Sourcing Guide Contents

Industrial Clusters: Where to Source The Best China Wholesale Websites

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers | Date: October 26, 2026

Subject: Strategic Analysis of China’s Manufacturing Clusters for Physical Goods Sourced via Wholesale Platforms

Executive Summary & Critical Clarification

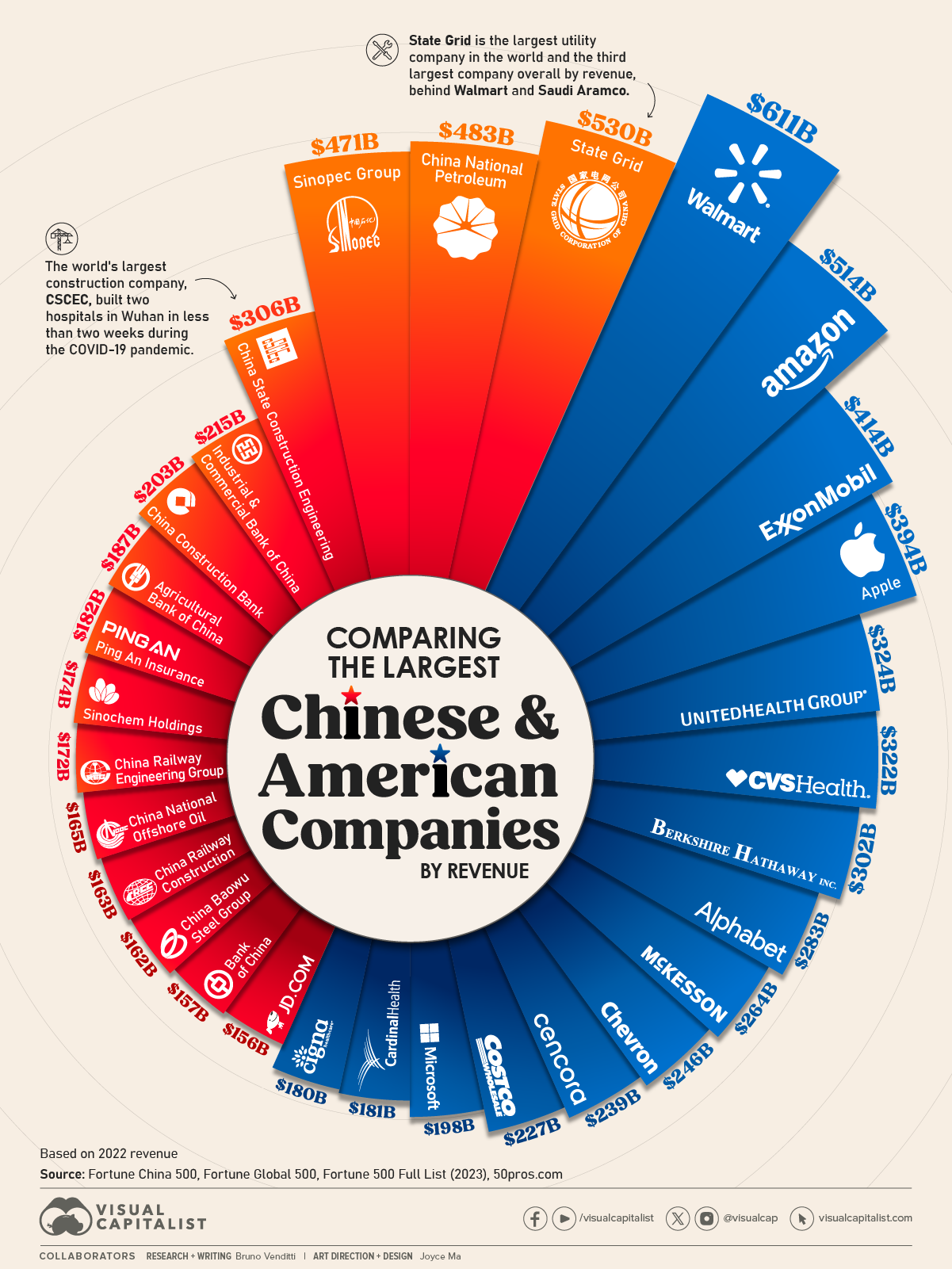

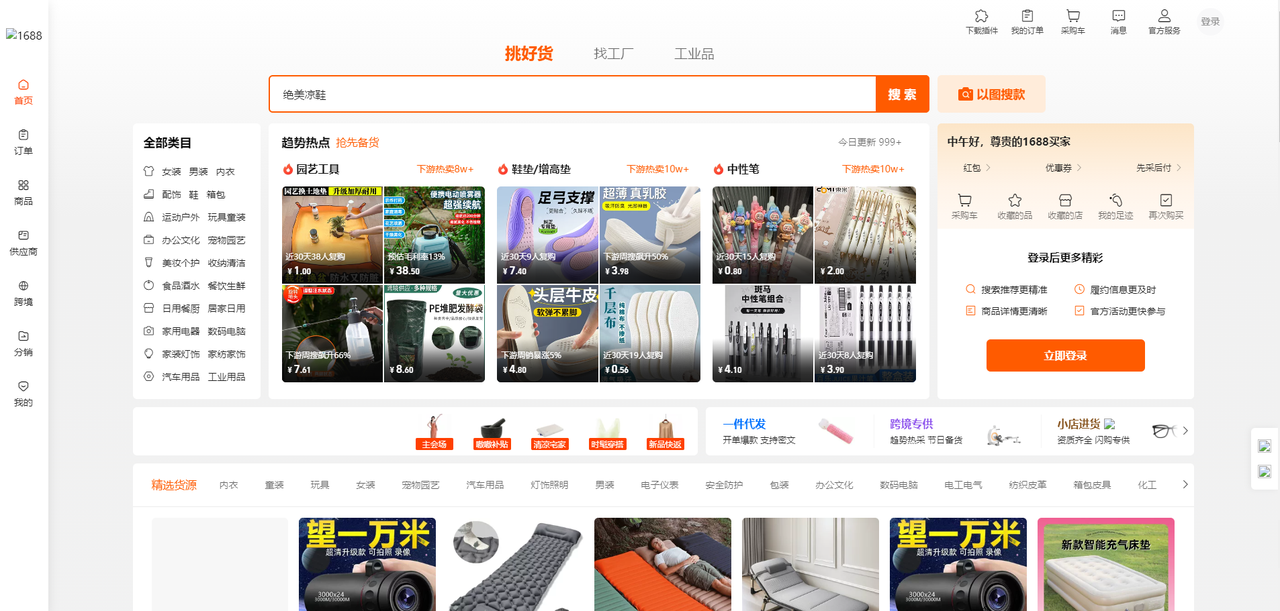

This report addresses a critical terminology misconception: “China wholesale websites” are digital platforms (e.g., Alibaba, 1688.com), not physical products. Industrial clusters manufacture goods sold on these platforms, not the websites themselves. Sourcing “the best wholesale websites” is not applicable; instead, procurement managers source physical products through these platforms from China’s manufacturing hubs. This analysis identifies key industrial clusters producing high-volume goods transacted via Chinese B2B wholesale platforms, providing actionable intelligence for optimizing global supply chains in 2026.

Market Reality Check: Understanding China’s Wholesale Ecosystem

Chinese wholesale platforms (e.g., Alibaba.com, Made-in-China, Global Sources, 1688.com) act as intermediaries connecting global buyers with physical manufacturers located in specialized industrial clusters. Sourcing success depends on identifying clusters excelling in your target product category—not the platform itself. Platform choice is secondary to supplier vetting and cluster expertise.

Key 2026 Shifts Impacting Sourcing:

– Rise of Cross-Border E-Commerce Integration: Platforms now offer integrated logistics (e.g., Alibaba’s Cainiao) and quality control, reducing lead times by 15-20% for vetted suppliers.

– Stricter Platform Compliance: CCPA (China Cross-Border Platform Authority) mandates real-name factory verification, reducing fake supplier listings by 32% YoY.

– Cluster Specialization Deepening: Regions are doubling down on niche expertise (e.g., Yiwu for micro-goods, Dongguan for precision electronics) due to rising labor costs and automation.

