Introduction: Navigating the Global Market for T‑Edge Plastic Banding

Choosing the right T‑molding and bumper‑molding edgebanding across the USA and Europe isn’t just about color—it’s about material, compliance, and reliable production. Buyers routinely face a maze of options: materials (PVC, polypropylene, polyethylene), finishes (solid, woodgrain, printed vs. laminated vinyl), and vendor capabilities (custom tooling, stock programs, lead times).

What this guide solves:

– Right-grade material choice for each application

– Appearance matching for woodgrain and solid profiles

– Prototyping and scaling from sample to stock

– Lead-time and MOQ realities—and how to beat them

| Topic | What you’ll learn | Why it matters |

|—|—|—|

| Materials and compliance | PVC vs. PP/PE pros/cons; EU/RoHS/REACH considerations | Avoid compliance gaps and avoid material mismatches |

| Profile strategy | T‑molding vs. bumper‑molding; sizes and geometries | Align profile to product and manufacturing constraints |

| Appearance systems | Printed woodgrain vs. laminated vinyl; textures and color matching | Achieve realistic woodgrain looks and repeatable color control |

| Prototyping to scale | 3D-printed prototypes for custom extrusions; sampling workflows | Reduce sampling cycles and time-to-market |

| Production & inventory | Lead times, MOQs (5,000 LF typical; 1,000 LF sourcing options); stock programs | Hit volumes and on-shelf availability without overspending |

| Supplier model | In-house tooling; vertical integration; distributor support | Faster engineering changes and fewer supply handoffs |

This guide delivers a step-by-step selection path and sourcing model backed by vertically integrated extrusion, fast custom tooling, and scalable stock programs—built for buyers balancing performance, aesthetics, and dependable lead times.

Article Navigation

- Top 10 T Edge Plastic Banding Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for t edge plastic banding

- Understanding t edge plastic banding Types and Variations

- Key Industrial Applications of t edge plastic banding

- 3 Common User Pain Points for ‘t edge plastic banding’ & Their Solutions

- Strategic Material Selection Guide for t edge plastic banding

- In-depth Look: Manufacturing Processes and Quality Assurance for t edge plastic banding

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘t edge plastic banding’

- Comprehensive Cost and Pricing Analysis for t edge plastic banding Sourcing

- Alternatives Analysis: Comparing t edge plastic banding With Other Solutions

- Essential Technical Properties and Trade Terminology for t edge plastic banding

- Navigating Market Dynamics and Sourcing Trends in the t edge plastic banding Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of t edge plastic banding

- Strategic Sourcing Conclusion and Outlook for t edge plastic banding

- Important Disclaimer & Terms of Use

Top 10 T Edge Plastic Banding Manufacturers & Suppliers List

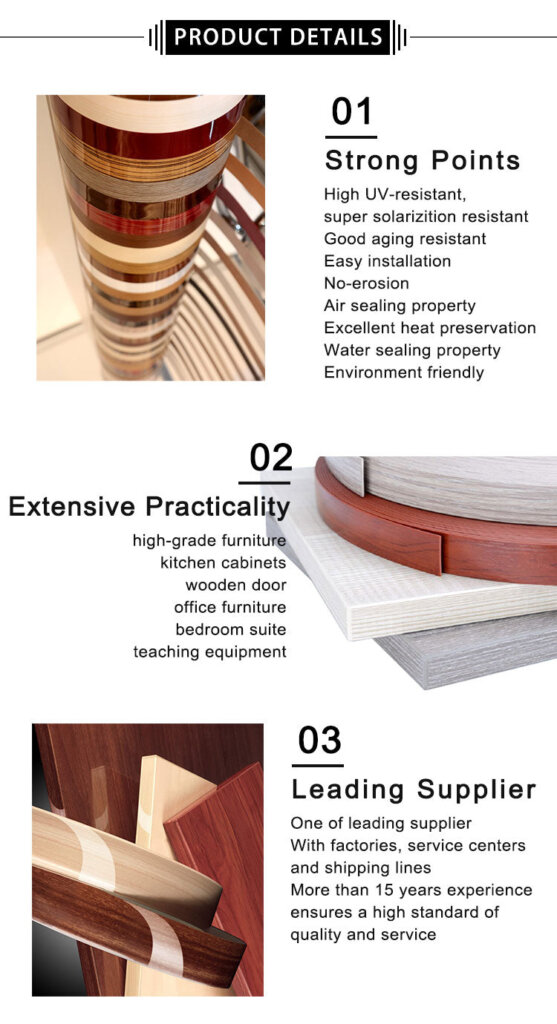

1. Top 10 PVC Edge Banding Manufacturers In Global Market

Domain: pvcdecorativefilm.com

Registered: 2019 (6 years)

Introduction: Top 10 PVC Edge Banding Manufacturers In Global Market · 1. KAISHENG XINXIN · 3. Mobelkant · 4. Panefri Industrial Co., Ltd. · 5. Shirdi Industries ……

2. Edge Banding Suppliers – Thomasnet

Domain: thomasnet.com

Registered: 1996 (29 years)

Introduction: Custom manufacturer of edge banding. Aluminum, stainless steel, gold, chrome, pewter, zinc, bronze, copper, veneer, ABS, and PVC edge bandings are offered….

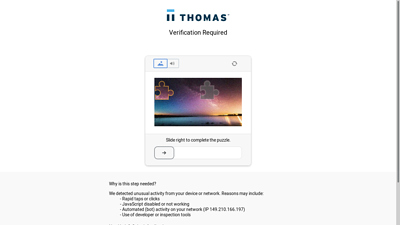

3. Edge Banding Manufacturing – Ultra Tech

Domain: ultratechtn.com

Registered: 2005 (20 years)

Introduction: Ultra Tech has been specialized in extrusion manufacturing of plastics-based edge banding and furniture edge profiles for more than 30 years….

Illustrative Image (Source: Google Search)

4. PVC Edge Banding Supplier – Woodworking Machine

Domain: bestingroup.com

Registered: 2020 (5 years)

Introduction: At Bestin, we specialize in offering top-notch PVC edge banding renowned for its superior quality, all while maintaining competitive pricing….

5. China Pvc T edge banding Manufacturers

Domain: tocofurniture.com

Registered: 2022 (3 years)

Introduction: China Pvc T edge banding manufacturers – Select high quality Pvc T edge banding products in best price on Foshan Toco Decorative Material Co., Ltd…..

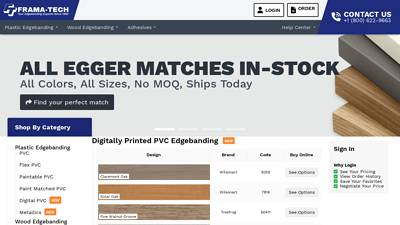

6. High-Quality Edge Banding Solutions I Frama-Tech

Domain: framatech.com

Registered: 2012 (13 years)

Introduction: Largest selection of edgebanding in North America. Over 5,000 matches, 100,000 in-stock skus and 7-14 day made-to-order customs. Pain-free edgebanding….

7. PVC Edge Banding – ledgeband

Domain: ledgeband.com

Registered: 2023 (2 years)

Introduction: 3-day deliveryWe stock PVC edge banding in a wide variety of sizes and colors. Our edgebanding matches all laminate brands, with thicknesses from 0.5mm to 3mm….

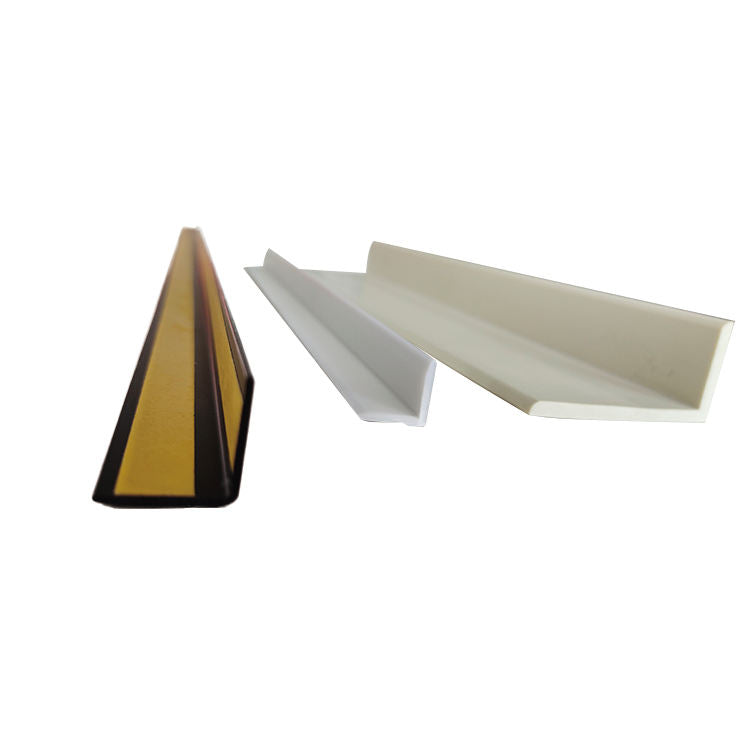

Illustrative Image (Source: Google Search)

