The global air suspension market is experiencing robust growth, driven by rising demand for enhanced vehicle ride comfort, increased adoption in commercial vehicles, and advancements in automotive technology. According to Grand View Research, the global air suspension market size was valued at USD 3.67 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 6.5% during the forecast period of 2023–2028, citing growing integration in electric vehicles and luxury passenger cars as key growth drivers. As demand surges, innovation and reliability have become critical differentiators among manufacturers. In this competitive landscape, a handful of companies lead the market through technological expertise, expansive product portfolios, and global distribution networks. Here are the top 5 air suspension manufacturers shaping the future of automotive ride dynamics.

Top 5 Suspension Neumatica Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Suspensión neumática

Website: colcat.weweler.eu

Key Highlights: Weweler is the only European spring manufacturer to develop and manufacture their own range of air suspension system solutions. WEWELER® suspensions are ……

#2 SAF CBXSSA Eje autodireccional

Domain Est. 2006

Website: safholland.com

Key Highlights: La suspensión neumática de bastidor fijo con eje autodireccional SAF CBXSSA reduce significativamente el rozamiento y el desgaste de los neumáticos y tiene en ……

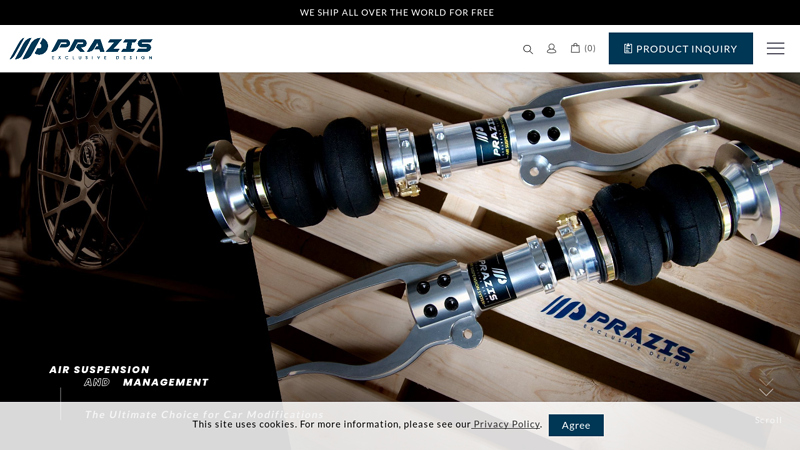

#3 Prazis Air Suspension

Domain Est. 2018

Website: prazis-airsus.com

Key Highlights: AIR SUSPENSION. With 32-level adjustable damping ; AIR MANAGEMENT. Exclusive designed management system ; WOODWORK. Adding elegance to space ; Cancellation kit….

#4 Services

Website: magnetimarelli-parts-and-services.es

Key Highlights: Nueva gama de compresores de Magneti Marelli Parts & Services para suspensiones neumáticas: 54 códigos para vehículos premium, ……

#5 Kit De Suspensión Neumática Para Coche Con Interruptor Tipo

Website: articulo.mercadolibre.cl

Key Highlights: Descripción. Manómetro universal con pantalla tres en uno con suspensión Air Ride con válvula solenoide y control remoto y panel, interruptor tipo barco, ……

Expert Sourcing Insights for Suspension Neumatica

H2: 2026 Market Trends for Air Suspension (Suspensión Neumática)

The global air suspension market, or suspensión neumática, is poised for significant transformation by 2026, driven by converging technological advancements, regulatory pressures, and shifting consumer demands. Here’s a breakdown of the key H2 (second half) 2026 market trends:

-

Accelerated Adoption in Electric Vehicles (EVs):

- Dominant Driver: EV manufacturers will increasingly integrate air suspension as a near-standard feature in premium and mid-range EVs. The need to manage heavy battery packs (improving ride comfort and handling), optimize aerodynamics (via automatic lowering at speed to extend range), and deliver a premium “silent glide” driving experience will be paramount.

