature curing or degradation.

– Segregate from oxidizers, strong bases, and incompatible chemicals.

– Use original or approved containers; do not transfer to unapproved vessels.

Transportation Considerations

Transport thread glue in accordance with:

– DOT (U.S.): 49 CFR regulations for hazardous materials.

– IATA: For air transport; strict limits on quantity and packaging.

– IMDG Code: For sea freight; requires proper stowage and segregation.

– ADR: For road transport in Europe; includes vehicle labeling and driver training.

Ensure drivers and handlers are trained in hazardous materials handling and emergency procedures.

Handling and Worker Safety

Protect personnel during loading, unloading, and warehousing:

– Provide appropriate PPE: chemical-resistant gloves, safety goggles, and ventilation or respirators if vapor exposure is possible.

– Train staff on spill response, first aid, and fire safety procedures.

– Prohibit eating, drinking, or smoking in storage and handling areas.

Environmental and Disposal Compliance

Follow environmental regulations for waste management:

– Do not pour thread glue down drains or dispose of in regular trash.

– Collect waste in approved containers labeled for hazardous waste.

– Dispose of via licensed hazardous waste handlers in compliance with local regulations (e.g., EPA, ECHA).

Emergency Response

Prepare for incidents with:

– Spill kits containing absorbents, neutralizers, and PPE.

– Fire extinguishers suitable for flammable liquids (e.g., CO₂ or dry chemical).

– Emergency contact numbers and response plans accessible on-site and with transporters.

– Immediate actions: evacuate area, ventilate, and avoid skin/eye contact.

Regulatory Compliance Summary

- OSHA (U.S.): Compliance with Hazard Communication Standard (HCS).

- REACH & CLP (EU): Ensure proper registration, labeling, and safety data.

- Globally Harmonized System (GHS): Use standardized hazard pictograms and SDS format.

- Regular audits and documentation reviews are recommended to maintain compliance.

Conclusion

Safely and legally managing the logistics of thread glue requires attention to chemical classification, packaging, documentation, and regulatory standards. By following this guide, organizations can protect personnel, ensure shipment integrity, and maintain compliance across supply chains. Always consult the product-specific SDS and local regulations before transport or storage.

Conclusion for Sourcing Thread Glue:

After evaluating various suppliers, product specifications, cost considerations, and performance requirements, it is concluded that sourcing thread glue should align closely with the intended application, production volume, and quality standards. High-performance threadlockers from reputable manufacturers—such as Loctite, Threebond, or Henkel—offer reliable consistency, temperature resistance, and thread-seizing capabilities critical for maintaining mechanical integrity.

Factors such as cure time, viscosity, strength (low, medium, or high), and substrate compatibility must be carefully matched to the assembly process. Additionally, sourcing from certified suppliers ensures compliance with industry standards (e.g., ISO, MIL-SPEC) and reduces risks related to supply chain interruptions or substandard materials.

Bulk purchasing from vetted suppliers can yield cost savings without compromising quality, especially when long-term partnerships and volume agreements are established. Environmental and safety considerations—including VOC content and proper handling procedures—are also important in the final decision.

In summary, a strategic sourcing approach—balancing performance, cost, reliability, and regulatory compliance—will ensure optimal selection and supply of thread glue for both operational efficiency and product durability.