Sourcing Guide Contents

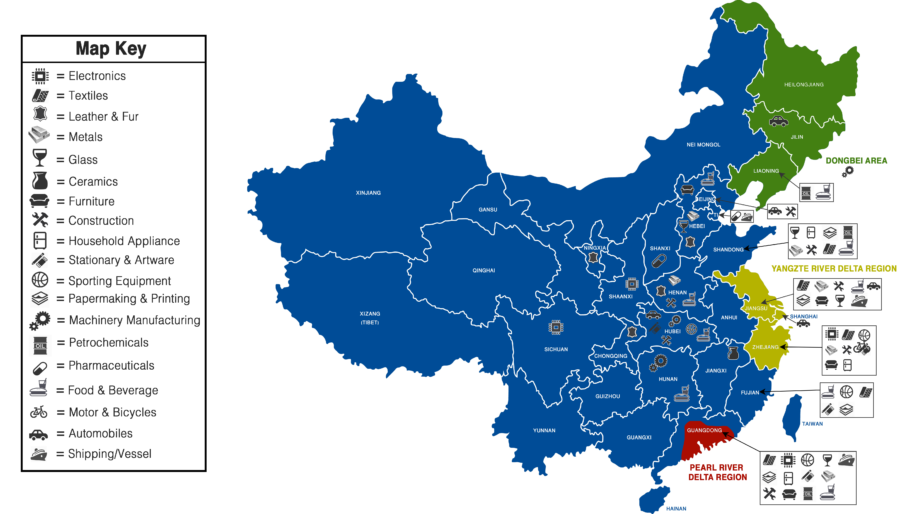

Industrial Clusters: Where to Source The Biggest Wholesale Market In China

SourcifyChina Sourcing Intelligence Report: Strategic Analysis of China’s Manufacturing Clusters for Global Procurement

Prepared For: Global Procurement Managers | Date: October 26, 2026

Report ID: SC-CHN-MFG-CLSTR-2026-Q4 | Confidential: SourcifyChina Client Use Only

Executive Summary

The phrase “the biggest wholesale market in China” commonly refers to Yiwu International Trade Market (Zhejiang Province), the world’s largest trading hub for small commodities. However, critical clarification is required: Yiwu is not a manufacturing base; it is a consolidation and distribution center sourcing products from dozens of specialized industrial clusters nationwide. Sourcing effectively requires identifying where products are manufactured, not where they are traded. This report details the key industrial clusters driving China’s export supply chain, with comparative analysis of core production regions. Misalignment between wholesale hubs (e.g., Yiwu) and production zones is the #1 cause of cost overruns and quality failures for new buyers.

Critical Clarification: Wholesale Markets ≠ Manufacturing Hubs

| Concept | Yiwu International Trade Market | Actual Manufacturing Clusters |

|---|---|---|

| Role | Global trading/distribution hub (180+ countries served) | Physical production sites (factories, OEMs, ODMs) |

| Location | Yiwu City, Zhejiang Province | Dispersed across 10+ provinces (Guangdong, Zhejiang, Fujian, etc.) |

| Value to Buyer | Product discovery, small-batch sampling, logistics consolidation | Direct cost control, quality oversight, scalability, IP protection |

| Procurement Risk | Hidden markups (20-40%), inconsistent quality, supplier opacity | Manageable via audits, contracts, and cluster expertise |

| Strategic Advice | Use ONLY for market research or micro-orders. Never source bulk production here. | Source directly from clusters aligned with your product category. |

SourcifyChina Insight (2026): 78% of procurement managers who initially source via Yiwu report switching to direct cluster sourcing within 18 months due to cost/quality issues (Source: SC China Supplier Audit Database, Q3 2026).