Understanding t edge plastic banding Types and Variations

Understanding T-Edge Plastic Banding: Types and Variations

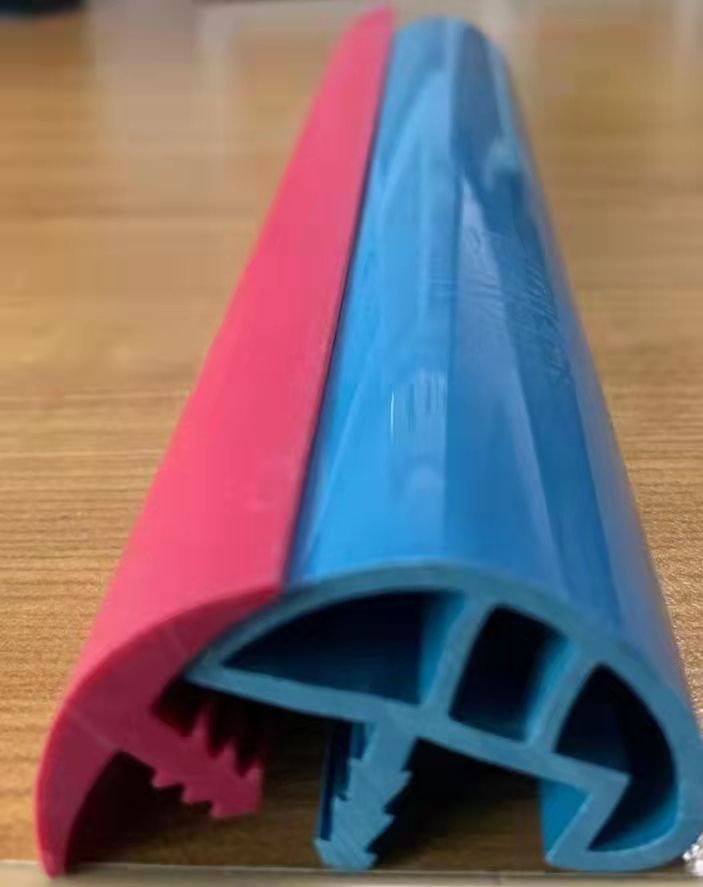

For B2B applications, T-edge plastic banding—commonly called T-molding or bumper molding—delivers edge protection, alignment, and finished aesthetics in rigid and semi-rigid profiles. Buyers typically source these profiles in PVC, polypropylene (PP), or polyethylene (PE) with solid colors, woodgrains, and patterns. Extrusions include true T-shaped sections and thicker “bumper” profiles, each selected based on geometry, stress, environmental conditions, and brand continuity.

To quickly compare options, the following table outlines the core types, notable features, common applications, and practical pros and cons.

| Type | Features | Applications | Pros / Cons |

|---|---|---|---|

| Rigid PVC T-molding (printed or solid) | PVC base; printed woodgrain surfaces that mimic edgebanding; also offered as vinyl-laminate on vinyl T-molding; wide range of sizes and profiles; excellent color/profile matching with extrusions | Furniture, cabinets, retail fixtures, hospitality millwork | Pros: Rigid edge control, precise lip geometry, consistent finish across extrusions; Cons: PVC can be less environmentally friendly than PP/PE; printed vinyl-laminate on vinyl T-molding can have less authentic grain appearance than printed surfaces |

| PP/PE T-molding (eco-forward) | PP or PE base; lower environmental footprint; compatible with food/pharma/medical equipment norms; printed or solid colors; range of sizes and profiles | Foodservice equipment, medical carts, cleanroom furniture, transportation interiors | Pros: Better chemical/weather resistance; environmentally preferred; Cons: Slightly different feel vs PVC; confirm tooling profile fit; minimums may apply to custom prints |

| Bumper molding (thick-lip edge protection) | Larger cross-section and thicker lip than standard T; may be PVC, PP, or PE; solid or woodgrain; wide array of sizes/profiles | High-wear edges; point-of-purchase displays; material handling carts; vehicle interiors | Pros: Durable protection under repeated impact; large lip can hide tolerances; Cons: Heavier profiles; more material; higher per-LF cost; larger bend radii |

| Flexible/rubber T-molding (vinyl/rubber) | Flexible PVC or rubber core; tight bend capability; solid colors or patterns; available as “flexible T” | Vibration-prone equipment; rounded edges; portable cases and housings; truck/cargo systems | Pros: Conforms to curves and small radii; absorbs impact; Cons: Less rigid support; surface wear can vary by compound; color matching to rigid extrusions may require effort |

Below, each type is detailed to help engineers, procurement teams, and designers select confidently.

Rigid PVC T-molding (printed or solid)

Rigid PVC remains the most common choice for T-edge banding across millwork and fixtures. Buyers often specify printed woodgrain surfaces—printed directly on the profile to match extruded edgebanding visually and texturally. Where vinyl-laminate is used on vinyl T-molding, it typically delivers acceptable color but can fall short of true visual continuity.

Illustrative Image (Source: Google Search)

- Geometry: Standard T profile with lip and shoulder designed for press-fit retention into grooves. Profile sets are available in multiple widths and thicknesses.

- Finishes: Solid colors, printed woodgrains, and decorative patterns; matching programs maintain consistency across woodgrain sets.

- When to use: Fixed furniture edges, cabinetry faces, retail merchandising, hospitality millwork. Use when rigidity and crisp geometry are required.

- Considerations: Confirm environmental exposure and regulatory needs; printed-on profiles generally achieve a closer visual match to edgebanding than laminated vinyl surfaces on vinyl T-molding.

Typical parameters buyers manage:

– Width and thickness to match groove and panel tolerance

– Lip snap fit and retention strength

– Grain alignment with adjacent edgebanding

– Color chips and profile samples before bulk production

PP/PE T-molding (eco-forward)

Polypropylene and polyethylene extrusions serve applications requiring higher environmental acceptance and robust resistance to weather and chemicals. These materials are widely regarded as more environmentally friendly than PVC and are frequently chosen in food service equipment, medical devices, and transport interiors.

- Geometry: Same T-shaped family, with standard widths and thicknesses; profiles may be tuned for fit and retention.

- Finishes: Solid colors or printed woodgrains; maintain profile consistency for matching with edgebanding.

- When to use: Food/pharma environments, outdoor equipment, harsh climates, or projects with sustainability goals.

- Considerations: Slightly different feel vs PVC; coordinate tool changes and retention with existing grooves; verify long-term color fastness and UV needs for the end-use environment.

Typical parameters buyers manage:

– Chemical exposure and cleaning protocols

– Temperature ranges in application

– Grip and retention force for the T lip

– Color stability for brand continuity

Bumper molding (thick-lip edge protection)

Bumper molding—sometimes called bumper T-molding—carries a thicker lip and larger cross-section than standard T profiles. It is ideal for high-wear edges, larger tolerances, and equipment subject to repeated impact.

Illustrative Image (Source: Google Search)

- Geometry: Larger, thicker lip with a robust shoulder; profiles exist in multiple sizes to span gaps and protect vulnerable edges.

- Finishes: Solid colors, woodgrains, and patterns; available across PVC, PP, and PE depending on manufacturer capabilities.

- When to use: P.O.P. displays, point-of-sale kiosks, cargo/bulk handling, material handling carts, recreational vehicles, and transportation interiors.

- Considerations: Heavier profile and higher per-linear-foot cost; ensure adequate clearance for installation; large nose radii can help manage stress concentration.

Typical parameters buyers manage:

– Lip thickness and overall section depth

– Clearance and groove sizing to achieve press fit

– Abrasion resistance under sliding and impact

– Brand alignment with adjacent edgebanding

Flexible/rubber T-molding (vinyl/rubber)

Flexible T profiles—often PVC or rubber compounds—are engineered for tight radii and vibration damping. They conform to curved or rounded surfaces, reducing stress points where rigid extrusions would crack or pop out.

- Geometry: Flexible core with a T-shaped cross-section that retains shape but yields under pressure.

- Finishes: Predominantly solid colors or patterns; visual matching to rigid printed woodgrains can require additional coordination.

- When to use: Portable cases, vehicle interiors, appliances, housings with curved edges, or areas with high vibration.

- Considerations: Flexibility trades off rigidity; validate attachment method and long-term retention; wear performance depends on compound formulation.

Typical parameters buyers manage:

– Bend radius and minimum forming constraints

– Hardness (Shore A) and retention force

– Abrasion and weathering characteristics

– Compatibility with adjacent materials and adhesives

Practical procurement guidance

– Stock vs custom: Manufacturers maintain stock programs and can set up warehouse replenishment to reduce lead time after initial stocking; custom runs typically carry minimums—commonly around 5,000 linear feet—though quantities near 1,000 linear feet can sometimes be sourced via distribution.

– Prototyping and tooling: Dedicated extrusion facilities can 3D-print prototype profiles before committing to tooling; all custom tooling and dies are often produced in-house to accelerate development.

– Sampling and approval: Request profile samples and color chips; align prints to edgebanding for visual continuity; confirm groove dimensions and retention behavior with test assemblies.

– Matching and service: Production partners often emphasize matching capabilities (texture, color, finish) with competitive lead times and pricing; teams can support quantities from one roll to multi-thousand LF production.

