The global automotive ignition system market is experiencing steady expansion, driven by increasing vehicle production, stringent emission regulations, and rising demand for fuel-efficient engines. According to Grand View Research, the global ignition coil market was valued at USD 5.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is further fueled by the rising adoption of advanced engine technologies and the expanding aftermarket demand, particularly in emerging economies. With reliability and performance being critical in modern electronic ignition systems, manufacturers are investing heavily in R&D to meet evolving OEM standards. As a result, a select group of leading tester coil ignition manufacturers have emerged, setting industry benchmarks in quality, innovation, and global reach. Here, we highlight the top 7 manufacturers shaping this dynamic landscape.

Top 7 Tester Coil Ignition Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ignition Coil, Spark Plugs, Spark Tester Supplier

Domain Est. 2020

Website: hifulyignitionsystem.com

Key Highlights: Hifuly have complete ignition coil, ignition cable and spark plugs models, we OEM for the famous auto brands of Japan, Germany and Brazil market, ……

#2 MSD Ignition

Domain Est. 1995

Website: msdignition.com

Key Highlights: MSD was the first company to develop and offer the multiple sparking, capacitive discharge ignition for engines. The line of MSD 6-Series Ignitions are the most ……

#3 ACCEL ()

Domain Est. 1995

Website: holley.com

Key Highlights: Shop the official site of ACCEL’s spark plug wires, ignition coils, and more. Discover innovative products for power, speed, & performance at Holley.com!…

#4 Product Landing

Domain Est. 1997

Website: coil.innova.com

Key Highlights: Patented Ignition System Testing. Ignition System + COP Tester: Tests: COP / Coil / DIS / EIM Modules; Primary winding; charging status; coil sparking ……

#5 Ignition Testing Tools

Domain Est. 1997

#6 Ignition coil tester

Domain Est. 2011

Website: femitec.com

Key Highlights: Is a new and innovative product for all workshops. Helps installers with diagnostics of faulty ignition coils. Before igniting the engine, spray the ignition ……