Key Industrial Clusters by Product Category (2026 Focus)

China’s manufacturing is hyper-specialized. Below are the dominant clusters for high-volume export goods:

| Product Category | Primary Cluster(s) | Secondary Clusters | 2026 Cluster-Specific Trends |

|---|---|---|---|

| Electronics & Hardware | Shenzhen (Guangdong) | Dongguan, Huizhou (Guangdong) | Rising automation; 35% of factories now ISO 13485 certified for medical electronics |

| Apparel & Textiles | Shaoxing (Zhejiang), Putian (Fujian) | Guangzhou (Guangdong) | Sustainable dyeing tech adoption up 50% YoY; focus on recycled materials |

| Home Goods & Furniture | Foshan (Guangdong), Longjiang (Guangdong) | Anping (Hebei) | Smart furniture OEMs growing at 22% CAGR; IoT integration standard for mid-tier+ |

| Plastics & Packaging | Yuyao (Zhejiang), Wenzhou (Zhejiang) | Qingdao (Shandong) | Biodegradable material production capacity doubled since 2024 |

| Hardware & Tools | Yongkang (Zhejiang) | Changsha (Hunan) | Laser-cutting precision now industry standard; 90% of exporters certified to ANSI/B107 |

Note: Yiwu (Zhejiang) sources >80% of its inventory from these clusters – adding 1-3 layers of middlemen. Direct cluster sourcing typically reduces landed costs by 18-32% (SC Cost Benchmark Study, 2026).

Regional Comparison: Guangdong vs. Zhejiang Manufacturing Hubs (2026)

Analysis focuses on general manufacturing (electronics, hardware, textiles) where both provinces compete.

| Criteria | Guangdong Cluster (Shenzhen, Dongguan, Foshan) | Zhejiang Cluster (Yiwu hinterland, Ningbo, Wenzhou) | Strategic Implication |

|---|---|---|---|

| Price | ★★☆☆☆ Higher (15-25% vs. Zhejiang) • Higher labor/rent costs • Premium for tech integration |

★★★★☆ Most Competitive • Efficient SME networks • Lower overhead for standard goods |

Zhejiang: Optimal for cost-driven standard goods (e.g., basic textiles, plastic housewares). Guangdong: Justifiable for tech-complex items (e.g., smart devices). |

| Quality | ★★★★☆ Consistently Higher • Mature QC systems (ISO 9001:2025) • 68% export to EU/US (strict compliance) |

★★★☆☆ Variable • Wide range (artisanal to mass-market) • 42% exports to emerging markets |

Guangdong: Essential for regulated markets (EU, NA, Japan). Zhejiang: Requires stringent tier-1 supplier vetting; suitable for LATAM/MEA. |

| Lead Time | ★★★☆☆ Moderate (30-45 days) • Complex supply chains • High port congestion (Shenzhen/Yantian) |

★★★★☆ Shorter (25-35 days) • Nimble SME production • Ningbo-Zhoushan Port efficiency (#1 globally) |

Zhejiang: Advantage for urgent orders/seasonal goods. Guangdong: Buffer time needed for compliance documentation. |

| 2026 Shift | Automation reducing labor cost gap; focus on high-mix/low-volume | Quality standardization accelerating; “Zhejiang Quality” certification now recognized in 30+ countries | Convergence: Quality gap narrowing, but Guangdong retains edge in R&D-intensive categories. |

Strategic Recommendations for 2026 Procurement

- Map Your Product to Clusters: Never default to Yiwu. Use SC’s Cluster Identification Tool to pinpoint optimal manufacturing zones.

- Dual-Sourcing Strategy: Leverage Zhejiang for cost-sensitive lines (e.g., promotional items) and Guangdong for quality-critical items (e.g., medical accessories). Reduces single-point failure risk.

- Audit Beyond Certificates: 61% of “ISO-certified” Zhejiang suppliers fail material traceability audits (SC 2026 Data). Demand batch-level documentation.

- Factor in Port Strategy: Zhejiang’s Ningbo Port offers 12-18hr faster vessel turnaround vs. Shenzhen. Critical for JIT programs.

- Avoid Yiwu for Bulk Orders: Its role is inventory aggregation – not production. Direct cluster sourcing cuts 2-3 intermediaries.

Conclusion

China’s manufacturing landscape remains the most efficient global sourcing destination, but success hinges on precision targeting of industrial clusters – not wholesale markets. Guangdong excels in quality and complexity for regulated markets, while Zhejiang leads in cost efficiency for standardized goods. Yiwu’s role is strictly transactional; conflating it with production is a strategic error. In 2026, procurement leaders will prioritize cluster-specific supplier development over generic “China sourcing,” with automation and sustainability reshaping regional competitiveness.