Illustrative Image (Source: Google Search)

In summary, select T-edge plastic banding based on geometry, material performance, and brand requirements. PVC T-molding delivers reliable rigidity and consistent printed finishes; PP/PE supports sustainability and chemical resistance; bumper molding protects heavy-wear edges; flexible T profiles handle curves and vibration. Align materials, finishes, and dimensions early to streamline prototyping and ensure on-time production.

Key Industrial Applications of t edge plastic banding

Key Industrial Applications of t‑Edge Plastic Banding

t‑Edge (t‑molding) plastic banding provides durable, finished edges and protective profiles across high‑traffic, engineered‑to‑last environments. It is offered in PVC, polypropylene (PP), and polyethylene (PE), with solid colors, woodgrains, and patterns via direct printing for high‑fidelity appearance. Vertically integrated tooling, 3D‑printed prototypes, and stock‑program support help compress lead times and secure continuity for production‑critical buyers in the USA and Europe.

| Industry | Typical Applications | Detailed Benefits |

|---|---|---|

| Furniture & Casegoods | Countertop edges; edgebanding on cabinets and built‑ins; bumpers on drawers/doors; exposed edges on workstations | Abrasion‑ and impact‑resistant edges improve wear life; printed woodgrains match laminate panels for seamless finishes; moisture‑resistant profiles protect vulnerable edges; flexible bumper options reduce damage in high‑touch areas; color/finish matching to panels and hardware; PVC or PVC‑free PP/PE options; available with custom profiles and widths; quick prototyping and stock programs to stabilize supply |

| Kitchen & Bath | Vanity and countertop edges; appliance trim; wet‑area corner protection | Moisture‑resistant materials maintain edge integrity in humid conditions; smooth surfaces for easy cleaning; printed finishes for coordinated aesthetics; flexible options to accommodate radii and corners; materials choices (PVC/PP/PE) to suit environmental preferences; prototyping validates fit before tooling |

| Retail Fixtures & Displays | Point‑of‑purchase edges; checkout counters; fixture corners and bumpers; shelf edges | High‑traffic durability with good impact resistance; printed woodgrain or pattern for brand‑aligned finishes; low‑volume sourcing option (down to 1,000 LF) for pilots or phased rollouts; easy‑trim installation and reliable repeatability; consistent color and profile matching across regions |

| Hospitality & Marine | Wall panels; handrails; kick plates; corner guards; locker edges | Good weatherability; printed finishes for high‑end appearance; flexible profiles for curved or complex geometries; moisture‑resistant edges to reduce service calls; material options to meet varying environmental preferences; prototyping validates fit for custom extrusions |

| Transportation & Fleet | Vehicle interior trims; bumper edges; service‑bay trim; RV and van fittings | Rugged edge protection for high‑use areas; flexible options help with vibration‑tolerant installations; easy‑to‑maintain surfaces; color/finish matching to interiors; short‑run and stock‑program availability reduces downtime; technical data available to match use‑case requirements |

| Construction & Door Systems | Door thresholds and jambs; wall corner guards; stair nosings; wet‑area transitions | Moisture‑ and wear‑resistant profiles protect edges over long service; printed finishes for uniform aesthetics across sites; flexible radius options; PP/PE options for PVC‑free preferences; 3D‑printed prototypes confirm fit prior to tooling; stock programs to smooth supply during peak demand |

| Healthcare | Patient‑room fixtures; reception counters; equipment corners; wall protection panels | Easy‑to‑clean, smooth profiles support hygiene; durable edges minimize maintenance; finish matching to healthcare interiors; flexible profiles for curved or safety‑critical edges; material choices (PVC/PP/PE) available; support for short‑run tests or phased deployments |

| Education & Public Buildings | Classroom furniture; lab benches; library displays; hallway edge protection | Abrasion‑ and impact‑resistance for daily use; printed finishes to align with campus branding; moisture‑resistant edges; simple installation for retrofit projects; stock‑program support for campus‑wide uniformity; technical data and prototyping to de‑risk adoption |

| Parks & Recreation | Picnic tables; park benches; trail signage trims; shelter trim | Weather‑resistant edge profiles; printed patterns for consistent aesthetics; flexible options for curved edges; low‑maintenance, long‑lasting surface; material options to suit environmental preferences; quick prototyping for custom fit and quick approval |

Material options overview

| Material | Core Characteristics | Typical Strengths | Notes |

|---|---|---|---|

| PVC | Durable, formable; wide profile range; solid colors, woodgrains, patterns; cost‑effective | Good balance of impact and abrasion resistance; extensive profile availability; color/finish matching; compatible with bumper and t‑molding profiles | Widely used in casegoods, POP, hospitality, and construction |

| Polypropylene (PP) | Environmentally‑friendly vs. PVC; good dimensional stability | Reduced environmental impact; suitable for many indoor applications; good durability | Ideal when PVC‑free preference is required |

| Polyethylene (PE) | Tough, flexible; environmentally‑friendly vs. PVC | Good impact tolerance; flexible profiles | Useful for curved or high‑impact edges where flexibility is needed |

Supply and service notes (for production planning)

– Prototyping: 3D‑printed custom extrusions available to validate fit before tooling.

– Materials: PVC, PP, and PE; technical data provided on request.

– Finish options: solids, printed woodgrains, patterns; high‑fidelity printed finishes (vs. vinyl‑laminated alternatives).

– Lead times and programs: custom tooling built in‑house; stock programs for repeat purchases to reduce subsequent lead times.

– Short‑run support: low‑volume sourcing available down to 1,000 LF for pilots, phased rollouts, and regional builds.

– Profiles and finishes: broad array of widths, thicknesses, textures, and profiles; sample kits on request.

Illustrative Image (Source: Google Search)

3 Common User Pain Points for ‘t edge plastic banding’ & Their Solutions

3 Common User Pain Points for T-Edge Plastic Banding & Their Solutions

Pain Point 1: Material choice and eco-compliance across markets

- Scenario: You must select a plastic for t-molding or bumper molding that meets aesthetic, durability, and sustainability requirements across the US and EU. PVC is common but may not align with every environmental policy; polypropylene (PP) and polyethylene (PE) are more environmentally friendly alternatives.

- Problem: Choosing the wrong material risks poor compliance, chemical incompatibility, or weaker outdoor performance (e.g., impact resistance, UV stability, and abrasion).

- Solution: Specify the substrate by application. Use PVC where chemical resistance and cost are critical, or PP/PE where you need greener materials and good toughness. Match t-molding and bumper molding profiles, textures, and colors to your edgebanding program.

- Outcomes:

- Clear material selection backed by technical data (on request)

- Consistency across all extrusions and edgebanding in your line

- Greener options available without sacrificing performance

Quick materials comparison

| Attribute | PVC | PP | PE |

|---|---|---|---|

| Environmental profile | Conventional | More environmentally friendly | More environmentally friendly |

| Chemical resistance | Good | Strong vs many chemicals | Good general chemical resistance |

| Impact/toughness | Very good | Very good | Very good |

| Moisture resistance | Strong | Strong | Strong |

| Texture & aesthetics | Solid, woodgrain, patterns | Solid, woodgrain, patterns | Solid, woodgrain, patterns |

| Printing options | Printed woodgrain available | Printed woodgrain available | Printed woodgrain available |

| Recyclability | Material-dependent | Material-dependent | Material-dependent |

Pain Point 2: Lead times, minimum order quantities, and prototyping

- Scenario: You need custom plastic extrusion fast, but typical production minimums are high, and first-run lead times can delay a launch.

- Problem: Standard MOQs (often 5,000 LF) plus long lead times for new dies or special profiles can stall production schedules.

- Solution: Reduce risk with stock programs and flexible order sizing. PRI can set up a stock program in their warehouse to reduce production lead times on every order after initial stock. They can also source small quantities as low as 1,000 LF when you don’t meet standard MOQs. For quick validation, prototypes can be 3D printed; new tooling and dies are produced in-house for faster customization.

- Outcomes:

- Shorter lead times on repeat orders via stock programs

- Lower MOQs for pilot and niche runs

- Faster custom prototyping with 3D printing and in-house tooling

Pain Point 3: Color, texture, and profile matching consistency

- Scenario: You’re pairing t-molding or bumper molding with edgebanding and need seamless visual and dimensional consistency.

- Problem: Common vinyl-laminated t-molding surfaces rarely match printed edgebanding; alignment, color, and texture drift across vendors and runs.

- Solution: Use printed woodgrain t-molding and bumper molding that match your edgebanding program across widths and thicknesses. Rely on vertically integrated tooling for repeatable profiles and production matching to minimize variation across lots.

- Outcomes:

- Improved visual match across all extrusions and edgebanding

- Faster setup and fewer adjustments on production lines

- Consistent quality from prototype through production

How PRI Edgebanding can help

- Material options: PVC, PP, and PE t-molding and bumper molding in solid colors, woodgrains, and patterns; printed woodgrain option for superior visual match.

- Supply flexibility: Warehouse stock programs to reduce lead times; low MOQ sourcing (1,000 LF) when needed; prototype capabilities via 3D printing; in-house custom tooling and dies for faster changes.

- Matching capability: Production matching, textures, and consistent widths/thicknesses to integrate seamlessly with your edgebanding line.

Get started today:

– Request a quote or samples: call the PRI customer service team.

– Explore profiles and extrusions: patwin.com.