- Cost Reduction & Scaling: Continued development of more cost-effective components and modular systems will make air suspension more accessible beyond luxury segments, pushing adoption into volume EV models.

-

Rise of Smart, Predictive, and Adaptive Systems:

- AI & Sensor Fusion: Air suspension systems will become significantly smarter. Integration with cameras, radar, LiDAR, GPS, and detailed map data will enable predictive adjustments. Systems will proactively raise the vehicle before known rough terrain or lower it before highways, optimizing comfort and efficiency.

- Advanced Damping Integration: Seamless integration with electronic dampers (MagneRide, etc.) will be standard, creating holistic “adaptive chassis” systems controlled by central vehicle computers for unparalleled ride and handling dynamics.

- Over-the-Air (OTA) Updates: Manufacturers will remotely update suspension software to improve performance, add new driving modes, or adapt to changing conditions without requiring physical visits.

-

Expansion Beyond Passenger Cars:

- Commercial Vehicles: Growth will accelerate in commercial trucks, buses, and delivery vans. Benefits include improved driver comfort (reducing fatigue), better cargo protection (reducing damage), increased payload capacity, enhanced stability, and compliance with stricter emissions/safety regulations. Autonomous delivery vehicles will heavily rely on sophisticated air suspension for smooth operation.

- Off-Highway & Specialty: Increased use in construction, agriculture, and mining equipment for operator comfort and machine stability on uneven terrain. Also growing in specialty applications like luxury RVs and high-end trailers.

-

Sustainability and Material Innovation:

- Lightweighting: A critical trend. Development and use of composite materials (e.g., carbon fiber, advanced polymers) for air springs, reservoirs, and components will intensify to reduce unsprung weight, improving vehicle efficiency (especially crucial for EVs) and performance.

- Recyclability: Increased focus on designing systems and components for easier end-of-life recycling, aligning with broader automotive sustainability goals.

-

Aftermarket Growth & Modernization:

- Retrofit Kits: The market for retrofit air suspension kits (especially for trucks, SUVs, and classic car restomods) will remain robust, driven by customization, lifting/leveling, and ride quality improvement desires.

- Enhanced Controls: Aftermarket systems will offer increasingly sophisticated smartphone app control, advanced leveling sensors, and integration with vehicle infotainment, blurring the line with OEM systems.

-

Consolidation and Strategic Partnerships:

- Supplier Landscape: The market will likely see consolidation among Tier 1 suppliers (like Continental, ZF, ThyssenKrupp, Hendrickson, Meritor) as the complexity and R&D costs of advanced systems rise. Partnerships between traditional suspension suppliers, electronics/semiconductor companies, and software firms will be crucial to develop integrated smart chassis solutions.

- OEM Direct Investment: Major automakers may increase in-house development or form deep strategic alliances with key suppliers to secure access to cutting-edge, differentiating suspension technology.

-

Focus on Reliability and Reduced Complexity:

- Addressing Pain Points: Learning from past reliability issues (air leaks, compressor failures), 2026 systems will prioritize increased durability, longer component lifespans, and simplified architectures to reduce maintenance costs and improve consumer confidence.

- Integrated Diagnostics: Advanced self-diagnostic capabilities will become standard, enabling proactive maintenance alerts and faster fault identification.

Conclusion for H2 2026:

By the second half of 2026, air suspension will transition from a premium luxury feature to a core enabling technology for the next generation of vehicles, particularly EVs and commercial fleets. The market will be defined by intelligence, integration, and sustainability. Systems will be smarter, predicting road conditions and adapting seamlessly. They will be more deeply integrated with the vehicle’s overall electronic architecture. While cost will remain a factor, economies of scale and innovation will drive broader accessibility. Success will belong to suppliers and OEMs who can deliver reliable, lightweight, intelligent, and cost-effective solutions that enhance the fundamental driving and riding experience while meeting the demands of electrification and autonomy.

