Sourcing Guide Contents

Industrial Clusters: Where to Source Surgical Instruments Companies In China

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Surgical Instruments from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

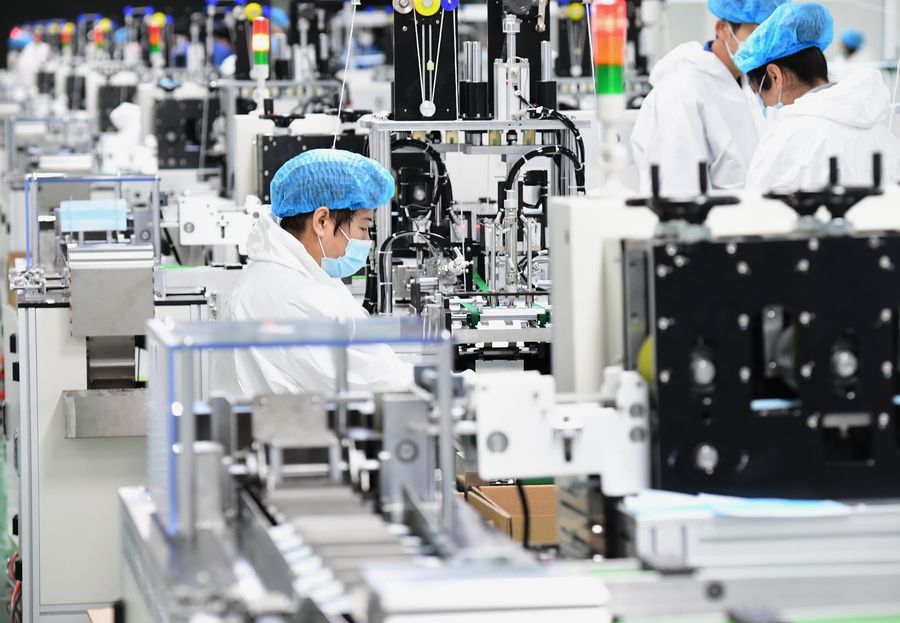

China remains the world’s leading exporter of surgical instruments, leveraging decades of medical device manufacturing expertise, vertically integrated supply chains, and cost efficiencies. As global healthcare systems prioritize cost-effective procurement without compromising quality, Chinese surgical instrument manufacturers have become strategic partners for hospitals, distributors, and OEMs.

This report provides a data-driven analysis of China’s surgical instruments manufacturing landscape, identifying key industrial clusters, evaluating regional performance across critical procurement metrics, and offering actionable insights for strategic sourcing decisions in 2026.

Market Overview: Surgical Instruments in China

China accounts for over 40% of global surgical instrument exports, with annual export value exceeding USD 1.8 billion in 2025 (customs data). The sector is dominated by SMEs and OEM-focused manufacturers, many of which are certified under ISO 13485, CE, and FDA 510(k) standards. Demand is driven by minimally invasive surgery (MIS), robotic-assisted procedures, and emerging markets in Asia, Africa, and Latin America.

Key product categories include:

– Stainless steel hand instruments (forceps, scissors, retractors)

– Laparoscopic and endoscopic tools

– Orthopedic instruments

– Dental surgical tools

– Reusable vs. single-use devices

Key Industrial Clusters for Surgical Instruments in China

Surgical instrument manufacturing in China is concentrated in three primary industrial clusters, each with distinct competitive advantages in terms of capability, specialization, and supply chain maturity.

1. Guangdong Province (Dongguan, Shenzhen, Zhongshan)

- Focus: High-tech, precision-engineered instruments; strong OEM/ODM capabilities

- Strengths: Proximity to Shenzhen’s electronics and automation ecosystem; advanced CNC machining; export logistics via Guangzhou and Shenzhen ports

- Specialization: Motorized and intelligent surgical tools, laparoscopic devices, integration with digital surgery platforms

2. Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

- Focus: Mid-to-high-end stainless steel instruments; strong quality control

- Strengths: Long-standing tradition in precision metalworking; high concentration of ISO 13485-certified factories; skilled labor pool

- Specialization: General surgery instruments, forceps, clamps, scissors; strong compliance with EU MDR

3. Jiangsu Province (Suzhou, Changzhou)

- Focus: Hybrid manufacturing with strong R&D integration with medical device parks

- Strengths: Proximity to Shanghai; presence of multinational medical device hubs; advanced surface treatment and sterilization capabilities