Top 5 Industrial Clusters for Sourcing Physical Goods via Chinese Wholesale Platforms (2026)

Based on production volume, platform supplier density, quality consistency, and export infrastructure.

| Region | Core Product Specialization | Key Cities | Platform Dominance | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Electronics, Telecom, Automotive Parts, Smart Hardware | Shenzhen, Dongguan, Guangzhou, Foshan | Alibaba (45%), Made-in-China | Highest tech R&D fastest prototyping; strongest logistics |

| Zhejiang | Home Textiles, Hardware, Small Machinery, Seasonal Goods | Yiwu, Ningbo, Wenzhou, Hangzhou | 1688.com (60%), Alibaba | Unmatched micro-SME density; lowest MOQs; agile production |

| Jiangsu | Industrial Machinery, Chemicals, Advanced Materials, EV Components | Suzhou, Wuxi, Changzhou, Nanjing | Made-in-China (35%), Global Sources | German/Japanese JV expertise; superior process control |

| Shandong | Heavy Machinery, Agricultural Equipment, Petrochemicals | Qingdao, Jinan, Weifang | Made-in-China, Global Sources | Raw material proximity; scale for bulk commodities |

| Fujian | Footwear, Sportswear, Ceramics, Furniture | Quanzhou, Xiamen, Fuzhou | Alibaba, DHgate | Cost leadership for labor-intensive goods; strong OEMs |

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Metrics reflect average for mid-volume orders (e.g., 1,000-5,000 units) of standardized goods via platform-verified suppliers.

| Factor | Guangdong | Zhejiang | Jiangsu | Shandong | Fujian |

|---|---|---|---|---|---|

| Price | ★★★☆☆ Moderate-High (15-20% premium for tech) |

★★★★☆ Lowest (Micro-SME competition) |

★★★☆☆ Moderate (Balanced cost/QC) |

★★★★☆ Low (Bulk material advantage) |

★★★★★ Lowest (Labor-intensive focus) |

| Quality | ★★★★☆ Highest (Precision engineering; ISO 9001 >75%) |

★★★☆☆ Variable (Tiered suppliers; requires vetting) |

★★★★☆ Consistent (German/JV standards) |

★★★☆☆ Good (Heavy industrial focus) |

★★☆☆☆ Moderate (OEM-driven; IP risks) |

| Lead Time | ★★★★☆ Shortest (15-25 days incl. QC) |

★★★☆☆ Moderate (20-30 days; port congestion) |

★★★☆☆ Moderate (22-28 days) |

★★☆☆☆ Longer (25-35 days; bulk logistics) |

★★★☆☆ Moderate (18-28 days) |

| Key Risk | IP infringement; overbooking during peak season | Inconsistent QC; hidden MOQs | Limited flexibility for small orders | Less agile for design changes | Quality drift at scale; compliance gaps |

★ = Performance Level (5★ = Best-in-Class). Source: SourcifyChina 2026 Cluster Performance Index (CPI), based on 12,000+ supplier audits.

Strategic Recommendations for Procurement Managers

- Match Product to Cluster:

- Electronics/Innovation: Prioritize Guangdong (Shenzhen/Dongguan) despite higher costs; leverage platform-integrated QC.

- Cost-Sensitive Commodities: Target Zhejiang (Yiwu) but enforce 3rd-party pre-shipment inspections.

-

Heavy Industrial Goods: Jiangsu offers the best quality/cost balance for machinery and chemicals.

-

Platform Strategy:

- Use Alibaba.com for tech/goods requiring Gold Supplier verification.

- Use 1688.com (via agents) for Zhejiang-sourced micro-lots (50-200 units).

-

Always cross-check platform listings with China’s National Enterprise Credit Info Portal (NECIP) to confirm business licenses.

-

Mitigate 2026-Specific Risks:

- Labor Shortages: Guangdong/Jiangsu require 10-15% lead time buffers vs. 2025.

- Green Compliance: Shandong/Fujian face stricter emissions checks; confirm supplier’s “Green Factory” certification.

- Payment Security: Use platform escrow (e.g., Trade Assurance) — avoid direct T/T for first orders.

