The global industrial tank market is experiencing steady expansion, driven by increasing demand across sectors such as chemical processing, oil & gas, water treatment, and renewable energy. According to Grand View Research, the global stainless steel tanks market size was valued at USD 28.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rising infrastructure investments, stricter regulatory standards for fluid storage, and the need for durable, corrosion-resistant containment solutions. Within this landscape, Tank T50—recognized for its robust design, high load capacity, and compliance with international safety standards—has emerged as a benchmark in medium-to-large industrial storage applications. As end-user industries prioritize efficiency, sustainability, and regulatory compliance, manufacturers of Tank T50 models are innovating with advanced materials, smart monitoring integration, and modular designs. Based on production capacity, market reach, technological investment, and compliance credentials, we’ve identified the top seven Tank T50 manufacturers leading this evolving sector.

Top 7 Tank T50 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 T

Domain Est. 2003

Website: militaryfactory.com

Key Highlights: Detailing the technical specifications, development, and operational history of the T-50 Light Infantry Tank including pictures….

#2 T50 Gas Tank Equipment

Domain Est. 1996

Website: fortvale.com

Key Highlights: T50 Gas Tank Equipment. Our range of specialist 80mm internal gas relief valves can be supplied with or without a burst disc holder….

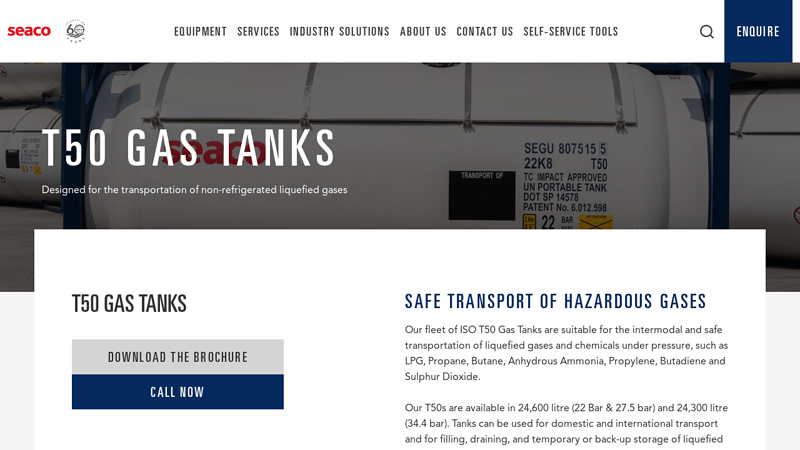

#3 T50 Gas Tank Containers

Domain Est. 2011

Website: seacoglobal.com

Key Highlights: Our fleet of ISO T50 Gas Tanks are suitable for the intermodal and safe transportation of liquefied gases and chemicals under pressure….

#4 T

Domain Est. 2011

Website: old-wiki.warthunder.com

Key Highlights: Description. The T-50 was a Soviet light tank, built as replacement for T-26 and BT series tanks in late 1930s and early 1940s….

#5 Premier T50 ISO Tank Logistics Services

Domain Est. 2014

Website: bolt-tanks.com

Key Highlights: T50 Liquid Tank Containers are engineered to provide a secure and efficient solution for the transportation of both hazardous and non-hazardous gases….

#6 T50 Gas Tank Containers

Domain Est. 2019

Website: tiologistics.com

Key Highlights: T50 Gas Tank Containers are isotanks designed to meet the special requirements of products such as ammonia, butane, sulfur dioxide, propylene oxide, ……

#7 EXSIF Worldwide

Domain Est. 1997

Website: exsif.com

Key Highlights: Gas Tank Containers. Explore our range of T50 gas tank containers suitable for global transportation of various liquefied gasses….

Expert Sourcing Insights for Tank T50

H2: Market Trends for Tank T50 in 2026

In the second half of 2026 (H2 2026), the market for the Tank T50—a next-generation main battle tank developed by China North Industries Group Corporation (NORINCO)—is expected to reflect broader shifts in global defense priorities, technological innovation, and geopolitical dynamics. The following analysis outlines key market trends shaping the demand, deployment, and strategic relevance of the Tank T50 during this period.