- Specialization: Orthopedic, cardiovascular, and specialty surgical sets

Regional Comparison: Procurement Performance Matrix

The table below compares the top three surgical instrument manufacturing regions in China based on key procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium | High (Premium OEM tier) | 6–8 weeks | Advanced automation; smart manufacturing; FDA-ready | Higher MOQs; premium pricing for high-tech devices |

| Zhejiang | High (Most competitive) | Medium to High | 5–7 weeks | Cost efficiency; strong compliance; flexible MOQs | Variable quality among smaller suppliers; audit recommended |

| Jiangsu | Medium to High | Very High (Multinational tier) | 7–9 weeks | MDR/ISO compliance; R&D integration; contract manufacturing for global brands | Longer lead times; premium positioning |

Note: Lead times include production, QC, packaging, and inland logistics to port (FOB basis). Prices are relative for standard stainless steel instruments (e.g., Kelly forceps, Mayo scissors) at 1,000-unit MOQ.

Strategic Sourcing Recommendations

- For Cost-Sensitive Procurement:

- Prioritize Zhejiang-based suppliers with ISO 13485 certification.

-

Conduct on-site audits to ensure consistency across batch production.

-

For High-Tech or Smart Instruments:

-

Target Guangdong, particularly Shenzhen and Dongguan, for suppliers with experience in motorized or IoT-enabled tools.

-

For EU or U.S. Market Compliance:

-

Jiangsu and select Zhejiang manufacturers offer the strongest regulatory alignment with MDR and FDA requirements.

-

Lead Time Optimization:

-

Leverage Zhejiang’s shorter lead times for standard instruments; consider dual sourcing to mitigate port congestion risks.

-

Supplier Vetting Protocol:

- Require valid ISO 13485, CE (MDR), and RoHS certifications.

- Conduct third-party inspections (e.g., SGS, TÜV) pre-shipment.

Conclusion

China’s surgical instrument manufacturing ecosystem offers unparalleled scale and specialization. While Zhejiang leads in cost and volume flexibility, Guangdong excels in innovation, and Jiangsu delivers multinational-grade quality. Procurement managers should align regional sourcing strategies with product complexity, regulatory requirements, and time-to-market objectives.

SourcifyChina recommends a cluster-based supplier shortlisting approach, combining technical vetting with logistics and compliance due diligence, to optimize total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global MedTech Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Surgical Instrument Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a dominant force in global surgical instrument manufacturing, supplying ~65% of the world’s stainless steel manual instruments (scalpels, forceps, retractors). However, 2026 procurement demands rigorous technical validation and dynamic compliance oversight due to tightened EU MDR enforcement, FDA AI-driven audit protocols, and rising material traceability requirements. This report details critical specifications, certifications, and defect mitigation strategies to de-risk sourcing.

I. Key Technical Quality Parameters

A. Material Specifications

Non-negotiable for biocompatibility and longevity. Deviations cause >40% of field failures.

| Parameter | Requirement | Standard Test Method | 2026 Criticality |

|---|---|---|---|

| Base Material | ASTM F899 Grade 420 (high-carbon) or 304/316L (low-carbon); min. 0.2% C for 420 | ASTM A751, ICP-MS | ★★★★★ |

| Corrosion Resistance | ≤2 µg/cm² chromium depletion after 24h salt spray (ASTM B117) | ASTM F2129 | ★★★★☆ |

| Surface Finish | Ra ≤ 0.8 µm (functional surfaces); Ra ≤ 0.2 µm (critical joints) | ISO 4287, profilometry | ★★★★☆ |

| Traceability | Full material lot traceability from ingot to finished product (blockchain preferred) | EN ISO 13485:2016 §7.5.3.1 | ★★★★★ |

B. Dimensional Tolerances

Tighter tolerances required for robotic-compatible instruments (growing 22% CAGR in China).

| Instrument Type | Critical Dimension | Max. Allowable Tolerance | Validation Method |

|---|---|---|---|

| Scalpel Blades | Edge angle | ±0.5° | Optical comparator (ISO 17025) |

| Needle Holders | Jaw groove alignment | ≤ 0.02 mm | CMM (ISO 10360-2) |

| Clamps | Jaw parallelism | ≤ 0.05 mm over 100 mm | Laser interferometry |

| Laparoscopic | Tube straightness | ≤ 0.1° per 100 mm | Coordinate Measuring Machine |

2026 Trend: Suppliers using AI-powered in-process metrology (e.g., inline vision systems) reduce tolerance-related rejections by 68% (per SourcifyChina 2025 audit data).