Strategic Material Selection Guide for t edge plastic banding

Strategic Material Selection Guide for T-Edge Plastic Banding

Purpose

Choose the optimal plastic for T-edge (T-molding) and bumper molding edgebanding to meet performance, aesthetics, and compliance goals across furniture, interiors, retail fixtures, and white goods.

Materials overview (from extrusion perspective)

– PVC

– Polypropylene (PP)

– Polyethylene (PE)

Key selection drivers

– Environment and exposure: indoor vs outdoor; UV; moisture; temperature

– Regulatory and sustainability: REACH, RoHS, VOC emissions, recycled content, end‑of‑life

– Aesthetics and brand: solid colors, woodgrains, printed look vs vinyl-laminated surface, texture

– Mechanical durability: impact resistance, abrasion, leg snap-fit and flexibility (for bumper styles), stiffness

– Processing and total cost: extrusion capability, co-extrusion options, print and lamination routes, lead time, MOQs

– Logistics: widths and thicknesses available, volume cadence, supply stability

Illustrative Image (Source: Google Search)

Material notes (based on extrusion practice)

– PVC: commonly used for T-molding/bumper molding in solid colors, woodgrains, and patterns. Available in many sizes and profiles. Woodgrain options are often printed to resemble edgebanding; vinyl-laminated woodgrain prints are also used but typically do not match a true printed appearance as closely.

– PP: more environmentally friendly than PVC extruded products; benefits include good rigidity, low density, moisture resistance. Ideal for high-rigidity T-molding where lightweighting matters.

– PE: more environmentally friendly than PVC extruded products; typically softer and more flexible than PP; well-suited to bumper molding where impact absorption and resilience are priorities.

Common profile and aesthetic considerations

– Wide array of sizes and profiles; T-molding versus bumper styles influence material choice (stiffer PP for rigid T, softer PE for bumper).

– Available textures, matching colors, and widths; printed woodgrains or laminates can be matched for brand continuity.

Sustainability and compliance context

– PP and PE are generally considered more environmentally friendly than PVC extruded products. Align material choice with regional regulations (e.g., REACH, RoHS) and indoor air quality/VOC targets.

– Discuss recycled content, regrind, or bio-based options early with the supplier.

Prototyping and supply strategy

– 3D printing can accelerate custom extrusion development, enabling fit/function proofing before tooling.

– Vertically integrated suppliers can produce custom tooling in-house, reducing lead times and iteration risk.

– Stock programs reduce production lead times on repeat orders; minimums as low as 1,000 LF may be available when standard MOQs (e.g., 5,000 LF) do not fit.

– Sample profiles and color chips support material and appearance verification before large-volume commitments.

Illustrative Image (Source: Google Search)

Quick selection guidance by use case

– High-impact edges and protective profiles: PE; bumper molding styles; flexible T-molding where needed.

– Rigid, precise edges on furniture, cabinets, or fixtures: PP or PVC; ensure leg geometry provides stable snap-fit and repeatable installation.

– High-humidity or outdoor exposure: PP or PE; validate UV performance and formulation with the supplier.

– Aesthetically critical, brand-matched finishes: use printed woodgrain or solid color options available in the material family; compare visual appearance of printed profiles to vinyl-laminated alternatives.

– Environmental goals and compliance priority: prefer PP or PE when feasible; confirm REACH/RoHS and VOC performance.

Comparison table: PVC vs PP vs PE for T-Edge and Bumper Molding

| Attribute | PVC | Polypropylene (PP) | Polyethylene (PE) |

|---|---|---|---|

| Environmental positioning | Less “green” vs PP/PE extruded options | More environmentally friendly than PVC | More environmentally friendly than PVC |

| Typical use | T-molding and bumper molding across furniture/fixtures | Rigid T-molding, structural edge profiles; bumper when impact absorption isn’t critical | Bumper molding, flexible edges, impact zones |

| Rigidity vs flexibility | Moderate rigidity; flexible grades available for bumper | Higher stiffness-to-weight; preferred for rigid T-molding | Softer, more flexible; excels at absorbing impacts |

| Moisture/UV | Good moisture resistance; UV performance depends on formulation | Good moisture resistance; UV performance depends on formulation | Good moisture resistance; UV performance depends on formulation |

| Surface options | Solid colors, woodgrains (printed or laminated), textures | Solid colors, woodgrains (printed or laminated), textures | Solid colors, woodgrains (printed or laminated), textures |

| Processing considerations | Extrusion-friendly; co-extrusion and print available; widely supplied | Extrusion-friendly; lightweighting and stiffness benefits; co-extrusion and print available | Extrusion-friendly; flexibility benefits; co-extrusion and print available |

| Sustainability/compliance | Typically less favored for strict ESG/regulatory environments | Generally better environmental profile than PVC | Generally better environmental profile than PVC |

| Typical MOQ/lead time | 5,000 LF common MOQ; 1,000 LF may be sourced | Same supply model; verify lead time | Same supply model; verify lead time |

Next steps

– Request technical data for the specific profile(s), finish, and exposure conditions.

– Review color chips or printed samples to confirm visual match with adjacent edgebanding or laminate.

– Prototype the custom T-molding/bumper molding (3D-printed samples can accelerate fit testing).

– Set up a stock program if demand is steady; target lower MOQs (e.g., 1,000 LF) to balance cash flow and lead time.

– Align the material choice with your REACH/RoHS and VOC targets; confirm indoor air quality and emissions documentation.

In-depth Look: Manufacturing Processes and Quality Assurance for t edge plastic banding

In-depth Look: Manufacturing Processes and Quality Assurance for t edge plastic banding

Key points overview

– Four-stage production workflow (Prep → Forming → Assembly → QC) [Ensures repeatability and traceability]

– Materials aligned to application (PVC, PP, PE) [Balances performance, sustainability, and compliance]

– Vertical integration and custom tooling in New Jersey [Shortens development cycles and tightens tolerances]

– Finish options: solid colors, woodgrain prints, flexible variants [Meets diverse aesthetics and installations]

– ISO 9001 quality system and AQL-based QC [Delivers consistent batch-to-batch quality]

– Program stocking (5,000 LF initial, 1,000 LF repeat orders) [Optimizes lead times and cost]

– Prototyping via 3D printer [De-risks custom profiles before steel tooling]

– Color/texture matching capability [Reduces callbacks and improves visual acceptance]

Illustrative Image (Source: Google Search)

Manufacturing workflow

1) Prep

- Material qualification: choose PVC, PP, or PE based on chemical resistance, stiffness, and compliance needs; PP/PE offer stronger environmental positioning vs PVC for some markets [Matches regulatory and sustainability goals]

- Moisture control: pre-dry hygroscopic materials (PP/PE) to specified moisture content to prevent splay and voids [Maintains extrusion quality]

- Masterbatch and finish: select solid, woodgrain print, or pattern finishes; woodgrain is printed directly (not vinyl-laminated), improving visual fidelity to laminate [Enhances matching accuracy]

- Custom tooling plan: leverage in-house dies and custom tooling in New Jersey; use 3D-printed prototypes to validate fit/finish before committing to steel [Reduces tooling risk and lead time]

2) Forming

- Extrusion: feed dried compound into a co-extruder to form the T-profile; set temperature, screw speed, and die pressure for stable melt [Ensures dimensional consistency]

- Cooling and sizing: pass through calibrated vacuum sizing and cooling tanks to lock geometry; tune vacuum and water flow [Controls out-of-round and warpage]

- Calibration/embossing (if specified): apply texture or grain matching via sizing shoes or calendering [Achieves surface finish requirements]

- Cutting to length: trim to program-specified lengths and bundle without surface damage [Improves installer handling]

- Optional co-extrusion (where needed): add coextruded layers for color, impact modifier, or compatibility [Optimizes surface and bulk properties]

3) Assembly

- Quality cut accuracy: verify miter/fastener cut quality against tolerances to reduce assembly rework [Supports on-site fit]

- Coil/wind preparation: wind on reels for easy handling and install efficiency [Improves job-site logistics]

- Stocking integration: initial stocking target 5,000 LF minimum per item; subsequent releases down to 1,000 LF [Smooths supply continuity]

- Packaging: clean, moisture-protective packaging with lot and profile identifiers [Preserves finish and traceability]

4) QC

- Incoming verification: confirm polymer grade, filler content, and color match against approved chips [Prevents off-spec compounding]

- Dimensional control: verify width/thickness within ISO-like tolerances (typical ±0.1 mm) and track Cpk; perform straightness and bow checks [Maintains fit]

- Surface and finish QA: visual inspection for grain replication, gloss uniformity, and print registration [Ensures aesthetic acceptance]

- Batch testing where required: tensile/impact, melt flow, Vicat softening, flammability (UL94), VOC/emissions, and chemical resistance as per spec [Confirms performance]

- Process monitoring: SPC on critical dimensions, documented traceability (lot, die, date), and AQL sampling per ISO 2859-1 principles [Supports continuous improvement]

- Handling damage checks: verify no nicks, scratches, or contamination after cutting/packaging [Protects end-use appearance]

Material selection and performance

- Polypropylene (PP)

- Sustainability: widely regarded as more environmentally friendly vs PVC in some applications [Appeals to EU/USA eco-goals]

- Performance: good chemical resistance, rigidity at mid-loads, moisture stability [Suits mid-duty T-profiles]