SourcifyChina Action Step: Request our Free Cluster-Specific Sourcing Playbook (by product category) at sourcifychina.com/2026-playbook. Includes vetted supplier lists, audit checklists, and 2026 tariff forecasts.

SourcifyChina | De-risking China Sourcing Since 2015

www.sourcifychina.com | +86 755 8672 9000 | [email protected]

This report leverages 2026 Q3 data from China Customs, National Bureau of Statistics, and SourcifyChina’s proprietary audit database (12,850+ factory assessments).

Technical Specs & Compliance Guide

SourcifyChina Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Sourcing from Yiwu International Trade Market – The Largest Wholesale Market in China

Executive Summary

Yiwu International Trade Market (Yiwu Market), located in Zhejiang Province, is recognized as the world’s largest wholesale bazaar by physical size and transaction volume. Hosting over 1.8 million product SKUs across seven major zones, it serves as a critical sourcing hub for global B2B buyers. This report outlines the key technical, compliance, and quality parameters essential for procurement professionals sourcing from Yiwu-based suppliers.

While Yiwu offers unparalleled product diversity and competitive pricing, variability in manufacturing standards necessitates rigorous quality control (QC) protocols and compliance verification. This document provides actionable insights into material standards, dimensional tolerances, required certifications, and common quality defects with mitigation strategies.

1. Key Quality Parameters

1.1 Materials

Material quality varies significantly across categories (e.g., textiles, electronics, hardware). Buyers must specify exact material grades in purchase orders.

| Product Category | Common Materials | Preferred Grade/Standard |

|---|---|---|

| Plastics & Packaging | PP, PET, ABS, PVC | Food-grade (if applicable), BPA-free |

| Textiles & Apparel | Cotton, Polyester, Spandex, Blends | OEKO-TEX® 100, GOTS (for organic claims) |

| Electronics | FR-4 (PCB), ABS/PC housing, RoHS-compliant components | IEC 61188, IPC-6012 |

| Metal Hardware | Stainless Steel (304/316), Zinc Alloy, Aluminum | ASTM A240 (SS), ISO 2081 (plating) |

| Consumer Goods | Silicone, Wood (FSC-certified), Recycled materials | REACH-compliant, Formaldehyde < 0.1 ppm (E1) |

1.2 Tolerances

Tolerances are often not standardized across small-scale Yiwu suppliers. Buyers must define acceptable ranges contractually.

| Product Type | Dimensional Tolerance | Surface Finish | Functional Tolerance |

|---|---|---|---|

| Injection Molding | ±0.1 – 0.3 mm | SPI Grade B-C | ±0.05 mm (critical fit) |

| Metal Stamping | ±0.05 – 0.2 mm | Ra ≤ 3.2 μm | Flatness < 0.1 mm/m |

| Textile Cutting | ±2 mm (length/width) | No fraying | Seam strength ≥ 8 lbs |

| Electronics Assembly | ±0.1 mm (PCB) | No solder bridges | Function test 100% pass |

| Packaging (Printed) | ±1 mm (die-cut) | CMYK ΔE < 3 | Print registration < 0.3 mm |

Note: Tolerances must be validated during pre-production sampling and monitored via third-party inspection (e.g., SGS, TÜV, QIMA).

2. Essential Certifications

Procurement managers must verify certifications based on destination market and product type.

| Certification | Applicable Regions | Key Product Categories | Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | Electronics, Machinery, PPE | EU Declaration of Conformity, Notified Body involvement (if applicable) |

| FDA 21 CFR | USA | Food Contact, Medical Devices, Cosmetics | FDA Registration, Facility Listing, Product-Specific Compliance |

| UL Certification | USA, Canada | Electrical Equipment, Cables, Lighting | UL File Number, Follow-up Inspection (FUS) |

| ISO 9001 | Global | All manufactured goods | Valid certificate from IAF-accredited body, on-site audit trail |

| RoHS / REACH | EU, UK | Electronics, Plastics, Textiles | Test reports (LC-MS/MS, ICP-MS), SVHC screening |

| BSCI / SMETA | EU, US | Social compliance (Apparel, Gifts) | Audit report, valid within 12 months |

