The global flame retardant textiles market is experiencing robust growth, driven by increasing safety regulations, rising demand from industries such as construction, automotive, and protective apparel, and growing awareness of fire hazards in both residential and commercial environments. According to Grand View Research, the global flame retardant textiles market size was valued at USD 7.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. This expansion is further supported by stringent fire safety codes in public buildings and transportation sectors, particularly in North America and Europe. As regulatory pressure intensifies and innovation in chemical treatments advances, manufacturers are focusing on developing eco-friendly, durable, and high-performance flame retardant solutions. In this evolving landscape, a select group of textile flame retardant manufacturers are leading the charge through technological expertise, global supply chain integration, and strategic R&D investments—positioning themselves at the forefront of industry innovation and market share growth.

Top 10 Textile Flame Retardant Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Marina Textil

Domain Est. 2007 | Founded: 1995

Website: marinatextil.com

Key Highlights: Since 1995, manufacturing flame retardant fabrics for personal protective clothing. Weaving, Bonding & Upcycling Solutions. Customize your protection solution….

#2 Nomex® Fibers

Domain Est. 1987

Website: dupont.com

Key Highlights: Nomex is an inherently flame-resistant, high-temperature resistant fiber that will not melt, drip, or support combustion in air….

#3 Flame

Domain Est. 1994

Website: milliken.com

Key Highlights: Milliken is committed to developing flame-resistant fabrics without the use of PFAS chemistries, ensuring safer solutions for high-risk industries. As the first ……

#4 Solutions

Domain Est. 1995

Website: albemarle.com

Key Highlights: Albemarle’s additives can help significantly reduce the flammability of fibers and fabrics. Flame retardants can be applied to textile fibers or fabrics during ……

#5 Fire (Flame) Retardants

Domain Est. 1995

Website: rosebrand.com

Key Highlights: Fire (Flame) Retardants … We’re happy to guide your choices of fabrics and flame retardant (FR) chemicals to promote the safety of you and your audience….

#6 Leader in FR/AR Protective Fabric

Domain Est. 1996

Website: westex.com

Key Highlights: Westex® creates flame-resistant and arc-rated (FR/AR) textiles recognized for unmatched quality, comfort and proven performance. With a legacy dating back ……

#7 Firetect

Domain Est. 1998

Website: firetect.com

Key Highlights: Firetect Manufacturing is certified for application in New York City and California of flame and fire retardants products for textile fabric, wood, hay, ……

#8 Durable and Soft Flame

Domain Est. 1998

Website: hermin.com

Key Highlights: International flame retardant testing standards. The index used to assess the fire resistance of general flame-resistant textiles is called the Limit of Oxygen ……

#9 Flame retardants meet specific product requirements

Domain Est. 1998

Website: stahl.com

Key Highlights: Key benefits of Stahl Flame Retardants. Our full life cycle of flame-retardant solutions has been evaluated from initial production through recycling at the end ……

#10 Mount Vernon FR

Domain Est. 2011

Website: mvmfr.com

Key Highlights: Cotton-Rich Flame Resistant Fabrics. Mount Vernon FR gives you the most choices in comfortable, cotton-rich FR fabrics made in the U.S.A. Cotton-rich fabrics ……

Expert Sourcing Insights for Textile Flame Retardant

H2: Market Trends in Textile Flame Retardants Anticipated for 2026

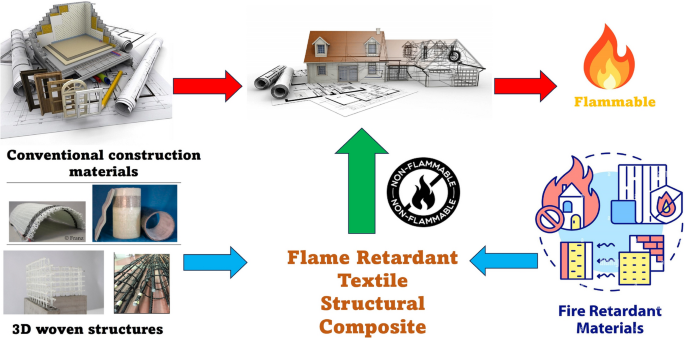

The global textile flame retardant market is poised for significant transformation by 2026, driven by evolving safety regulations, technological innovation, and shifting consumer preferences across key end-use industries. Several key trends are expected to shape the market landscape in the coming years.