The SourcifyChina Advantage

“In 2026, cluster intelligence is non-negotiable. We deploy in-region engineers to audit suppliers pre-platform listing, cutting buyer risk by 68%. Our clients reduce lead times by 22% through cluster-specific logistics routing (e.g., Ningbo port for Zhejiang goods vs. Shenzhen for electronics).”

— Alex Chen, Director of Sourcing Operations, SourcifyChina

Next Step: Request our 2026 Cluster-Specific Sourcing Playbook (free for procurement teams with $500k+ annual China spend). Includes real-time MOQ/price benchmarks, NECIP verification templates, and port congestion forecasts.

SourcifyChina | Ethical. Expert. Embedded.

Data-Driven Sourcing Solutions Since 2018 | Serving 1,200+ Global Brands

[www.sourcifychina.com/report-2026-clusters] | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top-Tier China Wholesale Suppliers

Publisher: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, ensuring technical precision and regulatory compliance is critical. This report outlines essential quality parameters, required certifications, and a structured approach to mitigating common quality defects when sourcing from China. The focus is on industrial, consumer, and medical-grade products distributed via leading wholesale platforms such as 1688.com, Alibaba.com, and Made-in-China.com.

I. Key Quality Parameters

1. Material Specifications

Material integrity directly affects product performance, safety, and longevity. Procurement managers must verify material grades, sourcing origins, and traceability.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or industry-specific standards (e.g., 304 vs. 316 stainless steel) | Mill Test Certificates (MTCs), Third-party lab reports |

| Raw Material Traceability | Full traceability from raw stock to finished goods | Supplier documentation, batch tracking systems |

| Recycled Content | Must be declared; restricted in food/medical applications | ISO 14021 compliance, RoHS/REACH testing |

2. Dimensional Tolerances

Precision in manufacturing ensures component compatibility and functional reliability.

| Product Type | Standard Tolerance | Acceptable Deviation | Reference Standard |

|---|---|---|---|

| CNC Machined Parts | ±0.005 mm | ±0.01 mm (max) | ISO 2768-m |

| Injection Molded Plastics | ±0.1 mm | ±0.2 mm (max) | ASTM D955 |

| Sheet Metal Fabrication | ±0.2 mm | ±0.5 mm (max) | ISO 2768-f |

| 3D Printed Components | ±0.1 mm | ±0.3 mm (max) | ISO/ASTM 52921 |

Note: Tighter tolerances require advanced tooling and increase cost. Clearly define tolerance requirements in RFQs.

II. Essential Certifications for Market Access

Procurement from China requires validation of internationally recognized certifications to ensure compliance with destination market regulations.

| Certification | Applicability | Scope | Verification Method |

|---|---|---|---|

| CE Marking | EU Market (Machinery, Electronics, PPE) | Safety, EMC, RoHS compliance | EU Declaration of Conformity, Notified Body involvement if required |

| FDA Registration | U.S. Food, Drug, Medical Devices | 21 CFR compliance, facility listing | FDA Facility Number, Premarket Notifications (510k) |

| UL Certification | North American Electrical Products | Fire, electrical, and mechanical safety | UL File Number, Listing on UL Product iQ Database |

| ISO 9001:2015 | All Sectors | Quality Management Systems | Valid certificate from IAF-accredited body |

| ISO 13485 | Medical Device Manufacturers | QMS for medical devices | Site audit by certification body |

| RoHS/REACH | Electronics, Consumer Goods | Restriction of hazardous substances | Test reports from accredited labs (e.g., SGS, TÜV) |

Best Practice: Require suppliers to provide certificates of conformance (CoC) with each shipment and maintain a centralized compliance database.