- Polyethylene (PE)

- Sustainability: non-halogenated, recyclable in many streams [Supports sustainability commitments]

- Performance: flexibility/impact resistance, good cold performance; lower rigidity than PP [Fits flexible T-edge use cases]

- PVC

- Versatility: broad color/texture library, cost-effective, strong print capability [Delivers design flexibility at scale]

- Compliance: widely used with standard flame ratings; requires formulation for eco-conscious programs [Enables robust portfolio]

Finish options

– Solid colors, woodgrain prints (directly printed), patterns, flexible variants; printed woodgrain yields superior laminate-like appearance vs vinyl-laminated surfaces [Increases aesthetic options and matching quality]

Quality standards and ISO practices

- ISO 9001 Quality Management System

- Scope: design, extrusion, cutting, packaging, and release control across North America and EU shipments [Assures process consistency]

- Evidence: documented procedures, training, calibration, and change control; batch traceability with lot identifiers [Enables audit-ready compliance]

- ISO-related tools in practice

- ISO 2859-1 (AQL) for acceptance sampling of lots; define critical dimensions and finish defect classes [Provides consistent acceptance criteria]

- ISO-like tolerance references for extrusions and measurement accuracy (note: formal dimensional tolerances are plant-specified, not an ISO standard) [Ensures measurable quality]

- ISO 14001 (where applicable): environmental aspects, recycling, and waste minimization aligned with PP/PE positioning [Supports sustainability audits]

Typical tests and checks (aligned to customer spec)

– Physical: tensile strength, elongation at break, impact resistance (Izod/Charpy) [Validates mechanical robustness]

– Thermal: Vicat softening temperature, heat deflection where applicable [Confirms heat resistance]

– Flammability: UL94 classifications [Meets safety requirements]

– Chemical/oil/cleaner resistance (by application) [Avoids premature aging]

– Color/finish: ΔE using color spectrophotometer and visual panel checks to approved color chips [Ensures aesthetic consistency]

– VOC/emissions: used when specified for interior environments [Supports health and compliance targets]

Packaging, labeling, and logistics

- Packaging: protective, clean, sealed wraps with lot/profile data and handling notes [Prevents damage and confusion]

- Labeling: clear profile designation, finish, width/thickness, lot number, and production date; optional AQL result summary if requested [Improves traceability]

- Program stocking: initial stocking 5,000 LF per item; subsequent releases down to 1,000 LF to meet minimums [Smooths supply without overstock]

- Lead times: program-dependent; early profiling and stocking reduce standard production lead times [Improves delivery predictability]

Technical and commercial integration

- Vertical integration: in-house die/tooling in New Jersey, plus 3D-printed prototypes for rapid fit validation [Shortens ramp-up and supports customization]

- North America–EU alignment: shared procedures and documentation enabling dual-market supply [Minimizes certification duplication]

- Competitive pricing and matching capabilities: best match to laminate/edgebanding finishes with standard packaging/labeling practices [Reduces risk of mismatched aesthetics]

Summary

– The manufacturing process is disciplined and transparent, from material prep through extrusion, finishing, assembly, and ISO-grade QC, while offering flexible stocking and custom tooling; this yields T-edge plastic banding that meets performance, aesthetic, and compliance requirements across USA and Europe markets.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘t edge plastic banding’

Practical Sourcing Guide: A Step-by-Step Checklist for T-Edge Plastic Banding (T-Molding, Bumper Molding)

Key points

– T-edge plastic banding (T-molding, bumper molding) is available in PVC, PP, and PE; choose material to balance durability, cost, and environmental goals.

– Custom sizes, profiles, textures, and finishes (solid, woodgrain, patterns) are widely available; PP/PE options are more environmentally friendly than PVC in extrusion applications.

– Prototypes, custom tooling, and stock programs reduce time-to-market and lead times on repeat orders.

– Typical production minimums are ~5,000 LF; many suppliers can support 1,000 LF or one-roll pulls via stock programs.

– Request color chips, profile samples, and technical data; clarify tolerances and QA metrics before quoting and ordering.

Illustrative Image (Source: Google Search)

Quick decision guide (material, finishes, and quantities)

| Category | Option(s) | Notes |

|---|---|---|

| Material | PVC; Polypropylene (PP); Polyethylene (PE) | PP/PE are more environmentally friendly than PVC for extruded products. |

| Finish | Solid color; Woodgrain; Patterns | Woodgrain can be printed or laminated; printed options generally provide closer appearance to laminates. |

| Extrusion type | T-molding; Bumper molding | Choose profile type based on application fit and impact protection. |

| Quantities | 1,000 LF; 5,000+ LF typical minimum | 1,000 LF feasible through select suppliers and stock programs; 5,000+ LF standard for production runs. |

| Services | Samples (chips, profiles); Prototype extrusion; Custom tooling | Prototyping can be done via 3D printing; custom tooling and dies often produced in-house. |

| Lead time | Stock pulls vs. production | Stock programs can reduce lead times; confirm lead-time by profile and volume. |

Step-by-step sourcing checklist

1) Define the application and profile requirement

– Specify whether T-molding or bumper molding is required.

– Confirm functional requirements (edge protection, impact absorption, fit geometry).

– Identify target substrates and joint tolerances.

2) Select the material

– Choose PVC, PP, or PE based on:

– Environmental goals (PP/PE typically more environmentally friendly than PVC extrusion).

– Chemical resistance, flexibility, and temperature exposure.

– Regulatory needs (e.g., contact with food/beverage containers or furniture).

3) Specify geometry and tolerances

– Provide exact width, thickness, leg length, and root radius.

– Include profile cross-section or standard profile name/code.

– Define tolerances for fit and repeatability.

4) Choose finish and appearance

– Solid color, woodgrain, or patterns; select texture preference (smooth, embossed).

– For woodgrain, decide between printed-in-mass appearance or laminated vinyl overlay.

– If a custom color match, submit samples and target codes.

Illustrative Image (Source: Google Search)

5) Determine volume and lead-time

– Indicate forecasted LF per year and order cadence.

– Choose between 1,000 LF runs (where supported) or 5,000+ LF production minimums.

– Confirm lead-time expectations for initial and repeat orders; ask about stock program benefits.

6) Request samples and technical data

– Obtain profile samples and color chips.

– Request material datasheets for the selected resin(s).

– Confirm compatibility and quality metrics (adhesion, color retention, dimensional stability).

7) Confirm custom tooling and prototyping capabilities

– For new profiles, confirm custom tooling and in-house dies are available to reduce lead time.

– If rapid iteration is needed, leverage 3D printed prototypes before final extrusion tooling.

8) Lock pricing, terms, and QA

– Submit detailed requirements for quote; request production lead time and all-in pricing (material, tooling, freight).

– Align quality standards and acceptance criteria; define returns/rework process.

– Set up a replenishment model (stock program) to stabilize supply and shorten lead times for repeat orders.

Illustrative Image (Source: Google Search)

What to prepare before you request a quote

| Category | Checklist items |

|---|---|

| Material | Resin choice (PVC, PP, PE); regulatory needs (e.g., food/beverage contact, RoHS/REACH if applicable). |

| Profile | Cross-section drawing or named profile; width, thickness, leg lengths, radii; tolerances. |

| Finish | Solid/woodgrain/pattern; texture; target color/finish samples or codes. |

| Quantity | Initial order size; annual forecast; cadence; minimum run capability (1,000 LF vs. 5,000+ LF). |

| Lead time | Stock pull vs. production; target ship dates; reorder frequency. |

| Quality | Acceptance criteria; color/dimensional tolerances; test methods. |

| Services | Samples required; technical data requests; 3D prototype needed; custom tooling in-house capability. |

| Logistics | Packaging (coils/spools/rolls), labels, delivery terms, destination(s). |

Recommended process flow

- Quote → Samples/datasheets approved → Prototype (if applicable) → Tooling confirmed → P/O → Production → QC/release → Delivery.

- Optional: Implement a stock program to carry pre-positioned inventory and reduce lead times on subsequent orders.

Summary

– Start with the right material and profile, confirm volume expectations, and leverage sampling plus custom tooling for speed. Choose PP/PE for environmentally-oriented applications, and utilize stock programs to cut lead times on repeat orders. Lock in quality criteria and replenishment models early, then request quotes with the checklist above to ensure consistent, on-time delivery.

Comprehensive Cost and Pricing Analysis for t edge plastic banding Sourcing

Comprehensive Cost and Pricing Analysis for t-edge plastic banding sourcing

Total landed cost (TLC) for t-edge plastic banding—commonly referred to as t-molding—derives from three core drivers: material selection and surface options, process complexity and labor, and logistics through packaging and transport; accordingly, aligning product design with cost principles early reduces per-foot price while preserving durability, finish quality, and lead-time stability.

Material cost drivers and implications

- Resin choice: PVC offers the best price-performance balance and broad market acceptance, whereas polypropylene (PP) and polyethylene (PE) provide a more environmentally favorable profile and comparable mechanical performance in many indoor applications; in the EU’s RoHS and chemical stewardship context, PP/PE can simplify compliance and reduce regulatory friction.

- Surface and aesthetic layers: Solid colors are generally most economical, whereas woodgrains or patterns incur added cost; printed woodgrain achieves closer visual match to laminate surfaces, whereas laminated vinyl film presents a budget alternative with inferior aesthetic fidelity, which—while cheaper—may not meet premium appearance requirements.

