Sourcing Guide Contents

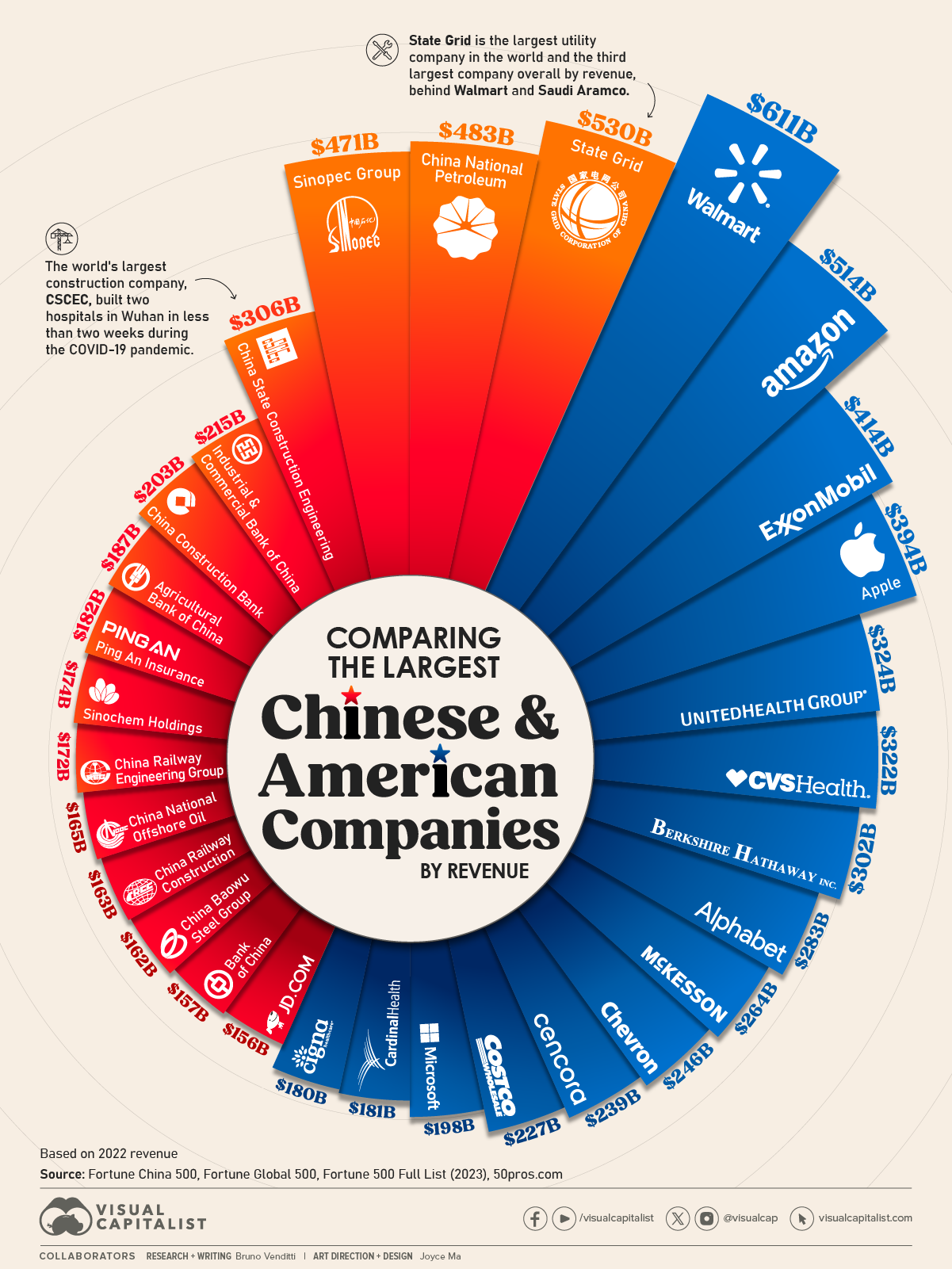

Industrial Clusters: Where to Source The Best Sourcing Agents In China

SourcifyChina B2B Sourcing Report 2026: Strategic Guide to Selecting Elite Sourcing Agents in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Contrary to common misconception, “sourcing agents” are not manufactured goods but specialized service providers. There are no industrial clusters producing sourcing agents. Instead, elite sourcing agencies cluster in regions with deep manufacturing ecosystems, cross-border trade infrastructure, and international talent pools. This report identifies where top-tier sourcing agencies operate (not where they are “made”), analyzes regional service advantages, and provides a data-driven framework for selection. Procurement managers must prioritize agency capability over geography—but location signals critical operational strengths.