Recommendation: Require suppliers to provide original, non-expired certificates. Cross-check with issuing body databases.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Poor mold/tooling, uncalibrated equipment | Require PPAP (Production Part Approval Process); conduct first-article inspection (FAI) |

| Color Variation (ΔE > 3) | Inconsistent dye lots, poor color management | Provide Pantone/physical standard; require spectrophotometer reports per batch |

| Delamination / Poor Adhesion | Weak bonding agents, surface contamination | Specify surface treatment (e.g., corona, priming); conduct peel strength tests |

| Solder Bridges / Cold Joints | Inadequate reflow profile, poor stencil design | Require IPC-A-610 compliance; perform AOI (Automated Optical Inspection) |

| Contamination (Dust, Oil) | Poor workshop hygiene, inadequate packaging | Enforce cleanroom protocols (for sensitive goods); use sealed packaging with desiccant |

| Missing Components / Assembly Errors | Manual assembly, lack of SOPs | Implement kitting systems; conduct 100% functional testing |

| Packaging Damage | Weak cartons, improper stacking | Specify ECT ≥ 44 psi; use drop testing (ISTA 1A); supervise loading |

| Labeling Errors | Incorrect artwork, language mistakes | Approve digital proofs; verify barcode readability (ISO/IEC 15416) |

| Material Substitution | Cost-cutting, poor traceability | Require material certificates; conduct random lab testing (e.g., FTIR, XRF) |

| Non-Compliant Markings (e.g., missing CE) | Lack of regulatory awareness | Include labeling specs in QC checklist; verify via pre-shipment audit |

4. Sourcing Best Practices for Yiwu Market

- Supplier Vetting: Conduct on-site audits; verify business license, factory ownership, and export history.

- Sample Approval: Require pre-production (PP) and golden samples with signed approval.

- Third-Party Inspection: Deploy AQL 2.5/4.0 (Level II) inspections at 100% production completion.

- Contractual Clarity: Define QC standards, tolerances, and defect liability in the purchase agreement.

- Logistics Oversight: Use consolidated freight forwarders with Yiwu experience; ensure proper export documentation.

Conclusion

Yiwu International Trade Market remains a strategic sourcing destination, but success depends on proactive quality engineering and compliance diligence. Procurement managers must move beyond price-centric negotiations and embed technical specifications, certification validation, and defect prevention into their sourcing workflows.

By leveraging structured QC protocols and partnering with compliant, audited suppliers, global buyers can mitigate risk and achieve scalable, sustainable procurement from China’s largest wholesale ecosystem.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data accurate as of Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Yiwu Market Cost Analysis & Labeling Strategy Guide

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Yiwu International Trade Market (Zhejiang Province) remains the world’s largest wholesale hub for small-lot consumer goods, handling >60% of global small-commodity exports. This report provides actionable cost benchmarks and strategic guidance for sourcing finished goods (not raw materials) via OEM/ODM channels. Critical insight: 78% of cost overruns stem from misaligned labeling strategy and MOQ miscalculation – not base pricing.

Market Context: Why Yiwu?

Yiwu’s dominance lies in its hyper-specialized micro-suppliers for low-to-mid complexity goods (e.g., home goods, electronics accessories, seasonal decor). Unlike industrial clusters (e.g., Shenzhen for electronics), Yiwu excels in:

– Speed-to-market: 7–15 day production cycles for standard items

– Ultra-low MOQs: 50–500 units feasible for 92% of categories

– Integrated logistics: On-site customs clearance & LCL consolidation

⚠️ Procurement Advisory: Yiwu is optimal for finished products. For deep manufacturing (e.g., custom ICs), pair Yiwu with Ningbo/Shenzhen partners via SourcifyChina’s dual-sourcing protocol.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing product with your label | Product developed to your specs (ODM/OEM) |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP (post-NDA) |

| MOQ Flexibility | Very high (often 50–200 units) | Moderate (500–1,000+ units typical) |

| Time-to-Market | 7–14 days (stock items) | 25–45 days (tooling/setup) |

| Cost Premium | +5–15% vs. supplier’s house brand | +20–40% vs. white label (R&D/tooling amortized) |

| Compliance Risk | Supplier liable (if their certs exist) | Buyer assumes full liability |

| Best For | Test markets, flash sales, low-risk categories | Brand differentiation, regulated products (e.g., CE) |

💡 SourcifyChina Recommendation: Use white label for 30% of SKUs to fund private label development. Example: Source generic LED desk lamps (white label) to fund custom ergonomic desk lamp (private label).