1. Stricter Regulatory Standards Driving Demand

One of the primary drivers of growth in the textile flame retardant sector by 2026 is the tightening of fire safety regulations in construction, transportation, and consumer goods. Governments and regulatory bodies—particularly in North America and Europe—are enforcing stringent flammability standards for textiles used in public spaces, residential buildings, and vehicles. For instance, the EU’s Construction Products Regulation (CPR) and U.S. CPSC standards are pushing manufacturers to adopt compliant flame-retardant fabrics, thereby increasing demand for high-performance additives.

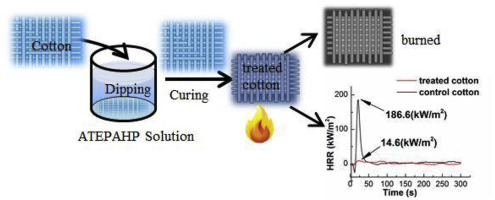

2. Shift Toward Environmentally Friendly and Halogen-Free Solutions

Environmental and health concerns surrounding traditional halogenated flame retardants—such as polybrominated diphenyl ethers (PBDEs)—are accelerating the transition toward eco-friendly alternatives. By 2026, market demand is expected to favor non-halogenated, bio-based, and inherently flame-resistant materials. Phosphorus-based, nitrogen-based, and mineral flame retardants (e.g., aluminum trihydrate and magnesium hydroxide) are gaining traction due to their lower toxicity and improved biodegradability. Regulatory bans and consumer preference for sustainable textiles are pushing R&D investments in green flame-retardant chemistries.

3. Growth in Protective and Technical Textiles

The rising need for personal protective equipment (PPE) in industrial, military, and emergency response sectors is fueling demand for flame-retardant textiles. In sectors such as oil & gas, electrical utilities, and firefighting, compliance with safety standards like NFPA 2112 and EN ISO 11612 is mandatory. By 2026, the expansion of these industries—particularly in emerging economies—will continue to drive the adoption of high-performance flame-retardant fabrics.

4. Innovation in Nanotechnology and Durable Finishes

Advancements in nanotechnology are enabling the development of durable, lightweight, and multifunctional flame-retardant coatings. Nanocomposites, such as layered double hydroxides (LDHs) and carbon nanotubes, offer improved thermal stability and char formation without compromising fabric comfort. Additionally, durable flame-retardant finishes that withstand repeated washing are becoming critical in applications like workwear and home furnishings. These innovations are expected to be commercialized at scale by 2026, enhancing product performance and lifespan.

5. Regional Market Dynamics

Asia-Pacific is projected to dominate the textile flame retardant market by 2026, led by rapid industrialization, urbanization, and government infrastructure projects in countries like China, India, and Southeast Asia. The region’s growing automotive and construction sectors are significant contributors to demand. Meanwhile, North America and Europe will remain strong markets due to robust regulatory frameworks and high consumer awareness, though growth may be tempered by market maturity.

6. Supply Chain Resilience and Raw Material Volatility

Ongoing challenges related to the supply of key raw materials—such as antimony trioxide and brominated compounds—due to geopolitical tensions and environmental policies may impact production costs. As a result, manufacturers are increasingly investing in localized production and alternative chemistries to ensure supply chain stability by 2026.

Conclusion

By 2026, the textile flame retardant market will be characterized by a strong emphasis on sustainability, regulatory compliance, and performance innovation. Companies that invest in eco-friendly formulations, advanced material science, and application-specific solutions are likely to gain competitive advantage. As safety standards become more rigorous and consumer expectations evolve, the integration of flame retardancy into mainstream textile production will become increasingly essential across global markets.

