The global thermosetting resins market is experiencing robust growth, driven by rising demand from end-use industries such as automotive, construction, electrical and electronics, and wind energy. According to a 2023 report by Grand View Research, the market was valued at USD 78.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by the superior thermal stability, mechanical strength, and chemical resistance offered by thermosetting resins like epoxy, phenolic, unsaturated polyester, and polyurethane. Additionally, increasing adoption in lightweight automotive components and renewable energy applications—particularly in blade manufacturing for wind turbines—has amplified market momentum. With Asia Pacific accounting for the largest share due to rapid industrialization and infrastructure development, particularly in China and India, the competitive landscape is becoming increasingly consolidated among key global players. As innovation and sustainability become central to material selection, the following ten companies stand out as leading thermosetting resin manufacturers, shaping the future of advanced materials across critical industries.

Top 10 Thermosetting Resin Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plenco

Domain Est. 1996

Website: plenco.com

Key Highlights: A leading North American manufacturer of phenolic resins and thermoset molding materials, selling products under its trademark Plenco….

#2 Advanced Materials

Domain Est. 1997

Website: huntsman.com

Key Highlights: In May 2020, Huntsman Advanced Materials completed the acquisition of CVC Thermoset Specialties (CTS), a North American specialty chemical manufacturer serving ……

#3 Bakelite®

Domain Est. 2000

Website: bakelite.com

Key Highlights: Global integrated producer of thermoset specialty resins, systems, and engineered thermoset molding compounds for various industries….

#4 Thermosetting Polyurethane Casting Materials

Domain Est. 2012

Website: thermosetsolutions.com

Key Highlights: We are at the forefront of thermosetting polyurethane technology with an in house R&D team that formulates and creates amazing liquid thermosetting materials….

#5 Proxxima

Domain Est. 2019

Website: proxxima.com

Key Highlights: What are Proxxima polyolefin thermoset resin systems? At ExxonMobil we’ve used advanced polymer technology to produce a new range of resin systems designed to ……

#6 RTP Company

Domain Est. 1996

Website: rtpcompany.com

Key Highlights: RTP Company’s engineered thermoplastic compounds provide you with solutions, customization, and services for all your thermoplastic needs….

#7 Composites and advanced materials

Domain Est. 2001

Website: arkema.com

Key Highlights: Arkema develops bio-based liquid resins and polymers that improve the performance and strength of your composites, in particular recyclable thermoplastic and ……

#8 Thermosetting resins (development products)

Domain Est. 2002

Website: idemitsu.com

Key Highlights: Thermosetting resins (development products) | Product list (in alphabetical order) | Advanced materials & Performance Chemicals | Business | Idemitsu Kosan….

#9 Thermoset & Thermoplastic Compression & Injection Molding

Domain Est. 2002

Website: coremt.com

Key Highlights: CMT is a leading plastic-engineered solutions company specialized in molding large & structural products, using thermoplastics and thermosets….

#10 Thermoset Resin Formulators Association

Domain Est. 2003

Website: trfa.org

Key Highlights: TRFA is the only organization dedicated to serving the needs and interests of all thermoset formulators and has a broader focus than just epoxy….

Expert Sourcing Insights for Thermosetting Resin

H2: 2026 Market Trends for Thermosetting Resins

The global thermosetting resin market is poised for significant evolution by 2026, driven by technological innovation, shifting industrial demands, and increasing sustainability mandates. These durable, heat-resistant polymers—used extensively in automotive, construction, electronics, and aerospace sectors—are adapting to new economic and environmental realities. Below are the key trends shaping the thermosetting resin landscape in 2026:

1. Rising Demand from Lightweight and High-Performance Applications

The automotive and aerospace industries continue to prioritize lightweight materials to improve fuel efficiency and reduce emissions. Thermosetting resins such as epoxy, phenolic, and polyurethane are increasingly used in composite materials for structural components. In 2026, growing adoption of carbon fiber-reinforced thermosets in electric vehicles (EVs) and next-generation aircraft is expected to boost market growth.

2. Expansion in Renewable Energy Infrastructure

Thermosetting resins are critical in manufacturing wind turbine blades, solar panel encapsulants, and electrical insulation systems. With global investments in wind and solar power accelerating, demand for epoxy and unsaturated polyester resins is projected to rise steadily by 2026, particularly in emerging markets across Asia-Pacific and Latin America.