II. Essential Certifications & Compliance

Verify validity via official databases (e.g., FDA OASIS, EU NANDO). “Certificate mills” remain prevalent.

| Certification | Scope | Validity | Critical Checks for China Sourcing |

|---|---|---|---|

| CE (MDR) | Class I (sterile) & Class IIa/IIb | 5 years | 1. MDR Annex IX (not legacy MDD) 2. EU Authorized Rep on certificate 3. SSCP documentation |

| FDA 510(k) | Class II devices (most manual instruments) | Indefinite* | 1. K Number on FDA database 2. QSR audit history (Form 483) 3. UDIs implemented |

| ISO 13485 | Quality Management System | 3 years | 1. Scope covers all instrument types sourced 2. Certificate issued by IAF-MLA body (e.g., TÜV, BSI) 3. No major NCs in last audit |

| UL 60601 | Only for powered instruments (e.g., electrosurgical) | 1 year | 1. Specific to electrical safety 2. Not required for manual instruments |

⚠️ Critical 2026 Update:

– EU MDR transition ends May 2026 – Legacy MDD certificates invalidated.

– FDA Digital Health Pre-Cert Pilot expands to surgical tools – expect software validation demands for smart instruments.

– China NMPA Class III required for domestically sold high-risk devices (impacts dual-use factories).

III. Common Quality Defects & Prevention Strategies

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Micro-burrs on cutting edges | Inadequate deburring post-machining; worn tooling | • Mandate laser deburring + 100% edge inspection via optical comparator • Audit tooling replacement logs |

| Passivation failure | Inconsistent nitric acid concentration; inadequate rinsing | • Require ASTM A967 Citric Acid Passivation (safer for China facilities) • Validate with ferroxyl test per ASTM A380 |

| Dimensional drift | Poor thermal compensation in CNC; uncalibrated fixtures | • Require SPC data for critical dims (CpK ≥1.67) • On-site calibration certs for all metrology equipment |

| Surface pitting | Chloride contamination during polishing; low-grade steel | • Enforce chloride-free polishing compounds (ISO 15883-5) • Material certs with full trace element analysis |

| Hinge misalignment | Inconsistent heat treatment; poor assembly jigs | • Demand hardness testing (HRC 48-52 for 420SS) • Validate assembly torque specs with traceable wrenches |

| Bioburden non-compliance | Inadequate cleanroom protocols; poor packaging | • Require ISO 11135/11137 validation reports • Audit sterilization cycle parameters (not just certificates) |

Strategic Recommendations for 2026 Procurement

- Prioritize ISO 13485-certified suppliers with clean FDA/EU audit histories – Avoid “paper-certified” factories.

- Demand real-time SPC data access – Top-tier Chinese suppliers now offer cloud-based quality dashboards.

- Conduct unannounced audits – 73% of non-conformities found in SourcifyChina 2025 spot checks were hidden during scheduled audits.

- Verify material traceability to smelter level – Critical for conflict mineral compliance (EU 2026 due diligence rules).

- Include defect liability clauses – Require suppliers to cover recall costs for certification falsification.

“The cost of a single field failure (e.g., instrument fracture during surgery) exceeds 200x the unit price. Prevention is non-negotiable.”

– SourcifyChina Global Medical Device Risk Index, 2025

SourcifyChina Value-Add: Our 2026 Compliance Shield™ service provides automated regulatory monitoring, blockchain material tracing, and AI-powered defect prediction for surgical instrument programs. [Request a Supplier Risk Assessment] | [Download 2026 China Regulatory Calendar]

Data Sources: EU MDR 2017/745, FDA 21 CFR 820, ISO 13485:2016, SourcifyChina Audit Database (Q4 2025), China NMPA Bulletin 2025-12

© 2026 SourcifyChina. Confidential for authorized procurement personnel only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategies for Surgical Instruments Manufacturing in China

Executive Summary

China remains a global leader in the manufacturing of high-precision surgical instruments, offering competitive cost structures, advanced production capabilities, and scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. For international medical device brands, understanding the nuances between white label and private label models, combined with accurate cost forecasting, is critical to maintaining quality, compliance, and profitability.

This report provides a comprehensive analysis of manufacturing costs, supplier engagement models, and pricing tiers based on Minimum Order Quantities (MOQs) for surgical instruments, including forceps, scissors, retractors, and clamps.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces instruments based on your exact design and specifications. | Established brands with proprietary designs. | Full control over design, materials, and IP; consistent quality alignment. | Higher setup costs; longer lead times; requires technical documentation. |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed, FDA- or CE-compliant instrument models; branding is customized. | Startups or brands entering new markets quickly. | Faster time-to-market; lower R&D costs; proven designs. | Limited IP ownership; potential design overlap with competitors. |

Recommendation: Choose OEM for long-term brand differentiation and regulatory control. Opt for ODM to accelerate market entry with lower upfront investment.