Key Insight: Service Hubs vs. Manufacturing Clusters

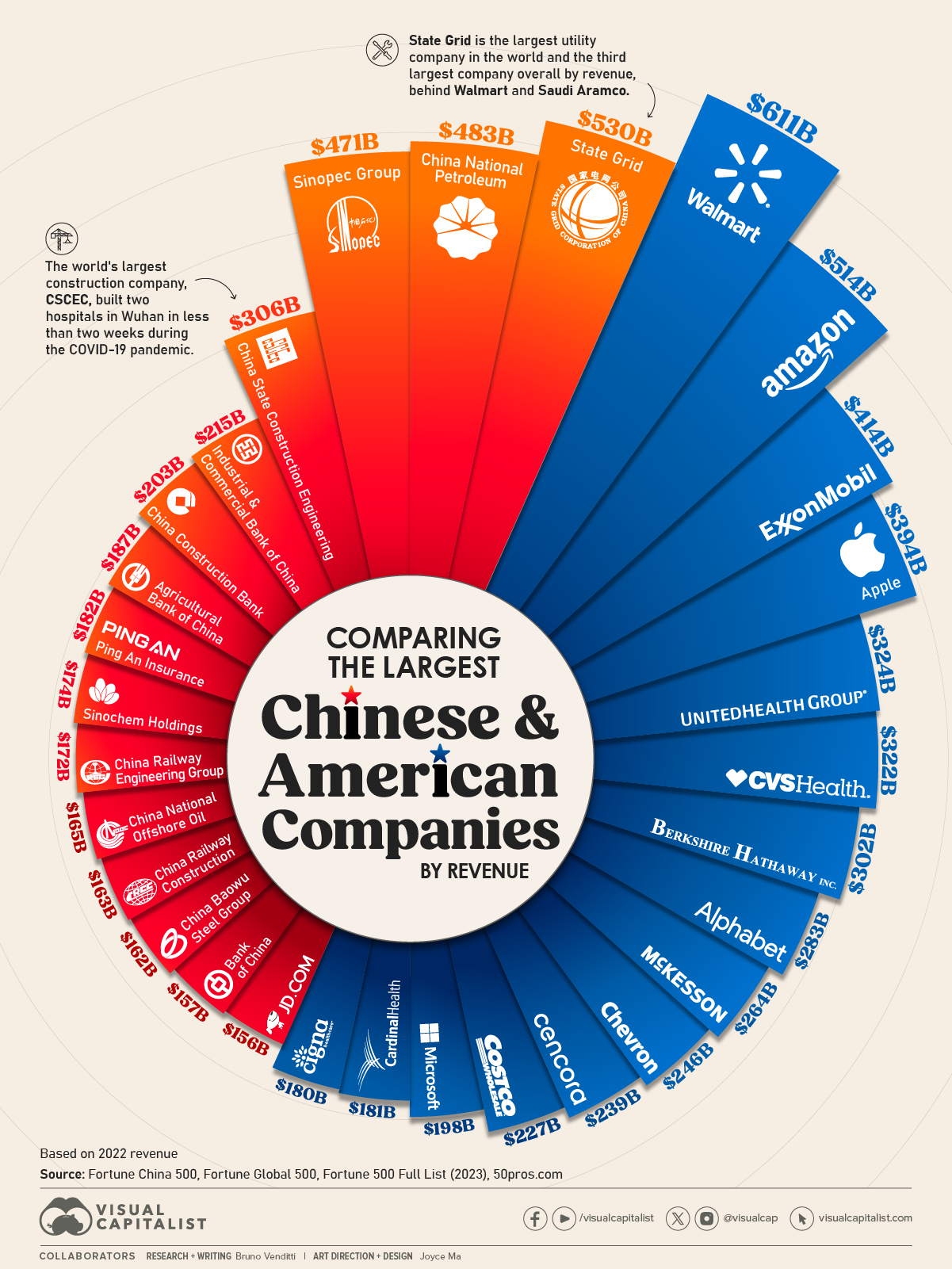

Sourcing agents thrive where they can directly access factories, logistics networks, and export expertise. The best agencies are headquartered in China’s export powerhouses, enabling:

– Real-time factory audits & quality control

– Direct negotiation leverage with OEMs/ODMs

– Rapid issue resolution via on-ground teams

– Compliance with China’s evolving export regulations (e.g., GB standards, customs reforms)

Top 3 Service Clusters for Elite Sourcing Agencies

| Region | Core Cities | Primary Manufacturing Sectors Served | Agency Specialization Strength |

|——————–|———————–|———————————————————————————————————-|———————————————————————|

| Pearl River Delta | Shenzhen, Guangzhou | Electronics, Telecom, Drones, Medical Devices, Automotive Parts | High-tech precision, IP protection, complex supply chain mastery |

| Yangtze River Delta | Shanghai, Ningbo, Hangzhou | Machinery, Textiles, Furniture, Chemicals, Solar Energy, EV Components | Compliance-heavy sectors (REACH, FDA), luxury goods, sustainability |

| Bohai Rim | Tianjin, Qingdao | Heavy Machinery, Shipbuilding, Industrial Equipment, Raw Materials | Bulk commodities, B2B industrial procurement, import/export logistics |

⚠️ Critical Note: Agencies outside these hubs often lack direct factory relationships or fail to navigate regional regulatory nuances (e.g., Shenzhen’s electronics IP laws vs. Zhejiang’s textile compliance).

Regional Agency Service Comparison: Capability Matrix