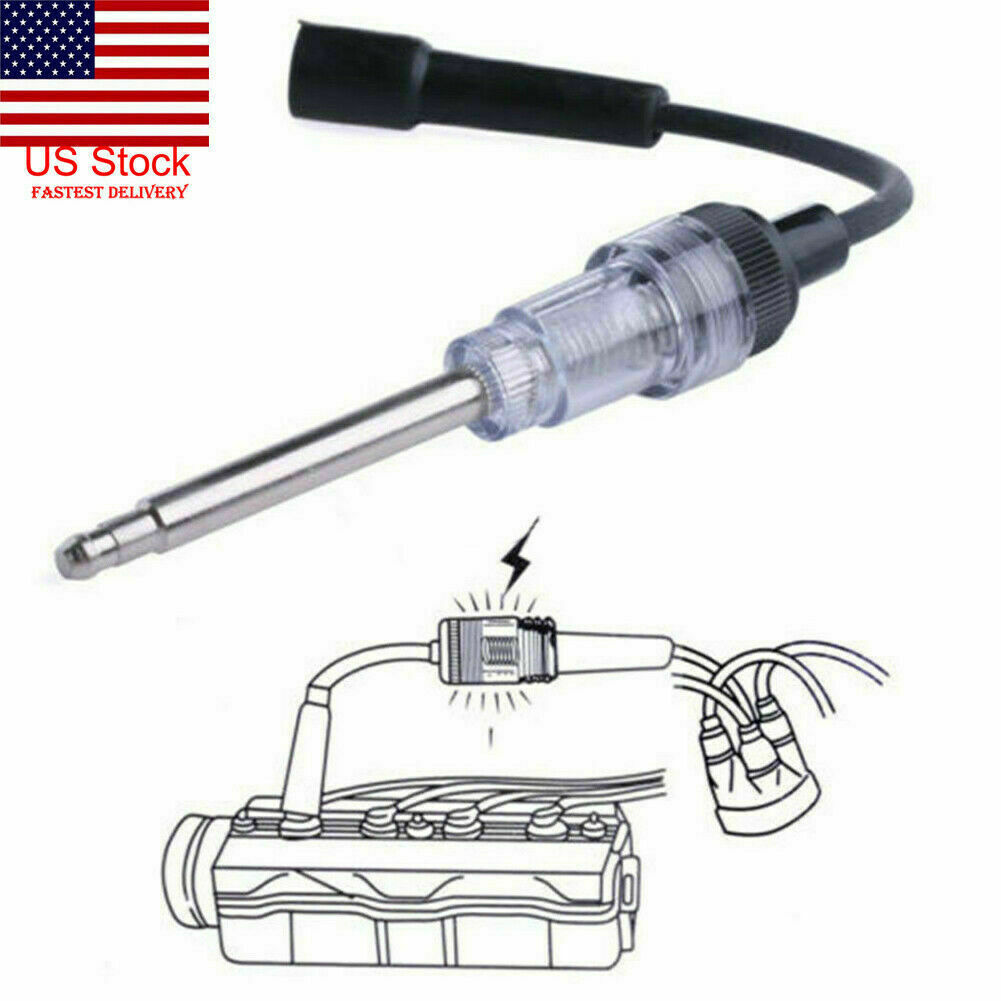

#7 DUOYI Spark Plug Tester Dual Holes Spark Tester Working …

Domain Est. 2022

Website: duoyitool.com

Key Highlights: DUOYI Spark Plug Tester Dual Holes Spark Tester Working Frequency 500-6000rpm Spark Plug Tool for 12V Gasoline Vehicles Ignition Coil Tester with A Protective…

Expert Sourcing Insights for Tester Coil Ignition

H2: 2026 Market Trends for Tester Coil Ignition

The global market for Tester Coil Ignition systems is poised for notable transformation by 2026, driven by evolving automotive technologies, stricter emissions regulations, and the ongoing shift toward electric and hybrid vehicles. While traditional internal combustion engine (ICE) vehicles remain a significant market segment—especially in emerging economies—test equipment for ignition coils continues to adapt to meet modern diagnostic demands.

1. Rising Demand for Advanced Diagnostic Tools

As vehicle ignition systems become more sophisticated, especially with the integration of direct ignition and coil-on-plug (COP) systems, there is a growing need for precise and automated tester coil ignition devices. By 2026, the market is expected to see increased adoption of smart testers with IoT connectivity, allowing real-time data analysis, cloud-based diagnostics, and integration with automotive repair management software.

2. Expansion in Aftermarket and Repair Services

Despite the rise of electric vehicles (EVs), a large global fleet of ICE and hybrid vehicles will require continued maintenance. This ensures sustained demand for ignition coil testers in automotive repair shops, dealerships, and independent service centers. The aftermarket segment is projected to grow at a CAGR of approximately 4–5% through 2026, particularly in Asia-Pacific and Latin America.

3. Technological Integration and Automation

Next-generation tester coil ignition systems are incorporating AI-driven analytics and machine learning to predict coil failure before it occurs. These predictive maintenance features are becoming standard in high-end diagnostic equipment, improving vehicle reliability and reducing downtime. Automated calibration and compatibility with multiple vehicle makes and models are key selling points expected to dominate the 2026 market landscape.

4. Regional Market Dynamics

– Asia-Pacific: Expected to lead market growth due to high vehicle production, rising car ownership, and expanding service infrastructure in countries like India, China, and Indonesia.

– North America and Europe: Mature markets with steady demand, driven by regulatory compliance and the need for precision diagnostics in high-performance and luxury vehicles.

– Emerging Markets in Africa and the Middle East: Increasing adoption of diagnostic tools as vehicle fleets grow and service standards improve.

5. Impact of Electrification

While full EVs do not use traditional ignition coils, hybrid vehicles (HEVs and PHEVs) still rely on ICE components, sustaining the need for coil ignition testing. Furthermore, legacy ICE vehicle support will remain vital through 2026 and beyond, ensuring continued relevance for these testers.