3. Sustainability and Bio-Based Resin Development

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing manufacturers to develop bio-based and recyclable thermosetting resins. Traditional thermosets are challenging to recycle due to their cross-linked structure, but advances in vitrimers and self-healing resins are gaining traction. In 2026, commercialization of partially bio-derived epoxy and phenolic resins is expected to grow, supported by R&D initiatives and government funding.

4. Growth in Electronics and 5G Infrastructure

The proliferation of 5G networks, electric vehicles, and advanced electronics is fueling demand for high-performance encapsulants and printed circuit boards (PCBs), which rely heavily on epoxy and silicone-based thermosets. These materials offer excellent thermal stability and electrical insulation. By 2026, Asia-Pacific—especially China, South Korea, and Japan—will remain the dominant market due to robust electronics manufacturing.

5. Regional Shifts and Supply Chain Reconfiguration

Geopolitical dynamics and supply chain resilience concerns are driving regionalization of resin production. In 2026, North America and Europe are investing in localized manufacturing to reduce dependency on Asian suppliers, especially for critical sectors like defense and aerospace. Meanwhile, India and Southeast Asia are emerging as production hubs due to lower costs and expanding infrastructure.

6. Price Volatility and Raw Material Constraints

Fluctuations in the prices of key feedstocks—such as benzene, propylene, and formaldehyde—remain a challenge. Crude oil volatility and disruptions in global chemical supply chains could impact resin pricing and availability. Companies are increasingly hedging through long-term contracts and vertical integration to stabilize supply.

7. Regulatory Pressures and VOC Emission Reduction

Environmental regulations, particularly in the EU and North America, are tightening restrictions on volatile organic compound (VOC) emissions from solvent-based resins. This is accelerating the shift toward low-VOC and water-based thermosetting systems. By 2026, compliance with REACH, EPA standards, and other regulations will be a key determinant of market competitiveness.

Conclusion

By 2026, the thermosetting resin market will be characterized by innovation in sustainable materials, increased application in high-growth industries, and strategic regional realignment. Companies that invest in green chemistry, digital supply chain tools, and high-performance formulations will be best positioned to capture market share in this evolving landscape.

Common Pitfalls in Sourcing Thermosetting Resin: Quality and Intellectual Property (IP) Risks

Sourcing thermosetting resins—such as epoxies, phenolics, polyurethanes, and unsaturated polyesters—requires careful due diligence. Buyers often face significant challenges related to quality consistency and intellectual property (IP) protection. Overlooking these areas can lead to production delays, product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Properties

Thermosetting resins are highly sensitive to formulation, curing conditions, and raw material sources. A common pitfall is receiving batches with inconsistent viscosity, gel time, cure profile, or mechanical properties. This variability can stem from uncontrolled manufacturing processes or substitution of raw materials by suppliers without notification. Resulting issues include defective end products, failed quality control tests, and supply chain disruptions.

Lack of Traceability and Documentation

Many suppliers, especially smaller or regional producers, may not provide comprehensive certificates of analysis (CoA), safety data sheets (SDS), or batch traceability. Without detailed documentation, it becomes difficult to verify compliance with industry standards (e.g., ISO, ASTM) or troubleshoot field failures. This lack of transparency increases risk, particularly in regulated industries like aerospace, automotive, or medical devices.

Inadequate Testing and Certification

Some sourced resins may not be tested under real-world application conditions. Relying solely on supplier-provided data without independent validation can be risky. For example, thermal stability or chemical resistance claims may not hold under actual use, leading to premature degradation. Failing to conduct application-specific testing before full-scale adoption is a frequent oversight.

Intellectual Property (IP)-Related Pitfalls

Use of Counterfeit or Reverse-Engineered Resins

A major IP risk is sourcing resins that infringe on patented formulations. Some suppliers, particularly in less-regulated markets, may produce “generic” versions of proprietary resins by reverse engineering. Using such materials exposes the buyer to legal liability for patent infringement, even if unintentional. Enforcement actions can lead to costly litigation, supply halts, and product recalls.