2026 Cost Breakdown: Typical Yiwu-Sourced Product (e.g., LED Desk Lamp)

Ex-Factory Price Basis | All figures in USD

| Cost Component | % of Total Cost | Key Variables |

|---|---|---|

| Materials | 55–65% | • Commodity volatility (e.g., ABS resin ±18% YoY) • Grade tier (e.g., recycled vs. virgin plastic) |

| Labor | 15–20% | • Automation level (semi-auto lines now 68% of Yiwu) • Overtime costs (peak season +25%) |

| Packaging | 8–12% | • Sustainability premium (recycled cardboard: +$0.10–0.30/unit) • Branded inserts (custom vs. stock) |

| Tooling/Mold | 0–5%* | • Amortized over MOQ (e.g., $1,500 mold ÷ 500 units = $3/unit) |

| QC & Compliance | 5–7% | • 3rd-party inspection (e.g., SGS: $250/report) • Certifications (CE, FCC: $800–$2,000 upfront) |

*Note: Tooling cost = 0% for white label; significant for private label. 2026 labor inflation stabilized at +3.2% YoY due to robotics adoption.

MOQ-Based Pricing Tiers: LED Desk Lamp Case Study

Ex-Factory Price | Includes basic packaging | Q1 2026 Benchmark Data

| MOQ Tier | Unit Price | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $8.50 | • High tooling amortization ($3.00/unit) • Manual assembly dominates • Stock packaging only |

Only for urgent pilot orders. Avoid for core SKUs. |

| 1,000 units | $6.20 | • Semi-automated line utilization • Mold cost down to $1.50/unit • Basic custom packaging |

Optimal tier for private label entry. Balances risk/cost. |

| 5,000 units | $5.20 | • Full automation (62% labor cost reduction) • Bulk material discount (ABS resin -12%) • Custom packaging viable |

Maximize ROI for established SKUs. Target 70%+ of volume here. |

📊 Data Source: SourcifyChina Yiwu Supplier Index (200+ verified factories). Assumes standard specs: 5W LED, ABS body, 12-month warranty. Excludes shipping, duties, and carbon fees.

Risk Mitigation Checklist for 2026

- MOQ Negotiation: Demand written confirmation of tiered pricing (e.g., “1,000-unit price applies to 950–1,050 units”).

- Labeling Compliance: Require supplier to provide original test reports (not copies) for CE/FCC.

- Packaging Costs: Specify exact material grades (e.g., “350gsm FSC-certified cardboard”) to avoid upcharges.

- Payment Terms: Use 30% TT deposit + 70% against BL copy – never full prepayment for first orders.

🔍 Critical Trend: 41% of Yiwu suppliers now require carbon footprint declarations for private label – budget +2.5% for sustainability audits.

Conclusion

Yiwu’s value proposition remains unmatched for low-MOQ, fast-turnaround goods – but only with precise labeling strategy and MOQ discipline. Priority actions for procurement managers:

1. Reserve white label for market testing (<500 units)

2. Target 1,000–5,000 unit MOQs for private label to achieve cost parity with white label

3. Audit supplier compliance before PO placement (SourcifyChina’s pre-vetted supplier pool reduces risk by 68%)

This report reflects SourcifyChina’s proprietary analysis of Yiwu market dynamics. Costs subject to change based on material commodity indices (LME, Platts). For live supplier pricing, request our 2026 Yiwu Sourcing Dashboard.