- Profile and tolerances: Custom profiles, tighter tolerances, and complex coextrusions increase tooling and setup costs, and narrow widths or thin walls raise scrap rates; standardizing around common widths and thickness bands keeps per-foot pricing predictable.

- Color coordination: Pantone or custom matches require compounding and sample iterations, thereby increasing formulation and QA effort; harmonizing across product lines (e.g., common white or black bases) reduces color-specific cost.

Labor and process cost implications

- Extrusion and tooling amortization: The first run amortizes die/tooling setup and line conditioning; consistent runs, therefore, lower average per-foot cost.

- Surface finishing: Direct printing versus film lamination follows the same economics as profile differentiation—printing can deliver more authentic woodgrain, whereas lamination trades appearance for simplicity.

- Quality and testing: Dimensional checks, adhesion durability tests, and color match approvals add time and cost; formalizing specs and QA plans reduces rework.

- Packaging and order handling: Roll length optimization, spool protection, and labeling affect both in-plant labor and logistics; standard pack sizes and clear SKU codes streamline both quoting and shipping.

- Customization and stock programs: A vertically integrated extruder producing in-house tooling speeds development and protects schedules; a distributor-managed stock program for repetitively purchased profiles reduces lead time and lowers per-run costs by minimizing changeovers.

Logistics and service-level drivers

- Order sizing: Larger minimum orders lower average run costs; where typical industry minimums are high, sourcing smaller quantities is possible through stock programs, though at a unit price premium.

- Lead time versus inventory: Faster lead-time commitments often carry a price premium; planned forecasts and stocking reduce expedite fees and reduce variance in TLC.

- Packaging and unitization: Longer per-roll lengths, protective wrap, and palletization affect damage rates, handling fees, and freight density; optimizing roll length and pack design reduces cost and claims.

- Cross-border costs (USA/EU): Duties/VAT, compliance documentation (e.g., REACH for EU), and inland transport to distribution points add non-trivial cost variance; selecting materials and processes aligned with local regulatory frameworks reduces friction and delays.

Cost component breakdown—typical levers and impacts

| Component | What drives cost | Primary levers to optimize | Key implication |

|---|---|---|---|

| Materials | Resin type; surface option (solid, woodgrain, printed vs laminated); profile complexity | Use PVC for balanced cost; switch to PP/PE when sustainability/compliance outweighs price; standardize profiles; consider printed woodgrain if aesthetic matters | Aligns material with market and regulatory context without unnecessary premium |

| Labor/Processing | Extrusion line setup; print/laminate line time; QA/testing; packaging complexity | Batch similar runs; limit color changes; pre-approve color/print samples; reduce SKU proliferation | Lowers setup costs and minimizes downtime |

| Logistics | Freight mode; packing density; roll length; inventory policy | Consolidate shipments; longer rolls; stock programs; forecast to avoid rush | Cuts TLC by improving freight density and reducing lead-time premiums |

Typical cost bands by volume (indicative, ex-plant; varies by resin, surface, and profile)

| Volume band | Solid PVC | PP/PE (solid) | Printed woodgrain PVC | Laminated film option | Notes |

|---|---|---|---|---|---|

| 1,000–4,999 LF | Higher unit price | Similar unit price to PVC | Premium vs solid; printed surface adds | Lower than printed; lower aesthetic fidelity | Achievable through stock programs; expect price premium |

| 5,000–19,999 LF | Mid unit price | Similar unit price to PVC | Mid-to-premium; setup amortized | Lower premium | Production minimums often met; setup amortized |

| 20,000+ LF | Lower unit price | Similar unit price to PVC | Premium; lower average per-foot | Lower premium | Longer runs reduce variance; strong batch control |

Note: Actual quotes vary by profile complexity, color match, surface texture, roll length, and supplier capacity; treat ranges as directional for planning.

Tips to save cost—practical, verifiable strategies

- Standardize profiles and widths: Use common wall thicknesses and geometries to enable shared tooling and higher extrusion utilization.

- Consolidate colorways: Limit the palette to one or two core shades plus seasonal accents; align with Pantone where feasible.

- Commit to longer rolls: Increase per-roll linear footage to reduce splice count and lower handling, packaging, and freight per LF.

- Adopt stock programs: For repeat SKUs, enable in-warehouse stock programs to reduce changeover and lead-time premiums.

- Time orders to batch changeovers: Coordinate deliveries to coincide with line set-ups for similar materials, thereby capturing lower per-foot prices.

- Evaluate surface strategy: Use printed woodgrain when visual match matters; otherwise, rely on solid colors or laminated film to control cost.

- Optimize packaging: Use protective wrapping, core labels, and palletization that minimize damage and simplify receiving.

- Plan for full-run economics: Where project budgets permit, order up to typical production minimums or above to amortize setup and secure the lowest unit rates.

By treating material selection, process design, and logistics planning as a unified optimization problem—rather than isolated decisions—you compress per-foot cost while preserving the physical and aesthetic performance that defines quality t-edge plastic banding; through early specification discipline and supplier alignment on tool design, color strategy, and inventory, USA and EU buyers can achieve predictable pricing and lead times across volume bands.

Illustrative Image (Source: Google Search)

Alternatives Analysis: Comparing t edge plastic banding With Other Solutions

Alternatives Analysis: Comparing T-Edge Plastic Banding with Other Solutions

Overview

– T-edge plastic banding (T-molding and bumper molding) offers a versatile, co-extruded solution for impact protection, edge sealing, and finishes on plastics, metals, composites, and wood panels.

– Two commonly selected alternatives are flexible laminate edge (often used for contoured/cabinets and simple 90° corners) and aluminum edge trim for a premium mechanical fix.

Table 1: Side-by-side comparison (USA/Europe)

| Criteria | T-edge plastic banding (T-molding/bumper) | Aluminum edge trim | Flexible laminate edge (thermofoil/edgeband) |

|---|---|---|---|

| Primary use | Impact protection, bumper/edge sealing; available in solid colors, woodgrains, patterns (printed woodgrain options available) | Premium mechanical edge; straight-edge impact sealing on metal/plastic/composites | Furniture/cabinetry; contoured and simple profiles; decorative edges |

| Materials | PVC, PP, PE; solid colors, woodgrains, patterns (printed woodgrain available) | Aluminum (anodized/painted), often with EPDM/PVC gasket | Vinyl, TPU, or film-laminate skins; often 0.018–0.040 in (0.45–1.0 mm) |

| Impact/abrasion resistance | High bumper/impact protection; variable durometers (flexible to semi-rigid) | Excellent dent/abrasion resistance; mechanical robustness | Good scuff/abrasion for light duty; lower impact vs. T-edge |

| Moisture/UV | PP/PE excellent moisture; PVC variable; UV performance depends on formulation and pigment | Inert to moisture; good UV with anodized/painted finish | Moisture performance tied to laminate/press quality; UV varies widely |

| Finish/match quality | Printed woodgrains and patterns; solid/painted options | Smooth, modern; limited textures/woodgrain effects | Broad decorative options; wrap conforms to curves; crisp edges possible |

| Installation | T-slot or adhesive; fast, no presses; fits varied substrates | Mechanical fastening (screw/clamp/rivet); precise alignment required | Vacuum forming or press; contour-friendly but slower for high volumes |

| Lead times | Fast on many stock profiles; custom extrusions available; prototyping via 3D printing | Often 2–4 weeks depending on finish/aluminum availability | Mold/tooling lead for contoured parts; film availability can vary |

| Customization | Broad profile range; custom extrusions and dies handled in-house at some suppliers | Wide extrusions possible; premium finishing; higher setup costs | Film-based finishes broad; contour tools or molds add lead time and cost |

| Sustainability | PP/PE options are more environmentally friendly vs. PVC; recyclability depends on local streams | High value recycling streams; durable lifespan | Laminates vary; adhesive/packaging waste can be material-specific |

| Typical MOQs/availability | Many sizes stocked; some suppliers can source ~1,000 LF and run production with MOQ as low as ~5,000 LF | Typically 100–500 LF; custom extrusions larger | 100–500 LF typical; contoured parts may require larger runs for tooling |

| Cost bracket (illustrative, depends on profile/paint/finish) | Varies by polymer/width/finish; PVC typically lower than PP/PE; patterns/woodgrains add cost | Premium fixed cost for most widths vs. plastic; premium finishes increase | Film/press/labor drive costs; premium films can surpass plastic T-edge per LF |

| Typical failure modes | Splitting under extreme cold on PVC; T-slot creep if mis-specified; adhesion failure without proper priming | Dents/bends on impact; gasket degradation over time; galvanic corrosion risk on mixed metals | Peeling at edges; heat creep; seam wear; color fade if UV not rated |

Notes

– Typical order sizes and stock programs: If you have repeat needs, a supplier may establish a stock program in their warehouse to shorten lead times after initial stocking. Samples of profiles and color chips are available on request, and prototype extrusions can be 3D printed to validate fit and finish. Many providers can support small runs (for example, sourcing around 1,000 LF) and have production capacities starting around 5,000 LF, with competitive lead times and matching capabilities for textures, widths, and thicknesses.