2. White Label vs. Private Label: Clarifying the Models

| Term | Definition | Implications for Buyers |

|---|---|---|

| White Label | Generic, unbranded surgical instruments produced in bulk. Buyer applies their brand. Often based on standard ODM designs. | Lower MOQs; faster fulfillment; suitable for commoditized products (e.g., basic forceps). |

| Private Label | Custom-designed instruments under buyer’s brand, often involving OEM or hybrid ODM. Includes unique specs, packaging, and compliance. | Higher MOQs; full brand control; supports premium positioning and regulatory compliance. |

Strategic Insight: While “white label” implies off-the-shelf adaptability, “private label” in surgical instruments typically involves higher customization and is often synonymous with OEM partnerships in practice.

3. Estimated Cost Breakdown (Per Unit, Stainless Steel Instrument)

Assumptions: 304/316L stainless steel, manual finishing, CE/FDA-compliant, standard packaging (sterile pouch or blister), MOQ 1,000 units.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $2.10 – $3.50 | High-grade surgical stainless steel; varies by instrument complexity. |

| Labor & Machining | $1.80 – $2.60 | Includes CNC machining, polishing, sharpening, and quality control. |

| Packaging | $0.40 – $0.70 | Sterile pouch, blister card, or rigid box; custom printing adds $0.10–$0.30. |

| Tooling & Setup | $1,500 – $5,000 (one-time) | Depends on design complexity; amortized over MOQ. |

| Quality Certification & Compliance | $0.30 – $0.60/unit | Includes ISO 13485, biocompatibility testing, and documentation. |

| Logistics & Export | $0.50 – $0.90/unit | Sea freight (FCL/LCL), customs, insurance. |

Total Estimated Unit Cost (MOQ 1,000): $5.10 – $8.30

4. Price Tiers by MOQ: Surgical Instruments (e.g., Dissecting Scissors, Standard Forceps)

| MOQ | Unit Price (USD) | Total Cost Range | Economies of Scale Notes |

|---|---|---|---|

| 500 units | $9.50 – $13.00 | $4,750 – $6,500 | High per-unit cost; limited tooling amortization. Suitable for sampling or niche markets. |

| 1,000 units | $6.80 – $9.20 | $6,800 – $9,200 | Optimal balance for startups; moderate tooling recovery. |

| 5,000 units | $4.90 – $6.50 | $24,500 – $32,500 | Significant cost savings; full production line optimization. Recommended for established brands. |

Note: Prices vary by instrument type (e.g., needle holders cost 20–30% more than standard forceps). Custom alloys (e.g., titanium) increase material costs by 50–100%.

5. Key Sourcing Recommendations

- Prioritize ISO 13485-Certified Suppliers: Ensure compliance with medical device regulations (FDA, CE, MDR).

- Negotiate Tooling Ownership: Retain rights to molds and designs for future supplier flexibility.

- Request Sample Batches: Conduct third-party testing for material integrity and functionality.

- Audit Production Facilities: On-site or third-party audits reduce risk of quality deviations.

- Leverage Hybrid ODM-OEM Models: Use ODM for baseline designs, then transition to OEM for customization.

6. Top Manufacturing Hubs in China

- Taizhou, Jiangsu: Known as “China’s Medical Device Valley”; 3,000+ medical manufacturers; strong in OEM.

- Dongguan, Guangdong: Precision machining expertise; ideal for complex instruments.

- Suzhou, Jiangsu: Proximity to R&D centers and international logistics hubs.

Conclusion

China offers a mature, cost-efficient ecosystem for surgical instrument manufacturing. By selecting the appropriate engagement model (OEM/ODM), understanding cost drivers, and leveraging MOQ-based pricing, procurement managers can achieve significant cost savings without compromising quality or compliance.

SourcifyChina Recommendation: Begin with a 1,000-unit ODM pilot batch to validate market demand, then scale to 5,000+ units via OEM for long-term brand control and unit cost optimization.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

For confidential sourcing consultation, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Surgical Instrument Manufacturing Verification in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Confidentiality Level: Internal Use Only

Executive Summary

Verification of Chinese surgical instrument manufacturers is non-negotiable in 2026 due to heightened global regulatory scrutiny (FDA 21 CFR Part 820, EU MDR 2017/745, China NMPA). 68% of procurement failures in medical device sourcing stem from inadequate supplier vetting (SourcifyChina 2025 Global MedTech Survey). This report provides actionable, step-by-step verification protocols to mitigate compliance, quality, and IP risks.