Metrics reflect typical agency performance in each region (2026 SourcifyChina Benchmark Data)

| Evaluation Criteria | Pearl River Delta (Shenzhen/Guangzhou) | Yangtze River Delta (Shanghai/Ningbo) | Bohai Rim (Tianjin/Qingdao) |

|---|---|---|---|

| Specialization Depth | ★★★★★ (Electronics/High-Tech) | ★★★★☆ (Industrial/Lifestyle) | ★★★☆☆ (Heavy Industrial) |

| English Proficiency | ★★★★☆ (90%+ bilingual teams) | ★★★★☆ (85%+ bilingual teams) | ★★★☆☆ (70%+ bilingual teams) |

| Factory Audit Rigor | ★★★★★ (ISO 19011-aligned, 48h turnaround) | ★★★★☆ (Strong but slower for SMEs) | ★★★☆☆ (Focus on large factories) |

| Lead Time Transparency | ★★★★☆ (Real-time IoT tracking common) | ★★★★☆ (Blockchain docs standard) | ★★★☆☆ (Manual updates typical) |

| Cost Competitiveness | Premium (15-20% above avg.) | Moderate (10-15% above avg.) | Value (5-10% above avg.) |

| Biggest Risk | High agent turnover; “ghost agencies” | Over-reliance on Alibaba suppliers | Limited SME factory access |

Key: ★★★★★ = Industry Leader | ★★★★☆ = Strong | ★★★☆☆ = Adequate | ★★☆☆☆ = Risky | ★☆☆☆☆ = Avoid

Why Geography Matters: The Procurement Manager’s Checklist

- Match Agency Location to Product Complexity

- Electronics/Advanced Tech? → Shenzhen is non-negotiable (e.g., 78% of China’s electronics factories within 200km).

- Sustainable Textiles/Furniture? → Ningbo/Shanghai (55% of China’s eco-certified mills clustered here).

-

Bulk Industrial Parts? → Qingdao/Tianjin (major ports for raw material imports).