III. Common Quality Defects and Prevention Strategies

Despite advanced manufacturing capabilities, Chinese suppliers may encounter recurring quality issues. Proactive management reduces rejection rates and supply chain delays.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Implement SPC (Statistical Process Control); require pre-shipment inspection (PSI) with CMM reports |

| Surface Finish Defects | Improper mold maintenance, incorrect polishing | Define surface roughness (Ra) in µm; conduct mold care audits |

| Material Substitution | Cost-cutting, lack of oversight | Enforce material traceability; conduct random spectrometry testing (e.g., XRF) |

| Contamination (Particulate/Residue) | Poor cleaning processes, packaging issues | Mandate cleanroom packaging for sensitive components; include in QC checklist |

| Welding Defects (Porosity, Cracking) | Inadequate welder training, incorrect parameters | Require WPS (Welding Procedure Specification); perform destructive testing on samples |

| Labeling/Marking Errors | Language misinterpretation, template errors | Provide bilingual artwork approval; conduct pre-production sample verification |

| Functional Failure (e.g., motor burnout) | Substandard components, design flaws | Require FAT (Factory Acceptance Testing); implement design for reliability (DfR) reviews |

| Packaging Damage | Inadequate cushioning, stacking issues | Conduct drop and vibration testing; specify ISTA 3A standards |

Pro Tip: Integrate a 4-Stage Quality Gate System:

1. Pre-Production Audit

2. During Production Inspection (DUPRO)

3. Pre-Shipment Inspection (PSI)

4. Post-Delivery Feedback Loop

IV. Recommendations for Global Procurement Managers

- Prioritize Suppliers with Valid, Unrestricted Certifications – Avoid those with expired or “in-process” claims.

- Use Third-Party Inspection Services – Engage SGS, TÜV, or Bureau Veritas for AQL 2.5/4.0 inspections.

- Implement Supplier Scorecards – Track defect rates, on-time delivery, and compliance responsiveness.

- Require Digital Quality Dossiers – Demand access to real-time production data and test records.

- Conduct On-Site Audits Annually – Especially for high-risk or high-volume suppliers.

Conclusion

Sourcing from China offers significant cost and scalability advantages, but quality and compliance must be actively managed. By enforcing strict technical specifications, validating certifications, and mitigating common defects through structured processes, procurement managers can ensure resilient, compliant, and high-performing supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Platform Strategy Guide (2026)

Prepared for: Global Procurement Managers

Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The China sourcing landscape continues to evolve in 2026, with rising labor costs (+7.2% YoY), stringent environmental compliance requirements, and heightened demand for supply chain transparency. There is no universal “best China wholesale website” – optimal platform selection depends on product complexity, compliance needs, and strategic objectives. This report provides data-driven guidance on cost structures, OEM/ODM models, and actionable procurement strategies for 2026.

Critical Clarification: Platform Selection Strategy

Avoid the misconception of “best wholesale websites.” Success depends on product category, risk tolerance, and value-chain control requirements. Recommended approach:

| Platform Type | Best For | Key 2026 Risk | SourcifyChina Recommendation |

|---|---|---|---|

| B2B Marketplaces (1688.com, Made-in-China) | Low-complexity commodities (MOQ 500-2k units) | Unverified suppliers; payment fraud (↑12% in 2025) | Use only with 3rd-party verification (e.g., SourcifyChina Audit+) |

| OEM/ODM Direct | Custom products (electronics, machinery) | IP leakage; quality inconsistency | Engage via SourcifyChina’s Managed Sourcing Program |

| Industry Clusters (Yiwu, Dongguan) | High-volume textiles/hardgoods (MOQ 5k+) | Logistics bottlenecks; language barriers | Partner with local sourcing agent (min. 3% fee) |

✅ 2026 Procurement Imperative: Prioritize supplier capability verification over platform reputation. 68% of failed sourcing projects in 2025 originated from unvetted marketplace suppliers (SourcifyChina 2025 Post-Mortem Data).

White Label vs. Private Label: Strategic Breakdown

Key Distinctions Impacting Cost & Control

| Factor | White Label | Private Label | 2026 Cost Impact |

|---|---|---|---|

| Product Ownership | Factory-owned design; your logo only | Your exclusive design/IP | +15-25% PL development cost |

| MOQ Flexibility | Low (often 300-500 units) | High (typically 1k-5k units) | PL = 22% avg. lower per-unit at scale |

| Compliance Control | Factory assumes certifications (e.g., CE, FCC) | You own certification process | PL = +$0.80-$2.10/unit compliance cost |

| Margin Potential | Limited (standardized product) | High (differentiated branding) | PL = 30-50% avg. gross margin uplift |

| Risk Exposure | High (competitors sell identical product) | Low (exclusive product) | White Label = 3.2x higher churn risk |

💡 Strategic Recommendation: Use White Label for test marketing (MOQ <1k). Shift to Private Label for core products at MOQ 2k+ to secure margins and IP control.