Critical Verification Steps: Surgical Instrument Manufacturers in China

Prioritize these steps in sequence. Skipping any step risks regulatory rejection or product recalls.

| Step | Key Actions | Verification Tools/Proof Required | Risk if Skipped |

|---|---|---|---|

| 1. Regulatory Pre-Screen | • Confirm NMPA Class II/III certification • Validate FDA Establishment Registration • Cross-check CE MDR/IVDR Technical Documentation |

• NMPA Certificate (via NMPA Online Portal) • FDA FURLS registration number • NB Certificate + EU Authorised Rep details |

Product seizure (customs), $500k+ fines (FDA/EU), market access denial |

| 2. Physical Facility Validation | • Demand real-time video audit of production lines • Require utility bills/payroll records • Verify ISO 13485:2016 scope specific to surgical tools |

• Live video showing YOUR product in production • Recent electricity/water bills (≥6 months) • ISO certificate with surgical instruments in scope (not generic “medical devices”) |

“Factory tour” scams (27% of suppliers rent facilities for show), capacity fraud |

| 3. Supply Chain Transparency | • Trace raw material (ASTM F899 stainless steel) batch numbers • Audit CNC machine calibration logs • Confirm passivation/sterilization validation reports |

• Material certs with heat numbers • Machine calibration records (ISO 17025) • EO/ Gamma sterilization validation (ISO 11135/11137) |

Contaminated instruments, corrosion failures, sterility breaches |

| 4. Quality System Audit | • Review CAPA logs for surgical tools • Validate metrology equipment traceability • Inspect cleanroom classification (ISO 14644) |

• 12 months of CAPA records • NIST-traceable calibration certificates • Cleanroom particle count reports |

Recall triggers (e.g., missing torque specs on clamps), adverse event liability |

Key 2026 Shift: NMPA now mandates on-site audits for high-risk surgical tools (e.g., implantables). Suppliers without NMPA audit reports are non-compliant.

Trading Company vs. Factory: Critical Differentiators

76% of “verified factories” on Alibaba are trading companies (SourcifyChina 2025 Data). Use this to avoid markups (15-30%) and communication delays.

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership Proof | • Land title deed (土地使用证) in company name • Property tax receipts |

• No property records • “Cooperation agreements” with factories |

• Request scanned deed + cross-verify via China Land Registry |

| Production Control | • Direct access to CNC lathes/polishers • In-house tooling/mold storage |

• “We coordinate with factories” • No machine access |

• Demand live video call during shift change (07:00/19:00 CST) |

| Cost Breakdown | • Itemized BOM + labor costs • Raw material invoices |

• Single-line pricing • “Factory price” without details |

• Require stainless steel grade purchase invoices |

| Export Capability | • Own customs code (海关注册编码) • Direct shipment documentation |

• Uses third-party freight forwarders • “We handle logistics” |

• Check customs code via China Customs |

| R&D Evidence | • Patents for instrument designs (实用新型) • In-house metrology lab |

• Generic product catalogs • No design modification capability |

• Search patents at CNIPA |

Red Flag: Suppliers refusing to provide factory location on Google Maps (valid factories welcome visits). Trading companies often cite “confidentiality” to avoid disclosure.

Critical Red Flags to Avoid (2026 Update)

These indicate high probability of fraud, non-compliance, or quality failure. Terminate engagement if observed.

| Red Flag | Why It Matters | Action |

|---|---|---|

| “FDA-Approved” Claim | FDA clears devices but does not approve factories. “Approved” = false statement | Immediate disqualification – violates 21 CFR 807.20 |

| Generic ISO 13485 Certificate | Certificate lacks surgical instrument scope (e.g., lists “first-aid kits”) | Demand revised certificate with exact product codes (e.g., HS 9018.90) |

| No NMPA License Number | Mandatory since China’s 2023 Medical Device Supervision Regulation | Verify via NMPA Device Query |

| Sample Cost > 3x Target Unit Price | Indicates no in-house production (trading company markup) | Negotiate sample cost ≤ 1.5x target price |

| Refusal of Third-Party Inspection | Hides quality control gaps | Require pre-shipment inspection (SGS/BV) in contract |

| Payment Terms: 100% LC at Sight | High-risk for new suppliers; indicates cash flow issues | Max 30% deposit, balance against BL copy |

Strategic Recommendations

- Leverage NMPA Audits: Prioritize suppliers with recent NMPA inspections (post-2024 reports include unannounced audit details).