Common Pitfalls When Sourcing Suspension Neumática (Quality, IP)

Sourcing pneumatic suspension systems—whether for commercial vehicles, industrial machinery, or specialized transportation—requires careful attention to quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, safety risks, legal disputes, and increased total cost of ownership. Below are key pitfalls to avoid:

Inadequate Quality Verification

One of the most frequent issues in sourcing pneumatic suspension components is assuming supplier claims without thorough validation. Buyers may focus solely on price, neglecting long-term reliability and safety.

- Reliance on Certifications Alone: While ISO or IATF certifications are important, they don’t guarantee batch-to-batch consistency. Always request test reports (e.g., fatigue testing, pressure cycling) and conduct factory audits.

- Poor Material Selection: Low-cost suppliers may use substandard rubber compounds or inferior metal fittings, leading to premature failure under stress or extreme temperatures.

- Lack of Real-World Testing Data: Ensure the suspension has been tested under conditions similar to your application (e.g., load cycles, environmental exposure). Absence of such data increases field failure risk.

Ignoring Intellectual Property (IP) Risks

Pneumatic suspension technology often involves patented designs, especially in compact or high-performance systems. Sourcing from unauthorized manufacturers can expose your business to legal liability.

- Counterfeit or Reverse-Engineered Products: Some suppliers offer “compatible” or “OEM-equivalent” parts that infringe on protected designs. These may appear identical but lack engineering validation and expose you to IP litigation.

- Unclear Licensing Agreements: Even when sourcing legitimate components, ensure your contract includes indemnification clauses protecting you from third-party IP claims.

- Design Replication Without Permission: Custom development based on existing patented systems—without licensing—can lead to infringement, especially in regulated markets like automotive or rail.

Insufficient Supplier Vetting

Choosing a supplier based on cost or convenience without due diligence increases exposure to both quality and IP issues.

- Hidden Manufacturing Locations: A reputable brand may outsource production to unqualified third parties. Verify the actual point of manufacture and quality control procedures.

- Lack of Traceability: Reputable suppliers provide batch traceability and material certifications. Without these, diagnosing field failures becomes difficult, and quality disputes are harder to resolve.

Overlooking Environmental and Compliance Standards

IP ratings (Ingress Protection) are critical for pneumatic systems used in harsh environments. Misunderstanding or misrepresenting IP ratings can compromise system integrity.

- Misleading IP Claims: Some suppliers exaggerate IP ratings (e.g., claiming IP67 when only IP54 is achieved). Request third-party test documentation for dust and water resistance.

- Non-Compliance with Regional Regulations: Emissions, noise, and material restrictions (e.g., REACH, RoHS) vary by region. Ensure components meet local standards to avoid customs delays or fines.

Failure to Secure Long-Term Support

Pneumatic suspension systems require ongoing maintenance and spare parts availability.

- Short Product Lifecycles: Low-cost suppliers may discontinue product lines without notice, leaving you without support.

- No Technical Documentation: Lack of installation guides, maintenance manuals, or CAD files increases integration risk and downtime.

Avoiding these pitfalls requires a structured sourcing strategy that balances cost with quality assurance, legal compliance, and long-term reliability. Engage engineering and legal teams early, conduct site audits, and prioritize transparency in supplier relationships.

Logistics & Compliance Guide for Suspension Neumatica

Overview

This guide outlines the key logistics and compliance considerations for the transportation, handling, and regulatory adherence related to Suspension Neumatica products. Proper management of these aspects ensures timely delivery, product integrity, and legal compliance across international and domestic markets.