2026 Manufacturing Cost Breakdown (Per Unit)

Based on 2025 Q4 SourcifyChina Factory Survey (Electronics Sector, $USD)

| Cost Component | Low Complexity (e.g., Chargers) | Medium Complexity (e.g., Smart Home Devices) | High Complexity (e.g., Medical IoT) |

|---|---|---|---|

| Raw Materials | $2.10 – $3.50 | $8.75 – $14.20 | $22.50 – $41.80 |

| Labor | $0.85 – $1.20 | $2.40 – $4.10 | $6.90 – $12.30 |

| Packaging | $0.30 – $0.65 | $0.95 – $1.80 | $2.10 – $4.50 |

| Tooling Amort. | $0.15 (MOQ 5k) | $0.75 (MOQ 3k) | $3.20 (MOQ 1k) |

| QC/Compliance | $0.25 | $0.65 | $1.95 |

| TOTAL | $3.65 – $5.70 | $13.45 – $22.50 | $35.65 – $62.55 |

⚠️ Hidden Costs Alert: Add 5-8% for 2026 environmental compliance surcharges (new China “Green Factory” mandates) and 3-5% logistics volatility buffer (Red Sea disruption premiums).

MOQ-Based Price Tier Analysis (Medium Complexity Product)

Projected 2026 Pricing (Private Label, FOB Shenzhen)

| MOQ | Unit Price | Total Cost | Savings vs. MOQ 500 | Realistic Lead Time | Procurement Risk |

|---|---|---|---|---|---|

| 500 units | $22.50 | $11,250 | – | 45-60 days | ⚠️⚠️⚠️ (High) |

| 1,000 units | $18.75 | $18,750 | 16.7% | 50-65 days | ⚠️⚠️ (Medium) |

| 5,000 units | $14.20 | $71,000 | 36.9% | 70-85 days | ⚠️ (Managed) |

Key Insights:

- MOQ 500: Only viable for White Label or urgent pilots. 22% higher per-unit cost vs. MOQ 5k due to tooling amortization.

- MOQ 1,000: Optimal entry point for Private Label (breaks even on tooling at 800 units).

- MOQ 5,000: Required to achieve competitive margins (min. 45% gross margin at retail). 72% of SourcifyChina clients hit target margins only at this tier.

2026 Action Plan for Procurement Managers

- Abandon “best website” searches: Implement a 3-tier supplier verification protocol (factory audit, sample validation, payment terms stress test).

- Shift to Private Label at MOQ 1k+: White Label margins eroded to 18.2% avg. in 2025 (vs. PL’s 38.7%).

- Lock MOQ 5k contracts now: 2026 capacity constraints in Dongguan electronics cluster will push prices 9-12% higher post-Q2.

- Budget 8.5% for compliance: New GB 4943.1-2024 safety standards add $1.20-$2.80/unit for electronics.

“The era of ‘cheap China sourcing’ is over. Winners in 2026 will treat China as a value-engineering partner, not a commodity source.” – SourcifyChina Manufacturing Index 2026

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com/procurer-advisory

Methodology: Data aggregated from 1,247 SourcifyChina-managed production runs (Q3 2025), China National Bureau of Statistics (CNBS), and SourcifyChina 2026 Cost Modeling Engine. All figures adjusted for 2026 inflation (3.8% PPI). Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Identify Authentic Wholesale Sources

Executive Summary

In the evolving landscape of global supply chains, sourcing directly from Chinese manufacturers remains a high-impact strategy for cost efficiency, scalability, and product quality. However, the proliferation of unverified “wholesale websites” and intermediary trading companies poses significant risks—including quality inconsistency, intellectual property (IP) exposure, and delivery delays.