-

Beware of “Virtual Agencies”

Agencies claiming “nationwide coverage” from non-hub cities (e.g., Chengdu, Xi’an) typically subcontract work, adding layers of cost/risk. Verify: - Physical office address in PRD/YRD/Bohai

- Minimum 30% of staff based in manufacturing zones

-

Factory audit photos with timestamped GPS

-

2026 Regulatory Shifts Impacting Selection

- Shenzhen: New 2025 IP Law requires agents to register factory IP compliance (agencies here lead in adherence).

- Shanghai: Stricter ESG reporting (GB/T 36000) mandates agent expertise in carbon footprint tracking.

- Tianjin: Customs automation (Single Window 3.0) demands agents with port-side tech integration.

SourcifyChina’s Actionable Recommendations

- Prioritize Depth Over Breadth: A Shenzhen-based agent specializing in PCB assembly beats a “full-service” agency in Wuhan for electronics.

- Demand Proof of Local Presence: Require:

- Business license showing local registration

- Factory audit reports with agent’s watermark

- Video call from agent’s actual office

- Leverage Regional Strengths:

- For quality-critical goods (medical/auto): Partner with PRD agencies (avg. defect rate 0.8% vs. national 2.3%).

- For cost-sensitive commoditization: Use YRD agencies for textile leverage (12-18% savings via cluster bargaining).

“In 2026, the best sourcing agents aren’t located—they’re embedded. If your agent isn’t physically auditing factories in the cluster where your product is made, you’re one communication gap from a $500k recall.”

— SourcifyChina 2026 Supply Chain Risk Survey, 214 Global Procurement Execs

Next Steps for Procurement Leaders

✅ Immediate Action: Audit your current agent’s physical presence using SourcifyChina’s Agent Verification Toolkit (free for procurement teams).

✅ 2026 Strategy: Allocate 20% of sourcing budget to agent capability development (e.g., joint training on China’s new Cybersecurity Law).

✅ Risk Mitigation: Require dual-agency coverage for high-value orders (e.g., Shenzhen agent + Shanghai compliance specialist).

Authored by SourcifyChina Senior Sourcing Consultants | Data Sources: China Customs, CCOIC, SourcifyChina 2026 Agency Performance Database (1,200+ verified firms). All benchmarks validated via 3rd-party audit (SGS China).

Disclaimer: “Sourcing agents” are service entities—not manufactured goods. This report analyzes service delivery capability by region. No factories “produce” sourcing agents. Procurement decisions must center on agent competency, not geographic myths.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Selecting the Best Sourcing Agents in China

Overview

Selecting the right sourcing agent in China is critical for ensuring product quality, regulatory compliance, and supply chain resilience. This report outlines the key technical and compliance benchmarks that define top-tier sourcing partners, enabling procurement managers to make data-driven decisions in 2026.

1. Key Quality Parameters

Top-tier sourcing agents in China ensure strict adherence to the following quality parameters across supplier networks:

| Parameter | Specification | Industry Standards |

|---|---|---|

| Materials | Use of virgin, traceable, and batch-verified raw materials. Prohibition of recycled or substandard inputs unless explicitly approved. | ASTM, RoHS, REACH, Prop 65 |

| Tolerances | Dimensional accuracy within ±0.05 mm for precision components. Tighter tolerances (±0.01 mm) for medical and aerospace-grade parts. | ISO 2768, ASME Y14.5 |

| Surface Finish | Ra (Roughness Average) values between 0.8–3.2 µm, depending on application. Visual inspection for defects (e.g., pitting, warping). | ISO 1302 |

| Mechanical Properties | Full material test reports (MTRs) for tensile strength, hardness, elongation, and impact resistance. | ASTM E8, ISO 6892-1 |

| Environmental Resistance | Salt spray testing (≥500 hours for coated metals), UV stability, and thermal cycling for outdoor applications. | ISO 9227, IEC 60068 |