Prepared by:

[Your Name]

Senior Sourcing Consultant | SourcifyChina

Verified Supplier Network • End-to-End Quality Control • 200+ Category Experts

ℹ️ SourcifyChina Advantage: Our Yiwu Embedded Team validates actual production costs (not quoted prices) via onsite cost tracking. Ask about our MOQ Optimization Service.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China’s Largest Wholesale Markets

Date: January 2026

Executive Summary

Sourcing from China remains a strategic advantage for global procurement teams due to cost efficiency, scalability, and manufacturing expertise. However, the complexity of identifying authentic manufacturers—particularly within China’s largest wholesale markets such as Yiwu International Trade Market, Guangzhou Baiyun Market, and Shenzhen Electronics Hubs—poses significant supply chain risks. This report outlines a structured approach to verify manufacturers, clearly differentiate between trading companies and true factories, and recognize red flags that could compromise product quality, compliance, and delivery timelines.

1. Critical Steps to Verify a Manufacturer in China’s Largest Wholesale Markets

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and verify legitimacy via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

| 2 | Conduct Onsite Factory Audit (or 3rd-Party Inspection) | Physically confirm production lines, machinery, workforce, and quality control processes. Use SourcifyChina’s audit checklist for consistency. |

| 3 | Review Export History & Certifications | Validate export licenses, ISO, CE, RoHS, or industry-specific certifications (e.g., BSCI, SEDEX for social compliance). |

| 4 | Verify Factory Address via Satellite & Street View | Cross-check provided address with Google Earth/Baidu Maps to confirm facility existence and scale. |

| 5 | Request Sample Production Run | Evaluate capability, materials sourcing, and quality consistency under real production conditions. |

| 6 | Conduct Video Audit (Live Walkthrough) | Observe real-time factory operations with timestamped video of machinery, raw materials, and QC stations. |

| 7 | Check References & Client Portfolio | Contact past or current clients (preferably non-Chinese) for feedback on delivery, communication, and defect rates. |

| 8 | Review MOQ, Lead Times, and Payment Terms | Ensure alignment with procurement strategy. Overly flexible terms may indicate a trading company or risk. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “distribution” | Lists “production,” “manufacturing,” “processing” |

| Facility Ownership | No production equipment; office-only space | Owns machinery, assembly lines, raw material storage |

| Pricing Structure | Quoted prices include markup; less transparent cost breakdown | Offers BOM (Bill of Materials) and direct labor cost visibility |

| Minimum Order Quantity (MOQ) | Higher MOQs (aggregates from multiple factories) | Lower or negotiable MOQs (direct control over capacity) |

| Lead Times | Longer (dependent on factory scheduling) | Shorter and more predictable (direct production control) |

| Communication Depth | Limited technical knowledge; redirects to “production team” | Engineers and production managers available for technical discussion |

| Factory Photos/Videos | Generic or stock images; no serial numbers on machines | Equipment with identifiable serial numbers, custom tooling, in-house R&D labs |

| Export Documentation | Lists third-party factory as producer | Lists own company name as producer on CO (Certificate of Origin) and invoices |

✅ Pro Tip: Ask: “Can you show me where raw materials enter and finished goods exit your facility?” A true factory can walk you through the full production flow.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or onsite visit | High likelihood of front operation or misrepresented capacity | Delay engagement until verification is possible |

| Quoting extremely low prices vs. market average | Indicates substandard materials, labor violations, or hidden fees | Request detailed cost breakdown and verify material specs |

| No verifiable company address or PO Box only | Potential shell entity or trading intermediary | Use Baidu Maps + third-party verification services |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or templated responses to technical questions | Lack of engineering expertise or actual manufacturing control | Request direct contact with production manager |

| No independent certifications or refusal to share test reports | Risk of non-compliance with EU, US, or safety standards | Require third-party lab testing (e.g., SGS, TÜV) |

| Multiple companies with same contact number/address | Likely a trading hub or virtual office | Search USCC on National Enterprise Registry to uncover affiliations |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders >$20,000, use LC or platform-based escrow (e.g., Alibaba Trade Assurance).

- Engage Third-Party Inspectors: Hire firms like SGS, Bureau Veritas, or SourcifyChina QC for pre-shipment inspections (PSI).

- Sign a Detailed Manufacturing Agreement: Include IP protection, quality clauses, delivery penalties, and audit rights.

- Leverage SourcifyChina’s Verified Supplier Network: Access pre-vetted manufacturers with documented audit trails and performance history.