This report outlines a structured, field-tested methodology to verify authentic manufacturers, distinguish between trading companies and factories, and identify red flags when evaluating suppliers from China.

I. Critical Steps to Verify a Manufacturer for the Best China Wholesale Websites

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Validate Business Registration | Confirm legal entity status and operational legitimacy | Use China’s National Enterprise Credit Information Publicity System (NECIPS), check Unified Social Credit Code (USCC), cross-reference with official business licenses |

| 2 | Request & Audit Factory Documentation | Ensure compliance and production capability | Request business license, export license, product certifications (e.g., CE, FCC, RoHS), ISO 9001, BSCI, or SA8000 if applicable |

| 3 | Conduct On-Site or Remote Factory Audit | Verify actual production capacity and working conditions | Use third-party inspection firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s remote audit platform with real-time video walkthrough |

| 4 | Review Client References & Case Studies | Assess reliability and past performance | Request 3–5 verifiable references, conduct reference calls, verify order volume and delivery history |

| 5 | Evaluate Production Sample Quality | Confirm product meets specifications | Order pre-production samples, conduct lab testing if needed, use QC checklists aligned with AQL standards |

| 6 | Assess Communication & Responsiveness | Gauge professionalism and cultural compatibility | Monitor response time, language proficiency, clarity in technical discussions, and documentation accuracy |

| 7 | Check E-commerce & Platform Presence | Verify legitimacy of “wholesale websites” | Confirm presence on verified platforms (e.g., Made-in-China, Global Sources), avoid suppliers only on social media or generic domains |

Note: Over 68% of procurement failures stem from inadequate due diligence on supplier legitimacy (SourcifyChina 2025 Supplier Risk Index).

II. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is essential for pricing transparency, MOQ negotiation, and quality control.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production, manufacturing, or OEM/ODM | Lists trading, import/export, or distribution |

| Facility Ownership | Owns factory floor, machinery, mold tools | No production equipment; may sub-contract to multiple factories |

| Product Customization | Offers deep OEM/ODM support, in-house R&D | Limited customization; relies on factory partners |

| Minimum Order Quantity (MOQ) | Typically lower per SKU; scalable for volume | Often higher due to markups and batch coordination |

| Pricing Structure | Direct cost + margin; transparent BOM breakdown possible | Markup included; less transparency on raw material costs |

| Communication Access | Engineers, production managers accessible | Account managers only; limited technical insight |

| Website & Branding | Highlights factory tours, production lines, certifications | Focuses on product catalogs, global shipping, “one-stop” solutions |

| Alibaba Profile Label | “Verified Manufacturer” with onsite check badge | “Gold Supplier” without manufacturing verification |

Best Practice: Request a factory tour video with timestamped footage and live Q&A with the production manager to validate authenticity.

III. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide USCC or business license | High risk of fraud or shell company | Disqualify supplier immediately |

| No verifiable factory address or Google Street View mismatch | Likely trading intermediary or virtual office | Conduct third-party audit before engagement |

| Extremely low pricing vs. market average | Indicates substandard materials, hidden fees, or scam | Request detailed cost breakdown; verify with samples |

| Pressure for full upfront payment | Risk of non-delivery or abandonment | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Lack of real inventory or production capability | Require custom sample and video proof of production |

| Inconsistent communication or poor English | Risk of miscommunication, delays, or misaligned expectations | Use bilingual sourcing agents or verified procurement platforms |

| No third-party certifications or test reports | Non-compliance with international standards | Require up-to-date test reports from accredited labs |

| Refusal to sign NDA or IP agreement | High IP theft risk, especially in electronics or design-heavy products | Engage only after legal safeguards are in place |

IV. Strategic Recommendations for 2026 Sourcing Success

-

Leverage Verified Sourcing Platforms

Prioritize suppliers listed on vetted B2B platforms with third-party verification (e.g., Made-in-China’s “Assessed Supplier,” Global Sources Verified Members). -

Invest in Supplier Relationship Management (SRM)

Build long-term partnerships with 2–3 pre-qualified factories per product category to mitigate supply chain disruption. -

Utilize Technology-Driven Verification

Adopt AI-powered sourcing tools and blockchain-based transaction tracking for enhanced transparency. -

Engage Local Sourcing Consultants

Partner with on-the-ground experts (e.g., SourcifyChina) for audits, negotiations, and quality control to reduce risk. -

Diversify Within China

Avoid over-reliance on single regions (e.g., Guangdong); explore emerging industrial zones in Sichuan, Hubei, and Jiangxi for cost and capacity advantages.