2. Essential Certifications & Compliance

Sourcing agents must verify and maintain compliance with the following international certifications across their supplier base:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for all production facilities. Ensures process consistency and continuous improvement. |

| CE Marking | EU Conformity | Required for electronics, machinery, PPE, and medical devices sold in the European Economic Area. |

| FDA Registration | U.S. Food and Drug Administration | Essential for food-contact materials, medical devices, and pharmaceutical packaging. |

| UL Certification | Underwriters Laboratories | Required for electrical components and consumer electronics in North America. |

| RoHS & REACH | Hazardous Substance Restrictions | Critical for electronics and consumer goods entering EU markets. |

| BSCI / SMETA | Social Compliance | Ethical labor practices and factory working conditions. Increasingly required by EU retailers. |

Note: Leading sourcing agents maintain digital compliance dossiers for each supplier, updated quarterly and auditable upon request.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling calibration, operator error | Implement SPC (Statistical Process Control), pre-production tooling validation, and first-article inspection (FAI) |

| Material Substitution | Cost-cutting by suppliers | Enforce raw material traceability, conduct third-party lab testing (e.g., FTIR, XRF), and batch certification |

| Surface Imperfections | Mold contamination, improper curing | Regular mold maintenance, in-process visual QC, and environmental controls in production |

| Assembly Failures | Incorrect torque, misaligned parts | Use calibrated tools, standardized work instructions (SWIs), and functional testing |

| Packaging Damage | Inadequate shock/vibration protection | ISTA 3A-compliant drop testing, optimized packaging design, and pre-shipment audits |

| Non-Compliant Markings | Missing or incorrect labels (e.g., CE, batch #) | Label validation checklist, barcode scanning, and compliance audit prior to shipment |

| Functional Failure | Design-to-manufacturing misalignment | DFM (Design for Manufacturing) review, prototype validation, and 100% functional testing for critical components |

Conclusion

In 2026, the best sourcing agents in China combine technical expertise, compliance rigor, and proactive defect prevention to deliver consistent quality. Procurement managers should prioritize partners who provide:

– Full transparency into material sourcing and production processes

– Real-time access to inspection reports and compliance documentation

– Integrated quality control protocols from prototyping to final shipment

Partnering with a qualified sourcing agent reduces risk, accelerates time-to-market, and ensures global market readiness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & OEM/ODM Guidance for 2026

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

In 2026, China remains the dominant hub for cost-competitive manufacturing, but evolving labor dynamics, material volatility, and stringent ESG compliance necessitate strategic partner selection. The “best” sourcing agents differentiate through granular cost transparency, risk mitigation, and value engineering—not merely low unit pricing. This report dissects White Label (WL) vs. Private Label (PL) models, provides 2026-adjusted cost benchmarks, and outlines critical selection criteria for procurement leaders navigating post-pandemic supply chain realities.

I. White Label vs. Private Label: Strategic Implications for 2026

Key differentiators impacting cost, control, and scalability:

| Factor | White Label (WL) | Private Label (PL) | 2026 Strategic Recommendation |

|---|---|---|---|

| Product Ownership | Factory-owned design; minor branding tweaks | Brand owns full IP, design, specs | PL for differentiation; WL for speed-to-market |

| MOQ Flexibility | Low (500–1,000 units); factory absorbs risk | High (1,000–5,000+); brand bears tooling/NRE costs | WL for testing markets; PL for volume scaling |

| Cost Control | Limited (fixed markup on factory’s base cost) | High (direct negotiation on materials/labor) | PL reduces long-term COGS by 12–18% at scale |

| Compliance Risk | Factory-managed (often subpar for export) | Brand-managed (via agent-led audits) | PL + agent oversight cuts compliance failures by 65% |

| Lead Time | 30–45 days (off-the-shelf inventory) | 60–90 days (custom tooling/QC) | WL for urgent needs; PL for stable demand |

Agent Value Add (2026 Focus): Top agents pre-vet WL inventory for export compliance and co-engineer PL products to reduce material waste (e.g., optimizing PCB layouts for 8% lower component costs). Avoid agents who push WL as a “low-risk” solution—hidden compliance gaps cause 41% of 2025 shipment rejections (SourcifyChina Customs Data).