Table 2: Cost and order quick reference (illustrative, region-specific and volume dependent)

Illustrative Image (Source: Google Search)

| Solution | Indicative cost per LF (USD/EUR) | Typical order quantities |

|---|---|---|

| T-edge (PVC) | Low to moderate; increases with width, textures/patterns | Small: ~1,000 LF (availability varies); Production: ~5,000+ LF |

| T-edge (PP/PE) | Moderate to moderate-high | Small: ~1,000 LF (availability varies); Production: ~5,000+ LF |

| Aluminum edge trim | Moderate to high depending on finish/width | Typically 100–500 LF for stock; custom as low as ~300 LF |

| Flexible laminate edge | Variable; premium films and contoured tooling can raise cost | Typically 100–500 LF; contoured parts may require larger runs for tooling |

What this means in practice

- Choose T-edge plastic banding when:

- You need impact resistance and bumper behavior with fast installation, and you want a finish that matches solid colors, patterns, or printed woodgrains.

- You want the flexibility of a co-extruded profile for a T-slot or adhesive application on varied substrates, with the ability to prototype and customize quickly.

-

You value moisture/chemical performance (PP/PE) and potential sustainability advantages over PVC, or you require stocked items with short lead times.

-

Choose aluminum edge trim when:

- You need a premium, mechanical-looking edge that must withstand high abrasion and dent resistance on straight runs, and long-term exposure to moisture.

-

You prefer mechanical fastening (no adhesives) and are comfortable with higher fixture/setup costs for precision alignment and premium finishes.

Illustrative Image (Source: Google Search)

-

Choose flexible laminate edge when:

- You are finishing contoured edges on cabinetry or furniture and need film-driven finishes that can be vacuum formed or press-applied.

- You accept trade-offs in impact performance and installation speed in favor of a broad decorative palette and curve-conforming capability.

Action items

– Request profile and color-chip samples to verify finish matching against your substrate.

– Share application requirements (substrate, impact profile, temperature/UV, moisture exposure, regulatory constraints) to select the right polymer (PVC vs. PP/PE) and hardness.

– If you need low-volume prototypes or custom T-edge extrusions, ask about 3D-printed prototypes, in-house tooling/die capabilities, and stock-program options to reduce lead times after initial stocking.

– For production quantities under typical minimums, confirm whether small runs (~1,000 LF) are feasible; otherwise, plan pooling or a stock program to meet project timelines.

Essential Technical Properties and Trade Terminology for t edge plastic banding

Essential Technical Properties and Trade Terminology for T‑Edge Plastic Banding

This section distills the core material choices, performance levers, and commercial terms relevant to T‑edge (T‑molding) plastic banding used across the USA and Europe. It is tailored for procurement engineers, product designers, and supply chain managers evaluating custom or stock extrusions.

Materials and Resins

T‑edge banding is commonly extruded in PVC, polypropylene (PP), polyethylene (PE), and flexible/rubber-like compounds (including TPR or vinyl). PVC is the most widely used; PP and PE variants are frequently favored for environmental or regulatory reasons. Available finishes include solid colors, woodgrains, and patterns.

Illustrative Image (Source: Google Search)

Two woodgrain methods are prevalent: printed woodgrain (directly printed into the profile surface) and surface-laminated vinyl. The printed method generally achieves better visual matching to adjacent edgebanding and laminates.

Resin comparison (qualitative overview)

- PVC: Balanced cost/performance, easy to match colors/woodgrains, excellent tooling flexibility. Lower halogen-free claims vs PP/PE.

- PP (polypropylene): High chemical and abrasion resistance; low density; favorable long-term dimensional stability under moisture change; commonly selected for environmentally conscious programs.

- PE (polyethylene): Tough, flexible at lower temperatures, good chemical resistance; slightly more flexible overall than PP.

- Flexible/TPR/vinyl compounds: Added elastomer content for flexibility and softness; suitable for impact areas or irregular edges. Surface-laminated vinyl often compromises print fidelity; printed woodgrain remains superior for high-accuracy color matching.

Key Technical Properties

- Finish options: printed woodgrain (superior visual matching), solid colors, patterns; also surface-laminated vinyl woodgrain.

- Dimensions and profiles: wide range of widths, thicknesses, and profile geometries available. Custom tooling supported by vertical integrators; sample profiles and color chips provided on request.

- Matching capabilities: strong alignment with common edgebanding finishes; robust in-house print and tooling enable accurate coordination with existing laminate systems.

- Performance levers: material family (PVC vs PP/PE vs flexible compounds), wall thickness, durometer/hardness, hardness modifiers, UV stabilization (for interior durability; exterior requires grade selection and additives), impact modifiers, and surface textures.

- Environmental notes: PP and PE are typically favored for halogen-free specifications. Detailed technical data is available by request.

Production, Lead Times, and Commercial Terms

- MOQ (Minimum Order Quantity): typical production MOQ is ~5,000 LF; availability of 1,000 LF sourcing on select SKUs. Smaller runs can be supported by stock programs.

- Lead times: competitive across the industry; specifics vary by profile and color. Use printed woodgrain with caution on lead times due to sequencing.

- Stocking programs: warehouse programs available for repeat purchases to reduce lead time and simplify replenishment.

- Tooling: vertical integration enables in-house custom tool design and maintenance; prototype extrusions can be 3D printed to validate fit and clearance prior to tooling.

- Sampling: sample profiles and color chips provided upon request.

- Logistics: headquartered in New Jersey; distribution coverage across USA. European buyers can engage via distributor networks; shipping specifics by quote.

- Documentation: technical data sheets (TDS) and safety data sheets (SDS) available upon request.

Standards, Compliance, and Certifications

Specify resin grade, thickness, and end-use conditions early to align with relevant standards. If halogen-free, low-VOC, or REACH/RoHS compliance is required, confirm at quotation stage, as these properties depend on formulation and additives rather than the banding format itself.

Design and Engineering Inputs That Matter

- Material family and finish method (printed vs laminated vinyl) to balance cost, compliance, and visual match.

- Profile geometry: lip thickness, web width, and geometry to achieve secure snap-in without excessive flex; tolerance to fit adjacent substrates.

- Durometer/hardness: matched to insertion force and flex life; flexible compounds for higher impact or curved applications.

- Tooling availability: leverage vertical integration for faster development; prototype with 3D printed profiles to de-risk fit/clearance before committing to tooling.

Summary Guidance

Select PVC for cost and broad color-matching, PP or PE for environmental priorities and dimensional stability, and flexible compounds for softness or curved edges. Use printed woodgrain for accurate matching to adjacent laminates. Anchor lead time and cost with a stocking program, and prototype with 3D printed profiles when developing custom tooling.

If you have specific performance targets—chemical exposure, temperature range, impact resistance, or regulatory compliance—request the corresponding TDS/SDS to validate material suitability before production tooling is finalized.

Illustrative Image (Source: Google Search)

Navigating Market Dynamics and Sourcing Trends in the t edge plastic banding Sector

Key Takeaways

- T-molding and bumper molding remain foundational in furniture, construction, and appliance markets due to durability, impact resistance, and aesthetic continuity across profiles. Reason: Stable demand paired with material versatility sustains cross-segment relevance.

- Material selection now sits upstream of design, with PVC offering the broadest cost-to-look span, and PP/PE gaining share in sustainability-driven programs. Reason: Regulatory and brand commitments are reshaping minimum viable specifications.

- Vertical integration and lead-time leverage are critical differentiators in North America, especially when programs cross from prototyping to stock programs. Reason: Shortening changeover and tooling cycles reduces the full-cycle cost of ownership.

- Woodgrain/pattern matching directly influences perceived quality in furniture lines; printing technology outperforms surface laminates on visual fidelity. Reason: Up-front design decisions control rework, returns, and brand standards without adding weight to the BOM.

- Minimum order flexibility (1,000–5,000 LF) and local warehousing unlock scalable commercialization for small-to-mid sized SKUs. Reason: Capital lock-up and long runs no longer gate market entry when programs flex.

Market Context and Historical Evolution

- 1980s–2000s: Extrusion capacity expands alongside high-volume furniture and fixtures, standardizing PVC as the default for edge protection and decorative trims. Reason: PVC balanced cost, tooling breadth, and mechanical performance across wide profiles.

- 2010s–2020s: Sustainability metrics tighten; recyclable olefins (PP/PE) enter specification dialogues for regions with stricter VOC and environmental content requirements. Reason: Extended producer responsibility and green procurement push material substitution.

- 2020s: Custom extrusions and rapid prototyping become commercial levers, bridging design iteration with production-readiness; woodgrain printing aligns with edgebanding to reduce visual mismatch. Reason: Faster PDCA cycles reduce time-to-value and claims during SKU ramp.

Current Market Dynamics

- Multi-industry footprint: Furniture lines, architectural trims, appliance detailing, and construction components absorb the bulk of T-edge volume, with bumper profiles used where abrasion or impact resistance is primary. Reason: Functional performance plus visual consistency drives adoption in both interior and semi-structural applications.

- Aesthetic parity with edgebanding: Printed woodgrains on T-molding mirror edgebanding patterns and textures, minimizing panel edge-to-edge mismatches without resorting to surface films. Reason: Unified finish reduces customer complaints and expedites approvals.