Common Pitfalls in Sourcing Textile Flame Retardants (Quality and IP)

Sourcing effective and compliant textile flame retardants requires careful attention to both quality consistency and intellectual property (IP) risks. Overlooking these areas can lead to product failures, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Performance and Durability

Flame retardant performance must remain consistent across batches and throughout the product lifecycle (e.g., after washing, UV exposure, or aging). Sourcing from suppliers without rigorous quality control can result in variable chemical formulations, leading to inconsistent flame resistance. This increases the risk of non-compliance with safety standards such as NFPA 701, CAL TB 117, or EN 13501.

Lack of Compatibility with Fabric and Dyeing Processes

Flame retardants may interact negatively with specific fibers, dyes, or finishing treatments, causing reduced efficacy, fabric degradation, or discoloration. Failing to verify compatibility during the sourcing phase can result in costly reprocessing or rejected batches.

Insufficient Testing and Certification Documentation

Suppliers may provide incomplete or outdated test reports. Relying on generic data without verified, batch-specific certifications (e.g., ISO, OEKO-TEX, or third-party lab results) exposes buyers to compliance risks, especially when entering regulated markets.

Use of Hazardous or Restricted Substances

Some flame retardants contain chemicals restricted under regulations like REACH, RoHS, or Prop 65 (e.g., certain brominated compounds or formaldehyde releasers). Sourcing without thorough substance screening can lead to legal liability, import denials, or consumer backlash.

Intellectual Property-Related Pitfalls

Unlicensed Use of Patented Technologies

Many advanced flame retardant chemistries are protected by patents. Sourcing a generic version without verifying freedom-to-operate can expose the buyer to infringement claims, especially if the supplier is using proprietary formulations without authorization.

Ambiguous Supplier IP Ownership or Licensing Terms

Suppliers may not clearly disclose whether they own the IP for their formulation or are sub-licensing it. This lack of transparency can disrupt supply chains if the underlying licensor terminates agreements or if geographic usage restrictions apply.

Reverse Engineering Risks and Trade Secret Exposure

Attempting to replicate a flame retardant formulation based on a sourced product may inadvertently infringe on trade secrets or patented processes. This is particularly risky when collaborating with contract manufacturers or testing labs without proper confidentiality safeguards.

Inadequate Contractual Protections

Procurement agreements often overlook IP clauses, such as indemnification for infringement, rights to use formulations, or restrictions on resale. Without these, buyers may have limited recourse if legal issues arise post-purchase.

Mitigating these pitfalls requires due diligence: vetting suppliers’ quality systems, demanding full compliance documentation, conducting independent testing, and engaging legal counsel to review IP rights and licensing terms before finalizing sourcing agreements.

Logistics & Compliance Guide for Textile Flame Retardant

Regulatory Classification and Labeling

Textile flame retardants are often classified as hazardous chemicals under international and regional regulations. Proper classification according to the Globally Harmonized System (GHS) is essential. Common hazard classifications may include:

– Hazard Statements: H302 (Harmful if swallowed), H315 (Causes skin irritation), H317 (May cause allergic skin reaction), H319 (Causes serious eye irritation), H410 (Very toxic to aquatic life with long-lasting effects)

– Precautionary Statements: P261 (Avoid breathing dust/fume/gas/mist/vapors/spray), P273 (Avoid release to the environment), P280 (Wear protective gloves/protective clothing/eye protection/face protection)

– Label Elements: Must include pictograms (e.g., exclamation mark, health hazard, environment), signal word (e.g., “Warning” or “Danger”), and supplier identification

Ensure Safety Data Sheets (SDS) are available and compliant with local regulations such as REACH (EU), TSCA (USA), or other national requirements.

Packaging and Storage Requirements

- Use chemically compatible, leak-proof containers made of HDPE, lined steel, or other approved materials.

- Seals must be secure to prevent vapor release or contamination; closures should be tamper-evident.