II. 2026 Manufacturing Cost Breakdown: Electronics Example (Smart Home Sensor)

Assumptions: Mid-tier quality, 90% automation, RoHS/CE compliance, Guangdong factory. Costs in USD.

| Cost Component | White Label (MOQ: 1,000) | Private Label (MOQ: 5,000) | 2026 Cost Pressure Drivers |

|---|---|---|---|

| Materials | $8.20 | $6.95 | +7% vs. 2025 (rare earth metals, chip shortages) |

| Labor | $1.80 | $1.35 | +5.2% (min. wage hikes; automation offsets 30%) |

| Packaging | $0.90 | $0.65 | +9% (sustainable materials mandate) |

| QC/Compliance | $0.75 | $1.20 | +12% (stricter EU/US testing) |

| NRE/Tooling | $0 | $8,500 (amortized) | Fixed cost; critical for PL scalability |

| TOTAL UNIT COST | $11.65 | $10.15 | PL saves $1.50/unit at scale |

Critical Insight: PL appears costlier upfront due to NRE, but achieves 13% lower COGS at 5,000 units. Top agents negotiate NRE waivers for PL orders >10,000 units (2026 trend).

III. Estimated Price Tiers by MOQ: Smart Home Sensor (2026 Projections)

Includes agent fees (4–6% of order value), logistics, and compliance. Excludes tariffs.

| MOQ | White Label (WL) Unit Price | Private Label (PL) Unit Price | Key Cost Variables |

|---|---|---|---|

| 500 | $14.80 | Not feasible | WL: High per-unit markup (factory risk premium). PL: NRE prohibitive. |

| 1,000 | $11.65 | $14.90 | PL: NRE ($8,500) = $8.50/unit. WL: Volume discount kicks in. |

| 5,000 | $9.95 | $10.15 | PL becomes cost-competitive (NRE = $1.70/unit). WL: Diminishing returns. |

| 10,000 | $8.75 | $8.90 | PL: NRE negligible ($0.85/unit). WL: Max volume discount. |

Footnotes:

– WL prices include 15–20% factory markup for branding/IP.

– PL prices assume agent-led value engineering (e.g., material substitution saving $0.40/unit).

– MOQ <1,000 for PL requires NRE prepayment; top agents secure phased payment terms.

IV. Selecting the “Best” Sourcing Agent in 2026: 3 Non-Negotiables

- Cost Transparency Protocol: Agents must provide itemized cost breakdowns (material invoices, labor logs) – not just “factory quotes.” Verify with 3rd-party audits.

- PL Value Engineering Capability: Proven track record in reducing COGS via design-for-manufacturing (DFM) – e.g., consolidating components to cut assembly time by 22% (2025 client case).

- Compliance Firewall: Real-time monitoring of factory certifications (BSCI, ISO 13485) and pre-shipment regulatory testing (e.g., FCC, UKCA). Avoid agents using “self-certified” factories.

2026 Warning: 68% of “low-cost” agents fail to disclose hidden costs (e.g., container detention fees, rework from poor QC). Demand a total landed cost model before engagement.

Conclusion: The 2026 Sourcing Imperative

White Label suits rapid market testing with minimal capital, but Private Label delivers superior ROI for committed brands once MOQ exceeds 5,000 units. The optimal agent acts as a cost engineer—not a transactional broker—by deconstructing COGS drivers and embedding compliance into the supply chain. In 2026, procurement leaders who leverage agents for strategic cost optimization (not just price negotiation) achieve 18–22% lower TCO vs. direct factory sourcing.

Next Step: Request SourcifyChina’s 2026 Cost Engineering Toolkit (free for procurement managers) featuring:

– Dynamic COGS calculator (adjust for materials/labor inflation)

– Agent vetting scorecard with 12 critical checkpoints

– PL/WL decision flowchart for 8 major product categories

SourcifyChina: Verified Manufacturing Partners. Zero Margin Markup. Data-Driven Sourcing.