Product Classification and Documentation

Suspension Neumatica components are typically classified under HS Code 8708.80 (Other parts and accessories for motor vehicles). Accurate classification is essential for customs clearance, tariff application, and trade compliance. Required documentation includes:

– Commercial invoice with detailed product description

– Packing list specifying weight, dimensions, and packaging material

– Certificate of Origin (preferably EUR.1 or ATR for EU trade)

– Bill of Lading or Air Waybill

– Material Safety Data Sheet (MSDS), if applicable

Packaging and Handling Requirements

To maintain product quality during transit:

– Use anti-static and moisture-resistant packaging for electronic components

– Secure pneumatic elements with protective caps to prevent contamination

– Apply shock and vibration indicators on sensitive units

– Label packages with handling instructions (e.g., “Fragile,” “Do Not Invert”)

– Ensure stackability and pallet stability for containerized shipping

Transportation Modes and Routes

Choose transportation methods based on urgency, cost, and destination:

– Air Freight: Recommended for urgent deliveries or high-value components; ideal for international express shipments

– Ocean Freight: Cost-effective for bulk orders; use 20’ or 40’ dry or refrigerated containers as needed

– Road Transport: Suitable for regional distribution within Europe or North America; ensure temperature-controlled vehicles if required

Route planning must consider customs checkpoints, border delays, and carrier reliability.

Customs Compliance and Import Regulations

Adhere to import regulations in the destination country:

– Verify compliance with local automotive safety standards (e.g., ECE R42 in Europe, FMVSS in the U.S.)

– Register with Authorized Economic Operator (AEO) programs to expedite customs clearance

– Ensure conformity with REACH, RoHS, and ELV directives for material content

– Maintain records for audit purposes under customs bonded programs

Storage and Inventory Management

At distribution centers or warehouses:

– Store products in dry, temperature-controlled environments (10–30°C recommended)

– Implement FIFO (First In, First Out) inventory rotation

– Use barcode or RFID tracking for real-time inventory visibility

– Conduct periodic audits to verify stock accuracy and product condition

Environmental and Safety Compliance

Suspension Neumatica systems may contain compressed air components and elastomeric materials subject to environmental regulations:

– Follow IATA/IMDG regulations when shipping pressurized components

– Dispose of packaging and non-reusable parts per local waste management laws

– Train logistics personnel in safe handling and emergency response procedures

Returns and Reverse Logistics

Establish a clear process for handling returns:

– Require return authorization (RMA) numbers for all incoming returns

– Inspect returned items for damage or misuse before processing refunds or exchanges

– Recycle or refurbish components where feasible to support sustainability goals

Key Contacts and Support

For logistics or compliance inquiries, contact:

– Logistics Coordinator: [email protected]

– Compliance Officer: [email protected]

– 24/7 Emergency Line: +1-800-XXX-XXXX

Adherence to this guide ensures efficient, compliant, and reliable distribution of Suspension Neumatica products worldwide.

Conclusion for Sourcing Pneumatic Suspension

Sourcing pneumatic suspension systems requires a strategic approach that balances quality, cost, reliability, and technical compatibility. After evaluating various suppliers, manufacturing regions, and product specifications, it is evident that selecting the right pneumatic suspension solution involves more than just price comparison. Critical factors such as durability, performance under varying load and road conditions, compliance with industry standards, and after-sales support must be prioritized.

Sourcing from reputable manufacturers—particularly those with certifications such as ISO/TS 16949 and experience in serving automotive or commercial vehicle sectors—ensures consistent quality and innovation. While suppliers from regions like Europe and North America often offer high-end, technologically advanced systems, competitive options from Asia can provide cost-effective solutions if stringent quality control measures are implemented.

Additionally, building long-term partnerships with suppliers who offer customization, responsive technical support, and warranty coverage can significantly reduce downtime and lifecycle costs. As vehicle electrification and advanced driver assistance systems (ADAS) grow, integrating smart pneumatic suspension systems with sensor-based controls will become increasingly important, influencing future sourcing strategies.

In conclusion, successful sourcing of pneumatic suspension systems hinges on a comprehensive evaluation that aligns technical requirements with supplier capabilities, while also anticipating future trends in vehicle dynamics and automation. A well-informed sourcing decision enhances not only vehicle performance and comfort but also operational efficiency and customer satisfaction.