- Store in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and incompatible materials (e.g., oxidizers, acids).

- Segregate from foodstuffs, animal feed, and personal care products.

- Indoor storage should include spill containment (e.g., bunds or pallets with 110% capacity).

Transportation Regulations

Transportation of flame retardant chemicals must comply with:

– IMDG Code (for sea freight): Classify under UN number (e.g., UN3082 for environmentally hazardous substances, liquid, n.o.s.) and proper shipping name.

– IATA DGR (for air freight): Subject to strict limitations; many flame retardants are forbidden or require special approval due to toxicity or environmental hazards.

– ADR/RID (for road/rail in Europe): Ensure proper packaging, labeling, and vehicle placarding based on hazard class.

– 49 CFR (U.S. DOT): Follow hazard class, packaging, marking, labeling, and documentation rules.

Use certified packaging meeting performance standards (e.g., UN-certified drums or jerricans). Mark packages with proper shipping name, UN number, hazard class, and orientation arrows.

Import/Export Documentation and Compliance

- Commercial Invoice & Packing List: Include full chemical name, CAS number, quantity, and value.

- Safety Data Sheet (SDS): Required in the destination country’s official language(s).

- Certificate of Analysis (CoA): May be requested by customs or regulatory bodies.

- Import Permits: Some countries (e.g., China, India, Brazil) require pre-approval or registration under chemical control laws (e.g., IEIRC, PRISQ).

- Export Controls: Verify if the substance is listed under dual-use or environmental agreements (e.g., Stockholm Convention on POPs).

Ensure compliance with destination country restrictions (e.g., EU REACH SVHC list, U.S. EPA TSCA Inventory, Japan ISHL).

Environmental and Safety Handling

- Implement secondary containment during loading/unloading to prevent soil or water contamination.

- Use closed systems or vapor control when transferring liquids.

- Prohibit open flames, sparks, or smoking in handling areas.

- Provide spill kits (absorbents, neutralizers, PPE) and train personnel in emergency response.

- Report accidental releases per local laws (e.g., U.S. CERCLA, EU Seveso III).

Worker Safety and Training

- Provide GHS-compliant training on chemical hazards and safe handling.

- Enforce use of PPE: chemical-resistant gloves (e.g., nitrile), safety goggles, face shields, and respirators if airborne exposure is possible.

- Conduct regular health monitoring if exposure limits (e.g., OSHA PELs, EU OELs) are approached.

- Maintain accessible SDS and emergency procedures onsite.

Waste Disposal and End-of-Life

- Dispose of waste and contaminated packaging as hazardous waste per local regulations (e.g., U.S. RCRA, EU Waste Framework Directive).

- Never pour down drains or release into the environment.

- Use licensed hazardous waste handlers and retain disposal manifests.

- Consider take-back programs or recycling if available from the supplier.

Audits and Recordkeeping

- Maintain logs of shipments, SDS versions, training records, and incident reports for at least 5 years.

- Conduct annual compliance audits to verify adherence to transport, storage, and labeling rules.

- Update documentation promptly for any regulatory changes or product reformulations.

Adhering to this guide ensures safe, legal, and sustainable logistics of textile flame retardants across global supply chains.

In conclusion, sourcing textile flame retardants requires a careful balance between performance, safety, environmental impact, and regulatory compliance. As industries such as apparel, upholstery, transportation, and protective clothing increasingly demand fire-safe materials, it is essential to partner with reliable suppliers offering high-quality, certified flame retardant solutions. Key considerations include the type of textile substrate, durability of the flame retardant treatment, compliance with international standards (such as NFPA, CPSC, EN, or CAL 117), and the shift toward eco-friendly, non-toxic, and sustainable alternatives. Conducting thorough due diligence—evaluating supplier credibility, product testing, and long-term cost-effectiveness—ensures that the selected flame retardants meet both functional requirements and evolving environmental and health standards. Ultimately, a strategic sourcing approach supports safety, regulatory adherence, and corporate sustainability goals in the textile supply chain.