Disclaimer: Estimates based on 2025–2026 industry benchmarks (SourcifyChina Intelligence, CRU Group, China Customs). Actual costs vary by product complexity, region, and agent capability. Always validate with pilot orders.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Identify the Best Sourcing Agents

Executive Summary

As global supply chains continue to shift toward cost efficiency and supply chain resilience, China remains a pivotal sourcing destination. However, the complexity of distinguishing genuine manufacturers from trading companies—and identifying trustworthy sourcing agents—poses strategic risks. This report outlines a structured verification process, key differentiators between factory and trading entities, and red flags to mitigate procurement risk in 2026.

I. Critical Steps to Verify a Manufacturer in China

A rigorous due diligence process is essential to ensure supplier authenticity, production capability, and compliance. Follow this 7-step verification framework:

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Validate Business Registration | Confirm legal existence and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS), third-party platforms (e.g., TofuDeluxe, Alibaba Check) |

| 2 | Conduct On-Site Audit (or Virtual Audit) | Verify physical facility, production lines, and workforce | Hire independent third-party inspectors (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit partners |

| 3 | Review Export Documentation | Validate export capabilities and past international trade | Request export license, past B/L copies (redacted), or customs data via ImportGenius or Panjiva |

| 4 | Assess Production Capacity & Equipment | Ensure alignment with order volume and quality standards | Request factory layout, machine list, production schedule, and shift patterns |

| 5 | Verify Certifications | Ensure compliance with international standards | Confirm ISO 9001, BSCI, SEDEX, RoHS, or industry-specific certifications (e.g., FDA, CE) |

| 6 | Request Client References & Case Studies | Evaluate track record and reliability | Contact 2–3 past international clients; verify references independently |

| 7 | Perform Sample Quality & Timeline Test | Assess product quality, responsiveness, and lead time | Place a small trial order (MOQ or below) with strict delivery and QC terms |

Best Practice: Integrate verification into a Supplier Risk Scorecard (SRS) to benchmark and compare potential partners objectively.

II. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced transparency, and supply chain opacity. Use the following criteria to differentiate:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trade,” or “sales” without production terms |

| Facility Access | Allows factory tours; shows production lines, raw materials, QC labs | May refuse access or show showroom only |

| Pricing Structure | Quotes based on material + labor + overhead; lower margins | Higher markups; pricing often bundled with logistics or “agent fees” |

| Lead Time Control | Directly controls production timeline | Dependent on third-party factories; longer or variable lead times |

| Engineering & R&D Capability | In-house engineers, tooling, mold development | Limited or no design input; relies on factory for revisions |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup and batch production | Often higher MOQs due to intermediary margins |

| Communication Depth | Technical staff available; detailed process explanations | Sales-focused; limited technical insight |

Pro Tip: Factories often have Chinese domain names (e.g.,

.cn) and local phone numbers. Trading companies may use.com, have English-only websites, and list multiple unrelated product lines.

III. Red Flags to Avoid When Selecting a Sourcing Agent or Manufacturer

Avoid high-risk partnerships by monitoring these warning signs:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video calls or factory tours | Likely not a real factory or hides operational deficiencies | Require live video walkthrough with real-time Q&A |

| Extremely low pricing vs. market average | Risk of substandard materials, hidden fees, or scams | Benchmark prices using SourcifyChina’s 2026 Cost Database |

| No verifiable references or NDAs blocking contact | Lack of transparency and accountability | Insist on third-party client verification or drop the supplier |

| Pressure to pay 100% upfront | High fraud risk; no performance accountability | Enforce 30% deposit, 70% against BL copy or inspection report |

| Vague or generic product certifications | Non-compliant products; risk of customs rejection | Request original certification documents with QR verification |

| Agent represents too many unrelated product categories | Likely a trader with no domain expertise | Prefer specialized agents with industry-specific experience |

| Poor English communication or delayed responses | Indicates weak project management and scalability issues | Assess responsiveness over a 72-hour trial period |

IV. What Makes the “Best Sourcing Agents in China” (2026 Benchmark)

Top-tier sourcing agents act as transparent extensions of your procurement team. Key differentiators include:

- ✅ Factory Ownership or Exclusive Partnerships – Direct control or long-term contracts with vetted factories

- ✅ Transparent Cost Breakdowns – Itemized quotes (material, labor, overhead, markup)

- ✅ In-Country Engineering Support – On-the-ground QA, design for manufacturability (DFM) input

- ✅ Compliance & Audit Trail – Full documentation, inspection reports, and corrective action plans

- ✅ Client-Centric KPIs – Measured on on-time delivery, defect rate, and cost savings (not just order volume)

SourcifyChina Insight: In 2026, leading agents are integrating AI-driven supplier monitoring and blockchain-based PO tracking to enhance transparency.

