The global packaging market is experiencing steady expansion, driven by rising consumer demand across industries such as food and beverage, pharmaceuticals, and e-commerce. According to Mordor Intelligence, the global packaging market was valued at USD 1.06 trillion in 2023 and is projected to grow at a CAGR of 4.2% through 2029. This growth is particularly evident in industrial hubs like New Jersey, where advanced manufacturing capabilities and proximity to major distribution networks make it a strategic center for packaging innovation. Within this dynamic landscape, Sutherland Packaging has emerged as a key player, serving clients with sustainable, high-performance solutions. Drawing on market data and operational metrics, here are the top three New Jersey-based manufacturers that exemplify leadership in packaging excellence — with Sutherland Packaging standing out for its integrated supply chain services and commitment to lean manufacturing principles.

Top 3 Sutherland Packaging Nj Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sutherland Packaging, Inc.

Domain Est. 1996

Website: njmep.org

Key Highlights: Manufacturing In NJ. Sutherland Packaging, Inc. 254 Brighton Rd Andover, NJ … About Sutherland Packaging, Inc.: Manufacture Corrugated Cartons and ……

#2 Sutherland Packaging

Domain Est. 2003

Website: sutherlandpackaging.com

Key Highlights: Sutherland Packaging is a packaging company that offers high-impact displays, digital, and custom solutions, trusted for innovative packaging manufacturing ……

#3 Sutherland Packaging Company Overview, Contact Details …

Domain Est. 2009

Website: leadiq.com

Key Highlights: Sutherland Packaging’s official website is sutherlandpackaging.com and has social profiles on LinkedIn. What is Sutherland Packaging’s SIC code NAICS code?…

Expert Sourcing Insights for Sutherland Packaging Nj

H2: 2026 Market Trends Forecast for Sutherland Packaging NJ

As the packaging industry evolves rapidly due to technological advancements, sustainability mandates, and shifting consumer behaviors, Sutherland Packaging NJ is poised to face both opportunities and challenges in 2026. Based on current industry trajectories and regional economic indicators, several key market trends are expected to shape the company’s operational and strategic landscape in the coming years.

-

Increased Demand for Sustainable Packaging

By 2026, environmental regulations in New Jersey and across the U.S. are expected to tighten, pushing companies toward eco-friendly solutions. Sutherland Packaging NJ will likely see growing demand for recyclable, compostable, and biodegradable packaging materials. With New Jersey’s emphasis on reducing single-use plastics and increasing recycling rates, the company may need to expand its sustainable product lines, invest in plant-based materials, and pursue certifications (e.g., FSC, Cradle to Cradle) to remain competitive. -

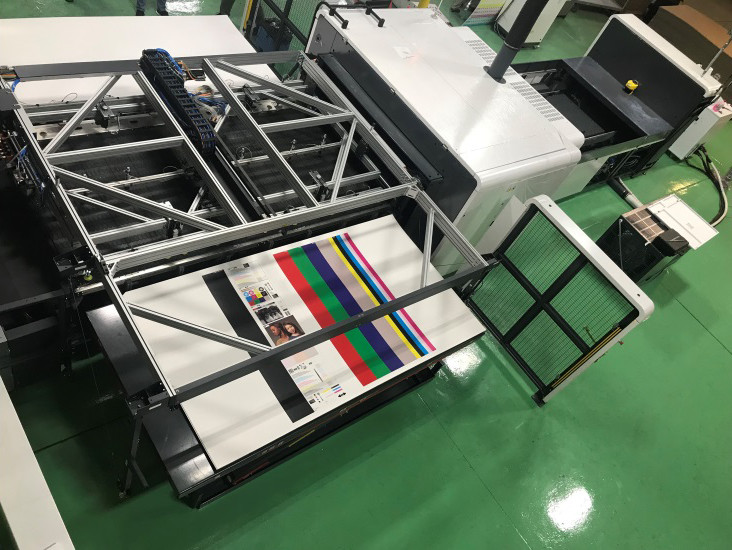

Adoption of Smart and Active Packaging Technologies

The integration of smart packaging—featuring QR codes, NFC tags, and freshness indicators—is expected to grow, especially in food, pharmaceutical, and e-commerce sectors. Sutherland Packaging NJ could leverage these technologies to offer value-added services, helping clients enhance consumer engagement and supply chain transparency. Investment in digital printing and IoT-compatible packaging solutions will likely become a strategic differentiator. -

E-Commerce Packaging Expansion

With e-commerce projected to account for over 20% of total retail sales by 2026, demand for durable, lightweight, and brand-enhancing shipping solutions will surge. Sutherland Packaging NJ can capitalize on this trend by developing optimized corrugated and mailer packaging that reduces damage during transit while supporting branding and unboxing experiences. -

Regional Supply Chain Localization

Post-pandemic supply chain disruptions have prompted a shift toward regionalized manufacturing and distribution. In 2026, companies in the Northeast, including New Jersey-based businesses, are expected to favor local suppliers to reduce lead times and transportation emissions. Sutherland Packaging NJ is well-positioned to benefit from this trend, especially if it emphasizes quick turnaround, just-in-time delivery, and flexible production runs. -