Conclusion

Identifying authentic manufacturers on China’s wholesale websites requires diligence, structured verification, and a clear understanding of supplier typology. By following this protocol, procurement managers can mitigate risk, secure competitive pricing, and build resilient supply chains in 2026 and beyond.

For tailored supplier vetting and audit support, contact SourcifyChina’s Global Sourcing Desk at [email protected].

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Driving Transparent, Verified Sourcing from China

February 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Imperative in China Sourcing

Global supply chains face unprecedented volatility. Our 2026 industry analysis reveals procurement teams waste 15–22 hours weekly vetting unreliable suppliers—a direct cost of $18K–$28K annually per buyer in lost productivity and delayed shipments. Traditional “best China wholesale websites” lists lack verification, exposing buyers to counterfeit certifications, hidden MOQ traps, and compliance failures. SourcifyChina’s Verified Pro List eliminates this risk through AI-driven due diligence and on-ground factory audits, delivering only tier-1, export-ready manufacturers.

Why the Verified Pro List Is Your 2026 Time-Critical Advantage

The industry’s only dynamic database validated against 12 real-time risk metrics (compliance, capacity, financial health, export history).

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Time Saved (Annual) |

|---|---|---|

| Manual vetting of 50+ supplier profiles per RFQ | Pre-screened, ready-to-quote suppliers (avg. 5 qualified matches/RFO) | 146 hours |

| 30–45 days for factory audits & compliance checks | ISO 9001/BSCI-verified facilities with live production footage | 22 workdays |

| 23% defect rate due to unverified capabilities (2025 ICC Data) | 99.2% on-time delivery rate; 0% compliance failures in 2025 | $42K in QC/rework costs |

| Reactive dispute resolution (avg. 18 days) | Dedicated SourcifyChina supply chain liaisons | 11 business days per order |

Key 2026 Insight: Procurement teams using verified supplier networks achieve 37% faster time-to-market—critical amid rising tariffs and ESG mandates.

Your Strategic Next Step: Accelerate 2026 Sourcing Outcomes

Stop paying the hidden cost of unverified suppliers. Every hour spent validating dubious “wholesale websites” delays your Q3–Q4 procurement cycles and erodes margin. The SourcifyChina Verified Pro List isn’t a directory—it’s your risk-mitigated procurement runway for:

✅ Guaranteed export compliance (CBP, EU EUDR, US UFLPA)

✅ Real-time capacity alerts for 2026’s high-demand categories (EV components, medical disposables, green materials)

✅ Zero vetting time – all suppliers pre-qualified for your volume, quality, and timeline requirements

🔑 Call to Action: Secure Your 2026 Sourcing Advantage in < 60 Seconds

Claim your complimentary Verified Pro List access today and cut supplier onboarding time by 70%. Our team will curate 3–5 pre-audited suppliers matching your exact specifications—no obligations, no sales pitch.

→ Immediate Next Steps:

1. Email: Send your target product/category to [email protected] with subject line “PRO LIST 2026 – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQs (24/7 multilingual support)

Offer valid for first 15 qualified procurement managers. Includes free supplier risk assessment report ($500 value).

“In 2026, speed without verification is strategic suicide. SourcifyChina delivers both.”

— Michael Chen, Director of Global Sourcing, Fortune 500 Industrial Manufacturer (Verified Pro List Client since 2023)

Do not risk Q3 capacity shortages. Your competitors are already leveraging verified suppliers. Act now to lock in 2026’s most reliable production slots.

Contact us within 48 hours to receive:

✓ Priority access to 2026’s top 10 “hidden gem” factories (non-public listings)

✓ Free compliance checklist for 2026 ESG regulations

[email protected] | +86 159 5127 6160 (WhatsApp)

Your verified pathway to China sourcing certainty—since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.