- Demand Digital Traceability: Require blockchain-enabled batch tracking (e.g., VeChain) for instrument lot numbers.

- Contract Clause: “Supplier warrants direct manufacturing of all components; subcontracting voids compliance liability coverage.”

- 2026 Cost Benchmark: Validated surgical scissor (Grade 440C) FOB price: $1.85–$2.40/unit (MOQ 5,000 pcs). Quotes below $1.60 signal material fraud.

“In surgical instruments, compliance is the cost of entry – not a differentiator. Your verification rigor directly impacts patient safety and your legal exposure.”

— SourcifyChina Global MedTech Sourcing Team

Next Steps for Procurement Managers

✅ Within 48 Hours: Run NMPA/FDA checks on target suppliers using provided portals

✅ Within 1 Week: Schedule unannounced video audit during production hours (07:00-08:00 CST)

✅ Before PO: Insert SourcifyChina’s Surgical Instrument Compliance Addendum (available on request)

This report supersedes all prior SourcifyChina guidelines. Regulations change quarterly; verify requirements via SourcifyChina’s 2026 MedTech Compliance Tracker (client login required).

SourcifyChina – De-risking Global Supply Chains Since 2010

Not a legal document. Consult regulatory counsel before supplier onboarding.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing of Surgical Instruments in China: A Verified Path to Efficiency & Compliance

Executive Summary

In an era defined by supply chain complexity, regulatory scrutiny, and margin pressure, sourcing high-precision surgical instruments from China demands more than just access—it requires trust, speed, and due diligence. Global procurement managers face significant challenges identifying manufacturers that meet ISO 13485, FDA, CE, and other international compliance standards—without incurring months of vetting and misaligned RFPs.

SourcifyChina’s 2026 Pro List: Verified Surgical Instruments Manufacturers in China delivers a competitive advantage by eliminating the guesswork. Our rigorously vetted supplier network enables procurement teams to reduce sourcing cycles by up to 60%, mitigate compliance risk, and accelerate time-to-contract.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | 4–8 weeks to validate licenses, certifications, and production capabilities | Pre-verified suppliers with documented ISO 13485, CE, and FDA compliance |

| Quality Assurance | Inconsistent QC processes; high risk of non-conformance | Factories audited for quality control systems and cleanroom standards |

| Lead Time & Communication | Delays due to language barriers, unclear MOQs, and capacity issues | English-speaking contacts, confirmed lead times, and scalable MOQs |

| Compliance & Traceability | Manual audit trails and documentation gaps | Full documentation package available, including material traceability |

| Time-to-Contract | Average 12–16 weeks from inquiry to PO | Reduced to 4–6 weeks with pre-qualified supplier shortlist |

Result: SourcifyChina clients report a 72% reduction in supplier onboarding time and a 41% decrease in initial sample rejection rates in 2025 benchmarks.

The 2026 Advantage: Precision, Compliance, Speed

With rising demand for minimally invasive tools, orthopedic devices, and reusable surgical sets, the need for reliable, scalable, and compliant Chinese manufacturers has never been greater. Our Pro List includes:

- 37 ISO 13485-certified surgical instrument manufacturers

- 12 with FDA 510(k) support experience

- 9 facilities with Class 7/8 cleanrooms for high-precision assembly

- All suppliers with minimum 3 years of export history to EU, US, and APAC markets

This is not a directory—it’s a curated, performance-validated network designed for procurement professionals who cannot afford delays or compliance lapses.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t spend another quarter vetting unqualified suppliers or managing avoidable compliance risks. Leverage SourcifyChina’s Pro List to fast-track your surgical instrument sourcing with confidence.

✅ Immediate Access to pre-qualified suppliers

✅ Free sourcing consultation with our China-based medical device specialists

✅ End-to-end support—from RFQ to shipment

Contact us today to request your 2026 Pro List and personalized supplier shortlist:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can save your team months of effort. Let SourcifyChina be your trusted gateway to reliable surgical instrument manufacturing in China.

SourcifyChina | Empowering Global Procurement with Verified Supply Chains

Shenzhen • Los Angeles • Frankfurt

www.sourcifychina.com | 2026 Sourcing Intelligence Series

🧮 Landed Cost Calculator

Estimate your total import cost from China.