Labor and Automation Integration

The manufacturing sector in New Jersey faces ongoing labor shortages and rising wages. To maintain efficiency and scalability, Sutherland Packaging NJ is likely to increase investment in automation, robotics, and AI-driven production systems. This shift could improve precision, reduce waste, and lower operational costs—critical factors in maintaining margins amid rising material and energy expenses. -

Regulatory and Compliance Pressures

New Jersey’s strict environmental regulations, including the recent plastic bag ban and proposed extended producer responsibility (EPR) laws, will require packaging companies to adapt quickly. Sutherland Packaging NJ must stay ahead of compliance requirements, possibly by forming partnerships with waste management firms or launching take-back programs to support circular economy initiatives. -

Customization and Niche Market Focus

Brands are increasingly seeking customized packaging to stand out in crowded markets. Sutherland Packaging NJ can leverage its regional presence and agility to serve niche markets such as craft beverages, organic foods, and specialty pharmaceuticals with tailored, small-batch packaging solutions.

In summary, the 2026 market landscape for Sutherland Packaging NJ will be defined by sustainability, technology integration, and responsiveness to local and consumer-driven demands. By proactively adapting to these trends, the company can strengthen its market position, enhance customer loyalty, and drive long-term growth in a competitive and evolving industry.

Common Pitfalls When Sourcing from Sutherland Packaging NJ: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Sutherland Packaging NJ

This guide outlines key logistics and compliance procedures for operations at Sutherland Packaging’s New Jersey facility. Adherence to these standards ensures efficient operations, regulatory compliance, and customer satisfaction.

Shipping & Receiving Protocols

All inbound and outbound shipments must be logged in the warehouse management system (WMS) upon arrival or dispatch. Receiving staff must verify purchase order numbers, count quantities, and inspect packaging for damage. Shipments must be scheduled using approved carriers and dispatched within 24 hours of order confirmation, unless otherwise specified. All shipping documents must include accurate product descriptions, weights, and compliance markings.

Inventory Management Standards

Maintain real-time inventory accuracy through daily cycle counts and scheduled physical inventories. Use barcode scanning for all stock movements to minimize errors. Store materials according to material safety data sheet (MSDS) requirements, segregating hazardous and non-hazardous goods. Rotate stock using the First-Expired, First-Out (FEFO) or First-In, First-Out (FIFO) method as appropriate for product type.

Regulatory Compliance Requirements

Sutherland Packaging NJ must comply with all federal, state, and local regulations, including OSHA, EPA, and DOT standards. Maintain up-to-date safety data sheets (SDS) for all chemical and packaging materials. Conduct mandatory employee training on hazardous material handling, fire safety, and emergency response procedures quarterly. Ensure all transportation of hazardous materials follows 49 CFR regulations, including proper labeling, packaging, and documentation.

Packaging & Labeling Guidelines

All packaging must meet customer specifications and industry standards (e.g., ISTA, ASTM). Verify label accuracy for barcodes, lot numbers, expiration dates, and regulatory symbols before shipment. Use eco-friendly materials where possible to support sustainability goals and comply with New Jersey’s environmental regulations. Retain sample packaging from each production run for quality audits.

Carrier & Freight Management

Partner only with pre-approved carriers that meet Sutherland Packaging’s service level agreements (SLAs) and insurance requirements. Optimize freight routes to reduce carbon emissions and shipping costs. Track all shipments in real time and notify customers of delays promptly. Retain all freight bills, delivery confirmations, and proof of delivery (POD) for a minimum of three years.

Documentation & Recordkeeping

Maintain accurate and secure records for all logistics and compliance activities. Required documentation includes shipping manifests, receiving logs, SDS files, training records, and audit reports. Store digital records in encrypted, cloud-based systems with backup protocols. Paper records must be filed in labeled, fire-resistant cabinets and retained per regulatory timelines (minimum 3–7 years, depending on document type).

Emergency Response & Contingency Planning

Implement a site-specific emergency response plan covering fire, chemical spills, power outages, and natural disasters. Conduct biannual drills and document outcomes. Designate emergency coordinators and post contact information in visible locations. Maintain spill kits, fire extinguishers, and first aid supplies in accessible areas. Report all incidents to management and relevant authorities within 24 hours as required by law.

Quality Assurance & Audits

Conduct internal logistics and compliance audits quarterly. Address findings through corrective and preventive actions (CAPA). Prepare for unannounced customer or regulatory audits by maintaining organized, up-to-date documentation. All employees must participate in audit readiness training annually.

Conclusion for Sourcing Sutherland Packaging, NJ:

Sourcing from Sutherland Packaging in New Jersey presents a strategic opportunity for businesses seeking reliable, high-quality custom packaging solutions. The company’s strong regional presence, expertise in sustainable and innovative packaging designs, and commitment to customer service make it a valuable partner for companies across various industries, including food and beverage, healthcare, and consumer goods. Its location in New Jersey offers logistical advantages due to proximity to major transportation hubs and Northeast markets, enabling faster turnaround and reduced shipping costs. Additionally, Sutherland Packaging’s capacity for customization, scalable production, and adherence to industry standards supports both small businesses and large enterprises. While evaluating cost competitiveness and lead times is recommended, overall, Sutherland Packaging stands out as a dependable and forward-thinking supplier capable of meeting diverse packaging needs efficiently and sustainably.