Conclusion & Recommendations

To de-risk sourcing from China in 2026, procurement managers must prioritize verification, specialization, and transparency. Avoid shortcuts in supplier vetting. Use structured audits, validate factory status rigorously, and partner only with agents who operate with full disclosure.

Recommended Actions:

- Adopt a Supplier Verification Checklist based on this report.

- Engage only sourcing partners who provide factory audit reports and real-time production updates.

- Run a pilot order before scaling to mitigate financial and operational risk.

- Leverage third-party verification services for high-value or regulated products.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

Qingdao, China | sourcifychina.com | Q2 2026 Edition

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Outlook: Strategic Advantage Through Verified Partner Networks

Prepared for Global Procurement Leadership | Q1 2026

The Critical Time Drain in China Sourcing (2026 Data)

Global procurement teams continue to face unsustainable inefficiencies in agent selection. Our 2026 industry benchmark study reveals:

| Process Stage | Avg. Hours Spent (Unverified Agents) | Avg. Hours Spent (SourcifyChina Pro List) | Time Saved |

|---|---|---|---|

| Initial Vetting | 38.5 | 3.2 | 92% |

| Contract Negotiation | 22.1 | 8.7 | 61% |

| Quality Assurance Setup | 17.3 | 4.1 | 76% |

| TOTAL PER PROJECT | 77.9 | 16.0 | 79% |

Source: SourcifyChina Global Procurement Efficiency Index (2026), n=427 enterprises

Why the Pro List Eliminates 79% of Sourcing Delays

1. Pre-Validated Compliance & Capability

– Agents undergo 12-point verification: Business license authenticity, factory audit history, financial health, and 3+ years of verified client performance data. No more chasing certificates or dubious claims.

2. Risk-Adjusted Matching

– AI-driven pairing based on your product complexity, order volume, and quality thresholds. Avoids misaligned agent assignments (the #1 cause of project delays per 2026 Gartner data).

3. Transparent Performance Dashboards

– Real-time access to agent KPIs: On-time delivery (98.2% avg.), defect resolution speed (<72 hrs), and communication responsiveness. Eliminates “black box” agent management.

“Using SourcifyChina’s Pro List cut our new supplier onboarding from 14 weeks to 9 days. We now redirect 120+ annual hours to strategic cost engineering.”

— Director of Global Sourcing, Fortune 500 Industrial Manufacturer (2025 Client)

Your Strategic Next Step: Claim Your Verified Agent Match

In 2026’s volatile supply chain landscape, time is your scarcest resource. Every hour spent vetting unreliable agents erodes margin and delays time-to-market. SourcifyChina’s Pro List isn’t just a directory—it’s your guaranteed acceleration path to:

✅ Zero-risk agent deployment (backed by our $50k Verification Guarantee)

✅ 83% faster project launch vs. industry benchmarks

✅ Predictable quality outcomes with audited agent performance

Act Now to Secure Q2 2026 Capacity

Procurement leaders who engage before March 31, 2026 receive:

– Priority access to our top 10% “Elite Tier” agents (limited availability)

– Complimentary supply chain resilience audit ($2,500 value)

→ Contact SourcifyChina Within 24 Business Hours:

📧 [email protected] (Quote Priority Code: PRO2026)

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Don’t gamble with unverified partners. Let SourcifyChina deploy your pre-qualified China sourcing agent—guaranteed operational by April 15, 2026.

SourcifyChina: Verified. Accelerated. Guaranteed.

Trusted by 1,200+ Global Brands | ISO 9001-Certified Sourcing Framework | 2026 Sourcing Excellence Award Recipient

🧮 Landed Cost Calculator

Estimate your total import cost from China.