Unclear Licensing and Usage Rights

Even when resins are legitimately produced, usage rights may be restricted. For example, a resin formulation might be licensed only for specific applications or geographic regions. Buyers who assume broad usage rights without reviewing licensing agreements may inadvertently violate IP terms, leading to disputes or loss of supply.

Lack of IP Indemnification in Contracts

Many procurement agreements fail to include IP indemnification clauses. Without such protections, the buyer bears full responsibility for any third-party IP claims arising from the supplied resin. This can result in significant financial exposure, especially if the supplier is unwilling or unable to defend against infringement allegations.

Mitigation Strategies

- Qualify Suppliers Rigorously: Audit potential suppliers for quality management systems (e.g., ISO 9001), process controls, and IP compliance practices.

- Require Full Documentation: Insist on batch-specific CoAs, SDS, and formulation disclosures where possible.

- Conduct Independent Testing: Validate key performance parameters and compliance with specifications before scaling up.

- Perform IP Due Diligence: Work with legal experts to verify that sourced resins do not infringe existing patents, especially for high-value or regulated applications.

- Negotiate Strong Contracts: Include warranties, IP indemnification, and audit rights in supply agreements to protect against quality and IP risks.

By proactively addressing these pitfalls, companies can ensure reliable supply, maintain product integrity, and safeguard against legal and operational risks when sourcing thermosetting resins.

Logistics & Compliance Guide for Thermosetting Resins

Overview of Thermosetting Resins

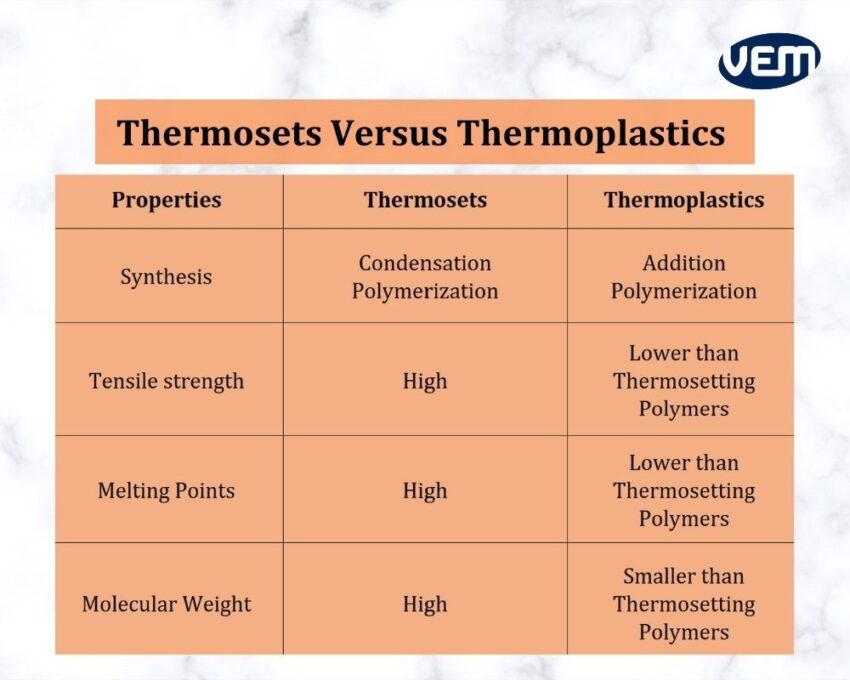

Thermosetting resins are polymers that irreversibly cure into a rigid, heat-resistant structure upon exposure to heat, catalysts, or radiation. Common types include epoxy, phenolic, polyester, urethane, and silicone resins. Due to their chemical composition and curing properties, they often fall under regulated substances for transportation and handling.

Hazard Classification and Identification

Thermosetting resins may be classified as hazardous materials depending on their formulation. Key hazards include:

– Flammability: Many resins and hardeners are flammable liquids (Class 3).

– Health Hazards: Possible skin/eye irritation, respiratory sensitization, or carcinogenicity (e.g., certain epoxy components).

– Reactivity: May undergo exothermic reactions during curing or when mixed with accelerators.

– Environmental Hazard: Some resins are toxic to aquatic life.

Always refer to the Safety Data Sheet (SDS), especially Section 2 (Hazard Identification), for GHS pictograms, signal words, and hazard statements.