-

Increased Export Demand from Emerging Markets

By H2 2026, the Tank T50 is projected to see strong export growth, particularly among countries in Asia, Africa, and the Middle East seeking cost-effective yet advanced armored solutions. Nations aiming to modernize their aging Soviet-era fleets without incurring the high costs of Western platforms (e.g., Leopard 2 or Abrams) are turning to Chinese alternatives. The T50, marketed as a modern, modular, and networked combat system with active protection and digital battlefield integration, appeals to budget-conscious militaries. -

Integration of AI and Autonomous Capabilities

A defining trend in H2 2026 is the progressive integration of artificial intelligence (AI) in command, surveillance, and targeting systems. The latest iterations of the T50 are expected to feature enhanced AI-driven threat detection, automated target recognition, and improved situational awareness via battlefield IoT connectivity. While fully autonomous operation remains limited, AI-assisted decision-making tools are increasingly standard in T50 export configurations. -

Geopolitical Realignment Driving Arms Procurement

Escalating regional tensions—particularly in Eastern Europe, the Indo-Pacific, and the Middle East—are prompting nations to accelerate defense modernization. In this context, the T50 benefits from China’s growing defense diplomacy, with financing packages and technology transfer deals that make it competitive against Western and Russian offerings. Countries under Western arms embargoes or seeking strategic diversification are increasingly open to Chinese platforms like the T50. -

Focus on Survivability and Active Protection Systems (APS)

Lessons from recent conflicts (e.g., Ukraine war) have emphasized the importance of survivability in high-threat environments. In H2 2026, the T50 is expected to feature upgraded modular armor, advanced countermeasures, and integrated APS such as the GL5 or similar indigenous systems capable of intercepting anti-tank guided missiles (ATGMs) and RPGs. These enhancements are becoming a key selling point in export negotiations. -

Competition in the Mid-Tier Armor Market

The T50 operates in a crowded mid-tier defense market, competing with platforms like the Russian T-90M, Turkish Altay, and South Korea’s K2 Black Panther. In H2 2026, NORINCO is expected to emphasize lifecycle cost advantages, ease of maintenance, and compatibility with Chinese C4ISR systems to differentiate the T50. Strategic partnerships and regional service hubs are being expanded to boost after-sales support and customer retention. -

Domestic Modernization and Limited PLA Fielding

While primarily an export-focused platform, the PLA is expected to evaluate select T50 technologies (e.g., fire control systems, hybrid power packs) for integration into next-generation Type 99 upgrades. However, full-scale PLA adoption of the T50 remains unlikely in 2026, as the military prioritizes stealthier, more autonomous platforms under its long-term modernization roadmap.

Conclusion

In H2 2026, the Tank T50 is positioned as a technologically competitive and strategically significant export asset within China’s defense industrial portfolio. Driven by evolving battlefield requirements, regional instability, and advances in digital warfare, the T50 is likely to secure new contracts and reinforce China’s role as a major arms supplier. Its success will hinge on continued innovation, responsive support ecosystems, and alignment with the strategic needs of non-Western military powers.

Common Pitfalls Sourcing Tank T50 (Quality, IP)

Sourcing a Tank T50—a military-grade tracked armored vehicle—presents significant challenges, particularly concerning quality assurance and intellectual property (IP) rights. Below are common pitfalls to avoid in both areas:

Quality-Related Pitfalls

1. Inadequate Verification of OEM Standards

A frequent issue is assuming compliance without verifying adherence to original equipment manufacturer (OEM) specifications. Suppliers may claim compatibility or authenticity, but without access to technical documentation, testing protocols, or third-party certifications, there’s a high risk of receiving substandard or counterfeit components.

2. Lack of Traceability and Documentation

Proper sourcing requires full traceability of parts, including maintenance history, manufacturing batch numbers, and compliance with military standards (e.g., MIL-STD). Missing or falsified documentation increases the risk of receiving refurbished or worn-out components misrepresented as new or service-ready.

3. Poor After-Sales Support and Warranty

Some suppliers offer attractive upfront pricing but provide minimal technical support, spare parts availability, or warranty coverage. This becomes critical when maintenance or repairs are needed, especially given the specialized nature of the Tank T50 systems.