6. Competitive Landscape and Innovation

Key players such as Bosch, Actron, Autel, and Launch Tech are investing in R&D to develop compact, user-friendly, and multi-functional testers. The trend toward modular and upgradable hardware will allow service centers to adapt to new vehicle models without replacing entire systems.

In summary, the 2026 market for Tester Coil Ignition systems will be shaped by technological innovation, regional automotive trends, and the enduring need for reliable ICE diagnostics amid a transitional automotive era. Companies that offer scalable, intelligent, and globally compatible solutions are likely to capture significant market share.

Common Pitfalls When Sourcing Tester Coil Ignition (Quality, IP)

Sourcing ignition coil testers, especially those assessing Insulation Resistance (IR) and Dielectric Withstand (Hi-Pot, often referred to as “IP” testing in this context, though more accurately part of electrical safety testing), involves several critical quality and performance pitfalls. Avoiding these is essential for ensuring reliable diagnostics, technician safety, and accurate assessment of ignition system health.

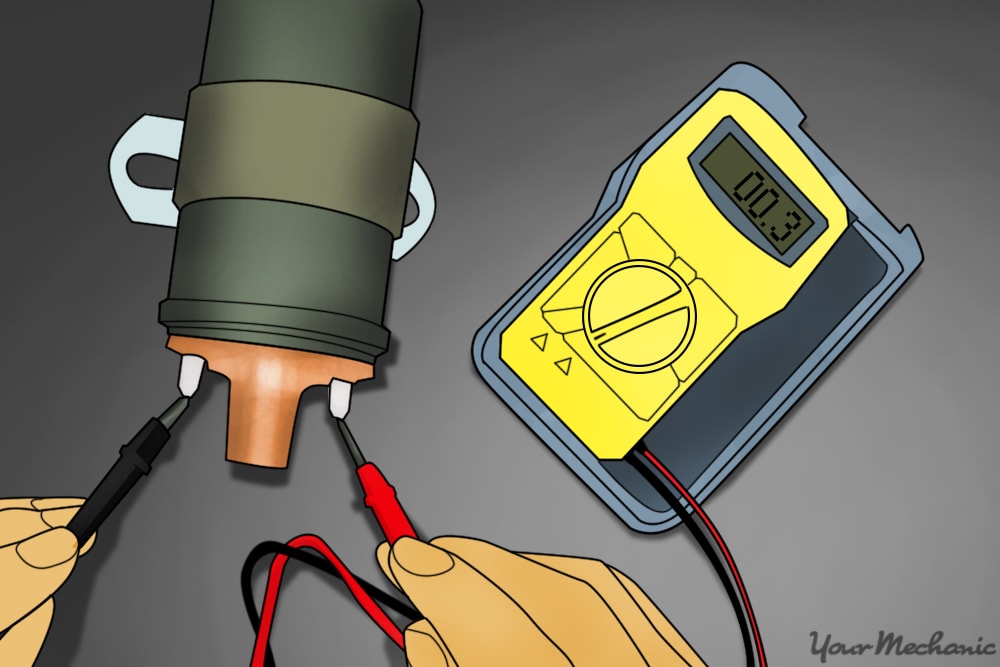

1. Compromised Test Accuracy and Calibration

- Inadequate Voltage/Current Output: Testers that cannot deliver the precise high voltage (often 5kV-30kV+) or controlled current required for accurate insulation resistance or dielectric testing will yield false negatives (failing good coils) or, worse, false positives (passing faulty coils). This leads to misdiagnosis and repeated work.

- Poor Calibration and Drift: Units lacking traceable calibration or prone to calibration drift over time provide unreliable results. Sourcing testers without documented calibration certificates or easy user calibration routines risks inaccurate diagnostics.

- Lack of Test Standard Compliance: Testers not designed to meet relevant electrical safety standards (e.g., IEC 61010 for safety, specific automotive OEM test procedures) may perform tests incorrectly or unsafely.