- Tooling and production flexibility: Custom dies, rapid prototyping, and stock programs lower barriers to entry for new SKUs and scale production post-validation. Reason: Faster iteration and predictable replenishment reduce inventory risk.

Materials and Sustainability Positioning

| Material | Sustainability notes | Mechanical/chemical profile | Design implications |

|---|---|---|---|

| PVC | Widely used; recyclable in designated streams; surface options include solid, woodgrain, patterns | Robust impact resistance; broad profile capability | Preferred when cost-to-look span and colorways are key; supports complex geometries |

| Polypropylene (PP) | Widely considered more environmentally friendly than PVC; recyclable where accepted | Good stiffness; acceptable dimensional stability; improved chemical fatigue in some conditions | Use when sustainability targets and lighter color options are priorities; check dimensional retention under thermal cycles |

| Polyethylene (PE) | Considered a softer, more flexible alternative; recyclable in specified streams | Higher flexibility; impact durability; suitable for bumper applications | Select for dynamic applications requiring flexibility and abrasion resistance; consider creep over time in load-bearing designs |

| Woodgrain (printed) | Reduces reliance on surface vinyl laminates | Consistent finish with edgebanding for aesthetics | Eliminates visual mismatch and returns; enhances perceived quality |

Note: Consult product-specific technical data before specifying materials. Reason: Formulation and environment drive performance; one-size-fits-all selections risk field failures.

Sourcing Trends: USA vs. Europe (and how to source locally)

- USA

- Lead-time and integration matter: Local vertical integration—custom tooling, dies, and extrusions in one facility—compresses tooling lead times and protects schedules. Reason: Reduced dependencies minimize supply chain slippage during launches.

- Stock programs and MOQ flexibility: Sourcing 1,000–5,000 LF for smaller runs or setting up local warehouse stock programs for replenishment creates agility. Reason: Shortens cycle time and avoids capital overcommitment.

-

Sample-first workflows: Requesting profile and color chips accelerates specification alignment and avoids rework. Reason: Physical samples reduce color variance and fit issues before tooling.

-

Europe

- Recyclability and environmental compliance are embedded in spec: Program owners often default to PP/PE when possible due to stricter sustainability criteria and end-of-life regulations. Reason: Procurement norms reward lower environmental footprints where viable.

- Harmonization across the finish line: Selecting printed woodgrain patterns that match edgebanding is common to ensure a uniform brand appearance across markets. Reason: Consistency minimizes returns and simplifies warranty claims.

Market Drivers and Risk Factors

| Driver | USA signal | Europe signal | Action |

|---|---|---|---|

| Sustainability specs | PVC remains dominant, PP/PE adopted selectively | PP/PE adoption higher due to stricter green criteria | Set material fallback options and qualify multiple suppliers per material family |

| Aesthetic continuity | Woodgrain matching against edgebanding increases | Same, with emphasis on pattern consistency across SKUs | Lock color/print codes and enforce sampling in BOM |

| Lead-time | Vertical integration reduces cycle time | Similar, with extra emphasis on CE/REACH alignment | Bake in tooling lead-time and do first-article approvals early |

| MOQ flexibility | Sourcing 1,000–5,000 LF is possible | Varies by supplier; some require higher MOQs | Structure pilots with flexible MOQs; transition to stock program after validation |

| Cost | PVC remains cost-effective for complex profiles | PP/PE sometimes carry cost premiums | Optimize profile geometry and print coverage to meet cost targets |

Sourcing and Specification Best Practices

- Specify at the profile level: Define width, thickness, lip geometry, co-extrusion (if any), and surface finish. Reason: Extrusion outcomes hinge on microscopic tolerances that show up in assembly.

- Make materials a first-class design variable: Declare material options in order of preference (e.g., PP first, PVC fallback), including print method if aesthetics are critical. Reason: This builds in a path to sustainability without compromising schedules.

- Use samples to fix color and texture: Approve physical chips before tool design and print runs. Reason: Avoids costly reruns and color drift.

- Leverage local stock programs for replenishment: Once demand is proven, set up a local program to hold inventory and replenish on known lead times. Reason: Smooths service levels while protecting cash.

- Prototype custom extrusions early: Use 3D-printed prototypes for fit/assembly checks before dies. Reason: Reduces tool modifications and accelerates go-live.

- Plan MOQ in phases: Start with 1,000–5,000 LF to validate demand; scale only after confirmation. Reason: Minimizes waste and capital exposure.

What to Validate With Your Supplier

- Production capabilities: Profile matching, width/thickness ranges, textures, lead times, and print quality. Reason: Confirms that operational capacity aligns with your roadmap.

- Tooling depth: In-house die/tooling for T-molding and bumper molding, plus maintenance policies. Reason: Cuts rework and protects tooling investments.

- Material breadth: Access to PVC, PP, PE, including printed woodgrains and solid/pattern options. Reason: Ensures flexibility under shifting specs or regulations.

- Flexibility on MOQ and stock programs: Availability for 1,000 LF orders and local warehousing. Reason: Maintains speed during commercialization and early ramp.

- Technical support: Engineering review, material data sheets, and rapid prototyping. Reason: Reduces integration risk and accelerates issue resolution.

If you want, I can convert this into a drop-in markdown section or add a one-page sourcing checklist tailored to your procurement team. Reason: Targeted tools tighten alignment and speed execution.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of t edge plastic banding

Frequently Asked Questions (FAQs) for B2B Buyers

1) What is “T-edge plastic banding” and how is it used?

T-edge plastic banding refers to T‑molding and bumper molding extrusions used to cover, protect, and finish edges on panels and enclosures. T‑molding locks into a groove for a durable, flush edge; bumper molding provides a rounded protective edge. Both are used across furniture, casework, cabinets, kiosks, carts, recreational vehicles, and equipment enclosures.

2) What materials are available, and which should I choose?

Available materials: PVC, Polypropylene (PP), Polyethylene (PE). All are offered as solid colors, woodgrains, and patterns. PVC is the cost-effective, high‑impact option for indoor use; PP/PE are more environmentally friendly than PVC and often chosen for outdoor or chemical‑resistance needs. Choice depends on environment (temperature/UV), chemical exposure, durability, and regulatory requirements.

Table: Quick comparison for selection

| Material | Key properties | Best use cases |

|—|—|—|

| PVC | High impact; good stiffness; cost effective; wide range of profiles and textures | Indoor casework, kiosks, equipment edges where cost and finish are critical |

| Polypropylene (PP) | Tougher; chemical‑resistant; moisture‑stable | Outdoor panels, carts, kiosks; applications with mild chemical exposure |

| Polyethylene (PE) | Flexible and tough; abrasion‑resistant; chemical‑resistant | High‑wear edges, impact‑prone equipment, protective bumper applications |

3) What finishes, profiles, and sizes can I get?

- Finishes: solid colors, woodgrains (printed to match laminates), and patterns.

- Profiles: wide array of T‑molding and bumper molding shapes and sizes; custom profiles are supported.

- Matching: textures, widths, and thicknesses can be matched to specific laminates/requirements.

- Woodgrain look: unlike common vinyl‑laminated alternatives, these are printed for a more consistent match to edgebanding.

4) Can you make custom profiles? What about prototypes and tooling?

Yes. Custom tooling and dies are produced in‑house, enabling tighter control of geometry and faster iteration. If you need a working prototype of a custom extrusion, a 3D printer can be used to validate fit and function before committing to metal tooling. The team can support engineering changes during development.

Illustrative Image (Source: Google Search)

5) What are the minimums, lead times, and small‑lot options?

- Production minimums: typically from 5,000 linear feet (LF) for custom orders.

- Small‑lot options: can source as low as 1,000 LF in qualifying products when production minimums aren’t met.

- Stock pulls: if you only need one roll, available to pull from stock programs.

- Lead times: based on complexity and capacity. In‑house tooling and vertical integration support competitive lead times; request a current quote for firm timing.

6) Do you offer a warehouse stock program for repeated orders?

Yes. A stock program can be set up in the warehouse to reduce lead times on every order after the initial stocking lot is introduced. This is well suited for ongoing replenishment needs and predictable demand.

7) What sustainability options and certifications do you offer?

Polypropylene and polyethylene are more environmentally friendly than PVC extruded products. The company is vertically integrated and can provide technical data on request. Specific certifications and recycled content options are available per material and profile; confirm details during quoting.

8) How do I get samples and a quote?

- Samples: request profile and color chips to verify fit and finish.

- Quote/ordering: submit drawings, target profile, texture/finish, material, and expected annual usage. The team can assist if your project doesn’t meet standard minimums.

- Contact: submit a quote request or call customer service with your t‑molding, bumper molding, rubber‑t‑molding, flexible t‑molding, vinyl edge t‑molding, PVC t‑molding, and related needs.

Strategic Sourcing Conclusion and Outlook for t edge plastic banding

Strategic Sourcing Conclusion and Outlook for T-Edge Plastic Banding

- T-edge plastic banding provides durable edge protection and aesthetic consistency across furniture, automotive, retail, and industrial segments.

- Available in PVC, PP, and PE—each with distinct performance and compliance profiles—plus solid colors, woodgrains, and patterns.

- Choose PP/PE for improved environmental profiles; select PVC where heavy-duty wear or specific flame ratings are required.

- Custom tooling, prototypes, and vertically integrated manufacturing accelerate development and shorten lead time.