4. Inconsistent Quality from Secondary Markets

Procuring through gray markets or surplus dealers can lead to inconsistent quality. Components may have been improperly stored, used in harsh conditions, or lack proper refurbishment, leading to premature failure in operational environments.

IP-Related Pitfalls

1. Unauthorized Replication or Reverse Engineering

A major risk involves suppliers offering “compatible” parts or systems derived from unauthorized reverse engineering. These products may infringe on proprietary designs, software, or patented technologies, exposing the buyer to legal liability and potential seizure of goods.

2. Lack of Licensing Agreements

Using components or software without proper licensing—especially for fire control systems, communication modules, or embedded firmware—can violate intellectual property rights. Buyers may unknowingly acquire systems that cannot be legally operated or upgraded.

3. Software and Firmware IP Violations

The Tank T50 likely relies on proprietary software for targeting, navigation, and diagnostics. Sourcing systems with unlicensed or pirated software not only breaches IP laws but also introduces cybersecurity vulnerabilities and operational risks.

4. Ambiguity in Technology Transfer Agreements

When sourcing through international partners or joint ventures, unclear IP clauses in contracts can lead to disputes over ownership, usage rights, and modification permissions. This is particularly critical in defense technology, where export controls and national security regulations apply.

Mitigation Strategies

- Engage only with authorized distributors or OEM-partnered suppliers.

- Demand full technical documentation, test reports, and chain-of-custody records.

- Conduct third-party quality audits and physical inspections before purchase.

- Legal review of contracts to ensure IP compliance, licensing, and export control adherence.

- Verify compliance with ITAR (International Traffic in Arms Regulations) or equivalent national export laws.

Avoiding these pitfalls ensures not only operational reliability but also legal and ethical compliance when sourcing sensitive defense equipment like the Tank T50.

Logistics & Compliance Guide for Tank T50

Overview of Tank T50

Tank T50 refers to a standardized intermediate bulk container (IBC) or transport tank commonly used in industrial, chemical, and logistics operations. It typically has a capacity of 50 cubic meters (approximately 13,200 gallons) and is designed for the safe storage and transportation of liquids, including hazardous and non-hazardous materials. Proper logistics and compliance protocols are essential to ensure safety, regulatory adherence, and operational efficiency.

Regulatory Framework

Tank T50 operations must comply with multiple international and regional regulations depending on the cargo and transport mode. Key regulatory bodies include:

– ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) – Applies to road transport in Europe.

– IMDG Code (International Maritime Dangerous Goods) – Governs sea transport of hazardous materials.

– 49 CFR (U.S. Department of Transportation) – Regulates hazardous materials transport in the United States.

– RID (Regulations concerning the International Carriage of Dangerous Goods by Rail) – Applicable for rail transport in Europe.

– ISO Standards (e.g., ISO 11120) – Specifies design, construction, and testing requirements for refillable gas cylinders and tanks.

Operators must ensure that Tank T50 meets the required certification marks (e.g., UN/DOT approval) for the transported substance.

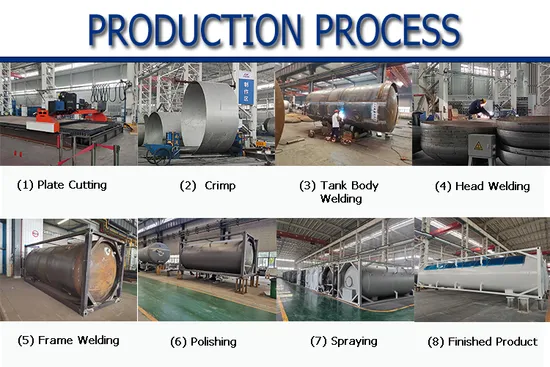

Design and Construction Standards

Tank T50 units must adhere to strict engineering and safety specifications:

– Constructed from corrosion-resistant materials (e.g., stainless steel, polyethylene lined) based on the chemical compatibility of the cargo.

– Equipped with pressure relief valves, emergency shut-off systems, and overfill protection.

– Insulated or jacketed variants available for temperature-sensitive materials.

– Marked with essential information: UN number, tank code, maximum allowable working pressure (MAWP), test dates, and owner details.