Packaging Requirements

Proper packaging is critical to prevent leaks, contamination, and reactions during transport:

– Use UN-certified containers suitable for liquid chemicals (e.g., drums, jerricans).

– Ensure compatibility between resin and packaging material (e.g., avoid certain plastics with strong solvents).

– Seal containers tightly and use secondary containment (e.g., pallet overwrap or containment trays).

– Segregate resins from hardeners, accelerators, and incompatible substances (e.g., oxidizers, acids).

Labeling and Marking

Packages must be clearly labeled according to regulatory standards:

– Proper Shipping Name (e.g., “Epoxy Resin,” “Flammable Liquid, N.O.S.”)

– UN Number (e.g., UN 1866, UN 1263, or substance-specific number)

– Hazard Class Labels (e.g., Class 3 Flammable Liquid, Class 8 Corrosive if applicable)

– GHS Labels on inner containers with pictograms, signal words, and hazard statements

– Shipper/Consignee information and emergency contact details

Transportation Regulations

Compliance with international and national regulations is mandatory:

International Air (IATA DGR)

- Follow IATA Dangerous Goods Regulations for air freight.

- Classify based on flash point and health risks.

- Limit quantities may allow exceptions for small packages (check Packing Instructions).

International Sea (IMDG Code)

- Comply with the IMDG Code for maritime shipping.

- Use proper marine pollutant markings if applicable (e.g., resin with aquatic toxicity).

- Stow away from heat sources and living quarters.

Ground Transport (e.g., ADR in Europe, 49 CFR in USA)

- ADR: European agreement for road transport; requires driver training and vehicle placarding.

- 49 CFR: U.S. DOT regulations; includes training, shipping papers, and placarding requirements.

Storage and Handling

Safe storage practices minimize risks:

– Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources.

– Maintain temperature within manufacturer’s recommended range to prevent premature curing.

– Use grounded containers to avoid static discharge (especially with flammable resins).

– Implement spill containment measures (e.g., spill trays, absorbents).

– Train personnel in safe handling, PPE use, and emergency response.

Documentation Requirements

Essential documents for legal and safe shipment:

– Safety Data Sheet (SDS): Must accompany shipments and be accessible to handlers.

– Shipper’s Declaration for Dangerous Goods: Required for air and sea transport of regulated quantities.

– Transport Emergency Card (TREM Card): Often required under ADR for road transport in Europe.

– Customs Documentation: Accurate HS codes and import/export declarations, especially for cross-border shipments.

Environmental and Disposal Compliance

- Dispose of waste resin, contaminated packaging, and spill materials as hazardous waste per local regulations (e.g., RCRA in the U.S.).

- Never pour resins down drains or into soil.

- Recycle or reclaim materials when possible through approved facilities.

Emergency Response

Prepare for potential incidents:

– Provide spill kits compatible with resin chemistry (absorbents, neutralizers).

– Train staff in first aid (e.g., eye flush procedures for splashes).

– Post emergency contact numbers (e.g., poison control, chemical response teams).

– Report spills or releases as required by local environmental agencies.

Regulatory Updates and Training

- Stay current with regulatory changes (e.g., updates to GHS, IATA, or REACH).

- Conduct regular training for logistics, warehouse, and safety personnel.

- Maintain records of training, shipments, and compliance audits.

Note: Always consult the manufacturer’s SDS and local regulatory authorities for formulation-specific requirements. Compliance ensures safety, avoids penalties, and supports sustainable operations.

Conclusion for Sourcing Thermosetting Resin:

Sourcing thermosetting resins requires a comprehensive evaluation of technical specifications, supplier reliability, cost-effectiveness, and compliance with regulatory and sustainability standards. These resins—such as epoxy, phenolic, unsaturated polyester, and melamine formaldehyde—offer superior thermal stability, chemical resistance, and mechanical strength, making them essential in industries like automotive, aerospace, electronics, and construction.

A successful sourcing strategy involves selecting suppliers who provide consistent quality, technical support, and scalability, while also aligning with environmental and safety regulations. Long-term partnerships, supply chain transparency, and consideration of alternative or bio-based resins can further enhance resilience and sustainability. Ultimately, effective sourcing of thermosetting resins not only ensures product performance and reliability but also supports operational efficiency and innovation in manufacturing processes.