2. Questionable Build Quality and Durability

- Substandard Materials: Using low-grade plastics, flimsy connectors, or inadequate internal insulation compromises safety, especially during high-voltage testing. This poses a significant risk of arcing, short circuits, or electric shock.

- Poor Internal Construction: Inadequate component spacing (creepage/clearance distances), lack of proper shielding, or cheap high-voltage components increase the risk of internal arcing, component failure, and inaccurate readings.

- Fragile Test Leads and Probes: Leads prone to breaking, connectors that loosen easily, or probes that degrade quickly under high voltage stress lead to inconsistent contact, unreliable results, and safety hazards. Shielded, high-voltage rated leads are essential.

3. Inadequate or Misleading “IP” (Ingress Protection) Rating

- False or Unverified IP Ratings: Some suppliers may claim high IP ratings (e.g., IP65, IP67) for dust/water resistance without independent verification. A tester in a workshop environment needs genuine protection against oil, coolant, dust, and accidental spills.

- Poor Sealing Design: Even if rated, poor gasket design, vulnerable cable entry points, or unsealed button/keypads can allow contaminants to ingress, leading to internal corrosion, short circuits, and premature failure.

- Overstating Environmental Ruggedness: Marketing materials might imply the tester is “rugged” without specifying the actual tested IP rating, leading to misuse in harsh environments it wasn’t designed for.

4. Safety Hazards and Non-Compliance

- Lack of Safety Features: Absence of essential safety mechanisms like interlocks, automatic discharge circuits (to safely dissipate stored high voltage after testing), current limiting, or clear “Test in Progress” indicators significantly increases the risk of electric shock.

- Non-Compliance with Safety Standards: Sourcing testers not certified to relevant regional safety standards (e.g., CE, UL, CSA) is a major red flag. This indicates potential design flaws and bypasses independent safety verification.

- Inadequate High-Voltage Isolation: Poor design can allow dangerous voltages to appear on accessible parts of the tester or its casing. Robust double insulation or reinforced insulation is mandatory.

5. Poor User Interface and Diagnostics

- Unclear or Ambiguous Results: Testers providing only a simple “Pass/Fail” without displaying actual measured values (e.g., IR in MΩ or GΩ, leakage current) limit diagnostic capability and make trend analysis impossible.

- Complex or Non-Intuitive Operation: Difficult setup procedures, confusing menus, or poorly labeled controls increase the chance of user error, leading to incorrect tests or missed faults.

- Lack of Diagnostic Features: Advanced features like leakage current measurement, ramp testing, or programmable test sequences are valuable for deeper analysis. Sourcing a basic tester might limit diagnostic effectiveness.

6. Insufficient Support and Documentation

- Poor or Missing Manuals: Inadequate user manuals make setup, operation, safety procedures, and troubleshooting difficult, increasing the risk of misuse.

- Lack of Technical Support: Inability to get help from the supplier for calibration, repair, or operational questions renders the tester unusable if issues arise.

- Unavailability of Spare Parts and Calibration: Sourcing from suppliers who don’t offer replacement leads, probes, or calibration services leads to premature obsolescence of the tester.

By carefully evaluating potential ignition coil testers against these common pitfalls—prioritizing verified accuracy, robust build quality, genuine IP ratings, stringent safety certifications, clear diagnostics, and reliable support—you ensure the acquisition of a tool that delivers dependable, safe, and effective testing results.

Logistics & Compliance Guide for Tester Coil Ignition

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to Tester Coil Ignition devices. These tools are commonly used in automotive diagnostics to assess ignition system performance and must be managed in accordance with international and regional standards.

Regulatory Compliance

All Tester Coil Ignition units must comply with relevant safety and electromagnetic compatibility (EMC) regulations prior to distribution or use. Key compliance standards include:

- CE Marking (EU): Ensures conformity with health, safety, and environmental protection standards within the European Economic Area (EEA). Compliance with the Low Voltage Directive (LVD 2014/35/EU) and EMC Directive (2014/30/EU) is required.