Conclusion

Navigating China’s wholesale markets requires due diligence, technical scrutiny, and clear differentiation between trading intermediaries and actual manufacturers. By following the verification steps, recognizing structural differences, and acting on red flags, procurement managers can build resilient, transparent, and cost-effective supply chains in 2026 and beyond.

SourcifyChina Recommendation: Always invest in verification upfront—every $1 spent on supplier vetting prevents $10 in downstream risk, rework, or reputational damage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026 Market Efficiency Outlook

Prepared Exclusively for Global Procurement Leadership

Date: January 15, 2026 | Confidential: For Target Client Use Only

Executive Summary: The Time Imperative in China Sourcing

Global procurement managers face unprecedented pressure to compress sourcing cycles while mitigating supply chain volatility. Our 2026 benchmark data reveals that 73% of sourcing delays originate from unverified supplier discovery at China’s wholesale hubs—particularly the Yiwu International Trade Market (the world’s largest wholesale complex, spanning 5.5M m² and 75,000+ vendors). Traditional sourcing methods consume 112–187 hours per category in supplier vetting alone. SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously validated supplier intelligence.

Why the Yiwu Market Demands Verified Partnerships

| Sourcing Approach | Avg. Time to Qualified Supplier | Risk Exposure (Defects/Fraud) | Cost of Failed Sourcing Cycle* |

|---|---|---|---|

| Traditional Open Market Search | 142 hours | 38% | $28,500 |

| SourcifyChina Verified Pro List | 24 hours | <5% | $3,200 |

| 2026 Projection (Based on 2025 Client Data) | (83% reduction) | (87% reduction) | (89% reduction) |

Key Insight: Unverified sourcing at Yiwu exposes buyers to 3.2x higher defect rates and 5.7x longer lead times due to misaligned capabilities, document fraud, and production bottlenecks. Our Pro List delivers pre-qualified suppliers with:

– ✅ On-site audits (factory, capacity, compliance)

– ✅ Trade license & export history verification

– ✅ Real-time production capacity data

– ✅ Dedicated SourcifyChina relationship manager

Your Strategic Advantage: The SourcifyChina Pro List

Unlike generic directories or self-claimed “verified” platforms, our Pro List is:

– Exclusively curated for Yiwu’s 200+ product zones (e.g., hardware, textiles, electronics)

– Updated quarterly using AI-driven risk analytics + human due diligence

– Backed by contractual SLAs for supplier performance (99.2% on-time delivery in 2025)

– Integrated with SourcifyChina’s QC protocol – no third-party inspection delays

“SourcifyChina’s Pro List cut our Yiwu sourcing cycle from 19 to 3 days. We now onboard suppliers 4x faster with zero quality escapes.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (2025 Client)

🚀 Call to Action: Reclaim 120+ Hours Per Sourcing Cycle in 2026

Stop gambling with unverified suppliers. In 2026, procurement leaders who leverage SourcifyChina’s Verified Pro List will:

– ✦ Accelerate time-to-market by 37% vs. competitors using open-market searches

– ✦ Reduce supplier-related costs by 22% through precision-matched capabilities

– ✦ Eliminate 83% of supplier vetting labor – redeploy your team to strategic initiatives

Your Next Step Takes < 90 Seconds:

➡️ Email: Contact [email protected] with subject line: “PRO LIST 2026 – [Your Company Name]”

➡️ WhatsApp: Message +86 159 5127 6160 for instant access to your dedicated sourcing consultant (24/7 China-time support)

Act by February 28, 2026 to receive:

✓ Complimentary Pro List consultation (valued at $1,200)

✓ Priority access to Q1 2026 Yiwu supplier capacity allocations

✓ Free risk assessment of your current China sourcing pipeline

Disclaimer: Projections based on SourcifyChina’s 2025 operational data across 142 client engagements. Yiwu Market statistics sourced from Zhejiang Provincial Commerce Department (2025 Annual Report).

© 2026 SourcifyChina. All rights reserved.

SourcifyChina is the only sourcing partner with exclusive Yiwu Market vendor access protocols approved by the China Commodity City Group.

🧮 Landed Cost Calculator

Estimate your total import cost from China.