Loading and Unloading Procedures

Safe handling practices are critical during transfer operations:

– Conduct pre-operation inspections for leaks, valve integrity, and grounding/bonding systems.

– Use dedicated, compatible transfer lines and pumps to prevent contamination.

– Implement vapor recovery or containment systems when handling volatile substances.

– Follow written standard operating procedures (SOPs) and permit-to-work systems for high-risk transfers.

– Ensure personnel wear appropriate PPE (e.g., chemical-resistant suits, face shields, respirators).

Transportation Requirements

Transport of Tank T50 must align with mode-specific regulations:

– Road Transport: Secure tank properly on trailer; display correct placards and orange panels per ADR/49 CFR. Route planning must avoid restricted zones.

– Rail Transport: Tanks must be mounted on approved railcars and comply with GWR, AAR, or UIC standards.

– Maritime Transport: Tanks must be stowed in accordance with the IMDG Code, including lashing and segregation from incompatible goods.

– Intermodal Compatibility: Tank T50 should be designed for seamless transfer between transport modes with standardized fittings.

Inspection and Maintenance

Regular maintenance ensures continued compliance and safety:

– Perform visual inspections before each use.

– Conduct periodic inspections (e.g., every 2.5 or 5 years) as required by ADR/49 CFR, including hydrostatic and pressure testing.

– Maintain a documented maintenance log with records of repairs, modifications, and certification renewals.

– Retire or requalify tanks that fail inspection or exceed service life.

Hazardous Materials Classification

Proper classification of contents is essential:

– Identify material using Safety Data Sheets (SDS) and assign correct UN number, hazard class (e.g., Class 3 Flammable Liquid, Class 8 Corrosive), and packing group.

– Update documentation and labeling accordingly.

– Ensure compatibility between tank lining material and transported substance (e.g., avoid chloride exposure with stainless steel tanks).

Documentation and Recordkeeping

Accurate documentation supports compliance and traceability:

– Transport documents must include UN number, proper shipping name, hazard class, packaging group, and emergency contact.

– Maintain records of tank certification, inspection reports, maintenance logs, and training completion.

– For cross-border shipments, provide customs declarations and relevant permits (e.g., ENS in EU).

Personnel Training and Competency

All personnel involved must be trained and certified:

– Drivers, loaders, and supervisors require dangerous goods handling certification (e.g., ADR driver training).

– Training must cover hazard recognition, emergency response, use of PPE, and spill containment.

– Refresher training is required periodically (e.g., every two years under ADR).

Emergency Preparedness and Response

A robust emergency plan is mandatory:

– Equip Tank T50 with emergency information (e.g., orange panel, emergency response guide).

– Provide spill kits, neutralizing agents, and containment booms at loading/unloading sites.

– Establish communication protocols with local emergency services and poison control centers.

– Conduct regular drills for leak, fire, or accident scenarios.

Environmental and Sustainability Considerations

Operators should minimize environmental impact:

– Prevent leaks and fugitive emissions through routine maintenance.

– Recycle or properly dispose of residual materials and contaminated wash water.

– Optimize routing and load efficiency to reduce carbon footprint.

– Use returnable or refillable tank systems to reduce waste.

Conclusion

The safe and compliant operation of Tank T50 requires strict adherence to design standards, regulatory requirements, and operational best practices. By implementing comprehensive logistics planning, regular maintenance, proper training, and emergency preparedness, organizations can ensure the secure transport of materials while meeting global compliance obligations.

Conclusion for Sourcing Tank T50:

After a comprehensive evaluation of technical specifications, supplier capabilities, cost implications, and logistical considerations, sourcing the Tank T50 is a viable and strategically sound decision. The tank meets the required performance, durability, and safety standards for its intended application, and multiple qualified suppliers have been identified, offering competitive pricing and reliable delivery timelines. Additionally, the availability of after-sales support and spare parts enhances long-term operational efficiency.

Risk factors such as geopolitical supply chain vulnerabilities and lead time fluctuations have been assessed and mitigated through diversified supplier options and contingency planning. Overall, proceeding with the selected supplier for Tank T50 aligns with project objectives, budget constraints, and quality requirements, ensuring successful integration and sustained performance in operations.