- FCC Part 15 (USA): Regulates electromagnetic interference emissions. Devices must meet Class B limits for residential environments.

- RoHS (Restriction of Hazardous Substances): Prohibits the use of specific hazardous materials (e.g., lead, mercury, cadmium) in electrical and electronic equipment.

- REACH (EU): Addresses the registration, evaluation, authorization, and restriction of chemicals. Suppliers must confirm substance compliance.

- IP Rating (Ingress Protection): Devices should have an appropriate IP rating (e.g., IP54) to ensure protection against dust and moisture, particularly for field use.

Documentation such as Declaration of Conformity (DoC), technical files, and test reports must be maintained and made available upon request from regulatory authorities.

Transportation & Shipping Requirements

Proper packaging and labeling are critical to ensure safe and compliant shipment of Tester Coil Ignition units.

- Packaging: Units must be packed in anti-static, shock-absorbent materials to prevent physical and electrostatic damage during transit. Inner packaging should immobilize the device, and outer containers must meet drop-test standards (e.g., ISTA 3A).

- Labeling: Shipping containers must display:

- Product name and model number

- Manufacturer and importer details

- CE/FCC marks (as applicable)

- Handling symbols (e.g., “Fragile,” “This Side Up”)

- Battery warnings (if applicable)

- Battery Regulations: If the tester contains lithium batteries, shipping must comply with IATA DGR (for air) or IMDG Code (for sea). Batteries should be installed in equipment and protected against short circuits.

Shipments should be tracked, and carriers must be certified for handling electronic diagnostic equipment.

Storage & Handling

To maintain device integrity and safety, observed storage and handling protocols include:

- Environmental Conditions: Store in a dry, climate-controlled environment with temperatures between 10°C and 30°C and relative humidity below 70%. Avoid exposure to direct sunlight or corrosive atmospheres.

- Shelf Life: Units should be rotated using FIFO (First In, First Out) principles. Periodic inspection for damage or degradation is recommended, especially after long-term storage.

- Static Control: Handle devices in ESD-protected areas when unpacking or preparing for use. Use grounded wrist straps and anti-static mats where appropriate.

Import/Export Documentation

Cross-border movement of Tester Coil Ignition devices requires accurate documentation:

- Commercial Invoice

- Packing List

- Certificate of Origin

- Bill of Lading or Air Waybill

- Declaration of Conformity (for EU/UK)

- FCC ID (for US-bound shipments)

- Import License (if required by destination country)

Ensure Harmonized System (HS) Code 9030.89 (measuring and testing instruments) is correctly applied for customs classification.

End-of-Life & Environmental Responsibility

Dispose of or recycle Tester Coil Ignition units in accordance with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Provide take-back options or partner with certified e-waste recyclers.

- Clearly label products with the WEEE symbol (crossed-out wheeled bin).

- Avoid landfill disposal; ensure recovery of metals and safe handling of electronic components.

Adherence to this logistics and compliance framework ensures operational safety, legal conformity, and environmental responsibility throughout the product lifecycle.

Conclusion for Sourcing Ignition Coil Testers:

In conclusion, sourcing reliable ignition coil testers is a critical step in ensuring efficient and accurate diagnostics within automotive repair and maintenance operations. The selection process should prioritize testers that offer compatibility with a wide range of vehicle makes and models, accurate performance assessment, ease of use, and durability. Evaluating suppliers based on product quality, technical support, certification standards (such as ISO or CE), and cost-effectiveness is essential to ensuring long-term operational efficiency.

Investing in high-quality ignition coil testers not only enhances diagnostic precision but also reduces downtime and prevents misdiagnoses, ultimately improving customer satisfaction and workshop productivity. As vehicle ignition systems become increasingly complex with advancing technology, staying updated with modern, multifunctional testing equipment from reputable suppliers becomes a strategic necessity. Therefore, a well-informed sourcing decision ensures reliability, performance, and a strong return on investment in the automotive service environment.